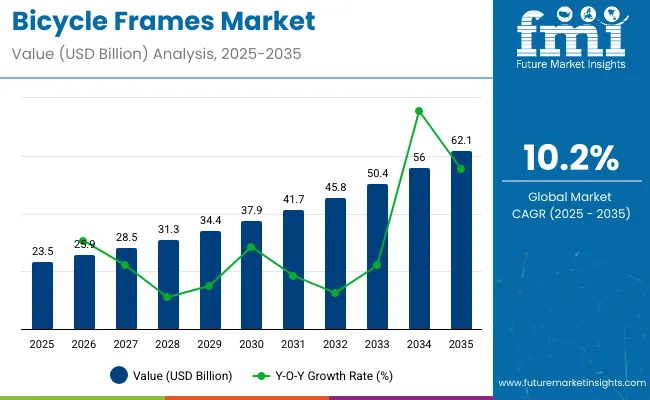

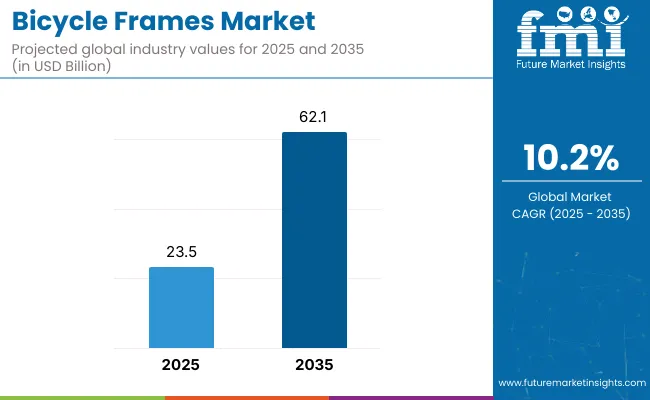

The bicycle frames market is valued at USD 23.5 billion in 2025 and is projected to reach about USD 62.1 billion by 2035, advancing at a compound annual growth rate of 10.2%. The multiplying factor for this period is approximately 2.6x, meaning the market in 2035 will be over two and a half times the 2025 base.

Quick Stats of Bicycle Frames Market

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 23.5 billion |

| Market Forecast Value in (2035F) | USD 62.1 billion |

| Forecast CAGR (2025 to 2035) | 10.2% |

An analysis of elasticity of growth in relation to macroeconomic indicators shows a strong linkage between consumer purchasing power, urban mobility trends, and health-focused lifestyles.

During periods of economic expansion, higher disposable incomes and greater investment in recreational activities significantly increase demand for premium and lightweight frames, particularly carbon fiber and aluminum variants. Rising fuel costs and urban congestion also act as macroeconomic drivers that enhance market elasticity, pushing consumers toward bicycles as an affordable and sustainable mobility option.

In contrast, economic slowdowns may reduce discretionary spending, temporarily softening growth in premium segments, although entry-level and mid-range frames tend to remain resilient due to their affordability. Health awareness campaigns, infrastructure investment in cycling lanes, and government incentives for eco-friendly transport further enhance elasticity by amplifying demand regardless of short-term fluctuations. This close interaction with macroeconomic indicators underscores the bicycle frames market’s responsiveness and long-term growth potential.

The market sits within several interconnected parent industries. Bicycle manufacturing contributes close to 40%, as frame design and production form the backbone of the cycling industry. Metals and alloys industry accounts for about 25%, supplying aluminum, steel, and titanium widely used in frame building. Composite materials sector represents nearly 15%, driven by the adoption of carbon fiber and advanced polymers for high-performance bikes. Sports and fitness equipment market holds around 12%, where cycling aligns with lifestyle and recreational demand. Logistics and aftermarket services carry close to 8%, covering distribution, repairs, and customization support.

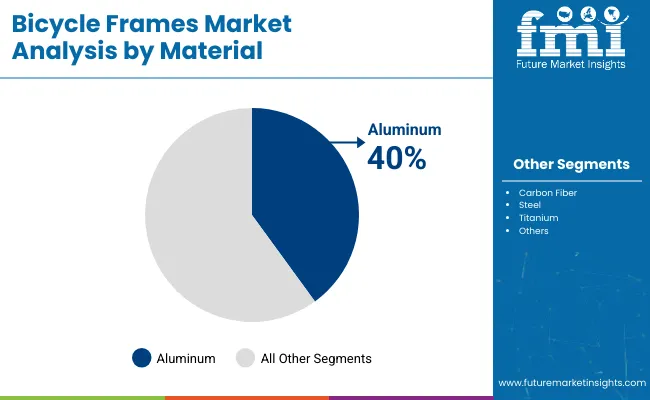

The market is advancing with new materials, design innovations, and manufacturing methods. Carbon fiber and hybrid composites are increasingly used to improve stiffness-to-weight ratios in high-performance and racing models. Aluminum alloys remain dominant in mid-range bikes due to affordability and durability, while titanium is carving a niche in premium custom frames.

Automation and 3D printing are streamlining prototyping and enabling complex geometries that were previously unattainable. Sustainability goals are encouraging the use of recyclable materials and eco-friendly coatings. Partnerships between frame manufacturers and bike brands are driving lightweight, aerodynamic, and ergonomic frame designs tailored to both professionals and recreational riders.

The bicycle frames market is valued at USD 23.5 billion in 2025 and is projected to reach USD 62.1 billion by 2035, expanding at a CAGR of 10.2%. Asia Pacific contributes more than 40% of total demand, while Europe and North America are strong in premium and e-bike segments. Aluminum frames dominate volume sales, carbon fiber is expanding in high-performance categories, and titanium maintains a stable position in niche endurance markets. Rising replacement rates, growing health awareness, and e-bike adoption continue to reinforce steady frame demand worldwide.

Driving Force Rising Fitness Participation and Material Transition

Fitness awareness and cycling adoption are fueling frame demand, with urban ridership adding millions of new consumers each year. Aluminum frames represent nearly 36% of global market share, offering affordability and up to 25% weight reduction compared to steel. Carbon fiber adoption is advancing at above 11% annually, benefiting competitive road, gravel, and mountain segments. Titanium frames account for under 5% but maintain resale value and durability. In Europe, nearly 37 million regular cyclists drive recurring frame sales, with replacement cycles averaging 5 years. These factors sustain consistent revenue growth, particularly in mid- to premium-level bicycles where material innovation enhances riding efficiency.

Growth Avenue Expansion of E-Bikes and Aftermarket Sales

E-bikes account for over 23% of global bicycle sales in 2025, directly impacting demand for specialized frames designed to handle higher torque and integrated batteries. Europe sold nearly 6.5 million e-bikes last year, strengthening the regional aftermarket and OEM segments. Reinforced aluminum alloys and composite frames dominate e-bike builds, creating new revenue streams for suppliers. Aftermarket replacement is valued above USD 8.5 billion annually, supported by customization trends and recurring upgrades. Online platforms already capture more than 21% of frame sales, posting double-digit growth as brands adopt direct-to-consumer models. This shift strengthens both aftermarket potential and profitability for global manufacturers.

Emerging Trend Advanced Manufacturing and Customization Growth

Digital manufacturing methods are transforming production cycles. 3D printing and automated fiber placement reduce prototyping time by 55% and cut scrap by more than 15%. Recycled aluminum now represents close to 16% of total frame output, reducing energy costs by nearly 12% per unit. Custom geometry programs account for about 11% of premium frame sales, allowing riders to optimize fit and ride performance. Modular frame platforms extend lifespan by supporting part upgrades rather than full replacements. These advancements align with rising demand for personalized and efficient bicycles, providing manufacturers with scalable solutions that balance innovation, cost, and consumer preference.

Market Challenge High Material Costs and Supply Chain Pressures

Carbon fiber frames average between USD 2,200 and USD 6,800 in premium categories, creating affordability barriers for mid-income buyers. Titanium, while only 3% of market share, averages USD 3,600 per frame, confining it to niche segments. Aluminum prices have increased nearly 12% in the last three years, straining manufacturer margins. Supply chain bottlenecks extend carbon composite lead times from 3 months to more than 6 months, delaying production schedules. Smaller brands lack economies of scale, making them more vulnerable to fluctuations in raw material costs and logistics expenses. These challenges increase overall retail prices by 9-13% across global markets.

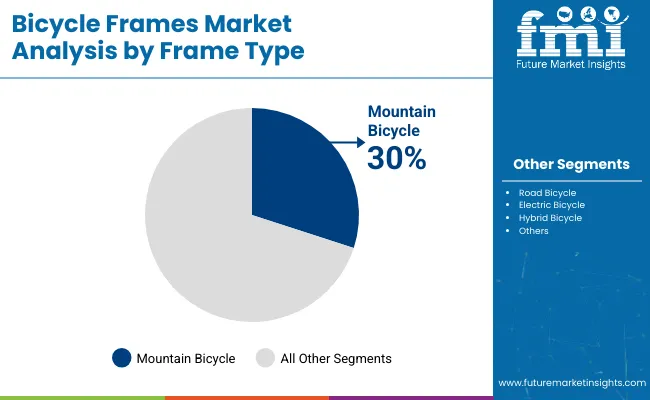

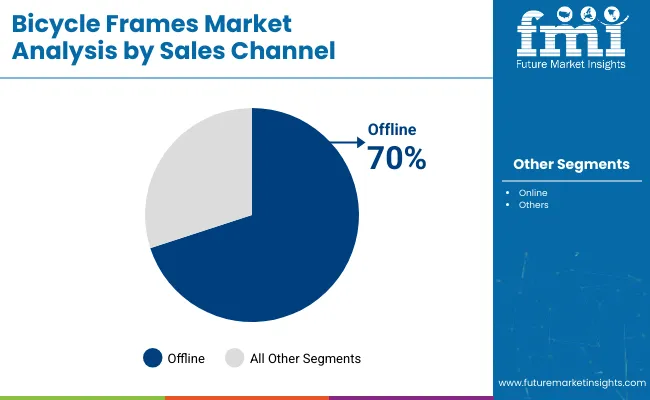

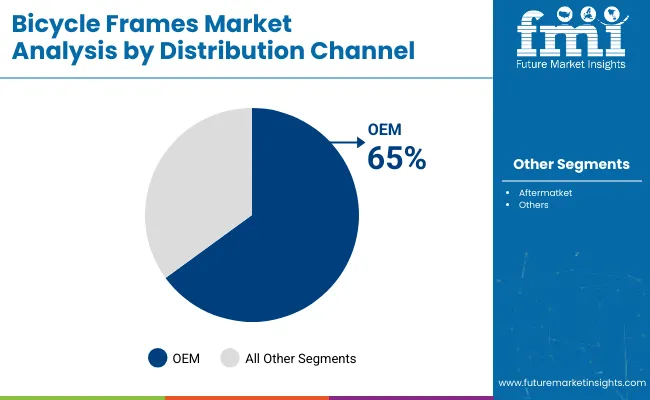

The bicycle frames market is driven by material, frame type, sales channel, and distribution channel. Aluminium leads with 40% share, carbon fiber 25%, steel 20%, titanium 10%, and others 5%. Mountain bicycles hold 30% share, followed by road 25%, electric 20%, and hybrid 15%. Offline sales dominate at 70%, online at 30%. OEM distribution captures 65%, aftermarket 35%. Understanding these segments helps manufacturers prioritize production, optimize supply chains, and target marketing campaigns efficiently, while ensuring alignment with evolving consumer preferences across premium and mass market segments.

Aluminium remains the preferred choice for bicycle frames due to lightweight construction and high corrosion resistance, accounting for 40% of material use. Carbon fiber holds 25%, valued for stiffness and competitive racing performance. Steel captures 20%, commonly used for durability and budget-friendly models. Titanium frames cover 10%, targeting premium users, while other materials represent 5% for specialized designs. Material selection impacts production techniques, costs, and end-user pricing. Manufacturers balance aluminium for mass production while reserving carbon fiber and titanium for niche applications, ensuring a mix of affordability and performance across the market.

Mountain bicycles dominate frame type with 30% share due to off-road performance and versatility. Road bicycles follow at 25%, preferred for speed and long-distance riding. Electric bicycles account for 20%, reflecting urban mobility and recreational use, while hybrid bicycles hold 15%, blending features from multiple categories. Frame design influences geometry, suspension, and rider comfort, guiding production and marketing efforts. Brands adjust inventory according to consumer demand for each type, balancing high-volume mountain and road bikes with growth in electric and hybrid models, responding to both sport-focused and casual cycling trends.

Offline sales dominate at 70%, allowing in-store experiences, test rides, and personalized fittings. Retailers benefit from direct interaction with customers and immediate purchase decisions. Online channels contribute 30%, facilitating convenience shopping and broad geographic reach. Sales channel choice impacts marketing strategies, promotional campaigns, and inventory distribution. Strong offline presence ensures brand visibility and consumer trust, while online platforms support supplementary sales, seasonal promotions, and wider accessibility. Companies leverage offline dominance for brand engagement events and workshops to improve customer retention and loyalty.

OEM distribution holds 65% share, supplying frames directly to manufacturers or brands, ensuring consistent quality and production efficiency. Aftermarket covers 35%, supporting repairs, upgrades, and accessories. OEM channels reduce intermediary costs and standardize product offerings, while aftermarket ensures continued customer engagement post-purchase. Distribution strategies affect logistics, supplier partnerships, and pricing models. Brands monitor the split to balance new production and parts availability, optimize delivery timelines, and meet market demand effectively. Strategic distribution planning helps maintain profitability while catering to both mass-market and premium segments.

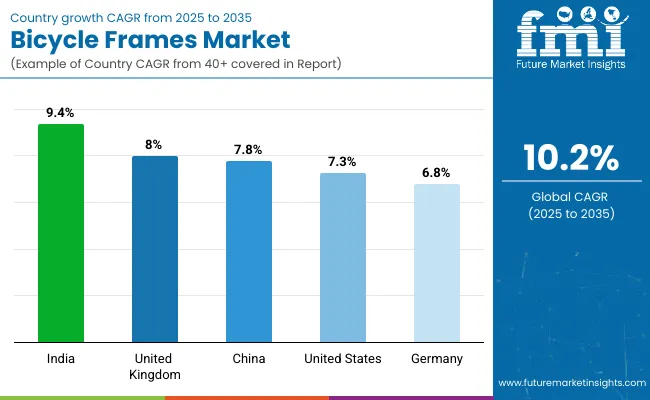

The global bicycle frames market is increasing at a CAGR of 10.2% from 2025 to 2035. India records 9.4%, −8% below the global rate, primarily due to rising domestic cycling demand supported by BRICS and ASEAN-linked urban mobility initiatives. China follows at 7.8%, −24% under the global CAGR, reflecting its large-scale BRICS-oriented production focused on exports rather than domestic consumption. The United Kingdom stands at 8%, −22% below the global average, with growth limited by a mature market and moderate adoption of premium bicycle segments. The United States posts 7.3%, −28% compared with the global rate, influenced by OECD-focused technological improvements but slower expansion in commuter cycling. Germany records 6.8%, −33% under the global CAGR, constrained by saturation in high-end bicycle demand and steady, incremental production. Overall, BRICS nations like India and China are leading expansion, while OECD markets are progressing steadily with technology-driven and niche-focused growth.

The bicycle frames market in China is likely to grow at a CAGR of 7.8%, below the global 10.2%. Growth is driven by expanding e-bike manufacturing, integration of lightweight alloys, and rising exports to Europe and North America. Despite a strong domestic production base, the CAGR remains lower than global averages due to market maturity and saturation in urban cycling segments. By 2030, China is expected to account for nearly 28% of global revenue, with steel and aluminum frames continuing to dominate the market.

India is expanding at a CAGR of 9.4%, slightly below the global 10.2%. Rapid adoption of sports bicycles, increasing interest in health-focused lifestyles, and local manufacturing expansions contribute to growth. By 2030, India is expected to capture 12% of the global market. Growth is concentrated in aluminum and carbon fiber frames, with domestic brands collaborating with international players to improve quality and design. The slightly lower CAGR reflects infrastructure and supply chain limitations affecting production scaling.

The market in Germany is projected to grow at a CAGR of 6.8%, below the global 10.2%. Growth is supported by rising demand for e-bikes and high-performance frames for competitive cycling. However, established market saturation and limited expansion opportunities keep CAGR lower than global averages. By 2030, Germany is expected to hold 10% of the European bicycle frame market, with carbon fiber frames gaining prominence among professional cyclists. Government initiatives for cycling-friendly infrastructure contribute indirectly to demand.

The United States market is expanding at a CAGR of 7.3%, below the global 10.2%. Growth is largely fueled by rising popularity of mountain bikes and e-bikes, with aluminum frames dominating the production mix. By 2030, the US market is projected to represent 15% of global revenue. Market maturity and high competition contribute to the slower CAGR. Focus on lightweight and customizable frames drives the premium segment, while overall market growth remains steady.

The United Kingdom is growing at a CAGR of 8%, below the global 10.2%. Growth is supported by increasing recreational cycling and investments in urban cycling infrastructure. By 2030, the UK market is expected to account for 7% of global revenue. Carbon fiber and aluminum frames are driving premium segment demand, while steel frames remain popular for budget-friendly bicycles. Market expansion is moderate due to limited domestic manufacturing and reliance on imports.

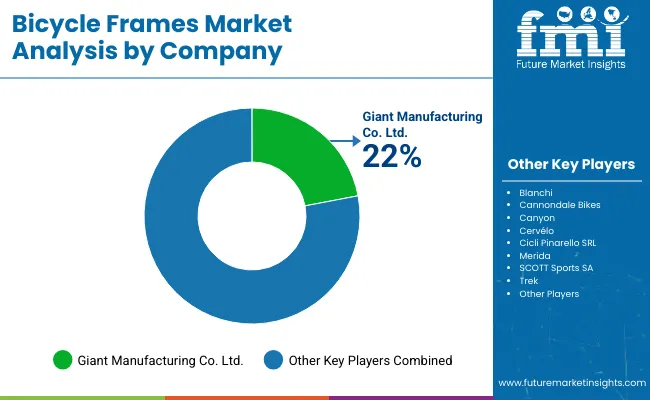

Industry Leader - Giant Manufacturing Co. Ltd. - 22%

The bicycle frames market is shaped by established brands that continue to focus on product development, material research, and distribution expansion to strengthen their positions. Giant Manufacturing Co. Ltd. has maintained a strong presence by investing in lightweight alloy and carbon fiber frames while extending its partnerships with global distributors. Trekfocus on high-performance models and has introduced advanced frame designs to target professional racing as well as consumer segments. Cannondale Bikes continues to develop innovative frame geometries and collaborates with professional cycling teams to boost visibility. Cervélo and Cicli Pinarello SRL remain strong in the premium segment, with a focus on aerodynamic designs and sponsorship of competitive cycling events.

Emerging strategies also include diversification across price categories and regional expansion. Merida and SCOTT Sports SA are focusing on mid-range and performance-oriented frames while expanding their dealer networks in Asia and Europe. Canyon has gained attention through direct-to-consumer sales models that reduce costs and improve accessibility to advanced frame designs. Bianchi, known for its heritage in cycling, continues to blend tradition with modern design by releasing limited edition frames for enthusiasts. These strategies, including product launches, R&D efforts, and team partnerships, highlight how both established and emerging companies are shaping the bicycle frames market.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 23.5 billion |

| Projected Market Size (2035) | USD 62.1 billion |

| CAGR (2025 to 2035) | 10.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Material Segments Analyzed | Aluminum, Steel, Carbon Fiber, Titanium, Others |

| Frame Type Segments Analyzed | Mountain Bicycle, Hybrid Bicycle, Electric Bicycle, Road Bicycle, Others |

| Sales Channels | Online, Offline |

| Distribution Channels | OEM, Aftermarket |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, Italy, United Kingdom, China, Japan, India, Brazil, Mexico, UAE, South Africa, others |

| Key Players Influencing the Market | Giant Manufacturing Co. Ltd., Trek, Merida, SCOTT Sports SA, Cannondale Bikes, Canyon, Cervélo , Cicli Pinarello SRL, Bianchi |

| Additional Attributes | Dollar sales by frame material and bicycle type, demand dynamics across road bikes, mountain bikes, and e-bikes, regional adoption trends across Asia-Pacific, Europe, and North America, innovation in carbon fiber composites, lightweight alloys, and aerodynamic designs, environmental impact of material recyclability and production waste, emerging use cases in connected bikes, custom 3D-printed frames, high-performance sports cycling |

The market is expected to reach USD 62.1 billion by 2035.

The market is growing at a CAGR of 10.2% during this period.

Aluminum leads with an estimated 35% share.

Mountain Bicycles are the leading type, estimated at 40% share.

Giant Manufacturing Co. Ltd. leads with 22% market share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bicycle Tire Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Components Aftermarket Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Crankset Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Drivetrain Cassette Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Saddle Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Electronic Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Device Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Gear Shifter Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Brake Lever Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Bottom Bracket Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Front Hub Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Rim Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Disc Brake Rotor Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Trip Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Mechanical Disc Brake Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Light Market Growth - Trends & Forecast 2025 to 2035

Bicycle Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bicycle Shoe Market - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA