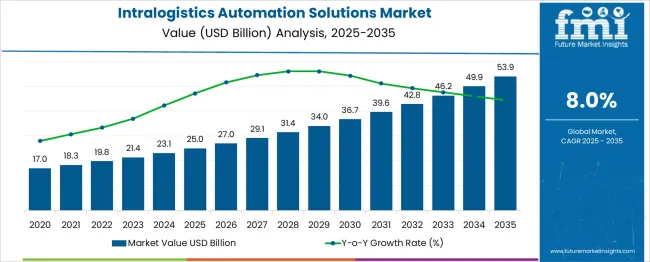

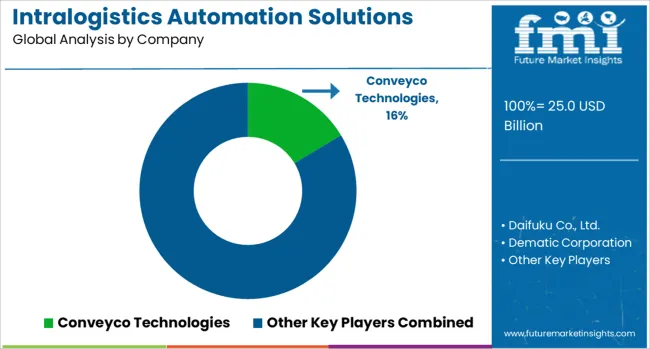

The Intralogistics Automation Solutions Market is estimated to be valued at USD 25.0 billion in 2025 and is projected to reach USD 53.9 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

| Metric | Value |

|---|---|

| Intralogistics Automation Solutions Market Estimated Value in (2025 E) | USD 25.0 billion |

| Intralogistics Automation Solutions Market Forecast Value in (2035 F) | USD 53.9 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The intralogistics automation solutions market is experiencing accelerated growth, driven by rising demand for efficient material handling, streamlined inventory control, and reduced operational costs across warehousing and manufacturing environments. Businesses are increasingly adopting automation to address labor shortages, enhance throughput, and improve accuracy in internal logistics processes.

The integration of advanced technologies such as AI, IoT, and robotics is reshaping intralogistics infrastructure, enabling real-time data-driven decision-making and end-to-end process visibility. With e-commerce expansion and omni-channel retailing adding complexity to supply chains, companies are turning to scalable automation platforms to meet fluctuating order volumes.

The market is expected to maintain strong growth momentum, supported by continuous investments in digital transformation, warehouse modernization, and customized intralogistics solutions tailored to industry-specific requirements. Future adoption will be further encouraged by sustainability goals, focusing on energy-efficient and space-optimized systems that align with environmental and operational performance metrics.

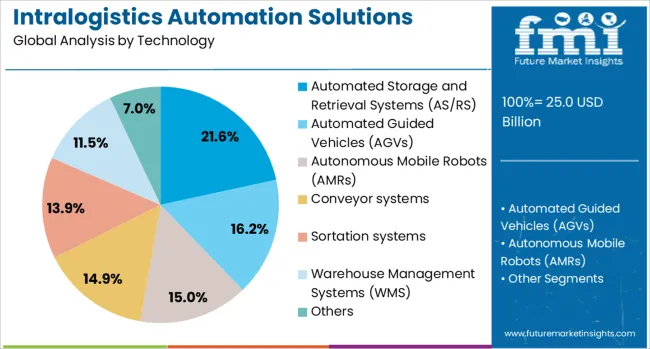

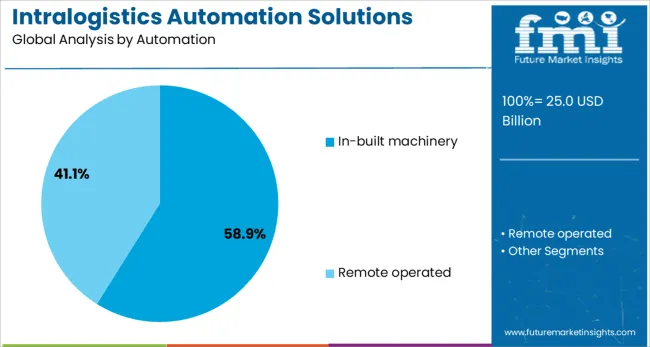

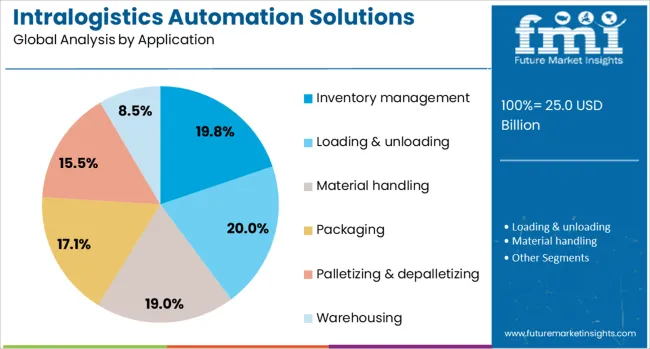

The intralogistics automation solutions market is segmented by technology, automation, application, and end user and geographic regions. The intralogistics automation solutions market is divided into Automated Storage and Retrieval Systems (AS/RS), Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Conveyor systems, Sortation systems, Warehouse Management Systems (WMS), and Others. In terms of automation, the intralogistics automation solutions market is classified into In-built machinery and remotely operated. Based on the application of the intralogistics automation solutions, the market is segmented into Inventory management, Loading & unloading, Material handling, Packaging, Palletizing & depalletizing, and Warehousing. The end-user market for intralogistics automation solutions is segmented into E-commerce & retail, Automotive, Food & beverage, Pharmaceuticals & healthcare, Electronics & semiconductor, Aerospace, Chemicals, and Others. Regionally, the intralogistics automation solutions industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automated storage and retrieval systems (AS/RS) segment commands a 21.6% market share within the technology category, owing to its pivotal role in optimizing space utilization, reducing manual errors, and accelerating picking efficiency in warehouse environments. AS/RS solutions have become critical to high-density storage and fast-paced operations, particularly in sectors such as e-commerce, automotive, and pharmaceuticals.

Their ability to support goods-to-person workflows, improve inventory accuracy, and reduce labor dependency makes them a strategic asset in logistics automation. Technological advancements including modular designs, shuttle-based systems, and integration with warehouse execution software have expanded AS/RS applications across both greenfield and brownfield facilities.

As supply chains continue to adopt lean and just-in-time inventory models, the demand for AS/RS is expected to grow, reinforced by its impact on throughput enhancement and facility optimization.

The in-built machinery segment holds a dominant 58.9% share in the automation category, reflecting its widespread integration within modern intralogistics systems. In-built automation encompasses embedded equipment such as conveyors, sorters, and palletizers that form the physical backbone of internal material flow.

These systems are essential for achieving synchronized movement of goods across receiving, storage, picking, and dispatch areas. The segment’s leadership is supported by the trend toward fixed, high-speed automation that minimizes human intervention and ensures continuous, reliable operations.

As warehouses become more complex and space-constrained, in-built machinery provides scalable infrastructure to support dynamic throughput requirements. Advances in machine control software, predictive maintenance, and energy-efficient designs are further enhancing the value proposition of in-built automation. The segment is poised for sustained growth as businesses seek long-term ROI from permanent automation installations tailored to high-volume operations.

The inventory management segment leads the application category with a 19.8% share, driven by the critical need to maintain real-time visibility, minimize stock discrepancies, and support demand forecasting. Automation in inventory management has become indispensable for industries aiming to balance cost efficiency with service-level accuracy.

Solutions such as automated tracking systems, smart shelves, and integrated warehouse management software are being widely deployed to eliminate manual record-keeping and streamline replenishment workflows. The segment's growth is reinforced by the rising complexity of product assortments and the shift toward omni-channel fulfillment, which demand higher agility and traceability within inventory systems.

As companies seek to optimize working capital and reduce excess stock, automated inventory management tools are becoming core components of intralogistics strategy. Continued innovation in sensor technologies and data analytics is expected to expand this segment’s scope, solidifying its role in intelligent warehouse operations.

Demand is rising for intralogistics automation across warehouses and distribution centres as throughput and flexibility needs scale. In 2024, deployments of autonomous mobile robots and sorter-integrated conveyors grew by 16 %. Asia-Pacific and North America recorded highest adoption. Providers now bundle robotics, AGV navigation, and software into modular, plug-and-play solutions.

Warehouse operators are adopting automation to improve speed and labor economics. Integration of autonomous mobile robots (AMRs) and sorter-based conveyors has reduced pick-and-pack cycle times by 19 % in high-volume facilities. Sortation systems now support mixed-sized packages and carton flows at speeds up to 2,500 units per hour per lane. Inventory accuracy has improved thanks to RFID-enabled totes and real-time inventory tracking tools, increasing accuracy rates to over 98 %. Systems with dynamic job allocation now optimize fleet movement across zones, cutting empty-run travel by 22 %. These developments are enabling facilities to shift from static shelving to zones paired with mobile robots, supporting flexible slotting and batch processing.

Despite performance benefits, intralogistics upgrades face barriers including capital intensity, integration complexity, and workforce adaptation. AMRs and sorter systems cost 15–20 % more than traditional material-handling lines, limiting adoption in mid-sized or budget-constrained sites. Retrofitting existing layouts often requires civil adjustments, power upgrades, or ceiling-mounted sensors, adding setup lead time of 4–6 weeks. Training warehouse workers and supervisors on coordinator dashboards takes up to 3 days per team, reducing early productivity by 9 %. In regions lacking certified integrators, deployment delays of 2–3 weeks per installation are common. Software customization efforts also extend commissioning timelines, especially where legacy WMS and ERP systems remain in operational use.

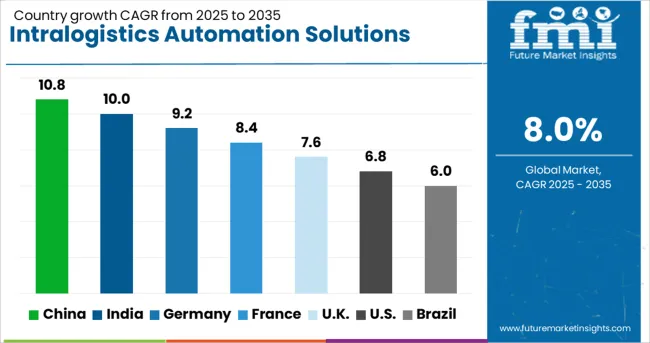

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

The global intralogistics automation solutions market is projected to grow at an 8% CAGR through 2035. China leads with a 10.8% CAGR, exceeding the global average by +35%, due to scaling e-commerce warehouses and AI-integrated systems. Germany follows at 9.2% (+15%) driven by lean manufacturing needs. France, at 8.4%, stays just above baseline, while the United Kingdom, at 7.6%, and the United States, at 6.8%, show below-average growth of –5% and –15%, respectively. Lower adoption in North America stems from longer equipment replacement cycles and labor retention strategies delaying automation investments. The report covers a detailed analysis of 40+ countries, with the top countries shared as a reference.

China is expected to witness a CAGR of 10.8% between 2025 and 2035 in the intralogistics automation solutions market. The expansion of distribution hubs by domestic e-commerce firms is driving demand for high-throughput automation systems. Automated sorting, robotic picking, and AGV deployment have seen high year-on-year penetration rates, particularly in tier-one logistics parks. Rising warehousing costs have pushed companies to implement conveyor-based modular solutions to achieve better ROI. Cold chain storage automation has increased in food and pharma verticals, indicating demand for climate-controlled robotic storage. Import substitution policies have incentivized local production of PLC-integrated ASRS modules. Market participants are prioritizing maintenance-free systems with real-time fault diagnostics. Equipment manufacturers are partnering with IoT platform developers to deliver integrated dashboards optimized for predictive maintenance.

Germany is projected to grow at a CAGR of 9.2% from 2025 to 2035, led by investments in automotive, pharmaceutical, and industrial manufacturing supply chains. Demand for automation upgrades is being shaped by precision-focused industries seeking cycle-time efficiency. Existing facilities are being retrofitted with real-time sensor-based conveyors and dynamic racking systems. The logistics requirements of B2B engineering suppliers have triggered partnerships with AMR providers to improve last-mile warehouse operations. IoT-enabled temperature and load monitoring features are being embedded across third-party logistics facilities to reduce product losses. German integrators are emphasizing software-based orchestration across shuttle, lift, and vertical carousels. These systems are now being co-developed with cyber-physical system designers for predictive inventory flows.

Brazil is estimated to grow at a CAGR of 6.0% from 2025 to 2035, driven by logistics improvements in the food processing and retail sectors. The need for higher operational continuity in tropical climates has increased the uptake of ruggedized AGVs and PLC-based material flow systems. Regional warehouse clusters are adopting basic pick-to-conveyor automation to improve outbound accuracy. Domestic equipment suppliers are prioritizing compact automated sorting lines suitable for narrow warehouse aisles. Retailers are integrating real-time inventory tracking using handheld device compatibility to reduce inventory gaps. Automation demand is being supported by the growing participation of domestic e-commerce operators expanding into rural markets through micro-fulfillment centers. Compliance with traceability regulations is another factor driving interest in barcode-synchronized systems.

The French market is set to grow at a CAGR of 8.4% during the 2025 to 2035 period, supported by demand from the FMCG and pharma sectors. Semi-automated handling equipment is being replaced with synchronized conveyor-motor systems connected via SCADA platforms. Intralogistics within pharmaceutical warehousing is transitioning to zone-based automation with controlled access protocols. National retailers are allocating capital expenditure to improve throughput rates in omnichannel distribution centers. Demand for rack-supported mezzanine structures with embedded pick-to-light systems is growing among consumer goods suppliers. Integrated data-visualization solutions are being deployed to enhance inventory accuracy and reduce picking errors. Domestic integrators are increasingly focused on creating modular plug-and-play systems for rapid scalability across facilities.

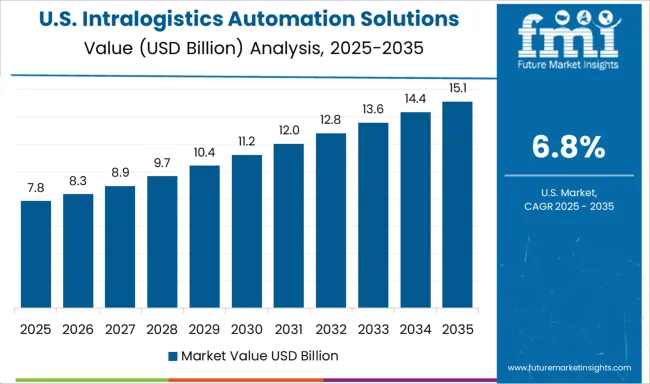

The United States is forecasted to expand at a CAGR of 6.8% between 2025 and 2035. Labor shortages across fulfillment centers are accelerating the adoption of goods-to-person and robotic picking systems. Multinational 3PLs are increasing investment in fully automated racking with digital twin support to streamline distribution planning. Omni-environment conveyors optimized for cross-dock logistics are gaining traction across refrigerated storage facilities. Retrofitting legacy warehouses with cloud-integrated software platforms is improving batch order management. The use of vision-based sorting arms has grown within postal and express parcel networks. Vendors are focusing on the deployment of AI-driven analytics for cycle time optimization across logistics chains, especially in high-volume e-commerce centers.

The intralogistics automation market is led by Conveyco Technologies, competing with global leaders Daifuku, Dematic, and Honeywell in automated storage and robotic fulfillment solutions. European specialists like SSI Schaefer and Swisslog excel in high-density systems and AI-driven sortation, while Knapp AG pioneers goods-to-person technologies. Surging e-commerce demand and labor shortages are accelerating adoption of autonomous mobile robots (AMRs) and predictive analytics for warehouse optimization. The market is shifting toward modular, scalable automation with interoperable robotics and IoT-enabled warehouse execution systems. Manufacturers focus on flexible solutions that combine AS/RS, AMRs, and AI-powered software to improve throughput in retail, manufacturing, and 3PL operations. Sustainability and energy efficiency are becoming key differentiators as companies seek to balance productivity gains with reduced operational costs in increasingly automated distribution centers.

| Item | Value |

|---|---|

| Quantitative Units | USD 25.0 Billion |

| Technology | Automated Storage and Retrieval Systems (AS/RS), Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Conveyor systems, Sortation systems, Warehouse Management Systems (WMS), and Others |

| Automation | In-built machinery and Remote operated |

| Application | Inventory management, Loading & unloading, Material handling, Packaging, Palletizing & depalletizing, and Warehousing |

| End User | E-commerce & retail, Automotive, Food & beverage, Pharmaceuticals & healthcare, Electronics & semiconductor, Aerospace, Chemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Conveyco Technologies, Daifuku Co., Ltd., Dematic Corporation, Honeywell International, Jungheinrich AG, Kardex Group, KION Group AG, Knapp AG, SSI Schaefer AG, and Swisslog Holding AG |

| Additional Attributes | Dollar sales by automation type and facility size, growing deployment in e-commerce fulfillment centers and manufacturing warehouses, stable integration across retail distribution and pharma logistics, innovations in AMRs, automated storage systems, and AI-driven orchestration platforms improve throughput, labor efficiency, and space utilization |

The global intralogistics automation solutions market is estimated to be valued at USD 25.0 billion in 2025.

The market size for the intralogistics automation solutions market is projected to reach USD 53.9 billion by 2035.

The intralogistics automation solutions market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in intralogistics automation solutions market are automated storage and retrieval systems (as/rs), automated guided vehicles (agvs), autonomous mobile robots (amrs), conveyor systems, sortation systems, warehouse management systems (wms) and others.

In terms of automation, in-built machinery segment to command 58.9% share in the intralogistics automation solutions market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automation Testing Market Size and Share Forecast Outlook 2025 to 2035

Automation COE Market Insights by Organization Size, Service Type, End User Verticals, and Region through 2035

Lab Automation Market Growth – Size, Trends & Forecast 2025 to 2035

Home Automation Sensors Market Size and Share Forecast Outlook 2025 to 2035

Home Automation Market Analysis by Product, Application, Networking Technology, and Region Through 2035

Form Automation Software Market – Digitizing Workflows

Hyperautomation Market

Water Automation & Instrumentation Market Trends & Forecast by Process Stage, Automation Technology, Instrumentation, End-User and Region through 2035

Retail Automation Market Size and Share Forecast Outlook 2025 to 2035

Postal Automation Systems Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Process Automation and Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

Network Automation Market - AI & Cloud Connectivity 2025 to 2035

Factory Automation And Industrial Controls Market Growth - Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Medical Automation Market Analysis - Innovations & Forecast 2025 to 2035

Evaluating Process Automation and Instrumentation Market Share & Provider Insights

Content Automation AI Tools Market

Building Automation System Market Size and Share Forecast Outlook 2025 to 2035

Building Automation System Industry Analysis in Korea Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA