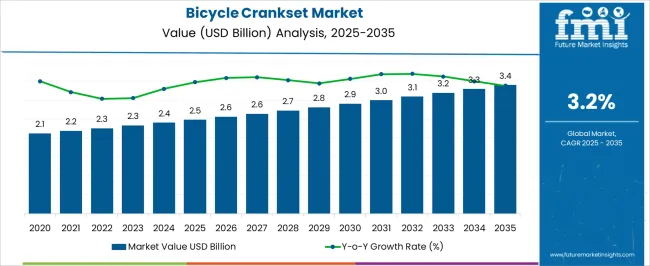

The bicycle crankset market, valued at USD 2.5 billion in 2025 and projected to reach USD 3.4 billion by 2035 with a CAGR of 3.2%, begins its transition from the early adoption stage into scaling during the mid-decade. Between 2020 and 2024, the market grew steadily from USD 2.1 billion to USD 2.4 billion, driven by a consistent but modest increase in uptake. The scaling phase from 2025 to 2030 reflects incremental gains, with values rising from USD 2.5 billion to USD 2.9 billion, as broader consumer bases and standardized supply chains solidify demand patterns across key segments. Between 2030 and 2035, the market consolidates, stabilizing while still expanding from USD 2.9 billion to USD 3.4 billion. During this phase, growth is less about accelerating volume and more about reinforcing share among established players. Annual increments become narrower, reflecting maturity as penetration reaches its natural ceiling. The CAGR of 3.2% demonstrates the long-term steadiness of this trajectory, with the market showing resilience despite slower expansion.

By 2035, consolidation ensures a well-defined industry structure, offering measured but dependable opportunities for participants.

| Metric | Value |

|---|---|

| Bicycle Crankset Market Estimated Value in (2025 E) | USD 2.5 billion |

| Bicycle Crankset Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

The bicycle crankset market, valued at USD 2.5 billion in 2025 and projected to reach USD 3.4 billion by 2035, at a CAGR of 3.2%, is part of the global bicycle components market, which is worth around USD 80 billion in 2025. Within this parent market, frames account for about 25%, wheels for 20%, tires for 15%, brakes for 10%, drivetrains including cranksets for 12%, saddles and seat posts for 5%, handlebars and stems for 5%, and pedals for 3%. Cranksets specifically hold about 3 to 4% of the overall components share, highlighting their steady but niche importance.

The broader global bicycle industry, expected to surpass USD 150 billion by 2035, maintains this distribution of component revenues, with frames and wheels together capturing nearly 45% of value. Cranksets remain a consistent contributor within the drivetrain segment, sustaining their 3% share due to essential replacement demand and integration across road, mountain, and e-bikes. While other categories, such as brakes and tires, benefit from higher wear-and-tear cycles, cranksets represent a more stable but slower-growing segment.

The current market scenario is shaped by increasing demand for high-performance, durable, and lightweight cranksets, particularly driven by growth in urban cycling and competitive sports. Advancements in material technologies and manufacturing processes are enabling the production of cranksets that strike a balance between strength and reduced weight, which is crucial for enhancing rider efficiency and comfort.

The future outlook appears positive, as environmental concerns and government initiatives continue to promote cycling infrastructure worldwide. Furthermore, the evolution of e-bikes and road bikes is expected to open new avenues for crankset innovation and adoption.

Investment in research and development is facilitating continuous improvements in crankset design, durability, and integration with other drivetrain components.

The bicycle crankset market is segmented by product, material, bicycle, sales channel, end use, and geographic regions. By product, bicycle crankset market is divided into Double chainring crankset, Single chainring crankset, and Triple chainring crankset. In terms of material, bicycle crankset market is classified into Aluminum, Carbon fiber, Steel, and Titanium. Based on bicycle, bicycle crankset market is segmented into Road bikes, Mountain bikes, Hybrid/commuter bikes, Electric bikes (E-bikes), Touring bikes, and Track bikes.

By sales channel, bicycle crankset market is segmented into Offline sales and Online sales. By end use, bicycle crankset market is segmented into Recreational riders, Professional cyclists, and Commuters. Regionally, the bicycle crankset industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

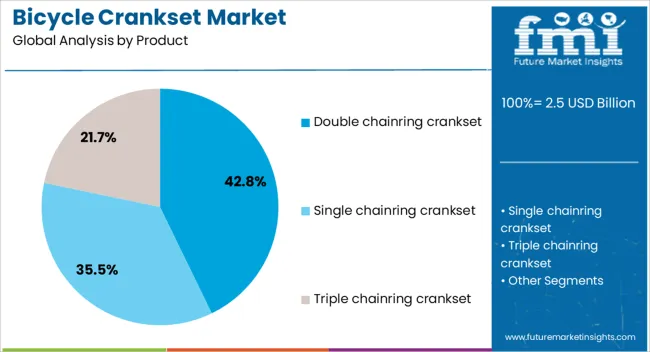

The Double Chainring Crankset segment is projected to hold 42.8% of the Bicycle Crankset market revenue in 2025, establishing it as the leading product type. This dominance is attributed to its optimal balance of gear range and efficiency, which meets the demands of both amateur and professional cyclists. The double chainring design offers versatility for varied terrain, enabling smoother gear shifts and better power transfer.

Its widespread adoption is reinforced by the preference for multi-speed bicycles that cater to a broad spectrum of riders. Furthermore, advancements in crankset engineering have enhanced the durability and weight profile of double chainring models, making them attractive in both road and mountain biking applications.

The compatibility of these cranksets with modern drivetrains and the relative cost-effectiveness compared to higher-complexity alternatives have further propelled their market growth. As cycling trends continue to evolve, double chainring cranksets are expected to maintain their leading market position.

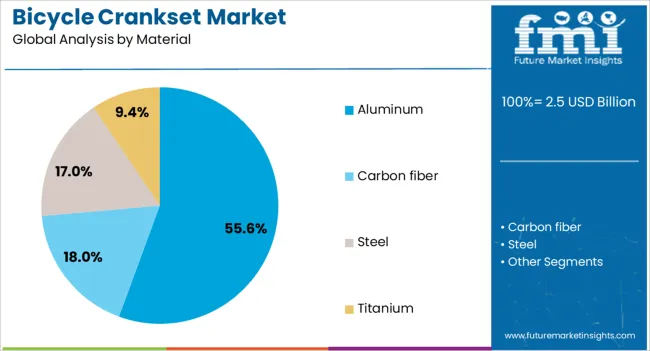

The Aluminum material segment is expected to account for 55.6% of the Bicycle Crankset market revenue in 2025, signifying its position as the most preferred material type. Aluminum is favored for its excellent strength-to-weight ratio, corrosion resistance, and cost efficiency. The material’s adaptability to precision machining and various surface treatments enables manufacturers to produce lightweight yet durable cranksets suitable for different cycling disciplines.

Additionally, the affordability of aluminum compared to premium materials like carbon fiber makes it accessible to a wide range of consumers. The segment’s growth has been supported by increased demand for mid-range bicycles and components that deliver reliable performance without premium pricing.

The recyclability of aluminum also aligns with growing environmental awareness within the cycling community Overall, the combination of mechanical performance, durability, and economic viability underpins the leadership of aluminum in the Bicycle Crankset market.

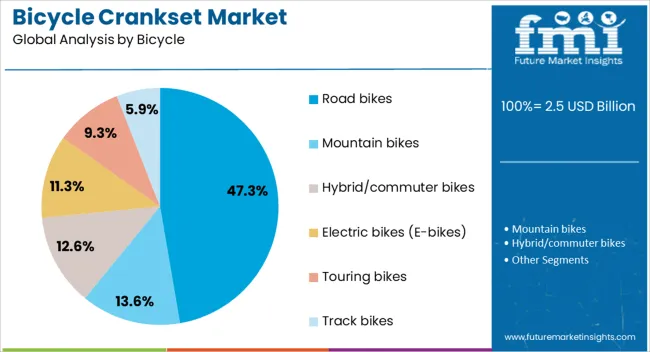

The Road Bikes end-use segment is anticipated to hold 47.3% of the Bicycle Crankset market revenue in 2025, marking it as the dominant category in terms of bicycle type. The growth of this segment is driven by rising participation in road cycling, both recreationally and competitively. Road bikes demand cranksets that deliver high efficiency, light weight, and precise power transfer, all of which align well with advanced crankset designs.

The increased popularity of endurance and racing cycling has stimulated the need for cranksets optimized for speed and aerodynamic performance. Moreover, improvements in crankset integration with electronic shifting and compatibility with various drivetrain systems have further bolstered adoption in this segment.

Infrastructure development, such as dedicated cycling lanes and organized events, has also contributed to market expansion. The preference for road bikes by fitness enthusiasts and professional cyclists alike is expected to sustain the segment’s leading share in the market in the future.

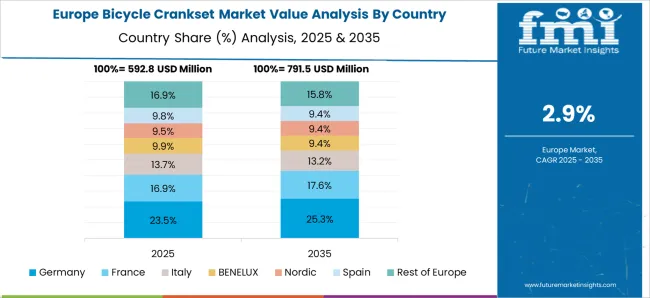

The bicycle crankset market is witnessing steady growth as cycling gains traction for fitness, commuting, and competitive sports. Europe and North America dominate demand for lightweight, aerodynamic cranksets tailored to professional cycling and premium e-bikes. Asia-Pacific shows rapid growth due to urban mobility requirements, rising recreational cycling, and growing disposable incomes. Manufacturers compete on material durability, weight reduction, chainring versatility, and drivetrain compatibility. Regional variations in cycling infrastructure, affordability, and consumer preference strongly influence adoption, procurement strategies, and brand positioning in global markets.

Material selection and weight optimization are critical factors shaping crankset adoption. In Europe and North America, carbon fiber and forged aluminum cranksets dominate premium bicycles and e-bikes, prioritizing stiffness, strength-to-weight ratio, and durability. These high-performance options cater to racing cyclists and professional athletes seeking efficiency and speed. Conversely, Asia-Pacific markets emphasize affordability and functional reliability, relying heavily on aluminum alloys and steel cranksets for mass-market commuter and recreational bicycles. This contrast in material choice affects drivetrain efficiency, product lifespan, and pricing strategies. Global suppliers targeting premium segments invest in advanced manufacturing and testing, while regional producers focus on scalable, cost-effective solutions. Material and weight contrasts strongly influence consumer preference, brand positioning, and competitive differentiation across recreational, commuter, and performance-driven cycling markets.

Chainring design, tooth count, and drivetrain compatibility significantly affect crankset performance across cycling styles. North America and Europe prioritize compact doubles, single-chainring setups, and precise drivetrain integration for road racing, mountain biking, and e-bikes. These options deliver efficient gear transitions, reduced weight, and optimized pedaling mechanics for challenging terrains. In contrast, Asia-Pacific markets favor triple-chainring cranksets, offering broader gear range, climbing ease, and versatility for commuting and utility bicycles. This divergence impacts riding efficiency, consumer satisfaction, and market segmentation. Global suppliers catering to premium segments offer advanced CNC-machined cranksets with drivetrain-specific compatibility, while regional manufacturers supply standardized chainring systems for affordability and versatility. Chainring and drivetrain contrasts directly influence product selection, application suitability, and competitiveness across performance cycling, recreational biking, and mass-market commuter segments worldwide.

The bicycle crankset market reflects distinct adoption patterns between performance cycling and mass-market usage. North America and Europe lead in premium crankset adoption, where professional cyclists, sports enthusiasts, and e-bike manufacturers demand precision-engineered products with lightweight, aerodynamic features. These segments drive innovation and command premium pricing. Asia-Pacific, however, prioritizes mass-market commuter bicycles where affordability, durability, and functional reliability outweigh advanced performance needs. This divergence influences pricing strategies, supply chain planning, and production priorities. High-end manufacturers invest heavily in R&D and collaborations with cycling teams, while regional producers emphasize scale-driven cost efficiency. The contrast between professional cycling requirements and commuter bicycle adoption continues to shape global market growth, positioning strategies, and competitive differentiation. Ultimately, this dual-market dynamic drives innovation at the top end and volume growth at the base of the industry pyramid.

Distribution networks and aftermarket support are critical to crankset accessibility and market penetration. In Europe and North America, specialized retailers, premium OEM partnerships, and structured after-sales service dominate, offering professional installation, customization, and long-term maintenance support. These channels strengthen brand reputation and customer loyalty among performance-oriented cyclists. In contrast, Asia-Pacific relies on regional distributors, local repair shops, and e-commerce platforms to address mass-market demand, prioritizing affordability and accessibility. Differences in distribution approaches influence consumer trust, repeat purchases, and market visibility. Suppliers with multi-channel strategies combining physical retail, OEM tie-ups, and strong service infrastructure gain an edge in premium segments. Regional producers, however, maintain competitiveness by leveraging cost-efficient supply chains and online accessibility. Distribution and service contrasts define adoption rates, user confidence, and overall competitive positioning across commuter, recreational, and high-performance cycling markets worldwide.

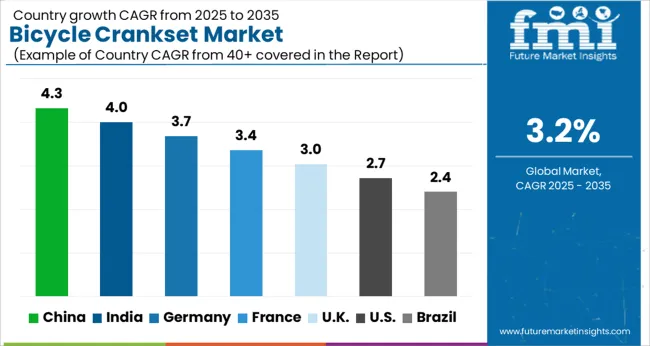

| Country | CAGR |

|---|---|

| China | 4.3% |

| India | 4.0% |

| Germany | 3.7% |

| France | 3.4% |

| UK | 3.0% |

| USA | 2.7% |

| Brazil | 2.4% |

The global bicycle crankset market was projected to expand at a 3.2% CAGR through 2035, supported by demand in urban mobility, sports, and recreational cycling. Among BRICS nations, China registered 4.3% growth as large-scale manufacturing hubs were operated with strong compliance to export and industrial standards, while India at 4.0% growth witnessed increased production capacity to address rising domestic and regional demand. In the OECD region, Germany at 3.7% maintained notable output under stringent mechanical and product regulations, while the United Kingdom at 3.0% relied on consistent demand from both sports and commuter bicycle segments. The USA, expanding at 2.7%, remained a mature market where incremental demand was observed across professional and recreational cycling, with product quality aligned to federal and industry-specific standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The bicycle crankset market in China is expanding at a CAGR of 4.3% driven by rising demand from commuters, recreational cyclists, and sports enthusiasts. Government backed cycling initiatives and fitness campaigns are encouraging more people to adopt bicycles for daily transport and exercise. Manufacturers based in China are supplying a wide range of cranksets, including lightweight aluminum and carbon models for performance bikes and cost effective steel versions for commuter bicycles. Strong production facilities and export capacity make China a key global hub for bicycle components. Distribution networks through bike shops, sports equipment stores, and e commerce platforms ensure widespread product availability. Cycling events and growing awareness of health benefits are boosting sales of mid to premium crankset models. Consumers prioritize durability, smooth performance, and affordability, supporting demand growth across different rider categories.

The bicycle crankset market in India is advancing at a CAGR of 4.0% supported by growing adoption of bicycles for commuting, fitness, and leisure. Urban and semi urban households are increasingly using bicycles as cost effective and practical mobility solutions. Manufacturers are offering cranksets suited to standard road bicycles, mountain bikes, and hybrid designs, ensuring accessibility for different user groups. Government programs that promote cycling as an active lifestyle choice are also fueling demand. Distribution networks through bicycle shops, hardware outlets, and online platforms provide wide reach. Consumers in India are gradually shifting toward higher quality cranksets as disposable incomes increase. The presence of a large youth population with growing interest in fitness and outdoor activities is further enhancing demand for modern and durable crankset models.

The bicycle crankset market in Germany is recording a CAGR of 3.7% supported by the country’s strong cycling tradition. Bicycles are widely used for commuting, sport, and leisure, creating steady demand for high quality cranksets. German consumers seek precision engineered products that enhance efficiency and deliver long service life. Manufacturers are introducing cranksets with lightweight alloys and carbon fiber for road bikes and robust models for mountain biking and e bike applications. Cycling infrastructure improvements and recreational events are further supporting growth. Retail availability through specialty bike stores and online channels ensures consumers can access a wide product range. Germany’s preference for performance oriented and reliable components continues to strengthen crankset sales and underlines its importance within the European market.

The bicycle crankset market in the United Kingdom is advancing at a CAGR of 3.0% with demand supported by growing cycling participation for commuting, fitness, and recreation. Infrastructure development and awareness campaigns have encouraged more households to consider cycling as a practical and healthy mobility choice. Manufacturers are offering cranksets for a variety of bicycles, including road, mountain, commuter, and e bikes, ensuring coverage of multiple segments. Online platforms, sports retailers, and independent cycle shops provide wide access to products. Consumers are increasingly favoring cranksets that balance performance, reliability, and comfort. Growth is also being encouraged by cycling clubs and events that promote active lifestyles. The United Kingdom remains a significant contributor to the European bicycle market with steady demand for cranksets across different consumer groups.

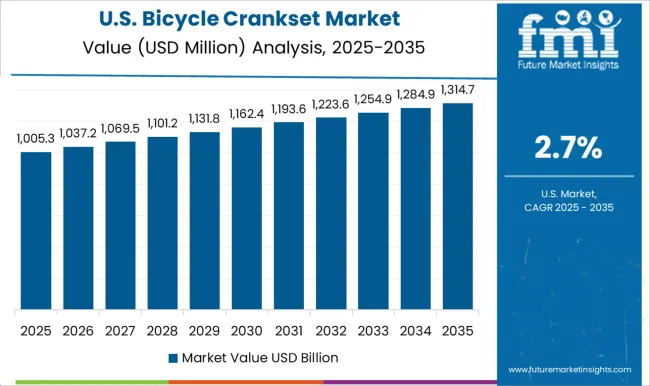

The bicycle crankset market in the United States is progressing at a CAGR of 2.7% supported by interest in fitness, commuting, and outdoor leisure activities. Rising participation in cycling events and recreational riding has created consistent demand for reliable and efficient cranksets. Manufacturers are supplying a wide variety of crankset options for road, mountain, hybrid, and electric bicycles. Distribution through sporting goods stores, specialized bicycle retailers, and online platforms ensures availability across urban and rural regions. Consumers are increasingly selecting cranksets that provide durability and smooth gear performance, while premium models are being adopted by enthusiasts seeking advanced features. Supportive infrastructure and community cycling programs are also adding to market expansion. The United States continues to represent a large consumer base with growing interest in active and outdoor lifestyles.

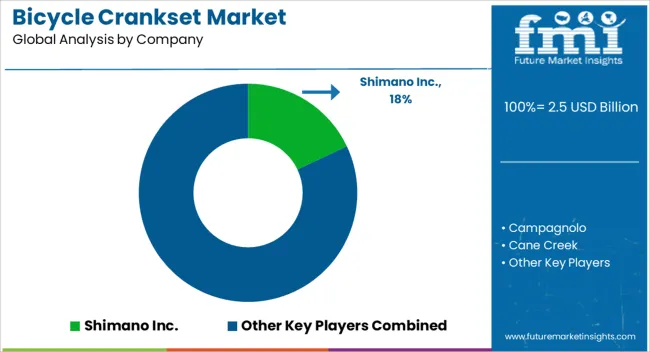

The bicycle crankset market is shaped by globally recognized manufacturers such as Shimano Inc., Campagnolo, Cane Creek, FSA (Full Speed Ahead), Hope Technology, Miche, Praxis Works, Race Face, SR Suntour, and SRAM LLC. These companies play a crucial role in advancing bicycle drivetrain technology, offering a wide range of cranksets designed for road bikes, mountain bikes, gravel, BMX, and e-bikes. Their focus is on improving power transfer, durability, and rider efficiency, catering to both professional athletes and recreational cyclists. Shimano, SRAM, and Campagnolo dominate the high-performance segment with precision-engineered cranksets that feature lightweight materials such as carbon fiber and advanced aluminum alloys. Their products integrate seamlessly with electronic shifting systems and are optimized for speed, efficiency, and reliability in competitive cycling. Meanwhile, FSA, Race Face, and Praxis Works provide versatile cranksets that cater to mid-to-high-end bicycles, emphasizing innovation in chainring design, stiffness, and ease of customization. On the other hand, SR Suntour, Cane Creek, Miche, and Hope Technology focus on specialized segments, offering cranksets suited for MTB riders, endurance cyclists, and enthusiasts seeking cost-effective yet durable options. Across the market, there is a growing demand for cranksets compatible with single-chainring (1x) drivetrains, e-bike integration, and designs that balance weight reduction with enhanced strength. With continuous innovation in aerodynamics, material science, and drivetrain integration, these suppliers remain pivotal in driving growth and setting benchmarks in the bicycle crankset market.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Product | Double chainring crankset, Single chainring crankset, and Triple chainring crankset |

| Material | Aluminum, Carbon fiber, Steel, and Titanium |

| Bicycle | Road bikes, Mountain bikes, Hybrid/commuter bikes, Electric bikes (E-bikes), Touring bikes, and Track bikes |

| Sales Channel | Offline sales and Online sales |

| End Use | Recreational riders, Professional cyclists, and Commuters |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Shimano Inc., Campagnolo, Cane Creek, FSA (Full Speed Ahead), Hope Technology, Miche, Praxis Works, Race Face, SR Suntour, and SRAM LLC |

| Additional Attributes | Dollar sales vary by crankset type, including single, double, and triple chainring cranksets; by material, spanning aluminum, carbon fiber, steel, and alloys; by application, such as mountain bikes, road bikes, hybrid bikes, and e-bikes; by distribution channel, including OEMs and aftermarket; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by cycling adoption, e-bike expansion, and demand for lightweight, durable components. |

The global bicycle crankset market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the bicycle crankset market is projected to reach USD 3.4 billion by 2035.

The bicycle crankset market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in bicycle crankset market are double chainring crankset, single chainring crankset and triple chainring crankset.

In terms of material, aluminum segment to command 55.6% share in the bicycle crankset market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bicycle Tire Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Components Aftermarket Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Drivetrain Cassette Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Frames Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bicycle Saddle Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Electronic Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Device Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Gear Shifter Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Brake Lever Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Bottom Bracket Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Front Hub Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Rim Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Disc Brake Rotor Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Trip Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Mechanical Disc Brake Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Light Market Growth - Trends & Forecast 2025 to 2035

Bicycle Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bicycle Bags and Backpacks Market - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA