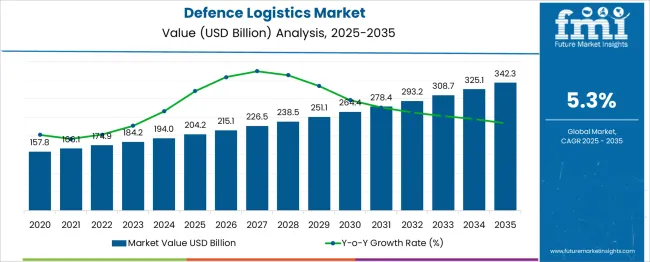

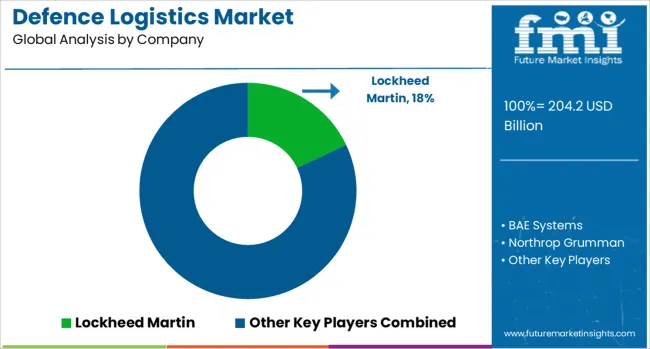

The defence logistics market is estimated to be valued at USD 204.2 billion in 2025 and is projected to reach USD 342.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. During the first half of the forecast period, from 2020 to 2025, the market is expected to increase from USD 157.8 billion to USD 204.2 billion, contributing USD 46.4 billion or nearly 25.1% of the total growth opportunity. Annual values within this phase include USD 166.1 billion in 2021, USD 174.9 billion in 2022, USD 184.2 billion in 2023, and USD 194.0 billion in 2024, reflecting steady adoption of advanced logistics solutions driven by modernization efforts in defense infrastructure.

Investments in supply chain digitization, automated warehousing, and real-time asset tracking support demand. The second half, spanning 2026 to 2030, is marked by continued expansion, with the market growing from USD 215.1 billion to USD 264.4 billion, adding USD 49.3 billion or 26.7% of the overall increase. This growth phase is fueled by strategic initiatives to enhance logistics resilience, integration of AI and robotics in supply operations, and expanding defense budgets globally. Emerging economies are accelerating the adoption of advanced logistics frameworks, contributing to market momentum. From 2031 to 2035, the market further rises from USD 278.4 billion to USD 342.3 billion, reflecting the maturation and scale-up of defense logistics capabilities worldwide. This back-weighted growth trend highlights opportunities for providers focusing on innovative, technology-driven logistics solutions that improve efficiency, reduce costs, and enhance operational readiness in dynamic defense environments.

| Metric | Value |

|---|---|

| Defence Logistics Market Estimated Value in (2025 E) | USD 204.2 billion |

| Defence Logistics Market Forecast Value in (2035 F) | USD 342.3 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The defense logistics market occupies a significant and evolving share across multiple military and support service domains. Within the overall defense supply chain management sector, defense logistics accounts for approximately 32–35%, reflecting its core role in mission readiness and operational continuity. In the global military transportation and warehousing ecosystem, its share stands at about 28–30%, driven by the increasing need for rapid deployment and secure storage of critical equipment.

For the procurement and inventory management segment, defense logistics contributes nearly 25–27%, emphasizing its importance in optimizing material availability and cost control. Within the broader defense services industry, the share of logistics solutions is estimated at 20–22%, as modernization programs prioritize integrated logistics support systems to improve efficiency. In the context of international military cooperation and allied force readiness, defense logistics holds around 12–14%, driven by cross-border supply coordination and joint operational planning. Growth in this market is propelled by rising geopolitical tensions, increasing defense budgets, and technological improvements in automated warehousing and predictive maintenance. Key focus areas include digitization of supply chains, real-time tracking systems, and adoption of resilient transportation networks for high-risk zones.

As nations emphasize agile and secure logistical frameworks to sustain combat operations and humanitarian missions, defense logistics continues to emerge as a cornerstone for global defense strategy, shaping future procurement and resource allocation models across armed forces.

Global defense agencies are prioritizing logistics modernization to support mission-critical operations, improve inventory accuracy, and respond swiftly to geopolitical threats. The increased procurement of technologically advanced systems, along with higher defense budgets and cross-border collaborations, is reshaping how logistics are planned and executed.

Emphasis is being placed on digital logistics platforms, real-time tracking, and integrated communication systems that provide situational awareness and rapid responsiveness. Governments and private sector partners are working together to build agile, scalable logistics systems capable of managing both routine supply and high-intensity mobilization scenarios.

These developments are creating new opportunities for logistics providers, technology integrators, and transportation partners to play a strategic role in defense operations. With increasing complexity in defense missions and the growing importance of supply continuity, the market is expected to register consistent growth in the coming years..

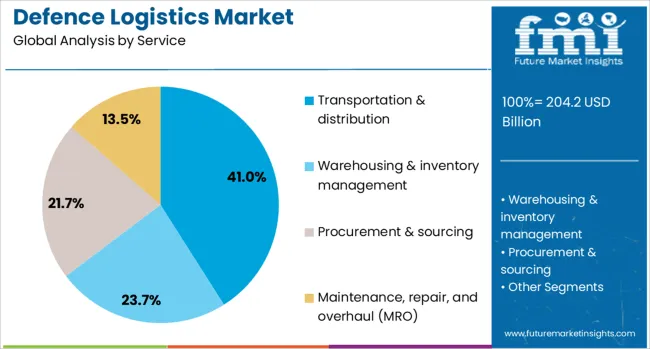

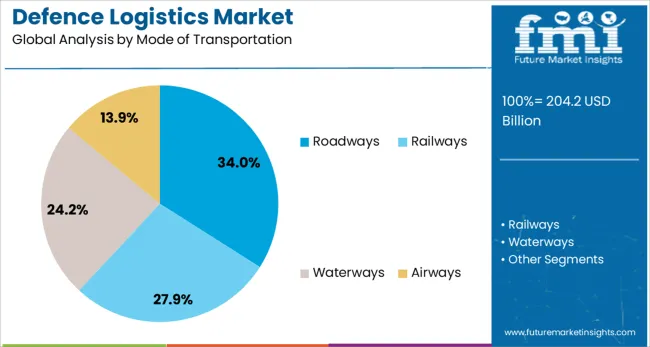

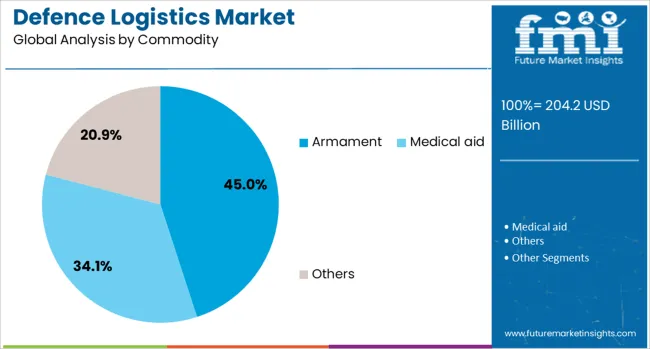

The defence logistics market is segmented by service, mode of transportation, commodity, end-user, and geographic regions. The defence logistics market is divided into Transportation & distribution, Warehousing & inventory management, Procurement & sourcing, and Maintenance, repair, and overhaul (MRO). In terms of mode of transportation, the defence logistics market is classified into Roadways, Railways, Waterways, and Airways. The defence logistics market is segmented into Armament, Medical aid, and Others. The end-user of the defence logistics market is segmented into the Army, Navy, and Air Force. Regionally, the defence logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The transportation and distribution service segment is projected to account for 41% of the defense logistics market revenue share in 2025, positioning it as the leading service category. This segment has witnessed accelerated adoption due to the critical requirement for reliable, timely, and coordinated movement of military equipment, supplies, and personnel. Operational readiness has been prioritized by defense organizations, leading to stronger demand for integrated transportation and distribution networks.

The reliance on these services has been supported by their ability to ensure end-to-end visibility, real-time tracking, and responsive delivery in both peacetime and combat scenarios. The strategic focus on rapid deployment and replenishment has contributed significantly to the segment’s growth.

Investments in infrastructure, secure cargo handling, and specialized freight systems have further improved performance standards. As defense operations continue to diversify across terrains and theaters, transportation and distribution services are expected to remain indispensable for maintaining operational continuity and strategic mobility..

The roadways mode of transportation segment is expected to hold 34% of the defense logistics market revenue share in 2025, making it the most utilized transport method. Road transport has maintained its dominant role due to its flexibility, reach, and cost-efficiency in supporting short to medium-range logistics operations. Defense forces have continued to rely on road-based solutions for intra-country and regional movement of equipment, fuel, ammunition, and provisions.

The segment’s growth has also been influenced by improvements in military-grade vehicle fleets, upgraded road infrastructure, and route optimization technologies. Roadways offer the tactical advantage of deployment under diverse weather and terrain conditions, including remote areas where other modes may be constrained.

The ability to enable just-in-time delivery of mission-critical assets has further strengthened its role in modern military logistics planning. As logistics strategies become more decentralized and demand faster turnaround times, road transport is expected to retain its strategic importance within the defense supply chain..

The armament commodity segment is anticipated to command 45% of the defense logistics market revenue share in 2025, establishing itself as the leading logistics category. The transportation and storage of armament require specialized handling, secure transit, and compliance with stringent safety protocols, all of which have contributed to increased investment in this segment.

Rising defense procurement and the modernization of military arsenals have led to higher volumes of weapon systems and munitions requiring safe and efficient movement. The logistical complexity associated with transporting armament, including the need for tracking, temperature control, and protective casing, has further elevated its share in the overall market.

Defense agencies have prioritized secure armament supply chains to ensure readiness and minimize the risks associated with delays or disruptions. As threats evolve and defense strategies become more reliant on precision-guided and high-value weaponry, the logistics of armament is expected to remain a key operational focus across global defense programs..

Defense logistics is evolving with integrated supply chains, rapid deployment strategies, and advanced planning tools to enhance operational readiness. However, rising costs, geopolitical risks, and complex global networks remain critical challenges for long-term efficiency.

Defense logistics has increasingly focused on creating cohesive supply networks that can function seamlessly across global military operations. This demand is fueled by complex mission requirements and the necessity for timely delivery of critical assets in hostile environments. Integrated platforms enable forces to monitor procurement, transportation, and warehousing under a unified system, reducing duplication and inefficiencies. Nations investing in multi-domain operations are emphasizing interoperability within allied forces, which places additional responsibility on logistics providers. The adoption of advanced analytics for inventory tracking and risk management is shaping new standards in operational readiness, while real-time visibility tools are becoming indispensable for ensuring uninterrupted defense supply chains during active deployments.

The strategic focus on quick response capabilities has placed immense importance on mobility within defense logistics. Military operations today require rapid transport of personnel, equipment, and essential supplies to conflict zones or disaster relief areas, often under constrained timelines. Air and sea lift capabilities, along with modular transport systems, are being prioritized to meet these requirements. Defense forces are deploying pre-positioned stockpiles and leveraging specialized logistics hubs to minimize delays. Enhanced coordination between procurement agencies and transport operators ensures the delivery of mission-critical resources without disruption, reinforcing operational efficiency in high-risk scenarios and supporting multi-theater readiness goals.

The complexity of defense supply networks has escalated due to geopolitical tensions, cross-border security mandates, and diversified procurement sources. Supply routes are often subjected to sudden disruptions arising from conflicts, trade restrictions, or cyber threats, making resilience a top priority. Governments and defense contractors are developing contingency strategies that include alternative sourcing models and redundant transportation routes. Emphasis on secure communication channels, classified data handling, and restricted-access facilities adds another layer of logistical planning. This evolving environment has driven defense organizations to adopt advanced planning systems and simulation tools, enabling predictive modeling for high-risk operational contexts worldwide.

Despite rising investments, defense logistics faces significant cost-related challenges associated with fleet maintenance, warehousing infrastructure, and specialized personnel training. Transporting oversized military equipment across continents, maintaining cold chains for sensitive items, and ensuring compliance with international defense treaties add to financial strain. Budget constraints compel defense forces to balance operational readiness with cost efficiency, leading to increased reliance on outsourced logistics support providers. Fuel price volatility and fluctuating global trade conditions further complicate long-term planning. To overcome these pressures, strategies such as performance-based contracting and consolidation of supply operations are being adopted, ensuring higher efficiency without compromising mission timelines.

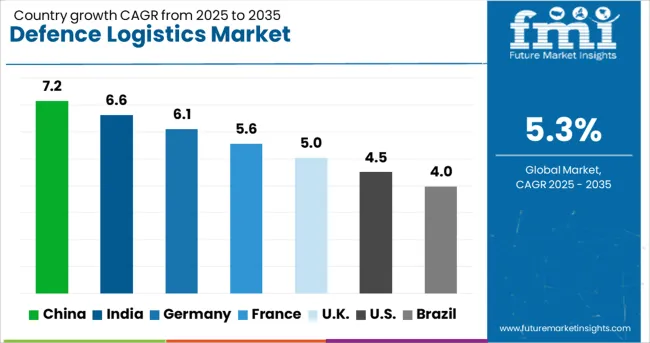

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The defense logistics market is projected to expand at a global CAGR of 5.3% from 2025 to 2035, supported by rising defense budgets, modernization initiatives, and strategic investments in supply chain resilience. China leads with a CAGR of 7.2%, driven by large-scale military infrastructure programs, advanced logistics hubs, and enhanced mobility requirements for its growing defense force. India follows at 6.6%, supported by procurement reforms, Make-in-India defense initiatives, and investment in rapid deployment capabilities. France posts 5.6%, influenced by overseas military deployments and digitization of defense supply networks. The United Kingdom grows at 5.0%, driven by the integration of real-time tracking solutions and performance-based logistics models. The United States achieves a CAGR of 4.5%, shaped by robust sustainment programs, technology-driven supply chain solutions, and growing partnerships with private defense contractors. The report covers over 40 countries, with these six markets representing critical benchmarks for developing defense logistics strategies globally.

China is projected to grow at a CAGR of 7.2% from 2025 to 2035, well above the global average of 5.3%, due to large-scale modernization of military logistics systems and integration of smart supply chain frameworks. During 2020–2024, the CAGR was around 6.0%, reflecting initial investments in transport assets and warehousing for strategic reserves. The rise in the next decade stems from aggressive investments in automation, digitized tracking, and enhanced air-sea lift capabilities for rapid deployment. Geopolitical priorities and extended missions in Asia-Pacific reinforce the need for robust logistics, making China a focal point in global defense supply chain advancement.

India’s CAGR is expected to reach 6.6% for 2025–2035, compared to about 5.4% during 2020–2024, reflecting expanded defense procurement and logistics reforms under Make-in-India initiatives. The earlier phase experienced moderate growth due to dependency on legacy systems and high costs for modernization. Post-2024, infrastructure improvements and digital platforms for real-time tracking have enhanced operational agility. Strategic investments in rapid deployment, cold-chain solutions for sensitive equipment, and fleet management tools further boost efficiency. Growing collaborations between defense agencies and private sector logistics partners make India a key regional leader in this space.

France is forecast to achieve a CAGR of 5.6% from 2025 to 2035, up from around 4.7% during 2020–2024, driven by upgrades in military infrastructure and advanced logistics systems supporting overseas missions. The earlier phase saw limited progress due to operational delays and budget constraints. The increase in the next decade is attributed to digital supply chain adoption, enhanced maritime logistics, and performance-based contracting models. Focus on interoperability with NATO forces and investment in secure communication systems adds momentum. These changes position France as a strategic player in European defense logistics modernization.

The United Kingdom is set to grow at 5.0% CAGR in 2025–2035, compared to nearly 4.2% during 2020–2024, as defense forces prioritize agile logistics solutions and enhanced fleet mobility. The earlier phase reflected moderate growth tied to legacy system reliance and budget realignments. The shift post-2024 is due to increased investment in predictive maintenance tools, rapid deployment frameworks, and strategic outsourcing for cost efficiency. These changes align with modernization strategies aimed at improving response times in high-risk zones. Collaborative contracts with private logistics providers are also strengthening operational capabilities.

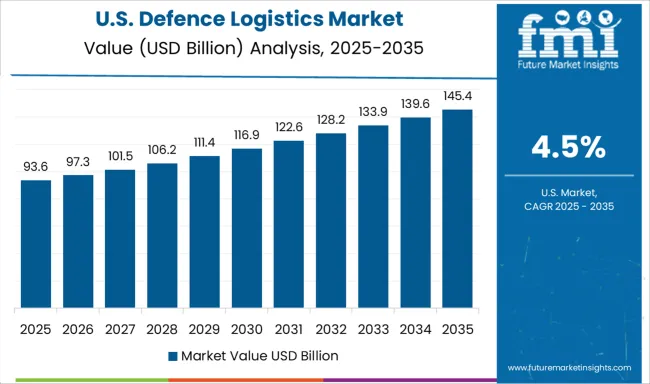

The USA CAGR stands at 4.5% for 2025–2035, an improvement from approximately 3.8% during 2020–2024, supported by renewed emphasis on operational readiness and sustainment programs. Earlier growth was modest due to reliance on established networks and slower adoption of digital supply models. The rise is driven by the modernization of distribution centers, investment in automated asset tracking, and enhanced partnerships with commercial logistics providers. Large-scale maintenance contracts and integration of simulation tools for supply chain planning further reinforce efficiency goals, ensuring sustained competitiveness in multi-theater operations.

The defense logistics market is highly competitive, dominated by leading global defense contractors that provide integrated solutions combining advanced technologies, supply chain optimization, and operational support. Lockheed Martin stands at the forefront with its robust portfolio of logistics support programs, offering predictive maintenance and advanced inventory systems to ensure mission readiness for air, land, and naval platforms. BAE Systems emphasizes end-to-end logistics solutions, integrating real-time tracking, maintenance support, and warehousing for large-scale military operations across allied nations. Northrop Grumman leverages its expertise in digital logistics and advanced data analytics to enhance supply chain visibility and resilience, particularly for aerospace and space defense missions. General Dynamics focuses on secure and efficient transportation networks, tactical vehicle readiness, and logistics IT systems that streamline fleet management and sustainment operations.

Boeing Defence capitalizes on its global presence to deliver performance-based logistics (PBL) solutions, reducing lifecycle costs while improving fleet availability for military aircraft and systems. Competitive differentiation revolves around integrated digital platforms, predictive analytics for asset management, and performance-based contracting models. Strategic priorities include enhancing automation in supply hubs, expanding partnerships with government agencies, and ensuring cybersecurity across defense supply chains. With rising geopolitical tensions and an increased emphasis on rapid deployment capabilities, these players are well-positioned to lead innovation and set benchmarks in the evolving defense logistics landscape.

Key strategies for 2024 and 2025 in the defense logistics market include a strong emphasis on integrated digital supply chain platforms, predictive analytics for maintenance, and performance-based logistics to reduce lifecycle costs. Increased geopolitical tensions and multi-theater operations drive investments in rapid deployment capabilities, pre-positioned assets, and resilient transport networks. Partnerships between defense agencies and private logistics providers are expanding to improve scalability and efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 204.2 Billion |

| Service | Transportation & distribution, Warehousing & inventory management, Procurement & sourcing, and Maintenance, repair, and overhaul (MRO) |

| Mode of Transportation | Roadways, Railways, Waterways, and Airways |

| Commodity | Armament, Medical aid, and Others |

| End-User | Army, Navy, and Air force |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lockheed Martin, BAE Systems, Northrop Grumman, General Dynamics, and Boeing Defence |

| Additional Attributes |

The global defence logistics market is estimated to be valued at USD 204.2 billion in 2025.

The market size for the defence logistics market is projected to reach USD 342.3 billion by 2035.

The defence logistics market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in defence logistics market are transportation & distribution, warehousing & inventory management, procurement & sourcing and maintenance, repair, and overhaul (mro).

In terms of mode of transportation, roadways segment to command 34.0% share in the defence logistics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Logistics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Logistics Robots Market Size and Share Forecast Outlook 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Logistics Packaging Industry

Logistics Outsourcing Market Analysis - Growth & Forecast 2025 to 2035

Logistics Visualization System Market

Logistics Automation Market

Cash Logistics Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Intralogistics Automation Solutions Market Size and Share Forecast Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Smart Logistics Services Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cloud Logistics Market Insights – Demand & Growth Forecast 2025 to 2035

Timber Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Secure Logistics Market Size and Share Forecast Outlook 2025 to 2035

Sea Air Logistics Market Size and Share Forecast Outlook 2025 to 2035

Digital Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA