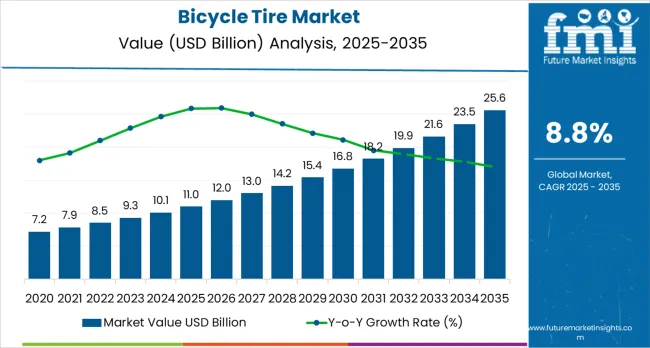

The global bicycle tire market is forecasted to grow from USD 11.0 billion in 2025 to approximately USD 25.5 billion by 2035, recording an absolute increase of USD 14.5 billion over the forecast period. This translates into a total growth of 131.8%, with the market forecast to expand at a CAGR of 8.8% between 2025 and 2035. The overall market size is expected to grow by nearly 2.32X during the same period, supported by surging e-bike adoption, increasing urbanization driving cycling infrastructure development, and growing consumer preference for eco-friendly transportation solutions across various global markets.

Between 2025 and 2030, the market is projected to expand from USD 11.0 billion to USD 16.8 billion, resulting in a value increase of USD 5.8 billion, which represents 40% of the total forecast growth for the decade. This phase of growth will be shaped by accelerating e-bike penetration across urban markets, expansion of cycling infrastructure in developing economies, and growing environmental consciousness driving shift toward eco-friendly mobility solutions. Governments worldwide are investing heavily in cycling infrastructure to reduce urban congestion and carbon emissions, creating substantial demand for high-performance bicycle tires.

From 2030 to 2035, the market is forecast to grow from USD 16.8 billion to USD 25.5 billion, adding another USD 8.7 billion, which constitutes 60% of the overall ten-year expansion. This period is expected to be characterized by mainstream adoption of tubeless and puncture-resistant tire technologies, integration of smart tire sensors for performance monitoring, and development of specialized tire compounds for diverse terrain and weather conditions. The growing popularity of adventure cycling, mountain biking, and long-distance touring will drive demand for premium, application-specific tire solutions across multiple consumer segments.

Between 2020 and 2025, the market experienced significant acceleration, driven by the COVID-19 pandemic's impact on personal mobility preferences and unprecedented surge in bicycle sales globally. The market developed as consumers recognized cycling as a safe, healthy, and environmentally friendly transportation alternative. Government stimulus programs supporting cycling infrastructure and bike-sharing initiatives further accelerated market expansion during this transformational period.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 11.0 billion |

| Market Forecast Value (2035) | USD 25.5 billion |

| Forecast CAGR (2025-2035) | 8.8% |

Market expansion is being supported by the global shift toward sustainable urban mobility and the corresponding surge in bicycle adoption across both developed and emerging economies. Modern cities are implementing comprehensive cycling infrastructure including dedicated bike lanes, bike-sharing programs, and secure parking facilities, making cycling a viable transportation option for millions of commuters. The growing health consciousness among consumers combined with rising fitness trends has positioned cycling as a preferred exercise activity, creating steady demand for quality bicycle tires across recreational and sports segments.

The explosive growth of electric bicycles represents a transformative market driver, with e-bikes requiring specialized tires capable of handling higher speeds, increased weight, and steady performance demands. E-bike adoption is accelerating globally, particularly in Europe and Asia, where government incentives and environmental regulations favor electric-assisted cycling. E-bike tires must deliver superior puncture resistance, extended durability, and enhanced grip characteristics, driving innovation in tire compounds and construction technologies that benefit the broader bicycle tire market.

Growing focus on performance, safety, and riding comfort is driving demand for advanced tire technologies from premium manufacturers with proven track records of innovation and quality. Consumers are increasingly willing to invest in high-quality tires that offer measurable benefits in rolling resistance, grip, durability, and puncture protection. The tubeless tire revolution has transformed performance expectations, with tubeless systems offering significant advantages in weight reduction, ride comfort, and puncture resistance compared to traditional tube-type tires. This technological shift is creating opportunities for manufacturers who can deliver reliable tubeless-compatible products across various price points.

The bicycle tire market is set for substantial growth and innovation driven by rising urbanization, cycling adoption, and environmental consciousness. As consumers seek durable, high-performance, low-resistance, and eco-friendly tires, new pathways emerge for capturing value along the supply chain, at the product level, and in geographic expansion.

Pathway A - Eco-Friendly &Sustainable Materials. Increasing demand for biodegradable, recycled, or bio-based rubber compounds enables manufacturers to command premium prices. Certification for eco-friendly sourcing and eco-labeling can generate revenue in a USD 2-4 billion pool.

Pathway B - Performance &Technology Innovation. Improving puncture resistance, rolling efficiency, and longevity through advanced compounds and manufacturing techniques (e.g., tubeless, self-sealing tires) creates premium offerings. Opportunity: USD 3-6 billion.

Pathway C - Low Resistance &Energy Efficient Tires. Focused on reducing rolling resistance to enhance cycling endurance and e-bike range, especially in urban and commuter markets. Potential market share: USD 4-7 billion.

Pathway D - New Formats &Design Differentiation. Development of wider tires, tubeless setups, and lightweight racing or mountain bike options. Innovating in tread pattern, sidewall design, and grip improves performance. Pool: USD 2-4 billion.

Pathway E - Regional &Local Market Expansion. Tailoring products for emerging markets with localized branding, sizing, and regional preferences. Lower production costs and regional supply chains boost margins. Upside: USD 3-6 billion.

Pathway F - Supply Chain Optimization &Raw Material Resilience. Source from regional suppliers, incorporate recycled rubber, and streamline logistics to offset raw material volatility and meet rising demand. Expected benefits: USD 2-4 billion.

Pathway G - Branding &ESG Premiums. Focusing sustainability, reducing carbon footprint during manufacturing, and supporting environmentally friendly practices build brand loyalty and enable premium pricing. Pool: USD 1-3 billion.

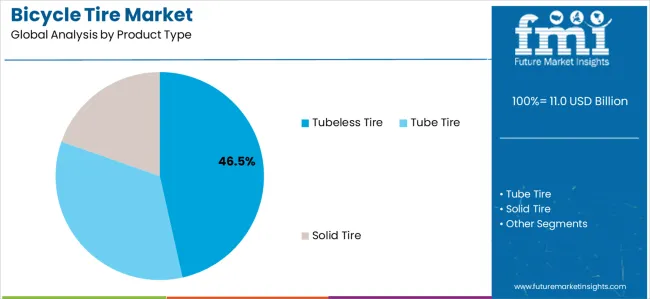

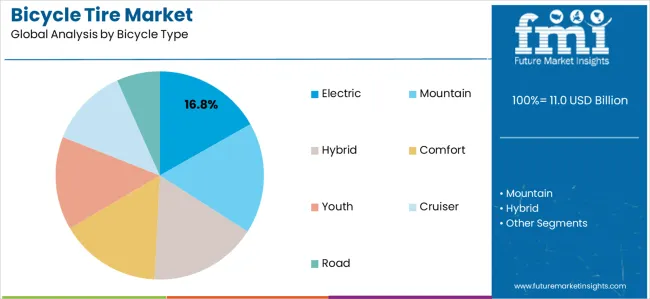

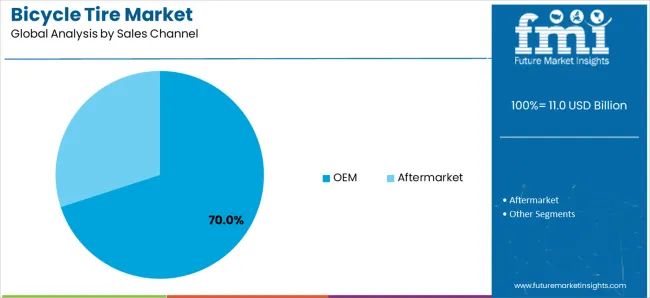

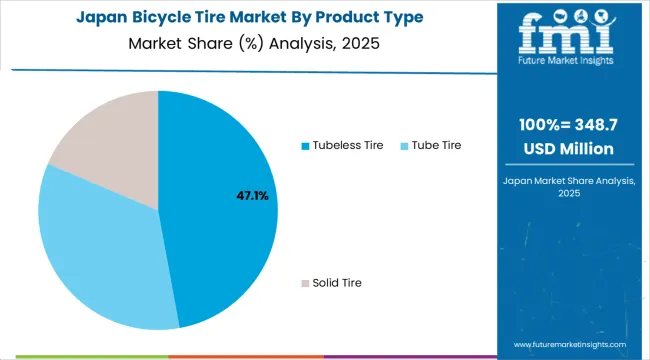

The market is segmented by product type, bicycle type, tire size, sales channel, and region. By product type, the market is divided into tubeless tires, tube tires, and solid tires. Based on bicycle type, the market is categorized into mountain, hybrid, electric, comfort, youth, cruiser, and road bicycles. By tire size, segments include up to 12 inches, 12-22 inches, and above 22 inches. The sales channel segment comprises OEM and aftermarket distribution. Regionally, the market is divided into Asia-Pacific, Europe, North America, Latin America, and Middle East &Africa.

Tubeless tire configurations are projected to account for 46.5% of the bicycle tire market in 2025. This leading share is supported by the growing adoption of tubeless systems among performance-oriented cyclists and increasing availability of tubeless-ready wheelsets across various bicycle categories. Tubeless tires eliminate the inner tube, reducing weight and rolling resistance while providing superior puncture protection through the use of liquid sealants that automatically seal small punctures during riding. The segment benefits from technological advancements that have simplified tubeless installation and improved air retention reliability, making tubeless systems accessible to mainstream consumers beyond professional and enthusiast markets.

Modern tubeless tire technology incorporates advanced bead designs, reinforced sidewalls, and optimized casing constructions that ensure reliable sealing without tubes. These innovations have significantly improved user experience while delivering measurable performance benefits in speed, comfort, and durability. Mountain biking and gravel cycling communities particularly drive tubeless adoption, as these disciplines benefit dramatically from the ability to run lower tire pressures for enhanced traction and comfort without risk of pinch flats. Road cycling is experiencing accelerating tubeless conversion as manufacturers develop lighter-weight tubeless road tires that match or exceed the performance of traditional tubular and clincher systems.

The growing popularity of adventure and bikepacking activities further accelerates tubeless adoption, as riders require maximum puncture resistance for multi-day expeditions in remote locations. Environmental considerations also favor tubeless systems, as they eliminate disposable inner tubes and reduce overall material consumption. The segment continues expanding into entry-level and mid-range bicycle markets as manufacturers develop more affordable tubeless-compatible products and bicycle brands increasingly specify tubeless-ready wheels as standard equipment.

Electric bicycle applications are expected to represent 16.8% of bicycle tire demand in 2025. This significant and rapidly growing share reflects the explosive adoption of e-bikes globally and the specialized tire requirements of electric-assisted cycling. E-bikes impose substantially greater demands on tires compared to conventional bicycles, requiring enhanced puncture protection, reinforced casing construction, and compound formulations capable of withstanding higher speeds and heavier loads. The segment benefits from continued e-bike market expansion, particularly in Europe where e-bikes represent over 20% of total bicycle sales, and in Asian markets where e-bikes serve as primary transportation for millions of commuters.

E-bike tire development represents a specialized engineering challenge requiring balance between durability, rolling efficiency, and weight considerations. These applications demand tires capable of sustained speeds exceeding 25-45 km/h while carrying combined rider and cargo weights often exceeding 120-150 kg. The growing focus on e-bike safety regulations and insurance requirements drives demand for tires specifically certified for electric bicycle use, with clear speed and load ratings. Cargo e-bikes and e-bike delivery fleets create additional demand for heavy-duty tire solutions capable of supporting loads exceeding 200 kg while maintaining reliability over high-mileage commercial use cycles.

The trend toward longer-range e-bikes and battery technology improvements enable extended riding distances, increasing the importance of tire durability and puncture resistance for users covering 50-100+ km per ride. The segment also benefits from premium e-bike categories including performance e-mountain bikes and e-road bikes, which require specialized tire designs combining e-bike durability with performance characteristics demanded by enthusiast riders. Government incentive programs promoting e-bike adoption in numerous countries ensure steady growth for this high-value tire segment.

Original Equipment Manufacturer (OEM) sales channels are projected to account for 70.0% of the bicycle tire market in 2025. This dominant share reflects the fundamental relationship between bicycle manufacturers and tire suppliers, with the vast majority of bicycles sold globally equipped with tires specified by the bicycle brand. OEM relationships enable tire manufacturers to secure large-volume contracts while bicycle brands benefit from customized tire specifications, co-branding opportunities, and competitive pricing structures. The segment benefits from strong growth in complete bicycle sales driven by e-bike expansion, increased cycling participation, and ongoing replacement of aging bicycle fleets in developed markets.

OEM tire supply relationships have evolved into strategic partnerships where tire manufacturers work closely with bicycle brands during product development phases to create application-optimized tire solutions. These collaborations result in tires specifically engineered to complement bicycle geometry, intended use cases, and brand positioning strategies. Premium bicycle manufacturers increasingly differentiate their products through exclusive tire partnerships, custom tread patterns, and co-branded tire sidewalls that enhance overall product appeal. The e-bike revolution particularly strengthens OEM channel dominance, as e-bikes require specialized tires typically specified during manufacturing rather than selected by end users.

The growing direct-to-consumer bicycle sales model strengthens OEM channel importance, as online bicycle brands maintain careful control over component specifications to ensure consistent product quality and customer experience. Bicycle sharing and rental fleet operators also source tires through OEM-style relationships with tire manufacturers, securing volume pricing and specialized products optimized for high-utilization commercial applications. The aftermarket channel, representing 30% of the market, serves replacement demand and upgrade opportunities, with growth driven by premium tire adoption among enthusiast cyclists seeking performance improvements beyond original equipment specifications.

The market is advancing rapidly due to the global eco-friendly movement, explosive e-bike growth, and increasing government investment in cycling infrastructure. The market faces challenges including raw material price volatility, intense price competition particularly in mass-market segments, and varying quality standards across different manufacturing regions. The market must navigate supply chain complexities, especially regarding distribution of diverse product specifications across fragmented retail networks and the growing importance of direct-to-consumer channels.

The extraordinary expansion of electric bicycle adoption worldwide is creating substantial demand for specialized tire solutions engineered to meet the unique performance requirements of e-bikes. E-bike tires must withstand significantly higher speeds, greater loads, and more demanding usage patterns compared to conventional bicycle tires, requiring advanced casing construction, reinforced puncture protection layers, and specially formulated rubber compounds capable of delivering extended durability. This segment is particularly valuable for tire manufacturers, as e-bike tires command premium pricing reflecting their enhanced engineering and performance characteristics. The e-bike market is projected to exceed 300 million units globally by 2030, ensuring steady demand growth for specialized e-bike tire solutions across urban commuter, cargo, and performance categories.

Governments and municipalities worldwide are implementing comprehensive cycling infrastructure programs as part of sustainable urban mobility strategies, including protected bike lanes, bike-sharing systems, and cycling superhighways connecting urban and suburban areas. These infrastructure investments directly stimulate bicycle usage, increasing both new bicycle sales and tire replacement demand as riders accumulate greater annual mileage. Cities including Copenhagen, Amsterdam, Paris, and Barcelona serve as models for cycling-focused urban planning, with hundreds of additional cities implementing similar programs. The COVID-19 pandemic accelerated these trends, with numerous cities installing emergency cycling infrastructure that is becoming permanent, fundamentally shifting urban transportation patterns and creating steady bicycle tire demand.

Continuous innovation in tire technology is expanding performance boundaries and creating new market opportunities, particularly in tubeless systems and advanced puncture protection technologies. Tubeless tires have evolved from niche products for professional cyclists to mainstream solutions available across multiple price points and bicycle categories. Manufacturers are developing simplified tubeless installation systems, improved sealant formulations, and enhanced bead retention designs that make tubeless technology accessible to average consumers. Simultaneously, advances in puncture protection including aramid fiber reinforcement, multi-layer casing construction, and specialized rubber compounds are delivering measurably improved durability, reducing maintenance requirements and total cost of ownership for consumers. Smart tire technologies incorporating embedded sensors for pressure monitoring, wear detection, and performance optimization represent emerging innovations that may reshape premium tire segments over the forecast period.

Growing environmental consciousness among consumers and regulatory pressure for green manufacturing practices are driving significant changes in bicycle tire development and production processes. Manufacturers are exploring eco-friendly rubber alternatives including dandelion-derived latex, recycled rubber incorporation, and bio-based synthetic rubber compounds that reduce petroleum dependence. End-of-life tire recycling programs and take-back initiatives are emerging as brand differentiators, with several manufacturers implementing circular economy models. The environmental benefits of cycling as a transportation alternative create positive associations for the industry, with consumers increasingly scrutinizing product sustainability credentials and favoring brands demonstrating environmental leadership. These trends are driving investment in green manufacturing technologies and eco-friendly material sourcing throughout the bicycle tire supply chain.

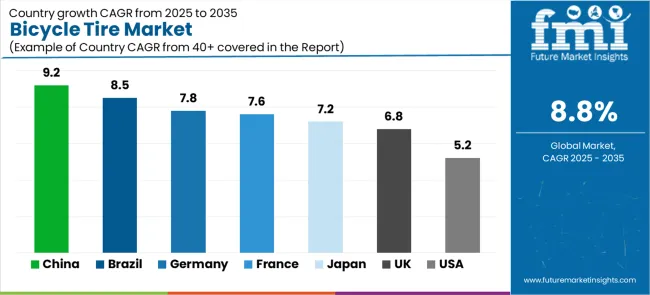

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.2% |

| Brazil | 8.5% |

| Germany | 7.8% |

| France | 7.6% |

| Japan | 7.2% |

| United Kingdom | 6.8% |

| United States | 5.2% |

The market is growing rapidly, with China leading at a 9.2% CAGR through 2035, driven by massive urban cycling adoption, world-leading e-bike manufacturing capacity, and government initiatives promoting eco-friendly transportation. Brazil follows at 8.5%, supported by expanding urban cycling culture, growing middle-class bicycle ownership, and improving cycling infrastructure in major metropolitan areas. Germany records strong growth at 7.8%, benefiting from Europe's most developed cycling infrastructure, premium e-bike market leadership, and strong consumer demand for high-performance tire solutions. France grows steadily at 7.6%, implementing ambitious cycling infrastructure programs and substantial government subsidies for e-bike purchases. Japan demonstrates healthy growth at 7.2%, focusing technological innovation, premium product development, and expanding urban cycling adoption. The United Kingdom maintains solid expansion at 6.8%, supported by major cycling infrastructure investments in London and other cities. The United States shows moderate growth at 5.2%, driven by recreational cycling demand, growing bike-sharing programs, and gradual urban infrastructure improvements.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

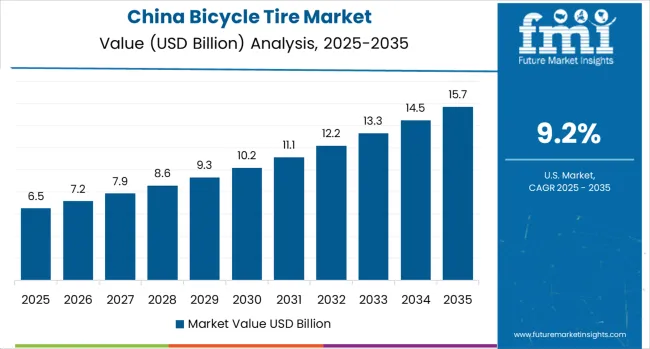

China is projected to exhibit the highest growth rate with a CAGR of 9.2% through 2035, driven by the country's position as the world's largest bicycle and e-bike market with over 300 million e-bikes in circulation. China's massive urban population and extensive cycling culture create unparalleled demand for bicycle tires across all product categories and price segments. The country dominates global bicycle and e-bike manufacturing, with Chinese factories producing over 60% of the world's bicycles and an even larger share of e-bikes, creating enormous OEM tire demand. Major Chinese cities are implementing comprehensive cycling infrastructure including segregated bike lanes and massive bike-sharing programs with fleets exceeding millions of bicycles requiring continuous tire replacement. The rapid growth of food delivery and logistics services relying on e-bikes creates substantial commercial tire demand, with delivery riders often replacing tires multiple times annually due to high-mileage usage patterns.

Brazil is expanding at a CAGR of 8.5%, supported by rapidly evolving urban cycling culture in major metropolitan areas including São Paulo, Rio de Janeiro, and Brasília, where cycling is transitioning from purely recreational activity to viable transportation option. Brazil's growing middle class and increasing health consciousness are driving bicycle ownership rates higher, with bicycles becoming aspirational purchases for fitness and leisure activities. Major Brazilian cities are implementing cycling infrastructure improvements including dedicated bike lanes, bike-sharing programs, and integration of cycling with public transportation systems. The country's large youth population and growing interest in mountain biking and cycling sports create demand for performance-oriented tire products across premium segments.

Germany is projected to grow at a CAGR of 7.8%, supported by the country's position as Europe's largest and most sophisticated bicycle market with the highest e-bike penetration rates on the continent. Germany leads European e-bike adoption with e-bikes representing over 40% of total bicycle sales, creating substantial demand for premium e-bike-rated tires capable of meeting stringent German safety and performance standards. The country's exceptional cycling infrastructure including over 75,000 km of dedicated cycling paths and comprehensive urban cycling networks supports high utilization rates and corresponding tire replacement demand. German consumers demonstrate strong willingness to invest in premium bicycle components including high-performance tires, supporting market value growth beyond pure volume expansion.

France is growing at a CAGR of 7.6%, driven by unprecedented government commitment to cycling infrastructure with multi-billion euro investment programs transforming French cities into cycling-friendly environments. France's national cycling plan includes development of extensive inter-city cycling routes, urban bike lane networks, and comprehensive bike-sharing systems across major metropolitan areas. The country offers substantial e-bike purchase subsidies reaching up to €4,000 for qualifying buyers, dramatically accelerating e-bike adoption and creating strong demand for e-bike-specific tire solutions. Paris is implementing one of Europe's most ambitious urban cycling transformations, with plans to create fully segregated cycling networks and reduce automobile traffic, serving as a model for other French cities.

Japan is expanding at a CAGR of 7.2%, driven by the country's focus on technological innovation, precision manufacturing, and development of advanced materials for bicycle components. Japanese consumers demonstrate sophisticated product preferences favoring high-quality, durable tire solutions with advanced performance characteristics. The country's densely populated urban centers including Tokyo, Osaka, and Nagoya create ideal conditions for cycling as short-distance transportation, with bicycles serving as crucial links in comprehensive public transportation networks. Japan's aging population is driving adoption of electric-assist bicycles, with e-bike technology originally developed for Japanese domestic market needs subsequently expanding globally.

The United Kingdom is projected to grow at a CAGR of 6.8%, supported by major cycling infrastructure investments in London and other British cities responding to air quality concerns and urban congestion challenges. The UK government has committed billions of pounds to cycling infrastructure development including segregated cycling superhighways, expansion of bike-sharing programs, and implementation of low-traffic neighborhoods that prioritize cycling and walking. London's cycling revolution has inspired similar transformations across Manchester, Birmingham, Edinburgh, and other urban centers, with cycling participation rates increasing dramatically following infrastructure improvements.

The United States is expanding at a CAGR of 5.2%, driven by substantial recreational cycling market including mountain biking, road cycling, and gravel riding segments characterized by premium product adoption and performance-oriented consumer preferences. While the US lags European and Asian markets in cycling infrastructure and commuter cycling adoption, the country leads in high-value recreational cycling categories supporting premium tire demand. Growing bike-sharing programs and micro-mobility services in major US cities are creating commercial tire demand, although adoption rates remain modest compared to European and Asian counterparts.

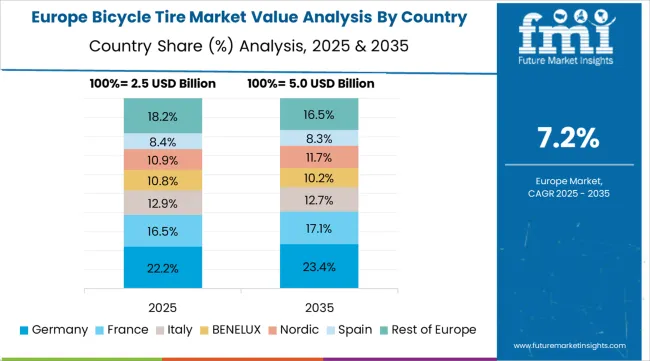

The bicycle tire market in Europe is projected to grow from USD 3.2 billion in 2025 to USD 4.6 billion by 2035, registering a CAGR of 3.7% over the forecast period. Germany is expected to maintain its leadership with a 32.5% share in 2025, supported by its position as Europe's largest e-bike market and exceptional cycling infrastructure development. France follows with 18.8% market share, driven by ambitious government cycling programs and substantial e-bike purchase subsidies reaching thousands of euros per buyer. The United Kingdom holds 15.2% of the European market, benefiting from major urban cycling infrastructure investments in London and other cities. Italy and Spain collectively represent 16.5% of regional demand, with growing focus on urban mobility solutions and recreational cycling tourism. The Netherlands commands 8.3% market share despite its smaller population, reflecting the world's highest per-capita bicycle ownership and cycling participation rates. The Nordic countries (Denmark, Sweden, Norway, Finland) account for 5.8% of the market, focusing premium product adoption and year-round cycling infrastructure. The Rest of Europe region, including Eastern European countries, Belgium, Switzerland, Austria, and other markets, accounts for 2.9% of the market, supported by expanding cycling infrastructure in cities like Vienna, Prague, Warsaw, and Budapest, along with growing e-bike adoption across Central and Eastern European markets.

The market is characterized by competition among established tire manufacturers with automotive heritage, specialized bicycle component companies, and Asian manufacturers serving mass-market and OEM segments. Companies are investing in advanced rubber compound development, tubeless technology innovation, eco-friendly material research, and manufacturing process optimization to deliver high-performance, durable, and cost-effective tire solutions. Strategic partnerships with bicycle manufacturers, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

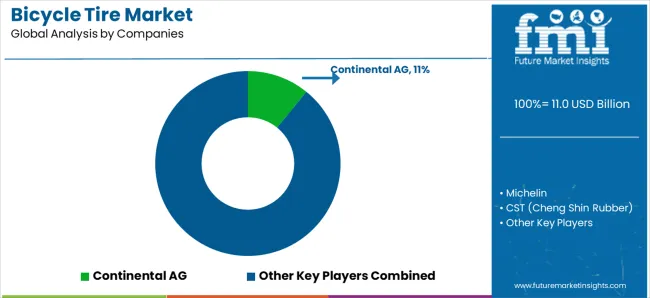

Continental AG, operating globally, maintains market leadership with approximately 12% share through comprehensive tire portfolios spanning road, mountain, urban, and e-bike categories with focus on premium positioning and technological innovation. Michelin, multinational, provides advanced tire solutions across cycling disciplines with focus on performance optimization, durability, and materials science expertise. CST (Cheng Shin), Taiwan-based, delivers extensive tire range serving OEM and aftermarket channels with competitive pricing and broad product availability. Kenda Tires offers diverse bicycle tire portfolio with strong presence in mountain bike and value segments.

Pirelli Tyre S.p.A. provides premium road and mountain bike tires leveraging motorsports technology transfer and performance heritage. Schwalbe delivers specialized tire solutions with particular strength in European markets and premium e-bike segments. Vittoria Industries offers performance-oriented road and mountain bike tires popular among enthusiast and competitive cyclists. Maxxis International maintains leadership in mountain bike tire category with extensive range of tread patterns and compound options.

Hangzhou Zhongce, Bridgestone Corporation, Hutchinson SA, Panaracer Corporation, IRC Tire, Challenge Tires, WTB (Wilderness Trail Bikes), Specialized Bicycle Components, Goodyear Tire &Rubber Company, and Vredestein offer specialized tire expertise, regional manufacturing capabilities, and technical innovation across global and regional networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.0 billion |

| Product Type | Tubeless Tire, Tube Tire, Solid Tire |

| Bicycle Type | Mountain, Hybrid, Electric, Comfort, Youth, Cruiser, Road |

| Tire Size | Up to 12 inches, 12-22 inches, Above 22 inches |

| Sales Channel | OEM, Aftermarket |

| Regions Covered | Asia-Pacific, Europe, North America, Latin America, Middle East &Africa |

| Country Covered | China, Germany, France, Japan, United States, United Kingdom, Brazil, and other 40+ countries |

| Key Companies Profiled | Continental AG, Michelin, CST (Cheng Shin), Kenda Tires, Pirelli Tyre S.p.A., Schwalbe, Vittoria Industries, Maxxis International, Hangzhou Zhongce, Bridgestone Corporation, Hutchinson SA, Panaracer Corporation, IRC Tire, Challenge Tires, WTB, Specialized Bicycle Components, Goodyear Tire &Rubber Company, Vredestein |

The global bicycle tire market is estimated to be valued at USD 11.0 billion in 2025.

The market size for the bicycle tire market is projected to reach USD 25.6 billion by 2035.

The bicycle tire market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in bicycle tire market are tubeless tire, tube tire and solid tire.

In terms of bicycle type, electric segment to command 16.8% share in the bicycle tire market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tire Marking Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Pressure Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Tire Cord Fabric Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Components Aftermarket Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Tire Retreading Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tire Cobalt Salt Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Tire Curing Bladder Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Crankset Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Drivetrain Cassette Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Frames Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bicycle Saddle Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Electronic Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Device Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Gear Shifter Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Brake Lever Market Size and Share Forecast Outlook 2025 to 2035

Tire and Wheel Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Bottom Bracket Market Size and Share Forecast Outlook 2025 to 2035

Tire Changing Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA