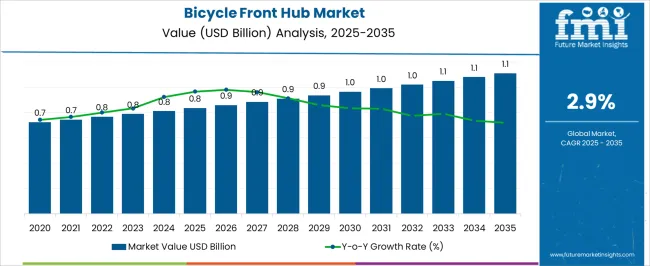

The bicycle front hub market is projected to grow from USD 0.8 billion in 2025 to USD 1.1 billion by 2035, representing a CAGR of 2.9%. This growth represents an absolute dollar opportunity of USD 0.3 billion over the decade. Expansion is supported by steady demand from the bicycle manufacturing and replacement parts sectors. Companies can leverage this predictable growth by optimizing production, distribution, and aftermarket services.

Early investments in market presence and supply chain efficiency allow stakeholders to capture a meaningful share of the expanding market, while ensuring consistent revenue streams from both OEM and replacement demand. Over the next ten years, the USD 0.3 billion opportunity highlights a steady growth trajectory for the bicycle front hub market. By 2035, revenue will be driven by both new bicycle production and replacement of existing hubs. The CAGR of 2.9% indicates moderate but reliable expansion, enabling companies to scale operations and strengthen regional distribution networks.

Firms can focus on aligning manufacturing capacity, sales strategies, and service availability with market demand to maximize returns. The absolute growth potential provides a clear incentive for businesses to maintain operational efficiency while capturing incremental revenue across the projected period.

| Metric | Value |

|---|---|

| Bicycle Front Hub Market Estimated Value in (2025 E) | USD 0.8 billion |

| Bicycle Front Hub Market Forecast Value in (2035 F) | USD 1.1 billion |

| Forecast CAGR (2025 to 2035) | 2.9% |

In the early growth phase of the bicycle front hub market, revenue expands gradually from USD 0.8 billion in 2025, reflecting a CAGR of 2.9%. Growth during this period is primarily driven by initial demand in new bicycle production and replacement parts. Companies focus on establishing supply chains, building distribution networks, and strengthening relationships with manufacturers and retailers. The absolute dollar opportunity in this phase is moderate, allowing firms to test strategies, optimize operations, and respond to market feedback.

Early growth lays a solid foundation for scaling while maintaining manageable risk and stable revenue capture. In the late growth phase, approaching 2035 and a market size of USD 1.1 billion, the bicycle front hub market experiences more noticeable revenue expansion due to broader adoption and replacement cycles. Market strategies shift toward scaling production, expanding regional reach, and leveraging established customer networks. The absolute dollar opportunity in this stage is significant, representing most of the USD 0.3 billion growth over the decade. Companies benefit from operational efficiencies and stronger brand presence, ensuring the 2.9% CAGR translates into consistent and profitable growth.

The bicycle front hub market is witnessing robust growth driven by the increasing popularity of cycling as a sustainable mode of transportation and a recreational activity. Advancements in lightweight materials, consumer preference for performance-oriented components, and growth in specialized bicycle categories such as mountain and gravel bikes are propelling demand for high-precision front hubs.

Urban infrastructure development promoting cycling lanes and rising fitness consciousness have further boosted aftermarket upgrades. Moreover, the surge in e-bike adoption is encouraging innovation in hub designs to accommodate torque and power transmission needs.

As manufacturers focus on durability, modularity, and compatibility with advanced suspension systems, the market is poised for continued technological evolution and expansion.

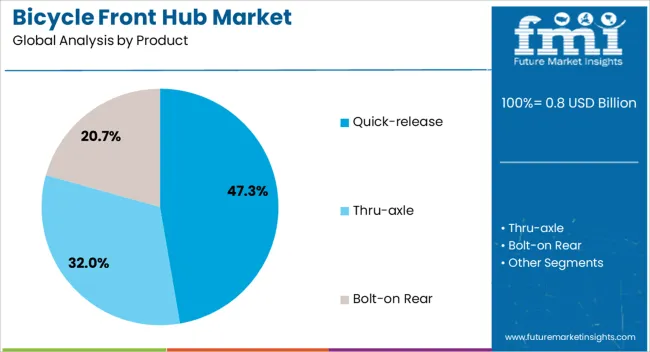

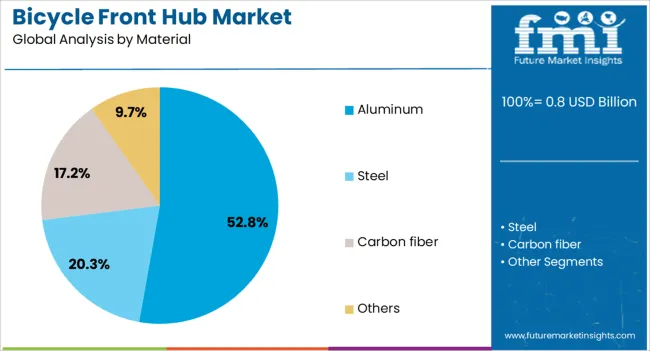

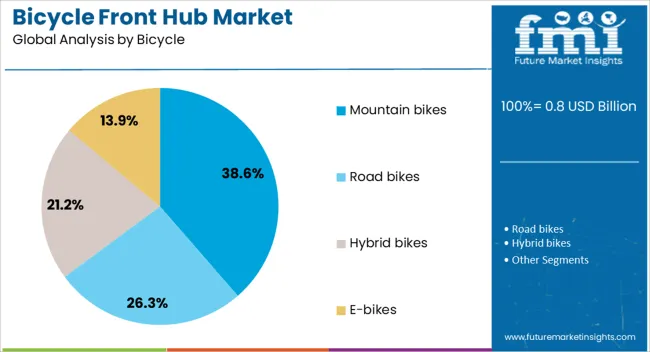

The bicycle front hub market is segmented by product, material, bicycle, distribution channel, and geographic regions. By product, bicycle front hub market is divided into Quick-release, Thru-axle, and Bolt-on Rear. In terms of material, bicycle front hub market is classified into Aluminum, Steel, Carbon fiber, and Others.

Based on bicycle, bicycle front hub market is segmented into Mountain bikes, Road bikes, Hybrid bikes, and E-bikes. By distribution channel, bicycle front hub market is segmented into OEM and Aftermarket. Regionally, the bicycle front hub industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Quick-release hubs are projected to account for 47.3% of the total bicycle front hub market by 2025, emerging as the leading product segment. Their convenience, ease of wheel removal, and compatibility with a wide range of frames make them highly preferred by both casual riders and competitive cyclists.

Quick-release systems significantly reduce downtime for maintenance and transport, which appeals to daily commuters and event racers alike. While through-axles have gained traction in niche performance segments, quick-release remains dominant in mainstream and mid-tier bicycle offerings.

Ongoing refinements in locking mechanisms and safety features are ensuring this segment maintains its widespread adoption.

Aluminum front hubs are expected to command 52.8% of the overall market in 2025, establishing them as the dominant material type. Aluminum’s favorable strength-to-weight ratio, corrosion resistance, and affordability make it the material of choice for both OEMs and aftermarket suppliers.

It allows for intricate CNC machining, which enhances hub performance through better aerodynamics and reduced rolling resistance. As consumers increasingly demand lightweight components that don’t compromise on strength, aluminum continues to outperform steel and carbon alternatives in most mass-market segments.

Additionally, its recyclability aligns with growing sustainability goals in the bicycle industry.

Mountain bikes are projected to hold 38.6% of the market share in 2025 within the bicycle category, making them the leading application for front hub sales. The rugged terrain and off-road use cases of mountain biking necessitate robust, high-torque front hubs that offer optimal shock absorption and traction.

As mountain biking gains popularity across both developed and emerging economies, demand for specialized hubs with advanced sealing, higher spoke counts, and disc brake compatibility is increasing.

Trail-specific designs, coupled with growth in recreational and adventure tourism, are expected to sustain mountain bikes as the top contributor to front hub demand.

The bicycle front hub market is growing as cycling adoption increases for recreation, fitness, commuting, and competitive sports. Front hubs, essential components connecting the front wheel to the fork and enabling smooth rotation, are increasingly being designed for performance, durability, and lightweight applications. Growth is driven by rising urban cycling, e-bike adoption, and demand for high-quality road, mountain, and hybrid bicycles.

Manufacturers offering front hubs with sealed bearings, corrosion-resistant materials, and compatibility with disc brakes or thru-axles are capturing opportunities across professional and recreational cycling markets. Integration with advanced wheelsets and compatibility with modern drivetrain systems further enhances market demand globally.

The bicycle front hub market faces challenges due to high production costs and stringent material requirements. Premium hubs made from aluminum, carbon fiber, or titanium ensure lightweight performance, durability, and corrosion resistance, but increase manufacturing costs. Maintaining precision in bearing alignment and machining tolerances is critical for smooth wheel rotation and rider safety. Smaller or budget bicycle brands may prefer standard or low-cost hubs, limiting adoption of high-performance models. Additionally, sourcing high-quality materials and precision components can be affected by supply chain disruptions. Manufacturers are addressing these challenges by optimizing production techniques, offering modular designs, and improving quality control to balance performance, durability, and cost efficiency for a broad range of bicycles.

Market trends are shaped by the growth of e-bikes, disc brakes, and sealed bearing technology in front hubs. Sealed bearings reduce friction, prevent dirt ingress, and extend hub lifespan, improving rider experience. E-bikes require hubs capable of handling higher torque and rotational loads, driving demand for stronger and more reliable designs. Disc brake compatibility, thru-axle systems, and quick-release mechanisms are increasingly standard in modern bicycles. These trends highlight a focus on durability, precision, and versatility, while also catering to recreational, professional, and urban cycling applications. Integration with advanced wheelsets and smart cycling technologies is further enhancing front hub performance and market appeal globally.

Opportunities in the bicycle front hub market are driven by rising cycling adoption, urban mobility initiatives, and professional cycling trends. Governments promoting cycling infrastructure, bike-sharing programs, and eco-friendly commuting solutions increase demand for durable and reliable hubs. Competitive cycling and mountain biking growth require high-performance hubs for lightweight, aerodynamic, and torque-resilient wheelsets. Additionally, the expansion of e-bikes in urban and recreational markets creates demand for front hubs designed for higher loads and motorized assistance. Manufacturers offering high-quality, performance-optimized hubs with wide compatibility and maintenance ease are well-positioned to capitalize on growing adoption across recreational, competitive, and commuter bicycles globally.

Market growth is restrained by material sourcing challenges, component standardization issues, and intense competition. High-performance hubs require premium aluminum, titanium, or carbon fiber, which may face price fluctuations or supply constraints. Differences in hub standards, axle types, and brake compatibility across bicycle segments can complicate manufacturing and limit cross-compatibility. Competition from low-cost regional manufacturers offering standard hubs reduces market share for premium suppliers. Additionally, maintaining consistent quality and precision in high-speed or off-road applications is critical to prevent product failures. Until supply chains stabilize, standardization improves, and differentiation through performance and durability is emphasized, adoption may remain concentrated in mid-to-high-end bicycles and e-bike segments.

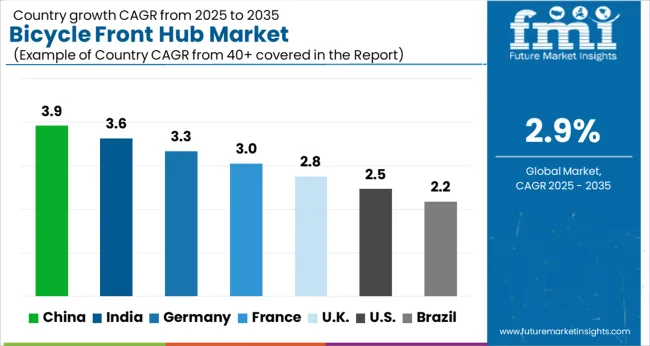

| Country | CAGR |

|---|---|

| China | 3.9% |

| India | 3.6% |

| Germany | 3.3% |

| France | 3.0% |

| UK | 2.8% |

| USA | 2.5% |

| Brazil | 2.2% |

The global bicycle front hub market is projected to grow at a CAGR of 2.9% through 2035, driven by demand across road bicycles, mountain bikes, and e-bikes. In BRICS nations, China has been recorded with 3.9% growth, where production and distribution of front hubs for urban and sports bicycles have been extensively carried out by manufacturers such as Shimano, Novatec, and SRAM. India has been observed at 3.6%, supported by rising adoption in commuter bicycles and regional assembly units. In the OECD region, Germany has been measured at 3.3%, where production for performance bicycles and export-oriented manufacturing has been steadily maintained. The United Kingdom has been noted at 2.8%, reflecting moderate deployment in recreational and professional cycling segments, while the USA has been recorded at 2.5%, with utilization in sports, leisure, and electric bicycles being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The market for bicycle front hubs in China is expanding at a CAGR of 3.9%, driven by growing bicycle manufacturing, urban mobility programs, and recreational cycling trends. Leading bicycle manufacturers in China are supplying high-quality front hubs for road bicycles, mountain bikes, and electric bicycles. Government initiatives promoting sustainable transport, cycling infrastructure, and public health programs are supporting adoption. Pilot deployments in urban cycling programs demonstrate operational benefits such as improved wheel stability, enhanced ride efficiency, and reduced maintenance requirements. Collaborations between component manufacturers, bicycle brands, and research institutions are advancing hub design, materials, and durability. Increasing demand for performance bicycles and last-mile mobility solutions continues to drive the Chinese bicycle front hub market.

The market for bicycle front hubs in India is growing at a CAGR of 3.6%, supported by rising bicycle production, urban cycling initiatives, and e-bike adoption. Manufacturers are supplying front hubs for mountain bikes, road bicycles, and electric bicycles to meet increasing consumer demand. Government programs promoting sustainable transport, public cycling facilities, and health-focused mobility campaigns encourage market adoption. Pilot projects in urban areas demonstrate benefits including enhanced wheel stability, smoother rides, and lower maintenance. Partnerships between local component manufacturers, bicycle brands, and technology providers are improving hub performance, material quality, and longevity. Expanding urban cycling networks and increasing demand for recreational and commuting bicycles are key drivers for the Indian market.

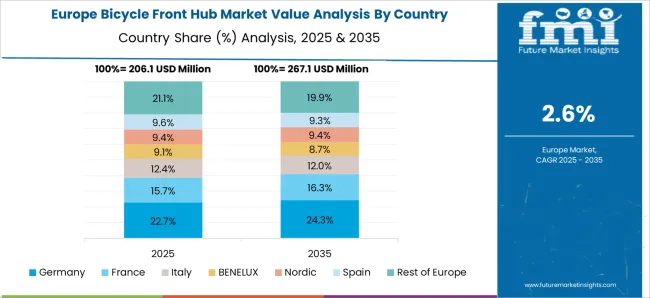

The market for bicycle front hubs in Germany is recording a CAGR of 3.3%, supported by a strong cycling culture, high-quality bicycle manufacturing, and e-bike adoption. Manufacturers provide advanced front hubs for mountain bicycles, road bicycles, and electric bicycles with focus on durability, lightweight design, and low maintenance. Government initiatives promoting urban cycling infrastructure, sustainable transport, and environmental awareness encourage market growth. Pilot deployments in city bike-sharing programs and recreational cycling facilities demonstrate operational benefits, including smoother rides, improved wheel performance, and longer product lifespan. Collaborations between manufacturers, bicycle brands, and research institutes are improving hub technologies and materials. Germany’s strong cycling culture and urban mobility programs support continuous growth in the bicycle front hub market.

The market for bicycle front hubs in the United Kingdom is growing at a CAGR of 2.8%, driven by urban cycling initiatives, commuter bicycles, and recreational cycling. Manufacturers supply front hubs for road bicycles, mountain bikes, and electric bicycles to meet urban and recreational cycling demand. Government programs supporting sustainable transportation, urban cycling infrastructure, and public health encourage adoption. Pilot projects in city bike-sharing schemes demonstrate benefits including improved ride stability, reduced maintenance, and enhanced cycling safety. Collaborations between component manufacturers, bicycle brands, and technology developers enhance hub performance, material quality, and durability. Increasing awareness of cycling as a sustainable commuting option is driving growth in the United Kingdom market.

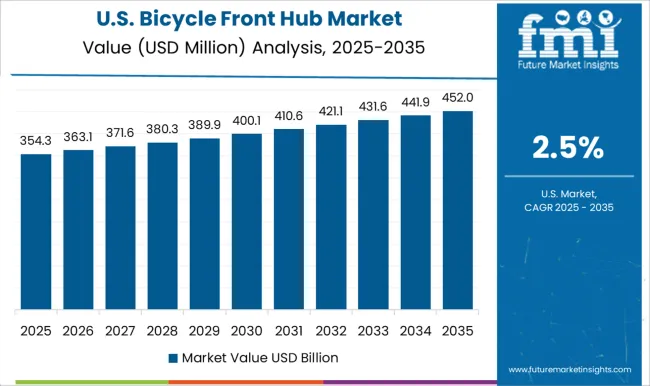

The market for bicycle front hubs in the United States is expanding at a CAGR of 2.5%, supported by recreational cycling, e-bike adoption, and urban commuting trends. Manufacturers provide front hubs for road bicycles, mountain bicycles, and electric bicycles, focusing on lightweight design, durability, and low maintenance. Government initiatives promoting cycling infrastructure, public health programs, and sustainable transportation support market adoption. Pilot implementations in bike-sharing programs and recreational cycling areas demonstrate operational benefits, including smoother rides, enhanced wheel stability, and longer hub lifespan. Partnerships between bicycle brands, component manufacturers, and research organizations are enhancing hub technology, materials, and performance. The rising popularity of cycling for recreation, commuting, and fitness is sustaining growth in the United States bicycle front hub market.

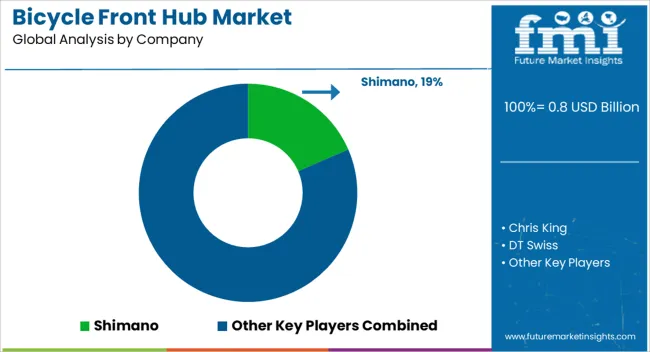

The bicycle front hub market is moderately fragmented, with a mix of large OEMs, premium niche manufacturers, and aftermarket specialists competing across segments such as e-bikes, performance road, mountain, and hybrid bikes. Key competitive levers include material innovation (aluminum, carbon fiber, advanced alloys), bearing systems (sealed bearings, low-friction designs), hub engagement speed, thru-axle vs quick-release standards, weight vs durability trade-offs, and customization ( axle standard, disc or rim brakes, colors, finishes ).

Major players commanding significant market share include Shimano, SRAM, DT Swiss, Novatec, Hope Technology, Chris King, and other high-end brands. These core competitors differentiate through robust R&D, precision manufacturing, wide distribution, and brand reputation among cycling enthusiasts. Smaller and niche manufacturers compete by offering specialized or customizable hubs with premium materials, bespoke features, or superior after-sales support.

Regionally, Asia Pacific remains a strong production and consumption base, driven by growing cycling culture, e-bike adoption, and infrastructure growth. Europe, with established cycling tradition and premium demand, favors high performance and innovation, while the Americas combine both utility and performance segments. Pricing competition is significant in lower to mid-tier hubs, while high-margin areas focus on premium materials, lightweight design, and precision tolerances. Trends like thru-axle adoption, e-bike compatibility, and demand for lightweight, sealed and durable hubs are intensifying rivalry among brands.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.8 Billion |

| Product | Quick-release, Thru-axle, and Bolt-on Rear |

| Material | Aluminum, Steel, Carbon fiber, and Others |

| Bicycle | Mountain bikes, Road bikes, Hybrid bikes, and E-bikes |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Shimano, Chris King, DT Swiss, Formula, Hope Technology, Industry Nine, Novatec, Phil Wood, SRAM, White Industries, and Others |

| Additional Attributes | Dollar sales by type including quick-release, thru-axle, and bolt-on hubs, application across road bikes, mountain bikes, and electric bicycles, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising cycling popularity, demand for lightweight and durable components, and increasing adoption of e-bikes. |

The global bicycle front hub market is estimated to be valued at USD 0.8 billion in 2025.

The market size for the bicycle front hub market is projected to reach USD 1.1 billion by 2035.

The bicycle front hub market is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in bicycle front hub market are quick-release, thru-axle and bolt-on rear.

In terms of material, aluminum segment to command 52.8% share in the bicycle front hub market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bicycle Tire Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Components Aftermarket Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Crankset Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Drivetrain Cassette Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Frames Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bicycle Saddle Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Electronic Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Device Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Gear Shifter Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Brake Lever Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Bottom Bracket Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Rim Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Disc Brake Rotor Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Trip Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Mechanical Disc Brake Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Light Market Growth - Trends & Forecast 2025 to 2035

Bicycle Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bicycle Bags and Backpacks Market - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA