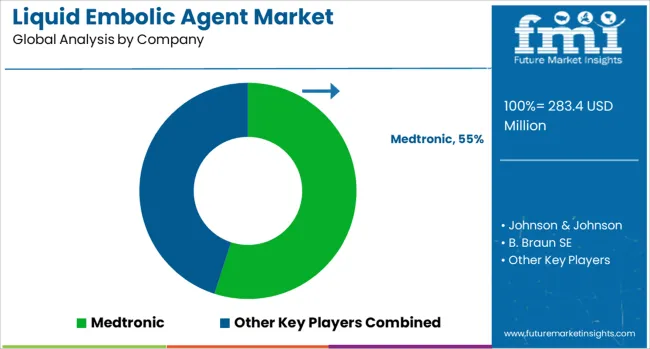

The global liquid embolic agent market is projected to grow from USD 283.4 million in 2025 to approximately USD 727.8 million by 2035, recording an absolute increase of USD 444.4 million over the forecast period. This translates into a total growth of 156.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 9.9% between 2025 and 2035. The market size is expected to grow by nearly 2.57X during the same period, supported by increasing prevalence of vascular disorders, advancing minimally invasive surgical techniques, and growing adoption of liquid embolic agents in interventional procedures.

Between 2025 and 2030, the liquid embolic agent market is projected to expand from USD 283.4 million to USD 431.6 million, resulting in a value increase of USD 148.2 million, which represents 33.3% of the total forecast growth for the decade. This phase of growth will be shaped by increasing adoption of minimally invasive procedures, expanding awareness of liquid embolic therapies among healthcare professionals, and growing prevalence of vascular disorders requiring interventional treatment across global healthcare systems.

From 2030 to 2035, the market is forecast to grow from USD 431.6 million to USD 727.8 million, adding another USD 296.2 million, which constitutes 66.7% of the ten-year expansion. This period is expected to be characterized by advancement in liquid embolic agent formulations, expansion of clinical applications beyond traditional vascular procedures, and development of next-generation embolic materials that offer improved safety profiles and enhanced clinical outcomes.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 283.4 million |

| Forecast Value in (2035F) | USD 727.8 million |

| Forecast CAGR (2025 to 2035) | 9.9% |

Market expansion is being supported by increasing prevalence of vascular disorders, including arteriovenous malformations, aneurysms, and hypervascular tumors that require advanced interventional treatment options utilizing liquid embolic agents for effective vessel occlusion. Growing adoption of minimally invasive surgical techniques and interventional radiology procedures is driving demand for sophisticated embolic materials that provide precise control and optimal clinical outcomes.

The expanding healthcare infrastructure in emerging markets and increasing availability of specialized interventional facilities are creating opportunities for liquid embolic agent adoption across diverse clinical applications. Technological advancement in embolic agent formulations, delivery systems, and imaging guidance is enabling more effective treatment procedures while improving patient safety and reducing procedure complexity for healthcare providers.

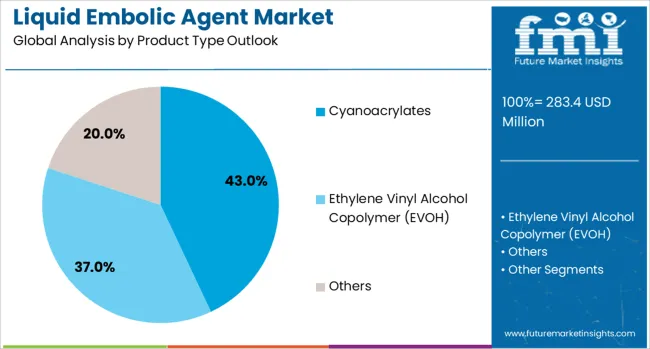

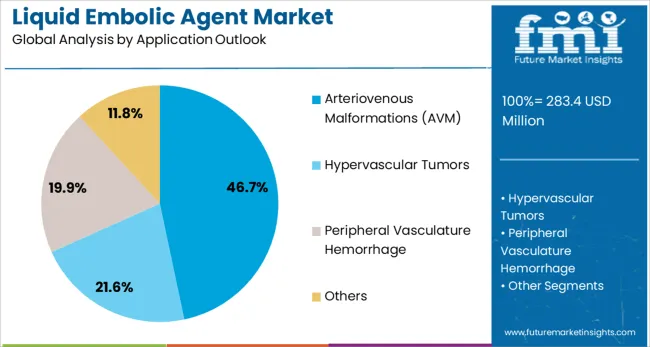

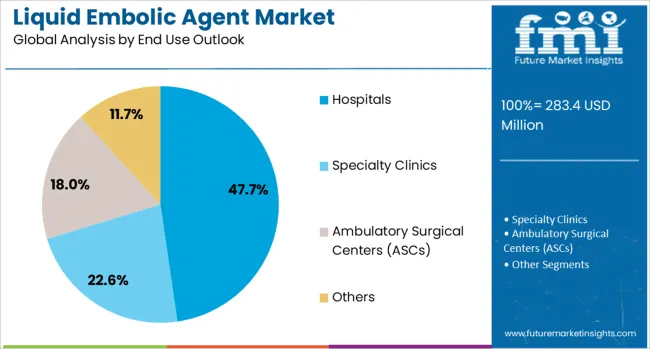

The market is segmented by product type, application, end use, and region. By product type, the market is divided into cyanoacrylates (including N-BCA n-Butyl Cyanoacrylate and N-HCA n-Hexyl Cyanoacrylate), ethylene vinyl alcohol copolymer (EVOH), and others. Based on application, the market is categorized into arteriovenous malformations (AVM), hypervascular tumors, peripheral vasculature hemorrhage, and others. In terms of end use, the market is segmented into hospitals, specialty clinics, ambulatory surgical centers (ASCs), and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Cyanoacrylates are projected to account for 43% of the Liquid Embolic Agent market in 2025. This leading share is supported by proven clinical effectiveness, rapid polymerization properties, and established usage patterns across diverse vascular applications, including arteriovenous malformations and tumor embolization procedures. Cyanoacrylates, including N-BCA and N-HCA formulations, provide reliable vessel occlusion with predictable handling characteristics that appeal to interventional specialists. The segment benefits from extensive clinical experience and comprehensive regulatory approvals across major healthcare markets.

Arteriovenous malformations (AVM) applications are expected to represent 46.7% of liquid embolic agent demand in 2025. This dominant share reflects the critical role of liquid embolic agents in treating cerebral and peripheral AVMs through precise vessel occlusion that prevents hemorrhage and neurological complications. AVM embolization procedures require advanced embolic materials that provide controlled delivery and reliable vessel closure while minimizing procedural risks. The segment benefits from growing awareness of AVM treatment options and expanding interventional capabilities.

Hospitals are projected to contribute 47.7% of the market in 2025, representing comprehensive medical facilities that perform complex interventional procedures requiring liquid embolic agents for vascular embolization treatments. Hospital-based interventional suites provide advanced imaging guidance, specialized equipment, and experienced medical teams necessary for successful embolic procedures. The segment is supported by increasing hospital investments in interventional capabilities and growing patient volumes requiring vascular interventions.

The liquid embolic agent market is advancing rapidly due to increasing prevalence of vascular disorders and expanding adoption of minimally invasive treatment approaches. The market faces challenges including high procedural costs, need for specialized training and expertise, and potential complications associated with embolic procedures that require careful patient selection and procedural planning. Innovation in embolic agent chemistry and delivery systems continue to influence market development patterns.

The growing demand for improved clinical outcomes is driving development of advanced liquid embolic agents that offer enhanced controllability, improved biocompatibility, and optimized polymerization characteristics for diverse clinical applications. Next-generation formulations incorporate innovative polymer chemistry and radiopaque additives that enable superior visualization and precise delivery control during interventional procedures. These advanced materials support complex embolization procedures while reducing procedural risks and improving patient outcomes.

Modern liquid embolic agents are being evaluated and adopted for expanded clinical applications beyond traditional vascular malformations, including tumor embolization, trauma hemorrhage control, and prophylactic vessel occlusion procedures. Advanced clinical research and regulatory approvals are enabling broader therapeutic applications that leverage the unique properties of liquid embolic materials for diverse medical conditions requiring vessel occlusion or flow modification.

| Countries | CAGR (2025-2035) |

|---|---|

| China | 13.4% |

| India | 12.4% |

| Germany | 11.4% |

| France | 10.4% |

| United Kingdom | 9.4% |

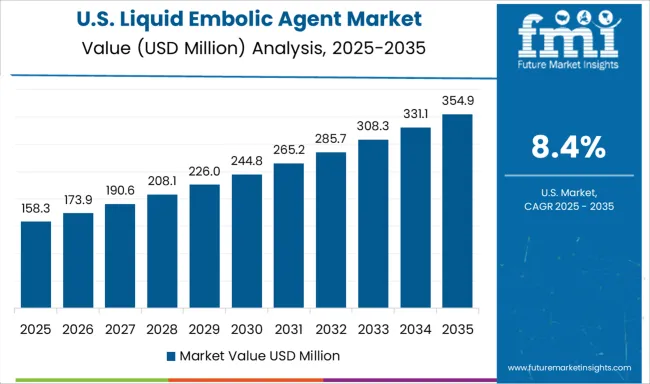

| United States | 8.4% |

| Brazil | 7.4% |

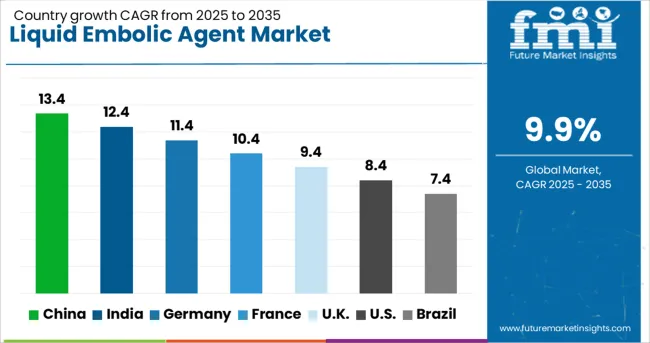

The liquid embolic agent market is growing rapidly across global markets, with China leading at a 13.4% CAGR through 2035, driven by expanding healthcare infrastructure and increasing prevalence of vascular disorders requiring advanced interventional treatment, followed by India at 12.4% supported by medical tourism growth and expanding healthcare infrastructure, while Germany records 11.4% emphasizing advanced medical technology and clinical excellence, France grows at 10.4% with interventional medicine expertise and comprehensive healthcare system support, the United Kingdom shows 9.4% growth focusing on evidence-based medicine and clinical standards, the United States expands at 8.4% with innovation leadership and regulatory expertise, and Brazil maintains 7.4% growth supported by healthcare system expansion and increasing awareness of interventional treatment options that create diverse opportunities for liquid embolic agent adoption across major medical centers and specialty clinics.

Revenue from liquid embolic agents in China is projected to exhibit the highest growth rate with a CAGR of 13.4% through 2035, driven by expanding healthcare infrastructure, increasing prevalence of vascular disorders, and growing adoption of advanced interventional procedures across major medical centers. The country's large patient population and improving healthcare access are creating substantial demand for liquid embolic therapies. Major medical device companies are establishing comprehensive distribution networks to serve growing market demand.

Revenue from liquid embolic agents in India is expanding at a CAGR of 12.4%, supported by growing medical tourism industry, expanding healthcare infrastructure, and increasing awareness of advanced vascular treatment options among healthcare providers and patients. The country's cost-effective healthcare delivery and skilled medical professionals are attracting international patients seeking interventional procedures. Domestic and international companies are investing in local distribution and training programs.

Demand for liquid embolic agents in Germany is projected to grow at a CAGR of 11.4%, supported by leadership in medical technology development, established healthcare infrastructure, and comprehensive insurance coverage for advanced interventional procedures that utilize liquid embolic materials. German medical centers are implementing cutting-edge interventional techniques with focus on clinical excellence and patient safety. The market is characterized by focus on innovation, quality, and evidence-based medicine.

Demand for liquid embolic agents in France is expanding at a CAGR of 10.4%, driven by established interventional medicine expertise, comprehensive healthcare system, and a growing focus on minimally invasive treatment approaches that utilize advanced embolic materials for vascular procedures. French medical centers are implementing sophisticated interventional techniques with a focus on patient outcomes and procedural excellence. The market benefits from strong clinical research capabilities and established medical education programs.

Demand for liquid embolic agents in the UK is growing at a CAGR of 9.4%, supported by an established healthcare system, focus on evidence-based medicine, and comprehensive clinical guidelines for interventional procedures utilizing liquid embolic materials. British medical centers are implementing standardized protocols for embolic procedures with a focus on patient safety and clinical effectiveness. The market is characterized by rigorous clinical evaluation and quality assurance standards.

Demand for liquid embolic agents in the USA is expanding at a CAGR of 8.4%, driven by advanced healthcare infrastructure, comprehensive research capabilities, and an established regulatory framework that supports innovation in liquid embolic agent development and clinical application. Large medical centers are implementing comprehensive interventional programs that utilize advanced embolic materials for diverse clinical indications. The market benefits from robust reimbursement systems and established physician training programs.

Revenue from liquid embolic agents in Brazil is growing at a CAGR of 7.4%, driven by expanding healthcare system, increasing awareness of interventional treatment options, and growing investments in medical infrastructure that support advanced vascular procedures utilizing liquid embolic materials. The country's large population and improving healthcare access are creating opportunities for interventional medicine expansion. Companies are developing localized distribution and training programs to serve growing market demand.

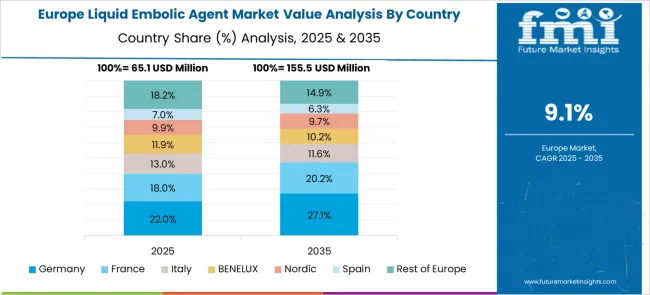

The European liquid embolic agent market is characterized by advanced healthcare systems and sophisticated medical technology infrastructure that support comprehensive interventional procedures utilizing liquid embolic materials for diverse clinical applications. Countries across the region maintain rigorous clinical standards and evidence-based treatment protocols that promote optimal patient outcomes while ensuring procedural safety and effectiveness. The market benefits from established medical education programs, comprehensive regulatory frameworks, and strong reimbursement systems that facilitate adoption of advanced liquid embolic agents across major medical centers and specialty clinics serving diverse patient populations requiring complex vascular interventions.

The liquid embolic agent market is defined by competition among medical device companies, specialized embolic material manufacturers, and interventional medicine suppliers offering diverse liquid embolic solutions for vascular procedures and interventional applications. Companies are investing in advanced polymer chemistry, delivery system innovation, clinical research, and physician education to deliver high-performance liquid embolic agents that provide superior clinical outcomes and procedural safety for interventional specialists and their patients. Strategic partnerships, clinical studies, and regulatory approvals are central to strengthening product portfolios and market positioning.

Major liquid embolic agent manufacturers maintain comprehensive product development capabilities and extensive clinical support services that enable healthcare providers to successfully implement advanced embolization procedures with optimal patient outcomes. Medtronic, USA-based, offers comprehensive liquid embolic solutions emphasizing clinical excellence and procedural innovation across diverse interventional applications. Johnson & Johnson provides advanced embolic materials with a focus on safety, efficacy, and physician training support.

B. Braun SE delivers specialized liquid embolic agents with a focus on quality and clinical performance optimization. Terumo and Boston Scientific Corporation offer innovative embolic solutions with comprehensive technical support and application development capabilities. Meril, GEM Srl, Balt, Sirtex (BlackSwan Vascular, Inc.), and INVAMED provide specialized liquid embolic expertise, advanced product formulations, and clinical application support across global and regional interventional medicine markets.

| Items | Values |

|---|---|

| Quantitative Units | USD 727.8 million |

| Product Type | Cyanoacrylates (N-BCA n-Butyl Cyanoacrylate, N-HCA n-Hexyl Cyanoacrylate), Ethylene Vinyl Alcohol Copolymer (EVOH), Others |

| Application | Arteriovenous Malformations (AVM), Hypervascular Tumors, Peripheral Vasculature Hemorrhage, Others |

| End Use | Hospitals, Specialty Clinics, Ambulatory Surgical Centers (ASCs), Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Medtronic; Johnson & Johnson; B. Braun SE; Terumo; Boston Scientific Corporation; Meril; GEM Srl; Balt; Sirtex (BlackSwan Vascular, Inc.); INVAMED |

| Additional Attributes | Dollar sales by product type, application, and end use, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established medical device companies and specialized embolic material manufacturers, adoption of advanced polymer chemistry and delivery system technologies, integration with minimally invasive surgical techniques and interventional radiology procedures, innovations in next-generation embolic agent formulations and clinical applications, and development of comprehensive physician training and clinical support programs. |

The global liquid embolic agent market is estimated to be valued at USD 283.4 million in 2025.

The market size for the liquid embolic agent market is projected to reach USD 727.8 million by 2035.

The liquid embolic agent market is expected to grow at a 9.9% CAGR between 2025 and 2035.

The key product types in liquid embolic agent market are cyanoacrylates, n-bca (n-butyl cyanoacrylate), n-HCA (n-hexyl cyanoacrylate), ethylene vinyl alcohol copolymer (EVOH), and others.

In terms of application outlook, arteriovenous malformations (avm) segment to command 46.7% share in the liquid embolic agent market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Processing Filter Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Liquid Oxygen Generator Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Bag Market Size and Share Forecast Outlook 2025 to 2035

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Armor Materials Market Size and Share Forecast Outlook 2025 to 2035

Liquid Synthetic Rubber Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymer (LCP) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA