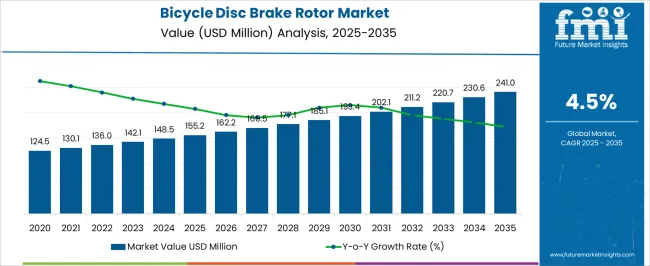

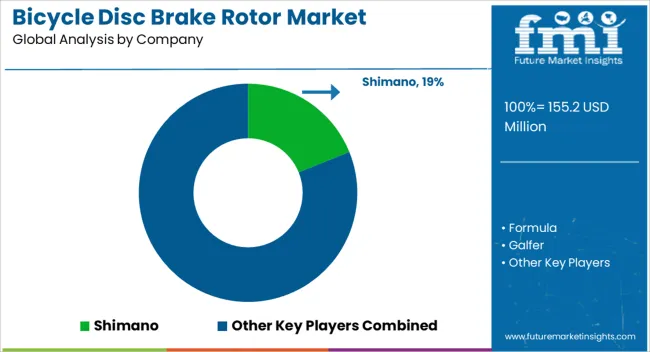

The bicycle disc brake rotor market is projected to grow from USD 155.2 million in 2025 to USD 241 million by 2035, registering a CAGR of 4.5% during the forecast period. Between 2025 and 2030, the market is expected to increase from USD 155.2 million to USD 193.4 million, driven by the rising popularity of cycling as a recreational and fitness activity, alongside the growing demand for high-performance braking systems.

Year-on-year analysis shows steady growth, with values reaching USD 162.2 million in 2026 and USD 169.5 million in 2027, supported by advancements in rotor material technologies and increased consumer awareness of braking safety. By 2028, the market is forecasted to reach USD 177.1 million, followed by USD 185.1 million in 2029 and USD 193.4 million by 2030.

Growth will likely be reinforced by increasing adoption of hydraulic disc brakes in both mountain and road bikes, driven by improvements in braking efficiency, comfort, and safety. Innovations in lightweight, corrosion-resistant materials and eco-friendly production methods are expected to provide further momentum. These dynamics position the bicycle disc brake rotor market as a key segment within the broader bicycle components industry, supporting the evolution of cycling technologies and growing infrastructure development.

| Metric | Value |

|---|---|

| Bicycle Disc Brake Rotor Market Estimated Value in (2025 E) | USD 155.2 million |

| Bicycle Disc Brake Rotor Market Forecast Value in (2035 F) | USD 241.0 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

The bicycle disc brake rotor market is experiencing steady growth, fueled by increasing demand for high-performance braking systems across mountain biking, road cycling, and urban commuting segments. Manufacturers are focusing on material innovation, weight reduction, and improved heat dissipation to meet the evolving performance needs of cycling enthusiasts and professionals.

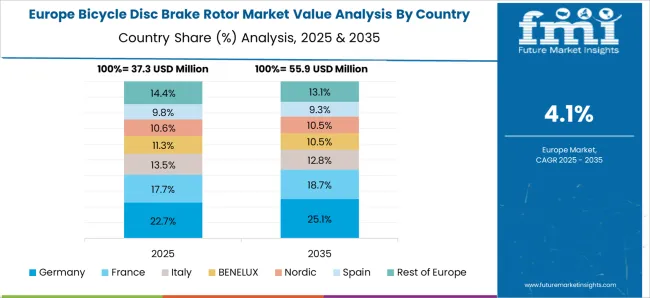

Urbanization and rising fitness consciousness are driving global bicycle adoption, while advancements in e-bikes and gravel bikes are encouraging rotor customization by size and mounting system. Regulatory encouragement for cycling infrastructure, especially in Europe and parts of Asia, is further creating new avenues for market expansion.

Technological enhancements in rotor surface design and integration with electronic braking modules are contributing to product differentiation. Going forward, the market is expected to benefit from growing OEM partnerships, aftermarket sales, and increased adoption of disc brakes in entry-level and mid-range bicycles.

The bicycle disc brake rotor market is segmented on the basis of mounting system, material, size, application, and geographic region. By mounting system, the market is divided into 6-Bolt and Center Lock variants. In terms of material, disc brake rotors are classified into stainless steel, aluminum, and composite materials. Based on size, rotors are commonly categorized into small (≤140 mm), medium (141–180 mm), and large (≥181 mm) diameters to suit different performance requirements. Applications span across road bicycles, mountain bicycles, electric bicycles, and other categories such as hybrid and BMX models. From a regional perspective, the market is assessed across North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

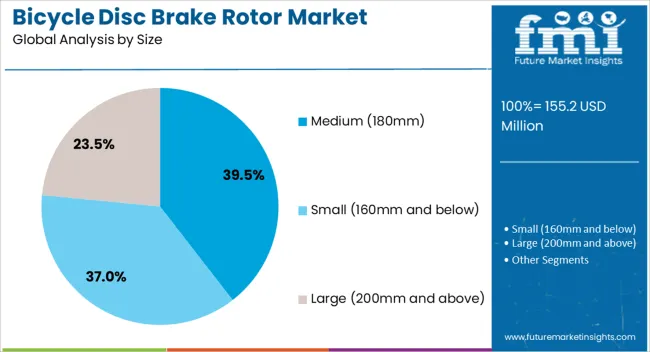

In 2025, the bicycle disc brake rotor market totals USD 155.2 million, with size split led by Medium (180 mm) at 39.5% of revenue. Small (≤160 mm) follows at 37.0%, reflecting broad fit on road, gravel, and urban bikes. Large (≥200 mm) accounts for 23.5%, concentrated in downhill and e-MTB use where heat control matters most. Medium maintains leadership due to balanced stopping power, lower fade on descents, and favorable OEM specifications across trail and all-terrain models.

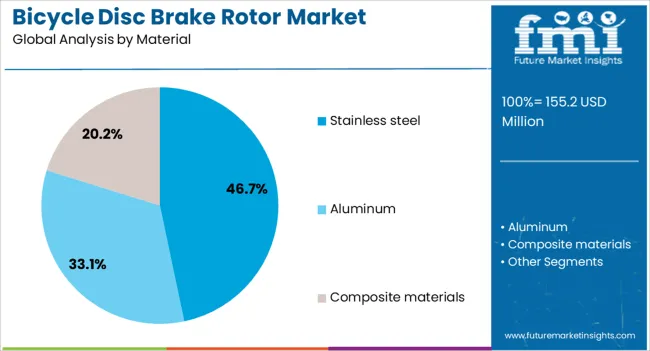

Stainless steel is projected to hold 46.7% of the market revenue in 2025, establishing it as the leading material type for bicycle disc brake rotors. Its prominence stems from superior corrosion resistance, strength retention under high temperatures, and affordability when compared to exotic alloys or composites.

Stainless steel rotors maintain consistent braking performance across varied terrains and weather conditions, making them highly dependable for both professional cyclists and casual riders. The material’s machinability also allows for precise cut patterns that aid in heat dissipation and rotor longevity.

Growing adoption in mid-range and high-volume bicycle models has further expanded its market reach. Additionally, stainless steel’s recyclability and alignment with sustainable material goals are gaining favor among environmentally conscious manufacturers and consumers.

The medium rotor size category (180mm) is expected to account for 39.5% of total market revenue in 2025, positioning it as the most widely used rotor size. This segment’s leadership is supported by its balanced performance in terms of braking power, heat management, and bike weight optimization.

The 180mm size has become the standard for many mountain and trail bikes where reliable stopping power is essential without compromising agility or adding excessive weight. It offers greater modulation than smaller rotors and less rotor fade under prolonged use, especially during downhill descents.

OEM specifications across multiple bicycle models increasingly favor the 180mm format due to its versatility and compatibility. As the trend toward all-terrain, hybrid, and e-MTBs continues, demand for medium-sized rotors is expected to maintain strong momentum in both original equipment and replacement markets.

The bicycle disc brake rotor market is growing due to the rising demand for advanced braking systems in high-performance bicycles. In 2024 and 2025, growth drivers include the increasing popularity of mountain biking and the growing focus on safety in cycling. Opportunities exist in the development of lightweight, corrosion-resistant materials. Emerging trends include the shift towards larger rotors for better performance in extreme conditions. However, market restraints such as high production costs and competition from traditional rim brakes limit the market's broader adoption.

The primary growth driver in the bicycle disc brake rotor market is the increasing demand for high-performance components in bicycles. In 2024, the surge in recreational and competitive cycling led to greater adoption of advanced braking systems, especially in mountain biking. Riders prioritized superior braking performance, making disc brake rotors essential for safety and control. As cycling continues to gain popularity globally, the need for durable and reliable braking systems is propelling the growth of the market across various cycling segments.

Opportunities are emerging with the development of lightweight and corrosion-resistant materials for bicycle disc brake rotors. In 2025, manufacturers increasingly focused on creating rotors from materials like aluminum alloys and carbon composites to reduce weight without compromising braking performance. These materials also offer enhanced resistance to wear and rust, particularly in harsh weather conditions, making them ideal for both road and off-road cycling. This innovation reflects growing demand for performance-enhancing yet durable bicycle components, creating substantial market opportunities.

Emerging trends in the market include the shift towards larger disc brake rotors for improved performance. In 2024, high-end mountain bikes and e-bikes increasingly featured rotors larger than the standard sizes, providing better heat dissipation and enhanced stopping power. These larger rotors are preferred for extreme conditions where braking efficiency is critical. This trend is indicative of the growing emphasis on performance-oriented cycling equipment, driving the demand for specialized disc brake rotor solutions across various cycling disciplines.

Key market restraints include high production costs and competition from traditional rim brakes. In 2024 and 2025, the cost of producing advanced bicycle disc brake rotors remained relatively high, particularly for those made from lightweight and corrosion-resistant materials. Additionally, rim brakes, which are simpler and less expensive, continue to pose competition in entry-level bicycles, limiting the wider adoption of disc brake systems in more budget-conscious market segments. These factors highlight the need for cost-effective solutions and value-driven innovations in the market.

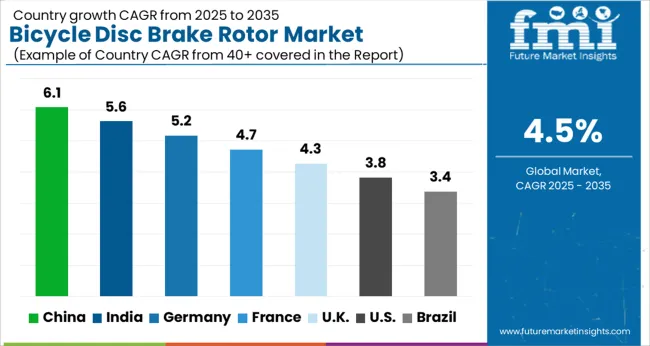

The global bicycle disc brake rotor market is projected to grow at 4.5% CAGR from 2025 to 2035. China leads with 6.1% CAGR, driven by the country’s rapidly growing bicycle industry, increasing demand for high-performance cycling components, and a focus on enhancing safety and braking efficiency. India follows at 5.6%, supported by the expanding middle class, rising interest in cycling for both recreational and fitness purposes, and growing infrastructure for cycling.

France records 4.7% CAGR, reflecting strong demand for high-quality, durable disc brake rotors for both professional and recreational cycling. The United Kingdom grows at 4.3%, while the United States posts 3.8%, reflecting steady demand in mature markets, with a growing focus on performance and safety in cycling. Asia-Pacific leads the market growth due to increased cycling participation, while Europe and North America focus on high-performance and innovative disc brake technologies.

The bicycle disc brake rotor market in China is forecasted to grow at 6.1% CAGR, driven by the country’s rapidly expanding cycling industry and the growing adoption of bicycles for urban mobility and fitness. The rise in cycling infrastructure development, particularly in major cities, encourages the use of advanced bicycle components like disc brake rotors. The growing popularity of high-performance cycling for both sports and leisure further accelerates demand for premium and durable braking systems.

The bicycle disc brake rotor market in India is projected to grow at 5.6% CAGR, supported by the expanding popularity of cycling for both recreational and fitness purposes. As the cycling culture grows in urban and suburban areas, the demand for high-performance bicycle components, including disc brake rotors, increases. India’s rising middle class, greater access to affordable bicycles, and improvements in cycling infrastructure all contribute to the market’s expansion.

The bicycle disc brake rotor market in France is expected to grow at 4.7% CAGR, driven by strong demand in the cycling community, particularly in the competitive and recreational sectors. France’s well-established cycling culture, along with the country’s emphasis on performance and quality, supports the adoption of advanced, high-quality bicycle components. The rising popularity of mountain biking and professional cycling events further accelerates the demand for high-performance disc brake rotors.

The bicycle disc brake rotor market in the United Kingdom is projected to grow at 4.3% CAGR, supported by increasing interest in cycling for fitness, commuting, and sports. The UK’s cycling infrastructure development, along with growing awareness about cycling safety and performance, boosts demand for high-quality braking systems. Additionally, the increasing use of bicycles in competitive sports, particularly mountain biking and road cycling, further drives market expansion.

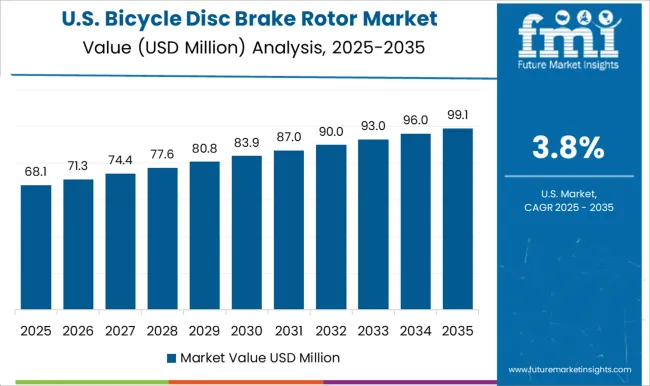

The bicycle disc brake rotor market in the United States is projected to grow at 3.8% CAGR, driven by steady demand for high-performance bicycles in both recreational and competitive sectors. As the popularity of cycling continues to rise, particularly in the mountain biking and road cycling communities, demand for premium braking systems increases. The growing focus on cycling safety, along with technological advancements in brake systems, further contributes to market growth in the USA

Heat management, noise control, rotor stiffness, and mounting formats define the competitive pace of the bicycle disc brake rotor market. OEM specifications and aftermarket demand are pursued simultaneously, with pricing pressure evident at entry levels, although performance tiers dominate customer decision-making.

Shimano is competing through thermal control, with a strategy centered on sandwich rotors featuring extended aluminum fins. The positioning is premium, focused on road and mountain bikes, with availability in Center Lock formats. SRAM is competing on thickness and stopping power, deploying the HS2 rotor at 2.00 mm with enhanced heat dissipation and flexible mounting. The positioning is oriented toward gravity and e-MTB segments.

Magura is competing through e-bike-optimized designs and rotor stiffness, using MDR-P two-piece construction with dovetail interlinking to improve heat resistance under heavy loads. The positioning targets high system weights, long braking cycles, and downhill applications. TRP is competing on control under load with very thick designs, specifically the 2.3 mm RS01E rotor engineered for demanding downhill and e-MTB riders. The positioning is heavy-duty, emphasizing stability and reliability in extreme performance conditions.

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Mounting System | 6-Bolt and Centerlock |

| Material | Stainless steel, Aluminum, and Composite materials |

| Size | Medium (180mm), Small (160mm and below), and Large (200mm and above) |

| Application | Mountain bikes (MTBs), Road bikes, Gravel bikes, and E-bikes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Shimano, Formula, Galfer, Hope Technology, Jagwire, KCNC, Magura, SRAM LLC, SwissStop, and Tektro |

| Additional Attributes | Dollar sales by rotor type and application, demand dynamics across mountain biking, road cycling, and electric bicycles, regional trends in disc brake rotor adoption, innovation in lightweight and heat-resistant materials, impact of regulatory standards on safety and performance, and emerging use cases in advanced bicycle systems and electric mobility. |

The global bicycle disc brake rotor market is estimated to be valued at USD 155.2 million in 2025.

The market size for the bicycle disc brake rotor market is projected to reach USD 241.0 million by 2035.

The bicycle disc brake rotor market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in bicycle disc brake rotor market are 6-bolt and centerlock.

In terms of material, stainless steel segment to command 46.7% share in the bicycle disc brake rotor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bicycle Mechanical Disc Brake Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Brake Lever Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Carbon Brake Disc Market Growth - Trends & Forecast 2025 to 2035

Automotive Carbon Brake Rotors Market Growth - Trends & Forecast 2025 to 2035

Particle Reinforced Aluminum Matrix Composite Brake Disc for Electric Automobiles Market Size and Share Forecast Outlook 2025 to 2035

Brake Pads and Shoes Market Size and Share Forecast Outlook 2025 to 2035

Disc Suspension Porcelain Insulator Market Size and Share Forecast Outlook 2025 to 2035

Brake System Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Tire Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Components Aftermarket Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Crankset Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Drivetrain Cassette Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Frames Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bicycle Saddle Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Electronic Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Device Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Gear Shifter Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Bottom Bracket Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA