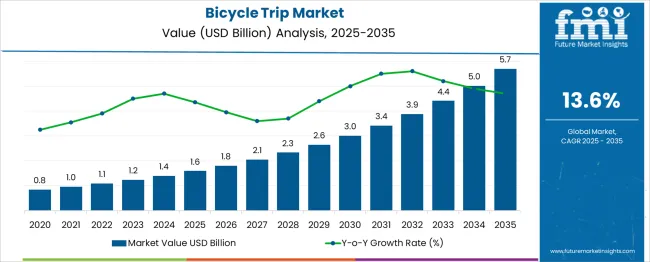

The bicycle trip market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 5.7 billion by 2035, registering a compound annual growth rate (CAGR) of 13.6% over the forecast period. This expansion reflects a strong growth multiplier of 3.56x, supported by a CAGR of 13.6%, driven by the rising popularity of adventure tourism, eco-friendly travel, and health-focused recreational activities. During the first five-year phase (2025–2030), the market is expected to reach USD 3.0 billion, adding USD 1.4 billion, which accounts for 34% of the total incremental growth, supported by increasing participation in organized cycling tours and growth in cycling infrastructure.

The second half (2030–2035) will contribute USD 2.7 billion, representing 66% of incremental growth, indicating an accelerated adoption pattern driven by digital booking platforms, bike-sharing initiatives, and cycling-focused travel experiences. Annual increments rise from USD 0.3 billion in early years to USD 0.6 billion toward 2035, showcasing significant momentum as urban and rural cycling routes expand globally. Companies leveraging customized packages, wellness-centric itineraries, and partnerships with hospitality and mobility service providers will be best positioned to capture value in this USD 4.1 billion growth opportunity, particularly across Asia-Pacific and European markets where cycling tourism is rapidly scaling.

| Metric | Value |

|---|---|

| Bicycle Trip Market Estimated Value in (2025 E) | USD 1.6 billion |

| Bicycle Trip Market Forecast Value in (2035 F) | USD 5.7 billion |

| Forecast CAGR (2025 to 2035) | 13.6% |

The bicycle trip market holds an emerging yet growing share across several travel and recreation-related sectors. In the cycling tourism market, its share is dominant at approximately 40–45%, as bicycle trips form the core offering of this category. Within the adventure and outdoor recreation market, it accounts for about 6–7%, since hiking, trekking, and water sports constitute larger portions. In the sports and fitness travel market, the share is around 8–10%, driven by rising interest in active holidays and health-oriented tourism. For the eco-tourism and sustainable travel market, bicycle trips contribute nearly 5–6%, as they align well with low-impact, environmentally friendly travel practices.

In the leisure and recreational travel market, its share stands at 3–4%, as beach vacations, city tours, and cultural trips dominate this segment. Growth is supported by increasing consumer preference for wellness travel, urban cycling experiences, and countryside exploration. Governments and tour operators are investing in dedicated cycling infrastructure, guided tours, and rental services to attract tourists. Additionally, e-bikes are making long-distance cycling more accessible, expanding market appeal. As sustainability and health-conscious travel trends accelerate globally, the bicycle trip market is expected to capture a larger share in these parent markets, establishing itself as a major segment of active tourism.

The post-pandemic shift toward outdoor and solo activities has intensified demand for independent, self-paced travel formats. Bicycle trips have emerged as a compelling alternative due to their alignment with eco-conscious values and the flexibility they offer across terrains and timeframes.

Technological improvements in GPS navigation, mobile route planning, and gear portability have further lowered barriers to entry for cyclists of varying experience levels. Urban infrastructure investments and government incentives promoting active mobility have laid the groundwork for expanded participation, particularly among younger demographics.

The market is also benefiting from social media exposure and a broader societal shift toward experiences over material consumption. With travelers seeking authentic and health-driven leisure options, the outlook for the Bicycle Trip market remains optimistic, supported by continued innovation in cycling equipment, accommodation models, and tour customization tools..

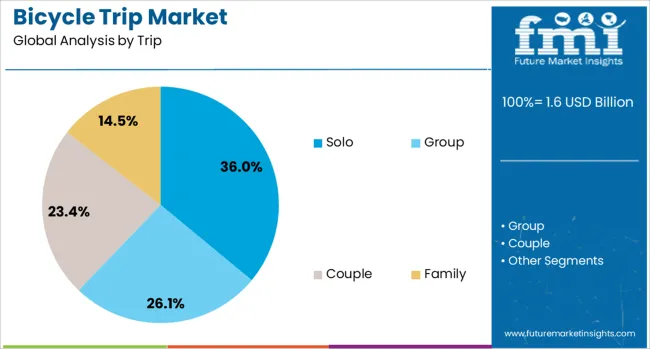

The bicycle trip market is segmented by trip, duration, purpose, age group, location, and geographic regions. By type of bicycle, the market is divided into Solo, Group, Couple, and Family. In terms of the duration of the bicycle trip, the market is classified into single-day and multi-day. Based on the purpose of the bicycle trip, the market is segmented into Sightseeing and cultural exploration, Eco-tourism, Health and wellness, Adventure and thrill, and Educational and historical tours. The bicycle trip market is segmented by age group into 18-30 years, 31-50 years, and above 50 years. Based on the location of the bicycle trip, the market is segmented into Urban, Rural, and Mixed terrain. Regionally, the bicycle trip industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solo trip segment is projected to hold 36% of the Bicycle Trip market revenue share in 2025, positioning it as the dominant trip type. This trend has been shaped by a growing preference for autonomy, self-reflection, and personalized exploration among travelers. The solo cycling experience allows individuals to craft flexible itineraries without dependency on group consensus, thereby enhancing the sense of freedom and self-determination.

This format has also gained traction due to rising awareness of mental wellness, where solo trips are perceived as therapeutic and enriching. With safety enhancements, real-time navigation tools, and widespread access to support networks, solo cyclists are increasingly empowered to venture longer distances with confidence.

The segment has also been propelled by the cultural shift toward individualistic experiences and the desire to disconnect from routine pressures. As the value placed on introspective and independent travel continues to rise, solo bicycle trips are expected to maintain a leadership position within the broader market..

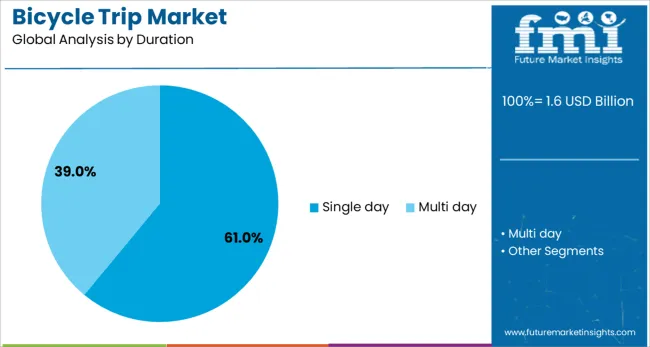

The single-day duration segment is anticipated to account for 61% of the Bicycle Trip market revenue share in 2025, making it the most preferred trip duration. This dominance is supported by the practicality and accessibility offered by short-duration cycling experiences, especially for urban and semi-urban populations. Single-day trips provide an efficient balance between recreational value and time commitment, enabling participants to enjoy physical activity, scenery, and exploration without requiring overnight arrangements.

The popularity of this segment has also been reinforced by its compatibility with work-life schedules, particularly among professionals and students seeking meaningful but time-efficient escapes. Increased development of local cycling circuits, greenways, and community-organized routes has further enhanced the viability of single day excursions.

Additionally, affordability and reduced logistical planning have contributed to the strong adoption of this format. As urban mobility and micro-tourism initiatives continue to evolve, the single day duration segment is expected to retain its position as the most practical and widely adopted format within the market..

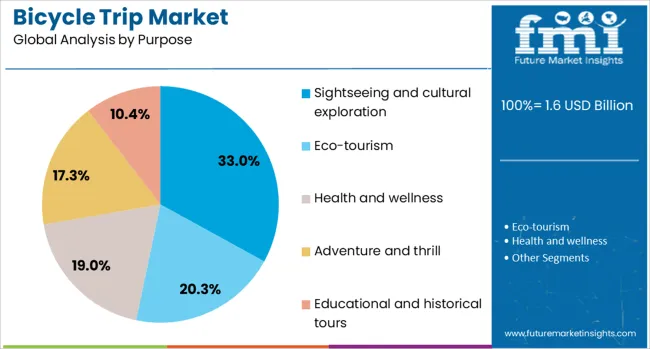

The segment for sightseeing and cultural exploration is expected to contribute 33% of the Bicycle Trip market revenue share in 2025, emerging as the primary motivation for travel. This segment has been propelled by the rising desire to engage deeply with local heritage, landmarks, and traditions in an environmentally responsible manner. Travelers have increasingly prioritized meaningful experiences that offer cultural enrichment alongside physical activity.

Bicycle travel enables intimate access to lesser-known attractions, historical sites, and cultural events that may not be accessible by conventional transport. The flexibility to explore off-the-beaten-path routes has enhanced the appeal of this purpose segment among experience-driven tourists.

Moreover, destination marketers and local tourism bodies have been actively promoting cultural cycling tours as part of heritage conservation and sustainable tourism strategies. The growing demand for interactive and educational travel formats continues to drive the relevance of sightseeing and cultural exploration, solidifying its role as a key purpose behind the decision to undertake bicycle trips..

Growth is fueled by increasing participation in organized cycling tours and city-based rental programs. Opportunities are evident in e-bike rentals, premium touring services, and app-based trip planning platforms. Trends point to group travel packages, themed cycling events, and integrated GPS-based safety features. However, adoption faces restraints from inadequate cycling infrastructure, unpredictable weather conditions, and limited storage in high-density cities. Overall, the outlook shows steady progress driven by experiential travel and active lifestyle trends.

The major growth driver is the increasing interest in outdoor recreational activities and fitness-oriented travel. In 2024 and 2025, cycling trips across scenic destinations and heritage routes gained traction, supported by organized operators offering guided packages. Metropolitan regions witnessed a rise in bike-sharing schemes and leisure rides for short-distance mobility. Events such as cycling marathons and themed expeditions further boosted participation among enthusiasts. This demand trajectory indicates that experiential travel and recreational fitness continue to shape market dynamics, making cycling trips a preferred option for both domestic and international travelers.

Significant opportunities are arising from the integration of e-bikes into organized trips and high-value tour packages. In 2025, tour operators in Europe and North America launched electric bike-assisted tours to cater to diverse age groups and improve accessibility for long routes. Premium offerings combining luxury accommodations with multi-day cycling trails gained popularity among affluent travelers seeking curated experiences. Partnerships between bike rental firms and travel platforms expanded the availability of customized itineraries. These developments show that e-bike adoption and experiential tourism formats will remain strong levers for revenue generation in the bicycle trip sector.

Emerging trends highlight the rise of group-based cycling experiences and technology integration for convenience and safety. In 2024, cycling tours combined with cultural events and culinary trails became popular across Europe and Asia-Pacific. Mobile applications offering real-time navigation, trip planning, and emergency assistance features were introduced to improve user engagement. Corporate wellness initiatives also encouraged team cycling programs as part of incentive travel. These patterns underscore a shift toward socially engaging and digitally enhanced experiences that make bicycle trips more appealing to both adventure seekers and urban commuters.

Infrastructure inadequacies and seasonal limitations influence market restraints. In 2024 and 2025, several regions reported lower adoption rates due to a lack of dedicated cycling lanes and insufficient rest-stop facilities on long-distance routes. Harsh weather conditions in certain geographies also disrupted scheduled trips, reducing operator revenues. Limited secure storage and high accident risks in congested cities further deterred participation in urban cycling programs. These barriers emphasize the need for improved infrastructure planning, safety measures, and climate-resilient operational strategies to ensure consistent market growth across diverse environments.

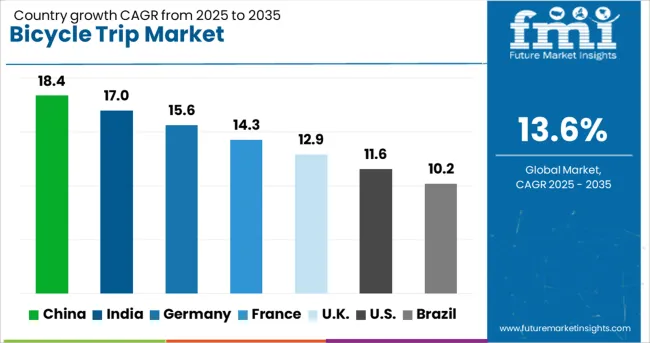

| Country | CAGR |

|---|---|

| China | 18.4% |

| India | 17.0% |

| Germany | 15.6% |

| France | 14.3% |

| UK | 12.9% |

| USA | 11.6% |

| Brazil | 10.2% |

The global bicycle trip market is projected to grow at 13.6% CAGR between 2025 and 2035. China leads with 18.4% CAGR, driven by large-scale investments in cycling infrastructure and integration of bike-sharing programs in urban mobility plans. India follows at 17.0%, supported by fitness-oriented commuting trends, eco-tourism, and strong government initiatives for non-motorized transport. France posts 14.3% CAGR, reflecting demand for leisure cycling and robust cycling infrastructure backed by tourism programs. The UK grows at 12.9%, while the United States records 11.6%, highlighting steady growth in bike tourism and recreational cycling. Asia-Pacific dominates due to sustainability-driven urban mobility projects, while Western markets focus on premium cycling experiences and smart bike-sharing ecosystems.

China leads global growth with an anticipated 18.4% CAGR, supported by aggressive expansion of bike-sharing platforms and government initiatives for green transportation. Urban mobility programs prioritize cycling as a sustainable commuting option, integrating bicycle lanes and smart docking stations in metropolitan areas. Rising interest in fitness and health drives recreational cycling, supported by mobile app-based trip planning and rental services. Local bike-sharing giants continue to invest in electric-assist bicycles to improve last-mile connectivity, while tourism authorities promote cycling routes in scenic destinations, strengthening the leisure segment.

The bicycle trip market in India is expected to grow at 17.0% CAGR, fueled by increasing fitness awareness, expanding tourism infrastructure, and eco-friendly commuting solutions. Smart city projects incorporate bicycle-sharing systems to reduce congestion and pollution in urban areas. Adventure tourism and rural cycling trails are gaining popularity, supported by state-level initiatives promoting cycling festivals and events. Domestic bike manufacturers collaborate with technology firms to develop GPS-enabled bicycles for guided cycling experiences. Rising demand for electric bicycles in metro cities further accelerates growth in urban trip segments.

France posts a 14.3% CAGR, underpinned by strong cycling culture, government incentives, and well-developed cycling routes. The country’s tourism sector actively promotes cycling holidays, supported by scenic trails across wine regions and coastal routes. Bike rental services and cycling tour packages dominate demand in leisure and travel segments. Digital integration through mobile apps enhances user convenience for route mapping and real-time booking. Premium cycling experiences, including guided tours and high-performance bikes, appeal to international tourists and domestic riders seeking luxury travel options.

The United Kingdom market is forecasted to expand at 12.9% CAGR, supported by growing investments in cycling infrastructure and active travel policies. Urban mobility strategies promote cycling as a key element of sustainable transport, encouraging daily commuting and short-distance travel. Bike-sharing programs, supported by mobile payment and app-based reservations, are gaining traction in metropolitan areas. Leisure cycling in countryside regions and along coastal paths continues to attract tourism-focused demand. Sustainability-conscious consumers increasingly prefer e-bikes for enhanced convenience and reduced travel time on hilly terrains.

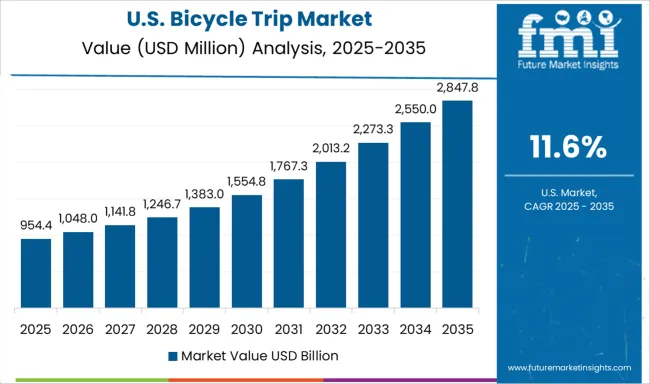

The United States market is projected to grow at 11.6% CAGR, reflecting strong adoption of cycling for recreation, fitness, and eco-tourism. Expansion of biking trails and urban greenways under federal and state programs fuels leisure cycling trips. Bike rental services and app-based tour planning platforms enhance accessibility for tourists and casual riders. Rising interest in wellness and outdoor activities boosts premium cycling experiences, including guided tours and adventure rides. Manufacturers and service providers are investing in electric-assist bike fleets to attract urban commuters and adventure cyclists seeking long-distance performance.

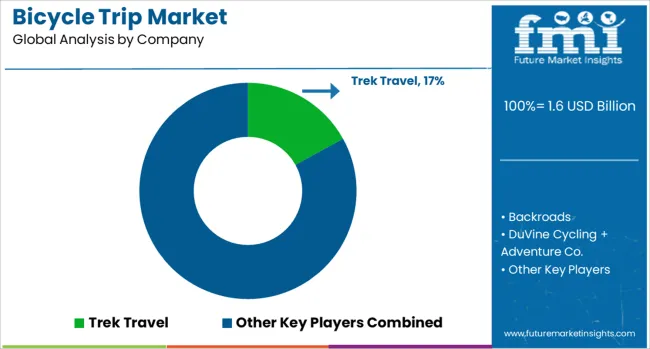

The bicycle trip market is moderately consolidated, with Trek Travel recognized as a leading player due to its extensive portfolio of premium cycling tours, personalized itineraries, and strong global presence. The company focuses on providing high-end experiences with luxury accommodations, expert guides, and top-quality bikes, making it a preferred choice among adventure travelers. Key players include Backroads, DuVine Cycling + Adventure Co., SpiceRoads Cycling, and Butterfield & Robinson. These companies specialize in curated cycling trips across scenic destinations worldwide, catering to diverse segments such as leisure riders, fitness enthusiasts, and luxury travelers. Their offerings often combine cycling with cultural experiences, gourmet dining, and local exploration to enhance customer value.

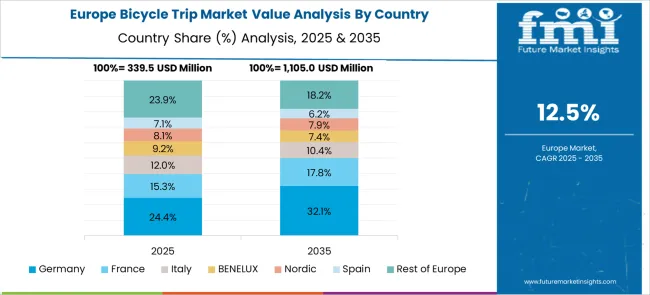

Market growth is driven by increasing interest in active travel, growing demand for experiential tourism, and rising health-conscious lifestyle trends. Leading operators are investing in customizable packages, e-bike options for broader accessibility, and sustainable travel practices to attract eco-conscious travelers. Emerging trends include technology integration for route planning and real-time support, small-group private tours for personalized experiences, and themed trips focusing on gastronomy, wine, and wellness. North America and Europe dominate the market due to established cycling infrastructure and high adoption of adventure tourism, while Asia-Pacific shows promising growth fueled by scenic cycling routes and emerging interest in active holidays.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Trip | Solo, Group, Couple, and Family |

| Duration | Single day and Multi day |

| Purpose | Sightseeing and cultural exploration, Eco-tourism, Health and wellness, Adventure and thrill, and Educational and historical tours |

| Age Group | 18-30 yrs, 31-50 yrs, and Above 50 yrs |

| Location | Urban, Rural, and Mixed terrain |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Trek Travel, Backroads, DuVine Cycling + Adventure Co., SpiceRoads Cycling, and Butterfield & Robinson |

| Additional Attributes | Dollar sales by tour type (solo, couple, group/family) and duration (day vs multi-day). Market size ~USD 1.36 B in 2024, forecasted to hit ~USD 2.99 B by 2030 at ~14.5% CAGR. Europe holds 38–45% share; Asia-Pacific fastest-growing. Buyers prioritize scenic routes, e-bike rentals, guided cultural itineraries, and personalized experience packages. |

The global bicycle trip market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the bicycle trip market is projected to reach USD 5.7 billion by 2035.

The bicycle trip market is expected to grow at a 13.6% CAGR between 2025 and 2035.

The key product types in bicycle trip market are solo, group, couple and family.

In terms of duration, single day segment to command 61.0% share in the bicycle trip market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bicycle Tire Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Components Aftermarket Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Crankset Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Drivetrain Cassette Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Frames Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bicycle Saddle Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Electronic Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Device Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Gear Shifter Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Brake Lever Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Bottom Bracket Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Front Hub Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Rim Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Disc Brake Rotor Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Mechanical Disc Brake Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Light Market Growth - Trends & Forecast 2025 to 2035

Bicycle Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bicycle Bags and Backpacks Market - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA