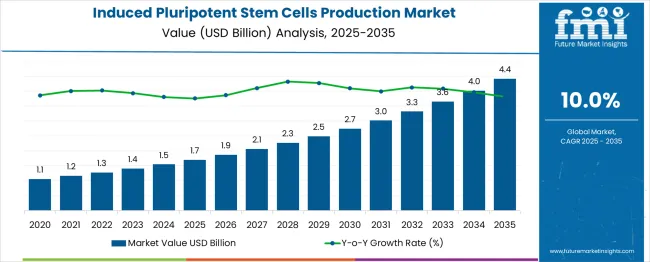

The induced pluripotent stem cells production market is valued at USD 1.7 billion in 2025 and is forecast to reach USD 4.4 billion by 2035, registering a CAGR of 10.0%. Analysis of the acceleration and deceleration pattern suggests an initial phase of stronger growth, driven by expanding research applications, increasing funding, and rising interest in regenerative medicine. As adoption broadens, the market experiences consistent acceleration through mid-forecast years, supported by technological advancements in cell reprogramming and differentiation. Toward the later years, a gradual deceleration is expected as the market approaches a more stable adoption curve, with growth sustained by clinical applications and commercialization but at a moderated pace compared to early expansion.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.7 billion |

| Forecast Market Value (2035) | USD 4.4 billion |

| Forecast CAGR (2025–2035) | 10.0% |

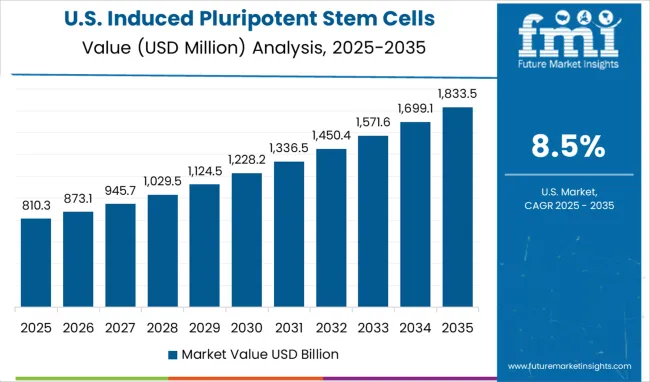

The market has gained significant momentum in recent years, driven by its expanding role in regenerative medicine, disease modeling, and drug discovery. Historical trends highlight consistent adoption across pharmaceutical and academic research institutions, supported by advances in reprogramming technologies and cell culture methods. When combined with a CAGR approach, long-term forecasting provides a reliable projection of market size. Current estimates suggest that the market will maintain a CAGR in the range of 8% to 10% over the next decade, reflecting strong demand for scalable iPSC production methods and increasing investments in personalized medicine research. The upward trendline confirms that market growth will not plateau in the near term, as emerging applications continue to drive new opportunities.

Looking forward to 2035, the market is projected to expand significantly, with CAGR-based compounding indicating a several-fold increase compared to its 2025 baseline. While occasional fluctuations may arise due to ethical debates, high production costs, and regulatory approval processes, these are expected to create short-term slowdowns rather than structural declines. Long-term trend analysis reinforces that the trajectory remains strongly upward, supported by breakthroughs in automated cell culture platforms and gene-editing integration. The combined forecasting approach illustrates that the induced pluripotent stem cells production market will remain a critical growth domain within life sciences, positioning itself as a cornerstone of future therapeutic and research innovations.

Market expansion is being supported by the revolutionary potential of iPSC technology in regenerative medicine and the growing demand for personalized therapeutic approaches that address individual patient genetic profiles. iPSCs offer unique advantages including patient-specific cell generation, unlimited proliferation capacity, and differentiation potential into any cell type, making them invaluable for drug development, disease modeling, and therapeutic applications. The technology addresses critical limitations of traditional cell sources while providing ethical alternatives to embryonic stem cells.

The increasing investment in regenerative medicine research and the growing focuses on personalized medicine are driving substantial demand for iPSC production capabilities and related technologies. Pharmaceutical companies are adopting iPSC platforms for drug discovery, toxicology testing, and therapeutic development to improve success rates and reduce development costs. Additionally, the advancing automation technologies and standardization of iPSC production protocols are making the technology more accessible and scalable for commercial applications, supported by regulatory framework development and quality assurance standards.

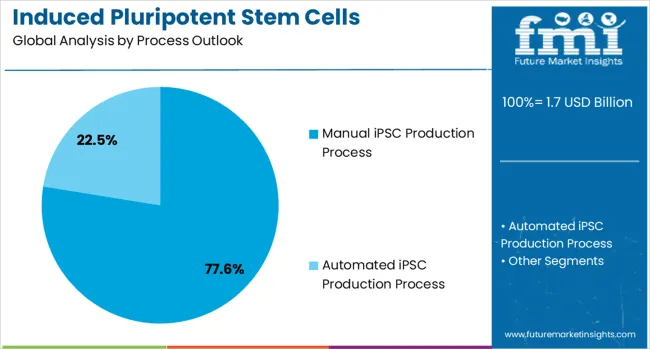

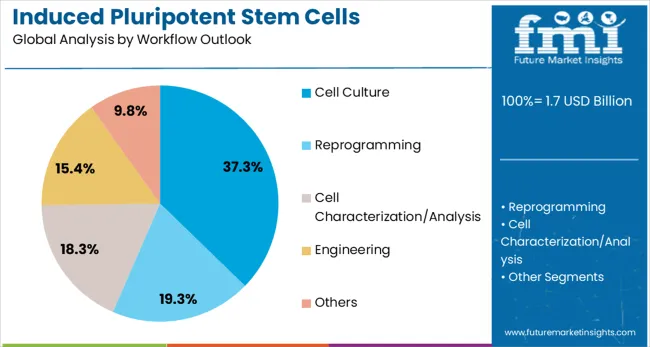

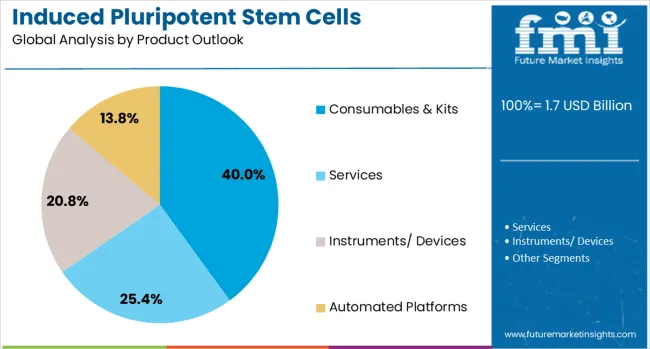

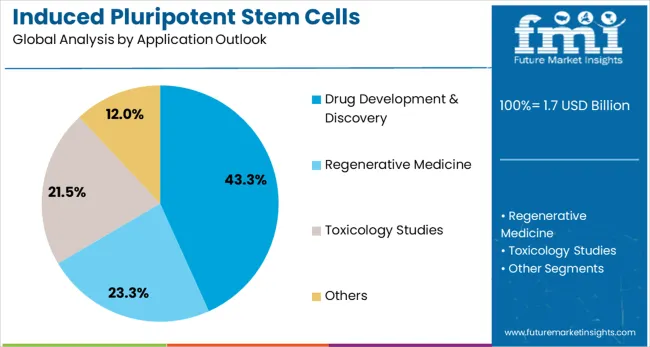

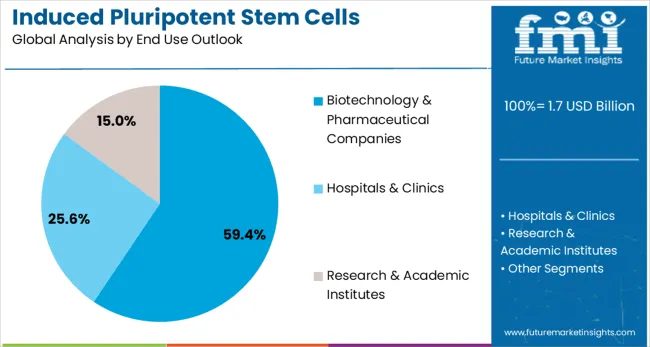

The market is segmented by process outlook, workflow outlook, product outlook, application outlook, end use outlook, and region. By process outlook, the market is divided into manual iPSC production process and automated iPSC production process. Based on workflow outlook, the market is categorized into cell culture, reprogramming, cell characterization/analysis, engineering, and others. In terms of product outlook, the market is segmented into consumables and kits, media, instruments/devices, services, and others. By application outlook, the market is classified into drug development and discovery, regenerative medicine, toxicology studies, and others. By end use outlook, the market is divided into biotechnology and pharmaceutical companies, hospitals and clinics, research and academic institutes, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Manual iPSC production processes are projected to account for 77.6% of the induced pluripotent stem cells production market in 2025. This leading share is supported by the current state of iPSC technology where manual processes remain essential for quality control, customization, and research applications. Manual production methods offer flexibility in protocol adaptation, specialized handling requirements, and research-specific modifications that automated systems cannot yet fully replicate. The segment benefits from established protocols, skilled technician expertise, and the ability to customize production parameters for specific research and therapeutic applications.

Cell culture workflows are expected to represent 37.3% of iPSC production activities in 2025. This dominant share reflects the critical importance of cell culture techniques in iPSC generation, maintenance, and differentiation protocols. Cell culture represents the foundation of iPSC technology, requiring specialized media, culture conditions, and handling procedures that ensure cell viability and pluripotency maintenance. The segment benefits from continuous advancement in culture media formulations, surface coating technologies, and environmental control systems that optimize iPSC production outcomes.

Consumables and kits are projected to contribute 40.0% of the market in 2025, representing the ongoing materials and reagents required for iPSC production and maintenance. These products include specialized culture media, reprogramming factors, characterization reagents, and quality control materials that are essential for successful iPSC generation. Consumables represent recurring revenue streams for suppliers and reflect the continuous material requirements of active iPSC research and production facilities. The segment is supported by advancing formulation technologies and standardized kit development that simplifies iPSC production protocols.

Drug development and discovery applications are estimated to hold 43.3% of the market share in 2025. This significant share reflects the substantial adoption of iPSC technology by pharmaceutical companies for drug screening, toxicity testing, and therapeutic target identification. iPSC-derived cell models provide superior predictive capabilities compared to traditional cell lines and animal models, enabling more accurate assessment of drug efficacy and safety. The segment benefits from increasing pharmaceutical industry recognition of iPSC technology value and growing regulatory acceptance of iPSC-based testing approaches.

Biotechnology and pharmaceutical companies are expected to represent 59.4% of iPSC production demand in 2025. This dominant share reflects the primary role of commercial organizations in driving iPSC technology development and application for therapeutic and research purposes. These companies possess the resources, expertise, and market focus necessary to translate iPSC technology into commercial products and services. The segment benefits from substantial industry investment in iPSC technology platforms and growing integration of iPSC applications into drug development pipelines.

The market is advancing rapidly due to scientific breakthroughs and increasing commercial applications. The market faces challenges including technical complexity, standardization requirements, and regulatory uncertainty for therapeutic applications. Quality control considerations and reproducibility requirements continue to influence production protocols and technology adoption patterns while ensuring research validity and therapeutic safety.

The growing development of automated iPSC production platforms is enabling standardized, scalable, and reproducible cell production that meets commercial and therapeutic application requirements. Advanced robotic systems, automated media handling, and integrated monitoring technologies are reducing manual labor requirements while improving production consistency and quality control. These technologies are particularly valuable for pharmaceutical companies and commercial service providers that require high-throughput iPSC production capabilities for drug development and therapeutic applications.

Modern iPSC production facilities are incorporating AI and machine learning technologies to optimize production protocols, predict cell behavior, and improve quality control processes. Advanced algorithms can analyze cell morphology, gene expression patterns, and differentiation potential to ensure optimal iPSC quality and functionality. These technologies enable predictive maintenance, process optimization, and automated decision-making that enhance production efficiency while reducing variability and production costs.

| Countries | CAGR (2025-2035) |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

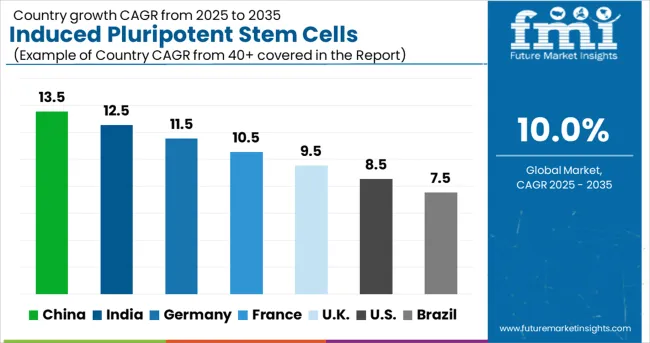

The global market is expected to grow at a CAGR of 10.0% between 2025 and 2035, driven by rising demand for regenerative medicine and expanding applications in drug discovery and disease modeling. China leads with 13.5% growth, supported by large-scale government funding in stem cell research and rapid expansion of biotechnology infrastructure. India follows at 12.5%, reflecting growing research collaborations and increasing focus on personalized medicine. Germany records 11.5%, driven by strong academic research and advanced clinical applications. France is projected at 10.5%, supported by adoption of innovative stem cell technologies in therapeutic development. The UK grows at 9.5% with increasing focus on translational research, while the USA expands at 8.5%, influenced by steady commercialization efforts and clinical trial activity. Brazil shows 7.5%, reflecting gradual development of regenerative medicine capabilities.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China is expected to record the highest CAGR of 13.5% between 2025 and 2035, driven by expanding research programs and government backed investments in stem cell technologies. Universities, biotech startups, and pharmaceutical companies have rapidly adopted iPSC technologies for regenerative medicine, toxicology testing, and rare disease research. Government initiatives have supported the establishment of stem cell banks and large scale production centers. Domestic players such as Jinan UniStem and international firms have collaborated to transfer advanced technologies. The increasing number of clinical studies using iPSC derived therapies is boosting market prospects, particularly in chronic disease management. China’s growing influence in global stem cell research is expected to further accelerate adoption over the forecast period.

India is forecasted to expand at a CAGR of 12.5% during 2025–2035, driven by rising investments in biotechnology research and regenerative medicine. Academic research institutions, hospitals, and biotech companies have embraced iPSC production for applications in oncology, neurology, and pharmacological testing. The Indian Council of Medical Research has provided regulatory oversight to ensure ethical compliance in stem cell research. Domestic companies and multinational providers have collaborated to establish production facilities and training programs. Increasing prevalence of chronic diseases has fueled demand for patient specific therapies, creating new opportunities. Cost effective research capabilities and skilled workforce are positioning India as a significant contributor to global iPSC development.

Germany is expected to grow at a CAGR of 11.5% from 2025 to 2035, supported by strong investments in biomedical research and pharmaceutical innovation. Universities, biotech firms, and healthcare institutions have adopted iPSC production for drug screening, disease modeling, and regenerative therapies. Regulatory guidelines under the European Medicines Agency have provided structured pathways for clinical adoption. Companies such as Evotec and Fraunhofer IGB have pioneered advancements in large scale cell reprogramming, cryopreservation, and high throughput screening. Integration of iPSC platforms with artificial intelligence and automation has further improved efficiency. Germany’s well established research infrastructure and skilled workforce are expected to sustain growth in the market over the coming decade.

France is projected to grow at a CAGR of 10.5% between 2025 and 2035, shaped by growing investments in regenerative medicine and public private partnerships. Research centers and biotech firms have increasingly adopted iPSC technologies for toxicology, cell therapy, and disease modeling. The French National Institute of Health and Medical Research has supported iPSC studies, ensuring ethical compliance and scientific advancement. Companies have invested in scalable production platforms and cryopreservation technologies to serve the pharmaceutical industry. Rising interest in neurological disorders and cardiovascular research has strengthened demand for iPSC based applications. With a strong focus on innovation and international collaborations, France is positioned for steady growth in the market.

The United Kingdom is expected to grow at a CAGR of 9.5% between 2025 and 2035, supported by government initiatives and investments in advanced therapies. Universities, biotech firms, and the National Health Service have promoted iPSC production for personalized medicine, oncology research, and toxicology testing. Regulatory oversight by the MHRA has guided ethical and safe applications in clinical studies. Companies such as Oxford Biomedica and ReNeuron have developed iPSC platforms for therapeutic purposes. Collaborations with European research consortia have strengthened technology access and innovation. Market expansion is anticipated as demand for iPSC derived therapies increases, particularly in rare disease treatment and regenerative care.

The market in the United States is projected to grow at a CAGR of 8.5% between 2025 and 2035, supported by advancements in regenerative medicine and biotechnology research. Academic institutions and private companies have invested in large scale iPSC facilities for disease modeling, drug discovery, and personalized medicine. Regulatory guidance from the FDA has shaped standards for safe iPSC generation and therapeutic applications. Leading players such as Fate Therapeutics and Thermo Fisher Scientific have expanded capabilities in cell reprogramming, cryopreservation, and automation technologies. Growth is further supported by rising clinical trials involving iPSC derived therapies, particularly in neurology and cardiology. Market adoption is expected to strengthen as advanced manufacturing processes improve scalability and cost efficiency.

Brazil is projected to grow at a CAGR of 7.5% between 2025 and 2035, influenced by increasing focus on biotechnology research and medical applications. Research institutes and hospitals have begun adopting iPSC technologies for regenerative therapies, toxicology studies, and chronic disease modeling. Government funding and partnerships with international biotech companies have facilitated gradual market penetration. Ethical guidelines and research frameworks have been established to regulate stem cell studies. Domestic laboratories are focusing on cost effective production methods to expand access. While adoption is at an early stage compared to developed regions, Brazil’s growing biomedical sector is expected to contribute steadily to global iPSC advancements.

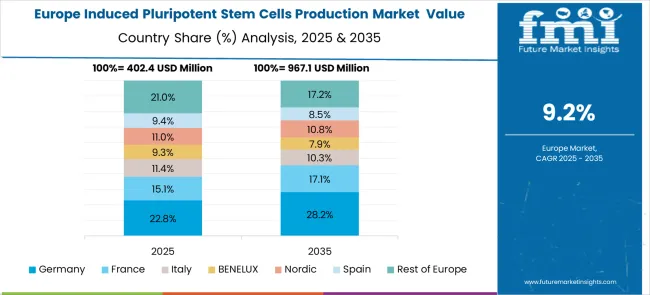

The market in Europe is projected to grow from USD 480.0 million in 2025 to USD 1.18 billion by 2035, registering a CAGR of 9.4% over the forecast period. Germany is expected to maintain its leadership with a 26.9% share in 2025, supported by strong biotechnology sector and advanced research infrastructure. The UK holds 24.1% market share, followed by France at 19.6%, Italy at 12.0%, and Spain at 8.7%. Nordic countries contribute 5.4% to the regional market, while BENELUX accounts for 2.8%. The Rest of Europe region represents 0.5% of the market, driven by emerging biotechnology initiatives in Eastern European countries.

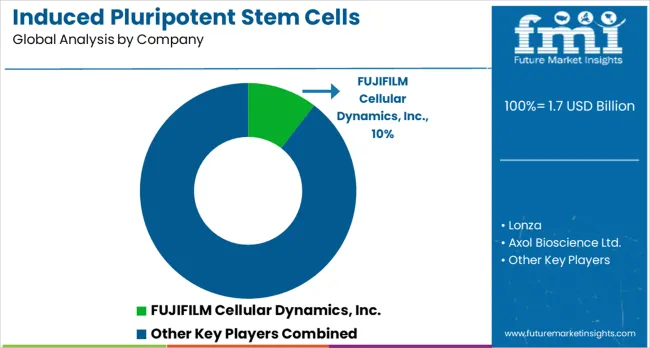

FUJIFILM Cellular Dynamics, Lonza, and Thermo Fisher Scientific lead the field with large-scale production systems, standardized cell lines, and end-to-end solutions for pharmaceutical research and clinical development. Their competitive advantage lies in global infrastructure, regulatory expertise, and integration of automation technologies that ensure reproducibility and high-quality output. Specialized players including Axol Bioscience, Evotec, and REPROCELL focus on custom iPSC-derived models, targeting applications in drug screening, disease modeling, and personalized medicine. These firms compete through innovation in differentiation protocols, advanced culture media, and efficient reprogramming methods. Fate Therapeutics extends competition toward therapeutic development, with pipelines based on iPSC-derived immune cells for cancer and regenerative medicine, positioning itself uniquely compared to companies with purely research-oriented offerings.

Smaller firms such as StemCellsFactory III and Applied StemCells compete by offering tailored services, niche protocols, and flexible production support for academic institutions and biotech start-ups. Product brochures in this segment highlight high-quality reprogramming kits, differentiation platforms, and cell banking services designed for both research and translational needs. The competitive environment is defined by the ability to deliver reliable, scalable, and clinically compliant iPSC production. Large corporations dominate with infrastructure and regulatory backing, while mid-sized and niche companies attract clients through customization and specialized innovation. Success in this market depends on technological precision, service adaptability, and alignment with the growing demand for stem cell-based drug discovery and regenerative medicine applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 billion |

| Process Outlook | Manual iPSC Production Process, Automated iPSC Production Process |

| Workflow Outlook | Cell Culture, Reprogramming, Cell Characterization/Analysis, Engineering, Others |

| Product Outlook | Consumables & Kits, Media, Instruments/Devices, Services, Others |

| Application Outlook | Drug Development & Discovery, Regenerative Medicine, Toxicology Studies, Others |

| End Use Outlook | Biotechnology & Pharmaceutical Companies, Hospitals & Clinics, Research & Academic Institutes, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, France |

| Key Companies Profiled | FUJIFILM Cellular Dynamics Inc., Lonza, Axol Bioscience Ltd., Evotec, Hitachi Ltd., REPROCELL Inc., Fate Therapeutics, Thermo Fisher Scientific Inc., StemCellsFactory III, Applied StemCells Inc. |

| Additional Attributes | Revenue analysis by process, workflow, product, application, and end use segments, regional research and development patterns across major biotechnology markets, competitive positioning with established biotechnology companies and pharmaceutical corporations, researcher and industry preferences for different iPSC production technologies and protocols, integration with automation and artificial intelligence technologies for enhanced production efficiency, innovations in quality control systems and standardization protocols for therapeutic applications, and adoption of regulatory-compliant production processes for clinical translation and commercial development. |

The global induced pluripotent stem cells production market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the induced pluripotent stem cells production market is projected to reach USD 4.4 billion by 2035.

The induced pluripotent stem cells production market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in induced pluripotent stem cells production market are manual ipsc production process and automated ipsc production process.

In terms of workflow outlook, cell culture segment to command 37.3% share in the induced pluripotent stem cells production market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drug-Induced Dyskinesia Market Size and Share Forecast Outlook 2025 to 2035

Drug-Induced Immune Hemolytic Anemia Market - Demand & Forecast 2025 to 2035

Opioid-Induced Constipation (OIC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Opioid-Induced Respiratory Depression Market

Steroid Induced Glaucoma Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heparin-Induced Thrombocytopenia (HIT) Treatment Market - Trends & Forecast 2025 to 2035

Dialysis Induced Anemia Treatment Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Radiation-Induced Myelosuppression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Radiation-Induced Fibrosis Treatment Market - Growth & Forecast 2025 to 2035

Contact-lens Induced Infections Market Size and Share Forecast Outlook 2025 to 2035

Chemotherapy-Induced Nausea And Vomiting Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Chemotherapy Induced Anemia Market Trends and Forecast 2025 to 2035

Chemotherapy-Induced Oral Mucositis Market – Growth & Forecast 2025 to 2035

Chemotherapy-Induced Myelosuppression Treatment Market Growth - Forecast 2025 to 2035

Radiotherapy-Induced Oral Mucositis Treatment Market Analysis – Growth & Forecast 2024-2034

Pelvic Cancer Induced Hemorrhegic Cystitis Market Size and Share Forecast Outlook 2025 to 2035

Chemotherapy Induced Thrombocytopenia Market

Production Logistics Market Size and Share Forecast Outlook 2025 to 2035

Production Printer Market - Growth, Demand & Forecast 2025 to 2035

Soda Production Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA