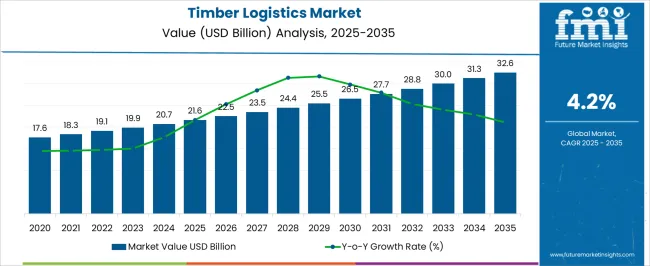

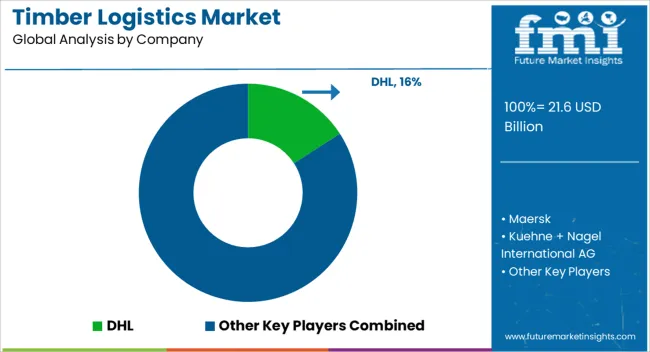

The timber logistics market is estimated to be valued at USD 21.6 billion in 2025 and is projected to reach USD 32.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

The timber logistics market is projected to reach 21.6 USD billion in 2025 and expand to 32.6 USD billion by 2035, registering a CAGR of 4.2%. Growth is anticipated to be driven by increasing demand for sustainable construction materials, rising global trade of lumber and wood products, and expansion of infrastructure projects in emerging markets. Timber transportation and storage efficiency are gaining attention due to rising focus on supply chain optimization and cost reduction. Shifts in regional production, especially from North America, Europe, and Southeast Asia, are influencing trade flows, while port facilities, warehousing, and multimodal transport integration support smoother distribution.

Technological integration in tracking, inventory management, and route optimization is enhancing operational efficiency. Furthermore, timber logistics providers are exploring value-added services such as pre-cut packaging, kiln-drying coordination, and eco-friendly transport solutions to meet evolving customer demands. Demand for engineered wood products, cross-laminated timber, and specialty hardwoods is also influencing logistics requirements, as manufacturers seek timely, reliable delivery. Over the next few years, expansion of commercial and residential construction in developing economies alongside steady demand in mature markets ensures consistent market growth. The interplay of global timber supply, transportation infrastructure, and trade policies is expected to shape the market landscape through 2035.

| Metric | Value |

|---|---|

| Timber Logistics Market Estimated Value in (2025 E) | USD 21.6 billion |

| Timber Logistics Market Forecast Value in (2035 F) | USD 32.6 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The timber logistics market is strongly influenced by five interconnected parent markets that collectively shape demand, operational efficiency, and supply chain optimization. The construction and infrastructure market holds the largest share at 30%, as residential, commercial, and industrial projects require timely delivery of lumber, engineered wood, and cross-laminated timber to maintain project schedules and quality standards. The furniture and wood products manufacturing market contributes 25%, driven by manufacturers’ need for reliable transportation of raw timber, panels, and specialty hardwoods to production facilities, ensuring minimal delays and cost-efficient operations. The paper, pulp, and packaging market accounts for 20%, with timber transported for conversion into paper products, cardboard, and other packaging solutions to meet industrial and consumer demand.

The export-import and global trade market adds 15%, as timber logistics supports international supply chains, balancing regional production, consumption patterns, and regulatory compliance in timber trade. Lastly, the wholesale and distribution network market holds a 10% share, facilitating the movement of timber from ports, warehouses, and distribution centers to end-users while optimizing inventory management and reducing lead times. Construction and furniture manufacturing sectors together account for 55% of overall demand, highlighting that timely, reliable delivery and supply chain efficiency remain the key growth drivers for timber logistics, while advancements in multimodal transport, tracking systems, and eco-friendly transportation solutions are expected to further expand adoption globally.

The timber logistics market is witnessing significant growth, driven by increasing global demand for timber products and the need for efficient supply chain management across forestry, construction, and industrial sectors. Expansion of the construction industry and rising demand for industrial roundwood are creating a substantial requirement for reliable timber transportation and service solutions. Technological advancements in logistics management, route optimization, and supply chain tracking are enhancing operational efficiency and reducing costs across timber distribution networks.

The growing adoption of integrated logistics services that combine transportation, warehousing, and inventory management is also supporting market expansion. Sustainability initiatives and regulatory compliance are influencing transport practices, promoting environmentally responsible logistics solutions. As timber production scales in both emerging and developed markets, the requirement for specialized transport services and infrastructure is increasing.

The market outlook remains strong, supported by the focus on reducing delivery lead times, minimizing losses, and ensuring safe handling of timber materials Efficient logistics operations are being recognized as critical for the competitiveness of timber supply chains globally.

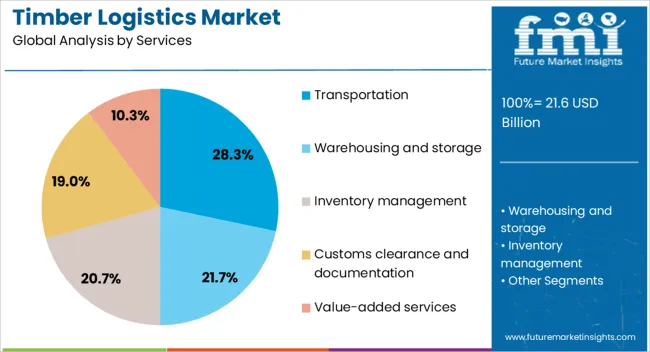

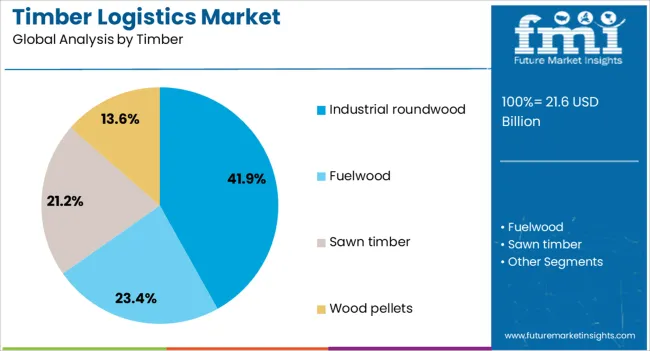

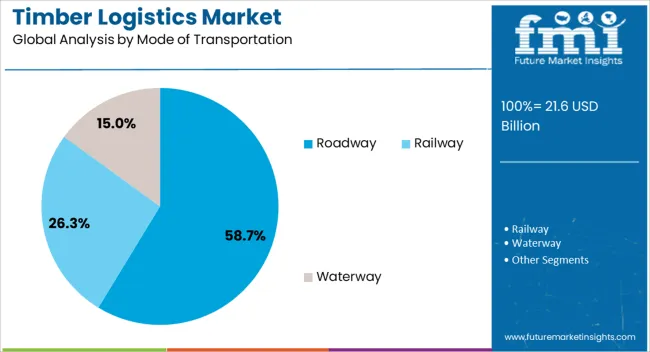

The timber logistics market is segmented by services, timber, mode of transportation, application, and geographic regions. By services, timber logistics market is divided into transportation, warehousing and storage, inventory management, customs clearance and documentation, and value-added services. In terms of timber, timber logistics market is classified into industrial roundwood, fuelwood, sawn timber, and wood pellets. Based on mode of transportation, timber logistics market is segmented into roadway, railway, and waterway. By application, timber logistics market is segmented into construction, furniture, paper and pulp, and others. Regionally, the timber logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The transportation services segment is projected to hold 28.3% of the timber logistics market revenue share in 2025, making it the leading service category. This segment’s dominance is being driven by the increasing reliance on third-party logistics providers to handle the complex requirements of timber movement across long distances. Specialized transportation solutions enable safe handling of timber products, reducing damage and losses during transit.

The adoption of route optimization technologies, vehicle tracking systems, and advanced fleet management tools is improving delivery reliability and operational efficiency. Rising demand for just-in-time supply chains in industrial construction and manufacturing is also reinforcing the segment’s leadership.

Additionally, transportation services are being preferred for their ability to integrate seamlessly with warehousing, packaging, and inventory management, offering end-to-end logistics solutions The segment is benefiting from ongoing investments in infrastructure, fleet modernization, and the development of specialized vehicles capable of handling timber of varying sizes and weights, further solidifying its market share.

The industrial roundwood segment is expected to account for 41.9% of the timber logistics market revenue share in 2025, establishing it as the leading application category. This segment’s growth is being supported by rising demand for roundwood in construction, manufacturing, and paper production. Efficient logistics and supply chain management are critical for maintaining quality, reducing wastage, and meeting delivery timelines for industrial roundwood.

The segment benefits from dedicated handling and storage solutions that ensure timber durability and compliance with regulatory standards. Expansion of industrial activities, particularly in emerging markets, is driving increased volume requirements, reinforcing the need for specialized logistics solutions.

Integration of software-driven inventory management, tracking systems, and warehouse coordination is enhancing operational efficiency The consistent demand for industrial roundwood, combined with the emphasis on reliable, safe, and cost-effective transport, is sustaining the segment’s market leadership and positioning it as the primary revenue contributor within the timber logistics ecosystem.

The roadway transportation segment is projected to capture 58.7% of the timber logistics market revenue share in 2025, making it the dominant mode of transport. Its leadership is being driven by the flexibility and accessibility that road networks provide, enabling deliveries to remote forest areas, construction sites, and industrial facilities. Road transportation allows for faster and more controlled movement of timber products compared to other modes, ensuring timely deliveries and reducing inventory holding costs.

The segment benefits from ongoing investments in highway and rural road infrastructure, which improve connectivity between timber production regions and end-use markets. Specialized trucks and trailers capable of handling large, heavy, and irregularly shaped timber loads are enhancing operational efficiency and reducing transit losses.

Rising demand for short-to-medium haul logistics and last-mile delivery solutions in timber supply chains is further reinforcing the segment’s market share The ability of roadway transport to integrate with warehousing and other logistics services positions it as the preferred mode for timber distribution across diverse applications and geographies.

The timber logistics market is largely propelled by the increasing demand from construction and furniture manufacturing sectors, which require reliable and timely delivery of lumber, plywood, and engineered wood products. International trade and export-import activities further influence market dynamics, necessitating efficient, cost-effective transportation solutions across borders. Companies are increasingly adopting advanced inventory management systems, route optimization techniques, and multimodal transport options to enhance supply chain reliability and reduce operational costs.

The timber logistics market is being shaped by growing demand for timely and cost-effective transportation of lumber, plywood, and engineered wood products. Construction firms, furniture manufacturers, and paper mills are increasingly relying on optimized routes, multimodal transport, and advanced warehousing to reduce delays and minimize spoilage. Rising international trade of timber, especially from North America, Europe, and Southeast Asia, has amplified the need for coordinated supply chains. Seasonal variations in logging, weather disruptions, and port congestion require agile logistics solutions that ensure consistent availability. Companies are investing in specialized vehicles, climate-controlled storage, and pre-sorting facilities to streamline deliveries. Integration with inventory management and predictive planning tools allows operators to handle large volumes efficiently, reducing operational bottlenecks and supporting uninterrupted supply to industrial and commercial consumers.

Construction and furniture production remain the primary end-use drivers for timber logistics. Residential, commercial, and infrastructure projects demand continuous supply of quality timber, cross-laminated panels, and hardwood for structural and aesthetic applications. Furniture and interior manufacturers require reliable deliveries of raw timber, veneers, and specialty woods to meet production schedules and seasonal market peaks. Large-scale construction projects, particularly in emerging markets, are encouraging logistics providers to offer tailored solutions such as pre-cut shipments, just-in-time deliveries, and dedicated trucking lanes. The increasing use of engineered wood products, including laminated beams and composite panels, has added complexity to transportation requirements. Efficient coordination between suppliers, transporters, and warehouses ensures timely inventory replenishment, reduces storage costs, and supports project completion timelines, strengthening the role of logistics in overall value chains.

Global timber trade is a key factor influencing logistics strategies. Timber exports from production-rich regions such as Canada, Russia, and Scandinavia feed demand in Asia, the Middle East, and Europe. Fluctuating tariffs, trade agreements, and regulatory compliance affect shipment schedules, requiring logistics companies to maintain flexible routing options and contingency plans. Port handling, customs clearance, and adherence to import/export documentation are critical to avoid delays. Logistics providers are leveraging strategic warehousing near ports and industrial hubs to bridge gaps between supply and consumption. Specialized cargo handling for high-value hardwoods, treated timber, and delicate panels ensures product quality is maintained. The export-import market contributes significantly to revenue streams, with global trade dynamics directly shaping operational priorities for timber logistics firms.

Efficiency in timber logistics increasingly relies on improved inventory control, tracking, and route optimization. Companies are using GPS-enabled fleet management, real-time shipment monitoring, and predictive demand planning to reduce lead times and transportation costs. Climate-sensitive timber products benefit from temperature-controlled storage and moisture regulation during transit. Consolidation of shipments and multimodal transport solutions, including rail, road, and inland waterways, are being implemented to increase cost efficiency. Collaboration with suppliers, distributors, and construction firms ensures synchronized delivery schedules, minimizing stockouts and project delays. Analytics-driven planning helps anticipate seasonal demand fluctuations, optimize load capacity, and reduce fuel consumption, reinforcing the role of operational precision and logistics expertise in maintaining a competitive edge in timber distribution networks.

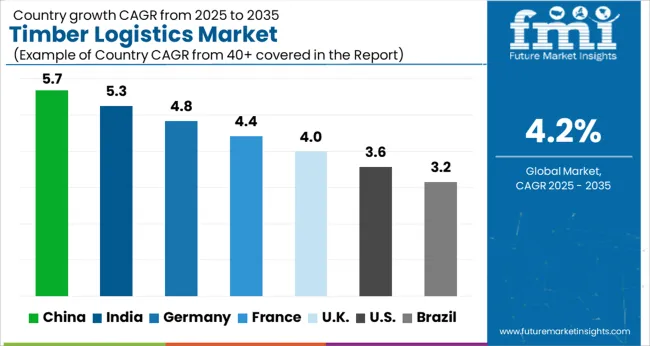

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| U.K. | 4.0% |

| U.S. | 3.6% |

| Brazil | 3.2% |

The global timber logistics market is projected to grow at a CAGR of 4.2% from 2025 to 2035. China leads with 5.7%, followed by India at 5.3%, Germany at 4.8%, the U.K. at 4.0%, and the U.S. at 3.6%. Expansion is driven by growing demand from construction, furniture, and industrial wood sectors, requiring efficient transportation and supply chain management. BRICS countries, particularly China and India, are scaling infrastructure, warehousing, and multimodal transport networks to support timber distribution. OECD nations such as Germany, the U.K., and the U.S. emphasize quality control, timely deliveries, and predictive planning to enhance operational efficiency and ensure reliability. The analysis spans over 40+ countries, with the leading markets detailed below.

The timber logistics market in China is projected to grow at a CAGR of 5.7% from 2025 to 2035, driven by booming construction, furniture manufacturing, and export-oriented timber production. Growing industrial parks, large-scale residential projects, and commercial infrastructure demand efficient timber supply chains and timely deliveries. Manufacturers and distributors are investing in multimodal transport, warehouse optimization, and advanced inventory management to ensure product quality and reduce lead times. Strategic partnerships between timber suppliers, transport providers, and port operators enhance cross-border trade efficiency. Domestic logistics firms are leveraging technology-driven planning for route optimization, cost control, and predictive maintenance. The rise of e-commerce in building materials and furniture distribution is also creating demand for flexible and reliable timber transport solutions.

India’s timber logistics market is expected to grow at a CAGR of 5.3% from 2025 to 2035, supported by the expansion of urban and industrial infrastructure projects. Demand from commercial construction, residential buildings, and furniture manufacturing is driving investment in efficient transportation networks and strategic storage facilities. Logistic providers are focusing on road, rail, and port connectivity to optimize timber movement across states while maintaining product quality. Warehouse automation and inventory tracking solutions are increasingly deployed to reduce delays and losses. Collaboration between timber manufacturers, transport companies, and e-commerce platforms ensures seamless delivery to end-users. Government initiatives to enhance industrial corridors and trade facilitation further accelerate market growth.

Germany’s timber logistics market is projected to expand at a CAGR of 4.8% from 2025 to 2035, led by high standards in construction, furniture, and industrial timber usage. Demand for sustainable, high-quality timber products necessitates reliable transport, storage, and handling solutions. Logistic firms are investing in automated warehouses, specialized vehicles, and predictive routing to maintain efficiency and product integrity. Collaboration with timber manufacturers and construction companies ensures timely deliveries to industrial and commercial projects. Advanced tracking, temperature and moisture control, and digital monitoring of shipments are increasingly employed to optimize operations. Cross-border trade with neighboring European countries also contributes to market expansion.

The timber logistics market in the U.K. is expected to grow at a CAGR of 4.0% from 2025 to 2035, driven by strong demand from residential and commercial construction and furniture manufacturing. Logistics providers focus on minimizing lead times and optimizing route efficiency through centralized warehouses, multimodal transport, and digital tracking systems. Timber suppliers collaborate with builders, architects, and distributors to ensure timely delivery and quality control. E-commerce platforms for construction materials and timber products are driving the need for flexible, fast, and reliable logistics solutions. Government-led building projects and housing initiatives further bolster market demand while encouraging innovation in supply chain management.

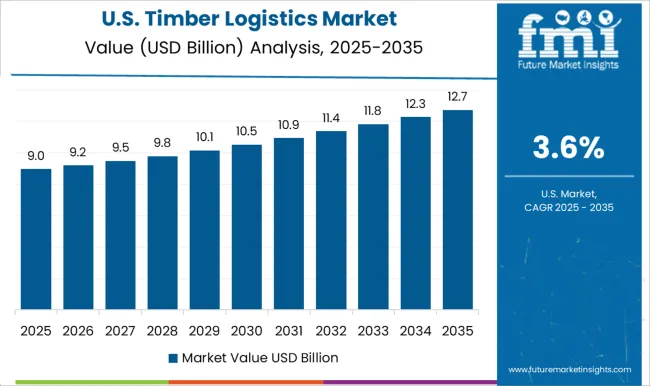

The U.S. timber logistics market is projected to grow at a CAGR of 3.6% from 2025 to 2035, supported by demand from residential, commercial, and industrial construction. Efficient timber supply chains require coordinated transport via road, rail, and ports, along with strategic storage solutions to maintain quality and reduce lead times. Logistic operators are adopting predictive planning, warehouse automation, and route optimization to meet growing demand. Partnerships with timber manufacturers, distributors, and construction companies ensure timely delivery across diverse geographies. Large-scale infrastructure projects and remodeling activities in urban and suburban areas further drive the need for reliable timber logistics. Emphasis on compliance, safety, and operational efficiency is a key differentiator for service providers.

Competition in the timber logistics market is driven by delivery reliability, multimodal transport efficiency, and supply chain integration. DHL and Maersk lead with global shipping networks, advanced tracking solutions, and large-scale distribution capabilities, enabling timely timber delivery across regions. Kuehne + Nagel International AG and DSV Global focus on multimodal transport, warehouse optimization, and inventory management for bulk timber shipments, catering to construction and furniture sectors. DB Schenker and C.H. Robinson differentiate through regional expertise, specialized handling, and digital logistics platforms that enhance visibility and reduce lead times.

FedEx emphasizes express freight solutions for high-value timber products, while DFDS Seaways and Ponsse PLC provide niche solutions for maritime and forestry logistics. Tembec Inc. integrates end-to-end timber supply chain management, combining harvesting, processing, and transport to optimize operational efficiency. Strategies in the market center on route optimization, warehouse automation, predictive inventory management, and integration with digital platforms for real-time tracking.

Service providers focus on compliance with safety and environmental standards, low-damage transport, and scalable solutions for both domestic and international timber distribution. Value-added offerings include temperature and moisture control, specialized packaging, and supply chain consulting for industrial and commercial customers. Marketing highlights network reach, shipment reliability, cost-efficiency, and operational transparency, reflecting a competitive landscape where service quality, speed, and technological integration define market leadership.

| Items | Values |

|---|---|

| Quantitative Units | USD 21.6 billion |

| Services | Transportation, Warehousing and storage, Inventory management, Customs clearance and documentation, and Value-added services |

| Timber | Industrial roundwood, Fuelwood, Sawn timber, and Wood pellets |

| Mode of Transportation | Roadway, Railway, and Waterway |

| Application | Construction, Furniture, Paper and Pulp, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DHL, Maersk, Kuehne + Nagel International AG, DSV Global, DB Schenker, C.H. Robinson, FedEx, DFDS Seaways, Ponsse PLC, and Tembec Inc. |

| Additional Attributes | Dollar sales, share, transport mode preferences, regional demand, supply chain efficiency, warehouse and inventory trends, lead times, multimodal integration, cost per shipment, top competitors, and growth by end-use segments. |

The global timber logistics market is estimated to be valued at USD 21.6 billion in 2025.

The market size for the timber logistics market is projected to reach USD 32.6 billion by 2035.

The timber logistics market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in timber logistics market are transportation, warehousing and storage, inventory management, customs clearance and documentation and value-added services.

In terms of timber, industrial roundwood segment to command 41.9% share in the timber logistics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Timber Construction Market Size and Share Forecast Outlook 2025 to 2035

Timber Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Timber Wrap Films Market by Thickness, Material Type, and Region 2025 to 2035

Cross Laminated Timber Market

Logistics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Logistics Robots Market Size and Share Forecast Outlook 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Logistics Packaging Industry

Logistics Outsourcing Market Analysis - Growth & Forecast 2025 to 2035

Logistics Visualization System Market

Logistics Automation Market

Cash Logistics Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Intralogistics Automation Solutions Market Size and Share Forecast Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Smart Logistics Services Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cloud Logistics Market Insights – Demand & Growth Forecast 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA