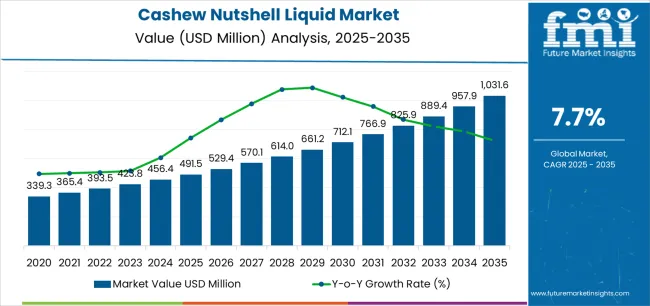

The Cashew Nutshell Liquid Market is estimated to be valued at USD 491.5 million in 2025 and is projected to reach USD 1031.6 million by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period.

The cashew nutshell liquid market is experiencing moderate growth, driven by the increasing utilization of CNSL-derived chemicals in industrial formulations. Derived from renewable agricultural waste, cashew nutshell liquid offers a sustainable feedstock for the production of resins, coatings, and surfactants.

Its unique phenolic composition provides superior thermal stability and chemical resistance, making it a valuable substitute for petroleum-based raw materials. The current market scenario is influenced by heightened awareness of green chemistry and the circular economy, promoting the adoption of bio-based materials across manufacturing sectors.

Ongoing research and development aimed at improving extraction efficiency and refining techniques have further enhanced product consistency. With industrial sectors prioritizing low-carbon alternatives, CNSL is expected to play a vital role in the transition toward environmentally friendly specialty chemicals.

| Metric | Value |

|---|---|

| Cashew Nutshell Liquid Market Estimated Value in (2025 E) | USD 491.5 million |

| Cashew Nutshell Liquid Market Forecast Value in (2035 F) | USD 1031.6 million |

| Forecast CAGR (2025 to 2035) | 7.7% |

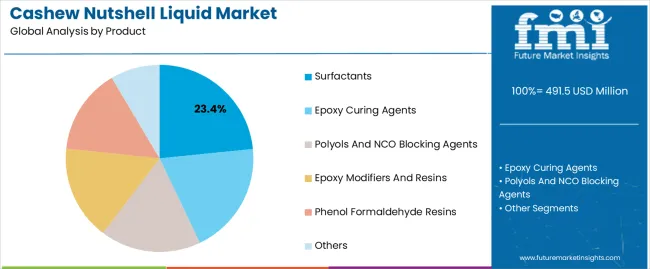

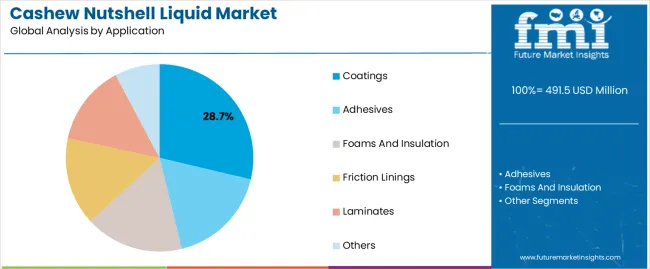

The market is segmented by Product and Application and region. By Product, the market is divided into Surfactants, Epoxy Curing Agents, Polyols And NCO Blocking Agents, Epoxy Modifiers And Resins, Phenol Formaldehyde Resins, and Others. In terms of Application, the market is classified into Coatings, Adhesives, Foams And Insulation, Friction Linings, Laminates, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The surfactants segment holds approximately 23.40% share in the product category, supported by growing use of CNSL-based surfactants in detergents, personal care products, and industrial cleaners. These bio-based surfactants exhibit superior emulsifying and wetting properties, enabling effective performance with reduced environmental impact.

The segment benefits from increased demand for natural and biodegradable cleaning agents, driven by sustainability initiatives and consumer awareness. Manufacturers are leveraging CNSL’s renewable nature to create high-performance alternatives that meet both industrial and regulatory standards.

Ongoing developments in non-ionic and anionic surfactant formulations have further diversified application potential. With expanding use in agrochemicals and specialty formulations, the surfactants segment is expected to maintain its growth trajectory in the near term.

The coatings segment dominates the application category with approximately 28.70% share, attributed to CNSL’s capability to produce high-performance resins with excellent chemical and corrosion resistance. These bio-based resins are widely utilized in industrial coatings, automotive finishes, and protective layers due to their durability and cost-efficiency.

The shift toward sustainable, low-VOC coating materials has accelerated CNSL adoption across manufacturing industries. Enhanced mechanical strength and thermal stability make CNSL-derived coatings suitable for metal, wood, and composite surfaces.

The segment also benefits from growing environmental regulations promoting eco-friendly production methods. With continued innovation in resin modification and cross-linking technologies, the coatings segment is expected to sustain its leadership throughout the forecast period.

The scope for cashew nutshell liquid rose at a 10.7% CAGR between 2020 and 2025. The global market is anticipated to grow at a moderate CAGR of 8.1% over the forecast period 2025 to 2035.

The market experienced steady growth during the historical period from 2020 to 2025, driven by advancements in extraction and processing technologies, which improved the efficiency and yield of cashew nutshell liquid production, which LED to the development of high quality cashew nutshell liquid derivatives with enhanced properties, expanding their applications and market potential.

Supportive regulatory frameworks and policies promoting the use of bio based products further stimulated market growth. Alignment with sustainability goals and environmental regulations enhanced the acceptance and adoption of cashew nutshell liquid derivatives.

Looking ahead to the forecast period from 2025 to 2035, the market is expected to witness significant growth. Market forecast projections anticipate continued expansion of end use industries such as automotive, construction, and packaging. The industries are expected to drive sustained demand for cashew nutshell liquid derived products, contributing to market growth.

Increasing globalization and trade liberalization are expected to facilitate market access and penetration into new geographical regions. Emerging markets with burgeoning industrial sectors offer lucrative opportunities for cashew nutshell liquid manufacturers to expand their market presence.

Cashew nutshell liquid is widely used in various industries such as automotive, coatings, adhesives, polymers, and lubricants due to its unique chemical properties. The growing demand for these industrial applications is a significant driver of the cashew nutshell liquid market.

Fluctuations in cashew nut prices, influenced by factors such as weather conditions, crop yields, and geopolitical events, can impact the cost of raw materials for cashew nutshell liquid production. Volatility in raw material prices can affect profit margins and investment decisions in the cashew nutshell liquid market.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by Korea and Japan. The countries are expected to lead the market through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 8.4% |

| China | 8.9% |

| The United Kingdom | 9.3% |

| Japan | 9.8% |

| Korea | 10.2% |

The cashew nutshell liquid market in the United States expected to expand at a CAGR of 8.4% through 2035. The government in the country has implemented policies and initiatives to promote the use of bio based materials and reduce dependence on fossil fuels. Supportive regulations and incentives encourage investment in bio based industries, including the cashew nutshell liquid market.

The United States is home to diverse industries such as automotive, construction, coatings, adhesives, and polymers, which are major consumers of cashew nutshell liquid derived products. The expansion of these industries drives demand for cashew nutshell liquid based solutions, boosting market growth.

The cashew nutshell liquid market in the United Kingdom is anticipated to expand at a CAGR of 9.3% through 2035. The consumers in the country are increasingly conscious of the environmental and health impacts of products they purchase.

There is a growing preference for natural and nontoxic alternatives in household and personal care products. Cashew nutshell liquid derived products, with their natural origin and eco-friendly properties, resonate with the consumers in the United Kingdom, driving market demand.

The country is known for its innovation and research capabilities across various industries. Investment in research and development activities aimed at improving cashew nutshell liquid extraction methods, refining processes, and developing new applications enhances the market potential of cashew nutshell liquid derived products, driving market growth.

Cashew nutshell liquid trends in China are taking a turn for the better. An 8.9% CAGR is forecast for the country from 2025 to 2035. China has a large agricultural sector, including significant cashew nut production in regions like Hainan Province.

The availability of cashew nut shells as a byproduct of the cashew nut processing industry provides a ready source of raw material for cashew nutshell liquid extraction, supporting the growth of the market in China.

The diverse manufacturing sector in the country spans industries such as automotive, electronics, construction, textiles, and packaging, all of which utilize cashew nutshell liquid derived products in various applications. The expansion of these industries and the increasing adoption of cashew nutshell liquid based solutions drive market growth in China.

The cashew nutshell liquid market in Japan is poised to expand at a CAGR of 9.8% through 2035. The participation of Japan in global trade networks provides opportunities for market expansion and access to international markets for cashew nutshell liquid derived products. Export of cashew nutshell liquid based products to other countries and partnerships with international stakeholders drive growth and revenue generation in cashew nutshell liquid sector in Japan.

The focus of the country on disaster resilience and safety drives demand for durable and high performance materials in construction and infrastructure projects. Cashew nutshell liquid derived products, known for their excellent adhesion, corrosion resistance, and weatherability, are preferred choices in such applications, driving market growth.

The cashew nutshell liquid market in Korea is anticipated to expand at a CAGR of 10.2% through 2035. Korean companies are investing in green technology and sustainable practices to reduce environmental impact and comply with regulations. Cashew nutshell liquid derived products, with their eco-friendly properties, are integral to green technology initiatives, driving market growth in green technology sector in the country.

The Korean government provides incentives and support for companies engaged in innovation and technology development. Cashew nutshell liquid based innovations, such as new formulations and applications, benefit from government support, driving market growth through increased investment in research and development.

The below table highlights how surfactants segment is projected to lead the market in terms of product, and is expected to account for a CAGR of 7.8% through 2035. Based on application, the coatings segment is expected to account for a CAGR of 7.6% through 2035.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Surfactants | 7.8% |

| Coatings | 7.6% |

Based on product, the surfactants segment is expected to continue dominating the cashew nutshell liquid market. The liquid contains phenolic compounds, which make it suitable for use as a raw material in the production of surfactants. Surfactants derived from cashew nutshell liquid offer excellent surface active properties, making them suitable for use in a wide range of applications, including detergents, cleaners, emulsifiers, and foaming agents.

Regulatory agencies in many regions are implementing policies and guidelines to promote the use of biobased and environmentally friendly products. Cashew nutshell liquid derived surfactants, being natural and renewable, receive favorable consideration under such regulatory frameworks, driving market growth for this segment.

In terms of application, the coatings segment is expected to continue dominating the cashew nutshell liquid market. The liquid contains phenolic compounds that impart excellent chemical properties, making it suitable for use in coatings formulations. Cashew nutshell liquid based coatings offer superior adhesion, corrosion resistance, and weatherability, driving demand for cashew nutshell liquid in the coatings segment.

Cashew nutshell liquid based coatings exhibit enhanced performance characteristics compared to traditional coatings. They offer excellent resistance to chemicals, abrasion, and UV degradation, making them suitable for a wide range of applications in industries such as automotive, aerospace, marine, and construction, driving demand for cashew nutshell liquid in the coatings segment.

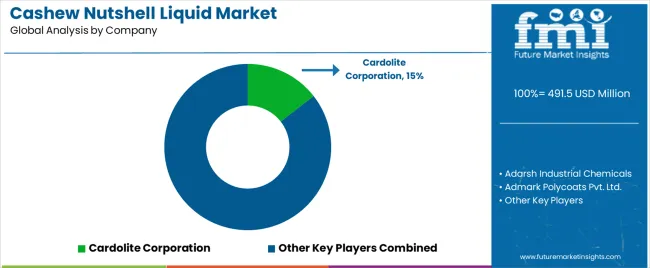

The competitive landscape of the cashew nutshell liquid market is characterized by several key players operating globally and regionally. The companies are involved in the extraction, processing, production, and distribution of cashew nutshell liquid derived products, catering to various industries such as coatings, friction linings, polymers, surfactants, and resin formulations.

Company Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 491.5 million |

| Projected Market Valuation in 2035 | USD 1031.6 million |

| Value-based CAGR 2025 to 2035 | 7.7% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Product, Application, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Adarsh Industrial Chemicals; Admark Polycoats Pvt. Ltd; Cardolite Corporation; Cashew Chem India; Cat Loi Cashew Oil Production & Export JSC; Equilex Chemicals B.V; Golden Cashew Products Pvt. Ltd; K2P Chemicals; LC Buffalo Co. Ltd.; Muskaan Group |

The global cashew nutshell liquid market is estimated to be valued at USD 491.5 million in 2025.

The market size for the cashew nutshell liquid market is projected to reach USD 1,031.6 million by 2035.

The cashew nutshell liquid market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in cashew nutshell liquid market are surfactants, epoxy curing agents, polyols and nco blocking agents, epoxy modifiers and resins, phenol formaldehyde resins and others.

In terms of application, coatings segment to command 28.7% share in the cashew nutshell liquid market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cashew Roasting Machine Market Size and Share Forecast Outlook 2025 to 2035

Cashew Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Cashew Milk Market Analysis by Form, End Use, Sales Channel, Packaging, and Product Type Through 2035

Market Share Insights for Processed Cashew Providers

Processed Cashew Market Trends – Snack Innovation & Industry Growth 2025 to 2035

Brief Outlook of Growth Drivers Impacting Consumption of UK Processed Cashew.

USA Processed Cashew Market Analysis – Growth & Industry Trends 2025-2035

Europe Processed Cashew Market by Conventional and Organic Varieties Through 2035

Brief Outlook of Growth Drivers Impacting Consumption of Asia Pacific Processed Cashew.

Liquid Packaging Bag Market Size and Share Forecast Outlook 2025 to 2035

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA