The Medical automation market will expand positively in 2025 to 2035 based on the increasing demand for improved healthcare and patient outcomes. Improved healthcare and patient outcomes are the major contributors towards growth in the healthcare automation market, which will reflect positively in 2025 to 2035. Growing emergence of advanced technologies like robotic, artificial intelligence (AI), and machine learning in health care units is bringing a complete changeover in health treatment operations, diagnosis, and therapy processes.

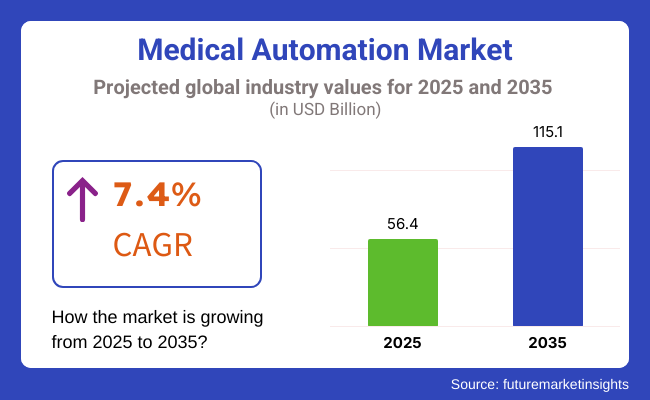

The market will be USD 115.1 Billion in the year 2035 and is growing on a compound annual growth rate (CAGR) of 7.4% over the forecast period. Processed Foods Market overview the overview consists of existing trends, size, share, and opportunities for growth in the global Processed Foods market. This section also includes details about the overall industry, such as the key players present in the market, their position in the market, and their growth strategies.

Need for Processed Foods Market Recent research shows that the demand for processed food products is rising due to the increasing urbanization of the population worldwide. The increasing healthcare expenditure and elderly populace is contributing to the growing use of healthcare machinery and equipment like AI-based diagnostic devices, intelligent infusion pumps to computer imaging to robotic surgeries and the sector is growing that is estimated to decrease the rate of human error, reduce costs and better human care.

Global health governments and administrations are turning towards interoperability standards and evidence-based decision-making such that incorporation of automated systems within existing healthcare systems can be seamless. Additionally, the manufacturers are putting significant research and development budgets into intelligent automation platforms that provide workflow simplification and predictive analytics for preventive treatment.

The therapeutic and imaging segments have a high percentage in the medical automation industry, with hospitals more and more depending on automated solutions to make diagnostics more accurate, streamline treatment protocols, and achieve better patient outcomes. The automated technologies have an important part to play in delivering quicker, more accurate medical procedures, lowering human errors, and maximizing efficiency in hospital processes, thus becoming unavoidable in diagnostic centers, surgery departments, and therapy.

Imaging automation has become one of the most used medical automation applications, providing quicker image processing, better diagnostic precision, and less manual intervention in imaging and radiology centers. Different from traditional diagnostic imaging solutions, automated imaging technology combines artificial intelligence (AI), deep learning, and cloud-based image analysis to better enhance radiological interpretations and automate the workload of medical professionals.

Increasing need for automated medical imaging solutions with artificial intelligence has increasingly fuelled adoption within radiology, cardiology, and oncology applications looking to achieve higher accuracy, productivity, and scalability in disease diagnosis. Large-scale studies show that AI-enhanced radiology significantly improves diagnostic speed, enhances early detection of health complications, and reduces human error susceptibility, invariably leading to better patient outcomes.

The proliferation of robot-managed imaging systems integrating automated ultrasound, real-time 3D scanning, and exact robotic biopsy procedures has solidified marketplace requirements, guaranteeing increased selection for minimally obtrusive diagnostic methods.

The inclusion of cloud-based automation of imaging encompassing real-time remote access to diagnostic visuals, AI-facilitated anomaly detection within images, and automated radiology reporting has additionally accelerated choice, guaranteeing optimized availability and workflow proficiency in diagnostic processes.

Emergence of intelligent imaging algorithms with deep learning-based image segmentation, computer-aided tumor detection, and predictive models for disease growth has maximized market growth to ensure increased adoption in the detection of early-stage diseases.

The implementation of imaging automation in point-of-care diagnostics, including handheld AI-based imaging devices, portable MRI machines, and automated blood vessel mapping for accurate surgery, has supported market growth, guaranteeing improved diagnostic availability in rural and remote healthcare facilities.

Though providing diagnostic accuracy and speed strengths, imaging automation is faced with challenges such as expensive investment requirements, difficulty in training AI models, and no integration with existing hospital IT infrastructure. However, emerging technologies in AI-driven imaging analytics, cloud-based radiology systems, and telemedicine integration are improving scalability, affordability, and accessibility, ensuring continued market growth for imaging automation.

Therapeutic automation has also found strong market traction in robotic-assisted surgery, drug delivery systems, and artificial intelligence -based rehabilitation as healthcare providers leverage automation more to increase the precision of treatments, shorten recovery times, and minimize the risk of surgeries. Unlike conventional treatments, automated therapeutic devices provide real-time monitoring, data-driven decision support, and increased procedural accuracy, which translate to better patient outcomes.

The escalating necessity for robotic-helped operations in orthopedics, cardiology, and neurosurgery has motivated assimilation of AI-powered surgical robots, as medical centers and operative facilities look for minimally invasive, high-exact robotic intercessions. Reports propose that robotic-aided surgeries better surgical accuracy, reduce post-procedural complications, and cut back health centre residencies, confirming superior patient recovery.

The development of mechanized pharmaceutical transport frameworks, including clever infusion pumps, AI-steered insulin administration, and wearable medicine dispensers, has bolstered demand in the market, making sure higher adoption in persistent illness administration and individualized medication.

The convergence of AI-aided rehabilitation automation, showcasing robotic exoskeletons for restoring mobility, VR-driven therapy, and intelligent physiotherapy tracking, has moreover boosted use, confirming better patient healing outcomes and improved therapy adherence. The evolution of precise-guided radiation treatment automation, featuring real-time tumour monitoring, AI-assisted radiation dosage computation, and robotic beam alignment, has optimized market growth, ensuring greater acceptance in oncology planning.

The adoption of automated ache management solutions, showcasing AI-driven neurostimulation implants, smart suffering relief wearables, and real-time patient feedback examination, has reinforced marketplace expansion, ensuring better ache leadership and enhanced patient high-quality of existence.

Despite its advantages in remedy accuracy and affected person protection, therapeutic automation faces challenges which includes regulatory approval complexities, high priced implementation, and the need for extremely expert experts to manipulate automated systems. However, emerging innovations in AI-powered robotic remedy, cloud-built-in surgical making plans, and wearable healing devices are enhancing scalability, affordability, and efficacy, ensuring ongoing marketplace increase for therapeutic automation.

The hospitals and diagnostic centers and research laboratories & institutes segments are two of the principal market drivers, as healthcare facilities increasingly adopt automated solutions to optimize workflow efficiency, patient care, and scientific research velocity.

Hospitals and diagnostic centers have become one of the biggest buyers of medical automation as healthcare professionals increasingly adopt AI-based systems, robot-assisted interventions, and data management software to improve operational effectiveness and patient outcomes. Unlike traditional hospital management practices, automated systems simplify patient registration, optimize resource utilization, and enhance real-time clinical decision-making, improving the delivery of care.

The escalating necessity for digitally driven hospital automation, with automated patient intake, predictive analytics guiding emergency reaction, and intelligent asset planning, has stimulated incorporation of advanced automation remedies as medical centers pursue to boost operational efficiency and decrease operational costs.

The expansion of automated diagnostic facilities, highlighted by AI-powered diagnostic labs, mechanized specimen examination, and rapid genetic screening, has intensified market demand, confirming more extensive integration in early disease identification and custom diagnostics. However, automated hospital administration faces hurdles such as cyber risks, steep investment expenses, and integration troubles with dated hospital frameworks. But emerging creative concepts in AI-guided medical centre administration platforms, blockchain-centered patient information protection, and real-time clinical verdict assistance systems are improving extensibility, protection, and adaptability, guaranteeing continued market growth for automated hospital administration.

Meanwhile, the implantation of robotic technology in analysis centers has strengthened marketplace requirement, making sure higher adoption in initial illness detection and precision diagnostics. Despite its benefits in hospital productivity and patient management, hospital automation confronts challenges for example cybersecurity issues, substantial investment costs, and integration problems with legacy hospital systems.

While automated research facilities and applications have seen significant uptake in biomedical investigations, pharmaceutical exploration, and clinical trial refinement, predominantly driven by scientific institutions progressively depending on mechanized laboratory arrangements to enhance trial exactness, quicken breakthrough schedules, and ensure adherence to regulatory directives. Unlike conventional lab workflows, AI-guided analysis frameworks provide experiment planning powered by machine intelligence, robot-assisted work streams, and mass data review, ensuring elevated replicability and productivity in scientific inquiry.

The escalating requirement for AI-aided research automation, including deep learning designs for drug screening, automated microscopy assessment, and live experiment tracking, has fuelled acceptance of lab digitization answers, as explore organizations look for to better information reliability and decrease human mistakes.

The expansion of large-scale screening digitization, featuring AI-supported compound screening, robotic fluid handling, and cloud-incorporated bioinformatics platforms, has reinforced industry demand, confirming greater approval in pharmaceutical R&D and individualized medicine investigation.

In spite of its advantages in study precision and scalability, lab automation in biomedical investigation faces obstacles such as lofty enactment expenses, skill deficiencies, and administrative restrictions on AI-directed analysis models. However, emerging developments in AI-aided research workflow automation, cloud-based scientific information storage space, and next-generation robotic lab assistants are optimizing efficiency, affordability, and accessibility, confirming continuing market broadening for digitized analysis facilities.

By Region North America accounts for a dominant market share in the field of medical automation owing to the presence of a strong healthcare infrastructure, technological innovations, and high investments in research and development. Advancements in robotic surgery systems, automated laboratory equipment, and imaging technologies are poised to spur market growth in the United States and Canada, the two primary contributors to global demand.

From using AI and machine learning algorithms to accelerate diagnostic processes, optimize patient management to improve the precision of complex medical procedures, healthcare providers across the region are embracing technology.

Rapid automation across health and social care have also compelled growing demand for remote monitoring, wearable health devices, and telemedicine platforms, particularly those powered by AI and efficient automation vendors. Besides clinical applications, pharmaceutical and biotechnology sectors in the region are deploying automated systems to speed up drug discovery, production and quality control.

Agencies like the FDA are supporting the use of automation in innovative ways to achieve compliance, minimize human error, and uphold rigorous safety standards. As companies continue to invest in healthcare technology, prioritize regulatory compliance, and seek more patient-centric solutions, North America will likely continue being a market leader for medical automation in the forecast period.

Europe accounts for a significant portion of the medical automation market, boasting advanced surgical robotics, automated diagnostic platforms, and smart medical devices. The long-advanced healthcare systems, as well as the quality standards focus in the region, have pushed for the adoption of such advanced automation technologies. In operating rooms, countries such as Germany, the United Kingdom, and France are leading the way to integrate robotic-assisted surgical systems.

Donnie Wright These systems boast greater accuracy and shorter recovery periods, and lower postoperative issues, thus blended into healthcare facilities. Another contributing factor is the European Union’s rigorously regulatory program, and initiatives like Horizon Europe, are incentivizing research and innovation in medical automation on the continent.

Additionally, given the recent global health crises, the demand for automated laboratory solutions is quite significant. The region’s aging population is also driving demand for automation of home healthcare equipment, which includes smart medication dispensers and wearable health monitors. Such devices help elderly patients to better manage their health conditions, leading to improved health outcomes and quality of life as well as reducing demand on health care providers.

Comprising of crucial measures devised by both legislative and local bodies, Europe has been staying ahead in the race of global medical automation market while maintaining a balance with the innovative, able and patient-oriented healthcare system.

Among these, the medical automation market in the Asia-Pacific region is expected to grow fastest due to widespread urbanization, increasing levels of healthcare expenditure, and a shift towards digital transformation. Japan, China, South Korea, and India are countries where advanced automation technologies are with orienteering in health systems.

In a regional push, led of course by China, with major financial investment on smart hospitals and AI-based diagnostic instruments, and even robotic-assisted surgeries. The Chinese government's health care reform and promotion of innovative medical technology also drive the use of automation solutions.

The same is true of Japan, where the country’s booming robotics industry has spurred cutting-edge robotic systems for surgery, rehabilitation and elder care. While the telemedicine purpose is to widen reach of healthcare services even in remote or rural India, the automated diagnostic platforms are helping prevent the pandemic situation at a much lower cost. This has led to the use of mobile health units that equipped with lab-on-chip devices based upon automation to fill the gap in healthcare access and increase the diagnostic speed.

The pharmaceutical and biotechnology mandates in Asia-Pacific are also utilising automation to refine the manufacturing, quality control, and clinical aspects of drugs. With a large and diverse patient population, the region provides a unique opportunity for data driven automated solutions to improve treatment personalization and improve healthcare outcomes.

Medical Automation: Complex Integration and Expensive Initial Investment

The Medical Automation Market technology must integrate automated systems seamlessly into existing healthcare infrastructure models, which require extensive planning, coordination, and investments in both infrastructure upgrades and ongoing maintenance. Many hospitals and medical facilities are still struggling with outdated systems, both automated equipment and legacy systems, and electronic health records (EHRs), and the ineffectiveness of data management results in inefficient patient management.

Adoption of AI & Robotics to Boost Market Growth

Growing integration of AI, robotics, and telemedicine providers are emerging as significant opportunities in the Medical Automation Market. AI is used to improve the accuracy and efficiency of disease detection while reducing human errors and allowing faster clinical decisions to be made. With robotic arms assisting surgeons, automating repeatable medical stuff, and enhancing patient recovery times Driven by the need for extreme efficiency, reduced human interaction, and increased patient throughput in hospitals and clinics, the demand for fully automated healthcare facilities is on the rise.

The Medical Automation Market grew during 2020 to 2024 due to the rising demand for precision healthcare, enhanced patient monitoring, and increased operational efficiency in hospitals. Healthcare providers turned to automated surgical systems, AI-assisted diagnostics, and robotic-assisted rehabilitation to improve treatment efficiency and decrease procedural hazards, leaving high demand for such technologies. Telehealth services and remote monitoring systems became mainstream and offered superior accessibility to health services.

Implementation of EMR led to elimination of paper based records which reduced errors in retrieving patient information. Even with these advancements, challenges such as high implementation costs coupled with data privacy concerns and regulatory compliance remained, causing adoption rates for some healthcare facilities to slow.

Future Outlook (2025 to 2035): A shift in the adoption of AI-driven automation, coupled with expanded robotic applications and enriched digital healthcare ecosystems, in the market. Healthcare institutions will have entirely automated workflows, utilizing AI-based diagnostics, predictive analytics and real-time monitoring, minimizing the need for human intervention in routine processes. The shift to decentralized and home-based healthcare services further drives the demand for portable automation systems and IoT-enabled medical devices that facilitate the delivery of remote patient care.

Sustainability will also gain prominence as businesses create energy-efficient automation technologies and sustainable hospital practices to minimize waste and operational expenses. This facilitates the need for highly automated and data-driven healthcare environments, which complement the trend towards personalized medicine and the use of AI-based treatment plans. Not only that, but AI-powered virtual assistants will streamline patient interactions, simplify appointment scheduling, and enhance chronic disease management to improve healthcare access and efficiency.

As these trends continue to evolve, the Medical Automation Market will disrupt patient care, hospital functions, and diagnostic accuracy. Micro care organizations including healthcare providers, research institutions, and technology companies should leverage the latest automation technologies to augment efficiency, reduce operational costs, and enhance patient outcomes. Businesses specializing in artificial intelligence-powered automation, eco-friendly healthcare solutions, and superior connectivity will take the sector into a new epoch of evolved medical functions.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with healthcare safety and patient data regulations |

| Technological Advancements | Adoption of AI-powered diagnostics and robotic-assisted surgeries |

| Telemedicine and Remote Care | A rise in telehealth and use of wearable medical devices |

| Automation in Surgery | Increased volume in robot-assisted surgical procedures |

| Workforce and Skill Adaptation | Need for specialized training in medical automation systems |

| Market Competition | Expansion of medical automation providers offering specialized solutions |

| Supply Chain Dynamics | Dependency on third-party suppliers for automation technology |

| Market Growth Drivers | Rising demand for precision healthcare and operational efficiency |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global regulatory frameworks for AI-integrated medical automation and increased oversight on patient data security. |

| Technological Advancements | Scaling of fully autonomous hospitals, real-time AI system patient monitoring, and applications of precision medicine |

| Telemedicine and Remote Care | Generalized use of AI-powered telemedicine and remote robotic-assisted healthcare services. |

| Automation in Surgery | Robotic precision surgeries are performed using AI for a higher degree of accuracy, minimum invasiveness, and lower recovery time. |

| Workforce and Skill Adaptation | Rise of AI-assisted clinical decision-making and workforce reskilling for automation integration. |

| Market Competition | Emergence of AI-focused healthcare automation start-ups driving innovation and competition. |

| Supply Chain Dynamics | Strengthened supply chains with predictive AI-based inventory management and decentralized automation production. |

| Market Growth Drivers | AI-powered decision-making, sustainability initiatives, decentralized healthcare models, and automation-driven advancements in personalized medicine. |

The USA medical automation sector is the most advanced globally due to increased emphasis on robotic operations, sophisticated medical technologies, strong healthcare facilities, and expanding requirement for automated processes. The health care system of the USA is rapidly adopting artificial intelligence, robot surgeries, and autonomous diagnosis for higher-quality care as well as efficient operations.

The application of robotic surgery is expanding tremendously, with da Vinci robotic systems and other artificially intelligent surgical tools improving precision in minimally invasive procedures. Automated dispensing of drugs, clinical decision support with AI, and robotic control of pharmacies are also becoming widespread at hospitals and health facilities.

The USA clinical diagnostic market is also leading in terms of automation with AI-driven imaging and high-throughput robotic laboratory systems complementing disease detection. Medical automation for elderly care and remote patient monitoring is also expanding due to an aging population and increasing demands for home healthcare offerings.

With federal incentives backing digital health, AI-powered medicine, and telemedicine, the USA medical automation industry is overdue for strong development in the coming decade.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.9% |

United Kingdom medical automation sector is expanding with government initiatives in the direction of digital healthcare, investment in AI-based diagnosis, and increased application of robotic healthcare systems. National Health Service (NHS) is emphasizing the automation of hospitals and laboratories for improved efficiency, reduced costs, and enhanced patient care.

The coming together of AI-powered diagnostics, robot-assisted surgeries, and automated dispensation of medications is racing ahead, eyeing the simplification of hospital workflows as much as surgical precision. Advanced hospitals are also being aided in the UK, where automation is at the centre of keeping patients under surveillance, mapping evidence-based care, and providing healthcare remotely.

With the increasing application of robotic surgery, digital pathology, and artificial intelligence-based clinical decision-making, the UK medical automation market will witness consistent growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.2% |

The European Union medical automation market is growing due to stringent healthcare regulations, investment in AI-driven healthcare technologies, and growing robotic procedure demand. Germany, France, and the Netherlands lead the medical robotics, AI diagnostics, and automated patient monitoring system market.

The EU's regulatory focus on precision medicine and patient safety is driving the adoption of automated drug dispensing, robotic surgery, and AI-based clinical decision support systems. The European Commission's plan for digital healthcare infrastructure is also driving smart hospitals and AI-based medical imaging systems across the region.

In addition, the aging population in Europe is fueling the elderly care robot growth, remote monitoring of patients, and robotic rehabilitation systems. The EU pharmaceutical sector is also modifying drug manufacturing and packaging processes to automation to increase efficiency and compliance with regulations.

As medical AI, robot surgery, and computer diagnostics continue to develop, the EU market is expected to expand significantly.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.5% |

Japan's medical automation sector is growing due to advances in robotics, integration of artificial intelligence in diagnostics, and need for care solutions for aged patients. Japan was the leader in medical robotics with Medtronic and Cyberdyne spearheading the design of robotic rehabilitation systems and AI-powered surgical devices.

Since Japan boasts over 28% of the population above the age of 65, the demand for robot-based home care, telemedicine patient monitoring, and artificial intelligence-based elderly care solutions is gigantic. Artificial intelligence-based physiotherapy and robotic exoskeletons are finding wider application in rehabilitation centers to improve mobility in the elderly and disabled.

Japan is also a leader in AI clinical diagnostics, telemedicine, and robotic surgery, with high accuracy in disease treatment and diagnosis. The use of smart automation in hospitals and clinics is also boosting market growth.

With more investment in healthcare robots and e-health technology, the Japanese market for medical automation is likely to increase gradually.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.4% |

The healthcare automation market in South Korea is expanding exponentially with the direct encouragement of the government towards healthcare implementation of AI, increasing investment in electronic hospitals, and increasing demand for robot-assisted surgery. South Korea leads the market of intelligent hospitals and integrates automation in patient care management, AI-based diagnostics, and telemedicine services.

The country's semiconductor and AI technologies are at the forefront of robot-assisted medical device applications, driving automation as a central aspect of precision medicine, drug discovery, and digital pathology. South Korea's focus on automated care for the elderly, including rehabilitation systems driven by AI and remote monitoring of patients, is also driving the expansion of the market.

With the advent of robotic surgery, artificial intelligence and computerized medical diagnosis-based clinical decision support, the South Korean medical automation market will witness robust growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.3% |

Increasing demand for AI-powered diagnosis, robot-assisted surgery, automated laboratory workflows, and smart medication management systems are the major drivers of the medical automation market. Robotics, AI-integrated medical devices, and digital health platforms are all key areas that companies are targeting in an effort to improve patient care, efficiency, and accuracy within health care settings. The field features a combination of prominent global medical technology companies and niche automation providers, with each faction driving innovation in areas like automated imaging, AI-powered diagnosis, and robotics for healthcare

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Siemens Healthineers AG | 15-20% |

| Medtronic plc | 12-16% |

| GE HealthCare | 10-14% |

| Philips Healthcare (Koninklijke Philips N.V.) | 8-12% |

| Intuitive Surgical, Inc. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Siemens Healthineers AG | Develops AI-powered medical imaging, robotic-assisted diagnostics, and digital health automation platforms. |

| Medtronic plc | Specializes in automated surgical robotics, AI-driven patient monitoring, and smart medication management solutions. |

| GE HealthCare | Manufactures automated imaging systems, AI-based diagnostics, and real-time patient monitoring automation. |

| Philips Healthcare | Provides AI-integrated healthcare automation, digital pathology, and remote patient management solutions. |

| Intuitive Surgical, Inc. | Offers robotic-assisted surgery systems (da Vinci Surgical System) for precision medical automation. |

Key Company Insights

Siemens Healthineers AG (15-20%)

Siemens Healthineers is the international market leader in medical automation and continues to invest heavily in AI-as-a-service, imaging, digital health automation, and robotic-assisted diagnostics to enhance workflow efficiency within healthcare environments.

Medtronic plc (12-16%)

Medtronic focuses on automating patient monitoring, AI-powered surgery systems, and smart medication delivery platforms that guarantee accurate and real-time healthcare automation.

GE HealthCare (10-14%)

GE HealthCare offers high-speed imaging automation, AI-enhanced diagnostics, and automated radiology, creating efficiencies across healthcare workflows and clinical decision-making.

Philips Healthcare (8-12%)

Philips Healthcare is developing AI-based remote patient monitoring, diagnostic automation, and smart healthcare data management systems to enhance clinical efficiency and telehealth features.

Intuitive Surgical, Inc. (5-9%)

The da Vinci Surgical System has continuously been the leading robotic-assisted surgery device to incorporate intelligent, AI-driven automation that delivers maximum precision over minimally invasive surgical methods.

Other key players (40-50% Combined)

Reporting on next-gen robotic healthcare, AI-driven diagnostics, and smart patient management by the medtech and AI healthcare automation companies. These include:

The overall market size for Medical Automation Market was USD 56.4 Billion In 2025.

The Medical Automation Markets expected to reach USD 115.1 billion in 2035.

The demand for the Medical Automation Market will be driven by the increasing need for improved patient care, reduced healthcare costs, and enhanced operational efficiency. Technological advancements in robotics, AI, and remote monitoring, along with rising healthcare automation adoption, will further propel market growth.

The top 5 countries which drives the development of Medical Automation Market are USA, UK, Europe Union, Japan and South Korea.

Imaging and Therapeutic Automation Drive Market to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 13: Global Market Attractiveness by Application, 2023 to 2033

Figure 14: Global Market Attractiveness by End Use, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 28: North America Market Attractiveness by Application, 2023 to 2033

Figure 29: North America Market Attractiveness by End Use, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 104: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medically Supervised Weight Loss Services Market Size and Share Forecast Outlook 2025 to 2035

Medical Smart Drug Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Medical EMR Input Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Anti-Decubitus Air Mattress Market Size and Share Forecast Outlook 2025 to 2035

Medical Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA