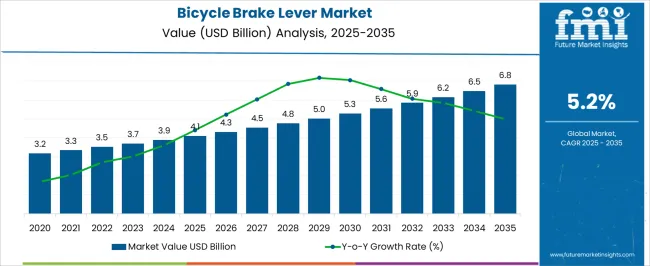

The bicycle brake lever market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 6.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

Market growth is expected to accelerate as demand for lightweight, ergonomic, and high-performance braking systems rises across urban commuting, mountain biking, and e-bike segments. The adoption of advanced materials such as aluminum alloys, carbon composites, and reinforced polymers is anticipated to enhance durability while maintaining responsiveness. Designs optimized for disc and hydraulic braking systems are projected to drive consumer preference and aftermarket upgrades. Deceleration patterns may emerge in mature regions due to saturation of standard bicycle models, but demand for premium and specialized levers is expected to maintain a positive trajectory.

Integration of sensor-based braking assistance and modular lever assemblies is anticipated to influence purchasing patterns and increase product differentiation. Regionally, Asia-Pacific is expected to contribute the largest incremental growth owing to rising urban cycling infrastructure, while Europe and North America are likely to experience stable yet consistent expansion driven by sport cycling and e-bike adoption. By 2035, emerging economies are projected to accelerate market penetration supported by initiatives promoting cycling and eco-friendly transportation. Overall, the market is estimated to advance steadily with variable acceleration across segments and geographies, driven by evolving consumer preferences, technical improvements, and broader cycling trends.

| Metric | Value |

|---|---|

| Bicycle Brake Lever Market Estimated Value in (2025 E) | USD 4.1 billion |

| Bicycle Brake Lever Market Forecast Value in (2035 F) | USD 6.8 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The bicycle brake lever market is strongly influenced by five interconnected parent markets, each contributing to overall adoption and revenue generation. The bicycle manufacturing market holds the largest share at 40%, as brake levers are essential components for commuter, mountain, and e-bike models, ensuring rider safety, performance, and regulatory compliance. The aftermarket replacement and upgrade segment follows with a 25% share, driven by rising consumer preference for ergonomic, lightweight, and high-performance levers to enhance existing bicycles. The sports and professional cycling market accounts for 15%, where advanced hydraulic and disc-compatible levers are adopted to meet competitive and recreational requirements.

The e-bike and electric mobility market holds a 12% share, with rapid adoption fueled by urban commuting trends, government incentives, and demand for energy-efficient personal transport solutions. Finally, the cycling accessories and components market represents 8%, supporting customization, modularity, and specialized lever designs for diverse riding conditions. Collectively, the bicycle manufacturing, aftermarket, and sports cycling segments account for 80% of overall market share, highlighting that production volumes, replacement demand, and performance-focused applications remain the primary growth drivers, while e-bikes and component innovation provide complementary, steady demand across regions globally.

The bicycle brake lever market is experiencing steady growth driven by the rising popularity of cycling for commuting, fitness, and recreational purposes. Increasing urban traffic congestion, environmental consciousness, and government initiatives promoting cycling infrastructure are boosting demand across multiple regions.

Technological advancements in lightweight materials, ergonomic designs, and integration with advanced braking systems are further enhancing product adoption. The surge in e-bikes and performance bicycles has also contributed to higher demand for precision-engineered brake levers that offer improved control and rider safety.

Additionally, the growing preference for customized and performance-oriented bicycles among enthusiasts is fostering the development of specialized braking solutions. The market outlook remains positive as cycling continues to gain traction globally, supported by sustainability trends and a shift toward healthier lifestyle choices.

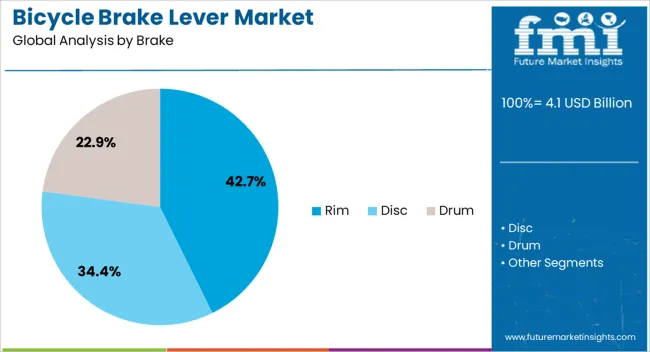

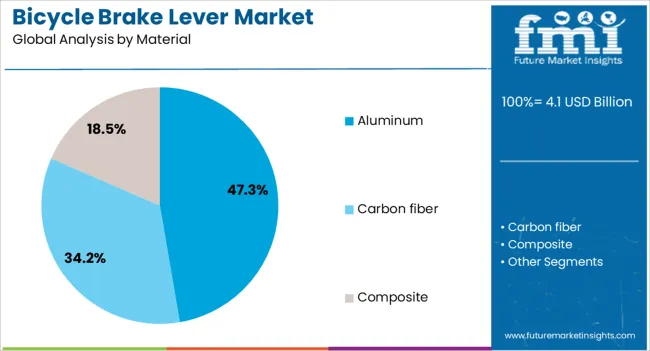

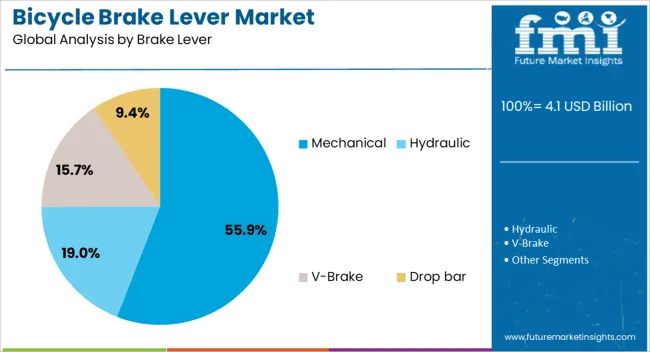

The bicycle brake lever market is segmented by brake, material, brake lever, bicycle, distribution channel, sales channel, and geographic regions. By brake, bicycle brake lever market is divided into rim, disc, and drum. In terms of material, bicycle brake lever market is classified into aluminum, carbon fiber, and composite. Based on brake lever, bicycle brake lever market is segmented into mechanical, hydraulic, V-brake, and drop bar. By bicycle, bicycle brake lever market is segmented into conventional and e-bike. By distribution channel, bicycle brake lever market is segmented into online and offline. By sales channel, bicycle brake lever market is segmented into OEM and aftermarket. Regionally, the bicycle brake lever industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The rim brake segment is projected to hold 42.70% of the total market revenue by 2025, making it a significant contributor within the brake category. Its dominance is supported by cost-effectiveness, ease of maintenance, and widespread compatibility with standard bicycle frames.

The lightweight nature of rim brakes and their sufficient stopping power for road cycling conditions have maintained their relevance, particularly in budget and mid-range bicycles.

Their simple mechanical design, affordability, and availability across global markets have allowed them to retain a strong presence, especially among recreational riders and commuters.

The aluminum segment is expected to account for 47.30% of the market revenue within the material category in 2025, positioning it as the leading choice. Aluminum brake levers are favored for their lightweight properties, durability, and corrosion resistance.

The material’s balance of strength and cost efficiency makes it ideal for both entry-level and high-performance bicycles.

Additionally, aluminum levers offer design flexibility, allowing manufacturers to produce ergonomic and aesthetically appealing components without compromising structural integrity.

The mechanical brake lever segment is set to represent 55.90% of the total market revenue by 2025, establishing itself as the dominant type. Its popularity stems from its straightforward operation, low maintenance requirements, and reliability in a variety of cycling conditions.

Mechanical levers are compatible with a wide range of brake systems, making them suitable for multiple bicycle categories.

Their affordability and ease of repair have further strengthened their adoption among both casual riders and professional cyclists who value consistency and control.

The bicycle brake lever market growth is fueled by commuter, sports, and e-bike adoption, along with material innovation and aftermarket upgrades. Regional trends and consumer preference for high-performance, ergonomic levers support steady expansion globally.

The bicycle brake lever market is driven by increasing adoption of bicycles for commuting, fitness, and recreational purposes. Lightweight and ergonomic levers are gaining preference among urban and performance-oriented cyclists, enhancing safety and control. Mountain biking and off-road cycling are boosting demand for durable, high-performance levers compatible with disc and hydraulic braking systems. E-bike growth has also contributed to lever adoption, as electric bicycles require reliable braking mechanisms for higher speeds and heavier loads. Consumer awareness regarding component quality and performance is prompting manufacturers to introduce specialized levers for different riding conditions. Seasonal promotions and cycling events further encourage upgrades and replacements, fueling aftermarket demand. Regional infrastructure development supporting cycling paths indirectly strengthens brake lever adoption globally.

Material choices and design improvements are key drivers shaping the bicycle brake lever market. Aluminum alloys, carbon composites, and reinforced polymers are increasingly adopted to reduce weight while maintaining durability and braking efficiency. Modular and adjustable lever designs allow customization for hand size and riding style, improving user comfort. Disc and hydraulic brake compatibility is becoming a standard requirement for premium and mid-range bicycles. Manufacturers are emphasizing corrosion resistance, strength, and ergonomics in product design to enhance performance and customer satisfaction. Innovative surface treatments and textured grips are being used to increase control and reduce slippage in wet or rough conditions. Design enhancements also support aesthetic appeal, influencing purchase decisions in competitive segments.

The aftermarket segment represents a significant revenue driver for bicycle brake levers, as consumers frequently replace or upgrade components for performance and style. High-performance levers, sensor-assisted braking, and adjustable systems are particularly popular among enthusiasts. Evolving consumer preference for customization encourages manufacturers to produce modular and compatible lever systems. Availability of branded and unbranded replacement products ensures accessibility across price segments. Seasonal sales, cycling events, and online marketplaces further boost replacement purchases. Regional differences in cycling culture influence aftermarket demand, with Asia-Pacific and Europe showing higher adoption due to urban commuting and recreational cycling growth. The aftermarket ensures continuous revenue streams beyond initial bicycle sales, supporting steady market expansion globally.

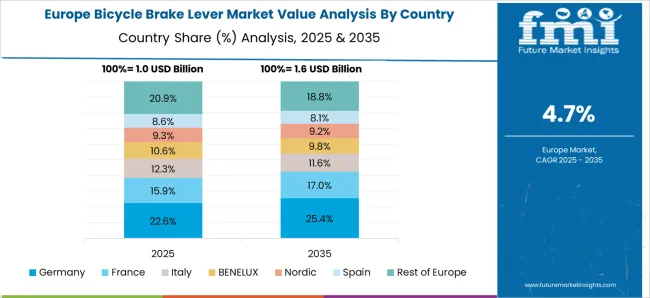

Geographic trends strongly influence the bicycle brake lever market, with Asia-Pacific contributing the largest share due to rising production volumes and increasing cycling adoption. Europe shows consistent growth driven by recreational cycling, professional sports, and e-bike adoption. North America is expanding steadily due to demand for mountain, road, and electric bicycles. Emerging regions are witnessing gradual penetration supported by infrastructure improvements, government programs, and cycling awareness campaigns. Local manufacturing capabilities and distribution networks impact availability and affordability, while premium and performance-focused segments continue to drive higher-margin sales. Regulatory standards for safety and component quality also encourage adoption of advanced brake levers, creating opportunities for manufacturers to differentiate products regionally.

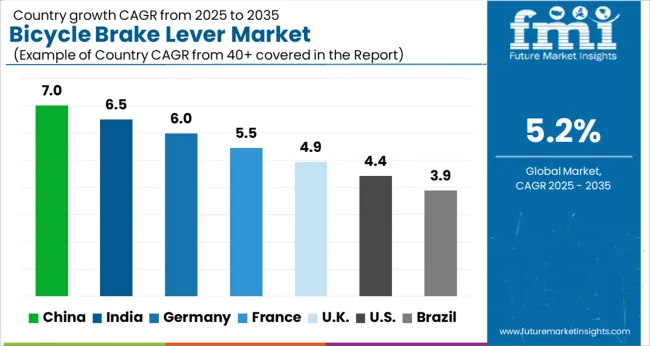

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The global bicycle brake lever market is projected to expand at a CAGR of 5.2% from 2025 to 2035. China leads growth at 7.0%, followed by India at 6.5% and Germany at 6.0%, while the UK and the USA grow at 4.9% and 4.4% respectively. BRICS nations, particularly China and India, are driving demand through rising bicycle production, e-bike adoption, and urban cycling infrastructure development. OECD countries, including Germany, the UK, and the USA, emphasize high-performance, ergonomic, and durable brake lever designs to meet commuter, sports, and recreational cycling needs. Growth is propelled by consumer preference for advanced braking systems, lightweight materials, and modular designs, creating opportunities across bicycle manufacturing, aftermarket upgrades, and premium segments. The analysis includes over 40+ countries, with the leading markets detailed above.

The bicycle brake lever market in China is projected to grow at a CAGR of 7.0% from 2025 to 2035, fueled by rapid expansion in bicycle manufacturing, increasing e-bike adoption, and growing urban cycling infrastructure. High-performance, hydraulic, and disc-compatible levers are in strong demand across commuter, mountain, and professional cycling segments. Collaborations with global suppliers facilitate access to advanced materials, modular designs, and ergonomic configurations. Investments in smart city programs, cycling tracks, and recreational initiatives provide a supportive environment for market adoption.

The bicycle brake lever market in India is expected to grow at a CAGR of 6.5%, driven by e-bike adoption, commuter bicycles, and performance-oriented cycling demand. Domestic manufacturers are introducing levers compatible with hydraulic and disc braking systems, emphasizing lightweight and ergonomic designs. Aftermarket replacement and upgrade demand is growing as enthusiasts seek high-performance and customizable components. Government initiatives promoting cycling and regional infrastructure improvements further support market expansion. Digital sales platforms and local distribution networks enhance accessibility and affordability across urban and semi-urban regions.

The bicycle brake lever market in Germany is projected to grow at a CAGR of 6.0% from 2025 to 2035, supported by professional cycling, recreational biking, and e-bike adoption. Consumers prioritize high-quality, durable, and ergonomically designed levers compatible with modern braking systems. Premium and performance-focused segments drive demand for hydraulic and modular lever assemblies. Collaborations between manufacturers and component suppliers enhance material quality, customization, and technical integration. Cycling events, competitions, and eco-mobility programs encourage replacement and upgrade purchases, providing continuous revenue streams for manufacturers.

The bicycle brake lever market in the UK is expected to grow at a CAGR of 4.9% from 2025 to 2035, driven by rising adoption of e-bikes, commuter bicycles, and recreational cycling. Consumers are favoring ergonomic, lightweight, and high-performance lever designs compatible with hydraulic and disc braking systems. Aftermarket demand for replacements and upgraded levers is increasing, particularly in urban regions. Collaborations between local manufacturers and international suppliers allow integration of advanced materials and modular systems. Cycling infrastructure improvements and government initiatives supporting active transport contribute to steady market expansion.

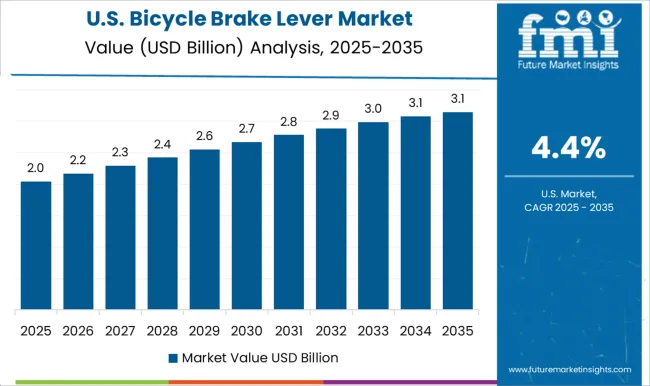

The bicycle brake lever market in the USA is projected to grow at a CAGR of 4.4% from 2025 to 2035, supported by e-bike sales, recreational cycling, and professional sport bicycle adoption. Lightweight, ergonomic, and performance-focused levers compatible with hydraulic and disc braking systems are increasingly preferred. Aftermarket replacement demand for high-performance levers remains a key growth driver. Collaborations with global suppliers enhance material quality, modular designs, and technical sophistication. Government programs promoting cycling infrastructure, eco-friendly transport, and urban mobility contribute to market stability and gradual expansion.

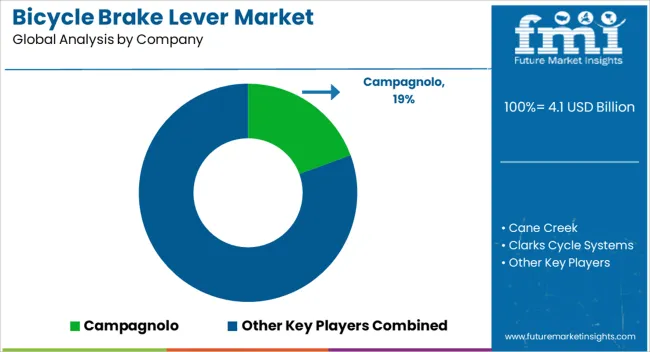

Competition in the bicycle brake lever market is primarily defined by performance, material quality, ergonomic design, and compatibility with diverse bicycle types. Leading global players such as Shimano and SRAM dominate the high-performance segment with hydraulic and mechanical levers optimized for commuter, mountain, and road bicycles. Their offerings emphasize modular designs, lightweight and durable materials, precision engineering, and consistent braking performance under various riding conditions. Campagnolo and FSA compete in the premium sport and professional cycling segment, catering to racing enthusiasts and high-end recreational riders.

Their products focus on advanced materials, aerodynamic lever designs, and seamless integration with high-performance braking systems. Mid-range and aftermarket-focused manufacturers including Cane Creek, TEKTRO, and Dia-Compe prioritize reliability, durability, and user-friendly lever configurations. These companies design levers compatible with both disc and rim brakes, offering ergonomic adjustments to enhance rider comfort. European and Asian players such as Hope Technology, Magura, and Clarks Cycle Systems emphasize lightweight, corrosion-resistant, and ergonomically optimized levers suited for recreational, commuter, and e-bike applications. Smaller manufacturers target cost-sensitive buyers and regional bicycle markets, producing entry-level levers and replacement components. Strategies across the market are concentrated on modular designs, material innovations, and performance optimization to maximize braking efficiency.

Partnerships with bicycle OEMs and aftermarket distributors allow manufacturers to provide tailored solutions that meet varying consumer needs while ensuring widespread adoption. Product catalogs feature hydraulic, mechanical, and disc-compatible levers, specifying reach adjustment, lever throw, weight, and compatibility with braking systems. Additional offerings include ergonomic grips, modular mounting options, and replacement parts to support reliable operation and consistent performance across diverse cycling conditions. Manufacturers increasingly highlight product differentiation through material selection, adjustability, and compatibility with multiple bicycle categories, creating opportunities to capture both premium and mainstream market segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.1 billion |

| Brake | Rim, Disc, and Drum |

| Material | Aluminum, Carbon fiber, and Composite |

| Brake Lever | Mechanical, Hydraulic, V-Brake, and Drop bar |

| Bicycle | Conventional and E-bike |

| Distribution Channel | Online and Offline |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Campagnolo, Cane Creek, Clarks Cycle Systems, Dia-Compe, FSA, Hope Technology, Magura, Shimano, SRAM, and TEKTRO |

| Additional Attributes | Dollar sales, market share, growth rate by region, segment demand (commuter, mountain, e-bike, sport), material trends (aluminum, carbon, polymers), aftermarket vs OEM adoption, competitive landscape, and key consumer preferences. |

The global bicycle brake lever market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the bicycle brake lever market is projected to reach USD 6.8 billion by 2035.

The bicycle brake lever market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in bicycle brake lever market are rim, disc and drum.

In terms of material, aluminum segment to command 47.3% share in the bicycle brake lever market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bicycle Tire Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Components Aftermarket Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Crankset Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Drivetrain Cassette Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Frames Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bicycle Saddle Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Electronic Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Device Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Gear Shifter Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Bottom Bracket Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Front Hub Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Rim Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Trip Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Light Market Growth - Trends & Forecast 2025 to 2035

Bicycle Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bicycle Bags and Backpacks Market - Trends, Growth & Forecast 2025 to 2035

Bicycle Shoe Market - Trends, Growth & Forecast 2025 to 2035

Bicycle Tourism Market Analysis By Type, by End User, by Tourist, by Booking Channel, by Region Forecast: 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA