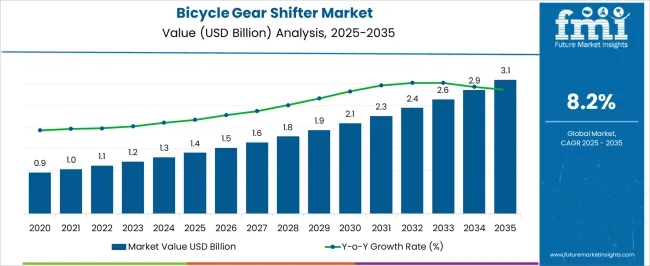

The bicycle gear shifter market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period. This early-phase growth is driven by the rising popularity of cycling, especially for recreational purposes, and the need for more efficient gear shifting systems. With advancements in mechanical and electronic gear technologies, demand for smoother, more precise gear changes increases steadily, contributing to moderate year-on-year growth.

This period sees the rapid adoption of electric bicycles (e-bikes), with gear shifters designed specifically for these systems driving higher sales. The expansion of cycling infrastructure in cities and the growing preference for high-performance bicycles further fuel this growth.

Innovations such as automated and smart gear systems for e-bikes propel continued growth, with technological advancements and a growing consumer base ensuring strong momentum across traditional and electric bicycle segments, reflecting a solid increase in both volume and value over the decade.

| Metric | Value |

|---|---|

| Bicycle Gear Shifter Market Estimated Value in (2025 E) | USD 1.4 billion |

| Bicycle Gear Shifter Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The bicycle components market contributes about 40-45%, encompassing all individual parts such as gears, shifters, pedals, and brakes that collectively define the cycling experience. The sports and recreation equipment market adds roughly 15-20%, driven by the increasing interest in cycling for both fitness and leisure, with gear shifters being a crucial component for multi-gear bicycles. The electric bicycle (e-bike) market provides approximately 12-18%, as the growing popularity of e-bikes requires advanced gear shifting technologies, especially in high-performance models. The automotive and transportation market accounts for 5-8%, with innovations in shifting mechanisms from the automotive sector influencing the design of bicycle gear shifters, particularly in premium and electric bikes.

The cycling accessories market supplies another 10-15%, as demand for specialized cycling accessories, including high-quality gear shifters, continues to grow with the rise in recreational cycling and professional competitions. These parent markets shape gear shifter designs, functionality, and integration with new technologies, while commercial success relies on innovation, performance, and expanding consumer interest across different cycling segments.

The bicycle gear shifter market is advancing steadily, propelled by growing consumer interest in cycling as both a recreational activity and a practical mode of transport. Rising health awareness, environmental concerns, and urban congestion have driven increased bicycle usage globally, creating a favorable environment for gear shifter innovation.

Gear shifters are essential for rider control and performance, and demand continues to shift toward lightweight, responsive, and user-friendly systems. As manufacturers focus on improving ergonomics, precision, and integration with advanced drivetrain components, the market is expected to benefit from sustained product development.

The expanding popularity of off-road and competitive cycling, combined with infrastructure investments in bike lanes and urban mobility programs, reinforces a positive growth trajectory. Demand is also amplified by consumer expectations for durability, aesthetics, and compatibility across various bike models, ensuring long-term market potential.

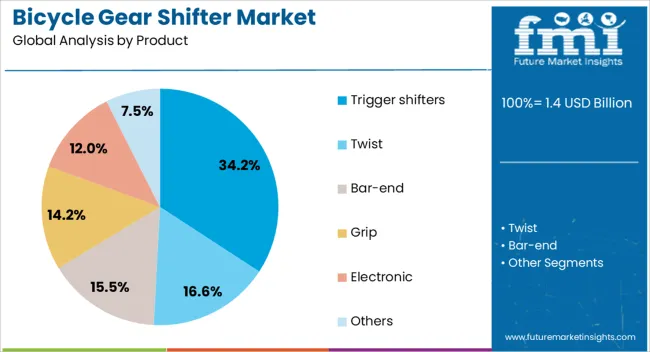

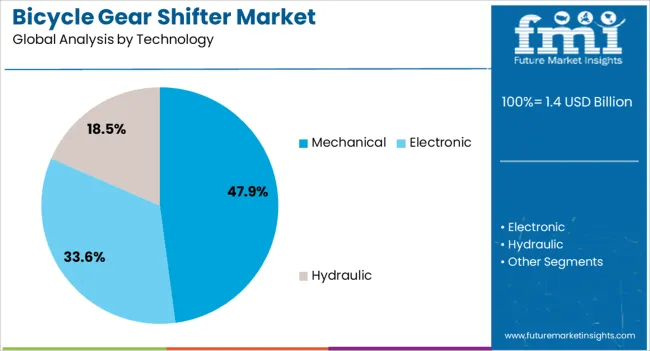

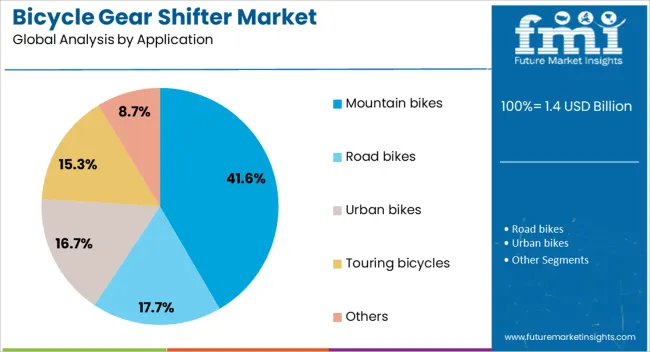

The bicycle gear shifter market is segmented by product, technology, application, distribution channel, and geographic regions. By product, bicycle gear shifter market is divided into Trigger shifters, Twist, Bar-end, Grip, Electronic, and Others. In terms of technology, bicycle gear shifter market is classified into Mechanical, Electronic, and Hydraulic. Based on application, bicycle gear shifter market is segmented into Mountain bikes, Road bikes, Urban bikes, Touring bicycles, and Others.

By distribution channel, bicycle gear shifter market is segmented into OEM and Aftermarket. Regionally, the bicycle gear shifter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The trigger shifters segment leads the product category with a 34.2% market share, attributed to its widespread usage among both casual and performance-oriented cyclists. Trigger shifters are favored for their reliable gear engagement, ease of use, and compact design, which provides smooth operation even under variable terrain conditions.

Their compatibility with flat handlebars and seamless integration with modern drivetrain systems have made them particularly popular in off-road and mountain biking segments. Manufacturers continue to refine trigger shifter mechanisms, focusing on lightweight materials, improved tactile feedback, and ergonomic positioning to enhance the rider experience.

As consumer preference leans toward mechanical efficiency and durability, trigger shifters are expected to maintain a strong foothold in the market, especially among riders who prioritize responsive and low-maintenance shifting systems.

The mechanical segment holds a dominant 47.9% share in the technology category, driven by its reliability, cost-efficiency, and ease of maintenance. Mechanical gear shifters remain the preferred choice for a wide range of bicycles due to their straightforward cable-based operation and minimal electronic components.

This technology is particularly attractive in emerging markets and among budget-conscious consumers, where repairability and affordability are key purchasing factors. Continued innovations in cable routing, friction reduction, and material strength have enhanced mechanical systems’ appeal without compromising performance.

Despite the rise of electronic alternatives, mechanical gear shifting maintains a significant market presence due to its resilience and adaptability across various cycling disciplines. As long as simplicity and dependability remain valued by riders, the mechanical segment is expected to retain a substantial share in the gear shifter landscape.

Mountain bikes account for 41.6% of the application category, establishing them as a major driver of demand in the bicycle gear shifter market. The rigorous performance requirements of off-road cycling demand robust and precise gear shifting systems, making mountain bikes a key application segment for both mechanical and advanced shifter technologies.

The segment’s growth is supported by increasing participation in trail riding, enduro, and downhill biking, alongside rising investments in bike parks and recreational trail networks. Gear shifter manufacturers are aligning product designs to meet the durability, reliability, and fast-response needs of this segment.

Additionally, as more amateur riders engage in mountain biking for fitness and adventure, demand for mid-range and high-performance gear systems continues to expand. The mountain bike segment is expected to maintain strong momentum, with gear shifter innovations directly influenced by terrain-specific requirements and rider feedback.

The bicycle gear shifter market is growing as cycling enthusiasts, OEMs, and aftermarket suppliers prioritize performance, precision, and durability. Demand is driven by advancements in shifting technology, the rise of electric bicycles (e-bikes), and the growing popularity of recreational and competitive cycling. Challenges include the need for lightweight yet robust materials, compatibility with various bicycle designs, and the development of cost-effective solutions for high-end and entry-level bikes.

Opportunities exist in wireless electronic shifting systems, integration with advanced bicycle components, and customizable gear shifters for specific cycling disciplines. Trends highlight smoother shifting mechanisms, increased gear range, and smart-bike integration.

Cycling enthusiasts and OEMs are increasingly demanding high-performance gear shifters that provide smooth, precise, and efficient shifting across various cycling applications. Advancements in mechanical, electronic, and hydraulic shifting systems are driving the market’s growth. With the rise of e-bikes and the growing interest in both recreational and competitive cycling, gear shifters have become a crucial component in improving cycling experiences. The demand for enhanced performance in off-road cycling, road racing, and urban commuting is pushing manufacturers to focus on delivering high-quality, durable, and lightweight gear shifting solutions.

As cycling continues to be a popular sport and mode of transportation, the need for reliable and easy-to-use shifting systems grows in parallel.

Constraints in the bicycle gear shifter market include high material costs, especially for lightweight and durable components such as alloys, carbon fiber, and advanced polymers. Compatibility challenges arise as gear shifters must work seamlessly with a wide range of bicycle models, including traditional, electric, and hybrid designs. Additionally, manufacturers must comply with local regulations regarding materials, safety, and performance standards. The technical complexity of designing gear shifters that perform reliably across various weather conditions, terrains, and riding styles adds to the cost. Buyers increasingly prioritize suppliers that offer proven solutions, effective warranty programs, and technical support to ensure compatibility, reliability, and safety in their gear shifter systems.

Opportunities are strongest in the development of wireless electronic gear shifting systems, which offer increased convenience, precision, and integration with smart bike technologies. E-bike manufacturers are particularly interested in seamless integration of advanced shifting systems that complement electric drive systems. Additionally, the market is seeing demand for customizable gear shifters tailored to specific cycling disciplines, such as mountain biking, road cycling, and commuting. The increasing popularity of urban cycling and e-bikes in regions like Europe, North America, and the Asia-Pacific presents a significant growth opportunity for gear shifter manufacturers. Suppliers offering innovative, user-friendly, and adaptable gear shifting solutions with strong support for electronic integration are well-positioned to capitalize on these trends.

The market is trending toward smoother, quieter, and more precise shifting systems. Enhanced materials, better cable routing, and advanced internal gearing are reducing friction, wear, and maintenance requirements. Smart-bike integration allows cyclists to track gear performance, adjust settings, and enhance the overall riding experience through digital interfaces. Additionally, the demand for lightweight and durable materials, such as carbon fiber and aluminum alloys, is growing as cyclists seek to optimize speed and performance.

Manufacturers are also focusing on expanding gear ranges to accommodate more diverse cycling needs, such as those required for e-bikes or competitive sports. Suppliers who invest in innovation, user-friendly designs, and advanced materials are expected to lead the market as these trends continue to evolve.

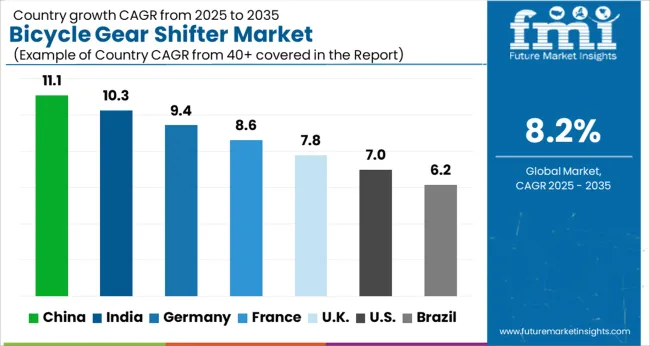

| Country | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| France | 8.6% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

The global bicycle gear shifter market is growing at a CAGR of 8.2% from 2025 to 2035. Among the leading markets, China holds the highest growth rate at 11.1%, followed by India at 10.3% and Germany at 9.4%. The United Kingdom and the United States show moderate growth at 7.8% and 7.0%, respectively. The growth is primarily driven by the increasing demand for high-performance bicycles, particularly e-bikes, and government support for cycling infrastructure. As cycling culture continues to grow globally, so does the demand for innovative and efficient gear shifter systems. The analysis includes over 40+ countries, with the leading markets detailed below.

The bicycle gear shifter market in China is projected to grow at a CAGR of 11.1% from 2025 to 2035. The surge in demand for bicycles, driven by growing urbanization, an increasing preference for eco-friendly transport, and rising participation in cycling activities, is a significant factor propelling this market. The increasing popularity of electric bikes (e-bikes) further boosts the demand for advanced gear shifting systems that offer precision and reliability. Domestic manufacturers are ramping up production to meet the rising demand, while international players are expanding their presence due to the country’s growing cycling culture. China’s government has also supported the expansion of cycling infrastructure in major cities, fueling the adoption of bicycles, including high-performance models that require advanced gear shifters.

The bicycle gear shifter market in india is expected to grow at a CAGR of 10.3% over the forecast period. The country’s growing focus on fitness, increased cycling participation, and the demand for efficient urban transportation are key factors contributing to this growth. As more people adopt cycling for leisure and commuting, the demand for high-quality gear shifters is rising. Additionally, India’s expanding middle class and improving disposable incomes are fueling the preference for better performance and comfort in bicycles, thus driving the adoption of advanced gear shifting technology. The market is also supported by the increasing number of cycling events and competitions, further promoting the demand for specialized gear shifters.

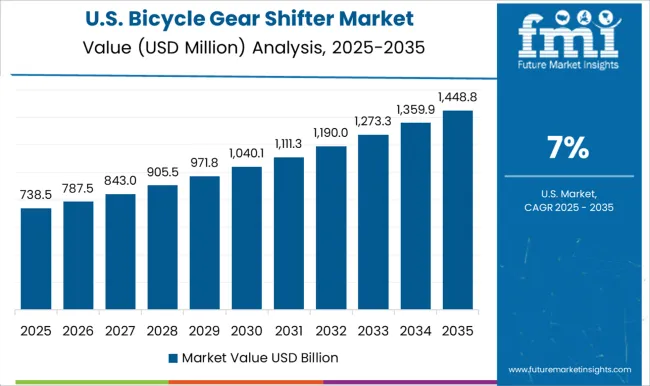

The USA bicycle gear shifter market is projected to grow at a CAGR of 7.0% from 2025 to 2035. With a robust cycling culture, increased focus on health and fitness, and growing urban cycling infrastructure, the demand for bicycles, particularly high-end models, is on the rise. The growing popularity of e-bikes in the USA, which require specialized gear shifters, is also a major driver of market growth. Additionally, more cycling events and competitions are taking place across the country, further driving the need for performance-driven gear systems. As American consumers continue to invest in high-quality bicycles for recreational and commuting purposes, the gear shifter market will continue to expand.

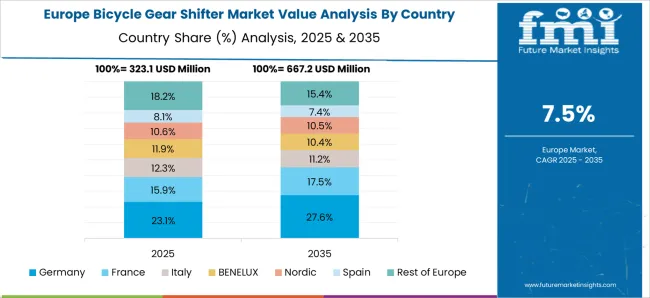

The bicycle gear shifter market in Germany is projected to grow at a CAGR of 9.4% from 2025 to 2035, supported by a well-established cycling culture and a strong preference for high-performance bicycles. Germany is one of the largest bicycle markets in Europe, with increasing demand for both traditional and electric bicycles, especially in urban areas. The country’s commitment to reducing carbon emissions has led to the expansion of cycling infrastructure, encouraging more people to adopt bicycles for commuting. Germany’s active participation in cycling events and its focus on innovation in the cycling industry provide significant opportunities for gear shifter manufacturers.

The UK bicycle gear shifter market is expected to grow at a CAGR of 7.8% from 2025 to 2035. As the country increasingly focuses on sustainable transport options, cycling has gained popularity, both as a leisure activity and as a mode of commuting. The government’s initiatives to promote cycling, including infrastructure development and incentives, are driving the adoption of bicycles with advanced gear systems. Furthermore, the rising demand for e-bikes and high-performance bicycles in the UK is fueling the need for precise, durable, and efficient gear shifters. With the growing trend of cycling events and competitions, the demand for specialized gear systems is expected to remain strong.

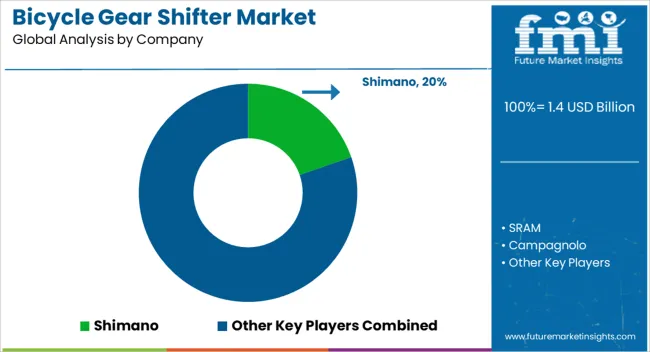

In the bicycle gear shifter market, competition is driven by performance, innovation, and market targeting. Shimano remains the dominant player, offering a vast range of mechanical and electronic shifting systems. Known for durability, precision, and a wide distribution network, Shimano caters to road, mountain, and gravel bike markets. Their flagship Di2 electronic shifting system provides seamless and precise gear changes, especially favored by professional cyclists. SRAM competes with its innovative wireless eTap systems, targeting high-end road and mountain bike enthusiasts. The brand is recognized for pushing technological boundaries, particularly with its wireless shifting and simplified setup. Campagnolo, renowned for high-performance, luxury components, caters to professional road cyclists, emphasizing the precision of its mechanical and electronic systems. Their Super Record EPS offers smooth gear transitions under extreme conditions, creating a niche in the premium market. Mid-tier players such as microSHIFT, L-TWOO, and Sensah focus on providing cost-effective alternatives without compromising quality. microSHIFT has gained traction in the mid-range market with affordable yet reliable mechanical and electronic gear systems, appealing to casual and recreational riders. L-TWOO is similarly positioning itself as a budget-friendly alternative with robust performance features.

Box Components, a newer contender, competes in the mountain bike sector, focusing on a combination of performance and affordability with their shifting systems designed for off-road cycling. Meanwhile, SunRace Sturmey Archer remains a key competitor by focusing on internal hub gears, ideal for city commuting and touring bikes, emphasizing simplicity and maintenance-free performance. Product brochures across these brands emphasize key selling points. Shimano promotes smooth shifting and long-lasting durability, while SRAM highlights wireless convenience and cutting-edge technology. Campagnolo's brochures focus on precision engineering for professional-grade cycling. microSHIFT, L-TWOO, and Box Components highlight affordability, ease of use, and consistent shifting. SunRace focuses on low-maintenance internal gear hubs, perfect for urban cycling needs. These brochures showcase a blend of quality, innovation, and practicality, catering to a wide range of cycling preferences.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Product | Trigger shifters, Twist, Bar-end, Grip, Electronic, and Others |

| Technology | Mechanical, Electronic, and Hydraulic |

| Application | Mountain bikes, Road bikes, Urban bikes, Touring bicycles, and Others |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Shimano, SRAM, Campagnolo, microSHIFT, L-TWOO, Sensah, Box Components, SunRace Sturmey Archer, Tektro, and Wolf Tooth |

| Additional Attributes | Dollar sales by product type (trigger shifters, twist shifters, electronic shifters), application (road bikes, mountain bikes, hybrid bikes, e-bikes), and gear system (derailleur, hub gears). Demand dynamics are influenced by cycling trends, innovations in electronic shifting technology, and the growing popularity of cycling for commuting and recreational activities. Regional trends indicate robust growth in North America, Europe, and Asia-Pacific, with increasing interest in sports cycling and the adoption of e-bikes. |

The global bicycle gear shifter market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the bicycle gear shifter market is projected to reach USD 3.1 billion by 2035.

The bicycle gear shifter market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in bicycle gear shifter market are trigger shifters, twist, bar-end, grip, electronic and others.

In terms of technology, mechanical segment to command 47.9% share in the bicycle gear shifter market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA