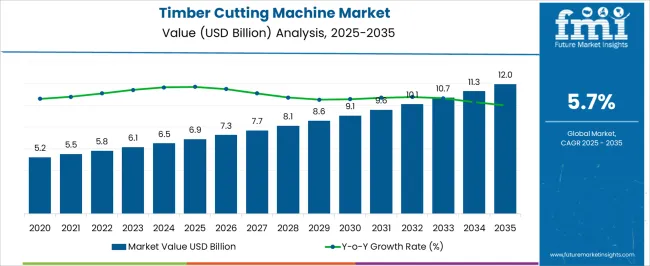

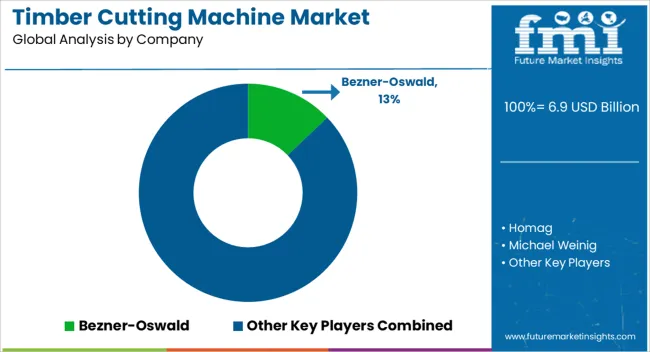

The Timber Cutting Machine Market is estimated to be valued at USD 6.9 billion in 2025 and is projected to reach USD 12.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

The timber cutting machine market has experienced steady growth, expanding from USD 5.2 billion in 2020 to USD 12.0 billion by 2035, reflecting a growth rate of 5.7%. Between 2020 and 2025, the market value increases from USD 5.2 billion to USD 6.9 billion, with an annual incremental growth that aligns with the increasing demand for timber cutting machinery in the forestry, construction, and woodworking industries. This early phase reflects market expansion driven by rising industrial demand, technological advancements in machine efficiency, and the integration of automation and digital controls to enhance cutting precision. From 2025 to 2030, the market continues to grow from USD 6.9 billion to USD 9.1 billion, driven by a steady adoption of advanced timber cutting technologies, especially in emerging markets where infrastructure development boosts the demand for forestry products. The period sees further gains, supported by rising environmental awareness and the growing need for sustainable timber production and harvesting practices. From 2031 to 2035, the market reaches USD 12.0 billion, marking a phase of more moderate growth, signaling potential market share erosion in mature regions due to market saturation and technological plateauing. Market leaders will need to focus on product innovation, energy efficiency, and regulatory compliance to retain their share in a competitive market. Overall, the market’s growth trajectory reflects a combination of steady gains and market maturity.

| Metric | Value |

|---|---|

| Timber Cutting Machine Market Estimated Value in (2025 E) | USD 6.9 billion |

| Timber Cutting Machine Market Forecast Value in (2035 F) | USD 12.0 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The timber cutting machine market is experiencing steady growth, supported by increasing demand for precision wood processing equipment across construction, furniture manufacturing, and industrial applications. Rising investments in automation and the shift toward advanced cutting technologies are driving adoption of high-performance machines that offer improved efficiency, accuracy, and reduced material waste. Manufacturers are focusing on integrating digital controls, real-time monitoring, and energy-efficient components to meet evolving industry standards and environmental regulations.

The market is also benefiting from the expansion of timber production capacity in emerging economies and the modernization of sawmills in developed regions. Technological advancements in blade design, material handling systems, and software integration are enabling faster and more consistent cutting operations.

Growing emphasis on operational safety and productivity optimization is further accelerating the replacement of older machinery with automated, high-precision solutions As wood processing industries continue to expand globally, demand for versatile and reliable timber cutting machines is expected to remain strong, supported by both large-scale industrial projects and small-to-medium manufacturing facilities.

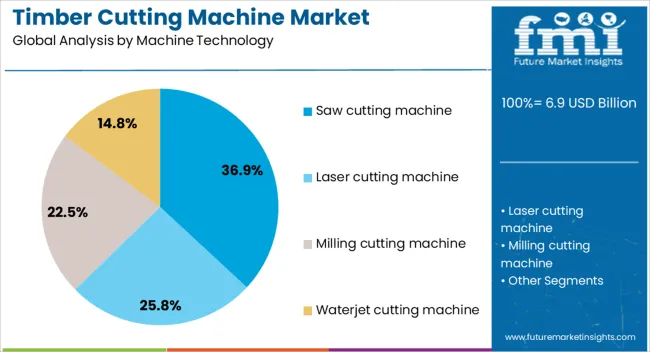

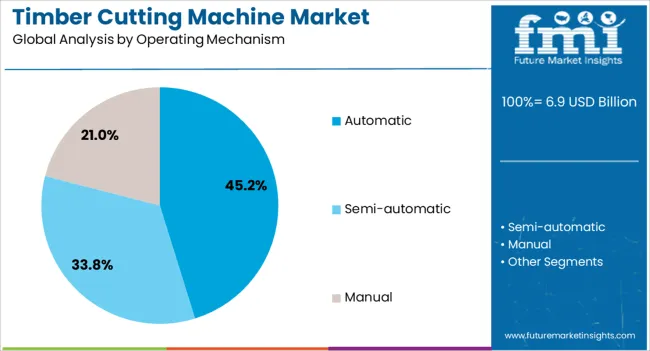

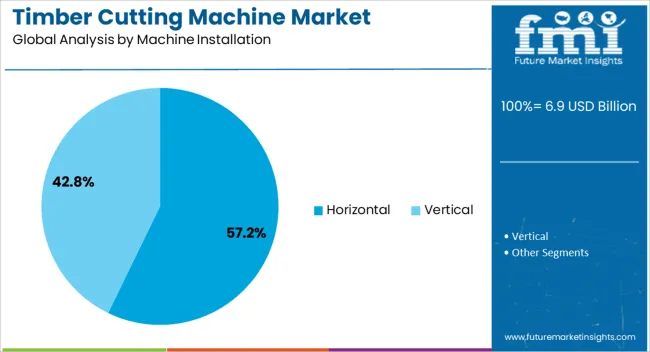

The timber cutting machine market is segmented by machine technology, operating mechanism, machine installation, end use industry, distribution channel, and geographic regions. By machine technology, timber cutting machine market is divided into Saw cutting machine, Laser cutting machine, Milling cutting machine, and Waterjet cutting machine. In terms of operating mechanism, timber cutting machine market is classified into Automatic, Semi-automatic, and Manual. Based on machine installation, timber cutting machine market is segmented into Horizontal and Vertical. By end use industry, timber cutting machine market is segmented into Furniture manufacturing, Building & construction, Forestry and logging, and Others (pulp & paper, packaging, etc.). By distribution channel, timber cutting machine market is segmented into Direct sales and Indirect sales. Regionally, the timber cutting machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The saw cutting machine segment is projected to hold 36.9% of the timber cutting machine market revenue share in 2025, making it the leading machine technology. This dominance is being driven by the segment’s versatility in handling a wide range of timber sizes and types while maintaining precision and high-speed operation. Saw cutting machines offer consistent cutting quality, making them well-suited for both mass production and customized manufacturing.

Advancements in blade technology and motor efficiency have improved operational performance while reducing maintenance requirements. The ability to integrate saw cutting machines with automated feeding and handling systems enhances productivity and minimizes downtime.

Their adaptability to various timber processing environments, from small workshops to large-scale industrial plants, has further reinforced their market position The segment is also benefiting from demand for machines capable of meeting strict dimensional accuracy standards, ensuring high-quality output for downstream applications in construction, furniture, and specialty wood products.

The automatic operating mechanism segment is anticipated to account for 45.2% of the timber cutting machine market revenue share in 2025, establishing itself as the leading operational mode. Its leadership is supported by the growing preference for automation in timber processing to increase productivity, reduce labor dependency, and maintain consistent quality. Automatic machines are designed with programmable controls, enabling precise adjustments to cutting speed, depth, and patterns, which minimizes waste and optimizes yield.

Integration with digital monitoring systems allows real-time tracking of performance and predictive maintenance, further enhancing operational efficiency. The segment’s growth is also being driven by heightened workplace safety requirements, as automatic systems reduce direct operator involvement in high-risk cutting processes.

Industries are increasingly investing in fully automated solutions to meet high-volume production demands while ensuring compliance with quality standards This shift toward automation is expected to continue as manufacturers seek scalable and cost-effective solutions to improve competitiveness in global timber markets.

The horizontal installation segment is expected to capture 57.2% of the timber cutting machine market revenue share in 2025, making it the dominant installation type. This preference is being driven by the segment’s operational stability, precision, and ability to handle large timber sections efficiently. Horizontal machines provide better support for the workpiece during cutting, which minimizes vibration and ensures cleaner, more accurate cuts.

Their configuration allows for easier integration into production lines, making them suitable for continuous operation in industrial environments. The segment is also benefiting from advancements in conveyor systems and automated material handling, which complement horizontal setups and improve workflow efficiency.

Additionally, the versatility of horizontal machines in accommodating various timber dimensions makes them a preferred choice across multiple wood processing applications As demand for high-capacity and precision timber cutting grows, the horizontal installation segment is expected to maintain its lead, supported by its proven reliability and compatibility with advanced automation technologies.

The timber cutting machine market is experiencing steady growth, driven by the increasing demand for timber in construction, furniture, and paper industries. Timber cutting machines play a crucial role in efficiently processing wood, improving productivity and reducing manual labor. With advancements in automation and precision cutting technologies, these machines are now capable of offering enhanced speed, accuracy, and efficiency, making them vital for large-scale timber processing. The growing construction industry, particularly in emerging economies, is driving the demand for timber cutting machines, as wood remains a primary material for various construction projects.

The timber cutting machine market faces several challenges that could hinder its growth. One of the primary obstacles is the high initial investment required for advanced timber cutting machines. The cost of machinery, installation, and training can be a barrier, particularly for small and medium-sized enterprises. While automation in timber cutting offers increased efficiency, it also requires a skilled workforce to operate and maintain these complex systems, which can be a challenge in certain regions. The availability of skilled labor is another hurdle, particularly in areas where the manufacturing industry is less developed. Issues related to the maintenance of timber cutting machines, such as the need for specialized spare parts and repair services, can lead to increased downtime and additional costs. These challenges require companies to continuously innovate and optimize their operations to remain competitive in the market.

The increasing focus on automation and digitalization in the timber processing industry is driving demand for advanced timber cutting machines that integrate with Industry 4.0 technologies. The trend toward greater precision in cutting, with less material waste and higher yield, is pushing manufacturers to innovate and incorporate more sophisticated technologies such as CNC machines and laser cutting. Another important trend is the shift towards environmentally conscious timber production processes, where machines that optimize cutting efficiency and reduce waste are becoming highly desirable. The rising adoption of robotic and collaborative systems in timber cutting is also influencing the market, enhancing productivity while ensuring greater safety in production facilities. The push for faster processing times in order to meet growing demand in construction and furniture manufacturing is accelerating the need for high-speed, automated timber cutting machines, signaling continuous technological advancements in the market.

The timber cutting machine market is primarily driven by the increasing demand for wood products across multiple industries. The growth of the construction sector, particularly in emerging economies, is a significant factor propelling the demand for timber cutting machines, as wood continues to be a popular material for residential and commercial buildings. The demand for precision cutting in furniture manufacturing and packaging is also boosting market growth. Advancements in automation and computer numerical control (CNC) technology are driving efficiency and accuracy in timber processing. The need for reduced labor costs and improved productivity is pushing timber mills and factories to adopt more advanced cutting machinery. The increasing emphasis on optimizing supply chains and minimizing waste in timber production is contributing to the market’s growth. As industries focus on improving production efficiency and reducing costs, the adoption of cutting-edge timber cutting machines is set to rise.

The timber cutting machine market presents numerous opportunities for innovation and expansion. One key opportunity is the continued development of automated and smart cutting machines, incorporating features such as AI, machine learning, and IoT for real-time monitoring and predictive maintenance. These technologies offer improved efficiency, reduced downtime, and enhanced precision, making them highly attractive for timber processing plants looking to streamline operations. The growing demand for high-quality wood products in the furniture and packaging industries presents another opportunity for growth, particularly for machines capable of precision cutting and shaping. The demand for timber cutting machines in emerging markets, particularly in Asia-Pacific and Latin America, is expanding as the construction and manufacturing sectors grow rapidly. Manufacturers have the opportunity to tap into these markets by providing cost-effective solutions that cater to the specific needs of these regions, thus broadening their customer base and increasing market penetration.

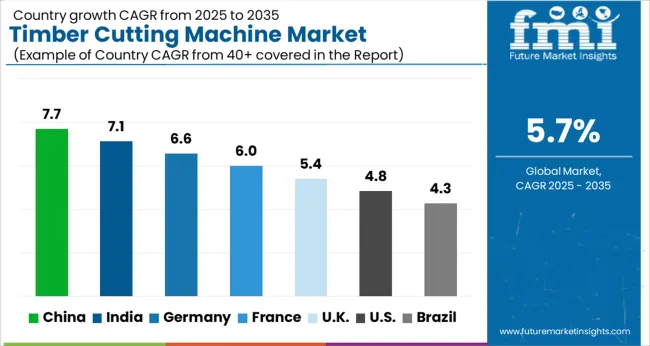

The global timber cutting machine market is projected to grow at a CAGR of 5.7% from 2025 to 2035. Among the key markets, China leads with a growth rate of 7.7%, followed by India at 7.1%, and Germany at 6.6%. The United Kingdom and the United States show more moderate growth rates of 5.4% and 4.8%, respectively. This growth is driven by increasing demand for high-performance, efficient cutting machinery across industries like construction, furniture, and packaging. Emerging markets like China and India are expanding rapidly, while developed markets continue to focus on precision, efficiency, and automation in timber processing. The analysis spans over 40+ countries, with the leading markets shown below.

China is projected to lead the global timber cutting machine market with a growth rate of 7.7% CAGR from 2025 to 2035. The c expanding manufacturing and construction sectors are key drivers of this growth. With a strong focus on improving timber processing in industries like furniture production and construction, China is increasingly adopting advanced timber cutting technologies. The rise of automation in the manufacturing sector is driving demand for high-performance cutting machinery that can meet the growing demand for precision and efficiency.The increased need for timber products in both domestic and international markets, particularly for use in construction projects, is expected to drive the growth of the timber cutting machine market in China.

The timber cutting machine market in India is projected to grow at a CAGR of 7.1% from 2025 to 2035. The demand for timber cutting machines is driven by the expanding construction, automotive, and furniture industries, all of which require precise and high-quality timber products. India’s growing urbanization and infrastructure development are creating opportunities for advanced timber processing technologies. The need for more efficient and cost-effective cutting solutions is pushing businesses to adopt modern machinery for timber processing. The increasing domestic and international demand for high-quality timber products, especially in the construction sector, will further propel the market growth in India.

The timber cutting machine market in France is expected to grow at a CAGR of 6.6% from 2025 to 2035. The demand for advanced cutting machines is driven by the strong manufacturing and industrial sectors, particularly in furniture production and construction. France’s emphasis on high-quality, precise timber products is further contributing to market growth. As industries seek to optimize production processes and improve operational efficiency, the adoption of automated cutting machines in timber processing is expected to rise. With increasing demand for timber products in both domestic and export markets, France is poised to see continued growth in this market.

The timber cutting machine market in the United Kingdom is projected to grow at a CAGR of 5.4% from 2025 to 2035. The UK’s demand for timber cutting machines is driven by the growing construction sector, which requires efficient and precise timber processing equipment. The need for advanced machinery to support high-quality construction materials, particularly in residential and commercial projects, is fueling market demand. The growing adoption of automated machinery in the woodworking and furniture manufacturing sectors is further contributing to the market's growth. With the rise of demand for timber-based products, the UK market is expected to experience steady growth.

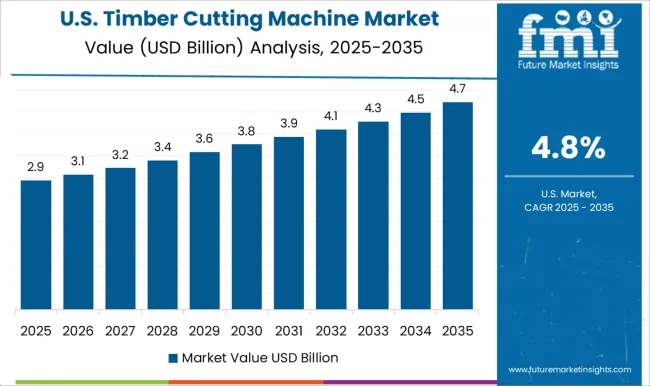

The timber cutting machine market in the United States is projected to grow at a CAGR of 4.8% from 2025 to 2035. The USA market is driven by the strong demand for timber products in the construction, furniture, and packaging industries. The adoption of advanced cutting technologies is increasing to meet the growing need for high-quality and precision-engineered timber products. As the demand for customized and cost-effective timber solutions rises, businesses are turning to more efficient cutting machines that can improve production and reduce costs. The USA market will continue to expand as these trends gain traction across various industries.

The timber cutting machine market is experiencing steady growth, driven by increasing demand for precision and efficiency in woodworking and timber processing. Key players in this market include Bezner-Oswald, Homag, Michael Weinig, SCM, Gelgoog Company, Salvador, Weho Machinery, Walter Werkzeuge, Socomec, Mebor, Salvamac, Nihar Industries, Kikukawa Enterprise, Umaboy, and T.L Pathak.

Bezner-Oswald is recognized for its high-quality timber cutting equipment, offering solutions for both large-scale industrial operations and smaller woodworking businesses. Homag, a global leader, specializes in advanced machinery for timber cutting, providing automated and highly efficient solutions for the furniture and construction industries. Michael Weinig and SCM are prominent for offering cutting-edge technology in timber cutting and processing, serving both traditional woodworking and modern mass production environments. Gelgoog Company provides a range of timber processing machines, including cutting machines tailored to the food and industrial sectors.

Salvador and Weho Machinery offer specialized machines designed for high precision and speed in cutting timber for construction and manufacturing purposes. Walter Werkzeuge and Socomec focus on providing efficient, high-performance tools and machines used for cutting timber in both small-scale and large-scale operations. Mebor and Salvamac cater to the needs of industrial timber processing with highly durable and efficient cutting equipment. Companies like Nihar Industries, Kikukawa Enterprise, Umaboy, and T.L Pathak contribute to the competitive landscape by offering localized and cost-effective timber cutting machines, focusing on both technological innovation and competitive pricing strategies.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Machine Technology | Saw cutting machine, Laser cutting machine, Milling cutting machine, and Waterjet cutting machine |

| Operating Mechanism | Automatic, Semi-automatic, and Manual |

| Machine Installation | Horizontal and Vertical |

| End Use Industry | Furniture manufacturing, Building & construction, Forestry and logging, and Others (pulp & paper, packaging, etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bezner-Oswald, Homag, Michael Weinig, SCM, Gelgoog Company, Salvador, Weho Machinery, Walter Werkzeuge, Socomec, Mebor, Salvamac, Nihar Industries, Kikukawa Enterprise, Umaboy, and T.L Pathak |

| Additional Attributes | Dollar sales by machine type (circular saws, band saws, jig saws), application (furniture, construction, industrial), and power source (electric, hydraulic). Demand dynamics are driven by the growing need for high-efficiency machines that minimize waste and improve productivity in timber processing. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, with industrial growth, technological advancements, and increasing demand for sustainable timber processing solutions. |

The global timber cutting machine market is estimated to be valued at USD 6.9 billion in 2025.

The market size for the timber cutting machine market is projected to reach USD 12.0 billion by 2035.

The timber cutting machine market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in timber cutting machine market are saw cutting machine, laser cutting machine, milling cutting machine and waterjet cutting machine.

In terms of operating mechanism, automatic segment to command 45.2% share in the timber cutting machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Timber Construction Market Size and Share Forecast Outlook 2025 to 2035

Timber Logistics Market Size and Share Forecast Outlook 2025 to 2035

Timber Wrap Films Market by Thickness, Material Type, and Region 2025 to 2035

Cross Laminated Timber Market

Cutting Tool Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cutting Boards Market Size and Share Forecast Outlook 2025 to 2035

Cutting Balloons Market Insights – Growth, Demand & Forecast 2025 to 2035

Cutting Fluid Market Growth – Trends & Forecast 2025-2035

Cutting and Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Die Cutting Machine Market

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Cutting Machine Market Trends, Outlook & Forecast 2025 to 2035

Wire-cutting EDM Machines Market Size and Share Forecast Outlook 2025 to 2035

Frame Cutting Jib Miner Market Size and Share Forecast Outlook 2025 to 2035

Stone Cutting Saw Blades Market Analysis & Forecast by Blade Type, Blade Diameter, End User, and Region Forecast Through 2035

Laser Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Glass Cutting Machine Market Size, Growth, and Forecast 2025 to 2035

Laser Cutting Machine Market Growth – Trends & Forecast 2024-2034

Cloth Cutting Machines Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA