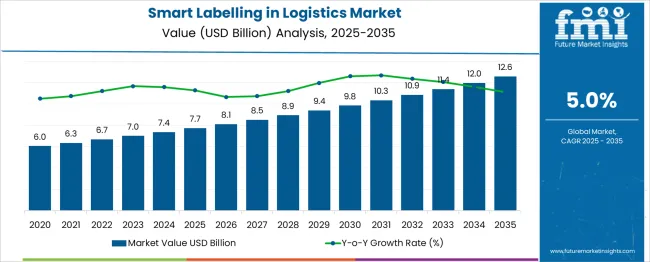

The Smart Labelling in Logistics Market is estimated to be valued at USD 7.7 billion in 2025. It is projected to reach USD 12.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

This moderate yet steady expansion reflects the rising integration of smart labelling technologies in real-time tracking, inventory accuracy, and supply chain automation. By 2030, the market is projected to reach USD 9.8 billion, capturing a five-year absolute increase of USD 2.1 billion. Between 2025 and 2030, the YoY growth rate remains stable, averaging around 5.0–5.3%, indicating sustained demand driven by both regulatory compliance and cost optimization efforts. Smart labels ranging from RFID and NFC tags to QR codes with sensor integration are increasingly adopted for their role in reducing manual error, enabling end-to-end traceability, and supporting data-driven logistics. Retail, e-commerce, and cold chain logistics are among the largest adopters, with pharmaceuticals and food sectors accelerating smart label usage to enhance transparency and reduce spoilage. As global logistics systems continue to digitize, the market’s growth will be supported by scalable, low-cost smart labelling solutions that combine data security, environmental durability, and easy integration across existing infrastructure.

| Metric | Value |

|---|---|

| Smart Labelling in Logistics Market Estimated Value in (2025 E) | USD 7.7 billion |

| Smart Labelling in Logistics Market Forecast Value in (2035 F) | USD 12.6 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The smart labelling in logistics market is shaped by several key parent markets, each contributing distinct shares based on application needs and adoption levels. The largest contributor is the logistics and supply chain visibility sector, holding around 35–40% of the total market. This segment includes parcel tracking, shipment authentication, route monitoring, and delivery status updates using technologies like RFID, QR codes, and IoT-enabled tags.

Retail and inventory management follow closely, with a share of approximately 20–25%, as retailers increasingly deploy smart labels to streamline stock tracking, reduce shrinkage, and enable automated inventory audits across warehouses and outlets. The food and beverage logistics sector accounts for about 15–18%, with smart labels used for temperature and humidity monitoring during cold-chain transportation to prevent spoilage and ensure quality compliance.

The healthcare and pharmaceutical logistics segment contributes roughly 10–12%, driven by high regulatory standards requiring real-time tracking, tamper evidence, and product authentication. Manufacturing and industrial logistics represent another 8–10%, where smart labelling is used for asset tracking, equipment identification, and supply chain automation. Remaining applications in automotive, electronics, and general freight collectively add about 5–7%. Together, these segments demonstrate how smart labelling enhances traceability, efficiency, and security across diverse logistics operations.

The smart labelling in logistics market is witnessing accelerated adoption as global logistics operations prioritize automation, traceability, and compliance-driven inventory management. Increasing globalization of trade, coupled with growing demand for real-time shipment visibility, has positioned smart labelling as a critical enabler of operational efficiency.

The shift from traditional barcoding to intelligent labelling systems such as RFID, NFC, and IoT-enabled tags is being propelled by rising investments in digital logistics infrastructure. As logistics providers aim to mitigate errors, reduce manual scanning, and enhance data accuracy, smart labelling solutions are being increasingly integrated with warehouse management systems, transportation management platforms, and cloud analytics.

The market is also benefiting from strict regulatory frameworks that mandate traceability in food, pharmaceuticals, and cross-border shipments, further supporting the uptake of intelligent labelling mechanisms. Over the coming years, advancements in label sensor technologies, coupled with scalable cloud architectures and API-driven platforms, are expected to strengthen the smart labelling ecosystem across both developed and emerging supply chains.

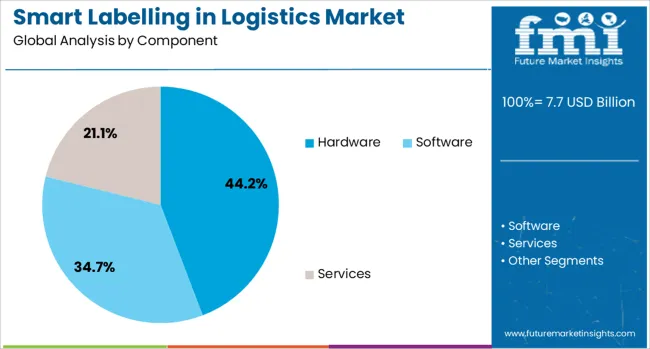

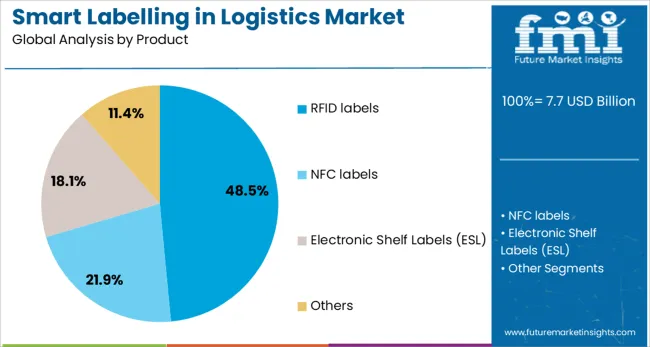

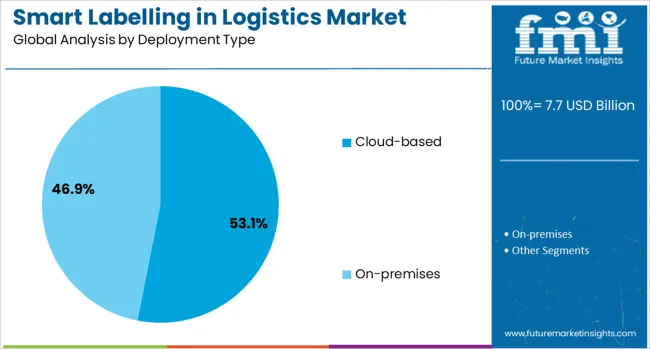

The smart labelling in logistics market is segmented by component, product, deployment type, company size, application, and geographic regions. The components of smart labelling in the logistics market are divided into Hardware, Software, and Services. In terms of the product of smart labelling in the logistics market, it is classified into RFID labels, NFC labels, Electronic Shelf Labels (ESL), and Others.

Based on the deployment type of the smart labelling in the logistics market, it is segmented into Cloud-based and On-premises. The smart labelling in logistics market is segmented by company size into Small and Medium-sized Enterprises (SME) and Large enterprises. The application of smart labelling in the logistics market is segmented into Inventory management, Asset tracking, Parcel tracking and delivery, Cold chain monitoring, and Others.

Regionally, the smart labelling in logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment is expected to capture 44.2% of the revenue share in the Smart Labelling in Logistics market in 2025, indicating its foundational role in enabling intelligent logistics networks. Growth in this segment has been primarily influenced by the rising deployment of RFID readers, label printers, encoders, and scanners across distribution centers, fulfillment warehouses, and cross-docking facilities.

Hardware infrastructure forms the core interface between physical goods and digital systems, enabling real-time communication of item-level data. Increasing demand for rugged, high-performance devices that support contactless scanning and automated inventory tracking has further propelled investment in this area.

The expansion of logistics hubs in e-commerce, retail, and cold chain sectors has reinforced the need for scalable and durable hardware components capable of supporting high-volume operations. Integration with edge computing systems and modular IoT platforms has also supported the segment’s relevance in smart warehouse transformation initiatives, ensuring continuous and secure asset monitoring throughout the supply chain.

The RFID labels segment is projected to account for 48.5% of the Smart Labelling in Logistics market’s revenue share in 2025, reflecting its critical importance in driving data-rich logistics operations. The dominance of RFID labels has been reinforced by their ability to enable non-line-of-sight data capture, real-time asset tracking, and bulk scanning of items in motion. These attributes have proven essential in modern logistics environments where speed, accuracy, and automation are paramount.

RFID labels offer greater durability and memory capacity compared to conventional barcodes, enabling secure and granular tracking of high-value and perishable goods. Increased adoption of RFID across third-party logistics, retail distribution, and last-mile delivery operations has expanded the use cases for these labels.

The declining unit cost of RFID tags, combined with enhanced read ranges and improved tag sensitivity, has further encouraged their widespread integration. Support for compliance-driven documentation and enhanced anti-counterfeiting measures has also contributed to sustained market penetration of RFID labels.

The cloud-based deployment type is forecast to contribute 53.1% of the total revenue share in the Smart Labelling in Logistics market in 2025, making it the dominant deployment model. The growth of this segment has been influenced by the increasing preference for scalable, centralized, and cost-efficient infrastructure that supports real-time data synchronization across geographically dispersed logistics networks.

Cloud-based platforms allow seamless integration of smart labelling systems with enterprise resource planning, inventory control, and fleet management systems, thereby optimizing end-to-end supply chain visibility. The flexibility to access labelling configurations, analytics dashboards, and compliance documentation from any location has made cloud deployment attractive for both large logistics operators and small-to-medium enterprises.

Enhancements in cloud security protocols, API integrations, and data redundancy mechanisms have further strengthened confidence in cloud-based adoption. As logistics organizations prioritize agility, remote operability, and continuous system updates, the cloud-based model is expected to remain the backbone of next-generation smart labelling ecosystems.

Opportunities in real-time tracking and automation are reshaping logistics operations. The integration of smart labels enhances supply chain visibility, efficiency, and data accuracy.

The logistics industry is increasingly adopting smart labelling technologies to enhance real-time tracking and visibility of goods throughout the supply chain. Smart labels, such as RFID and NFC tags, provide automated data collection, reducing manual errors and improving inventory accuracy. These technologies enable businesses to monitor the movement of products in real-time, facilitating better decision-making and responsiveness to disruptions. The integration of smart labels with IoT devices further enhances visibility, allowing for proactive management of logistics operations. As e-commerce continues to grow, the demand for efficient and transparent supply chains drives the adoption of smart labelling solutions, leading to improved operational efficiency and customer satisfaction.

The integration of smart labelling with IoT and automation technologies is transforming logistics operations. Smart labels equipped with sensors can monitor various parameters, such as temperature, humidity, and shock, providing valuable data for managing sensitive shipments like pharmaceuticals and perishable goods. This integration allows for automated alerts and actions based on real-time data, reducing the need for manual intervention and minimizing the risk of human error. Additionally, the use of machine learning algorithms can predict potential issues and optimize routing and inventory management. As businesses seek to streamline operations and reduce costs, the adoption of smart labelling combined with IoT and automation technologies is becoming increasingly prevalent, offering significant improvements in supply chain efficiency and reliability.

Smart labels are evolving to embed sensors that monitor temperature, humidity, vibration, and location in real‑time. These sensors support logistics use cases like cold chain monitoring and asset tracking in medical and perishable cargo, accelerating condition monitoring applications at a high growth rate. Micro sensor integration enables continuous data capture across multiple environmental dimensions, boosting visibility and reducing spoilage risk. The spread of IoT integration enables smart labels to communicate wirelessly to cloud platforms, supporting route optimization and exception alerts. Battery‑powered labels account for over one quarter of label hardware demand, illustrating reliance on autonomous sensing capabilities. As supply chains digitize, demand for sensor-equipped smart labels continues to rise across goods movement operations, enhancing transparency and enabling responsive decision making

Parcel delivery and logistics operations are rapidly adopting smart labels to enable seamless tracking from dispatch through delivery endpoints. Modern smart labels—using RFID, GPS, cellular, or Bluetooth—allow carriers to maintain package-level visibility without manual barcode scanning. These technologies minimize misloads, reduce losses, and optimize delivery routes using continuous location data and environmental insights. High-value goods particularly benefit from real-time tracking accuracy, with sensors detecting shock, light exposure, or temperature fluctuations to manage quality. The parcel tracking & delivery segment leads smart label adoption, supported by global logistics providers prioritizing transparency. This presents significant opportunity for label providers to partner with delivery and e-commerce platforms seeking granular tracking and client-facing visibility features

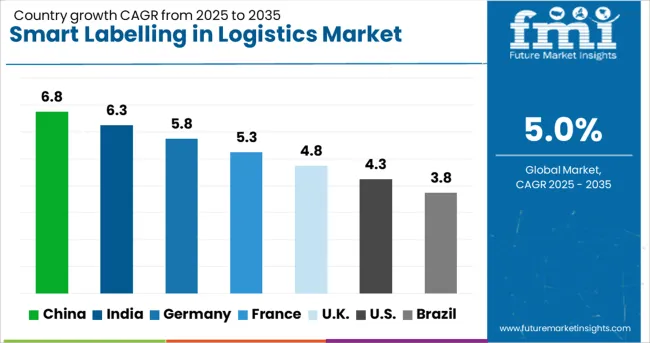

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global smart labelling in logistics market is projected to grow at a CAGR of 5% through 2035, driven by increased adoption of tracking and inventory management systems. Among BRICS nations, China leads with 6.8% growth, supported by rapid expansion of warehousing infrastructure and distribution centers. India follows at 6.3%, where modernization of supply chains and retail logistics has accelerated label implementation. In the OECD region, Germany reports 5.8% growth, backed by regulatory standards for traceability and quality assurance.

France, growing at 5.3%, has seen consistent uptake through industrial and retail sectors. The United Kingdom, at 4.8%, reflects gradual integration of labeling solutions in freight and last-mile delivery. Market developments have been influenced by compliance requirements, interoperability standards, and procurement policies. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The smart labelling market in China is growing at a CAGR of 6.8%, driven by increasing adoption in supply chain tracking and inventory management. RFID and QR code labels are being integrated into logistics operations to enhance real-time visibility and accuracy. Production of smart labels with embedded sensors for temperature and humidity monitoring has been scaled to meet demand from pharmaceutical and food logistics sectors. Advanced printing technologies have been adopted to ensure durability during transit. Collaborative efforts between label manufacturers and logistics providers have improved integration with warehouse management systems. Packaging units with tamper-evident smart labels have gained popularity. Distribution networks have expanded to support growing e-commerce and cold chain logistics requirements.

India’s smart labelling market is advancing at a CAGR of 6.3%, supported by rising demand for enhanced shipment tracking and anti-counterfeiting solutions. Barcode and NFC-enabled smart labels have been increasingly used across warehousing and distribution operations. Production of temperature-sensitive smart labels for cold chain logistics has been expanded. Packaging units incorporating tamper-proof smart labels have been introduced to improve security. Quality assurance processes have been strengthened to ensure label readability and sensor accuracy. Collaborations between manufacturers and logistics companies have facilitated adoption in retail and pharmaceutical supply chains. Distribution capabilities have been enhanced to support growth in e-commerce and fast-moving consumer goods sectors.

In Germany, the smart labelling market is growing at a CAGR of 5.8%, with applications in real-time tracking, anti-counterfeiting, and condition monitoring. RFID and sensor-enabled labels have been integrated into automotive and pharmaceutical logistics. Production processes have been optimized to enhance label durability and sensor functionality. Regulatory compliance related to data security and environmental standards has been ensured. Packaging with smart labels featuring tamper-evident properties has gained adoption. Partnerships between smart label producers and supply chain operators have led to customized solutions for high-value goods. Investments in R&D have focused on improving sensor accuracy and label lifespan. Distribution channels have been aligned to support both large-scale and niche logistics requirements.

France’s smart labelling market is expanding at a CAGR of 5.3%, supported by demand in pharmaceutical, food, and luxury goods logistics. Smart labels with embedded temperature and humidity sensors are being used extensively for cold chain monitoring. Barcode and QR code labels have been integrated into warehouse management systems to enhance accuracy. Packaging suppliers have introduced tamper-proof and anti-counterfeit smart labels. Quality testing standards have been established to ensure label reliability under varying conditions. Collaborations between label manufacturers and logistics providers have driven innovations in real-time data capture and reporting. Distribution networks have expanded to accommodate growth in e-commerce and perishable goods sectors.

The smart labelling market in the United Kingdom is progressing at a CAGR of 4.8%, supported by increasing adoption in retail, pharmaceutical, and food logistics. NFC and RFID-enabled smart labels have been implemented to improve shipment tracking and inventory accuracy. Packaging units with tamper-evident and anti-counterfeit smart labels have been introduced to enhance security. Quality assurance processes have been strengthened to ensure sensor performance and label durability. Collaborations between logistics companies and label manufacturers have led to customized solutions for temperature-sensitive shipments. Distribution channels have been optimized to serve e-commerce and fast-moving consumer goods sectors. Consumer demand for transparency and product authenticity has driven innovation in smart labelling technologies.

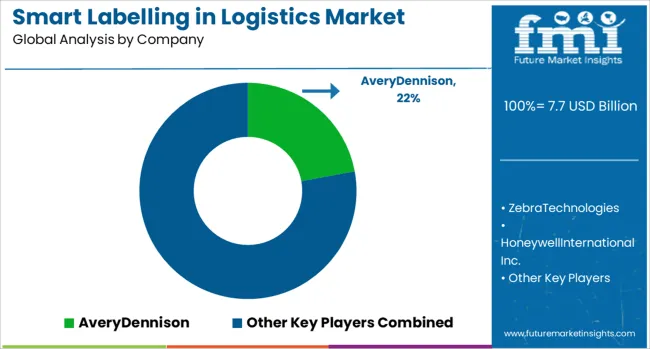

The smart labelling market in logistics is evolving rapidly as global supply chains demand greater visibility, accuracy, and automation. This market features a mix of technology providers specializing in RFID (Radio Frequency Identification), barcode systems, and integrated software platforms. At the forefront is Avery Dennison, which leads the sector with its expansive portfolio of RFID labels and intelligent tagging solutions.

These technologies enable real-time tracking and inventory optimization, particularly in warehousing, freight, and distribution centers. Zebra Technologies enhances operational efficiency with its barcode printers, scanners, and RFID systems that are widely adopted in e-commerce and last-mile delivery networks. Honeywell International Inc. supports logistics companies with integrated labelling and data capture hardware, coupled with software that ensures accurate tracking from origin to destination. Oracle Corporation contributes a software-centric approach, integrating smart labelling into cloud-based supply chain platforms for predictive analytics, routing, and inventory forecasting.

Meanwhile, Impinj and Smartrac N.V. play pivotal roles in RFID innovation, offering high-performance inlays and connectivity solutions that enhance traceability at the item level. Smaller players like Sato Holdings focus on robust printers and smart labels that perform reliably in demanding environments such as cold chains and industrial logistics. Collectively, these firms are transforming logistics through intelligent labelling, driving automation, compliance, and real-time decision-making. As the demand for faster delivery and tighter inventory control grows, smart labelling technologies are becoming essential tools in modern logistics infrastructure.

According to Checkpoint Systems' official press release, Checkpoint Systems opened a USD 40 million RFID facility in Mexico City on July 8, 2025. Spanning 10,000 sqm, it produces 4.2 billion RFID inlays annually using advanced technology. Certified to SMETA and FSC CoC, this expansion boosts North American supply chains and highlights their commitment to innovation.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.7 Billion |

| Component | Hardware, Software, and Services |

| Product | RFID labels, NFC labels, Electronic Shelf Labels (ESL), and Others |

| Deployment Type | Cloud-based and On-premises |

| Company Size | Small and Medium-sized Enterprises (SME) and Large enterprises |

| Application | Inventory management, Asset tracking, Parcel tracking and delivery, Cold chain monitoring, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AveryDennison, ZebraTechnologies, HoneywellInternationalInc., OracleCorporation, Impinj, SatoHoldings, and SmartracN.V. |

| Additional Attributes | Dollar sales by smart labelling type including RFID tags, NFC tags, and QR codes, by application in inventory tracking, asset management, and cold chain monitoring, and by geographic region including North America, Europe, and Asia-Pacific; demand driven by supply chain digitization, real-time visibility, and IoT integration; innovation in durable, low-cost, and sustainable labels; costs influenced by raw material prices and infrastructure investments; and emerging use cases in pharmaceuticals, food logistics, and e-commerce delivery. |

The global smart labelling in logistics market is estimated to be valued at USD 7.7 billion in 2025.

The market size for the smart labelling in logistics market is projected to reach USD 12.6 billion by 2035.

The smart labelling in logistics market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in smart labelling in logistics market are hardware, software and services.

In terms of product, rfid labels segment to command 48.5% share in the smart labelling in logistics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Smart Doorbell Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA