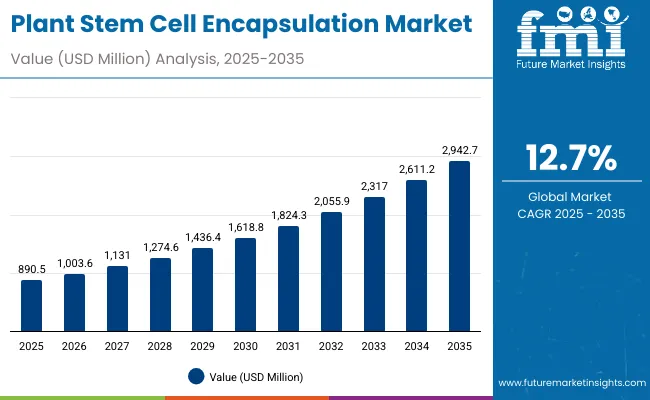

The Plant Stem Cell Encapsulation Market is expected to record a valuation of USD 890.5 million in 2025 and USD 2,942.7 million in 2035, with an increase of USD 2,052.2 million, which equals a growth of nearly 230% over the decade. The overall expansion represents a CAGR of 12.7% and more than a 3X increase in total market value.

During the first five-year period from 2025 to 2030, the market increases from USD 890.5 million to USD 1,618.8 million, adding USD 728.3 million, which accounts for 35.5% of the total decade growth. This phase records steady adoption in anti-aging and regeneration skincare, driven by demand for high-efficacy formulations based on bioactive encapsulated stem cells. Serums dominate this phase as they cater to over 50% of all applications due to their higher delivery efficiency, lightweight texture, and compatibility with microsphere and liposome technologies.

The second half from 2030 to 2035 contributes USD 1,323.9 million, equal to 64.5% of total growth, as the market jumps from USD 1,618.8 million to USD 2,942.7 million. This acceleration is powered by the widespread commercialization of nanocapsules and hydrogel-based delivery systems, combined with the rise of AI-powered formulation design and microbiome-targeted encapsulation. The proliferation of hybrid cosmetic-biotech collaborations and the expansion of luxury skincare lines in China, Japan, and India are expected to drive exponential value creation. The software-equivalent revenue stream within this industry comes from licensing proprietary encapsulation technologies and patent royalties, which together will account for a rising portion of total value by 2035.

Plant Stem Cell Encapsulation Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Market Value (2025E) | USD 890.5 million |

| Forecast Market Value (2035F) | USD 2,942.7 million |

| Forecast CAGR (2025 to 2035) | 12.70% |

From 2020 to 2024, the Plant Stem Cell Encapsulation Market grew from an estimated USD 620 million to USD 890.5 million, driven by strong R&D investments in encapsulation biotechnology and the commercialization of botanical actives sourced from alpine and marine plants. During this period, the competitive landscape was dominated by biotech developers and premium skincare manufacturers controlling nearly 75% of total revenue. Leaders such as Mibelle Biochemistry and Givaudan Active Beauty advanced encapsulated delivery systems that improved ingredient stability, efficacy, and sustained release. Competitive differentiation relied heavily on the ability to maintain bioactivity during storage and skin penetration, while the packaging and sensorial performance served as key differentiators in luxury and dermocosmetic segments.

Technology transfer and formulation licensing began gaining traction toward 2024, signaling a structural shift from product-based to technology-driven value creation within the market.

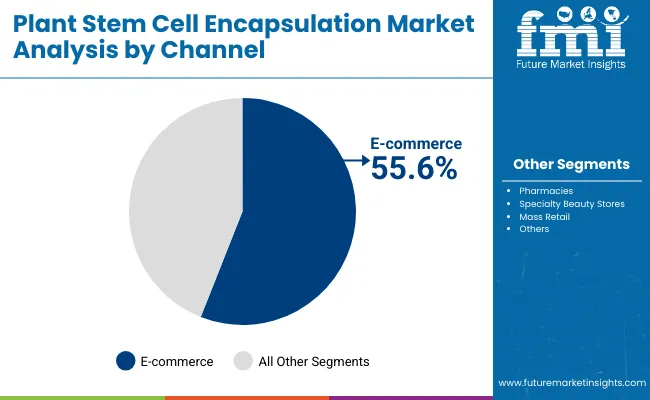

Demand for encapsulated plant stem cell formulations is expected to expand to USD 890.5 million in 2025, as encapsulation becomes an industry benchmark for high-performance skincare innovation. The revenue mix is rapidly evolving, with serums and ampoules leading product adoption and E-commerce channels surpassing 55% share through digital-native beauty brands.

Traditional cosmetic houses face growing competition from bio-labs and independent D2C innovators offering liposome-based delivery for anti-aging and brightening applications. Leading firms are shifting toward AI-optimized encapsulation processes and hybrid models combining plant stem cells with peptides and ceramides for amplified regenerative efficacy. The competitive advantage is increasingly shaped by proprietary biotechnology, sustainability in sourcing, and partnerships between cosmetic formulators and biotech R&D companies, rather than packaging or branding alone.

The Plant Stem Cell Encapsulation Market is growing due to technological convergence between biotechnology and cosmetics, which has improved the bioavailability and stability of active ingredients. Advances in microsphere and liposome encapsulation have enabled time-controlled delivery of plant-derived actives such as edelweiss, alpine rose, and apple stem cells. These encapsulated systems prevent oxidation and degradation, resulting in higher efficacy and improved consumer-perceived results in anti-aging, regeneration, and brightening functions.

In addition, nanocapsule and hydrogel technologies have elevated delivery precision by ensuring deeper skin penetration and compatibility with sensitive-skin formulations. The rise of AI-assisted encapsulation design, biodegradable carrier materials, and peptide-binding encapsulation techniques has further diversified application areas across serums, creams, and ampoules. Industries across the skincare and cosmeceutical spectrum are driving demand for encapsulated solutions that balance efficacy with clean-label and sustainable sourcing.

The expansion of personalized skincare and biotech collaboration models has further accelerated growth. E-commerce remains the most influential distribution channel, supported by digital consultations, AR-driven diagnostics, and subscription-based skincare ecosystems. Segment growth is expected to be led by anti-aging and wrinkle reduction functions, serum-based formulations, and microsphere encapsulation technologies due to their superior delivery performance and alignment with consumer trends in high-performance skincare.

The market is segmented by Function, Product Type, Technology, Channel, and Region.

Functions include Anti-aging & wrinkle reduction, Repair & regeneration, Brightening, and Hydration, reflecting the diversity of biological benefits derived from encapsulated plant stem cells. Product types cover Serums, Creams & lotions, Ampoules, and Masks, forming the core product categories that define application and delivery format.

| Product Type | Value Share % 2025 |

|---|---|

| Serums | 51.5% |

| Others | 48.5% |

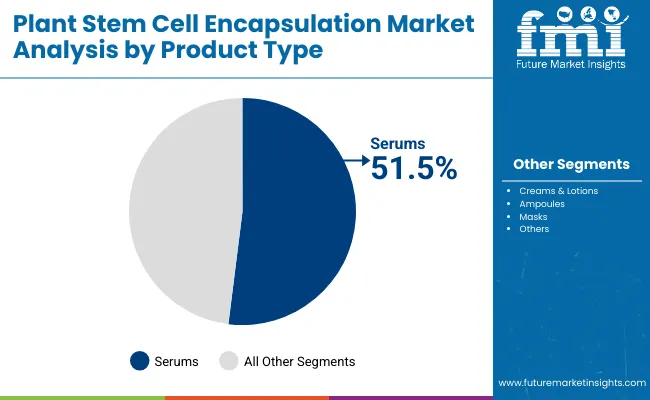

The Serum segment is projected to contribute 51.5% of the Plant Stem Cell Encapsulation Market revenue in 2025, maintaining its leadership as the dominant product type. This dominance is attributed to the growing consumer preference for lightweight, fast-absorbing, and high-efficacy formulations that leverage encapsulation for improved actives delivery. Serums provide enhanced penetration and higher concentration of encapsulated actives, making them the preferred choice for anti-aging, brightening, and repair applications.

This segment’s momentum is supported by rapid innovation in dual-phase encapsulation, airless packaging, and AI-assisted ingredient calibration. Major brands are also developing multi-dose ampoule kits and smart refills, which have amplified the adoption of encapsulated serums across online retail and premium skincare platforms. As the technology matures, serums are expected to remain the cornerstone of encapsulated skincare portfolios worldwide.

| Channel | Value Share % 2025 |

|---|---|

| E-commerce | 55.6% |

| Others | 44.4% |

The E-commerce segment is forecasted to hold 55.6% of the market share in 2025, led by strong consumer engagement through online beauty platforms and brand-owned digital stores. Online-exclusive launches, subscription skincare models, and influencer-driven marketing campaigns have elevated the digital channel to the top revenue contributor globally.

E-commerce platforms have enabled better consumer education regarding encapsulated technologies and sustainability claims, while offering dynamic personalization through quizzes and AR-based diagnostic tools. Furthermore, increasing digitalization in China, South Korea, and the USA has boosted online conversions for biotech skincare. As D2C and hybrid digital-physical retail evolve, the E-commerce channel is set to maintain its dominance throughout the decade.

| Technology | Value Share % 2025 |

|---|---|

| Microsphere encapsulation | 48.5% |

| Others | 51.5% |

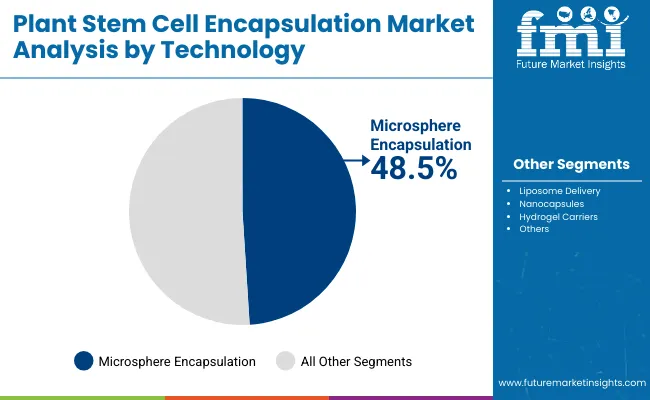

The Microsphere encapsulation technology segment is projected to account for the largest share of Plant Stem Cell Encapsulation Market revenue in 2025, establishing it as the leading encapsulation method. This technology offers controlled release, enhanced ingredient stability, and sustained bioavailability, making it ideal for high-performance skincare formulations.

Microspheres, often derived from biodegradable polymers and natural gums, protect sensitive plant actives from oxidation and UV degradation while ensuring prolonged skin contact time. Advances in biopolymer coatings, microfluidic encapsulation, and crosslinked hydrogel spheres have expanded its application across serums and creams. Given its balance between cost, efficacy, and scalability, microsphere encapsulation is expected to remain the preferred method through 2035, while liposomes and nanocapsules will continue gaining relevance in advanced anti-aging and regenerative treatments.

Technological Synergy Between Bioencapsulation and Cosmetic Actives

One of the most powerful growth drivers in the Plant Stem Cell Encapsulation Market is the technological convergence of biotechnology and cosmetic formulation science, particularly in controlled delivery systems. The market has evolved from using basic encapsulation for stability to deploying multi-layer microsphere and nanocapsule matrices that deliver precise time-release of plant stem cell actives such as edelweiss, sea fennel, and Swiss apple extracts.

These technologies enhance efficacy by ensuring that active cells remain viable until absorption, minimizing oxidation and degradation during storage. Companies like Mibelle Biochemistry and Givaudan Active Beauty are developing next-generation encapsulation protocols that combine liposome bilayers with peptide linkers, allowing controlled diffusion through skin layers. This has significantly increased ingredient potency, driving adoption by luxury skincare brands. Furthermore, encapsulation technology has become a key differentiator in patent portfolios, fueling licensing-based revenue and long-term R&D collaboration between biotech labs and cosmetic houses globally.

Rising Demand for Sustainable and Biodegradable Encapsulation Carriers

The second major driver is the shift toward sustainable encapsulation materials in response to tightening environmental regulations and consumer scrutiny. Brands are increasingly replacing synthetic polymers and silicone shells with biodegradable polysaccharide hydrogels, alginate spheres, and plant-derived nanofibers that align with clean beauty standards.

This movement is particularly strong in Europe and Japan, where regulatory bodies such as the EU Cosmetics Regulation (EC No. 1223/2009) and Japan’s quasi-drug framework are influencing encapsulation material compliance. By 2030, over 40% of encapsulated formulations are projected to use biodegradable systems, reducing microplastic concerns while maintaining performance. Companies like Clarins and Amorepacific have pioneered plant-based encapsulation matrices, leading to both sustainability branding advantages and improved ingredient compatibility. The integration of green chemistry principles into encapsulation manufacturing is now a central value driver that is attracting both institutional investors and biotech partnerships.

High Cost of Encapsulation Technology Scale-up and Validation

Despite its growth, the Plant Stem Cell Encapsulation Market faces a structural restraint in the high production and validation costs associated with encapsulation at scale. Developing microsphere or liposome systems involves complex emulsion processes, particle size control, and compatibility testing under ISO and cosmetic GMP conditions.

For smaller brands and contract manufacturers, the cost per kilogram of encapsulated actives can exceed conventional formulations by 200-300%. Moreover, maintaining consistency across batches requires specialized equipment such as microfluidizers, ultrasonic dispersers, and precision homogenizers, which demand significant capital investment.

The regulatory validation of encapsulated actives also remains lengthy, as proving bioavailability and sustained-release efficacy often necessitates both in-vitro diffusion studies and human skin compatibility trials. These costs limit scalability, particularly in emerging markets, where local manufacturers still rely on conventional emulsions.

Complexity of Stability and Release Control in Multi-Active Formulations

Another major restraint is the challenge of stability when encapsulating multiple actives within a single carrier system. As brands move toward "all-in-one" multifunctional skincare products, ensuring that diverse actives such as antioxidants, peptides, and stem cell extracts retain stability without premature release has become technically demanding.

Encapsulation systems must maintain structural integrity under varying temperature, pH, and viscosity conditions during both production and consumer use. The risk of cross-reactivity between encapsulated molecules can compromise efficacy and shelf life. For instance, co-encapsulating hydrophilic plant extracts with lipophilic compounds often leads to uneven diffusion rates or burst release.

These issues increase formulation time and R&D cost, while also deterring mass adoption by private-label or low-cost brands. Manufacturers must invest in predictive modeling and nanostructure simulations to optimize release kinetics capabilities not yet common across all regions.

Emergence of AI-Driven Formulation Design and Predictive Encapsulation Modeling

A defining trend shaping the next decade of the Plant Stem Cell Encapsulation Market is the integration of artificial intelligence and computational modeling in formulation design. Leading biotech labs and skincare conglomerates are adopting AI-based platforms to simulate encapsulation dynamics, predict stability under stress conditions, and optimize active-to-carrier ratios for improved absorption efficiency.

AI tools can analyze molecular interactions between stem cell metabolites (such as polyphenols or amino acids) and encapsulation materials to forecast shelf stability and release timing before physical trials. This has drastically reduced development timelines from 18-24 months to under 10 months for certain premium brands.

Companies like Estée Lauder and Shiseido are now building digital formulation twins to model ingredient diffusion and consumer response, enhancing personalization at scale. The AI-driven encapsulation process is also enabling faster adaptation to market trends like sensitivity-friendly skincare and microbiome-safe formulations, making it one of the most transformative technological shifts in this sector.

Asia-Pacific Becoming the Global Production and Innovation Hub

Another significant trend is the geographic pivot of encapsulated plant stem cell R&D and manufacturing toward Asia-Pacific, particularly China, Japan, and South Korea. These countries are rapidly scaling domestic biotech infrastructure to support plant tissue culture and encapsulation research.

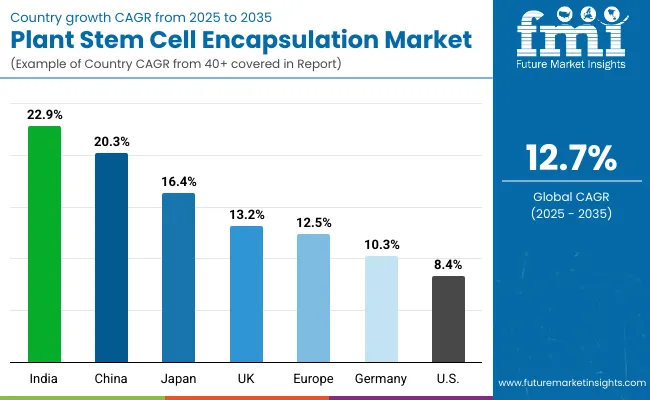

China’s CAGR of 20.3% and India’s 22.9% clearly highlight the speed of adoption. Regional players are integrating microfluidic encapsulation lines and fermentation-based stem cell cultivation, reducing dependency on imported raw materials. The combination of local botanical biodiversity and advanced encapsulation labs has made Asia a global innovation hub.

Brands like Amorepacific and KORRES are using indigenous plant cells (ginseng, lotus, centella) encapsulated in bio-based carriers to create culturally relevant, high-performance skincare. The expansion of e-commerce and social commerce in the region also ensures faster go-to-market cycles. This shift is redefining the global competitive balance, positioning Asia-Pacific not only as a consumer market but as the epicenter of encapsulated cosmetic biotechnology innovation.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 20.3% |

| USA | 8.4% |

| India | 22.9% |

| UK | 13.2% |

| Germany | 10.3% |

| Japan | 16.4% |

| Europe | 12.50% |

The Plant Stem Cell Encapsulation Market shows clear regional divergence in growth trajectories between mature and emerging economies. China, India, and Japan are expected to drive the majority of incremental revenue gains through 2035, recording CAGRs of 20.3%, 22.9%, and 16.4%, respectively. These Asian markets are benefitting from rapid adoption of biotech-driven skincare innovations and the growing preference for encapsulated serums and ampoules among younger consumers seeking visible, science-backed results. China’s growth is reinforced by aggressive investment in domestic cosmetic biotechnology, where local laboratories are scaling microfluidic encapsulation and fermented plant cell extraction capabilities.

India, on the other hand, is emerging as the fastest-growing market globally, supported by rising disposable income, an expanding cosmeceutical segment, and a strong trend toward vegan and herbal encapsulated formulations. Japan continues to strengthen its premium skincare ecosystem, integrating liposome delivery systems into anti-aging and hydration categories across leading domestic brands. Collectively, the Asia-Pacific region is poised to account for more than half of the global market’s new value creation over the decade, with local R&D hubs rapidly transitioning from ingredient importers to exporters of patented encapsulation technologies.

In contrast, the USA and Europe represent more mature but stable segments of the Plant Stem Cell Encapsulation Market, growing at 8.4% and 12.5%, respectively. The USA market, while slower in absolute percentage growth, remains central to premium skincare innovation due to its concentration of biotech startups, clean-beauty brands, and e-commerce-driven sales models, especially through direct-to-consumer channels. Europe, including key markets such as Germany (10.3%) and the UK (13.2%), continues to advance through regulatory leadership and strong consumer demand for biodegradable encapsulation carriers and plant-derived actives.

Germany is at the forefront of sustainable material development, while the UK is emerging as a testing ground for AI-based formulation design and adaptive encapsulation systems used in premium brands like Clarins and Estée Lauder. Together, these regions define the dual growth narrative of the market Asia’s expansion fueled by technological scaling and new consumer acquisition, and the West’s growth anchored in sustainability, regulation-driven innovation, and premiumization.

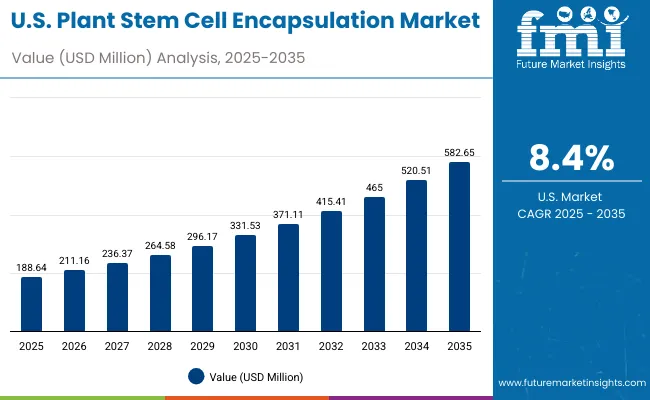

| Year | USA Plant Stem Cell Encapsulation Market (USD Million) |

|---|---|

| 2025 | 188.6 |

| 2026 | 211.2 |

| 2027 | 236.4 |

| 2028 | 264.6 |

| 2029 | 296.2 |

| 2030 | 331.5 |

| 2031 | 371.1 |

| 2032 | 415.4 |

| 2033 | 465.0 |

| 2034 | 520.5 |

| 2035 | 582.7 |

The Plant Stem Cell Encapsulation Market in the United States is projected to grow at a CAGR of 8.4%, driven by a strong consumer shift toward biotech-enhanced anti-aging and repair skincare products. The integration of encapsulated botanical actives in dermocosmetic formulations is expanding, particularly within premium and clinical-grade beauty ranges.

Growing awareness of cellular regeneration and sustained-release delivery systems has led to higher adoption by dermatologists and medi-spa chains. The market is also benefitting from the expansion of e-commerce and digital skincare consultations, where brands use AI-based skin analysis tools to recommend encapsulated formulations. The rise of D2C startups and clean beauty innovators is further increasing competition, leading to rapid innovation in nanocapsule-based formulations with biodegradable carriers.

The Plant Stem Cell Encapsulation Market in the United Kingdom is expected to grow at a CAGR of 13.2%, supported by strong uptake across premium skincare, dermatology-led retail, and sustainable biotech segments. British consumers are increasingly gravitating toward encapsulated serums and creams formulated with ethically sourced plant actives and biodegradable encapsulation materials.

The UK has also emerged as a European R&D hub for AI-based encapsulation design and clinical validation, with academic collaboration playing a central role in innovation. Domestic brands are focusing on transparency and efficacy, launching encapsulated formulations featuring alpine rose and grape stem cell complexes to compete with continental European players. Demand is also being driven by the growth of green laboratories and incubators under public-private partnerships that emphasize sustainability and low-waste cosmetic production.

India is witnessing exceptional growth in the Plant Stem Cell Encapsulation Market, projected to expand at a CAGR of 22.9% through 2035 the highest globally. The surge is led by a growing middle-class consumer base, rising awareness of cosmeceutical-grade skincare, and increased investments in domestic cosmetic manufacturing. Local brands are incorporating plant-derived stem cells from lotus, neem, and centella asiatica within encapsulated formulations, catering to both Ayurvedic and modern skincare preferences.

Cost-effective microsphere and hydrogel technologies have enabled scalability for smaller contract manufacturers and private-label producers. Furthermore, the government’s Make-in-India initiative is encouraging biotech startups to localize encapsulation technologies that were previously imported from Europe. With higher affordability and expanding digital retail access, encapsulated serums and ampoules are becoming mainstream across tier-2 and tier-3 cities.

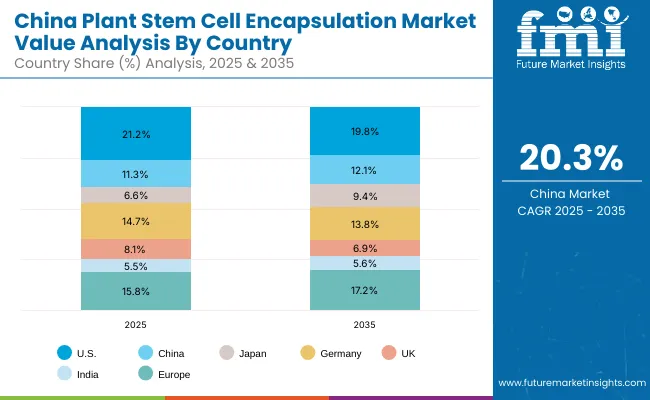

| Countries | 2025 Share (%) |

|---|---|

| USA | 21.2% |

| China | 11.3% |

| Japan | 6.6% |

| Germany | 14.7% |

| UK | 8.1% |

| India | 5.5% |

| Europe | 15.8% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 19.8% |

| China | 12.1% |

| Japan | 9.4% |

| Germany | 13.8% |

| UK | 6.9% |

| India | 5.6% |

| Europe | 17.2% |

The Plant Stem Cell Encapsulation Market in China is expected to grow at a CAGR of 20.3%, among the highest worldwide. The market’s momentum is driven by the rapid industrialization of the cosmetic biotechnology sector and an expanding ecosystem of domestic R&D laboratories. Chinese beauty and biotech companies are pioneering the use of microfluidic encapsulation, fermentation-derived plant actives, and AI-optimized liposome delivery systems for personalized skincare.

Government incentives for bio-based industries, combined with the rising popularity of sustainable and natural cosmetics, have strengthened local innovation capacity. In addition, China’s dominance in E-commerce through platforms like Tmall, Douyin, and RED has amplified brand visibility, accelerating mass consumer adoption. Affordable yet technologically sophisticated encapsulated serums are fueling growth not just in urban centers but also across lower-tier cities.

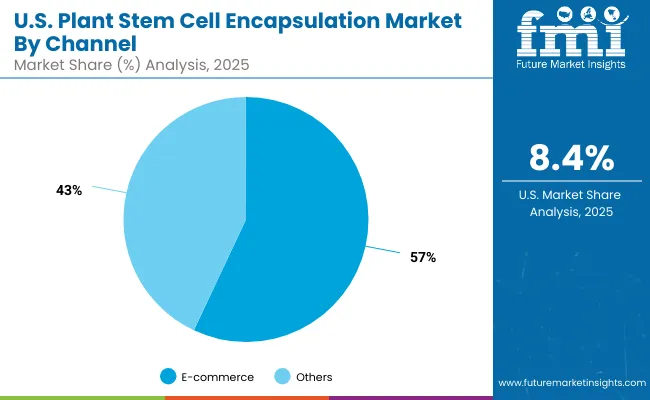

| USA Channel | Value Share % 2025 |

|---|---|

| E-commerce | 57.3% |

| Others | 42.7% |

The Plant Stem Cell Encapsulation Market in the United States is projected at USD 188.6 million in 2025, with E-commerce accounting for 57.3% and offline channels representing 42.7%. This digital dominance reflects the country’s transition toward online personalization and subscription-led skincare ecosystems, where consumer engagement is increasingly driven by AI-powered diagnostic platforms and data-driven skincare mapping. USA consumers exhibit a strong preference for encapsulated actives that offer measurable improvements in elasticity, hydration, and cell repair, driving the success of serum-based formats integrated with nanocapsule or liposome delivery systems.

The rise of clinical skincare and medically endorsed beauty brands has been instrumental in reshaping the American market. Dermatologists and estheticians are actively integrating encapsulated stem cell serums into in-office and at-home protocols to accelerate post-procedure recovery and dermal regeneration. In addition, bio-collaboration models between skincare brands and biotech labs are expanding offering proprietary encapsulation platforms licensed for anti-aging and regeneration categories. As USA consumers continue to prioritize long-term skin health over temporary cosmetic benefits, encapsulation technologies will remain central to the country’s premium skincare evolution.

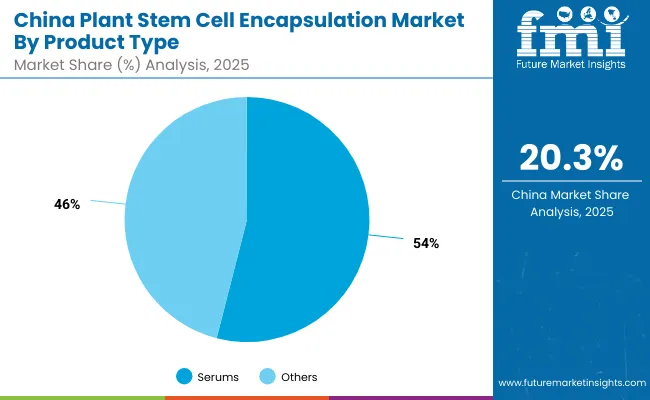

| China Product Type | Value Share % 2025 |

|---|---|

| Serums | 53.6% |

| Others | 46.4% |

The Plant Stem Cell Encapsulation Market in China is valued at USD 100.6 million in 2025 and is expected to expand at a CAGR of 20.3%, the fastest among leading global markets. Serums dominate with 53.6% share, supported by massive consumer adoption across online beauty platforms like Tmall, JD.com, and Douyin. China’s skincare sector is rapidly transforming into a biotechnology-led ecosystem, where microfluidic encapsulation and fermentation-based plant cell extraction are enabling high-efficacy, locally developed actives. This technical capability has reduced dependency on imported materials while enhancing formulation authenticity and brand differentiation.

The market’s growth trajectory is anchored in the national focus on sustainable cosmetics, with regulatory frameworks encouraging clean encapsulation practices and biodegradable carriers. Domestic brands are launching encapsulated serums formulated with lotus, ginseng, and green tea stem cell extracts ingredients deeply tied to traditional Chinese wellness philosophy but now powered by nanotechnology. Strategic investments from tech conglomerates and biotech incubators have further strengthened domestic production capacity. By 2035, China is expected to evolve from a manufacturing hub to a global exporter of encapsulated stem cell actives, reshaping the competitive balance of the market.

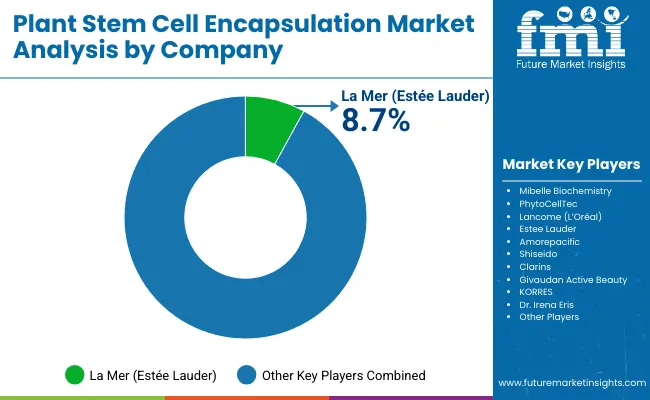

The Plant Stem Cell Encapsulation Market is moderately fragmented, with biotechnology firms, luxury skincare conglomerates, and active ingredient suppliers competing across specialized product categories. Estée Lauder’s La Mer leads with an 8.7% value share, leveraging its pioneering use of marine and plant-based encapsulated actives in luxury skincare formulations. The brand’s success stems from integrating liposome and nanocapsule delivery systems that enhance penetration depth and bioavailability, while maintaining exclusivity through proprietary encapsulation patents.

Key ingredient manufacturers such as Mibelle Biochemistry and Givaudan Active Beauty anchor the technology-driven side of the market. Mibelle’s PhytoCellTec™ platform remains the gold standard for plant stem cell encapsulation, widely licensed by international cosmetic houses. Givaudan, meanwhile, has evolved into a full-service biotechnology provider, developing biodegradable encapsulation matrices and supporting sustainability-led product innovation. Clarins, Shiseido, and Amorepacific lead the formulation and brand innovation segments by integrating AI-driven formulation design with encapsulation for targeted anti-aging and brightening outcomes.

Mid-sized innovators such as KORRES and Dr. Irena Eris focus on localized production and cultural adaptation, using indigenous botanical actives encapsulated through hydrogel and liposomal carriers to strengthen regional consumer loyalty. These players combine clean-label marketing with clinical-grade efficacy, bridging natural and technological skincare segments. The competitive landscape is evolving from a focus on ingredient quality to a broader ecosystem competition where brand success depends on integrated partnerships among biotech suppliers, digital formulation platforms, and retail analytics ecosystems.

Competitive differentiation now centers on sustainability, skin compatibility, and long-term performance validation. Brands with capabilities in AI-based release modeling, biodegradable carrier innovation, and encapsulation patents are expected to dominate through 2035, as consumer demand increasingly favors transparent science-backed skincare solutions.

Key Developments in Plant Stem Cell Encapsulation Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Function | Anti-aging & wrinkle reduction, Repair & regeneration, Brightening, and Hydration |

| Product Type | Serums, Creams & lotions, Ampoules, and Masks |

| Technology | Microsphere encapsulation, Liposome delivery, Nanocapsules, and Hydrogel carriers |

| Channel | E-commerce, Pharmacies, Specialty beauty stores, and Mass retail |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, and South Africa |

| Key Companies Profiled | Mibelle Biochemistry, PhytoCellTec, Lancome (L’Oréal), Estée Lauder, Amorepacific, Shiseido, Clarins, Givaudan Active Beauty, KORRES, and Dr. Irena Eris |

| Additional Attributes | Dollar sales by product type and function, adoption trends in liposome and nanocapsule delivery systems, rising demand for encapsulated serums and anti-aging formulations, sector-specific growth in premium skincare and dermocosmetics, encapsulation technology advancements in controlled-release and bioavailability, software-enabled formulation modeling, integration with AI-based personalization tools, regional growth influenced by biotech collaboration and sustainable material sourcing, and innovations in microsphere and hydrogel carrier design. |

The Plant Stem Cell Encapsulation Market is estimated to be valued at USD 890.5 million in 2025.

The market size for the Plant Stem Cell Encapsulation Market is projected to reach USD 2,942.7 million by 2035.

The Plant Stem Cell Encapsulation Market is expected to grow at a 12.7% CAGR between 2025 and 2035.

The key product types in the Plant Stem Cell Encapsulation Market are Serums, Creams & lotions, Ampoules, and Masks.

In terms of product type, the Serums segment is expected to command the leading share of 51.5% in the Plant Stem Cell Encapsulation Market in 2025, driven by its superior active delivery efficiency and rising consumer demand for high-performance skincare formats.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant Stem Cell Skincare Product Market Size and Share Forecast Outlook 2025 to 2035

Hematopoietic Stem Cell Transplantation Market - Trends & Growth 2025 to 2035

Stem Cell Therapy Market Size and Share Forecast Outlook 2025 to 2035

Stem Cell Concentration System Market Size and Share Forecast Outlook 2025 to 2035

Stem Cell Panel Market

Cell Therapy Systems Market Size and Share Forecast Outlook 2025 to 2035

Live Cell Encapsulation Market Analysis & Forecast for 2025 to 2035

Cell Harvesting Systems Market Size and Share Forecast Outlook 2025 to 2035

Single Cell Analysis System Market Growth – Trends & Forecast 2025 to 2035

Automated Cell Block Systems Market

Automated Cell Culture Systems Market Analysis - Size, Share & Forecast 2025-2035

Automated Cell Biology Systems Market Size and Share Forecast Outlook 2025 to 2035

Induced Pluripotent Stem Cells Production Market Size and Share Forecast Outlook 2025 to 2035

Automated Cell Therapy Processing Systems Market Trends - Outlook & Forecast 2025 to 2035

Subcutaneous Implantable Defibrillator System Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Feed Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Moisture Tester Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Diacetate Film Market Size and Share Forecast Outlook 2025 to 2035

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA