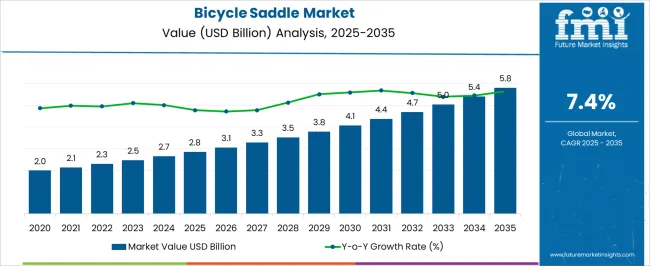

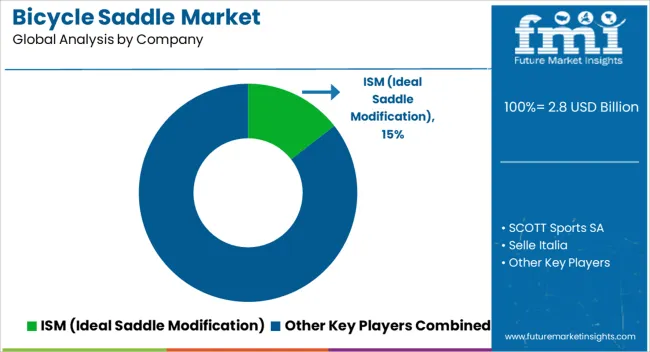

The bicycle saddle market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 5.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period. Initial adoption is driven by increasing demand for high-performance and ergonomic saddles across recreational and professional cycling segments. Early adopters, primarily cycling enthusiasts and sports professionals, influence product design and technology trends, encouraging innovations in lightweight materials, advanced cushioning, and aerodynamically optimized shapes.

The gradual market growth from USD 2.8 billion in 2025 to USD 3.8 billion by 2030 indicates the mainstream adoption phase, where increasing awareness among casual cyclists and urban commuters expands the customer base. During this phase, economies of scale are realized in manufacturing and distribution, while competition intensifies, prompting differentiation through comfort, durability, and aesthetic design. Market penetration in emerging regions contributes to volume growth, though product adoption is moderated by affordability and consumer familiarity with performance-focused saddles. By 2035, the market reaching USD 5.8 billion suggests a transition toward late-stage adoption, where most target consumers are acquainted with advanced saddle technologies, and incremental innovation drives sales rather than entirely new product categories.

The adoption lifecycle reflects a progression from niche early adopters to broad-based mainstream users, highlighting the importance of continuous product enhancements, strategic pricing, and regional market expansion to sustain growth throughout the market maturity curve.

| Metric | Value |

|---|---|

| Bicycle Saddle Market Estimated Value in (2025 E) | USD 2.8 billion |

| Bicycle Saddle Market Forecast Value in (2035 F) | USD 5.8 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The bicycle saddle market represents a specialized segment within the global cycling components and sports equipment industry, emphasizing comfort, ergonomics, and performance optimization. Within the broader bicycle components sector, it accounts for about 4.2%, driven by demand from road bikes, mountain bikes, and electric bicycles. In the premium and performance cycling segment, its share is approximately 5.1%, reflecting the adoption of lightweight materials, ergonomic designs, and pressure-relieving technologies. Across the recreational and commuter cycling market, it contributes around 3.8%, supporting comfort, durability, and ride efficiency. Within the e-bike and electric mobility category, it represents 4.5%, highlighting integration with smart and adjustable seat systems.

In the overall cycling and sports equipment ecosystem, the market contributes about 4.0%, emphasizing design innovation, rider comfort, and performance enhancement. Recent developments in the bicycle saddle market have focused on ergonomics, material innovation, and customization. Groundbreaking trends include memory foam and gel padding, 3D-printed structures, and adjustable rails to optimize rider comfort. Key players are collaborating with frame manufacturers, sports scientists, and material developers to introduce lightweight, durable, and anatomically optimized saddles. Adoption of pressure-mapping, shock-absorbing technologies, and weather-resistant materials is gaining traction. The digital integration with smart sensors for posture monitoring and ride analytics is being explored.

The bicycle saddle market is experiencing steady growth, supported by rising cycling participation rates, increasing adoption of premium bicycles, and growing emphasis on rider comfort and ergonomics. Advancements in saddle design, incorporating lightweight materials, enhanced cushioning, and anatomically optimized shapes, are driving replacement and upgrade demand. Urban commuting trends, recreational cycling, and the popularity of competitive sports have collectively expanded the customer base.

Additionally, e-commerce penetration has widened accessibility, offering diverse product ranges and customization options to a global audience. Sustainability considerations, including the use of eco-friendly materials and responsible sourcing, are influencing product development and purchase preferences.

As disposable incomes rise and health-conscious lifestyles become more prevalent, consumers are investing in high-quality saddles to enhance performance and reduce discomfort during long rides. The market outlook remains positive, with technological innovations, targeted marketing strategies, and supportive cycling infrastructure initiatives expected to maintain momentum in both developed and emerging regions.

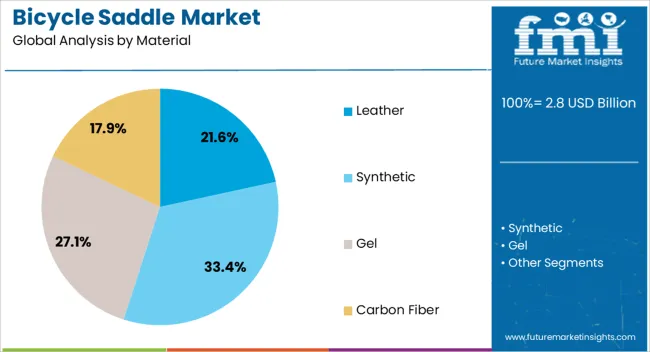

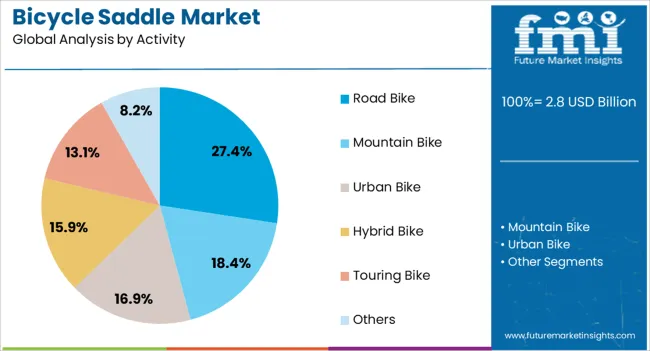

The bicycle saddle market is segmented by material, activity, distribution channel, and geographic regions. By material, bicycle saddle market is divided into Leather, Synthetic, Gel, and Carbon Fiber. In terms of activity, bicycle saddle market is classified into Road Bike, Mountain Bike, Urban Bike, Hybrid Bike, Touring Bike, and Others.

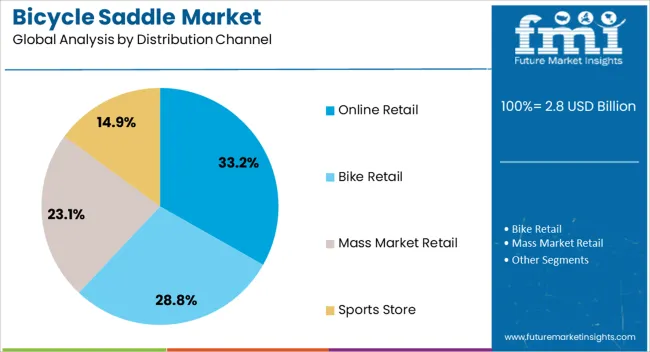

Based on distribution channel, bicycle saddle market is segmented into Online Retail, Bike Retail, Mass Market Retail, and Sports Store. Regionally, the bicycle saddle industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The leather segment holds a notable position in the material category of the bicycle saddle market, accounting for approximately 21.6% of the share. Its appeal lies in the combination of durability, aesthetic value, and comfort adaptability, as leather saddles tend to conform to the rider’s anatomy over time. Demand in this segment has been reinforced by the premium cycling community, where heritage designs and craftsmanship are highly appreciated.

Leather’s natural breathability and longevity provide a value proposition that synthetic alternatives often cannot match, particularly for touring and long-distance cyclists. While higher maintenance requirements and sensitivity to weather conditions remain limiting factors, niche market positioning and strong brand heritage continue to sustain its relevance.

Customization options, including embossed patterns and color variations, have further elevated its market appeal. Given the ongoing preference for premium and classic bicycle components, the leather segment is expected to maintain steady demand within its specialized consumer base.

The road bike segment dominates the activity category, holding approximately 27.4% of the bicycle saddle market. This leadership is underpinned by the high-performance requirements of road cycling, where saddle design directly influences efficiency, aerodynamics, and comfort during extended rides. Manufacturers targeting this segment focus on lightweight structures, pressure-relief channels, and high-resilience padding to meet the demands of competitive cyclists and enthusiasts.

Growth in organized cycling events, fitness-oriented road cycling, and cross-border sports tourism has fueled product innovation and replacement cycles in this category. Additionally, consumer willingness to invest in premium saddles for performance gains and injury prevention has supported market expansion.

While the segment is mature in developed markets, emerging economies are seeing accelerated adoption due to rising participation in amateur racing and fitness cycling. With continuous product advancements and alignment with the sport’s performance-driven culture, the road bike segment is expected to retain its dominant share in the coming years.

The online retail segment leads the distribution channel category, representing approximately 33.2% of the bicycle saddle market. Growth in this segment has been propelled by the convenience of direct-to-consumer purchasing, extensive product availability, and competitive pricing models offered by e-commerce platforms. The ability to compare specifications, read reviews, and access niche or imported brands has significantly influenced consumer buying behavior.

Online channels have also enabled brands to bypass traditional distribution constraints, expanding reach to rural and international customers. The segment’s expansion is further supported by the integration of virtual fitting tools, detailed product imagery, and flexible return policies that reduce purchase hesitation.

Seasonal discounts, bundled offers, and targeted digital marketing have amplified online sales performance. As internet penetration deepens and mobile commerce adoption accelerates, the online retail segment is expected to strengthen its position, benefiting from the ongoing shift toward digital-first purchasing habits in the cycling accessories market.

The market has been expanding steadily due to increasing demand for comfort, performance, and ergonomic designs across urban commuting, recreational, and professional cycling segments. Bicycles equipped with advanced saddles are being increasingly preferred for long-distance rides, racing events, and mountain biking activities.

Lightweight materials, enhanced cushioning technologies, and anatomically designed saddle structures have improved rider experience and reduced fatigue. Manufacturers are innovating with gel padding, carbon fiber rails, and ventilated designs to meet performance and comfort requirements. Growth in e-bikes, cycling tourism, and cycling-focused fitness initiatives has further bolstered market adoption.

Technological advancements in bicycle saddle design have played a crucial role in market growth. Ergonomic shaping, pressure relief cut-outs, and multi-density foam cushions are being employed to reduce discomfort and pressure on sensitive areas. Carbon fiber and titanium rails offer lightweight yet durable structures suitable for competitive cycling and mountain biking applications. Ventilated designs and moisture-wicking covers improve airflow and reduce sweat accumulation during long rides. Smart saddle integration, including sensors to monitor posture, pedaling efficiency, and pressure points, is emerging in high-end bicycles. Manufacturers are leveraging 3D printing and precision molding to customize saddle shapes according to rider requirements.

The rising adoption of e-bikes and urban commuting bicycles has expanded the demand for high-quality saddles. E-bike riders often cover longer distances, increasing the importance of comfort and ergonomic designs in daily usage. Urban cycling initiatives, bike-sharing programs, and smart city transportation infrastructure have created demand for durable, low-maintenance saddle solutions. Manufacturers are designing saddles with enhanced wear resistance, anti-theft features, and weather-proof materials for public usage. Additionally, foldable and compact bicycles are being equipped with adjustable and lightweight saddles to support mobility and convenience. The convergence of urban mobility trends and e-bike proliferation has strengthened the market for bicycle saddles, making it critical to address both functional performance and user comfort across various city and commuter applications.

Professional cycling and sports applications are significant contributors to bicycle saddle market growth. Competitive cycling, triathlons, and mountain biking events require lightweight, aerodynamic, and pressure-optimized saddles to enhance performance. Customized saddle geometries, specialized padding, and tension-adjustable rails are implemented to improve pedaling efficiency and rider endurance. Sports teams and professional cyclists increasingly collaborate with saddle manufacturers to develop bespoke solutions tailored for specific racing or terrain conditions. High-performance saddle adoption ensures reduced fatigue, optimal weight distribution, and injury prevention during rigorous activities. As global interest in competitive cycling rises, these performance-oriented saddle solutions continue to be a primary driver for innovation, material investment, and market expansion, particularly in regions with well-established cycling cultures.

Sustainability and material innovation have become key trends shaping the bicycle saddle market. Manufacturers are adopting recycled polymers, eco-friendly foams, and vegan leather alternatives to meet environmental regulations and consumer preference for sustainable products. Lightweight and durable composites reduce environmental impact during production and extend product lifecycle. Innovations in biodegradable and recyclable materials allow alignment with circular economy principles, appealing to environmentally conscious consumers.

Enhanced manufacturing efficiency, water-based coatings, and solvent-free adhesives are reducing energy and chemical usage. The integration of sustainable practices with performance-oriented designs ensures that bicycle saddles not only meet comfort and ergonomic expectations but also comply with growing regulatory and consumer-driven environmental standards, driving long-term adoption globally.

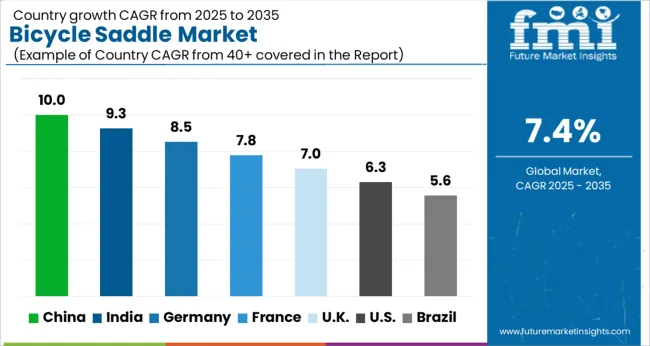

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.6% |

The market is projected to grow at a CAGR of 7.4% from 2025 to 2035, driven by rising cycling activities and demand for ergonomic and performance-oriented designs. China leads with 10.0%, reflecting large-scale manufacturing and strong domestic demand. India follows at 9.3%, benefiting from expanding urban cycling infrastructure and increasing consumer interest. Germany holds 8.5%, focusing on premium and technologically advanced saddle solutions. The UK records 7.0%, supported by cycling culture and fitness trends. The USA reaches 6.3%, influenced by recreational cycling and e-bike adoption. Market expansion is fueled by innovation in materials, comfort, and sustainability-focused designs across regions. This report includes insights on 40+ countries; the top markets are shown here for reference.

China recorded a 10.0% CAGR, driven by growing demand for both recreational and commuter bicycles, and expansion of e-bike adoption in urban areas. Manufacturers invested in ergonomic, lightweight, and high durability saddle designs to improve rider comfort and performance. Research and development focused on advanced materials, shock absorption, and aerodynamics for premium and sports bicycles. Competitive strategies included collaborations with local bicycle brands, distribution network expansion, and after sales support. Adoption was highest among urban commuters, cycling enthusiasts, and e-bike users. Strategic partnerships with e-commerce platforms and retail chains enhanced accessibility and market penetration, while continuous innovation in saddle technology supported premiumization and differentiation across consumer segments.

India demonstrated a 9.3% CAGR, supported by rising adoption of bicycles for commuting, fitness, and recreational purposes. Manufacturers invested in high comfort, durable, and adjustable saddles to cater to varied rider preferences. Competitive strategies emphasized local production, collaboration with bicycle manufacturers, and after sales support. Demand was highest in urban centers, tier 2 and 3 cities, and regions with growing cycling awareness. R&D focused on shock absorption, lightweight materials, and ergonomic design. Expansion of e-bike adoption and cycling events further reinforced market growth. Partnerships with retail chains and online platforms facilitated accessibility and customization options for end users, driving increased sales.

Germany progressed at an 8.5% CAGR, shaped by rising recreational cycling, sports biking, and urban commuting adoption. Manufacturers emphasized ergonomic, performance-oriented, and lightweight saddle designs for road bikes, e-bikes, and mountain bicycles. Competitive advantage was achieved through technological innovation, premium materials, and collaboration with professional cycling brands. Adoption was particularly strong among enthusiasts and performance cyclists. Product differentiation relied on material durability, comfort, and aerodynamic design. Export potential and international cycling events further shaped innovation strategies. Sustainable and high quality manufacturing practices reinforced Germany’s position as a key market for advanced bicycle saddle technologies with strict standards of performance and reliability.

The United Kingdom advanced at a 7.0% CAGR, influenced by urban commuting, recreational cycling, and e-bike adoption. Manufacturers developed ergonomic, lightweight, and durable saddle designs with comfort and performance as priority features. Competitive strategies included partnerships with bicycle brands, product customization, and after sales support. Adoption was highest among urban cyclists, sports enthusiasts, and e-bike users. Technological innovation in materials, shock absorption, and design aesthetics drove premium segment growth. Cycling events, awareness campaigns, and online sales platforms further supported market penetration. Product quality, comfort, and ergonomic enhancements remained critical factors influencing consumer purchasing decisions in both performance and leisure cycling segments.

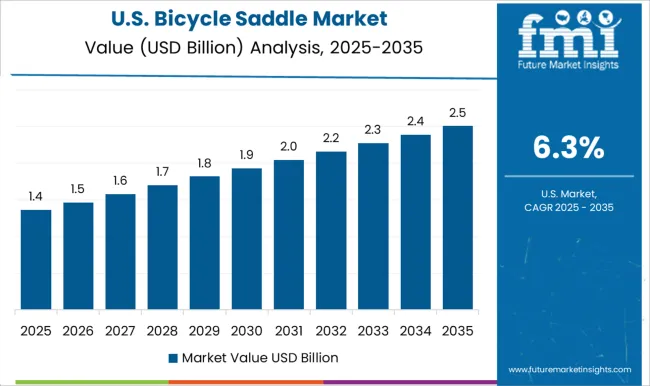

The United States grew at a 6.3% CAGR, driven by recreational cycling, urban commuting, and expanding e-bike adoption. Manufacturers focused on lightweight, ergonomic, and high durability saddles to enhance comfort and performance. Competitive strategies included collaborations with bicycle brands, R&D in materials and shock absorption, and distribution through retail and e-commerce channels. Adoption was highest among urban cyclists, performance enthusiasts, and e-bike users. Product differentiation relied on comfort, durability, and innovative materials. Cycling events and fitness trends further reinforced demand. Regional partnerships with distributors and retailers facilitated accessibility, while continuous innovation in saddle technology supported premiumization and consumer preference for high quality, reliable bicycle components.

The market has been shaped by a mix of high performance innovators and established cycling brands, competing on comfort, durability, and ergonomic precision. ISM (Ideal Saddle Modification) has focused on anatomical design and pressure relief technologies, targeting long-distance and endurance cyclists. Selle Italia and Selle Royal have emphasized advanced padding materials, cutout designs, and lightweight structures to enhance rider comfort while maintaining strength and reliability.

SCOTT Sports SA and Specialized Bicycle Components, Inc. have concentrated on performance-oriented geometries, integrating carbon-reinforced bases, flexible rails, and aerodynamic shapes suitable for competitive racing and mountain biking. Shanghai Phoenix Bicycle Co., Ltd has positioned itself in the mass market segment, providing durable and cost-effective saddles for urban commuters and recreational riders, balancing affordability with functional design. Shimano Inc. and Terry Bicycles have differentiated themselves through specialized technologies, including vibration absorption systems, breathable coverings, and adjustable rail mechanisms.

Product brochures consistently highlight pressure distribution, ergonomic shaping, and materials optimized for long-term comfort. ISM and Selle Italia emphasize the benefits of anatomical cutouts to reduce pressure on sensitive areas, while Selle Royal and Terry Bicycles promote cushioning systems that adapt to casual cycling habits. SCOTT and Specialized showcase performance-oriented innovation, where weight reduction and stiffness optimization directly enhance pedaling efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| Material | Leather, Synthetic, Gel, and Carbon Fiber |

| Activity | Road Bike, Mountain Bike, Urban Bike, Hybrid Bike, Touring Bike, and Others |

| Distribution Channel | Online Retail, Bike Retail, Mass Market Retail, and Sports Store |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ISM (Ideal Saddle Modification), SCOTT Sports SA, Selle Italia, Selle Royal, Shanghai Phoenix Bicycle Co Ltd, SHIMANO INC., Specialized Bicycle Components, Inc., and Terry Bicycles |

| Additional Attributes | Dollar sales by saddle type and application, demand dynamics across commuter, mountain, and road bicycles, regional trends in cycling adoption, innovation in ergonomic design, lightweight materials, and shock absorption, environmental impact of material production and disposal, and emerging use cases in e-bikes, performance cycling, and smart-connected bicycle systems. |

The global bicycle saddle market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the bicycle saddle market is projected to reach USD 5.8 billion by 2035.

The bicycle saddle market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in bicycle saddle market are leather, synthetic, gel and carbon fiber.

In terms of activity, road bike segment to command 27.4% share in the bicycle saddle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bicycle Tire Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Components Aftermarket Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Crankset Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Drivetrain Cassette Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Frames Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bicycle Electronic Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Device Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Gear Shifter Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Brake Lever Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Bottom Bracket Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Front Hub Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Rim Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Disc Brake Rotor Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Trip Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Mechanical Disc Brake Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Light Market Growth - Trends & Forecast 2025 to 2035

Bicycle Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bicycle Bags and Backpacks Market - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA