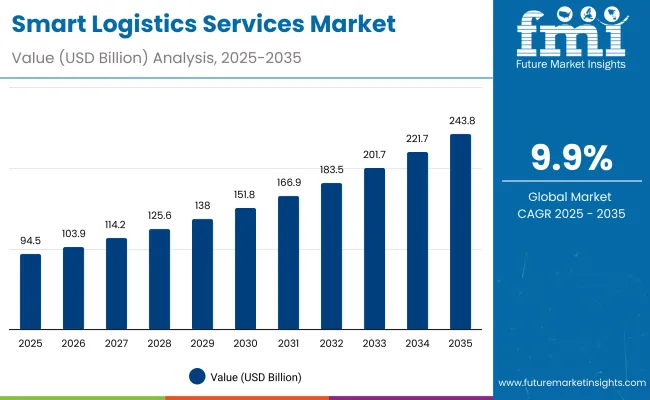

The Smart Logistics Services market is expected to record a valuation of USD 94.5 billion in 2025 and USD 243.8 billion in 2035, with an increase of USD 149,320.2 million, which equals a growth of 158% over the decade. The overall expansion represents a CAGR of 9.9% and a 2.6X increase in market size.

Smart Logistics Services Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 94.5 billion |

| Market Forecast Value in (2035F) | USD 243.8 billion |

| Forecast CAGR (2025 to 2035) | 9.9% |

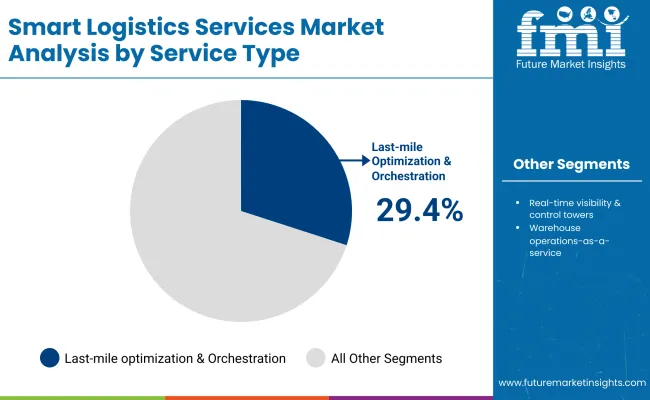

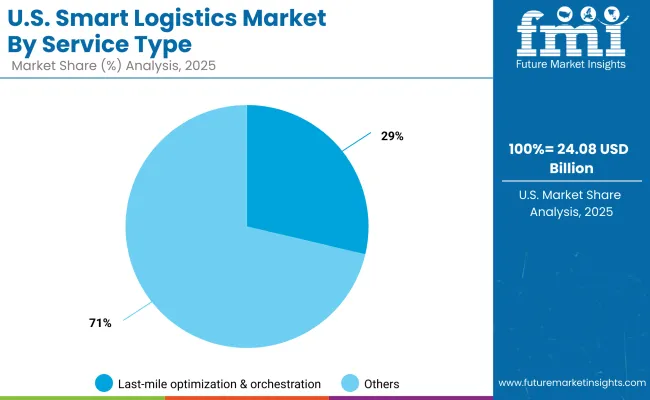

During the first five-year period from 2025 to 2030, the market rises from USD 94.5 billion to USD 151,813.7 million, adding USD 57,294.8 million, which accounts for 38% of the total decade growth. This phase records steady adoption in retail & e-commerce, consumer electronics, and pharma logistics, driven by the need for last-mile efficiency and real-time visibility. Last-mile optimization & orchestration leads with a 29.4% share in 2025, while transaction-based models gain traction across enterprises.

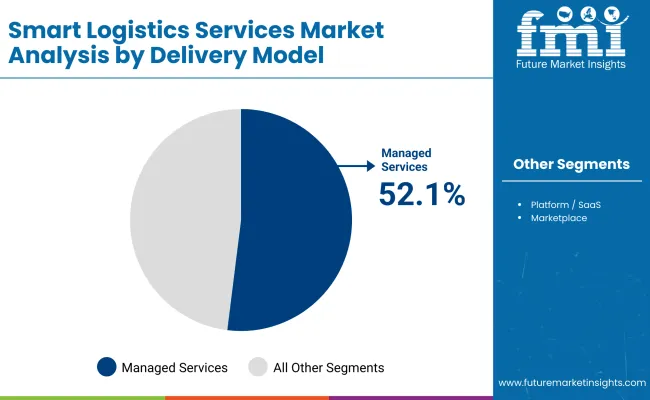

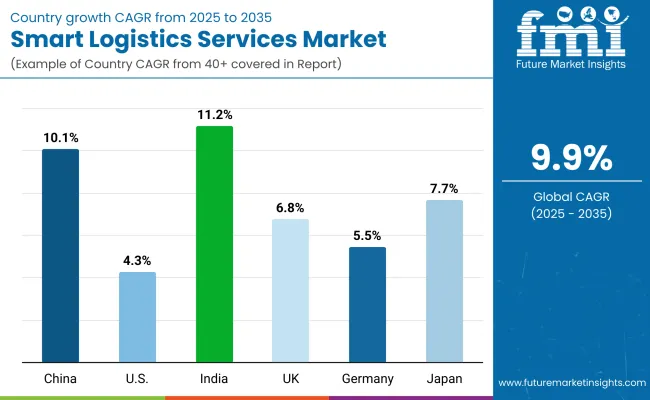

The second half from 2030 to 2035 contributes USD 92,025.4 million, equal to 62% of total growth, as the market jumps from USD 151,813.7 million to USD 243.8 billion. This acceleration is powered by the widespread deployment of cloud-native logistics platforms, AI-driven control towers, robotics-enabled warehouses, and cold-chain compliance systems. By 2035, managed services strengthen their dominance with over 52% share, while China and India emerge as the fastest-growing regions, expanding at 10.1% and 11.2% CAGR respectively.

From 2020 to 2024, the smart logistics market was shaped by rapid digitization of supply chains, accelerated by e-commerce growth and post-pandemic resilience strategies. During this phase, the competitive landscape was led by global integrators such as DHL, UPS, and FedEx, who controlled a significant share of revenue. Competitive differentiation focused on network scale, last-mile efficiency, and integrated freight forwarding capabilities, while digital platforms and SaaS-based models were still in early adoption. Managed services accounted for a growing share but remained below 50% of market revenues.

By 2025, demand for Smart Logistics Services will expand to USD 94.5 billion, with the revenue mix shifting as managed services (52.1% share) and cloud-native deployments gain dominance. Traditional logistics giants face increasing competition from digital-first players such as Flexport and ShipBob, who leverage AI-driven control towers, subscription-based platforms, and cloud interoperability. The competitive edge is moving away from asset-heavy operations alone toward ecosystem integration, scalability, and recurring service revenues.

Shift from Asset-Centric to Service-Centric Logistics - Enterprises are increasingly outsourcing logistics functions such as control tower management, returns optimization, and compliance monitoring. This transition toward managed services and SaaS-based orchestration is fueling recurring revenue streams and reducing reliance on traditional, asset-heavy models.

Regulatory Push for Transparency & Compliance - Governments worldwide are enforcing stricter trade compliance, cold-chain monitoring, and sustainability reporting. This is accelerating adoption of real-time visibility platforms, IoT-enabled monitoring, and AI-driven compliance tools, making smart logistics services a necessity rather than an optional upgrade.

The Smart Logistics Services market is segmented by service type, transport mode, delivery model, pricing model, end industry, deployment, and region. Service offerings range from last-mile optimization, visibility platforms, digital freight brokerage, warehouse automation, cold-chain monitoring, reverse logistics, to customs compliance, catering to end-to-end logistics needs. Transport modes include road, ocean, air, rail, and multimodal, while delivery models span managed services, SaaS platforms, and shipper-carrier marketplaces. Pricing structures cover transaction-based, subscription, and contract models, with enterprises increasingly shifting toward predictable engagements. End-use industries such as retail & e-commerce, consumer electronics, pharma, automotive, manufacturing, and food & beverage drive adoption, supported by cloud-native, hybrid, and on-prem deployments. Regionally, growth is led by China and India, alongside steady expansion in the USA, Germany, Japan, and the UK, underscoring the global scale of adoption.

| Service Type | Value Share% 2025 |

|---|---|

| Last-mile optimization & orchestration | 29.4% |

| Others | 70.6% |

The last-mile optimization & orchestration segment is projected to contribute 29.4% of the Smart Logistics Services revenue in 2025, maintaining its position as the leading service category. Growth is driven by the surge in retail and e-commerce deliveries, where efficient routing, orchestration platforms, and delivery scheduling are critical to customer satisfaction. Enterprises are prioritizing investments in AI-enabled route planning, automated dispatching, and dynamic fleet orchestration, making last-mile optimization central to logistics digitalization.

The segment’s momentum is further supported by the shift toward hyperlocal fulfillment centers, increased same-day/next-day delivery commitments, and integration with gig-economy delivery networks. As logistics providers scale operations across urban and semi-urban regions, last-mile solutions are being enhanced with real-time visibility, predictive analytics, and customer communication tools. This ensures that last-mile optimization remains the backbone of smart logistics services, anchoring digital transformation in the industry.

| Delivery Model | Value Share% 2025 |

|---|---|

| Managed services | 52.1% |

| Others | 47.9% |

The managed services segment is forecasted to hold 52.1% of the market share in 2025, led by its role in enabling enterprises to outsource complex logistics operations such as control tower management, BPO-driven orchestration, and end-to-end supply chain visibility. These services are favored for their ability to optimize cost, ensure regulatory compliance, and provide scalability, making them highly attractive to global shippers and manufacturers.

Widespread adoption is supported by the growing complexity of global trade, multi-country freight flows, and the need for 24/7 monitoring of logistics networks. Managed services providers are increasingly integrating AI-based predictive analytics, IoT-enabled tracking, and automated workflow management, reducing delays while enhancing resilience.

As industries expand cross-border operations and prioritize resilient, digital-first supply chains, managed services are expected to retain dominance, shaping the backbone of the Smart Logistics Services market over the next decade.

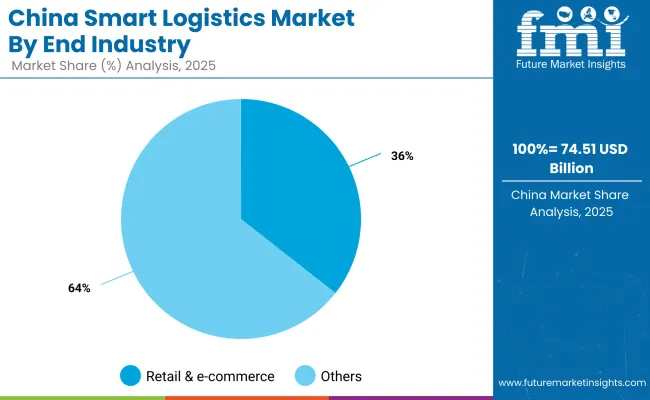

| End Industry | Value Share% 2025 |

|---|---|

| Retail & e-commerce | 34.5% |

| Others | 65.5% |

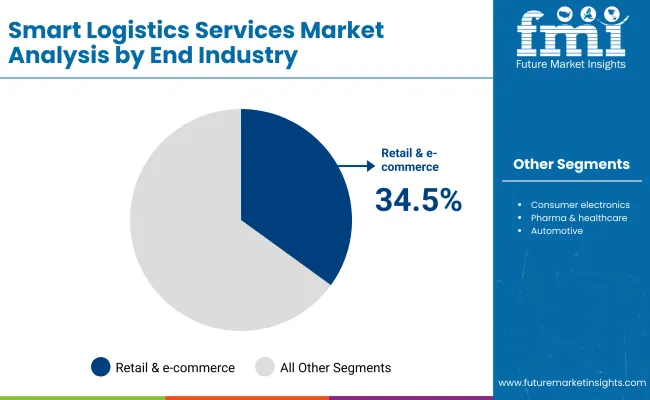

The retail & e-commerce segment is projected to account for 34.5% of the Smart Logistics Services revenue in 2025, establishing it as the leading end-use industry. This dominance is driven by the surge in online shopping, omnichannel retailing, and demand for same-day/next-day delivery, which place immense pressure on logistics networks to operate with speed, visibility, and cost efficiency.

The segment benefits from the rapid deployment of AI-enabled last-mile optimization, real-time order tracking, automated returns management, and cloud-native orchestration platforms. Retailers and e-commerce giants are also investing in micro-fulfillment centers, warehouse robotics, and predictive analytics, ensuring shorter lead times and higher customer satisfaction.Given its scale, pace of innovation, and consumer-driven urgency, retail & e-commerce is expected to remain the backbone of demand in the Smart Logistics Services market throughout the forecast period.

E-commerce Boom Driving Last-Mile Demand

The surge in global e-commerce and omnichannel retail is placing unprecedented demand on logistics networks, particularly in the last-mile segment. Customers expect faster deliveries, real-time tracking, and seamless returns, which is driving adoption of smart logistics services such as orchestration platforms, dynamic route optimization, and AI-powered fleet management. This rapid shift toward customer-centric delivery models ensures sustained growth for digital logistics solutions.

Rising Regulatory Compliance in Global Trade

Governments and trade authorities worldwide are tightening compliance standards related to customs, sustainability, and cold-chain monitoring. Industries such as pharmaceuticals, food, and healthcare face stringent requirements for safety and traceability. Smart logistics platforms with IoT sensors, AI-driven compliance tools, and control tower visibility are increasingly being deployed to ensure adherence. This regulatory push acts as a catalyst, driving enterprises to invest in smart logistics systems.

High Integration & Transition Costs

Despite its benefits, the adoption of smart logistics services is often slowed by high transition costs. Integrating AI-enabled platforms, robotics, and cloud-based orchestration into legacy supply chain systems requires significant capital investment and skilled workforce training. Small and mid-sized enterprises, in particular, face challenges in justifying these upfront costs, which creates a barrier to large-scale adoption and slows the pace of market expansion.

Shift Toward Platformization and Service-Centric Models

A major trend shaping the industry is the pivot from asset-heavy operations to service-driven logistics ecosystems. Providers are increasingly adopting platform-based models-SaaS logistics tools, managed service engagements, and digital freight marketplaces-that generate recurring revenues and foster ecosystem collaboration. This platformization trend is further enhanced by AI, predictive analytics, and cloud-native deployments, enabling logistics players to scale efficiently while delivering end-to-end digital visibility.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 10.1% |

| USA | 4.3% |

| India | 11.2% |

| UK | 6.8% |

| Germany | 5.5% |

| Japan | 7.7% |

The global Smart Logistics Services market shows strong regional variations in adoption speed, largely shaped by e-commerce expansion, digital infrastructure maturity, and regulatory mandates for supply chain visibility.

Asia-Pacific emerges as the fastest-growing region, anchored by India at 11.2% CAGR and China at 10.1% CAGR. India’s trajectory reflects rising digitization initiatives, adoption of control tower platforms, and growing demand for managed logistics services from manufacturing and e-commerce sectors. China’s growth is supported by its cross-border e-commerce ecosystem, government-backed digital trade corridors, and investments in AI-driven logistics visibility and compliance platforms. Europe maintains a robust growth profile, led by Germany (5.5%) and the UK (6.8%), with adoption supported by stringent compliance frameworks, carbon reporting mandates, and logistics automation in retail and automotive supply chains.

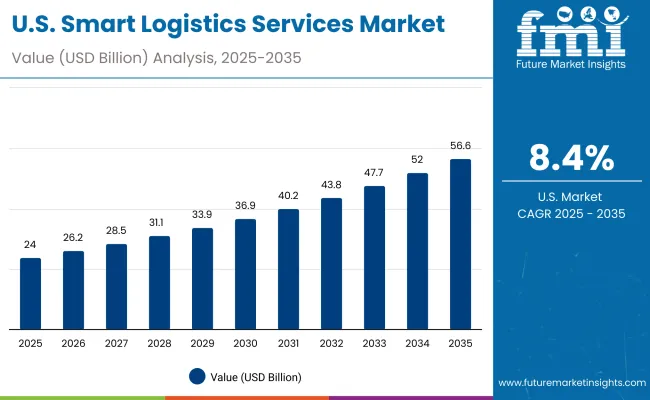

Germany’s logistics service providers are rapidly deploying warehouse robotics and cloud-native orchestration platforms, while the UK is expanding in returns management and last-mile delivery optimization. North America shows moderate expansion, with the USA at 4.3% CAGR, reflecting a mature logistics infrastructure and widespread adoption of 3PL/4PL models. Growth here is more service-driven, with demand concentrated in subscription-based SaaS logistics platforms, AR/VR-enabled warehouse training, and AI-powered fleet orchestration rather than large-scale infrastructure overhauls. Japan (7.7%) balances steady growth through automation in cold-chain logistics, robotics-driven warehouses, and IoT-enabled monitoring for pharmaceuticals and food safety, highlighting its focus on quality and compliance-driven adoption.

| Year | USA Smart Logistics Services (USD Billion) |

|---|---|

| 2025 | 24086.23 |

| 2026 | 26238.16 |

| 2027 | 28582.36 |

| 2028 | 31135.98 |

| 2029 | 33917.76 |

| 2030 | 36948.07 |

| 2031 | 40249.12 |

| 2032 | 43845.09 |

| 2033 | 47762.33 |

| 2034 | 52029.55 |

| 2035 | 56678.02 |

The USA Smart Logistics Services market is projected to expand at a steady CAGR of ~8.4% (2025-2035), supported by the widespread adoption of digital platforms, automation, and managed logistics services. Growth is led by retail and e-commerce, where demand for last-mile optimization, real-time visibility, and returns management is rising sharply. Manufacturing and automotive supply chains are increasingly adopting orchestration platforms and predictive analytics to streamline multi-modal logistics.

Healthcare and pharma logistics are also key contributors, with cold-chain monitoring and compliance-driven digital solutions gaining traction. In addition, sustainability-focused reporting and carbon tracking mandates are creating new demand for cloud-based orchestration and SaaS models.

The Smart Logistics Services Market in the UK is expected to grow at a CAGR of ~6.8% (2025-2035), fueled by strong e-commerce penetration, sustainability targets, and digital-first logistics transformation. Retailers are adopting last-mile orchestration platforms to improve same-day and next-day delivery, while the manufacturing sector is investing in predictive logistics solutions to optimize multi-modal supply chains. Public-private collaborations under the UK’s Future of Mobility and Net-Zero initiatives are pushing enterprises to integrate green logistics reporting and EV-based delivery networks.

India is witnessing rapid growth in the Smart Logistics Services Market, projected to expand at a CAGR of ~11.2% (2025-2035). This momentum is supported by rising e-commerce activity in tier-2 and tier-3 cities, government-backed Digital India and Gati Shakti initiatives, and cost-efficient managed service platforms. MSMEs and regional manufacturers are turning to cloud-based orchestration to reduce inefficiencies in fragmented logistics networks. Additionally, the growing adoption of AI-based route optimization and IoT-enabled fleet monitoring is streamlining operations for retail, pharma, and automotive supply chains.

The Smart Logistics Services Market in China is forecasted to grow at a CAGR of ~10.1% (2025-2035), the highest among leading economies. Expansion is driven by nationwide smart city programs, advanced e-commerce ecosystems, and large-scale industrial automation. Chinese retailers and manufacturers are increasingly adopting autonomous delivery systems, AI-driven orchestration, and IoT-enabled warehousing. Municipal projects around digital twins and logistics hubs are further accelerating adoption. Local technology firms, with competitive pricing and innovation in AI + logistics platforms, are also enabling faster integration of smart logistics across sectors.

| Countries | 2025 Share (%) |

|---|---|

| USA | 25.5% |

| China | 7.9% |

| Japan | 6.0% |

| Germany | 10.4% |

| UK | 7.1% |

| India | 3.6% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 23.2% |

| China | 11.9% |

| Japan | 6.9% |

| Germany | 15.3% |

| UK | 8.1% |

| India | 4.9% |

The Smart Logistics Services Market in Germany is expected to expand steadily at a CAGR of ~5.5% (2025-2035), supported by the country’s strong industrial base and leadership in Industry 4.0 adoption. German manufacturers are increasingly embedding AI-driven logistics orchestration platforms into production and distribution to synchronize factory output with global supply chains. Automotive OEMs and tier-1 suppliers are leveraging predictive logistics services for just-in-time and just-in-sequence delivery. Logistics hubs across Hamburg, Frankfurt, and Munich are integrating IoT-enabled warehousing to support Europe’s growing e-commerce demand. Furthermore, compliance with EU sustainability directives is pushing logistics firms to adopt EV-based fleet management, carbon tracking, and circular packaging logistics.

| USA By Service Type | Value Share% 2025 |

|---|---|

| Last-mile optimization & orchestration | 28.7% |

| Others | 71.3% |

The Smart Logistics Services Market in the United States is projected at USD 24,086.23million in 2025, with last-mile optimization & orchestration accounting for 28.7% of total market value. This strong share reflects the USA focus on addressing delivery bottlenecks in urban areas and meeting consumer expectations for same-day and next-day delivery. Service-based solutions such as route optimization, dynamic scheduling, and AI-driven demand forecasting are gaining priority over traditional logistics infrastructure upgrades.

The USA market is also witnessing a shift toward cloud-based logistics management systems, which allow for real-time fleet visibility, integration with e-commerce platforms, and improved customer communication. Retailers and logistics providers are investing heavily in automation-enabled warehouses and driverless delivery pilots, further accelerating adoption. Sustainability goals, particularly around electrification of delivery fleets and carbon-neutral logistics strategies, are additional growth drivers.

| China By End Industry | Value Share% 2025 |

|---|---|

| Retail & e-commerce | 35.6% |

| Others | 64.4% |

The Smart Logistics Services Market in China is valued at USD 7451.14 million in 2025. The dominance of warehouse automation is driven by China’s high-volume e-commerce and retail sectors, which require fast, accurate, and scalable order fulfillment. Automated guided vehicles (AGVs), robotic sorting, and AI-driven inventory tracking are increasingly critical to reducing operational bottlenecks and improving delivery speed.

Portability, modularity, and integration with existing warehouse management systems (WMS) further accelerate adoption, making warehouse automation the backbone of efficient logistics operations. Transportation optimization platforms remain important for urban delivery and last-mile logistics but show slightly slower growth due to infrastructure limitations and regulatory compliance requirements.

As China expands Industry 4.0 and smart city initiatives, AI-powered predictive analytics combined with smart logistics services will become essential for real-time supply chain visibility, cost reduction, and service-level improvement.

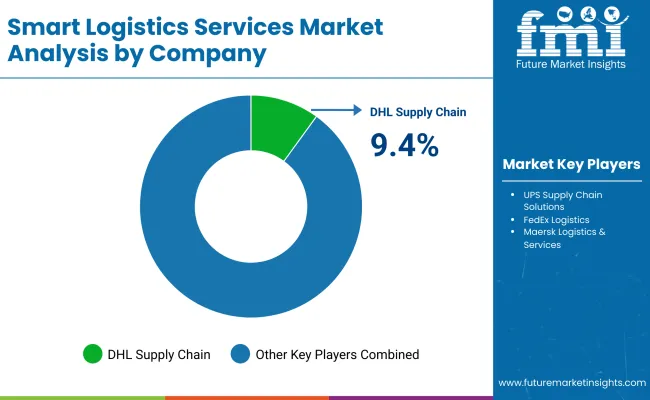

The Smart Logistics Services Market is moderately fragmented, featuring global leaders, regional innovators, and niche-focused specialists operating across multiple logistics segments. Major players such as DHL Supply Chain, Kuehne + Nagel, and DB Schenker hold significant market share, driven by advanced warehouse automation, AI-based route optimization, and end-to-end supply chain visibility solutions. Their strategies increasingly emphasize predictive analytics, IoT-enabled fleet management, and cloud-based logistics platforms for e-commerce, retail, and industrial clients.Mid-sized players, including XPO Logistics, GXO Logistics, and CEVA Logistics, focus on flexible and technology-driven offerings such as last-mile delivery optimization, autonomous guided vehicle (AGV) integration, and smart inventory management. Their adoption is fueled by modular, scalable solutions suitable for both urban and regional supply chains.

Specialized providers like ShipBob, Stord, and Flexport cater to specific niches such as SME e-commerce fulfillment, temperature-sensitive logistics, or customized regional delivery services. Their competitive edge lies in tailored solutions, regional adaptability, and integration with client-specific platforms rather than global reach. Competitive differentiation is increasingly moving away from individual service offerings toward integrated ecosystems combining predictive analytics, real-time tracking, AI-driven automation, and subscription-based logistics solutions.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 94,518.9 Million |

| Service Type | Last-mile optimization & orchestration, Real-time visibility & control towers, Digital freight brokerage & TMS-as-a-service, Warehouse operations-as-a-service (WMS, robotics enablement), Cold-chain monitoring & compliance, Reverse logistics & returns optimization, Customs & trade compliance services |

| Transport Mode | Road, Ocean, Air, Rail, Multimodal |

| Delivery Model | Managed services (outsourced ops, control tower BPO), Platform / SaaS (self-serve), Marketplace (shipper-carrier network) |

| Pricing Model | Transaction-based (per shipment/stop), Subscription (seat / account / lane), Contract / retainer (managed engagement) |

| End Industry | Retail & e-commerce, Consumer electronics, Pharma & healthcare, Automotive, Industrial & manufacturing, Food & beverage |

| Deployment | Cloud-native, Hybrid, On- prem managed |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DHL Supply Chain, UPS Supply Chain Solutions, FedEx Logistics, Maersk Logistics & Services, Kuehne+Nagel, DSV, XPO, Flexport, GXO Logistics, ShipBob |

| Additional Attributes | Revenue segmentation by service type and pet type, adoption trends of mobile versus traditional grooming, rising demand for eco-friendly and premium treatments, growth in luxury grooming services, app-based booking and tracking platforms, integration with tele-grooming and AI-based pet monitoring, regional trends shaped by urbanization and pet ownership, and innovations in portable grooming equipment and automated tools. |

The global Smart Logistics Market is estimated to be valued at USD 94,518.9 million in 2025.

The market size for Smart Logistics is projected to reach USD 243,839.1 million by 2035.

The Smart Logistics Market is expected to grow at a 9.9% CAGR between 2025 and 2035.

The key services types are Last-mile optimization & orchestration, Real-time visibility & control towers, Digital freight brokerage & TMS-as-a-service, Warehouse operations-as-a-service (WMS, robotics enablement), Cold-chain monitoring & compliance, Reverse logistics & returns optimization, Customs & trade compliance services.

In terms of service type, last-mile optimization and orchestration solutions are expected to command the largest share, around 29.4%, in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Labelling in Logistics Market Size and Share Forecast Outlook 2025 to 2035

Third Party Logistics Services Market Size and Share Forecast Outlook 2025 to 2035

Smart Meeting Pod Market Size and Share Forecast Outlook 2025 to 2035

Smart Electrogastrogram Recorder Market Size and Share Forecast Outlook 2025 to 2035

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Logistics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA