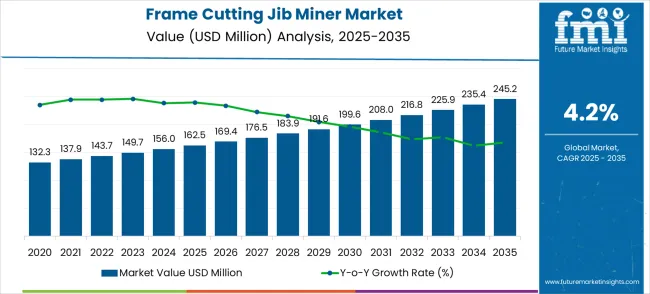

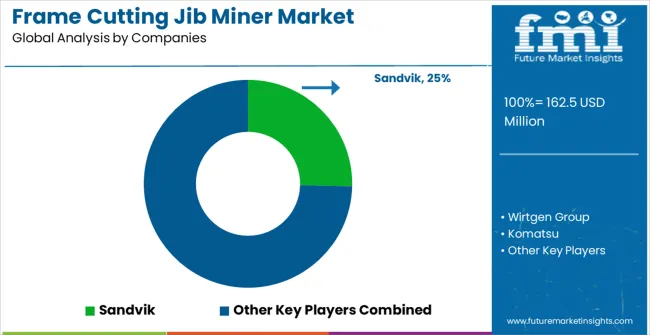

The frame cutting jib miner market, valued at USD 162.5 million in 2025 and projected to reach USD 245.2 million by 2035 at a CAGR of 4.2%, demonstrates distinct patterns when early-stage and late-stage growth are compared. During the early growth phase, the market experienced rapid adoption in mining regions with high mechanization needs. Investments focused on establishing infrastructure, educating operators, and demonstrating the operational efficiency and safety benefits of frame cutting jib miners. Price sensitivity and regional availability influenced adoption, leading to a concentrated growth pattern in North America, Europe, and select Asia Pacific countries.

In the late growth phase, the market expansion becomes more uniform and diversified. Adoption spreads to emerging mining regions, supported by improved distribution networks, cost optimization, and enhanced product customization. Innovations in automation, remote operation, and energy efficiency drive incremental sales, while regulatory compliance and environmental considerations encourage modernization of older fleets. Comparing the curves, early growth is steeper due to initial demand surge and early adopters, whereas late growth is steadier, reflecting broader global adoption and technological maturity

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 162.5 million |

| Forecast Value in (2035F) | USD 245.2 million |

| Forecast CAGR (2025 to 2035) | 4.2% |

From 2030 to 2035, the market is forecast to grow from USD 199.6 million to USD 245.2 million, adding another USD 45.6 million, which constitutes 55.1% of the overall ten-year expansion. This period is expected to be characterized by the expansion of automation technologies in underground mining, the integration of advanced monitoring systems, and the development of specialized mining equipment for complex geological formations.

Between 2020 and 2025, the frame cutting jib miner market experienced steady growth, driven by increasing coal demand and growing recognition of frame cutting jib miners as essential equipment for efficient thin seam coal extraction in underground mining operations. The market developed as mining operators recognized the potential for specialized cutting equipment to enhance extraction efficiency while improving safety conditions in challenging underground environments. Technological advancement in cutting technologies and automation systems began priortizing the critical importance of maintaining precise extraction capabilities and operational reliability in underground coal mining applications.

The frame cutting jib miner market represents a specialized underground mining equipment segment driven by coal demand, mining mechanization, and productivity enhancement in challenging geological conditions. With the global market growing from USD 162.5 million in 2025 to USD 245.2 million by 2035 at a 4.2% CAGR, strategic opportunities emerge through automation integration, thin seam specialization, and geographic expansion in coal-intensive economies. Reef deposits commanding USD 60.5 million in 2025, thin coal seam dominance, and China's 5.7% growth rate reflect the critical role of specialized extraction equipment in maximizing resource recovery from complex underground formations.

The market benefits from mechanization trends in underground mining, safety regulation enforcement, and operational efficiency demands. Thin coal seam applications' market leadership demonstrates the technical complexity and specialized requirements of extracting resources from confined spaces. At the same time, the prominence of reef deposits signals the need for precision equipment capable of following complex geological formations.

Market expansion is being supported by the increasing global demand for efficient coal extraction equipment and the corresponding need for specialized mining machinery that can operate effectively in thin coal seams while maintaining high productivity and safety standards across various underground mining applications. Modern mining operators are increasingly focused on implementing extraction solutions that can maximize coal recovery, minimize waste generation, and provide consistent performance in challenging geological conditions. Frame cutting jib miners' proven ability to deliver precise cutting capabilities, enhanced extraction efficiency, and operational flexibility make them essential equipment for contemporary underground coal mining and thin seam extraction operations.

The growing focus on mining productivity and safety enhancement is driving demand for frame cutting jib miners that can support mechanized extraction processes, reduce manual labor requirements, and enable efficient mining operations in confined spaces and challenging seam conditions. Mining operators' preference for equipment that combines extraction precision with operational safety and cost-effectiveness is creating opportunities for innovative mining equipment implementations. The rising influence of environmental regulations and green mining practices is also contributing to increased adoption of frame cutting jib miners that can provide efficient extraction with reduced environmental impact and improved resource recovery.

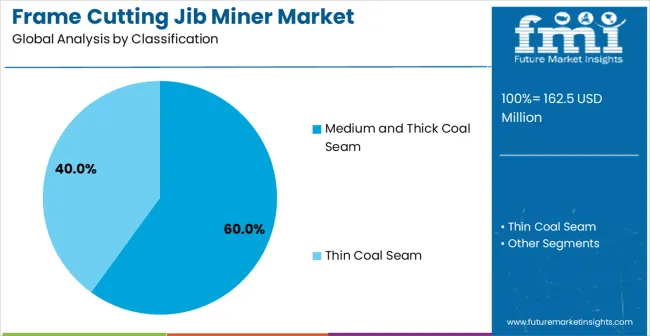

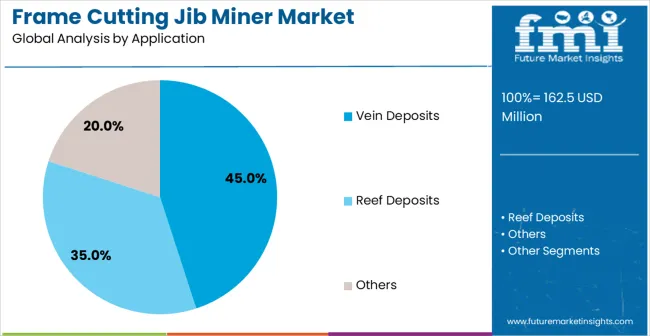

The frame cutting jib miner market is expanding, driven by the demand for efficient underground coal mining solutions. Medium and thick coal seams dominate the coal seam type segment with a 60% market share, reflecting the widespread use of these miners in high-yield mining operations. In terms of application, vein deposits account for approximately 45% of the market, highlighting the preference for these miners in targeted coal extraction. These segments represent the most significant investment opportunities due to consistent adoption in mining operations and the need for advanced equipment that improves productivity and operational safety.

Medium and thick coal seams hold a 60% share of the coal seam type segment, making them the primary focus for frame cutting jib miner deployment. These miners are preferred for their ability to handle high-volume coal extraction efficiently, particularly in underground operations with thicker seam profiles. Leading manufacturers include Joy Global, Caterpillar, Sandvik, and Eickhoff. Their equipment offers robust cutting capabilities, high operational reliability, and adaptability to varying seam conditions, ensuring steady production rates. The combination of productivity, safety features, and operational efficiency reinforces the dominance of medium and thick coal seam applications in this market.

Vein deposit applications account for approximately 45% of the market, reflecting their leading role in targeted coal extraction. Frame cutting jib miners are used extensively in underground operations to efficiently access narrow to medium vein coal deposits. Manufacturers such as Joy Global, Caterpillar, Sandvik, and Eickhoff provide equipment designed for high precision, safety, and consistent performance. The segment benefits from growing demand for mechanized mining solutions that improve productivity and reduce labor intensity. Expansion of mining activities in regions with significant vein deposits is driving adoption, making this application the focal point for market investment.

The frame cutting jib miner market is expanding due to increasing demand for minerals and metals worldwide. Mining companies are adopting these machines to improve operational efficiency, enhance safety, and reduce labor requirements. Advanced designs with durable components and precision cutting allow miners to operate in deeper, more complex mining environments. Rising infrastructure projects globally are increasing the need for raw materials, indirectly boosting demand for efficient mining equipment. Additionally, stringent environmental regulations encourage adoption of safer, low-impact machinery to reduce operational risks and environmental damage. Technological improvements in automation, energy efficiency, and maneuverability make frame cutting jib miners increasingly attractive to mining operators. Together, these factors are fueling steady market growth across regions.

Despite increasing demand, several challenges restrict adoption of frame cutting jib miners. High initial purchase costs and installation expenses make them less accessible for small and medium-sized mining companies. Operational complexity requires trained operators capable of handling precision equipment, adding labor requirements and training costs. Maintenance and replacement of cutting heads, hydraulic systems, and structural components contribute to ongoing expenses. Mining conditions such as rock hardness and site layout can affect performance and lifespan, requiring customization in some cases. Market uncertainty caused by fluctuating commodity prices may delay equipment investment. These factors collectively create barriers to wider adoption, especially in emerging markets or smaller mining operations with limited financial and technical resources.

Current market trends show a shift toward automation and environmentally conscious designs. Frame cutting jib miners are increasingly equipped with sensors, monitoring systems, and IoT-enabled features for real-time performance tracking and predictive maintenance. Modular and flexible designs allow mining operators to adapt equipment to varying geological conditions and project requirements. Manufacturers are developing energy-efficient machines with reduced environmental impact to meet regulatory standards and environment goals. Customization is rising as company’s demand equipment tailored to rock type, mine depth, and operational layout. These innovations enhance efficiency, safety, and productivity while minimizing operational downtime. Overall, the market is moving toward smarter, more adaptable, and eco-friendly mining solutions that align with modern operational and regulatory needs.

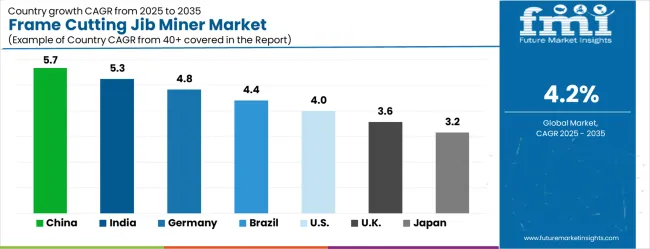

The global frame cutting jib miner sector is projected to grow at a CAGR of 4.2%, with a multiplication factor of 1.42 over the forecast period. China leads at 5.7% (1.74x), 1.5 points above the global average, driven by expanding mining activities and infrastructure development. India follows at 5.3% (1.69x), 1.1 points higher than the global rate, supported by growing industrial demand, both part of the BRICS group along with Brazil, which records 4.4% (1.56x), slightly above the global CAGR due to mining modernization. Germany grows at 4.8% (1.61x), 0.6 points above global growth, reflecting advanced mining technologies in Europe. The USA shows 4.0% (1.50x), slightly below global expansion, while the UK at 3.6% (1.43x) and Japan at 3.2% (1.38x) trail the global average. ASEAN and Oceania regions show adoption at 4-5% (1.44-1.56x), supported by growing mining projects and mechanization. The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| Brazil | 4.4% |

| USA | 4.0% |

| UK | 3.6% |

| Japan | 3.2% |

China leads the Frame Cutting Jib Miner market with 5.7% CAGR, surpassing the global rate of 4.2%. Adoption is fueled by coal mining, tunneling, and construction sectors across Shanxi, Inner Mongolia, and Shaanxi provinces. Local and international suppliers such as Sandvik and Caterpillar are providing high-efficiency, automated miners optimized for large-scale operations. Increasing demand for improved safety, precision cutting, and reduced labor intensity supports market expansion. Integration of advanced control systems allows better operational monitoring and improved productivity. Government initiatives for modernizing mining equipment are accelerating adoption, particularly in high-yield coal and mineral mining regions. Companies are investing in service networks to reduce downtime and enhance equipment reliability.

India holds a 5.3% CAGR in the Frame Cutting Jib Miner market. Adoption is concentrated in Jharkhand, Chhattisgarh, and Odisha due to dense coal mining operations. Suppliers like Caterpillar and Sandvik are supplying high-performance miners designed for longwall and mechanized mining. Safety enhancement, operational efficiency, and reduction of manual labor are driving factors. Growing infrastructure projects and industrial mineral extraction further support market expansion. Equipment with modular designs is increasingly preferred for faster deployment and easier maintenance. Local service networks and training programs improve adoption and operational reliability.

Germany records 4.8% CAGR for the Frame Cutting Jib Miner market. Adoption is concentrated in lignite and salt mining, particularly in North Rhine-Westphalia and Saxony. Suppliers including Sandvik and Caterpillar provide automated and precision cutting solutions. Adoption is driven by the need for safer operations and efficiency in dense underground mining environments. Modular and compact miners are increasingly used to optimize space and reduce downtime. Germany’s strong regulatory framework ensures equipment meets high safety and operational standards, reinforcing market growth. Industrial minerals and coal remain primary end-use applications.

Brazil maintains a 4.4% CAGR in the Frame Cutting Jib Miner market. Adoption is concentrated in Minas Gerais, Pará, and São Paulo, driven by coal and iron ore mining. Suppliers like Caterpillar and Sandvik are providing miners optimized for both underground and semi-mechanized operations. Demand is increasing for safer operations, precision cutting, and reduced labor dependency. Integration with digital monitoring and remote operation improves productivity. Expansion in mineral mining and infrastructure projects supports growth. Modular miners are preferred for flexible deployment in diverse geological conditions.

The United States records a 4.0% CAGR. Adoption is focused in West Virginia, Pennsylvania, and Kentucky for coal and industrial mineral extraction. Suppliers including Caterpillar and Sandvik provide miners with automated control systems and advanced safety features. Adoption is driven by labor reduction, operational efficiency, and compliance with safety regulations. Integration with longwall mining and mechanized tunneling supports high productivity. Expansion in coal and mineral infrastructure ensures steady demand. Equipment with modular and compact designs is preferred to optimize underground operations and reduce maintenance complexity.

The United Kingdom holds a 3.6% CAGR. Adoption is concentrated in Northumberland and Yorkshire due to coal mining and mineral operations. Suppliers like Sandvik and Caterpillar provide automated miners suitable for narrow underground tunnels. Safety compliance and labor reduction are key drivers. Compact, modular miners are favored for limited space and easier maintenance. Industrial mineral extraction supports steady adoption, and modernization of mining infrastructure is encouraging equipment upgrades. Integration with monitoring systems improves productivity and operational reliability.

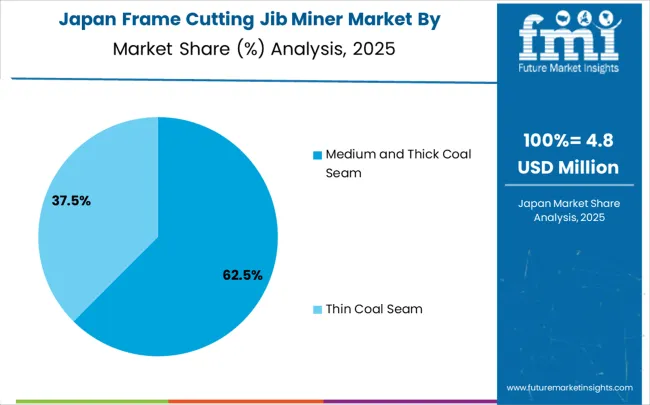

Japan holds a 4.8% CAGR, below the global average. Adoption is concentrated in Hokkaido, Ibaraki, and Fukuoka for coal and mineral extraction in underground mines. Suppliers including Sandvik and Caterpillar provide compact, automated miners designed for space-constrained operations. Demand is driven by efficiency, safety, and precision cutting. Modernized miners are replacing older manual systems, improving labor efficiency and reducing operational risks. Compact modular designs help optimize limited underground space, while integration with digital monitoring systems enhances productivity and reliability.

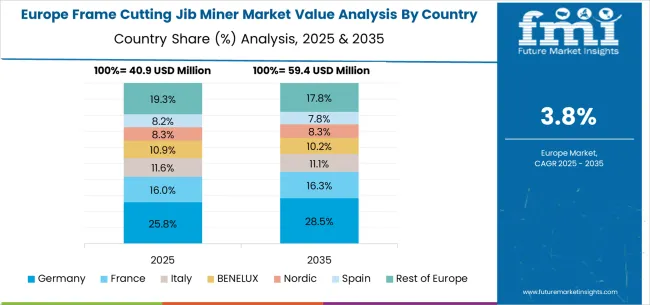

The frame cutting jib miner market in Europe is projected to grow from USD 40.9 million in 2025 to USD 59.4 million by 2035, registering a CAGR of 3.8% over the forecast period. Germany is expected to maintain its leadership position, with its share rising from 25.8% in 2025 to 28.5% by 2035, supported by its strong mining technology base, advanced equipment manufacturing, and engineering networks.

France is projected to hold 16.0% share in 2025, increasing slightly to 16.3% by 2035, benefiting from demand in mining machinery integration and underground infrastructure projects. Italy is anticipated to contribute 11.6% in 2025, which will grow to 11.3% by 2035, reflecting steady adoption in quarrying and mineral excavation industries.

The BENELUX region will represent 10.0% in 2025, expanding to 12.0% by 2035, supported by specialized equipment imports and technology partnerships. The Nordic countries are forecast to hold 8.3% in 2025, increasing to 8.7% by 2035, driven by sustainable mining initiatives and underground safety solutions.

Spain will account for 8.2% in 2025, edging down slightly to 7.8% by 2035, reflecting moderate demand in tunneling and construction-related mining. Meanwhile, the Rest of Europe will represent 19.3% in 2025, easing to 15.4% by 2035, indicating consolidation and slower growth across Eastern European markets.

The frame cutting jib miner market is characterized by competition among established mining equipment manufacturers, specialized underground mining technology providers, and integrated mining solution companies. Companies are investing in advanced cutting technology research, automation enhancement, precision manufacturing improvements, and comprehensive product portfolios to deliver consistent, high-performance, and reliable mining equipment solutions. Innovation in cutting systems, automation technologies, and safety features is central to strengthening market position and competitive advantage.

Sandvik leads the market with a strong market share, offering comprehensive mining equipment solutions with a focus on advanced technology and operational efficiency capabilities. Wirtgen Group provides specialized mining equipment with attention on underground applications and cutting technology systems. Komatsu delivers innovative mining technologies with a focus on automation and productivity enhancement. Xi'an Coal Mining Machinery focuses on coal mining equipment and specialized engineering solutions for demanding mining applications. SANY offers comprehensive mining equipment with priortize on the industrial and construction sectors.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 162.5 million |

| Coal Seam Type | Thin Coal Seam, Medium and Thick Coal Seam |

| Application | Reef Deposits, Vein Deposits |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Sandvik, Wirtgen Group, Komatsu, Calbah Industries, Xi'an Coal Mining Machinery, and SANY |

| Additional Attributes | Dollar sales by coal seam type and application category, regional demand trends, competitive landscape, technological advancements in mining systems, cutting innovation, automation development, and safety enhancement |

The global frame cutting jib miner market is estimated to be valued at USD 162.5 million in 2025.

The market size for the frame cutting jib miner market is projected to reach USD 245.2 million by 2035.

The frame cutting jib miner market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in frame cutting jib miner market are medium and thick coal seam and thin coal seam.

In terms of application, vein deposits segment to command 45.0% share in the frame cutting jib miner market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Frameless Structural Glass Balustrade Market Size and Share Forecast Outlook 2025 to 2035

Frame Alignment Systems Market Size and Share Forecast Outlook 2025 to 2035

Mainframe Security Market

Half-frame Oblique Cameras Market Size and Share Forecast Outlook 2025 to 2035

Full-frame Oblique Cameras Market Size and Share Forecast Outlook 2025 to 2035

Space Frame Market Size and Share Forecast Outlook 2025 to 2035

Rubber Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Frames Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aluminum Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Plate and Frame Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Back Mount Frames Market Size and Share Forecast Outlook 2025 to 2035

Rail Brake Frame Market

Aircraft Seat Frames Market

Aircraft Window Frame Market Size and Share Forecast Outlook 2025 to 2035

Automotive Seat Frame Market

Nitinol Heart Valve Frames Market Analysis Size and Share Forecast Outlook 2025 to 2035

Solar Aluminum Alloy Frame Market Size and Share Forecast Outlook 2025 to 2035

Cutting Tool Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cutting Boards Market Size and Share Forecast Outlook 2025 to 2035

Cutting and Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA