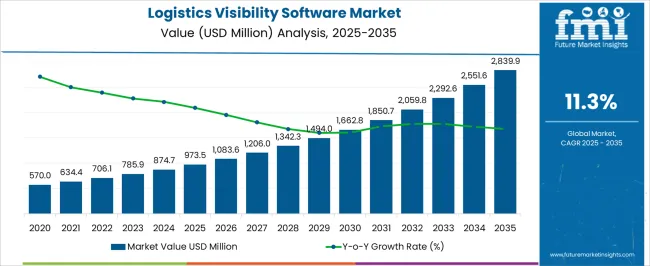

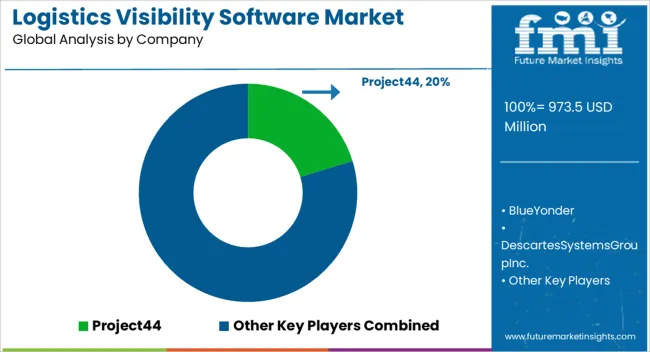

The logistics visibility software market is estimated to be valued at USD 973.5 million in 2025 and is projected to reach USD 2839.9 million by 2035, registering a compound annual growth rate (CAGR) of 11.3% over the forecast period.

Expanding global trade networks and rising complexity in multi-modal logistics push enterprises to invest in visibility tools that enhance route optimization, predictive analytics, and risk management. Between 2031 and 2035, the market scales from USD 1,083.6 billion to USD 1,850.7 billion, benefiting from the integration of AI-driven insights, IoT-enabled devices, and blockchain for secure and transparent data sharing across stakeholders. This period witnesses strong uptake in retail, manufacturing, and e-commerce, where streamlined operations and reduced delivery delays provide competitive advantages. Enterprises increasingly focus on predictive maintenance, cargo condition monitoring, and carbon emission tracking within their supply chains. The strong emphasis on efficiency, resilience, and compliance ensures that logistics visibility software becomes a cornerstone for modern supply chain management across industries.

Cross-functional tensions emerge prominently in software deployment decisions where data analysts prioritize comprehensive visibility features including customer behavior tracking while legal departments impose restrictions on personal data collection and international transfer protocols. Supply chain operations encounter implementation challenges when integrating multiple transportation management systems that demand standardized data formats yet operate across carriers using incompatible communication protocols and varying compliance requirements. Quality assurance teams face operational difficulties when validating software performance metrics while accommodating regulatory frameworks that limit data retention periods and require extensive audit documentation.

Technology integration involving blockchain platforms promises enhanced supply chain transparency yet creates operational tensions between immutable record-keeping capabilities and data protection regulations requiring individual rights to data deletion and correction. Processing facilities encounter implementation challenges when coordinating smart contract functionality with existing enterprise resource planning systems that operate on different data models and security frameworks. Logistics operators face difficulties when implementing distributed ledger technologies that require consensus mechanisms across multiple stakeholders while maintaining transaction processing speeds necessary for real-time operations.

Predictive analytics advancement creates operational complexity as machine learning algorithms require extensive historical data access for training purposes while privacy regulations impose restrictions on automated processing that affects individual rights and business relationships. Supply chain facilities encounter challenges when implementing demand forecasting systems that promise inventory optimization yet require customer purchasing pattern analysis that may conflict with data minimization principles required by privacy legislation. Transportation networks face coordination difficulties when deploying route optimization algorithms that must balance efficiency improvements against data collection limitations imposed by driver privacy rights and employment regulations.

| Metric | Value |

|---|---|

| Logistics Visibility Software Market Estimated Value in (2025 E) | USD 973.5 million |

| Logistics Visibility Software Market Forecast Value in (2035 F) | USD 2839.9 million |

| Forecast CAGR (2025 to 2035) | 11.3% |

The logistics visibility software market is experiencing accelerated growth as supply chain resilience, transparency, and digitization become strategic imperatives for businesses across industries. Enterprises are increasingly investing in platforms that provide end-to-end shipment tracking, predictive analytics, and disruption management to address growing demands for operational efficiency and customer satisfaction. The push for automation and real-time data has been intensified by rising e-commerce volumes, global trade complexity, and the need for proactive risk mitigation.

Integration with telematics, GPS, and IoT sensors has enabled real-time monitoring of assets across transportation modes, providing actionable insights into delivery performance and compliance. The adoption of API-first, cloud-native architectures is enabling faster deployments, seamless integration with TMS and WMS platforms, and dynamic scalability.

As global logistics networks face mounting pressure from fluctuating demand and capacity constraints, software that delivers visibility, accountability, and agility is being prioritized With evolving customer expectations and heightened regulatory scrutiny, logistics visibility solutions are becoming central to supply chain transformation strategies.

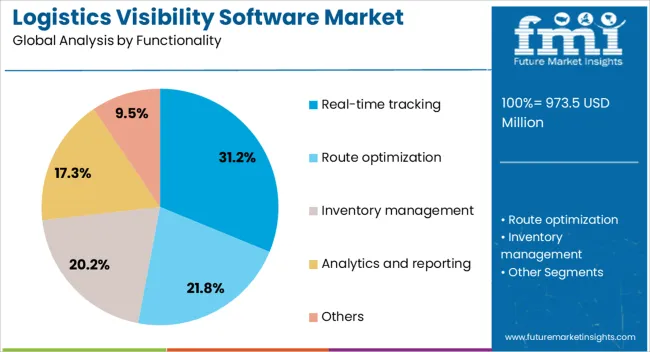

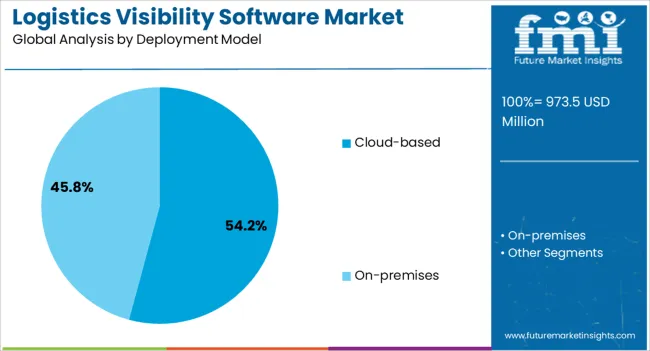

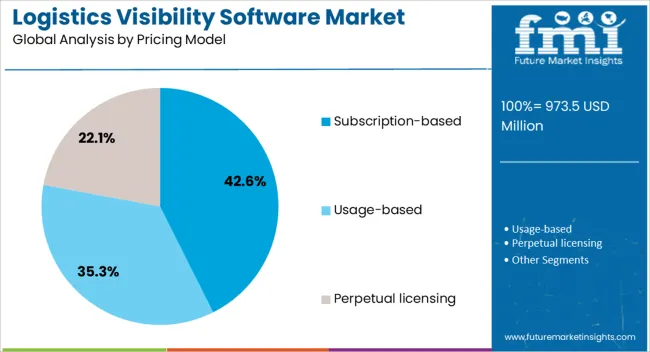

The logistics visibility software market is segmented by functionality, deployment model, pricing model, enterprise size, end user industry, and geographic regions. By functionality, logistics visibility software market is divided into Real-time tracking, Route optimization, Inventory management, Analytics and reporting, and Others. In terms of deployment model, logistics visibility software market is classified into Cloud-based and On-premises. Based on pricing model, logistics visibility software market is segmented into Subscription-based, Usage-based, and Perpetual licensing. By enterprise size, logistics visibility software market is segmented into Large enterprises and SME. By end user industry, logistics visibility software market is segmented into Transportation & logistics, Retail, Manufacturing, Food & Beverages, Automotive, Healthcare, and Others. Regionally, the logistics visibility software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The real-time tracking segment is expected to account for 31.2% of the logistics visibility software market revenue in 2025, reflecting its central role in addressing the industry's demand for continuous shipment monitoring. The rise in customer expectations for instant delivery updates and precise estimated arrival times has led to widespread implementation of real-time tracking capabilities. This functionality has been increasingly adopted across third-party logistics providers, retailers, and manufacturers aiming to improve delivery performance and reduce service disruptions.

The growing integration of GPS, RFID, and IoT devices into freight and fleet operations has enabled real-time data collection, which is then visualized and analyzed through software platforms. Enhanced decision-making capabilities, driven by real-time alerts and exception handling, have contributed to the segment’s growth.

Additionally, regulatory requirements related to cargo security and compliance have further increased the reliance on live tracking features The ability to proactively respond to transit delays and reroute shipments dynamically has positioned real-time tracking as a fundamental function in modern logistics ecosystems.

Cloud-based deployment models are projected to contribute 54.2% of the total revenue share in the logistics visibility software market in 2025, underscoring their growing importance in achieving digital scalability and infrastructure flexibility. Organizations are increasingly moving away from on-premise solutions to cloud-hosted platforms due to their ease of integration, lower upfront costs, and rapid deployment timelines.

Cloud infrastructure allows for high system availability, real-time data access across geographies, and enhanced collaboration between supply chain stakeholders. The shift has been further supported by improvements in data encryption, cybersecurity protocols, and compliance certifications, which have addressed earlier concerns over data privacy.

Additionally, cloud-native solutions offer continuous updates and access to the latest features without service disruption, which is essential for time-sensitive logistics operations As global logistics environments become more interconnected and responsive, the scalability and reliability provided by cloud-based platforms are making them the preferred deployment model for both SMEs and large enterprises.

The subscription-based pricing model is anticipated to account for 42.6% of the logistics visibility software market revenue in 2025, reflecting a growing preference for flexible, pay-as-you-scale solutions. Businesses are increasingly seeking pricing structures that align with operational budgets and evolving needs, rather than large upfront capital expenditures. Subscription models allow users to access advanced features and integrations without long-term commitments, making them attractive to logistics firms with variable shipment volumes or seasonal demand fluctuations.

This pricing approach also supports predictable IT spending and facilitates quick onboarding of new users and modules as business needs expand. Vendors have responded by offering tiered subscription plans with scalable functionalities that cater to different organizational sizes and complexity levels.

Additionally, the model enables continuous feature enhancements and technical support, which has been essential in maintaining uninterrupted logistics operations As digital transformation in logistics accelerates, the flexibility and cost-efficiency of subscription-based offerings are solidifying their position as the preferred choice among visibility software buyers.

Logistics visibility software adoption is rising across e-commerce, manufacturing, and regulated sectors. Its ability to provide compliance support, real-time tracking, and data-driven insights ensures long-term value for global supply chains.

The logistics visibility software market is being fueled by the rapid growth of e-commerce and retail logistics, where real-time tracking and delivery transparency have become non-negotiable. Retailers and online platforms are leveraging such software to improve customer satisfaction by providing accurate delivery estimates, proactive delay notifications, and improved last-mile execution. Increasing consumer expectations for same-day or next-day delivery are pushing logistics providers to deploy visibility platforms that integrate shipment data across multiple carriers. This has also led to more investment in predictive tools that forecast disruptions and optimize routes. As retail supply chains expand globally, visibility solutions are serving as a backbone for inventory coordination, fleet optimization, and cross-border delivery management.

Manufacturing and automotive industries are increasingly adopting logistics visibility software to manage complex global supply chains. The sector requires precise monitoring of inbound materials and outbound finished goods to minimize disruptions and maintain production schedules. Automotive companies rely on real-time tracking for parts delivery, especially for just-in-time and just-in-sequence manufacturing. This software helps manufacturers gain deeper insights into transit performance, supplier reliability, and inventory flow, reducing the risk of bottlenecks. Predictive alerts and automated reporting allow companies to address issues before they impact production lines. With supply chains stretching across continents, end-to-end visibility has become critical for ensuring operational continuity and cost efficiency in industrial ecosystems.

Logistics visibility software is seeing rising adoption due to regulatory and compliance requirements across multiple regions. Stricter standards on documentation, customs clearance, and environmental reporting have encouraged logistics firms to adopt platforms that provide real-time transparency and digital record-keeping. The software supports compliance with government mandates, allowing companies to demonstrate shipment accuracy, regulatory adherence, and carrier accountability. Industries such as pharmaceuticals and food rely heavily on this technology to ensure traceability, as they face stringent quality and safety regulations. Automated compliance checks, audit trails, and integrated documentation management features are now core functions of advanced platforms. These capabilities are making visibility software an indispensable tool for businesses navigating complex regulatory frameworks.

The ability to transform logistics data into actionable insights has become a major driver for adoption. Visibility software offers advanced analytics to track carrier performance, optimize costs, and measure delivery efficiency. By analyzing real-time data, logistics providers can identify recurring bottlenecks, monitor shipment health, and optimize route planning for improved performance. Companies are also using this data to negotiate contracts with carriers and manage service-level agreements more effectively. Predictive analytics is helping shippers anticipate seasonal surges, port delays, or weather disruptions, reducing the impact of uncertainties. With businesses prioritizing cost control and customer satisfaction, the role of analytics-driven visibility platforms is set to strengthen further.

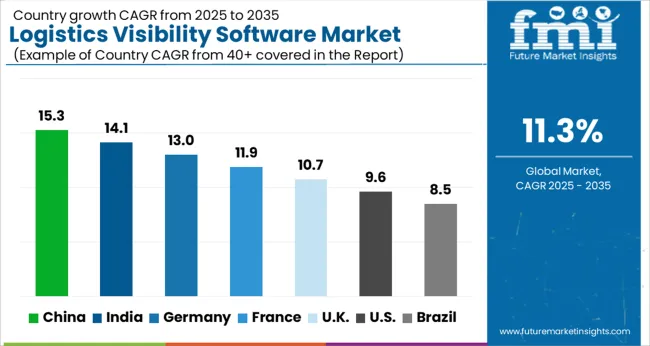

| Country | CAGR |

|---|---|

| China | 15.3% |

| India | 14.1% |

| Germany | 13.0% |

| France | 11.9% |

| UK | 10.7% |

| USA | 9.6% |

| Brazil | 8.5% |

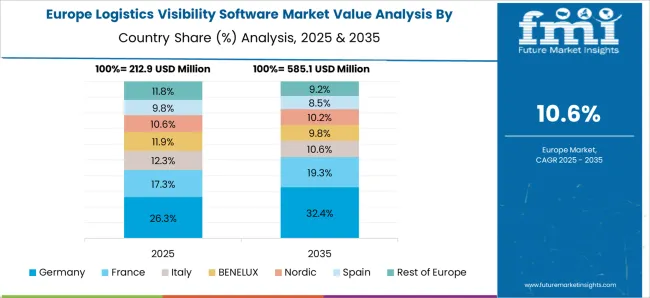

The logistics visibility software market is projected to expand globally at a CAGR of 11.3% from 2025 to 2035, driven by rising e-commerce demand, complex global trade flows, and the need for real-time shipment tracking. China leads with a CAGR of 15.3%, fueled by rapid expansion in cross-border trade, advanced digital logistics platforms, and strong government investment in smart supply chain technologies. India follows at 14.1%, supported by fast-growing retail and FMCG sectors, along with digital adoption by third-party logistics providers. France grows at 11.9%, backed by retail distribution, food traceability requirements, and government focus on digital freight corridors. The United Kingdom posts 10.7% CAGR, supported by demand for compliance-driven solutions in post-Brexit trade and strong e-commerce penetration, while the United States reaches 9.6%, reflecting a mature market where adoption is led by predictive analytics, large 3PLs, and visibility-driven performance contracts. This assessment highlights Asia-Pacific as the fastest-growing hub for logistics visibility software adoption, while Europe and North America remain essential for compliance-led, innovation-focused deployments.

China is projected to post a 15.3% CAGR during 2025–2035, surpassing the global trajectory of 11.3%. From 2020–2024, the market was expanding at about 12.9%, primarily due to the integration of digital freight platforms and early investments in e-commerce logistics. The stronger pace in the next phase will be driven by large-scale adoption of AI-enabled predictive analytics, government-backed smart trade corridors, and rising cross-border shipments through Belt and Road initiatives. Logistics providers are investing in platforms that support multimodal visibility across shipping, rail, and trucking. The country’s manufacturing strength combined with retail e-commerce expansion has created a demand premium for robust visibility solutions.

India is forecasted to grow at a 14.1% CAGR during 2025–2035, compared with around 11.7% between 2020–2024, maintaining a premium over the global 11.3% average. Early momentum came from digital freight apps and increased transparency demands in FMCG and retail distribution. The acceleration is explained by growth in online retail, rapid infrastructure upgrades, and supply chain digitalization initiatives under the government’s logistics efficiency mission. Domestic 3PLs are adopting advanced cloud-based platforms to meet client needs for predictive ETAs, compliance, and cost efficiency. The country’s strong pharmaceutical exports and agricultural trade are also fueling demand for temperature-controlled visibility solutions. This transformation ensures logistics visibility software remains critical to India’s economic and trade expansion.

France is projected to advance at a 11.9% CAGR during 2025–2035, above the global average of 11.3%, up from nearly 10.2% in 2020–2024. Earlier momentum was tied to compliance with EU logistics reporting standards and digital freight initiatives. The improvement in CAGR reflects wider adoption of platforms for retail distribution, food traceability, and medical supplies. Logistics providers are increasingly relying on software for customs clearance automation and real-time monitoring of cross-border freight across EU nations. The country’s strong retail and food industries are pushing for improved freshness assurance and delivery reliability. With national investments in green freight corridors and port upgrades, visibility platforms are gaining stronger relevance across French supply chains.

The United Kingdom is expected to record a 10.7% CAGR during 2025–2035, compared with an estimated 9.1% during 2020–2024, slightly below the global average of 11.3% but still demonstrating steady growth. The lower earlier rate reflected slower digital adoption in fragmented logistics operations, but the acceleration is now supported by post-Brexit compliance needs, e-commerce growth, and increased trade with non-EU partners. Logistics firms are integrating predictive visibility tools to manage port congestion, optimize customs documentation, and provide accurate ETAs for customers. Cold-chain logistics, particularly in pharmaceuticals and grocery retail, is driving higher adoption. SMEs are also embracing subscription-based visibility software, improving transparency across regional supply chains.

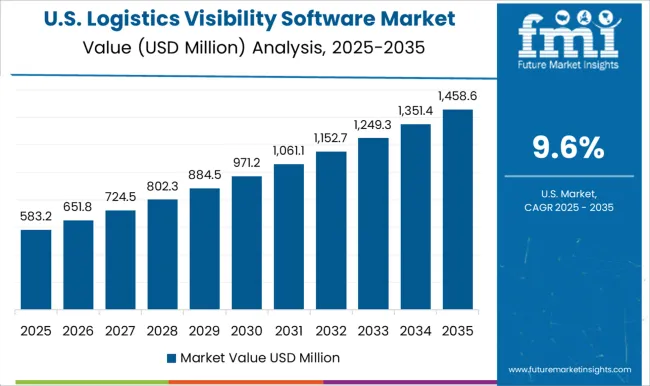

The United States is projected to grow at a 9.6% CAGR for 2025–2035, compared to roughly 8.4% during 2020–2024, trailing the global rate of 11.3% but maintaining a steady performance. Early growth was fueled by adoption among large 3PLs and retailers, but broader penetration across mid-sized firms has been slower. The improvement reflects increased integration of predictive analytics, AI-based ETA tracking, and higher service-level expectations in retail and industrial logistics. The aftermarket and spare parts logistics sector, combined with demand from food distribution networks, is strengthening adoption. While the USA remains a mature market, focus on advanced analytics and integration with warehouse systems ensures continued role for visibility platforms.

The logistics visibility software market is driven by global technology leaders and supply chain innovators offering advanced, data-driven platforms that enable real-time tracking, predictive analytics, and end-to-end transparency. Project44 leads the industry with its real-time transportation visibility platform, providing predictive ETAs, multimodal tracking, and integration capabilities for global shippers and logistics providers. Its focus on automation, analytics, and API-driven connectivity has positioned it as a preferred partner for enterprises seeking supply chain resilience.

Blue Yonder leverages artificial intelligence and machine learning to deliver predictive logistics visibility, demand forecasting, and transportation optimization. Its cloud-based platform helps retailers and manufacturers align planning and execution in dynamic market conditions. Descartes Systems Group emphasizes compliance, digital documentation, and cross-border logistics visibility, offering solutions that enhance trade management and operational efficiency.

Manhattan Associates integrates warehouse, transportation, and visibility solutions to improve order accuracy and delivery performance across large logistics networks. Infor provides cloud-based logistics visibility applications embedded within its ERP and supply chain suites, enabling unified operational oversight. IBM Corporation applies AI, blockchain, and hybrid cloud to enhance transparency, predictive insights, and risk management across supply chains. E2open delivers an end-to-end supply chain orchestration platform, combining real-time visibility, collaboration, and analytics for global manufacturers and logistics providers.

| Item | Value |

|---|---|

| Quantitative Units | USD 973.5 Million |

| Functionality | Real-time tracking, Route optimization, Inventory management, Analytics and reporting, and Others |

| Deployment Model | Cloud-based and On-premises |

| Pricing Model | Subscription-based, Usage-based, and Perpetual licensing |

| Enterprise Size | Large enterprises and SME |

| End User Industry | Transportation & logistics, Retail, Manufacturing, Food & Beverages, Automotive, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | project44, Blue Yonder, Descartes Systems Group, Manhattan Associates, Infor, IBM Corporation, and E2open |

| Additional Attributes | Dollar sales, share, adoption trends by e-commerce and 3PLs, regional growth hotspots, competitor strategies, integration with IoT and AI, regulatory impacts, and long-term scalability opportunities. |

The global logistics visibility software market is estimated to be valued at USD 973.5 million in 2025.

The market size for the logistics visibility software market is projected to reach USD 2,839.9 million by 2035.

The logistics visibility software market is expected to grow at a 11.3% CAGR between 2025 and 2035.

The key product types in logistics visibility software market are real-time tracking, route optimization, inventory management, analytics and reporting and others.

In terms of deployment model, cloud-based segment to command 54.2% share in the logistics visibility software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Supply Chain Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

First Mile Logistics Delivery Software Market Size and Share Forecast Outlook 2025 to 2035

Automotive Logistics Management Software Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Logistics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Logistics Robots Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Camera (SDC) Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Logistics Packaging Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA