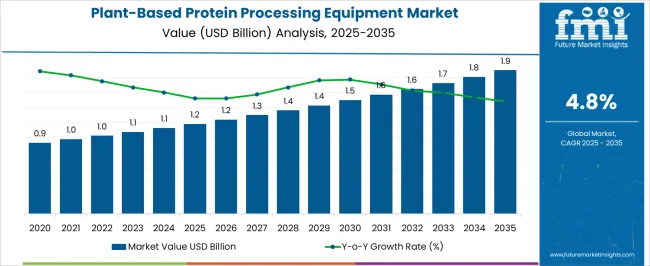

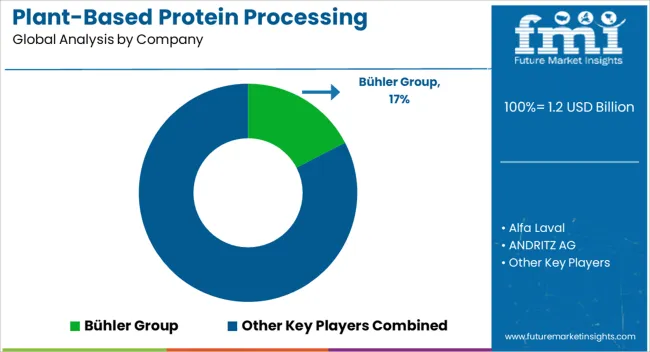

In 2025, the plant-based protein processing equipment market is valued at USD 1.2 billion and is expected to reach USD 1.9 billion by 2035, growing at a CAGR of 4.8%. The absolute dollar opportunity over this period is USD 0.7 billion, representing the additional revenue potential from 2025 to 2035. This growth reflects rising demand for plant-based protein products and the need for processing infrastructure to support production. Companies can capitalize on this opportunity by expanding equipment offerings, optimizing production capacity, and targeting key manufacturing regions to capture incremental revenue throughout the decade-long market expansion.

From a financial perspective, the absolute dollar opportunity of USD 0.7 billion provides measurable potential for business growth and market share capture. With the market gradually increasing from USD 1.2 billion in 2025 to USD 1.9 billion in 2035 at a CAGR of 4.8%, stakeholders can plan investments and production scaling strategically. By focusing on high-demand regions and improving supply chain efficiency, companies can maximize revenue while managing operational costs. This predictable growth trajectory allows for informed decision-making and strategic planning to optimize returns over the ten-year period.

| Metric | Value |

|---|---|

| Plant-Based Protein Processing Equipment Market Estimated Value in (2025 E) | USD 1.2 billion |

| Plant-Based Protein Processing Equipment Market Forecast Value in (2035 F) | USD 1.9 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

A breakpoint analysis for the plant-based protein processing equipment market highlights key thresholds where growth accelerates or strategic adjustments are necessary. With the market at USD 1.2 billion in 2025 and projected to reach USD 1.9 billion by 2035 at a CAGR of 4.8%, early breakpoints occur around USD 1.4–1.5 billion. These levels represent initial market momentum where rising demand for processing equipment creates opportunities for expanding production capacity, optimizing distribution, and targeting emerging manufacturers.

Identifying these breakpoints helps companies allocate resources efficiently, prioritize high-potential segments, and implement targeted strategies to capture revenue during early growth phases. Later-stage breakpoints occur between USD 1.7–1.8 billion as the market approaches maturity and competition intensifies.

Surpassing these thresholds may require businesses to refine operational efficiency, enhance service offerings, and strengthen relationships with key buyers to sustain growth. Monitoring these breakpoints allows companies to anticipate shifts in market dynamics and adjust investments, production, and marketing strategies accordingly. By aligning business actions with these key thresholds, stakeholders can maximize revenue potential, strengthen market positioning, and navigate the steady growth trajectory from 2025 to 2035 with strategic precision.

The market is experiencing robust expansion due to rising consumer demand for sustainable and health-conscious protein alternatives. The shift towards plant-based diets, supported by increasing awareness of environmental and ethical concerns, is driving investments in efficient processing technologies.

Continuous innovations positively influence the market’s future outlook in equipment that enhance the texture, flavor, and nutritional quality of plant proteins. Growing adoption across food and beverage industries, including meat alternatives and dairy substitutes, is further boosting demand.

Additionally, advancements in processing techniques aimed at improving scalability and reducing production costs are expected to accelerate growth. The market benefits from expanding production capacities and diversified protein sources, which enable manufacturers to respond flexibly to evolving consumer preferences and regulatory standards worldwide.

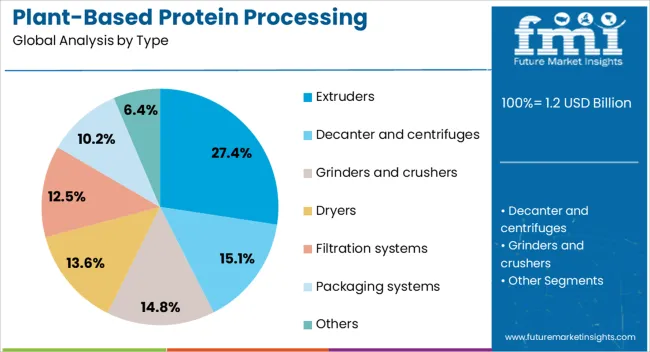

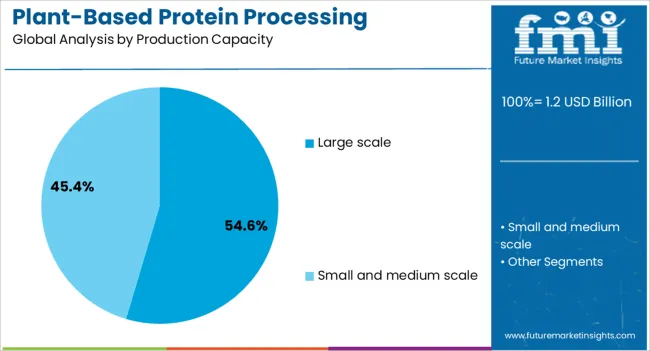

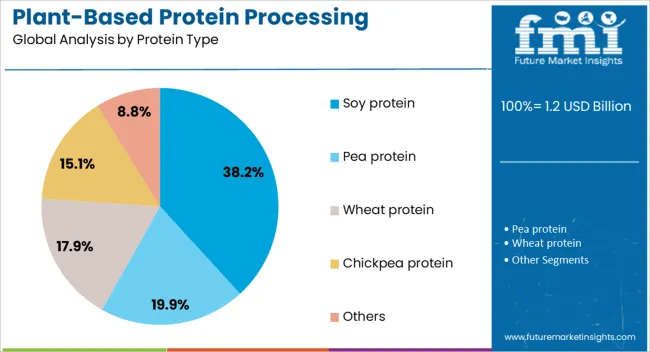

The plant-based protein processing equipment market is segmented by type, production capacity, protein type, application, distribution channel, and geographic regions. By type, plant-based protein processing equipment market is divided into Extruders, Decanter and centrifuges, Grinders and crushers, Dryers, Filtration systems, Packaging systems, and Others. In terms of production capacity, plant-based protein processing equipment market is classified into Large scale and Small and medium scale. Based on protein type, plant-based protein processing equipment market is segmented into Soy protein, Pea protein, Wheat protein, Chickpea protein, and Others.

By application, plant-based protein processing equipment market is segmented into Powder, Isolates, Concentrates, and Texturized products. By distribution channel, plant-based protein processing equipment market is segmented into Direct sales and Indirect sales. Regionally, the plant-based protein processing equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The extruders segment is anticipated to hold 27.4% of the Plant-Based Protein Processing Equipment market revenue share in 2025, positioning it as a key technology type within the industry. This segment’s growth is being attributed to its capability to create textured plant proteins that closely mimic animal-based products, which is critical for consumer acceptance.

Extrusion technology offers precise control over processing conditions, enabling the production of a wide range of textures and product forms. The segment has been favored due to its efficiency in scaling production and its versatility across various plant protein raw materials.

Furthermore, extruders facilitate cost-effective manufacturing processes by reducing waste and energy consumption As the demand for meat analogs and other innovative protein products increases, extruder equipment continues to be widely adopted for its essential role in product development and large-scale production.

The large scale production capacity segment is projected to command 54.6% of the market revenue in 2025, reflecting its dominance in meeting the growing demand for plant-based protein products. This leadership is being driven by the need for high-throughput processing solutions capable of supporting mass production and supply chain efficiencies.

Large scale equipment enables manufacturers to optimize operational costs while ensuring consistent product quality. The trend toward industrial-scale manufacturing is supported by expanding investments in plant-based protein product lines and the increasing presence of major food companies entering this sector.

Scalability and automation features inherent in large-scale processing equipment are pivotal factors enabling rapid market penetration and supply reliability. As global demand intensifies, large-scale capacity is expected to remain the backbone of the plant-based protein processing equipment market.

The soy protein segment is forecasted to hold 38.2% of the market revenue share in 2025, representing the leading protein type within the Plant-Based Protein Processing Equipment market. The growth of this segment is primarily due to soy’s widespread availability, nutritional profile, and functional properties suitable for diverse food applications.

Soy protein’s compatibility with existing processing technologies and its established supply chain infrastructure have facilitated its prominent position. This segment’s expansion is further supported by the versatility of soy protein in creating textured products, beverages, and fortified foods.

Additionally, soy protein processing benefits from ongoing technological improvements that enhance flavor masking and digestibility. The continued consumer acceptance of soy-based products globally positions this protein type as a critical driver for equipment demand and innovation in the plant-based protein industry.

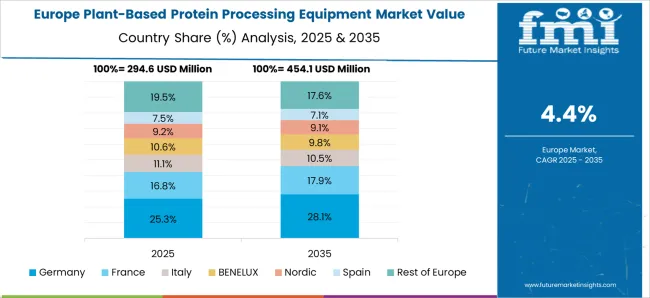

The plant-based protein processing equipment market is growing due to rising demand for alternative protein products, increasing health-conscious consumer behavior, and expansion of plant-based food manufacturing. North America and Europe lead in high-tech extrusion, drying, and separation equipment for textured vegetable proteins, soy isolates, and pea protein concentrates.

Asia-Pacific shows rapid growth fueled by rising population, plant-based dietary adoption, and expansion of commercial food processing facilities. Manufacturers differentiate through throughput capacity, energy efficiency, modularity, and precision control. Market expansion is supported by vegan and flexitarian trends, investments in clean-label foods, and technological upgrades in protein processing. Companies offering scalable, customizable, and automated solutions gain an edge in high-value applications, while regional suppliers focus on cost-efficient equipment suitable for small and medium-scale processors. Equipment performance, reliability, and regional adoption differences directly influence competitiveness and market penetration.

Plant-based protein equipment varies by function, extruders, homogenizers, dryers, and separators. Europe and North America emphasize high-capacity, multi-functional systems for large-scale production of textured protein and isolates, ensuring consistent quality and reduced processing time. Asia-Pacific markets often adopt modular or single-function equipment for emerging protein processors, balancing cost and performance. Differences in throughput, energy efficiency, and precision control directly affect product quality, production efficiency, and operational costs. Leading global suppliers provide integrated systems with advanced automation and quality monitoring, while regional manufacturers focus on affordability and basic functionality. These contrasts influence adoption patterns, production planning, and supplier competitiveness across professional-scale and emerging markets.

Processing equipment must handle diverse plant-based raw materials such as soy, pea, lentil, rice, and hemp. North America and Europe prioritize machines compatible with multiple protein sources and advanced ingredient blends to meet varied consumer preferences. Asia-Pacific processors often focus on cost-effective equipment tailored to locally available raw materials. Differences in raw material adaptability affect product innovation, operational flexibility, and production consistency. Suppliers offering equipment compatible with a wide range of protein sources secure premium contracts, while regional manufacturers provide specialized or mono-purpose solutions. These contrasts shape adoption trends, equipment selection, and regional competitiveness, especially as demand for novel plant-based proteins continues to rise globally.

Advanced processing equipment integrates automation, real-time monitoring, and energy-efficient systems. Europe and North America focus on high-precision, energy-saving machines with remote monitoring, automated cleaning, and process optimization for consistent protein quality. Asia-Pacific markets adopt simpler, semi-automated systems emphasizing affordability and ease of maintenance. Differences in automation and efficiency influence operational costs, throughput, and product consistency. Manufacturers offering fully automated, energy-efficient solutions gain competitive advantages in high-volume and premium applications, while regional suppliers capture emerging processors seeking cost-effective solutions. Variations in system sophistication shape adoption, supplier credibility, and market positioning across developed and emerging regions.

Plant-based protein processing equipment is distributed through direct OEM sales, specialized dealers, and integrated project solutions. North America and Europe emphasize direct sales with installation, technical training, and after-sales support, while Asia-Pacific relies on regional distributors and service networks to reach small- and medium-scale processors. Differences in distribution and support affect customer trust, adoption speed, and long-term operational reliability. Suppliers providing comprehensive training, maintenance contracts, and spare parts access capture premium market segments, whereas regional producers rely on cost competitiveness. These contrasts determine adoption, equipment uptime, and regional market penetration, influencing supplier strategy and positioning in both mature and emerging markets.

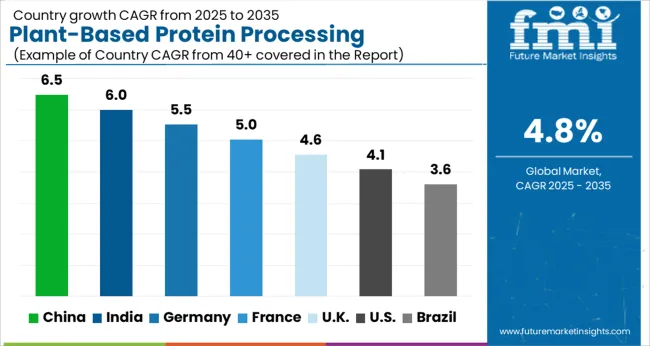

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The global plant-based protein processing equipment market was projected to grow at a 4.8% CAGR through 2035, driven by demand in food processing, alternative protein production, and nutraceutical applications. Among BRICS nations, China recorded 6.5% growth as large-scale production and processing facilities were commissioned and compliance with food safety and equipment standards was enforced, while India at 6.0% growth saw expansion of manufacturing units to meet rising regional demand. In the OECD region, Germany at 5.5% maintained substantial output under strict industrial and safety regulations, while the United Kingdom at 4.6% relied on moderate-scale operations for plant-based protein production. The USA, expanding at 4.1%, remained a mature market with steady demand across food processing and alternative protein segments, supported by adherence to federal and state-level safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Plant-based protein processing equipment market in China is growing at a CAGR of 6.5%. Between 2020 and 2024, growth was driven by rising demand for plant-based protein products, expansion of food processing industries, and consumer shift toward vegan and vegetarian diets. Manufacturers focused on high-capacity, energy-efficient, and versatile equipment for protein extraction, isolation, and texturization. Investments in advanced machinery and adoption of international processing standards expanded industrial capacity. In the forecast period 2025 to 2035, growth is expected to accelerate with deployment of automated, smart, and sustainable processing equipment, along with integration with plant-based meat and dairy alternatives production lines. China remains a leading market due to its large food processing sector, rising health consciousness, and rapid urbanization.

Plant-based protein processing equipment market in India is growing at a CAGR of 6.0%. Historical period 2020 to 2024 saw growth supported by increasing demand for vegetarian and vegan protein sources, rising food processing investments, and growing awareness of health and nutrition. Manufacturers focused on versatile, cost-effective, and high-efficiency equipment suitable for local crops such as soy, pea, and lentil. Urbanization and rapid growth of packaged food industries further supported market expansion. In the forecast period 2025 to 2035, market growth is expected to continue with adoption of smart, automated, and sustainable processing systems integrated into plant-based meat, dairy alternatives, and protein-rich food production lines. India is projected to maintain strong growth due to expanding food processing sector, government support, and rising consumer awareness.

Plant-based protein processing equipment market in Germany is growing at a CAGR of 5.5%. Between 2020 and 2024, growth was supported by rising demand for plant-based foods, sustainable processing, and innovation in protein alternatives. Manufacturers focused on advanced, high-capacity, and energy-efficient equipment for protein extraction, isolation, and texturization. In the forecast period 2025 to 2035, market growth is expected to continue steadily with adoption of smart, automated, and environmentally friendly equipment. Increasing consumer preference for plant-based diets, regulatory support for sustainable food production, and industrial investment will further support adoption. Germany remains a key European market due to high consumer awareness, strong food processing industry, and sustainability initiatives.

Plant-based protein processing equipment market in the United Kingdom is growing at a CAGR of 4.6%. During 2020 to 2024, adoption was driven by increasing plant-based food consumption, growth of food processing facilities, and rising health consciousness. Manufacturers focused on energy-efficient, versatile, and user-friendly processing equipment. In the forecast period 2025 to 2035, market growth is expected to continue moderately with adoption of smart, automated, and sustainable systems for protein extraction, isolation, and product diversification. Expansion of plant-based dairy and meat alternatives, government support for sustainable food processing, and technological innovation will further support market development. The United Kingdom market demonstrates stable growth with emphasis on sustainability, efficiency, and high-quality production.

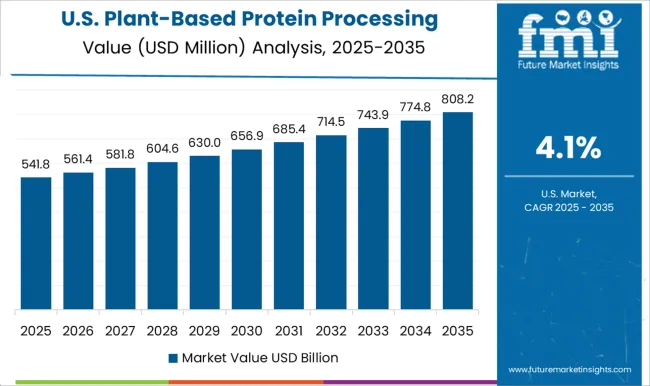

Plant-based protein processing equipment market in the United States is growing at a CAGR of 4.1%. Historical period 2020 to 2024 saw growth fueled by rising plant-based diet adoption, development of food processing facilities, and consumer focus on health and sustainability. Manufacturers focused on high-performance, energy-efficient, and reliable equipment suitable for soy, pea, and other protein sources. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption of automated, smart, and eco-friendly equipment integrated into plant-based meat, dairy alternatives, and protein product lines. Technological innovation, increasing plant-based food demand, and sustainability initiatives will further support expansion. The United States market demonstrates stable growth with emphasis on reliability, efficiency, and environmental compliance.

The plant-based protein processing equipment market is supplied by manufacturers specializing in extrusion, milling, and protein isolation systems. Competition is influenced by equipment capacity, processing efficiency, automation, and customization for different protein sources. Observed industry patterns indicate that China leads with 6.5% market share, followed by India at 6.0% and Germany at 5.5%, while the UK and USA account for 4.6% and 4.1%, respectively. Brochures from key suppliers highlight high-shear extruders, air classification systems, and precision drying equipment optimized for soy, pea, and other plant proteins. Specifications focus on throughput, energy efficiency, moisture control, and adaptability to batch or continuous processes.

Strategies across suppliers emphasize modular design, technology licensing, and regional service networks. Chinese and Indian manufacturers focus on large-scale, high-capacity equipment for cost-sensitive markets. German and UK suppliers prioritize precision engineering, durability, and low maintenance for premium and export-oriented operations. USA companies integrate automation, process monitoring, and multi-protein compatibility for R&D and commercial applications. Observed practices include retrofitting existing lines, reducing processing downtime, and offering turnkey solutions to food manufacturers, nutraceutical producers, and plant-based meat innovators.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Type | Extruders, Decanter and centrifuges, Grinders and crushers, Dryers, Filtration systems, Packaging systems, and Others |

| Production Capacity | Large scale and Small and medium scale |

| Protein Type | Soy protein, Pea protein, Wheat protein, Chickpea protein, and Others |

| Application | Powder, Isolates, Concentrates, and Texturized products |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bühler Group, Alfa Laval, ANDRITZ AG, Bepex International LLC, Clextral SAS, Coperion GmbH, Equinom, Flottweg SE, GEA Group, Glatt Group, Hosokawa Micron B.V, Koch Separation Solutions, Lyco Manufacturing, Netzsch-Feinmahltechnik GmbH, and SPX FLOW Inc |

| Additional Attributes | Dollar sales vary by equipment type, including extruders, separators, mixers, dryers, and grinders; by application, such as plant-based meat, dairy alternatives, protein powders, and beverages; by end-use industry, spanning food & beverages, nutraceuticals, and dietary supplements; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for plant-based proteins, clean-label products, and sustainable food production. |

The global plant-based protein processing equipment market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the plant-based protein processing equipment market is projected to reach USD 1.9 billion by 2035.

The plant-based protein processing equipment market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in plant-based protein processing equipment market are extruders, decanter and centrifuges, grinders and crushers, dryers, filtration systems, packaging systems and others.

In terms of production capacity, large scale segment to command 54.6% share in the plant-based protein processing equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant-Based Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant-Based Protein Beverages Market Trends – Growth & Forecast 2025 to 2035

Demand for Plant-Based Protein Flavor Maskers and Enhancers in Latin America Size and Share Forecast Outlook 2025 to 2035

High-Protein Plant-Based Cheese Alternatives in the EU Analysis Size and Share Forecast Outlook 2025 to 2035

Pea Protein in Plant-Based Meat Analysis - Size Share and Forecast outlook 2025 to 2035

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Protein Crisps Market Outlook - Growth, Demand & Forecast 2025 to 2035

Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Protein Supplement Market - Size, Share, and Forecast 2025 to 2035

Protein Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein Purification and Isolation Market Insights – Size, Share & Forecast 2025 to 2035

Protein Ingredients Market Analysis - Size, Share, and Forecast 2025 to 2035

Protein A Resins Market Trends, Demand & Forecast 2025 to 2035

Proteinase K Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA