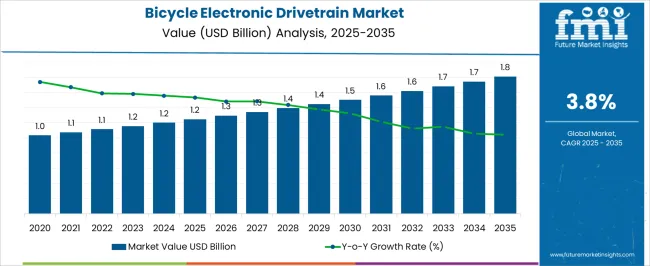

The bicycle electronic drivetrain market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 1.8 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

The incremental growth from 1.2 billion to 1.4 billion over the first five years reflects the increasing adoption of basic electronic shifting systems, which are primarily integrated into commuter and mid-range bicycles. These systems contribute a foundational share of the market due to their cost efficiency and ease of implementation, representing the entry-level technology segment within the broader drivetrain ecosystem. As the market progresses from 2030 to 2035, values rising from 1.5 billion to 1.8 billion indicate enhanced contributions from advanced drivetrain technologies, including multi-speed electronic shifting, wireless control systems, and integrated power-assist synchronization.

These high-end systems cater to performance-oriented bicycles and professional e-bike segments, offering superior precision, reliability, and customization. The shift in contribution composition highlights a transition where premium electronic drivetrain solutions begin to account for a larger portion of overall market value, signaling both technological maturity and evolving consumer demand for performance and convenience. The contribution analysis by technology reveals a market dominated initially by conventional electronic systems, progressively augmented by sophisticated solutions. This trend underscores the gradual technology-driven value shift and the strategic importance of innovation in capturing incremental market growth within the e-bike drivetrain sector.

| Metric | Value |

|---|---|

| Bicycle Electronic Drivetrain Market Estimated Value in (2025 E) | USD 1.2 billion |

| Bicycle Electronic Drivetrain Market Forecast Value in (2035 F) | USD 1.8 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The bicycle electronic drivetrain market represents a specialized segment within the global cycling and electric mobility industry, emphasizing precision shifting, energy efficiency, and performance optimization. Within the broader bicycle components sector, it accounts for about 4.5%, driven by demand from e-bikes, mountain bikes, and high-performance road bicycles. In the electric bicycles segment, its share is approximately 6.2%, reflecting adoption of integrated electronic shifting systems, battery-assisted drivetrains, and smart control interfaces.

Across the premium and performance bicycle market, it contributes around 3.8%, supporting smooth gear transitions, reduced maintenance, and enhanced riding experience. Within the sports and recreational cycling equipment category, it represents 4.1%, highlighting growing interest from enthusiasts and competitive riders. In the overall cycling technology and e-mobility ecosystem, the market contributes about 3.6%, emphasizing precision engineering, reliability, and integration with connected cycling solutions. Recent developments in the bicycle electronic drivetrain market have focused on system integration, smart control, and durability. Groundbreaking trends include wireless electronic shifting systems, regenerative braking integration, and connectivity with mobile apps for performance monitoring and route optimization.

Key players are collaborating with battery manufacturers, sensor providers, and software developers to enhance efficiency, responsiveness, and rider experience. Adoption of lightweight materials, corrosion-resistant components, and modular designs is gaining traction to reduce weight and improve maintenance. The innovations in AI-assisted gear adjustment and real-time diagnostics are enabling predictive maintenance and optimized performance. These advancements demonstrate how technology, connectivity, and precision engineering are shaping the market.

The bicycle electronic drivetrain market is experiencing accelerated growth, supported by advancements in cycling technology and the rising adoption of performance-oriented bicycles. The integration of electronic shifting systems has been driven by the demand for precise, reliable, and low-maintenance drivetrain solutions, which cater to both competitive and recreational riders. Global market dynamics are influenced by the expansion of premium cycling segments, improved battery efficiency, and the incorporation of wireless communication protocols.

Growing investments by manufacturers in lightweight materials and aerodynamic designs are further enhancing product adoption. Additionally, urban mobility trends and the popularity of endurance cycling events are sustaining consumer interest.

While the initial cost of electronic drivetrains remains a limiting factor in some regions, increasing economies of scale and aftermarket availability are expected to mitigate price constraints over time. Forecasts indicate sustained double-digit growth in the coming years, with continued uptake across road, gravel, and triathlon bikes, reinforcing the market’s position within the broader high-performance cycling equipment industry.

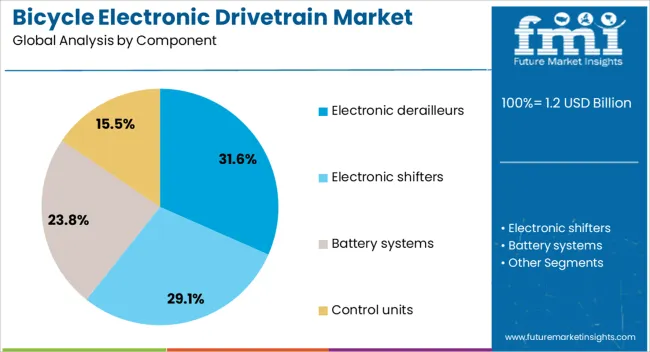

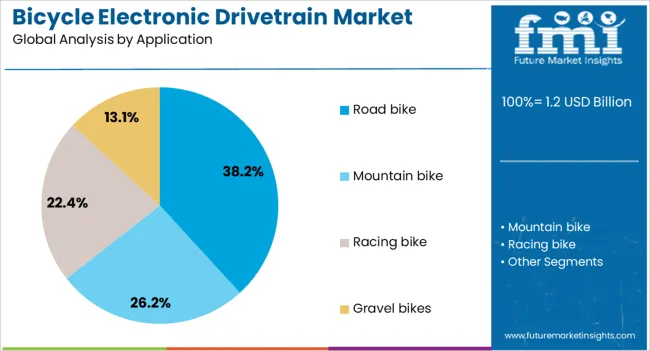

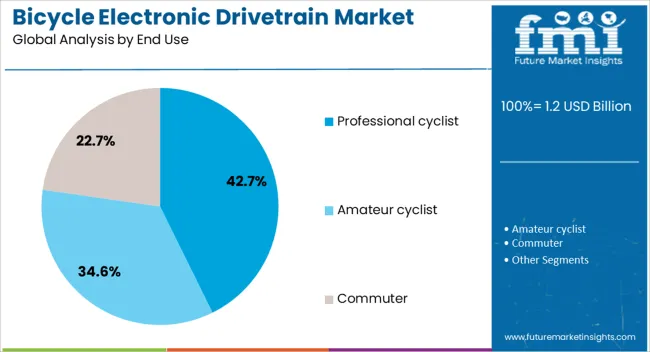

The bicycle electronic drivetrain market is segmented by component, application, end use, distribution channel, and geographic regions. By component, bicycle electronic drivetrain market is divided into electronic derailleurs, electronic shifters, battery systems, and control units. In terms of application, bicycle electronic drivetrain market is classified into road bike, mountain bike, racing bike, and gravel bikes. Based on end use, bicycle electronic drivetrain market is segmented into professional cyclist, amateur cyclist, and commuter. By distribution channel, bicycle electronic drivetrain market is segmented into OEM and aftermarket. Regionally, the bicycle electronic drivetrain industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Electronic derailleurs account for approximately 31.6% of the component share in the bicycle electronic drivetrain market, maintaining their lead due to their precision, rapid shifting capabilities, and minimal need for mechanical adjustments. Their popularity has been reinforced by the demand from competitive cyclists who value consistent performance under variable riding conditions.

The segment benefits from ongoing product innovation, including lighter construction, extended battery life, and enhanced integration with cycling computers for real-time data tracking. The adoption of wireless technology in electronic derailleurs has further streamlined installation and reduced maintenance complexities, appealing to both professional and high-end amateur riders.

Additionally, brand-led ecosystem integration encourages customer loyalty and repeat purchases. With sustained investment in R&D and growing acceptance in mid-range models, electronic derailleurs are projected to remain the dominant component choice, supported by their reliability, smooth operation, and compatibility with modern bike frames.

The road bike segment leads the application category with a 38.2% share, driven by the performance benefits of electronic drivetrains in competitive and endurance cycling disciplines. The precision shifting and reduced physical effort required by electronic systems align well with the demands of road cyclists, especially during high-speed racing and steep climbs.

This segment’s growth has been supported by the increasing penetration of electronic shifting into both professional racing teams and enthusiast-level bicycles. Advancements in aerodynamic frame integration and weight reduction have further complemented drivetrain efficiency, enhancing rider experience and performance outcomes.

The segment’s share is also bolstered by the expanding popularity of long-distance cycling events and tours, which encourage investment in reliable, low-maintenance gear systems. As manufacturers continue to refine product offerings for road bikes with wider gear ranges and faster shifting speeds, adoption is expected to deepen, ensuring the segment retains its leading position over the forecast horizon.

The professional cyclist segment dominates the end-use category, holding a 42.7% share in the bicycle electronic drivetrain market. This dominance is attributed to the critical role of performance optimization and marginal gains in competitive cycling, where precision shifting and dependable gear changes are essential for race outcomes. Professional cyclists are early adopters of advanced drivetrain technologies, often influencing broader consumer trends through high-visibility sponsorships and race performance.

The segment benefits from direct manufacturer support, including custom-tuned drivetrains, exclusive firmware updates, and seamless integration with performance monitoring tools. Increased investment by professional cycling teams in electronic drivetrains has set new standards for competitive equipment, further solidifying their market position.

Moreover, the proven reliability of electronic systems under extreme conditions enhances trust and long-term adoption. With ongoing technological advancements and the trickle-down effect into consumer segments, the professional cyclist category is expected to remain the primary driver of innovation and market influence in the coming years.

The market has been gaining traction across recreational, professional, and commuter cycling segments due to increasing demand for precision gear shifting, reduced maintenance, and enhanced rider experience. These systems, typically featuring electronic derailleurs, shifters, and battery packs, offer reliable and consistent performance under varied terrains and conditions. Growth has been supported by the rising popularity of e-bikes and competitive cycling, which demand lightweight, efficient, and electronically controlled drivetrains. Manufacturers have been investing in advanced technologies such as wireless communication, integrated sensors, and modular components to improve energy efficiency and durability.

The rapid expansion of e-bikes has been a significant driver for the bicycle electronic drivetrain market. Electrically assisted bicycles require electronic gear systems to manage power delivery, optimize battery efficiency, and provide smooth shifting under different riding conditions. Urban commuters and long-distance riders prefer electronic drivetrains due to their precise control, reduced mechanical wear, and lower maintenance requirements. Manufacturers have been integrating Bluetooth connectivity and sensor-based shifting to enhance user experience. The growing interest in health-conscious transportation and eco-friendly mobility has encouraged e-bike adoption. As e-bike sales continue to rise in Europe, North America, and Asia-Pacific, demand for reliable and high-performance electronic drivetrain systems has increased proportionally. Collaborations between drivetrain suppliers and bicycle manufacturers have strengthened supply chains, enabling broader market penetration across recreational and urban commuting segments.

Professional and competitive cycling events have fueled demand for high-precision electronic drivetrain systems. Road and mountain biking enthusiasts require fast, accurate, and consistent gear changes under challenging terrains and varying load conditions. Lightweight and modular electronic components, such as derailleurs, shifters, and controllers, have been developed to enhance performance while minimizing energy consumption. Cycling teams and individual athletes increasingly prefer electronic drivetrains due to improved efficiency, reduced fatigue, and precise tuning capabilities. Manufacturers have been leveraging advanced materials like carbon fiber and aluminum alloys to reduce system weight. The influence of professional cycling on recreational and amateur riders has amplified market adoption, as consumers seek similar performance standards in personal bicycles, thereby driving the broader integration of electronic drivetrain solutions across multiple cycling segments globally.

Technological advancements have been central to expanding the bicycle electronic drivetrain market. Wireless communication, integrated sensors, and real-time monitoring systems have improved gear-shifting accuracy, battery management, and system diagnostics. Lithium-ion battery integration allows longer range and consistent performance in electronic drivetrains. Modular design and customizable firmware enable users to adapt gear ratios and shifting response according to personal preferences. Moreover, predictive algorithms for load and cadence adjustments have been incorporated to optimize rider efficiency and component lifespan. Manufacturers are also focusing on corrosion-resistant materials and improved sealing to extend durability in wet or off-road conditions. These innovations have strengthened the market by offering reliable, user-friendly, and technologically advanced drivetrain solutions for both casual riders and professional cyclists.

Aftermarket availability and service support have been driving the adoption of bicycle electronic drivetrain systems. Repair, calibration, and upgrade services are critical for maintaining the performance and longevity of these electronic components. Authorized service centers and mobile technicians provide installation, diagnostics, and firmware updates, enhancing consumer confidence in electronic drivetrain reliability. The third-party component manufacturers and accessory providers have expanded product offerings, including batteries, sensors, and controllers compatible with multiple drivetrain systems. Training programs and digital platforms have been introduced to educate consumers and bike shop personnel on installation and maintenance practices. The increasing ecosystem of aftermarket support, combined with growing consumer awareness, has contributed to broader acceptance and adoption of electronic drivetrains across recreational, commuting, and competitive cycling markets.

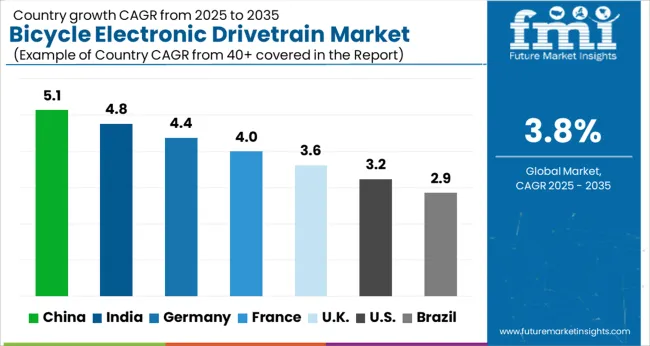

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

The market is expected to register a CAGR of 3.8% from 2025 to 2035, driven by increasing adoption of e-bikes and demand for precision gear systems. China leads with 5.1%, supported by large-scale bicycle manufacturing and growing urban mobility initiatives. India follows at 4.8%, where cycling infrastructure expansion and rising e-bike sales contribute to growth. Germany records 4.4%, backed by engineering expertise and advanced drivetrain technologies. The UK holds 3.6%, benefiting from increasing recreational cycling and commuter adoption. The USA registers 3.2%, where innovation in lightweight and high-efficiency systems is shaping the market. The adoption is influenced by efficiency, convenience, and integration with modern e-mobility solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

China recorded a 5.1% CAGR, driven by increasing adoption of e bikes, urban mobility programs, and cycling tourism initiatives. Manufacturers invested in high precision electronic drivetrain systems and integrated battery management solutions to meet demand from mid to high end e bikes. Domestic suppliers collaborated with global technology partners to introduce modular and customizable drivetrains suitable for city commuting, recreational, and competitive cycling. Demand was also influenced by smart bike initiatives incorporating IoT connectivity for performance tracking. Competitive strategies included rapid product development, regional assembly hubs, and strategic partnerships with bike brands to expand presence in both domestic and export markets. Energy efficiency, durability, and reliability were prioritized in all drivetrain innovations.

India demonstrated a 4.8% CAGR, supported by growth in urban cycling, fitness awareness, and e bike adoption. Domestic manufacturers and technology partners invested in lightweight electronic drivetrains, integrating battery management systems suitable for Indian road conditions. Demand from metropolitan areas and tourist destinations encouraged modular designs and low maintenance solutions. Partnerships with bicycle brands and e mobility startups were used to expand reach across both urban and semi urban markets. Competitive positioning was achieved through energy efficient drivetrains, localized after sales support, and promotional campaigns targeting cycling enthusiasts and first time e bike buyers. Government incentives for electric mobility indirectly stimulated the uptake of electronic drivetrain bicycles.

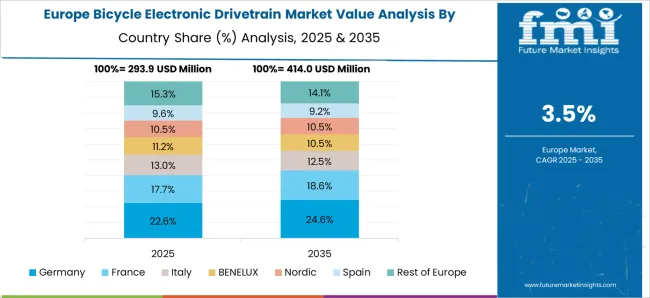

Germany advanced at a 4.4% CAGR, shaped by high e bike adoption, commuter cycling culture, and recreational riding trends. Manufacturers focused on high performance electronic drivetrains with precise gear shifting, integrated battery systems, and software enabled performance tracking. Demand was concentrated in metropolitan regions and tourist cycling corridors. Competitive strategies included partnerships with premium bicycle brands, integration of IoT enabled systems, and modular drivetrain options for mid to high end e bikes. Innovation focused on durability, energy efficiency, and low maintenance. German companies leveraged long term supply agreements and quality certifications to differentiate offerings, while export demand from neighboring European markets also influenced production and development priorities.

The United Kingdom progressed at a 3.6% CAGR, driven by urban cycling infrastructure expansion, commuter e bike adoption, and leisure cycling. Manufacturers focused on lightweight and reliable electronic drivetrains suitable for varied terrain and short to medium distance commuting. Partnerships with local bicycle retailers and e bike rental programs helped increase consumer trial and adoption. Competitive strategies emphasized battery management efficiency, low maintenance, and seamless integration with existing bike frames. Innovation in electronic shifting systems and regenerative braking enhanced user experience. After sales service and warranty programs played a key role in influencing buyer decisions, while e bike subscription models encouraged wider market acceptance.

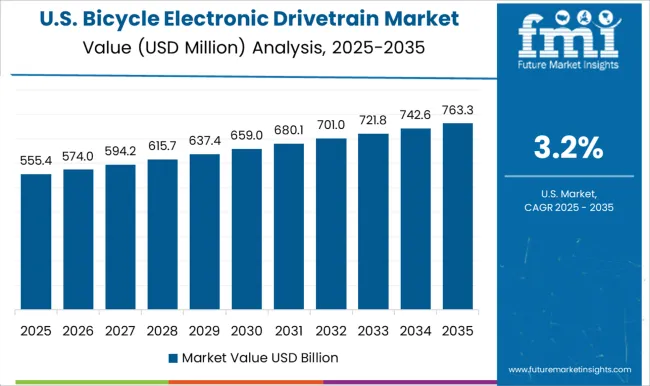

The United States expanded at a 3.2% CAGR, influenced by growing popularity of e bikes for urban commuting, recreation, and fitness. Manufacturers invested in high performance electronic drivetrains with precise shifting, battery monitoring, and durability suited for diverse terrain conditions. Demand was driven by metropolitan areas, cycling clubs, and recreational parks. Competitive strategies included collaboration with premium bike brands, modular system design for mid to high end e bikes, and integration of smart connectivity for performance tracking. Energy efficiency, longevity, and low maintenance were emphasized to appeal to tech savvy consumers. Regional assembly facilities and after sales networks were used to improve supply chain efficiency and service coverage.

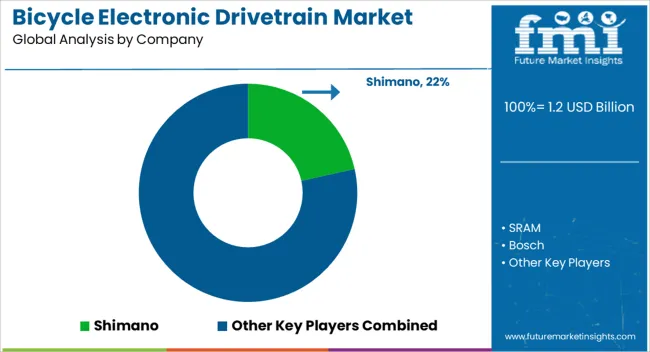

The market has been shaped by a mix of premium component manufacturers and innovative tech providers. Shimano, SRAM, and Bosch have focused on integrated electronic shifting systems, blending precision, reliability, and energy efficiency. Their strategies emphasize seamless connectivity with e bikes, long battery life, and durable components for professional and recreational cycling. Giant and Campagnolo have targeted performance oriented users, highlighting lightweight construction and responsive shifting. Bafang and Fazua GmbH have concentrated on modular electric drivetrain solutions, enabling flexible installation and compatibility across multiple bike platforms.

Smaller and regional players such as MAGURA, Rotor Bike Components, and TranzX have differentiated through customization and performance tuning. Product brochures display advanced electronic actuators, wireless interface options, and low maintenance systems. Focus is placed on smooth gear transitions, optimized torque sensors, and enhanced rider control. Shimano and Bosch emphasize compatibility with smart cycling apps, while SRAM and Campagnolo highlight racing oriented precision. Brochures project technical superiority and endurance under diverse riding conditions, aiming to appeal to both competitive cyclists and casual e bike users. Competition in the market revolves around innovation, energy efficiency, and user experience.

Bafang and Fazua promote lightweight and modular designs for urban and trekking e bikes. MAGURA and Rotor present high torque handling and precision control as key selling points. TranzX focuses on affordable performance for regional markets. Across the industry, brochures serve as a concise tool to communicate system reliability, ease of installation, and technological advantage, creating a landscape where product functionality, rider ergonomics, and electronic integration drive customer preference.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 billion |

| Component | Electronic derailleurs, Electronic shifters, Battery systems, and Control units |

| Application | Road bike, Mountain bike, Racing bike, and Gravel bikes |

| End Use | Professional cyclist, Amateur cyclist, and Commuter |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Shimano, SRAM, Bosch, Giant, Campagnolo, Bafang, MAGURA, Rotor Bike Components, TranzX, and Fazua GmbH |

| Additional Attributes | Dollar sales by drivetrain type and application, demand dynamics across commuter, mountain, and road e-bikes, regional trends in electric mobility adoption, innovation in motor efficiency, gear integration, and lightweight design, environmental impact of battery and electronic component production, and emerging use cases in urban mobility, cargo e-bikes, and connected bicycle systems. |

The global bicycle electronic drivetrain market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the bicycle electronic drivetrain market is projected to reach USD 1.8 billion by 2035.

The bicycle electronic drivetrain market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in bicycle electronic drivetrain market are electronic derailleurs, electronic shifters, battery systems and control units.

In terms of application, road bike segment to command 38.2% share in the bicycle electronic drivetrain market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA