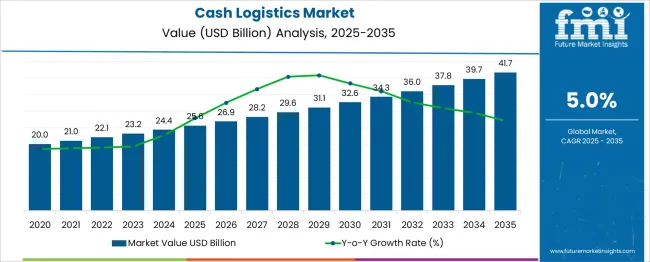

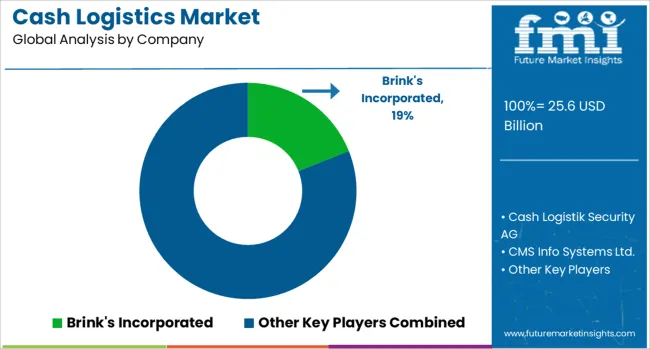

The Cash Logistics Market is estimated to be valued at USD 25.6 billion in 2025 and is projected to reach USD 41.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. A consistent annual increase of approximately USD 1.3 to 2.0 billion has been registered throughout the timeframe. The slope of the growth curve follows a steady upward trajectory, neither exponential nor flat, but gently sloped.

The first five years witnessed a rise from USD 25.6 billion to USD 31.1 billion, reflecting a modest acceleration aligned with demand from banking, retail, and ATM replenishment services. From 2030 onward, the incline continues in a uniform pattern, with the market growing from USD 32.6 billion to USD 41.7 billion over the final five years.

No sharp inflection points or plateau zones appear in the data series, reinforcing that the curve maintains a nearly linear shape. This uniformity suggests that structural demand rather than cyclical spikes are shaping the sector. The consistent gradient also signals low volatility, with volume and frequency of cash movements acting as steady contributors. This shape is indicative of a mature industry with recurring service-based contracts and minimal disruption risks.

| Metric | Value |

|---|---|

| Cash Logistics Market Estimated Value in (2025 E) | USD 25.6 billion |

| Cash Logistics Market Forecast Value in (2035 F) | USD 41.7 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The cash logistics market is witnessing steady expansion, driven by the continued need for secure, traceable, and regulated physical currency movement despite ongoing digitalization. Factors such as ATM replenishment, cash-intensive retail transactions, and cross-border currency flows are sustaining the market, especially in emerging economies.

Technological integration-such as real-time tracking, intelligent cash safes, and automated reconciliation systems-is enhancing efficiency and transparency. Meanwhile, regulations around armored vehicle security, staff vetting, and cash handling compliance are reshaping vendor operations.

The demand for integrated cash management outsourcing, encompassing pick-up, processing, and vaulting, is accelerating as banks and large enterprises aim to reduce overheads and improve operational control. Growing security threats and labor shortages are further pushing companies toward consolidated, tech-enabled cash logistics services.

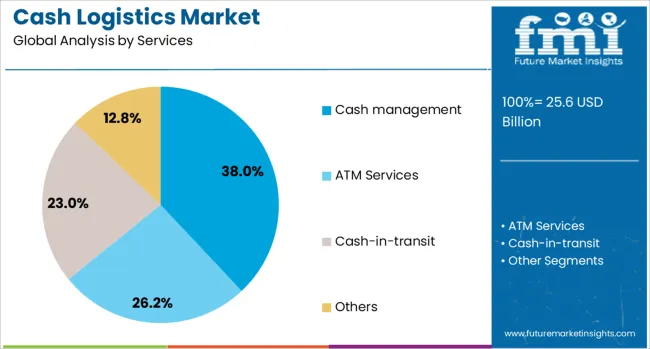

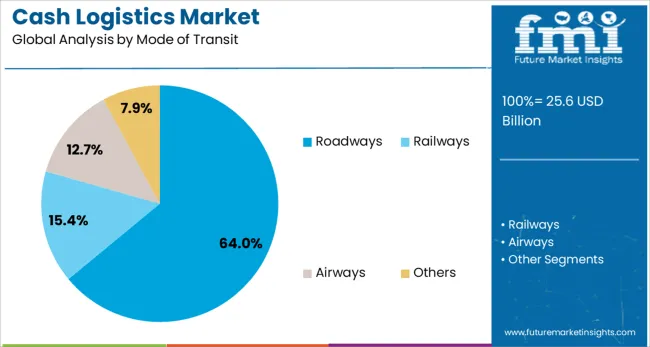

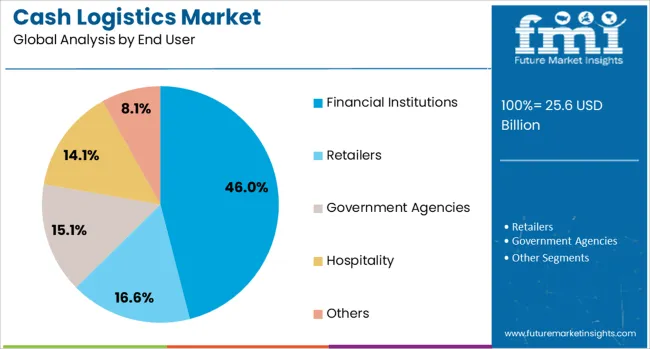

The cash logistics market is segmented by services, mode of transit, end user, and geographic regions. The services of the cash logistics market are divided into Cash management, ATM Services, Cash-in-transit, and others. In terms of mode of transit, the cash logistics market is classified into Roadways, Railways, Airways, and others. Based on the end user of the cash logistics market, it is segmented into Financial Institutions, Retailers, Government Agencies, Hospitality, and others. Regionally, the cash logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Cash management services are expected to dominate with 38.00% of the revenue share in 2025, making them the leading service type within the cash logistics market. The increasing outsourcing of end-to-end cash handling, including counting, reconciliation, and deposit processing, is fueling this growth.

Banks, retailers, and large cash-intensive institutions are seeking reliable third-party providers to manage inflows and outflows with minimal manual intervention. Advanced vaulting, real-time inventory management, and automated cash centers are enabling service providers to deliver greater value through reduced turnaround time and cost control.

As transaction volume volatility increases across ATMs and retail, demand for dynamic cash forecasting and float optimization solutions is expected to rise, further bolstering this segment.

Roadways are forecast to account for 64.00% of total transit mode usage in the cash logistics market by 2025, securing their position as the dominant transportation method. This preference is driven by the flexibility, route optimization, and vehicle-level security that road transit enables for intracity and intercity movements.

Armored vans and GPS-tracked fleets provide a secure medium for large and small-scale currency transfers, reducing both operational risk and insurance overheads. Additionally, the expansion of urban infrastructure and increased ATM density have strengthened the efficiency of road-based delivery networks.

Real-time visibility, driver authentication, and automated dispatch systems are helping cash logistics firms maximize reliability, even in high-risk or remote regions.

Financial institutions are projected to represent 46.00% of the end-user share in 2025, emerging as the primary clientele for cash logistics providers. Their dependency on third-party vendors for ATM cash replenishment, vault services, and currency processing is rising, especially as banks look to optimize fixed costs and enhance network efficiency.

Branch rationalization strategies have increased reliance on mobile cash solutions and regional service hubs. Moreover, regulatory scrutiny on audit trails, chain-of-custody, and compliance reporting has necessitated specialized service-level agreements.

The banking sector’s need for real-time data, tamper-evident systems, and adherence to global security standards makes financial institutions a priority segment within the cash logistics value chain.

The cash logistics market is expanding robustly due to sustained demand for secure cash handling despite digital payment adoption. The global market value exceeded USD 23 billion in 2023 and is projected to grow at a mid single-digit CAGR through the coming decade. Expansion of ATM networks, retail footprints, and financial inclusion programs has driven cash-in-transit and management services across retail, banking, and government sectors. Innovations like smart safes, GPS tracking, and AI-enabled forecasting are enhancing operations. Growth is especially strong in Asia Pacific and North America.

The cash-in-transit segment accounts for the majority of activity in the cash logistics market, serving as the backbone for retail and banking cash distribution. Service providers manage secure movement of physical currency among ATMs, bank branches, and commercial outlets. The proliferation of ATM infrastructure and retail growth has increased pickup frequency and demand for armored transport. Alongside cash-in-transit, cash management services—such as smart safe monitoring and cash reconciliation—are growing fastest, driven by automation and operational efficiency goals. Systems that incorporate real-time tracking, route optimization, and mobile cash handling have become standard. Logistics solutions that combine transit, processing, and in-field management capabilities are

Providers are introducing digital enhancements such as GPS, IoT-enabled smart safes, real-time monitoring, and AI-driven demand forecasting to reshape the market. These upgrades deliver route efficiencies, theft resistance, and enhanced cash visibility. Integration with client systems—financial institutions, retailers, and ATM operators—has enabled seamless supply chain collaboration. Facilities are adopting cash recyclers to reduce transit needs, while back-end systems provide cash balancing and audit reporting. Automation, including smart lockers and sensor-driven vaulting, supports service quality and compliance. As the market evolves, operators are transforming from transport providers into cash ecosystem partners, offering end-to-end solutions that unify inventory, logistics, and risk management under single system architectures.

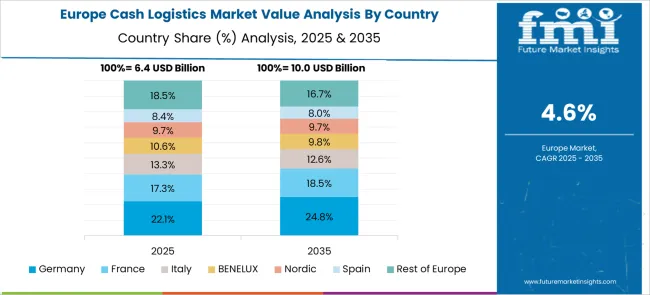

Asia Pacific leads regional growth, accounting for over one-third of transactions, spurred by growing retail networks, ATMs, and financial inclusion efforts in countries like India and China. North America retains a strong share with mature infrastructure, automation, and security-heavy processing. Europe also reflects steady demand due to banking modernization and regulatory compliance. Emerging economies in Latin America, the Middle East, and Africa are experiencing accelerated adoption as retail formats evolve and cash remains central to daily transactions. Regionally tailored solutions, such as RFID-tracked, armored route services or last-mile pickups, address local terrain and security risks. Providers have gained traction by offering modular service models adapted to urban density, infrastructure constraints, and regulatory complexity across diverse regions.

The cash logistics market faces persistent operational challenges related to security risk, cost structure, and competition from digital payments. Armed transport, insurance, and facility infrastructure contribute to high fixed costs, affecting profitability for smaller providers. Rising incidents of armed robbery and internal theft risk require continuous investments in training and surveillance. Urban congestion and regulatory roadblocks may disrupt routing and fulfillment. Meanwhile, the shift toward digital payments presents demand uncertainty in some mature markets. Strategic responses include service diversification into asset handling, digitization, robotics for cash processing, and subscription-based forecasting services. Partnerships with banks and retailers allow providers to extend scope beyond transit into cash lifecycle management. Investment in tech-enabled, scalable solutions will define competitive advantage in a still-critical yet evolving market.

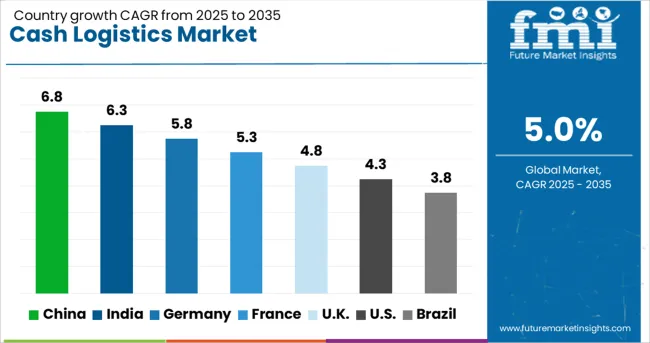

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global cash logistics market is forecast to grow at a CAGR of 5% from 2025 to 2035. Rising demand for secure transport, ATM replenishment, and vault management continues to support expansion across both OECD and ASEAN countries. Despite digital payment penetration, several economies have retained significant reliance on physical currency due to regulatory, geographic, and infrastructural dynamics. Countries such as China, India, and Germany have exceeded the global growth rate, owing to large retail ecosystems and security upgrades. OEM investments in armored vehicles, integrated cash tracking systems, and regional security alliances have added momentum to market operations. Additionally, regulatory enforcement around bank outsourcing protocols and interbank fund transfers has contributed to regional and domestic logistics optimization.

China is projected to grow at a CAGR of 6.8%, well above the global average of 5%. The market has benefited from the continuation of cash in circulation, particularly across tier-2 and tier-3 cities. Cash management firms have expanded armored fleet sizes and implemented centralized dispatch hubs. Integrated AI-based surveillance and route optimization tools have gained use in high-density zones.

India’s market is forecast to grow at 6.3% CAGR, outperforming the global average. Cash demand in retail, informal trade, and tier-2 zones has remained elevated. ATM refills and cash collection services have scaled through PPP-led security upgrades. Indigenous manufacturing of armored transport vehicles has improved fleet deployment timelines across regions. ASEAN collaboration has assisted with currency processing technology transfers.

Germany is expected to grow at a CAGR of 5.8%, exceeding the global average. Compliance with European Central Bank mandates and OECD-aligned audit regulations has improved security standards. Urban and suburban retail operations have remained cash-intensive. Logistics operators have integrated tamper-proof packaging and encrypted route protocols, while biometric access control is now widely used for vault operations.

United Kingdom’s market is projected to expand at a CAGR of 4.8%, slightly below the global figure. Traditional bank branches and cash-based retail continue to sustain market demand. Investments in courier-grade armored vehicles and centralized vaulting networks have offset declines from digital transactions. Security audit trails, mandated under OECD policy, have been implemented widely.

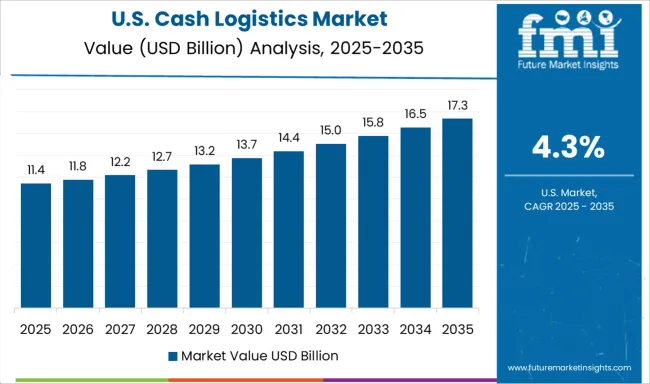

The United States is anticipated to record a CAGR of 4.3%, falling below the global average. Fragmentation of logistics protocols across states and increased e-payment adoption have moderated market activity. However, demand from casino, retail, and healthcare sectors has supported armored fleet and vault services. Regional logistics providers have adopted AI-based routing and digitized inventory management.

Brink's Incorporated remains a dominant force in the cash logistics market by operating one of the largest global fleets for currency transport, vaulting, and ATM services. G4S Limited, now under Allied Universal, provides integrated cash cycle management across banks, retail chains, and public infrastructure networks. CMS Info Systems Ltd. holds a major presence in India, offering cash-in-transit, ATM replenishment, and secure cash vaulting services.

GardaWorld supports clients in North America and the Middle East, focusing on armored transport, route optimization, and compliance management. Cash Logistik Security AG serves specialized European markets with end-to-end cash logistics tailored for regional banking and retail sectors. Global Security Logistic Co. has focused on emerging Asian markets, using scalable armored transport infrastructure for high-risk zones.

Security and Intelligence Services Ltd. (SIS) offers a blend of technology-enabled cash services in South Asia, including ATM operations and currency processing. The market is being shaped by digital tracking systems, increasing ATM penetration in tier-2 and tier-3 cities, and a heightened demand for risk mitigation services in cash-heavy economies. Providers are differentiating through digital vaulting, real-time tracking, route analytics, and secure armored vehicle innovations to address evolving threats and operational cost pressures.

Smart safes and automated real-time tracking became widespread in the USA and EU to reduce manual intervention. Strategic mergers, including regional consolidations, helped preserve service coverage despite a decline in cash usage. Japan and South Korea advanced AI-led routing for armored transport fleets, enhancing efficiency. These changes reflect confirmed efforts to digitize, consolidate, and future-proof cash handling across technologically advanced and high-demand markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 25.6 Billion |

| Services | Cash management, ATM Services, Cash-in-transit, and Others |

| Mode of Transit | Roadways, Railways, Airways, and Others |

| End User | Financial Institutions, Retailers, Government Agencies, Hospitality, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Brink's Incorporated, Cash Logistik Security AG, CMS Info Systems Ltd., G4S Limited, GardaWorld, Global Security Logistic Co., and Security and Intelligence Services Ltd. |

| Additional Attributes | Dollar sales by service type (cash in transit, ATM replenishment, cash management), end user (banks, retailers), demand from ATM rollout and outsourcing, regional gains in Asia Pacific, innovation in AI routing and vault tech, environmental impact of armored fleets, and emerging use cases in CBDC logistics and crypto cold storage... |

The global cash logistics market is estimated to be valued at USD 25.6 billion in 2025.

The market size for the cash logistics market is projected to reach USD 41.7 billion by 2035.

The cash logistics market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in cash logistics market are cash management, atm services, cash-in-transit and others.

In terms of mode of transit, roadways segment to command 64.0% share in the cash logistics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Logistics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cashew Nutshell Liquid Market Size and Share Forecast Outlook 2025 to 2035

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Logistics Robots Market Size and Share Forecast Outlook 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Cashew Roasting Machine Market Size and Share Forecast Outlook 2025 to 2035

Cashew Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Cashew Milk Market Analysis by Form, End Use, Sales Channel, Packaging, and Product Type Through 2035

Cash Management Services Market – Trends & Forecast 2025 to 2035

Key Players & Market Share in the Logistics Packaging Industry

Logistics Outsourcing Market Analysis - Growth & Forecast 2025 to 2035

Logistics Visualization System Market

Logistics Automation Market

Cash Sorting Machines Market

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Intralogistics Automation Solutions Market Size and Share Forecast Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Smart Logistics Services Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA