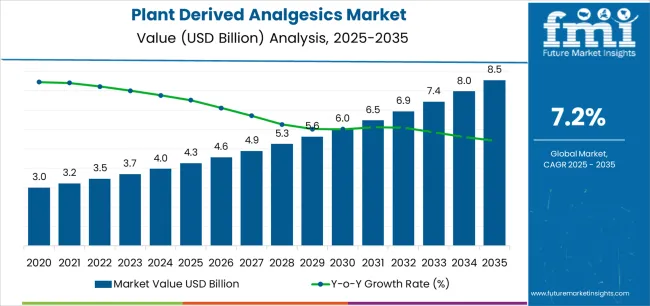

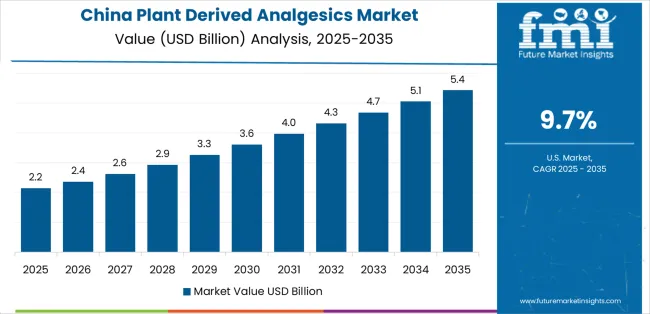

The plant derived analgesics market stands at the threshold of a decade-long expansion trajectory that promises to reshape pain management technology and natural therapeutic solutions. The market's journey from USD 4,262.9 million in 2025 to USD 8,543.8 million by 2035 represents substantial growth, demonstrating the accelerating adoption of botanical pain relief compounds and natural medicine optimization across pharmaceutical manufacturing, healthcare delivery, and consumer wellness sectors.

The first half of the decade (2025-2030) will witness the market climbing from USD 4,262.9 million to approximately USD 6,035.0 million, adding USD 1,772.1 million in value, which constitutes 41% of the total forecast growth period. This phase will be characterized by the rapid adoption of cannabinoid-based analgesics, driven by increasing regulatory acceptance and the growing need for alternative pain management solutions worldwide. Enhanced extraction technologies and standardized formulations will become standard expectations rather than premium options.

The latter half (2030-2035) will witness continued growth from USD 6,035.0 million to USD 8,543.8 million, representing an addition of USD 2,508.8 million or 59% of the decade's expansion. This period will be defined by mass market penetration of natural pain management alternatives, integration with comprehensive healthcare protocols, and seamless compatibility with existing pharmaceutical infrastructure. The market trajectory signals fundamental shifts in how healthcare providers approach pain treatment and medication selection, with participants positioned to benefit from growing demand across multiple product types and therapeutic applications.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Prescription opioid analgesics (morphine, codeine) | 52% | Hospital-driven, chronic pain management |

| Over-the-counter plant derivatives | 24% | Salicin, curcumin, topical formulations | |

| CBD & cannabinoid products | 14% | Growing regulatory acceptance, wellness trend | |

| Compounded formulations | 10% | Custom dosing, specialized applications | |

| Future (3-5 yrs) | Cannabinoid therapeutics | 35-40% | Medical cannabis, CBD prescriptions, regulatory expansion |

| Next-gen opioid alternatives | 25-30% | Abuse-deterrent formulations, targeted delivery | |

| Topical & transdermal systems | 15-20% | Localized pain relief, sustained release patches | |

| Nutraceutical pain management | 12-16% | Curcumin, botanical blends, preventive wellness | |

| Digital health integration | 8-12% | Smart dosing, pain monitoring apps, telemedicine prescriptions | |

| Personalized formulations | 5-8% | Genetic profiling, customized combinations |

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) | USD 4,262.9 million |

| Market Forecast (2035) | USD 8,543.8 million |

| Growth Rate | 7.2% CAGR |

| Leading Technology | Morphine |

| Primary Application | Chronic Pain Management |

The market demonstrates strong fundamentals with morphine-based products capturing a dominant share through proven analgesic efficacy and pain management optimization. Chronic pain management applications drive primary demand, supported by increasing prevalence of pain conditions and therapeutic requirement needs. Geographic expansion remains concentrated in developed markets with established pharmaceutical infrastructure, while emerging economies show accelerating adoption rates driven by healthcare access initiatives and rising pain management standards.

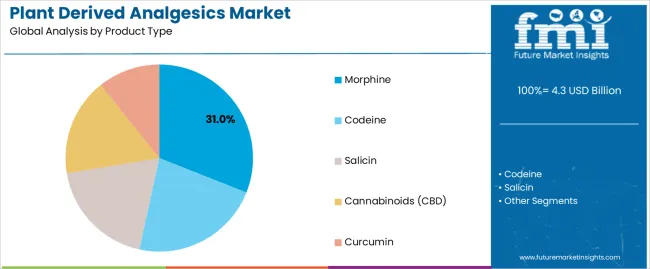

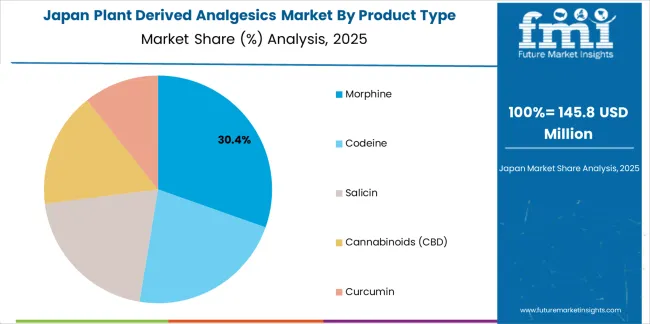

Primary Classification: The market segments by product type into morphine, codeine, salicin, cannabinoids (CBD), and curcumin, representing the evolution from traditional opiate analgesics to diverse botanical pain management solutions for comprehensive therapeutic optimization.

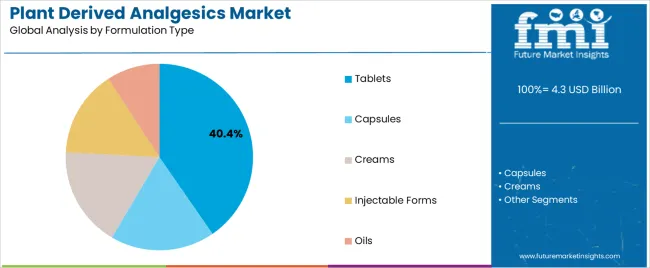

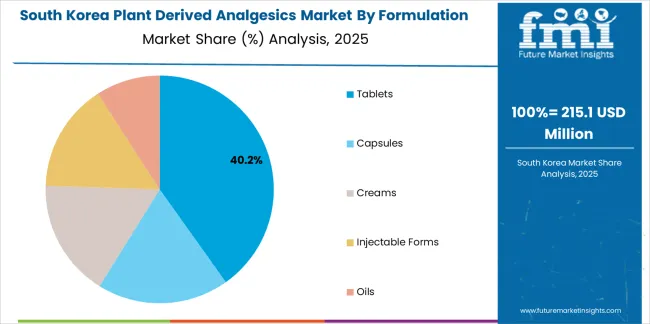

Secondary Classification: Formulation type segmentation divides the market into tablets, capsules, creams, injectable forms, and oils sectors, reflecting distinct requirements for administration routes, onset speed, and duration standards.

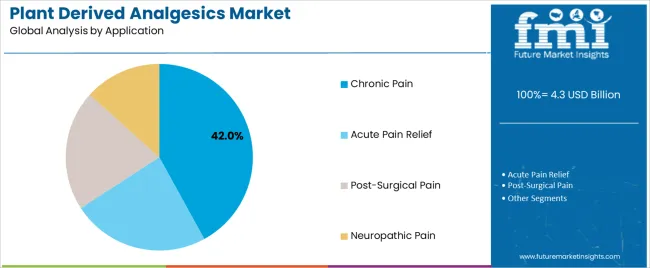

Tertiary Classification: Application segmentation covers chronic pain management, acute pain relief, post-surgical pain, and neuropathic pain, sales channel segmentation spans hospitals, clinics, retail sales, online sales, and hypermarkets & supermarkets, while regional distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa.

The segmentation structure reveals technology progression from traditional opiate medications toward diverse botanical alternatives with enhanced safety profiles and targeted mechanisms, while application diversity spans from hospital-based acute care to consumer self-care applications requiring accessible plant-based solutions.

Market Position: Morphine commands the leading position in the plant derived analgesics market with 31% market share through superior analgesic features, including potent pain relief, well-established clinical protocols, and comprehensive healthcare integration that enable medical facilities to achieve optimal pain control across diverse acute and chronic pain environments.

Value Drivers: The segment benefits from healthcare provider preference for proven analgesic systems that provide consistent pain management performance, dose flexibility, and therapeutic reliability without requiring extensive patient education. Advanced formulation features enable controlled-release delivery, parenteral administration, and integration with existing pain protocols, where efficacy and safety monitoring represent critical treatment requirements.

Competitive Advantages: Morphine products differentiate through proven clinical effectiveness, extensive safety documentation, and integration with multimodal pain management approaches that enhance patient outcomes while maintaining optimal comfort standards suitable for diverse surgical, cancer, and chronic pain applications.

Key market characteristics:

Codeine maintains a 17% market position in the plant derived analgesics market due to its moderate potency properties and combination therapy advantages. These products appeal to healthcare providers requiring mild-to-moderate pain relief with lower abuse potential for outpatient applications. Market presence is sustained by prescription volumes, emphasizing accessible pain management and cough suppression through established pharmaceutical formulations.

Salicin products capture 17% market share through natural anti-inflammatory requirements in over-the-counter applications, traditional medicine usage, and consumer preference for botanical alternatives. These consumers demand gentle pain relief capable of addressing musculoskeletal discomfort while providing natural product positioning and herbal medicine heritage.

Cannabinoids (CBD) account for 17% market share through expanding regulatory acceptance in pain management, anti-inflammatory applications, and wellness positioning requiring alternative pain relief mechanisms with favorable safety profiles for diverse pain conditions.

Curcumin products capture 17% market share through anti-inflammatory properties, joint health applications, and preventive wellness approaches requiring natural pain prevention with antioxidant benefits and disease-modifying potential.

Market Context: Tablets demonstrate the highest market presence with 40.4% share due to widespread adoption of oral solid dosage forms and increasing focus on patient convenience, dose accuracy, and medication adherence applications that maximize therapeutic compliance while maintaining manufacturing efficiency standards.

Appeal Factors: Healthcare providers and patients prioritize formulation convenience, storage stability, and dosing precision that enables reliable medication administration across multiple therapeutic scenarios. The segment benefits from substantial pharmaceutical investment and controlled-release technologies that emphasize tablet development for pain management and therapeutic optimization applications.

Growth Drivers: Extended-release tablet technologies incorporate abuse-deterrent features as standard formulation elements for opioid products, while patient preference increases demand for oral administration capabilities that comply with convenience standards and minimize administration complexity.

Market Challenges: Varying absorption profiles and onset times may limit tablet suitability across different pain intensity scenarios or patient populations.

Application dynamics include:

Capsules capture 20% market share through alternative oral dosage requirements in rapid-onset applications, liquid-fill formulations, and patients preferring capsule swallowing over tablet administration.

Creams account for 15% market share, including localized pain relief applications, musculoskeletal conditions, and patients seeking non-systemic exposure with targeted pain management at application sites.

Injectable formulations maintain 15% market share through hospital acute pain management, post-surgical analgesia, and emergency department applications requiring rapid onset and precise dose titration for severe pain control.

Oils capture 9.6% market share through sublingual administration, cannabinoid delivery, and alternative medicine applications requiring flexible dosing with rapid absorption characteristics.

Market Position: Chronic Pain Management commands significant market presence with 42% share through long-term therapeutic requirements that demand sustained analgesic efficacy for persistent pain conditions affecting daily functioning.

Value Drivers: This application category addresses growing prevalence of chronic conditions including arthritis, back pain, neuropathy, and cancer-related pain requiring continuous medication with acceptable long-term safety profiles.

Growth Characteristics: The segment benefits from aging demographics, increasing pain disorder prevalence, and healthcare system emphasis on quality of life improvement that support sustained analgesic demand and pain management protocol advancement.

Acute Pain Relief captures 28% market share through immediate pain management in injuries, dental procedures, minor surgeries, and short-duration painful conditions requiring temporary analgesic intervention.

Post-Surgical Pain applications account for 18% market share, including orthopedic procedures, abdominal surgeries, and recovery periods requiring multimodal analgesia with opioid-sparing approaches for optimal pain control and rehabilitation.

Neuropathic Pain maintains 12% market share through diabetic neuropathy, postherpetic neuralgia, and nerve injury conditions requiring specialized analgesics with distinct mechanisms addressing nerve pain characteristics.

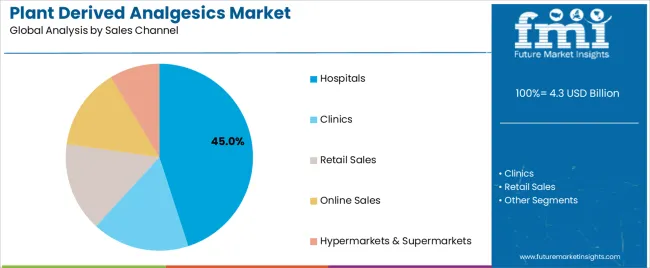

Market Position: Hospitals command dominant market presence with 45% share through inpatient care requirements that demand comprehensive analgesic formularies for acute and post-operative pain management.

Value Drivers: This channel provides controlled medication access, professional administration, and comprehensive pain protocols that meet requirements for severe pain management while maintaining safety monitoring.

Growth Characteristics: The segment benefits from surgical volume growth, pain service expansion, and enhanced recovery protocols that support hospital analgesic utilization and multimodal pain management adoption.

Clinics capture 22% market share through outpatient pain management, primary care prescribing, and specialty pain centers requiring analgesic options for ambulatory care and chronic condition management.

Retail sales account for 18% market share, including community pharmacies, prescription dispensing, and over-the-counter products enabling convenient analgesic access for consumer pain management needs.

Online sales capture 10% market share through e-pharmacy growth, telemedicine prescriptions, and direct-to-consumer channels providing convenient access with home delivery for chronic medication needs.

Hypermarkets & Supermarkets maintain 5% market share through over-the-counter analgesic sales, consumer products, and accessible pain relief options for minor pain conditions and self-care applications.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Chronic pain prevalence & aging demographics (arthritis, back pain, cancer-related pain) | ★★★★★ | Growing chronic pain burden drives analgesic demand; aging populations require long-term pain management with plant-derived alternatives offering favorable safety profiles. |

| Driver | Opioid crisis & demand for alternatives (abuse concerns, overdose deaths, addiction risks) | ★★★★★ | Opioid epidemic creates urgency for safer alternatives; healthcare providers seek plant-based options with lower addiction potential while maintaining efficacy. |

| Driver | Cannabis legalization & CBD acceptance (medical marijuana laws, hemp-derived products) | ★★★★★ | Expanding legal frameworks enable cannabinoid market growth; regulatory acceptance drives research, product development, and therapeutic integration. |

| Restraint | Regulatory complexity & controlled substance scheduling (DEA regulations, prescription requirements) | ★★★★☆ | Opioid analgesics face strict regulatory controls; prescription requirements, dispensing limitations, and monitoring programs create access barriers and compliance burdens. |

| Restraint | Efficacy concerns & standardization challenges (variable potency, extraction inconsistency) | ★★★☆☆ | Botanical products face standardization issues; inconsistent active compound concentrations and bioavailability variations limit clinical adoption and therapeutic reliability. |

| Trend | Precision medicine & pharmacogenomics (genetic testing, personalized dosing, metabolism profiling) | ★★★★★ | Genetic variability affects opioid metabolism; CYP2D6 testing enables personalized codeine and morphine dosing for optimized efficacy and safety. |

| Trend | Multimodal pain management protocols (combination therapy, opioid-sparing approaches, regional anesthesia) | ★★★★☆ | Evidence-based protocols reduce opioid dependence; plant-derived analgesics integrated with NSAIDs, regional blocks, and non-pharmacological approaches for comprehensive care. |

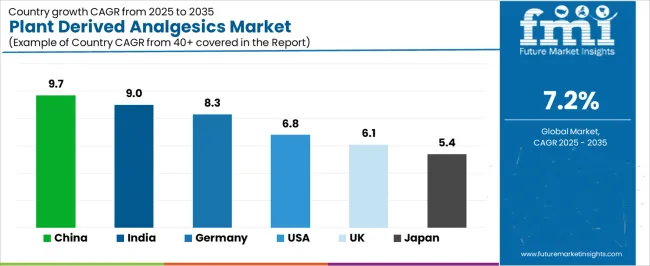

The plant derived analgesics market demonstrates varied regional dynamics with Growth Leaders including China (9.7% growth rate) and India (9.0% growth rate) driving expansion through healthcare infrastructure development and traditional medicine integration programs. Steady Performers encompass Germany (8.3% growth rate), United States (6.8% growth rate), and developed regions, benefiting from established pharmaceutical industries and pain management protocol advancement. Emerging Markets feature developing regions where healthcare access initiatives and medication affordability support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through traditional medicine heritage and pharmaceutical manufacturing development, while European countries maintain strong expansion supported by natural medicine acceptance and cannabis legalization trends. North American markets show moderate growth driven by opioid alternative seeking and medical cannabis programs.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 9.7% | Focus on traditional medicine integration; manufacturing scale | Quality control issues; export restrictions |

| India | 9.0% | Lead with affordable generics; ayurvedic combinations | Regulatory inconsistency; counterfeit products |

| Germany | 8.3% | Emphasize cannabis therapeutics; quality standards | Strict regulations; reimbursement barriers |

| United States | 6.8% | Push opioid alternatives; evidence generation | DEA scheduling; litigation risks; pricing pressure |

| U.K. | 6.1% | Offer NHS-approved options; cost-effectiveness | Formulary restrictions; budget constraints |

| Japan | 5.4% | Premium quality; safety documentation | Conservative prescribing; traditional preferences |

China establishes fastest market growth through comprehensive healthcare expansion programs and traditional medicine integration development, incorporating plant derived analgesics as standard components in pharmaceutical formularies and traditional Chinese medicine applications. The country's 9.7% growth rate reflects government initiatives promoting healthcare access and traditional medicine modernization that encourage the use of botanical analgesics in hospital and community healthcare facilities. Growth concentrates in major urban centers, including Beijing, Shanghai, and Guangzhou, where pharmaceutical manufacturing showcases integrated plant-based analgesic production that appeals to healthcare providers seeking traditional medicine compatibility and modern pharmaceutical standardization applications.

Chinese pharmaceutical manufacturers are developing botanical analgesic solutions that combine traditional herbal medicine knowledge with modern extraction technologies, including standardized formulations and quality-controlled production. Distribution channels through hospital pharmacies and retail chains expand market access, while government healthcare programs support adoption across diverse pain management and traditional medicine segments.

Strategic Market Indicators:

In Mumbai, Delhi, and Bangalore, healthcare facilities and pharmaceutical companies are implementing plant derived analgesics as standard therapeutic options for pain management and ayurvedic medicine applications, driven by increasing healthcare access and government pharmaceutical programs that emphasize the importance of affordable medication availability. The market holds a 9.0% growth rate, supported by government generic medicine initiatives and traditional medicine system integration programs that promote botanical analgesics for healthcare and ayurvedic facilities. Indian healthcare providers are adopting analgesic products that provide cost-effective pain management and traditional medicine compatibility, particularly appealing in regions where medication affordability and traditional therapy acceptance represent critical healthcare requirements.

Market expansion benefits from growing generic pharmaceutical manufacturing and ayurvedic medicine infrastructure that enable widespread production of plant-based analgesics for domestic and export applications. Technology adoption follows patterns established in pharmaceutical development, where affordability and traditional medicine integration drive product acceptance and market deployment.

Market Intelligence Brief:

Germany establishes market leadership through comprehensive medical cannabis programs and advanced pharmaceutical infrastructure development, integrating plant derived analgesics across pain management and palliative care applications. The country's 8.3% growth rate reflects established pharmaceutical industry relationships and progressive cannabis policy adoption that supports widespread use of botanical analgesics in hospital and outpatient facilities. Growth concentrates in major healthcare centers, including Berlin, Munich, and Hamburg, where pain management expertise showcases mature plant-based analgesic deployment that appeals to physicians seeking evidence-based botanical options and cannabis therapeutic applications.

German pharmaceutical providers leverage established distribution networks and comprehensive clinical evidence capabilities, including cannabis prescription programs and quality assurance systems that create prescriber confidence and patient access. The market benefits from mature healthcare standards and pain management guidelines that support botanical analgesic adoption while encouraging research advancement and therapeutic optimization.

Market Intelligence Brief:

United States demonstrates growing plant derived analgesics adoption with 6.8% growth rate, driven by opioid crisis response and alternative pain management seeking. Major healthcare markets including California, Texas, and Florida showcase pain management innovation where plant-based analgesics provide options for chronic pain patients seeking opioid alternatives and physicians implementing opioid-sparing protocols to address addiction concerns and improve patient safety. The market benefits from medical cannabis legalization in multiple states, substantial pain management research, and growing consumer demand for natural health products. American healthcare providers prioritize evidence-based efficacy, regulatory compliance, and integration with comprehensive pain management approaches.

Distribution patterns favor established pharmaceutical channels with controlled substance expertise, while medical cannabis dispensaries serve qualified patients through state-regulated programs. Market growth concentrates in chronic pain and palliative care segments where botanical alternatives address opioid concerns while maintaining analgesic efficacy.

Market Intelligence Brief:

United Kingdom's healthcare market demonstrates moderate plant derived analgesics adoption with 6.1% growth rate, supported by NHS pain management programs and medical cannabis framework development. Major healthcare regions including London, Manchester, and Birmingham showcase pain service development where botanical analgesics provide treatment options for chronic pain patients within structured clinical pathways and specialist pain clinic protocols. The market benefits from established pharmaceutical distribution, growing medical cannabis prescribing, and evidence-based pain management guidelines emphasizing multimodal approaches.

British healthcare providers prioritize cost-effectiveness, clinical evidence, and formulary approval for medication adoption. Distribution channels through NHS pharmacies and specialist pain services expand access for qualified patients meeting clinical criteria.

Strategic Market Considerations:

Japan's market expansion benefits from aging population pain management needs, including chronic pain in elderly populations and cancer care, with healthcare programs increasingly recognizing botanical analgesics for specific therapeutic applications. The country maintains a 5.4% growth rate, driven by demographic pressures and gradual acceptance of alternative pain management approaches, including botanical options with established safety documentation.

Market dynamics focus on pharmaceutical-grade botanical products that balance therapeutic efficacy with rigorous quality standards important to Japanese healthcare regulations. Growing chronic disease prevalence creates continued demand for diverse analgesic options in healthcare infrastructure and pain management program development.

Strategic Market Considerations:

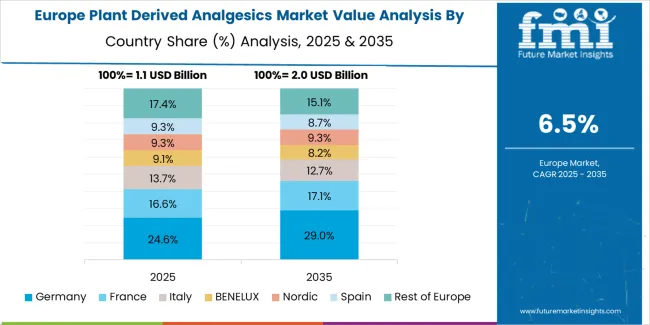

The plant derived analgesics market in Europe is projected to grow from USD 1,492.4 million in 2025 to USD 2,847.6 million by 2035, registering a CAGR of 6.7% over the forecast period. Germany is expected to maintain its leadership position with a 32.8% market share in 2025, supported by its advanced medical cannabis infrastructure and major pharmaceutical manufacturing centers in North Rhine-Westphalia, Bavaria, and Baden-Württemberg.

United Kingdom follows with a 23.4% share in 2025, driven by comprehensive NHS pain management programs and specialist cannabis prescribing framework development. France holds a 18.6% share through hospital pain services and emerging medical cannabis pilot programs. Italy commands a 13.7% share, while Spain accounts for 11.5% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 6.9% to 8.2% by 2035, attributed to increasing plant-based analgesic adoption in Nordic countries and emerging Eastern European markets implementing pain management modernization programs.

South Korea demonstrates emerging plant derived analgesics adoption with 7.4% growth rate, driven by pharmaceutical innovation and healthcare system modernization. Major healthcare centers including Seoul, Busan, and Incheon showcase research hospitals where botanical analgesic development explores traditional Korean medicine integration with modern pharmaceutical formulations to address chronic pain conditions through culturally appropriate therapeutic approaches. The market benefits from advanced pharmaceutical manufacturing, growing chronic disease burden, and research interest in botanical medicine optimization.

Korean healthcare providers prioritize evidence-based efficacy, safety documentation, and integration with conventional pain management protocols. Market growth reflects both pharmaceutical industry innovation and gradual healthcare system acceptance of botanical alternatives. Distribution channels through hospital pharmacies and healthcare institutions serve medical applications, while growing interest in preventive wellness creates consumer market opportunities. Research partnerships between Korean pharmaceutical companies and traditional medicine institutions facilitate botanical analgesic development tailored to local healthcare needs and regulatory requirements including standardized herbal extracts and modern delivery systems for traditional medicinal plants with analgesic properties.

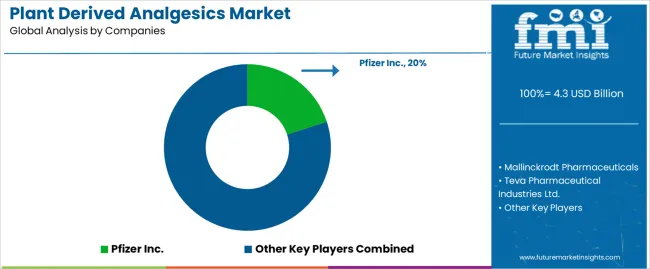

The plant derived analgesics market demonstrates moderately consolidated competitive dynamics with approximately 40-60 active pharmaceutical manufacturers globally, where top 5 players control 55-60% revenue share through established product portfolios, regulatory expertise, and healthcare provider relationships. Market leadership requires balancing multiple capabilities including botanical sourcing, extraction technology, pharmaceutical formulation, regulatory compliance, and clinical evidence generation across diverse therapeutic and consumer segments.

Structure: Competitive landscape divides between established pharmaceutical companies with comprehensive analgesic portfolios including plant-derived options, specialized botanical medicine manufacturers focused on natural pain relief, generic pharmaceutical companies producing off-patent plant analgesics, and emerging cannabis-focused companies developing cannabinoid therapeutics. Traditional pharmaceutical leaders maintain advantage through regulatory expertise and healthcare system relationships, while botanical specialists differentiate through extraction technology, standardization capabilities, and natural product positioning.

Leadership is maintained through: extensive distribution networks, regulatory compliance capabilities, clinical evidence portfolios, and healthcare provider relationships (medical education programs, formulary inclusion, prescription support, patient assistance programs).

What's commoditizing: generic morphine and codeine formulations, basic curcumin supplements, and standard CBD oils without differentiation or clinical validation.

Margin Opportunities: abuse-deterrent opioid formulations, pharmaceutical-grade cannabinoid medicines, novel delivery systems (transdermal patches, sublingual films), combination products with synergistic botanicals, personalized pain medicine services, and comprehensive pain management programs integrating plant-based options.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Major pharmaceutical companies | Opioid manufacturing, regulatory expertise, distribution scale | Established products, healthcare relationships, quality systems | Innovation speed; natural product positioning; cannabis entry |

| Generic manufacturers | Cost-effective production, regulatory pathways, volume capacity | Pricing competitiveness, manufacturing efficiency, market access | Brand differentiation; premium positioning; novel formulations |

| Botanical medicine specialists | Extraction technology, standardization expertise, natural positioning | Quality botanical sourcing, traditional medicine knowledge, consumer trust | Pharmaceutical regulations; clinical evidence; prescription market |

| Cannabis companies | Cannabinoid expertise, cultivation control, novel products | Innovation capability, consumer engagement, alternative channel | Traditional healthcare access; regulatory complexity; evidence gaps |

| Nutraceutical brands | Consumer marketing, retail distribution, wellness positioning | Brand recognition, direct-to-consumer capability, lifestyle integration | Pharmaceutical standards; prescriber relationships; efficacy evidence |

Market competition intensifies around regulatory compliance, clinical evidence generation, and differentiated formulation development. Companies investing in abuse-deterrent technologies, pharmaceutical-grade cannabinoid medicines, and comprehensive clinical programs position themselves advantageously for sustained market share gains. Success increasingly depends on balancing botanical authenticity with pharmaceutical rigor and evidence-based medicine requirements that drive prescriber confidence and healthcare system adoption across diverse pain management applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 4,262.9 million |

| Product Type | Morphine, Codeine, Salicin, Cannabinoids (CBD), Curcumin |

| Formulation Type | Tablets, Capsules, Creams, Injectable Forms, Oils |

| Application | Chronic Pain Management, Acute Pain Relief, Post-Surgical Pain, Neuropathic Pain |

| Sales Channel | Hospitals, Clinics, Retail Sales, Online Sales, Hypermarkets & Supermarkets |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | China, India, Germany, United States, United Kingdom, Japan, South Korea, France, Canada, Australia, and 30+ additional countries |

| Key Companies Profiled | Pfizer Inc., Mallinckrodt Pharmaceuticals, Teva Pharmaceutical Industries Ltd., Johnson & Johnson, NOW Foods, Purdue Pharma L.P., Sun Pharmaceutical Industries Ltd., Endo Pharmaceuticals Inc., GW Pharmaceuticals |

| Additional Attributes | Dollar sales by product type and application categories, regional adoption trends across East Asia, North America, and Western Europe, competitive landscape with pharmaceutical manufacturers and botanical medicine suppliers, healthcare provider preferences for analgesic efficacy and safety profiles, integration with pain management protocols and multimodal therapy approaches, innovations in extraction technology and formulation development, and advancement of plant-based analgesics with enhanced performance and pain relief optimization capabilities. |

The global plant derived analgesics market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the plant derived analgesics market is projected to reach USD 8,543.8 billion by 2035.

The plant derived analgesics market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in plant derived analgesics market are morphine, codeine, salicin, cannabinoids (cbd) and curcumin.

In terms of formulation type, tablets segment to command 40.4% share in the plant derived analgesics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Beverage Market Forecast and Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Plastic Market Forecast and Outlook 2025 to 2035

Plant Stem Cell Encapsulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Skincare Product Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Cheese Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plant Sterol Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Foam Market Size and Share Forecast Outlook 2025 to 2035

Planting Machinery Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Based Meals Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Squalane Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Breeding Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Protein Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Plant-Powered Exfoliants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA