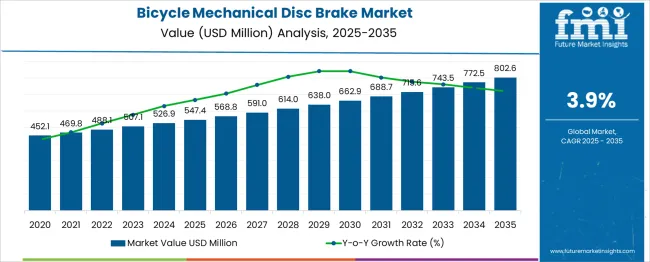

The Bicycle Mechanical Disc Brake Market is estimated to be valued at USD 547.4 million in 2025 and is projected to reach USD 802.6 million by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

The value expansion underscores a stable demand trajectory, particularly supported by the growth of mid-range commuter and recreational bicycle segments across both developed and emerging economies.

Between 2025 and 2030, the market is anticipated to cross USD 662.8 million, yielding a five-year absolute gain of USD 115.4 million, or approximately 45% of the total value increase forecast through 2035. Mechanical disc brakes remain favored in the mass-market category for their cost-efficiency, lower maintenance complexity, and compatibility with a wide range of bicycle frames.

The absolute dollar opportunity is largely fueled by sustained urban cycling adoption, rising demand for utility and hybrid bikes, and public infrastructure investments in cycling-friendly transport systems. While hydraulic systems dominate the performance segment, mechanical variants continue to command volume share, especially in Asia-Pacific and Latin America. As unit sales increase, incremental gains are also expected through modest price improvements driven by material upgrades such as stainless steel rotors and sealed cabling, contributing to steady value creation.

| Metric | Value |

|---|---|

| Bicycle Mechanical Disc Brake Market Estimated Value in (2025 E) | USD 547.4 million |

| Bicycle Mechanical Disc Brake Market Forecast Value in (2035 F) | USD 802.6 million |

| Forecast CAGR (2025 to 2035) | 3.9% |

In the Bicycle Mechanical Disc Brake market, manufacturers compete by targeting performance optimization, cost-efficiency, and OEM integration. A key strategy involves engineering brake systems that deliver consistent stopping power under variable conditions, with key performance metrics such as braking force over 2,000 N and heat tolerance up to 400°C without significant fade. Manufacturers aim to reduce lever effort while maintaining modulation precision features valued in both entry-level and mid-tier bikes. Pricing is critical; mechanical disc brakes typically cost 30–50% less than hydraulic systems, making them ideal for mass-market bicycles. Leading players differentiate through modular designs that simplify installation and maintenance, reducing assembly times for OEMs by up to 20%. Durability also plays a role, with rotor and pad materials optimized for wear resistance over 10,000+ braking cycles.

To capture volume, manufacturers establish partnerships with bicycle brands, often becoming preferred suppliers for specific models or categories such as MTB, gravel, or commuter bikes. Global sourcing and lean manufacturing practices are employed to maintain margins in a highly cost-sensitive market. Additionally, adapting to regional standards (e.g., ISO 4210 compliance) allows broader market access. Overall, winning strategies focus on balancing performance, affordability, and seamless integration into OEM supply chains.

The bicycle mechanical disc brake market is experiencing robust growth, propelled by the rising demand for precision braking and rider safety across recreational and competitive cycling segments. Mechanical disc brakes have gained popularity due to their consistent performance under varying terrain and weather conditions. Unlike traditional rim brakes, these systems allow better heat dissipation and enhanced control during high-speed descents, making them ideal for modern cycling environments.

The global emphasis on fitness, outdoor sports, and eco-friendly commuting is expanding the bicycle user base, particularly in urban and trail-focused regions. The increasing presence of cycling events, coupled with the rise in premium bicycle sales, has created a fertile landscape for advanced braking systems.

Continuous product innovation in lightweight calipers, rotors, and brake pads, along with manufacturer emphasis on durability and low maintenance, is further supporting adoption. As consumer preferences lean toward precision and modularity in bicycle components, mechanical disc brakes are expected to remain integral to the broader evolution of performance bicycles.

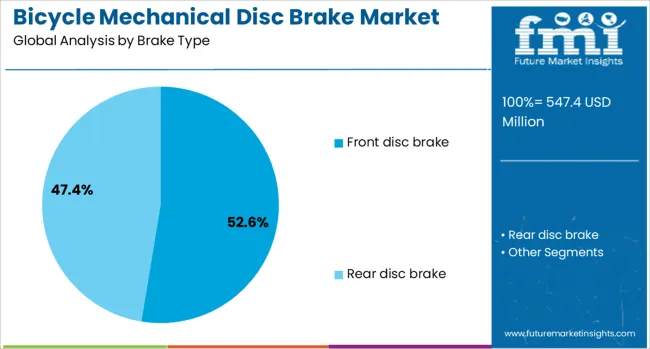

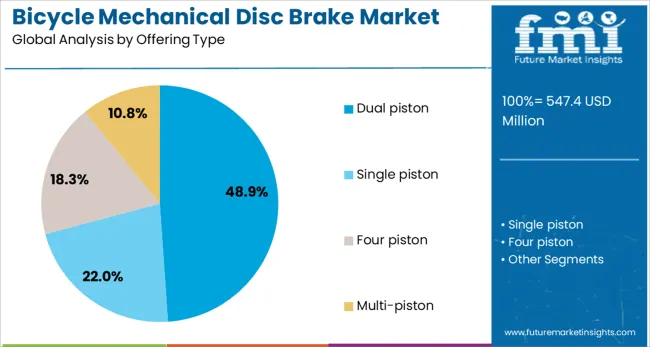

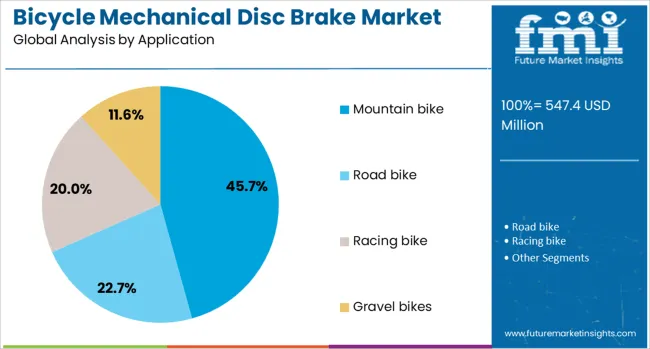

The bicycle mechanical disc brake market is segmented by brake type, offering type, application, distribution channel, and geographic regions. By brake type, the mechanical disc brake market is divided into Front disc brake and Rear disc brake. In terms of offering types, the bicycle mechanical disc brake market is classified into Dual piston, Single piston, four piston, and Multi-piston. Based on the application of the bicycle mechanical disc brake, the market is segmented into Mountain bikes, Road bikes, Racing bikes, and Gravel bikes.

The distribution channel of the bicycle mechanical disc brake market is segmented into OEM and Aftermarket. Regionally, the bicycle mechanical disc brake industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The front disc brake segment is projected to hold 52.6% of the total revenue share in the bicycle mechanical disc brake market in 2025, establishing itself as the most preferred brake type. The segment’s leadership is attributed to its critical role in managing momentum and delivering primary braking force during high-speed stops.

Mechanical disc systems designed for front wheel application are favored for their efficiency in distributing pressure evenly while minimizing wheel lock and slippage. The growing popularity of rugged terrain cycling and commuter bikes with high load-bearing capabilities has driven increased reliance on front braking control.

Manufacturers have also optimized the geometry and caliper design of front disc brakes to support customizable torque application and improved rotor clearance, enhancing rider confidence during descents and sharp turns. Additionally, improved cable routing systems and frame compatibility have streamlined installation across various bicycle models, solidifying the front disc brake's dominance in this evolving market.

The dual piston segment is anticipated to represent 48.9% of the bicycle mechanical disc brake market revenue share in 2025, underlining its growing prominence among advanced braking configurations. The adoption of dual piston setups has been driven by their ability to apply symmetrical braking force on both sides of the rotor, resulting in enhanced stopping power and reduced wear on brake pads.

This configuration has been increasingly incorporated into mid to high-end bicycles, where performance and safety standards are prioritized. Riders seeking consistent braking modulation across different surfaces have shown strong preference for dual piston calipers due to their responsiveness and improved lever feel.

Mechanical disc brake systems with dual piston mechanisms have also benefited from design improvements that support low-profile mounting and reduced weight, without compromising durability. These features have made them well suited for cyclists demanding precision control and balanced force distribution, particularly in technical riding conditions and endurance cycling formats.

The mountain bike segment is expected to account for 45.7% of the overall revenue share in the bicycle mechanical disc brake market in 2025, making it the largest application segment. This growth is being driven by the essential role of mechanical disc brakes in navigating steep descents, unpredictable terrain, and variable surface traction typical of mountain biking.

Mechanical systems have been favored in this segment due to their lower maintenance requirements, mechanical simplicity, and field-serviceable nature, especially in remote or off-road conditions. As participation in mountain biking continues to rise globally, especially across adventure tourism and recreational sports sectors, the demand for reliable and responsive braking has intensified.

Manufacturers are integrating mechanical disc brake systems with advanced rotor profiles, heat-resistant materials, and trail-optimized calipers to meet these demands. The consistent upgrade cycles within the mountain bike community and the growing consumer preference for durable, modifiable components have further reinforced the segment's dominance in this market.

Growing urban mobility trends and performance expectations are expanding adoption of mechanical disc brakes across commuter and adventure bicycles. Riders seek reliable stopping power in wet or gritty conditions without hydraulic system complexity, making mechanically actuated disc systems increasingly popular.

Mechanical disc brake systems are gaining traction among bicycles used for city commuting, touring, and off‑road cycling due to their consistent brake performance in rain, mud, or dust. Riders benefit from strong stopping capability with minimal contamination influence, and simple cable actuation avoids issues of fluid leaks. Adjustment and pad replacement can be handled with basic tools—this reduces professional servicing costs and downtime. Suitable for entry‑level and mid‑range bikes, these brakes deliver reliable function without hydraulic pressure sensitivity. As cycling infrastructure expands in many cities, demand for dependable, easy‑to‑service braking solutions is rising among rental bike fleets, bicycle couriers, and variety‑led commuter classes.

Manufacturers are offering upgrade kits with longer‑lasting pads, reinforced lever assemblies, and tool‑free adjustment mechanisms to appeal to cycling enthusiasts and urban commuters alike. Collaboration with bicycle repair shops and mobile service networks enables accessible pad swaps, cable replacements and tune‑ups of mechanical disc systems. Component suppliers are establishing local assembly hubs near urban clusters to bundle brakes with frames or wheels, cutting lead time and improving fitment accuracy. Subscription packages for replacement wear parts and performance tuning help build long‑term user relationships. Partnership with commuter bike rental platforms and bike‑city programs supports product trials and brand visibility. These modular and locally deployed service strategies help mechanical disc brakes reach broader rider segments and simplify adoption in both retail and shared bicycle ecosystems.

Mechanical disc brakes rely on cable actuation, which provides less modulation and stopping power compared to hydraulic systems. Riders often report the need for regular cable tension adjustments and lever re-centering, especially in high-use segments like e‑bikes or hilly terrain. Feedback from experienced cyclists highlights that these systems lose responsiveness in wet or muddy conditions and require frequent maintenance, sometimes weekly prong adjustment under heavy use. For riders exceeding average body weight or carrying load, single-piston mechanical calipers often fail to maintain stable braking performance. As a result, consumer confidence drops and many upgrade to hydraulic components. These performance limitations undermine adoption in performance cycling segments and reduce user satisfaction in mixed riding conditions.

Mechanical disc brakes continue to dominate the OEM and aftermarket segments due to their simplicity and lower integration costs. Bicycle manufacturers that prioritize cost efficiency and component modularity favor cable brakes for commuter, hybrid, and entry-level mountain bikes. Reports show OEM channels contribute approximately 60 to 70% of total unit shipments, while aftermarket users seeking easy field-serviceable systems drive the rest. This distribution balance supports steady revenue and broad availability. Aftermarket upgrades, including higher-quality calipers or premium cables, yield higher profit margins compared to OEM contracts. Brands that offer upgrade kits along with instructional support for installation maintain strong customer loyalty. This dual-channel structure ensures mechanical disc systems remain viable for cost-sensitive and service-focused cyclists.

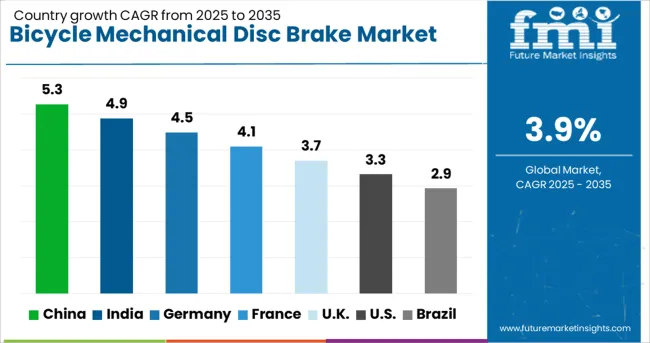

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

China, representing the BRICS group, is forecasted to grow at a 5.3% CAGR from 2025 to 2035, backed by large-scale bicycle component manufacturing hubs and rising global exports of mid-range and entry-level bikes. India follows at 4.9%, where disc brake usage is expanding across urban commuter segments and local assembly units in tier-2 and tier-3 cities. Among OECD countries, Germany is expected to grow at 4.5%, supported by the incorporation of mechanical disc brakes in hybrid, trekking, and budget e-bikes across local and export markets. France, growing at 4.1%, sees steady demand from cycling tourism zones and domestic brands targeting recreational cyclists. The United Kingdom, with a CAGR of 3.7%, shows consistent sales through online retailers and independent bicycle dealers, especially in cities with expanding cycle-to-work programs. The report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The mechanical disc brake market in China is growing at a CAGR of 5.3 %, fueled by increasing demand for affordable and durable braking solutions in both recreational and commuter bicycles. Shift to city living and growing e-bike sales are influencing product development focused on high braking efficiency and minimal maintenance. Domestic manufacturers are introducing adjustable caliper systems and high-precision rotors to meet the needs of performance and entry-level riders. Local cycling infrastructure improvements and fitness trends are boosting consumer interest. Online retailers are enhancing product visibility by offering bundled kits and installation tools. Compatibility with a broad range of bicycles is encouraging upgrades from traditional rim brakes. Mass production and supply chain advantages allow competitive pricing across regions. With strong domestic consumption and growing exports to neighboring countries, China remains a key contributor to the global mechanical disc brake market.

India is witnessing a 4.9 % CAGR in the bicycle mechanical disc brake market, driven by increased adoption of geared and performance bikes across urban and semi-urban areas. Rising awareness of road safety and interest in fitness cycling are pushing demand for reliable braking systems. Domestic brands are launching disc brake models compatible with commuter and budget bicycles, aiming for wide accessibility. Government support for green mobility and improved cycling infrastructure is also contributing to sales. Mechanical disc brakes are gaining popularity over rim brakes due to better all-weather performance and minimal service requirements. E-commerce platforms are enabling direct-to-consumer sales, expanding reach to tier-two and tier-three cities. Affordable aftermarket kits with simple mounting mechanisms are attracting hobbyists and students. The growing popularity of cycling events and tours is reinforcing the shift toward disc-based braking systems.

In Germany, the bicycle mechanical disc brake market is growing at 4.5 % CAGR, driven by increasing interest in sustainable transportation and precision engineering. Disc brakes are preferred for their consistent stopping power, especially in all-weather commuting and touring. German manufacturers are focusing on lightweight, low-noise braking components using advanced alloys and machine-cut rotors. Environmental concerns and urban bike-sharing programs are also promoting disc brake-equipped cycles. Consumers are willing to invest in higher-performance brake systems for safety and long-term durability. DIY bike maintenance culture is strong, boosting demand for modular brake kits. Compatibility with e-bikes and gravel bikes is further expanding the customer base. Retailers are promoting brake upgrades as essential safety enhancements for long-distance and daily use. Continuous product development ensures compliance with EU cycling safety regulations while catering to both recreational and professional riders.

The mechanical disc brake market in France is registering a 4.1 % CAGR as consumers prioritize cycling safety, especially in urban areas and hilly terrains. Local manufacturers are enhancing product performance by using weather-resistant materials and ergonomic lever designs. There is a notable rise in bicycle use for commuting, fitness, and tourism, all of which benefit from improved braking systems. Public bike-sharing initiatives are incorporating disc brakes into their fleets for better control and rider confidence. French consumers appreciate mechanical disc brakes for their simplicity, low maintenance, and effectiveness across terrains. Sales channels are expanding through bicycle service shops and online stores offering French-language support. Lightweight construction and tool-free adjustability are among key product features being emphasized. Government subsidies on green mobility continue to indirectly support the growth of disc-equipped bikes.

The United Kingdom bicycle mechanical disc brake market is advancing at a CAGR of 3.7 %, supported by growing bike commuting and leisure cycling culture. With a focus on safety, mechanical disc brakes are being adopted in entry-level mountain bikes, folding bikes, and cargo cycles. Retailers are offering upgrade kits and services to convert traditional rim-brake bikes. Product development emphasizes corrosion resistance and reduced weight, meeting demands of both daily users and adventure cyclists. Urban congestion and fuel costs are encouraging the use of bicycles, further promoting disc brake installations. Online platforms provide access to global brands and parts, supporting consumer interest in DIY upgrades. Disc brakes are increasingly present in rental and shared bike fleets due to their durability. Innovations in caliper design and brake pad materials are contributing to quieter operation and enhanced control.

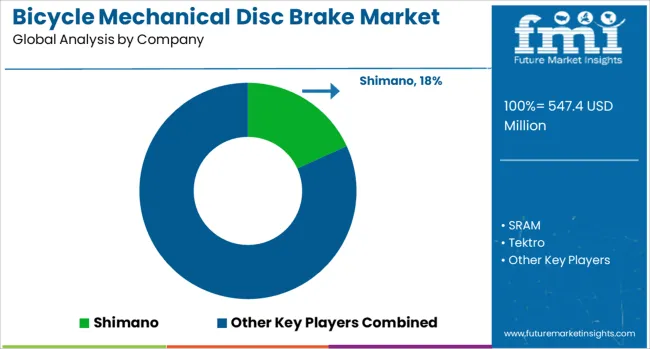

The bicycle mechanical disc brake market is composed of a diverse range of manufacturers, from global component giants to niche specialists, segmented into Tier 1 and Tier 2 suppliers. Shimano stands out as the dominant Tier 1 player, renowned for its high-performance mechanical disc brake systems that combine durability, reliability, and ease of maintenance. These brakes are widely adopted across various bicycle types, including commuter, mountain, and touring bikes, making Shimano a preferred choice for OEMs and casual riders alike.

SRAM and Tektro also occupy prominent Tier 1 positions, offering a strong portfolio of mechanical disc brakes that balance affordability with consistent performance. Their products are favored in mid- to high-end segments, supporting a wide range of cycling disciplines from recreational to competitive use. In the Tier 2 segment, companies such as Magura, Hayes, and Campagnolo focus on innovation, offering advanced modulation capabilities and compact caliper designs tailored to fit a variety of bicycle geometries.

These brands cater to riders seeking precise braking control and enhanced performance, often integrating unique features that differentiate their products in the market. Beyond these, smaller or specialized manufacturers like Formula, Box Components, Jagwire, and Cane Creek target the aftermarket and performance-oriented segments, providing lightweight, customizable brake components suited for competitive cyclists and enthusiasts.

Their offerings include options for fine-tuning brake feel, weight reduction, and enhanced aesthetics. Together, these manufacturers contribute to a dynamic market landscape that addresses the diverse needs of riders—from everyday commuters to serious mountain bikers and racers—while driving technological advancements and expanding product accessibility worldwide. The competition fosters continuous improvements in brake reliability, modulation, and compatibility, essential for the evolving demands of modern cycling.

A successful bicycle mechanical disc brake market strategy is to focus on innovation in lightweight, durable materials, enhancing braking performance, and expanding e-bike partnerships. Investing in R&D and targeting growing cycling infrastructure and urban mobility trends will drive market growth and consumer adoption globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 547.4 Million |

| Brake Type | Front disc brake and Rear disc brake |

| Offering Type | Dual piston, Single piston, Four piston, and Multi-piston |

| Application | Mountain bike, Road bike, Racing bike, and Gravel bikes |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Shimano, SRAM, Tektro, Magura, Hayes, Campagnolo, Formula, BoxComponents, Jagwire, and CaneCreek |

| Additional Attributes | Dollar sales by caliper type including single-piston mechanical and hybrid lever systems, rotor size such as 160 mm and 180 mm, and by application including road, mountain, hybrid, and electric bikes; demand driven by affordability, infrastructure growth, and entry-level e-bike adoption; innovation in stainless steel rotors, compressionless-cable upgrades, and modular aftermarket pads; and emerging opportunities in DIY retrofits and bike-share fleets. |

The global bicycle mechanical disc brake market is estimated to be valued at USD 547.4 million in 2025.

The market size for the bicycle mechanical disc brake market is projected to reach USD 802.6 million by 2035.

The bicycle mechanical disc brake market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in bicycle mechanical disc brake market are front disc brake and rear disc brake.

In terms of offering type, dual piston segment to command 48.9% share in the bicycle mechanical disc brake market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bicycle Tire Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Components Aftermarket Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Crankset Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Drivetrain Cassette Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Frames Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bicycle Saddle Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Electronic Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Device Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Gear Shifter Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Bottom Bracket Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Front Hub Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Rim Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Trip Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Light Market Growth - Trends & Forecast 2025 to 2035

Bicycle Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bicycle Bags and Backpacks Market - Trends, Growth & Forecast 2025 to 2035

Bicycle Shoe Market - Trends, Growth & Forecast 2025 to 2035

Bicycle Tourism Market Analysis By Type, by End User, by Tourist, by Booking Channel, by Region Forecast: 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA