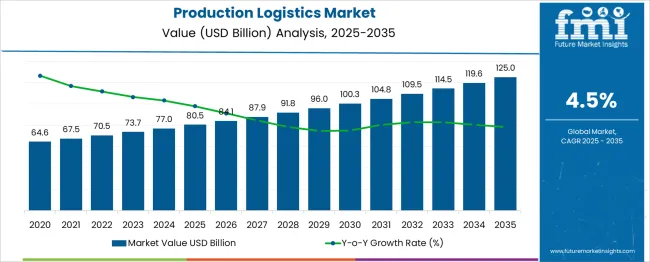

The Production Logistics Market is estimated to be valued at USD 80.5 billion in 2025 and is projected to reach USD 125.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

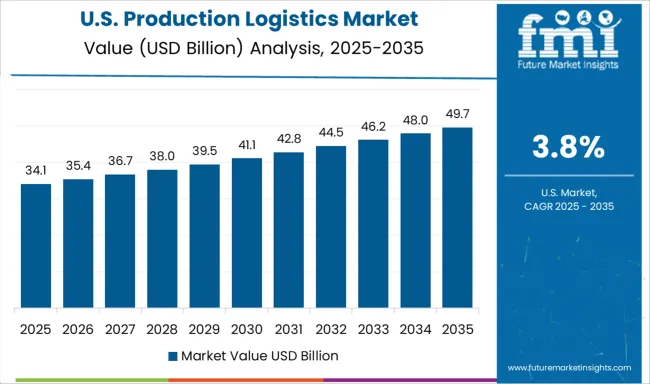

Analysis of the year-on-year increments reveals a consistent acceleration in absolute growth, though the percentage growth rate experiences mild deceleration, common in maturing markets. In the early phase (2025–2029), annual increases range between USD 3.6–4.2 billion, with YoY percentage growth gradually tapering from around 4.5% to 4.3%. This stage is supported by stable demand for warehousing automation, supply chain optimization, and integration of digital tracking systems. From 2030 onward, absolute gains expand further, with yearly increments rising to USD 4.5–5.4 billion by 2035. However, percentage growth slips marginally below 4.2%, reflecting the compounding effect on a larger base value. This indicates a shift from early adoption-driven momentum to volume-based scaling, where efficiency improvements and incremental process automation sustain expansion rather than disruptive leaps. The pattern suggests a market in a sustained growth phase, with innovation in AI-powered logistics orchestration and predictive supply chain analytics continuing to push volumes higher. While absolute growth accelerates in later years, the declining percentage trend points to gradual maturation, favoring long-term strategic investments over short-term speculative plays.

| Metric | Value |

|---|---|

| Production Logistics Market Estimated Value in (2025 E) | USD 80.5 billion |

| Production Logistics Market Forecast Value in (2035 F) | USD 125.0 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The production logistics market is seen as a specialized yet steadily expanding category within its parent industries. It is estimated to account for about 3.0 % of the global supply chain and logistics market indicating growing demand for optimized production-to-distribution workflows. Within the overall logistics services sector a share of approximately 4.5 % is assessed reflecting integration of production planning and material handling.

In the manufacturing execution systems segment a contribution of around 3.8 % is observed as logistic systems are increasingly integrated with MES solutions. Within the industrial automation and robotics market about 2.9 % is calculated given the rise of automated intralogistics. In the industrial engineering and operations consulting industry a share of roughly 2.2 % is evaluated supported by advisory services for lean production logistics models.

Trends in this market have been shaped by increasing adoption of end to end visibility platforms and real time tracking across the production floor. Innovations have been focused on integration of automated guided vehicles and autonomous mobile robots for in plant transport. Interest has increased in demand driven replenishment systems and digital twin simulations deployed for production throughput optimization.

The Asia Pacific region has been observed to show the fastest growth while North America has maintained significant implementation of advanced data driven logistics operations. Strategic initiatives have included collaborations between software vendors and robotics firms to deliver modular production logistics platforms equipped with predictive analytics and adaptive routing capabilities.

The production logistics market is experiencing accelerated evolution due to rising automation across manufacturing operations, just-in-time (JIT) inventory models, and the integration of AI and IoT into supply chain systems. As organizations aim to reduce lead times and improve overall equipment efficiency (OEE), logistics is becoming a core differentiator in production workflows.

Increasing reliance on real-time data exchange, synchronized material flow, and responsive warehouse systems is pushing manufacturers to adopt more robust logistics platforms. Additionally, environmental regulations and sustainability goals are prompting optimization in fleet management, packaging, and route planning.

These factors, combined with growing demand for agile and scalable logistics infrastructures, are expected to significantly shape the production logistics market outlook.

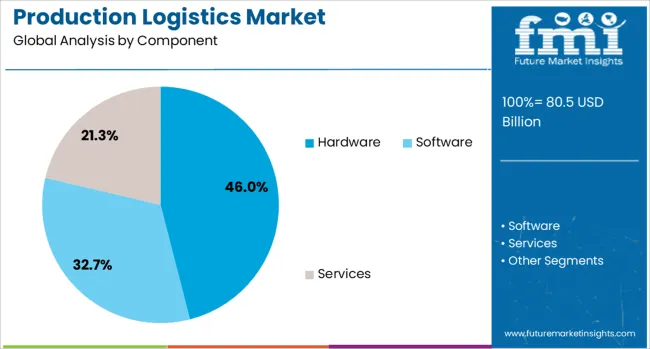

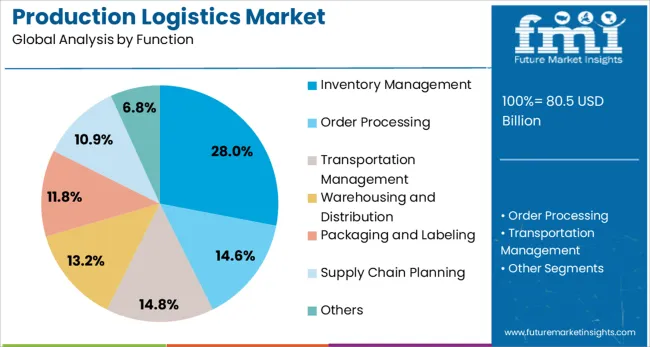

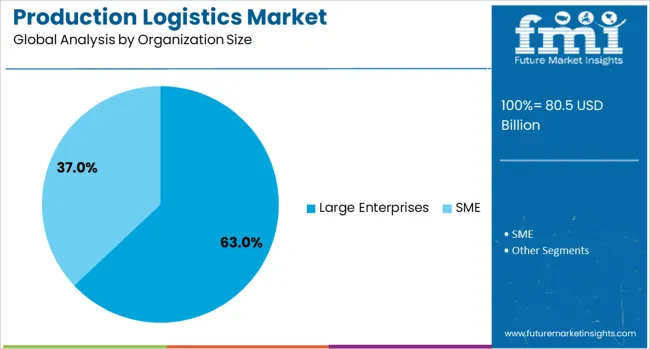

The production logistics market is segmented by component, function, organization size, end-use, and geographic regions. The production logistics market is divided into Hardware, Software, and Services. In terms of the function, the production logistics market is classified into Inventory Management, Order Processing, Transportation Management, Warehousing and Distribution, Packaging and Labeling, Supply Chain Planning, and Others. Based on organization size, the production logistics market is segmented into Large Enterprises and SMEs. The production logistics market is segmented by end-use into Automotive, Consumer Goods, Healthcare, Food and Beverage, Retail and E-commerce, Aerospace and Defense, Electronics, Chemicals, Pharmaceuticals, and Others. Regionally, the production logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Hardware is projected to dominate the component segment of the production logistics market with a 46.00% share by 2025. This prominence is due to increasing deployment of automated storage and retrieval systems (ASRS), robotic picking solutions, conveyors, and real-time tracking sensors.

As manufacturing plants strive for reduced manual dependency, the integration of hardware for physical movement and asset tracking becomes indispensable. High adoption of RFID systems, barcode scanners, and wearable devices also boosts operational transparency and worker efficiency.

Hardware solutions provide the structural backbone for smart logistics and are especially critical in high-throughput environments, where uptime and fault tolerance are essential.

Inventory management is expected to hold a 28.00% market share among production logistics functions in 2025, making it the largest sub-segment. The surge is being fueled by the need for real-time stock visibility, optimized material handling, and the avoidance of production bottlenecks.

Manufacturers are increasingly investing in intelligent inventory systems to reduce carrying costs and streamline production planning. The ability to track, forecast, and replenish inventory dynamically across distributed sites is vital for maintaining manufacturing continuity, especially in volatile demand cycles.

These systems also help organizations align with lean manufacturing principles and reduce waste, which is critical in competitive global markets.

Large enterprises are anticipated to contribute 63.00% of the total production logistics market revenue by 2025, making them the leading customer group. This dominance stems from their complex supply chains, high production volumes, and greater budgets for deploying comprehensive logistics solutions.

These organizations typically operate across multiple facilities and regions, necessitating integrated logistics platforms that ensure synchronized inbound and outbound flows. Furthermore, large enterprises are more likely to adopt cutting-edge technologies such as AI-driven analytics, autonomous vehicles, and digital twins to gain competitive advantages.

Their long-term focus on supply chain resilience and global scalability continues to drive strong demand in this segment.

Production logistics solutions have been increasingly implemented to manage material flow, storage, and information exchange across manufacturing environments. These systems ensure that raw materials, components, and finished goods are efficiently moved through production lines. Growth has been supported by the integration of automated guided vehicles, real-time tracking systems, and warehouse automation technologies. Industries such as automotive, electronics, and consumer goods have been prioritizing production logistics to reduce bottlenecks, optimize throughput, and maintain just-in-time manufacturing schedules while improving visibility across the supply chain.

Manufacturers have been adopting production logistics systems to streamline workflows and minimize non-value-added movement of goods. Automated material handling equipment, barcode tracking, and warehouse management software have been deployed to synchronize supply of parts with production line requirements. Automotive plants in Germany, Japan, and the United States have utilized these solutions to maintain just-in-sequence assembly processes, reducing storage space needs and work-in-progress inventory. Cost savings have been achieved through reduced manual handling, lower error rates, and improved utilization of labor and equipment. Real-time visibility into inventory status has allowed production planners to respond quickly to supply chain disruptions. Companies have considered the combination of lower operational costs and increased production stability as a decisive factor in investment, especially when aligning production output with fluctuating market demand across global manufacturing networks.

The incorporation of production logistics into Industry 4.0 ecosystems has enabled higher levels of automation, data sharing, and predictive control. Factories in South Korea, China, and Northern Europe have been implementing Internet of Things sensors, autonomous mobile robots, and AI-driven scheduling platforms to optimize material delivery to workstations. Digital twins have been used to simulate production flows, enabling identification of inefficiencies before physical changes are made. Cloud-based platforms have facilitated cross-facility coordination, allowing centralized control of inventory and transport tasks. Integration with enterprise resource planning systems has created seamless information flow from procurement to dispatch. Predictive analytics has allowed accurate forecasting of component needs, reducing the risk of line stoppages. This combination of operational control and data-driven decision-making has been considered an important enabler of competitive manufacturing performance in high-output industries.

Production logistics systems have been tailored to meet the specific requirements of different manufacturing sectors. In electronics assembly, precision material delivery and anti-static handling have been prioritized, while in food and beverage production, compliance with hygiene standards has been integrated into storage and transport processes. Pharmaceutical manufacturers have relied on validated logistics systems to ensure traceability and temperature control. Modular conveyor designs and adaptable storage units have allowed facilities to reconfigure logistics layouts for new product lines without significant downtime. Suppliers offering turnkey solutions with sector-specific compliance documentation and post-installation support have gained preference in competitive bidding processes. Industry-specific customization has been viewed as a decisive factor for ensuring smooth operations, reducing changeover times, and maintaining production continuity in highly regulated and quality-sensitive environments.

Despite the operational benefits, the adoption of advanced production logistics systems has been constrained by high initial investment costs and complexity in integrating new solutions with existing infrastructure. Retrofitting older facilities with automated storage systems, robotic handlers, and sensor networks has required significant downtime and technical expertise. Smaller manufacturers with limited budgets have hesitated to invest due to uncertain return on investment, especially in volatile demand environments. Compatibility issues between legacy machinery and modern logistics software have created additional barriers. The need for specialized training to operate and maintain advanced systems has added to implementation costs. In markets where labor costs remain low, the perceived benefits of automation have been offset by the affordability of manual handling. Broader adoption may depend on the availability of modular, scalable systems that allow phased investment while minimizing disruption to production schedules.

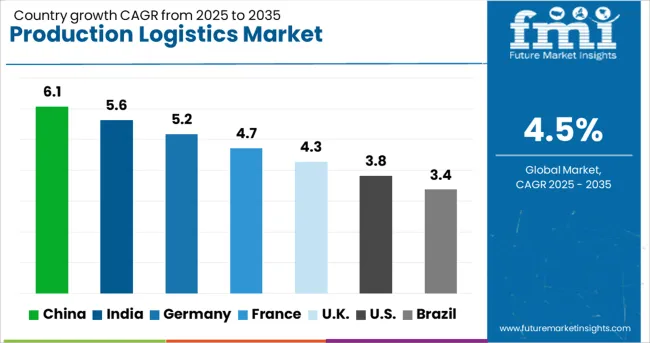

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The production logistics market is expected to grow at a global CAGR of 9.5% between 2025 and 2035, supported by advancements in automation, demand for just-in-time manufacturing, and integration of digital supply chain solutions. China leads with a 6.1% CAGR, driven by large-scale manufacturing hubs and investment in smart logistics infrastructure. India follows at 5.6%, fueled by industrial corridor developments and expansion in automotive and electronics production. Germany, at 5.2%, benefits from Industry 4.0 adoption and precision manufacturing capabilities. The UK, projected at 4.3%, sees growth from technology-led warehouse optimization. The USA, at 3.8%, reflects stable adoption in aerospace, defense, and industrial manufacturing logistics. The report provides insights for 40+ countries, with the five below highlighted for their operational influence and growth outlook.

China is projected to grow at a CAGR of 6.1% from 2025 to 2035 in the production logistics market, supported by large-scale manufacturing and increasing automation in supply chain operations. Key providers such as SF Express, JD Logistics, and Sinotrans are investing heavily in AI-powered warehouse management systems and autonomous material handling. Expansion of high-tech manufacturing hubs in provinces like Guangdong, Jiangsu, and Zhejiang is fueling demand for integrated logistics solutions that reduce production lead times. Investments in smart warehousing, robotics, and real-time tracking are positioning China as a global leader in production logistics capabilities.

India is expected to achieve a CAGR of 5.6% from 2025 to 2035 in the production logistics market, driven by rapid industrial expansion and the growth of manufacturing clusters. Logistics providers such as Delhivery, Mahindra Logistics, and Gati-KWE are enhancing in-plant logistics, assembly line feeding, and just-in-time delivery services for automotive, electronics, and FMCG industries. Government infrastructure upgrades, including dedicated freight corridors, are improving connectivity between production centers and distribution hubs. Adoption of warehouse automation and digital inventory control is steadily increasing across medium and large manufacturers.

Germany is projected to post a CAGR of 5.2% from 2025 to 2035 in the production logistics market, supported by Industry 4.0 adoption and advanced automation systems. Leading logistics companies like DHL Supply Chain Germany, DB Schenker, and Kuehne+Nagel are deploying IoT-enabled warehouse networks and predictive maintenance tools. The automotive and machinery sectors are key demand drivers for precision-based logistics solutions. Robotics-assisted picking, AI-driven route planning, and real-time production monitoring are becoming standard in high-tech manufacturing facilities. Germany’s focus on sustainability is also leading to the integration of energy-efficient material handling systems.

The United Kingdom is forecasted to grow at a CAGR of 4.3% from 2025 to 2035, supported by modernization in manufacturing supply chains and investment in logistics technology. Providers such as Wincanton, DHL Supply Chain UK, and GXO Logistics are offering end-to-end production logistics services for sectors like aerospace, pharmaceuticals, and electronics. Growth is also fueled by digital twin technology adoption in warehouse operations, enhancing predictive supply chain management. The push for lean manufacturing practices is increasing the demand for agile, adaptable logistics systems.

The United States is expected to record a CAGR of 3.8% from 2025 to 2035 in the production logistics market, driven by demand from manufacturing-intensive states such as Texas, California, and Michigan. Key providers including Ryder Supply Chain Solutions, XPO Logistics, and Penske Logistics are investing in AI-powered supply chain visibility platforms and high-speed conveyor systems. Growth is also driven by the adoption of warehouse robotics in sectors like automotive, aerospace, and consumer goods. Strategic partnerships between logistics firms and manufacturers are helping optimize production flows and reduce operational costs.

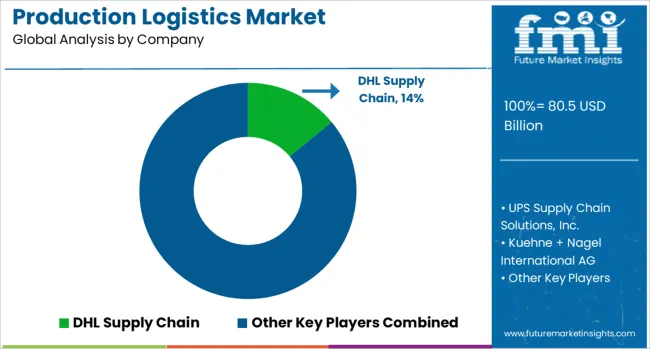

The production logistics market is dominated by global logistics and supply chain specialists that manage end-to-end material flow from suppliers to manufacturing lines and finished goods distribution. DHL Supply Chain and UPS Supply Chain Solutions, Inc. lead with integrated warehousing, just-in-time delivery, and vendor-managed inventory services tailored to industries such as automotive, electronics, and consumer goods.

Kuehne + Nagel International AG and DB Schenker Logistics provide large-scale inbound and outbound logistics coordination, supported by advanced digital tracking systems and global multimodal transport networks. XPO Logistics, Inc. and CEVA Logistics AG specialize in contract logistics for high-volume production environments, offering customized solutions such as line-feeding operations and synchronized supply deliveries.

DSV Panalpina A/S and Nippon Express Co., Ltd. combine international freight forwarding with in-plant logistics to ensure continuous production flow for complex manufacturing setups. C.H. Robinson Worldwide, Inc. and Expeditors International of Washington, Inc. leverage strong carrier relationships and technology platforms to provide flexible, cost-optimized production logistics services. Key strategies in this market include long-term contracts with manufacturers, investment in automation for warehouse and inventory handling, and deployment of data-driven forecasting tools to align supply with production demand.

Competitive advantages are shaped by global coverage, vertical industry expertise, and the ability to adapt to production scheduling changes in real time. Entry into this market is restricted by high infrastructure investment needs, strong incumbent relationships with major manufacturers, and the requirement for extensive transport and warehousing networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 80.5 Billion |

| Component | Hardware, Software, and Services |

| Function | Inventory Management, Order Processing, Transportation Management, Warehousing and Distribution, Packaging and Labeling, Supply Chain Planning, and Others |

| Organization Size | Large Enterprises and SME |

| End-use | Automotive, Consumer Goods, Healthcare, Food and Beverage, Retail and E-commerce, Aerospace and Defense, Electronics, Chemicals, Pharmaceuticals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DHL Supply Chain, UPS Supply Chain Solutions, Inc., Kuehne + Nagel International AG, DB Schenker Logistics, XPO Logistics, Inc., CEVA Logistics AG, DSV Panalpina A/S, Nippon Express Co., Ltd., C.H. Robinson Worldwide, Inc., and Expeditors International of Washington, Inc. |

The global production logistics market is estimated to be valued at USD 80.5 billion in 2025.

The market size for the production logistics market is projected to reach USD 125.0 billion by 2035.

The production logistics market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in production logistics market are hardware, _automated storage and retrieval systems (asrs), _conveyors and sortation systems, _automated guided vehicles (agvs), _robotic picking systems, _others, software, _warehouse management systems (wms), _transportation management systems (tms), _inventory management systems, _supply chain management software, _others, services, _consulting, _implementation, _maintenance and support and _training.

In terms of function, inventory management segment to command 28.0% share in the production logistics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Logistics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Logistics Robots Market Size and Share Forecast Outlook 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Production Printer Market - Growth, Demand & Forecast 2025 to 2035

Key Players & Market Share in the Logistics Packaging Industry

Logistics Outsourcing Market Analysis - Growth & Forecast 2025 to 2035

Logistics Visualization System Market

Logistics Automation Market

Cash Logistics Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Intralogistics Automation Solutions Market Size and Share Forecast Outlook 2025 to 2035

Soda Production Machine Market Size and Share Forecast Outlook 2025 to 2035

Early Production Facility Market Size and Share Forecast Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Smart Logistics Services Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cloud Logistics Market Insights – Demand & Growth Forecast 2025 to 2035

Timber Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA