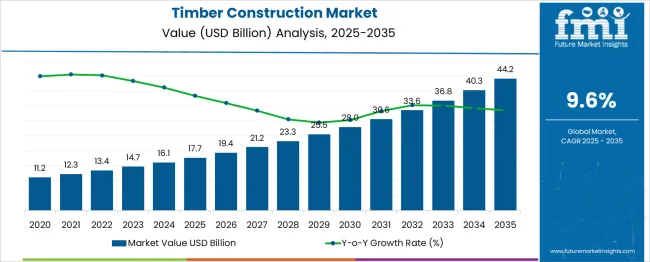

The global timber construction market is anticipated to expand from USD 17.7 billion in 2025 to approximately USD 44.2 billion by 2035, recording an absolute increase of USD 26.54 billion over the forecast period. This translates into a total growth of 150.1%, with the market forecast to expand at a CAGR of 9.6% between 2025 and 2035. The market size is expected to grow by nearly 2.5X during the same period, supported by increasing focus on green architecture practices, growing demand for environmentally friendly building materials, and rising adoption of timber in modern architectural designs.

Between 2025 and 2030, the timber construction market is projected to expand from USD 17.68 billion to USD 27.94 billion, resulting in a value increase of USD 10.26 billion, which represents 38.6% of the total forecast growth for the decade. This phase of growth will be shaped by accelerating adoption of mass timber technologies, increasing government support for green architecture initiatives, and growing recognition of timber's carbon sequestration benefits. Construction companies and architectural firms are expanding their timber construction capabilities to address the growing demand for green building solutions across residential and commercial sectors.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 17.7 billion |

| Forecast Value in (2035F) | USD 44.2 billion |

| Forecast CAGR (2025 to 2035) | 9.6% |

From 2030 to 2035, the market is forecast to grow from USD 27.9 billion to USD 44.2 billion, adding another USD 16.7 billion, which constitutes 61.4% of the ten-year expansion. This period is expected to be characterized by widespread adoption of engineered wood products, advancement in timber construction technologies, and development of high-rise timber buildings. The growing focus on net-zero carbon buildings and circular economy principles will drive demand for timber construction solutions with enhanced structural performance and sustainability credentials.

Between 2020 and 2025, the timber construction market experienced steady expansion, driven by increasing environmental consciousness in the construction industry and growing recognition of timber's structural and aesthetic advantages. The market developed as governments and construction companies began prioritizing renewable building materials to meet climate targets and reduce construction-related carbon emissions. Green building certifications and sustainability frameworks began emphasizing the importance of timber construction in achieving environmental goals.

Market expansion is being supported by the increasing global focus on green architecture practices and the urgent need to reduce carbon emissions from the building sector. Construction industry stakeholders are increasingly recognizing timber's potential as a renewable, carbon-negative building material that can significantly reduce the environmental impact of construction projects. Timber's ability to sequester carbon throughout its lifecycle, combined with its excellent strength-to-weight ratio and design flexibility, makes it an attractive alternative to conventional building materials.

The growing development of engineered wood products such as cross-laminated timber (CLT), glued laminated timber (glulam), and laminated veneer lumber (LVL) is expanding the structural capabilities of timber construction. These advanced timber products enable the construction of larger, taller, and more complex buildings that were previously only feasible with steel or concrete. The rising influence of green building standards, green architecture movements, and government incentives for low-carbon construction is accelerating market adoption across different building types and geographic regions.

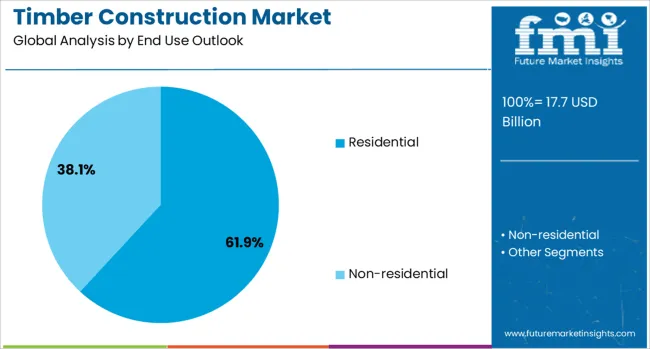

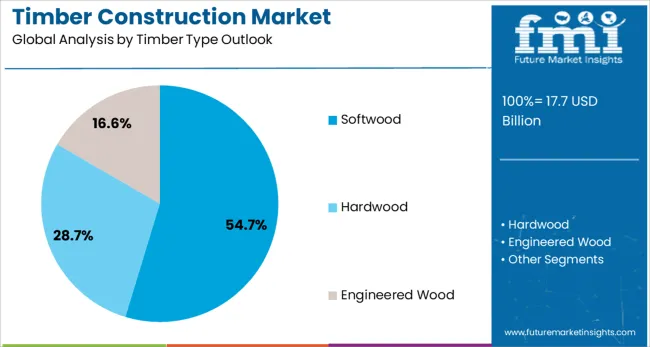

The market is segmented by end use, timber type, and region. By end use, the market is divided into residential and non-residential construction. Based on timber type, the market is categorized into softwood, hardwood, and engineered wood products. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The residential construction segment is projected to account for 61.9% of the timber construction market in 2025, reaffirming its position as the primary application area for timber building solutions. The segment's dominance reflects the widespread adoption of timber frame construction in single-family homes, multi-family housing, and low-rise residential developments. Timber's natural insulation properties, aesthetic appeal, and ability to create warm, comfortable living spaces make it particularly attractive for residential applications.

This segment benefits from the growing consumer preference for green housing options and the increasing awareness of timber's health and wellbeing benefits. The speed of timber construction, which can significantly reduce project timelines compared to traditional building methods, provides additional advantages for residential developers facing housing supply pressures. Government initiatives promoting affordable and green housing solutions continue to support timber adoption in residential construction, particularly in markets with strong forestry industries and established timber building traditions.

Softwood timber is projected to represent 54.7% of timber construction demand in 2025, underscoring its role as the preferred material for structural applications and general construction purposes. The abundance of softwood species such as pine, spruce, and fir, combined with their favorable mechanical properties and cost-effectiveness, drives their widespread use in construction projects. Softwood's consistent grain patterns, ease of processing, and excellent strength characteristics make it ideal for framing, flooring, and structural components.

The segment is supported by well-established supply chains and green forest management practices in major timber-producing regions. Advanced treatment technologies and preservation methods have enhanced softwood's durability and resistance to environmental factors, expanding its application scope. As construction companies increasingly prioritize material efficiency and sustainability, softwood timber's renewable nature and carbon storage capabilities will continue to position it as a fundamental building material in the global construction industry.

The timber construction market is advancing rapidly due to increasing environmental regulations favoring renewable building materials and growing awareness of timber's carbon sequestration benefits. The market faces challenges including concerns about fire safety, durability perceptions, and building code limitations in certain regions. Innovation in timber engineering, fire-resistant treatments, and hybrid construction systems continue to influence market development and adoption patterns.

The continuous development of mass timber products and engineering techniques is expanding the possibilities for timber construction in large-scale and high-rise projects. Innovations in connection systems, prefabrication methods, and digital design tools are improving construction efficiency and structural performance. These technological advances are enabling architects and engineers to design increasingly ambitious timber buildings that challenge conventional construction paradigms.

Modern timber construction increasingly incorporates hybrid systems that combine timber with other materials such as steel or concrete to optimize structural performance and cost-effectiveness. These hybrid approaches leverage the strengths of different materials while maintaining timber as the primary structural element. The development of innovative connection methods and composite systems is enabling more flexible and efficient design solutions for complex building projects.

| Country | CAGR (2025-2035) |

|---|---|

| China | 13% |

| India | 12% |

| Germany | 11% |

| France | 10.1% |

| UK | 9.1% |

| USA | 8.2% |

| Brazil | 7.2% |

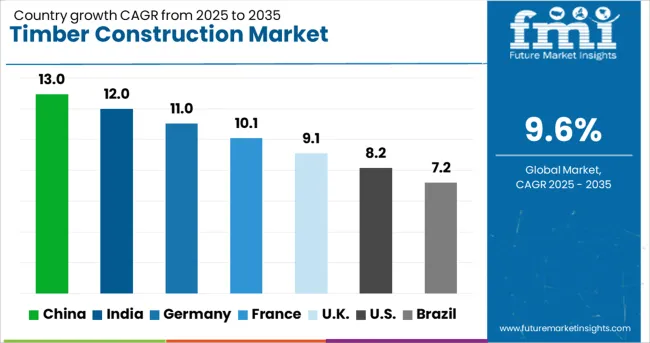

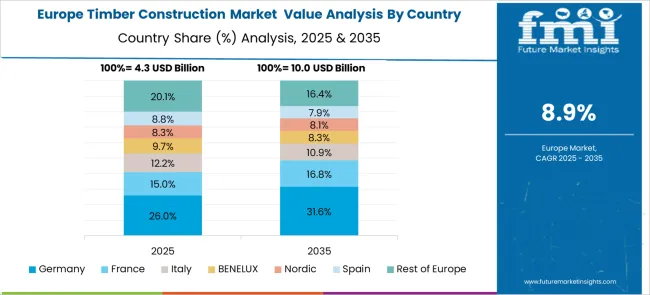

The timber construction market is experiencing robust growth globally, with China leading at a 13% CAGR through 2035, driven by rapid urbanization, government support for green building practices, and increasing adoption of prefabricated timber construction systems. India follows at 12%, supported by growing awareness of green architecture alternatives and rising demand for affordable housing solutions. Germany shows strong growth at 11%, emphasizing advanced timber engineering and stringent sustainability standards. France records 10%, focusing on bio-based construction materials and public sector timber building mandates. The UK demonstrates 9.1% growth, prioritizing modern methods of construction and net-zero carbon objectives. The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Revenue from timber construction in China is projected to exhibit strong growth with a CAGR of 12.96% through 2035, driven by government initiatives promoting green building practices and increasing recognition of timber's environmental benefits. The country's massive construction sector and growing focus on green development are creating significant opportunities for timber construction technologies. Major international timber companies and domestic manufacturers are establishing production facilities and partnerships to serve the expanding Chinese market for engineered wood products and timber building systems.

Revenue from timber construction in India is expanding at a CAGR of 12.0%, supported by increasing awareness of green architecture practices, growing demand for affordable housing, and rising interest in alternative building materials. The country's rapid urbanization and infrastructure development needs are creating opportunities for timber construction solutions that offer speed, sustainability, and cost-effectiveness. International timber technology providers and local construction companies are collaborating to adapt timber building systems to Indian climate conditions and construction practices.

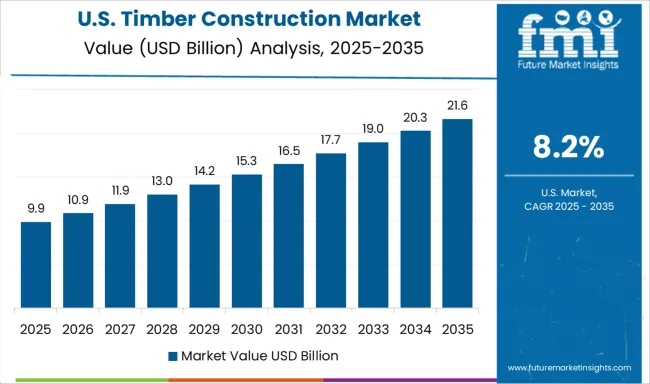

Demand for timber construction in the USA is projected to grow at a CAGR of 8.2%, supported by increasing adoption of mass timber technologies and evolving building codes that permit taller timber structures. American architects and developers are increasingly embracing timber construction for its aesthetic appeal, construction speed, and environmental benefits. The market is characterized by innovative projects showcasing timber's potential in commercial, institutional, and multi-family residential buildings.

Revenue from timber construction in Germany is projected to grow at a CAGR of 11.04% through 2035, driven by the country's strong commitment to green architecture, advanced timber engineering capabilities, and comprehensive regulatory framework supporting wood construction. German companies consistently lead in developing innovative timber building systems, prefabrication technologies, and energy-efficient timber structures that set international benchmarks.

Revenue from timber construction in the UK is projected to grow at a CAGR of 9.1% through 2035, supported by government focus on modern methods of construction and increasing adoption of offsite timber manufacturing. British developers and housing associations are increasingly utilizing timber frame construction to address housing shortages while meeting sustainability objectives.

Revenue from timber construction in France is projected to grow at a CAGR of 10% through 2035, supported by ambitious government regulations mandating timber use in public buildings and promoting bio-based construction materials. French architects and engineers are developing innovative timber solutions that combine structural performance with architectural excellence.

The timber construction market is characterized by competition among established forestry companies, engineered wood manufacturers, specialized timber construction firms, and integrated building solution providers. Companies are investing in production capacity expansion, technological innovation, green forest management, and comprehensive building system development to deliver high-performance timber construction solutions. Product innovation, technical expertise, and project execution capabilities are central to strengthening market position and customer relationships.

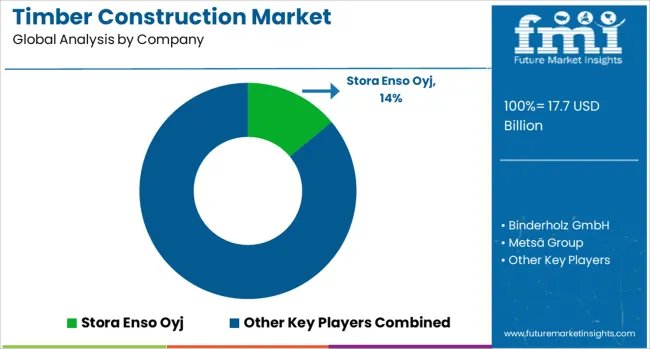

Stora Enso Oyj, Finland-based, leads the market with 14% global value share, offering comprehensive engineered wood products and building solutions with focus on cross-laminated timber and green architecture systems. Binderholz GmbH, Austria, provides integrated timber construction solutions from raw material processing to finished building systems. Metsä Group, Finland, delivers advanced wood products and timber construction materials with focus on green forest management. B&K Structures, UK, specializes in engineered timber structures and offsite construction solutions.

Mayr-Melnhof Holz Holding AG and Hasslacher Holding GmbH, both Austria-based, provide extensive timber processing capabilities and engineered wood products for construction applications. Weyerhaeuser Company, USA, offers comprehensive wood products and timber building materials across North American markets. Structurlam Mass Timber Corporation, Canada, focuses on mass timber manufacturing and innovative timber building systems. Sterling Structural provides specialized timber engineering and construction services for complex projects.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 17.7 billion |

| End Use | Residential, Non-residential |

| Timber Type | Softwood, Hardwood, Engineered Wood |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Stora Enso Oyj, Binderholz GmbH, Metsä Group, B&K Structures, Mayr-Melnhof Holz Holding AG, Hasslacher Holding GmbH, Weyerhaeuser Company, Structurlam Mass Timber Corporation, and Sterling Structural |

| Additional Attributes | Dollar sales by timber grade and treatment type, regional construction trends, competitive landscape, buyer preferences for certified timber, integration with green building certifications, innovations in fire-resistant treatments, acoustic performance enhancements, and prefabrication technologies |

The global timber construction market is estimated to be valued at USD 17.7 billion in 2025.

The market size for the timber construction market is projected to reach USD 44.2 billion by 2035.

The timber construction market is expected to grow at a 9.6% CAGR between 2025 and 2035.

The key product types in timber construction market are residential and non-residential.

In terms of timber type outlook, softwood segment to command 54.7% share in the timber construction market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Timber Logistics Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA