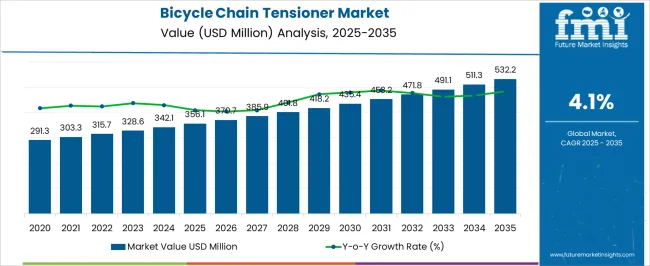

The global bicycle chain tensioner market is projected at USD 356.1 million in 2025 and is anticipated to reach USD 532.2 million by 2035, advancing at a compound annual growth rate (CAGR) of 4.1% over the forecast period. A 10-year growth comparison illustrates the steady and consistent expansion of this market, reflecting both evolving consumer preferences and the gradual modernization of bicycle components.

In the first half of the decade, from 2025 to 2030, the market is expected to grow from USD 356.1 million to approximately USD 418.2 million, indicating a moderate annual increase as demand is primarily driven by urban cycling trends, increased recreational biking, and the replacement of conventional chain systems with enhanced tensioners for improved performance. The latter half, spanning 2031 to 2035, shows the market expanding further from USD 435.4 million to USD 532.2 million, highlighting rising adoption in e-bikes, sports bicycles, and high-performance cycling segments. This period also reflects incremental growth resulting from technological refinements in tensioner designs, improved durability, and rising consumer awareness of performance-enhancing components. The 10-year comparison underscores a balanced growth trajectory, with early years focusing on market penetration in developed regions, and later years capturing emerging markets and niche segments. Overall, the steady CAGR and the decade-long progression emphasize how industry players can leverage innovation, distribution expansion, and targeted marketing to capitalize on long-term opportunities within the bicycle chain tensioner sector.

| Metric | Value |

|---|---|

| Bicycle Chain Tensioner Market Estimated Value in (2025 E) | USD 356.1 million |

| Bicycle Chain Tensioner Market Forecast Value in (2035 F) | USD 532.2 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

The bicycle chain tensioner market is closely influenced by five interconnected parent markets that collectively drive its adoption and long-term growth. The largest contributor is the bicycle and e-bike manufacturing market, which accounts for about 40% share, as chain tensioners are essential components that ensure smooth drivetrain operation, reduce chain slippage, and enhance overall riding performance across various bicycle types. The aftermarket bicycle parts and accessories sector contributes around 25%, as replacement and upgrade demand for chain tensioners rises among cycling enthusiasts, professional riders, and maintenance service providers. The cycling sports and recreation market holds close to 15% influence, supported by the growing participation in competitive cycling, mountain biking, and adventure sports, which emphasizes the need for reliable drivetrain components. The micro-mobility and urban transportation market adds nearly 12%, as bicycles and e-bikes increasingly serve as alternatives for short-distance commuting, driving demand for durable, low-maintenance chain tensioning systems. The logistics and bicycle repair service sector contributes close to 8%, as professional repair shops and service centers facilitate the installation, adjustment, and replacement of chain tensioners for end-users, ensuring consistent performance and safety. In an opinionated view, the distribution of market influence shows that bicycle manufacturing and aftermarket upgrades form the backbone of this market, while sports adoption and urban mobility trends continue to expand its commercial relevance. This interconnected ecosystem indicates that the bicycle chain tensioner market is supported by multiple industries, ensuring sustained demand, operational resilience, and steady year-on-year growth.

The bicycle chain tensioner market is expanding steadily as cycling gains momentum across urban commuting, recreational use, and sports. The increased demand for efficient drivetrain systems, especially in single-speed and fixed-gear bicycles, has highlighted the importance of chain tensioners in ensuring optimal performance and rider safety.

Growing consumer preference for low-maintenance and smoother cycling experiences has accelerated adoption of advanced tensioning solutions. The market is further supported by the rise of e-bikes and premium bicycle segments that require precise chain alignment to function efficiently.

As cycling infrastructure and fitness awareness grow globally, manufacturers are investing in durable and ergonomic designs to cater to varying rider preferences. The outlook remains strong with innovation in tensioner automation, lightweight materials, and compact form factors likely to drive long-term market growth.

The bicycle chain tensioner market is segmented by offering, application, material, distribution channel, and geographic regions. By offering, bicycle chain tensioner market is divided into Automatic tensioners and Manual tensioners. In terms of application, bicycle chain tensioner market is classified into Single speed bikes, Internal hub geared bikes, and Fixed gear bikes. Based on material, bicycle chain tensioner market is segmented into Steel, Aluminum, Carbon Fiber, Titanium, and Composite Materials. By distribution channel, bicycle chain tensioner market is segmented into OEM and Aftermarket. Regionally, the bicycle chain tensioner industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

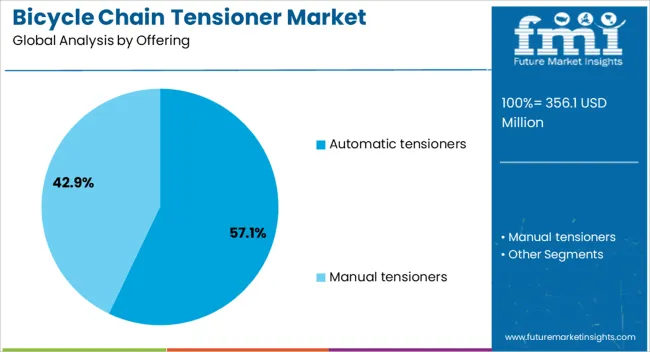

Automatic tensioners dominate the offering category with a commanding 57% market share, driven by their ability to maintain consistent chain tension without manual adjustment. These systems are favored for their user-friendly design, particularly among casual riders and urban commuters seeking hassle-free performance.

The integration of automatic tensioners reduces wear on chains and sprockets, thereby extending component lifespan and minimizing maintenance intervals. Their utility is amplified in environments where terrain variability and load fluctuations can affect drivetrain performance.

Manufacturers are incorporating compact, durable, and vibration-resistant features to meet the evolving expectations of consumers. With the growing adoption of fixed-gear and single-speed bicycles, the demand for precision-tuned automatic tensioners is expected to remain high, sustaining this segment's leadership position in the market.

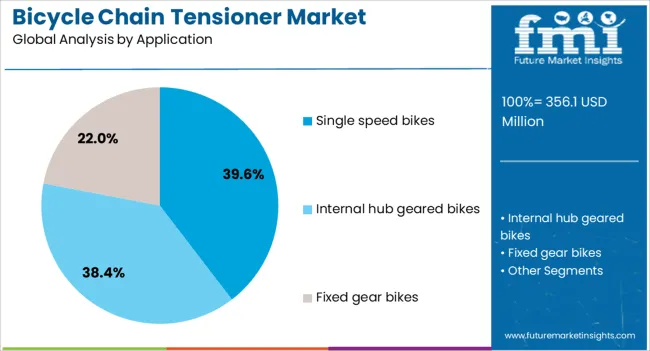

Single speed bikes account for 40% of the market under the application category, highlighting their widespread use in urban mobility and recreational cycling. These bikes, known for simplicity and ease of maintenance, rely heavily on efficient chain tensioners to ensure smooth operation.

The growing appeal of minimalistic bicycle designs and reduced mechanical complexity has reinforced the prominence of this segment. Single speed models are especially popular among new riders and commuters seeking reliable transportation with fewer breakdown risks.

As urban centers promote eco-friendly mobility solutions, the production and use of single speed bicycles are expected to grow, further boosting the demand for compatible tensioning systems. The segment benefits from ongoing innovations in lightweight components and design adaptability, ensuring continued relevance in both entry-level and premium bicycle categories.

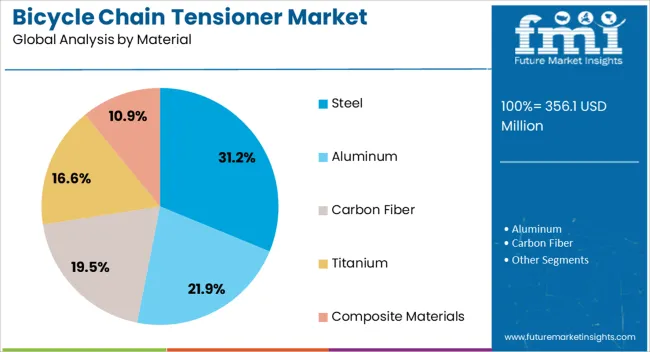

Steel remains the leading material segment with a 31% market share, attributed to its durability, load-bearing capacity, and cost-effectiveness. Despite competition from lighter materials, steel is widely used in chain tensioners due to its ability to withstand mechanical stress and environmental wear. This makes it a preferred choice for manufacturers targeting long-lasting, rugged cycling components.

Steel tensioners also provide structural integrity under high-torque conditions, particularly in commuter and utility bicycles. While modern designs are gradually incorporating aluminum and composite alternatives, steel continues to dominate in markets prioritizing affordability and robust construction.

Its recyclability and established manufacturing processes contribute to its persistent use. The segment is expected to maintain its relevance through cost optimization strategies and applications where reliability is prioritized over weight savings.

The bicycle chain tensioner market is being shaped by rising demand from cycling and e-bike segments, integration with advanced drivetrain systems, focus on durability and lightweight designs, and regional growth driven by cycling infrastructure. Increased adoption of bicycles for commuting, fitness, and recreation is expanding the market, while OEM collaborations ensure high-performance, reliable components. Material innovations and adjustable designs enhance product longevity and efficiency. Regional infrastructure development, including dedicated bike lanes and e-bike promotion, supports market penetration. These combined dynamics are driving sustained growth, strengthening product relevance, and creating opportunities for manufacturers across global bicycle markets.

The market is witnessing growth due to increasing popularity of cycling for commuting, fitness, and recreational purposes. E-bikes and geared bicycles are becoming more prevalent, which has driven the adoption of chain tensioners to maintain smooth drivetrain operation. Riders are seeking reliable components that enhance performance, reduce wear, and minimize maintenance needs. Bicycle manufacturers are incorporating tensioners in both mid-range and premium models to ensure consistent chain alignment and efficiency. The growing interest in cycling as a sustainable transport alternative and fitness activity is expanding the user base, supporting the market’s steady growth across urban and semi-urban regions.

Bicycle chain tensioners are increasingly being integrated with advanced drivetrain systems and multi-gear setups. This integration ensures optimal chain tension across different gear ratios, improving pedaling efficiency and rider experience. Manufacturers are offering tensioners compatible with lightweight frames, suspension systems, and electric-assist bicycles. High-performance components such as derailleur systems and belt drives benefit from tensioner adoption, which extends product life and reduces mechanical issues. Suppliers are collaborating with OEMs to provide reliable, durable, and adjustable tensioners. Integration with modern bicycle technology is enhancing product value, creating a strong incentive for manufacturers and cyclists to adopt chain tensioners across various bicycle segments.

Durability and lightweight construction are key factors driving chain tensioner adoption. Components are being manufactured using aluminum alloys, reinforced plastics, and composite materials to withstand stress while minimizing weight. Adjustable designs allow precise tension control, reducing chain slippage and maintenance frequency. Innovations in corrosion-resistant coatings and high-strength materials are improving performance under different riding conditions. Companies are investing in R&D to produce tensioners that are robust yet compatible with emerging e-bike technologies. By prioritizing performance, longevity, and minimal weight, manufacturers are meeting the expectations of both recreational and professional cyclists, further accelerating market growth and product differentiation.

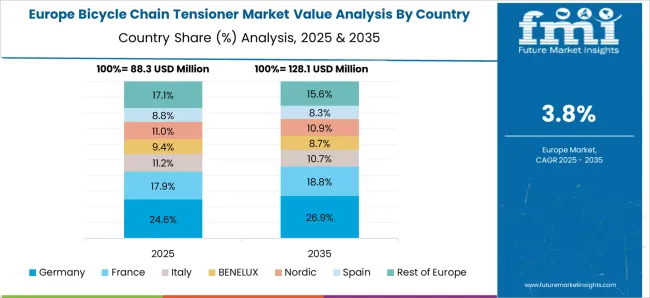

Market growth is being supported by the expansion of cycling infrastructure and promotion of urban mobility solutions. Countries in Europe, North America, and Asia-Pacific are investing in dedicated bike lanes, bike-sharing programs, and e-bike adoption initiatives. These measures are increasing bicycle usage, which in turn drives demand for components like chain tensioners. Regional manufacturing hubs are supplying OEMs and aftermarket channels, ensuring consistent availability. Partnerships between local distributors and international suppliers are strengthening supply chains. As cycling becomes a mainstream mode of transportation and leisure activity, the chain tensioner market is expected to witness broader adoption and penetration across urban and suburban populations.

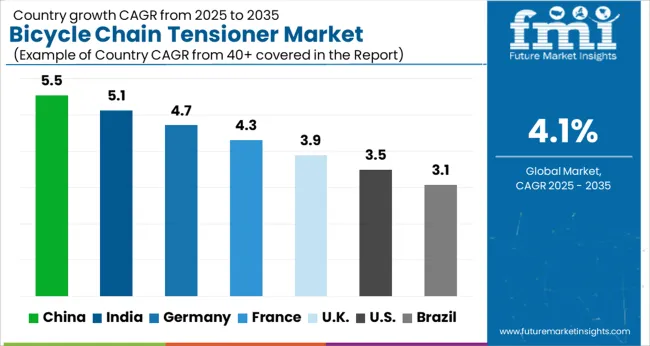

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

The global bicycle chain tensioner market is projected to grow at a CAGR of 4.1% from 2025 to 2035. China leads with 5.5%, followed by India at 5.1%, Germany at 4.7%, the UK at 3.9%, and the USA at 3.5%. Expansion is driven by rising bicycle production, growing adoption of electric bicycles, and increasing demand for performance and durability components. BRICS countries, particularly China and India, are scaling manufacturing capacity, component standardization, and supply chain efficiency to meet domestic and export demand. OECD nations such as Germany, the UK, and the USA emphasize quality assurance, precision engineering, and after-sales support to enhance reliability and customer satisfaction. The analysis spans over 40+ countries, with the leading markets detailed below.

The bicycle chain tensioner market in China is projected to grow at a CAGR of 5.5% from 2025 to 2035, supported by increasing bicycle production and rising demand for urban mobility solutions. E-bikes, foldable bikes, and high-performance bicycles are gaining popularity among urban commuters and fitness enthusiasts, driving the need for durable and reliable chain tensioners. Domestic manufacturers are investing in R&D to improve materials, reduce weight, and enhance corrosion resistance, meeting both performance and safety standards. Growing export demand for Chinese bicycles also encourages component innovation and quality improvements. Expansion of cycling infrastructure in major cities further supports adoption of bicycles and related components.

The bicycle chain tensioner market in India is expected to grow at a CAGR of 5.1% between 2025 and 2035, driven by increasing bicycle use for daily commuting and recreational activities. The rapid adoption of e-bikes and foldable bicycles, along with government initiatives promoting sustainable transport, is expanding demand for reliable drivetrain components. Domestic component manufacturers are focusing on cost-effective, high-quality chain tensioners to serve both urban commuters and rural cyclists. Rising awareness of fitness and cycling culture among younger populations is creating additional growth opportunities. Partnerships with international brands for technology transfer and quality enhancement further strengthen the market.

The bicycle chain tensioner market in Germany is projected to grow at a CAGR of 4.7% from 2025 to 2035, supported by high cycling penetration and demand for premium bicycles. Performance bicycles, e-bikes, and mountain bikes dominate urban and recreational usage, requiring high-precision tensioning systems for optimal drivetrain efficiency. German manufacturers emphasize lightweight, durable materials and integrated solutions for both commuter and professional bicycles. The market benefits from well-developed cycling infrastructure and strong consumer preference for eco-friendly transport options. Export-oriented production also drives innovation, as manufacturers cater to both European and global standards for performance and reliability.

The bicycle chain tensioner market in the UK is expected to grow at a CAGR of 3.9% from 2025 to 2035, supported by urban cycling initiatives and increasing popularity of e-bikes. Commuters and recreational cyclists seek low-maintenance, efficient drivetrain components, boosting demand for reliable chain tensioners. Manufacturers are introducing modular designs, lightweight alloys, and corrosion-resistant finishes to improve performance and longevity. Expansion of bike-sharing programs and cycling lanes in metropolitan areas further promotes bicycle adoption. Marketing efforts highlighting product durability, ease of installation, and compatibility with diverse bicycle types encourage both consumer and commercial uptake.

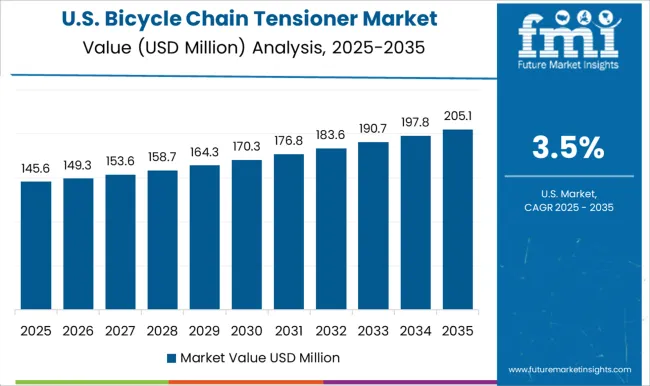

The bicycle chain tensioner market in the USA is projected to grow at a CAGR of 3.5% from 2025 to 2035, supported by increasing interest in e-bikes, mountain bikes, and road bicycles. Demand for high-quality drivetrain components is rising among recreational and professional cyclists seeking durability and smooth performance. Manufacturers are focusing on modular designs, lightweight alloys, and corrosion-resistant coatings to enhance reliability and longevity. Cycling infrastructure expansion, including bike lanes and trails, promotes adoption in urban and suburban areas. Partnerships between component suppliers and bicycle brands enable rapid innovation and improved product offerings, while growing fitness and outdoor recreation trends further support market growth.

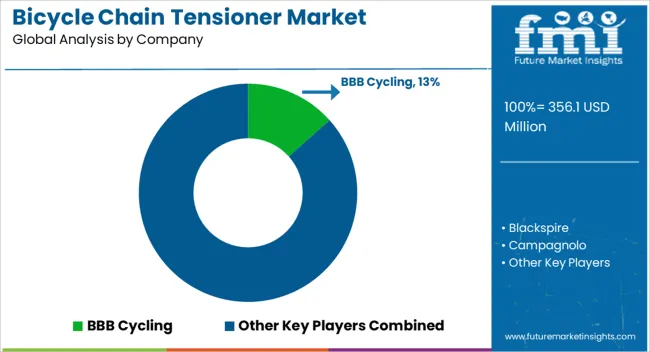

Competition in the bicycle chain tensioner market is driven by material quality, design precision, and adaptability to diverse bike types. Leading players, including Problem Solvers and T-Cycle, focus on high-performance solutions for single-speed, internally geared, and adventure bicycles. Products such as the Problem Solvers Two-Pulley Chain Tensioner and the T-Cycle Chain Tensioner for Rectangular Tubing ensure precise chain alignment, reduced wear, and enhanced durability. SE Bikes and ZTTO target affordability and ease of installation, appealing to urban commuters and entry-level cyclists. ZTTO’s E-bike Single Speed Derailleur Chain Tensioner and SE Bikes Lockit Tensioners address the specific demands of e-bikes, handling higher chain stress and providing stability during motor-assisted rides. These companies leverage lightweight alloys, corrosion-resistant coatings, and compact designs to balance performance and convenience. Innovation is centered on reliability under varied cycling conditions, from daily commuting to gravel or adventure cycling. Market differentiation is achieved through tailored solutions for niche requirements, with emphasis on ease of use, installation speed, and adaptability to different frame geometries. Strategies focus on product robustness, precise engineering, and user-centric features. Product brochures provide critical information including chain compatibility, material composition, weight, and installation guidance.

| Item | Value |

|---|---|

| Quantitative Units | USD 356.1 Million |

| Offering | Automatic tensioners and Manual tensioners |

| Application | Single speed bikes, Internal hub geared bikes, and Fixed gear bikes |

| Material | Steel, Aluminum, Carbon Fiber, Titanium, and Composite Materials |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BBB Cycling, Blackspire, Campagnolo, Full Speed Ahead, MRP, Paul Component, Rohloff AG, Shimano, SRAM, and Wolf Tooth |

| Additional Attributes | Dollar sales, share, product type demand, regional adoption, end-use segment trends, competitor landscape, pricing benchmarks, material preferences, innovation in design, distribution channels, aftermarket and replacement trends. |

The global bicycle chain tensioner market is estimated to be valued at USD 356.1 million in 2025.

The market size for the bicycle chain tensioner market is projected to reach USD 532.2 million by 2035.

The bicycle chain tensioner market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in bicycle chain tensioner market are automatic tensioners, _spring-loaded, _roller-based, _eccentric, _others, manual tensioners, _fixed-position, _screw-adjust, _bolt-on and _others.

In terms of application, single speed bikes segment to command 39.6% share in the bicycle chain tensioner market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA