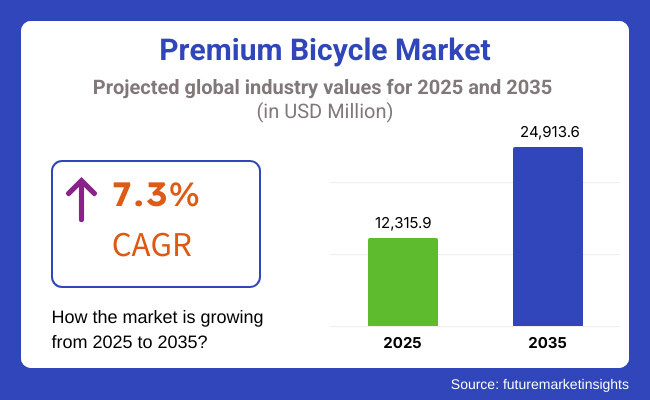

The premium bicycle market is anticipated to be valued at USD 12,315.9 million in 2025. It is expected to grow at a CAGR of 7.3% during the forecast period and reach a value of USD 24,913.6 million in 2035.

Even in the premium bicycle segment, a market poised to double in size from 2025 to 2035 as cyclists are looking for lightweight and technologically superior options. Mobility solutions are trending towards sustainability, while an increasing consciousness of fitness and government programs promoting cycling infrastructure establishment are also major drivers of market growth.

The market is estimated to be USD 12,315.9 million in 2025 and is further anticipated to extend to USD 24,913.6 million by 2035 at a possible CAGR of 7.3% in between 2025 to 2035. The factors affecting market growth include heightened investments in urban mobility structures, increased demand for high-performance electric and road bicycles, and an increasing migration of consumers wanting to cycle for fitness and leisure.

Premium bicycles play a vital role in urban mobility, endurance sports, and adventure biking. The transition to carbon fiber frames, aerodynamic bikes, and AI-based ride analytics is driving another evolution of the market, enhancing rider experience and performance differentiation.

The period 2020 to 2024 saw a boom in the bicycle market, wherein premium bikes became increasingly leveraged for fitness, commuting and leisure activities by a broad audience. Cycling was being marketed to consumers on the basis of lighter materials, greater durability and smart technology.

The cycling boom both for sport and as a commuting alternative created a market for expensive light-weight bicycle frames, higher gears, and super-smooth e-bikes. Manufacturers were now focused with creating carbon fibre frames, AI based performance-trackers, smart sensor systems just to meet the dynamics of customer requirements.

Compliance with stringent regulations set forth by authorities such as the European Cyclists' Federation (ECF), USA Consumer Product Safety Commission (CPSC), and International Cycling Union (UCI) with regard to safety, sustainability, and performance design and manufacture of the bicycle. The challenges, including the ever-increasing costs of production, low levels of production, and the necessity of continuous technological advancement, made these designs an uphill task for mass adoption.

Technology such as AI cycling analytics, IoT bike safety and security, and performance optimization via sensors has improved the rider experience while minimizing the need for maintenance. Smart biking ecosystems opened up for cyclists to optimize performance, integrate cloud-based solutions for tracking, and have other safety-enhancing features.

Supply chain distortion, the increasing cost of high-end components, and erratic availability of raw materials were still essential constraints duly affecting adoption. The firms started plowing investments into developing AI-enabled fitness tracking platforms with creation of cloud-based solutions for bike maintenance working side-by-side to maximizing the potential of high-efficient drivetrain technologies to secure reliability, rider satisfaction, and cost-effectiveness.

Future Trends (2025 to 2035)

New technologies such as AI-based cycling assistance, improved aerodynamic designs, and innovative materials will change the entire marketplace between 2025 and 2035. The defining market applications would be in self-adjusting gear systems, real-time cycling diagnostics, and energy-efficient battery charging technology for e-bikes. These will become key characteristics that will redefine the experience of riders and value sustainability.

With the implementation of automated gear shifting, crash detection by AI, and real-time terrain adaptation mechanisms, a cyclist will be able to ride his bike with much greater speed and safety. Analyses invented by AI will assure real-time optimization of a ride, predictive maintenance alerts, and performance training recommendations, thus improving durability and riding efficiency.

Thus, the further application of solar e-bikes, modular frame design, and 3D printing of components will continue to optimize the use of high-end bikes. The result will be better performance as well along with lighter weight and longer durability. It will also compel manufacturers to get the most out of their investment and increase their sustainability levels.

Bike-sharing programs are decentralizing, routes are optimized by AI, and smart bikes-for-bikes connectivity to reduce city congestion and develop more mobility solutions. Automated ride analytics, efficient use of artificial intelligence to track cycling efficiency, and a robust blockchain system to verify ownership will be unleashed by companies to make maintenance effortless and more efficient.

As smart mobility ecosystems develop, IoT-connected monitoring of storage bicycles, analyzed energy consumed at any one time, and cycling management in the cloud will begin to take over. Users will gain value from these insights ''biking with AI'' contra decentralized hubs used for maintaining their bikes and tracking the data from rides through blockchain.

The future of this technology for high-end bikes includes lighter materials, automation, and predictive maintenance. Companies would focus more on closed-loop recycling of bicycle parts, AI-adaptive riding solutions, and blockchain-protected ride data security to make the high-performance cycling experience more effective and economically sustainable. Further entry into the market includes real-time bike health monitoring, enhanced safety through AI, and predictive replacement scheduling of components.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments introduced safety and sustainability regulations for high-performance bicycles. | AI-driven cycling efficiency regulations, decentralized bike-sharing compliance, and blockchain-secured ride tracking policies will shape future regulations. |

| Industry adopted IoT-based bike tracking, carbon fiber frames, and smart braking systems. | AI-powered ride optimization, automated shifting technology, and self-repairing bike frames will drive future innovations. |

| Premium bicycles were used for professional cycling, urban commuting, and endurance sports. | AI-powered real-time cycling insights, adaptive riding assistance, and smart mobility solutions will expand market applications. |

| Manufacturers integrated cloud-based ride monitoring, smart gear systems, and advanced bike safety solutions. | With AI-power-driven operational analytics, decentralized bike-sharing networks, and blockchain-supported bike-tracking, this form of cycling will set a new standard for ultra-endurance racing. |

| Companies explored high-efficiency bike components, eco-friendly manufacturing, and smart energy recovery systems. | The AI-influenced transport optimization, local recycling of materials, and decentralized repair hubs would improve sustainability. |

| Predictive analytics improved bike maintenance tracking, energy optimization, and automated bike operation assistance. | Predictive maintenance will be transformed by quantum computing-assisted ride simulation, AI-powered real-time route planning, and blockchain-oriented ride verification. |

| Increased carbon fiber costs, component shortages, and scaling issues were typical supply chain challenges. | AI-supported supply chain monitoring, blockchained component sourcing, and decentralized bike manufacturing will ensure improved market access. |

| Growth was fueled by increasing interest in cycling, advancements in smart biking technology, and rising sustainability awareness. | Expansion in the future will be driven by decentralized ridesharing solutions enabled by autonomous bike-sharing solutions, cost-effective smart bike design. |

Challenges

One of the major challenges in the market is the high initial investment cost associated with advanced cycling technologies and lightweight materials. Consumers must also weigh costs versus performance and durability. Meanwhile, the availability of charging infrastructure for electric bicycles in some regions also hinders the adoption of e-bikes.

However, supply chain disruptions and fluctuations in raw material prices have also affected the manufacture and the pricing of bicycles. A latest challenge that every company operating in this space comes across is the continuous need for innovation in aerodynamic designs of bicycles along with rider-assist technologies, as consumer expectations keep shifting.

Opportunities

The growing popularity of urban cycling, AI-powered fitness tracking, and smart mobility solutions is pushing businesses to develop innovative bicycle models tailored to tech-savvy riders. Market demand is driven forward by an increasing number of high-performance bikes being used from competitive racing to long-distance touring to daily commuting.

The expanding e-bike sector, especially in city transportation and recreational cycling, is increasing the need for durable frames, advanced battery systems, and AI-based ride analytics. Bicycle manufacturers and service providers have new opportunities due to emerging markets and the infrastructure development of developing countries.

New materials like lightweight carbon fiber and systems such as smart braking and real-time performance tracking have strengthened durability and riding experiences. Cloud-connected cycling apps, virtual cycling communities, and alerts to the automated maintenance of bicycles will further innovate the industry, opening new avenues for growth to market players.

The electric premium bicycles segment is increasing because of its efficiency, convenience, and eco-fenefficiency. Advancement in battery technology and lightweight materials has led to the effective providing of smooth riding assisted experience on an electric bicycle. Both urban commuters and long-distance riders use these bicycles since they reduce physical exertion while producing speed and performance.

With governments doing their utmost to promote sustainable mobility, the use of electric bicycles is on the rise. Regenerative braking, intelligent connectivity, and longer battery life are now catching the attention of professional cyclists and everyday commuters. With increasing infrastructure development for e-bikes, the demand for electric premium bicycles is expected to shoot up significantly.

The mountain segment is fueled by sport enthusiasts and competition-level riders looking for high-performance bikes that can conquer rough terrane. Mountain bikes are characterized by their sophisticated suspension systems, durable frames and high-traction tires to support stability and control during downhill treks. The market growth is further fuelled by the increasing demand for outdoor adventure sports.

Innovations in lightweight carbon fiber frame construction and hydraulic braking system technologies give safety and maneuverability to premium mountain bikes. The riders demand precision engineering and proper shock-absorption technology for a smooth and controlled ride. With the growing trends in adventure tourism and recreational cycling, the mountain bicycle segment continues to see steady demand.

The men's segment is the most dominant segment in the market since their riders show a strong appetite for performance bikes and custom-designed bicycles. They have aerodynamic frames, advanced gearing mechanisms, and comfortable designs that earn them a spot in the favorite list of professional cyclists and health enthusiasts. Rising popularity of cycling clubs and long-distance events also fuels demand.

For men, high-performance cycles are manufactured keeping in mind durability, comfort, and speed. Many brands are capable of customizing frames and components to suit particular riding requirements. Recognition of the health benefits and environmentally friendly aspects of cycling has prompted a grow-ing number of male riders to invest in high-quality bikes for recreation and competition.

North America is expected to showcase a substantial market share, primarily driven due to the rise in high-performance road and electric bicycles adoption, health awareness, and government initiatives favoring bike-friendly infrastructure. The USA and Canada are the prime players, with urban capitals investing into cycling lanes, bike-sharing programs, and incentives on e-bike adoption.

For commuting, exercise, and recreation, performance is on-the-rise with a good number of high-end bicycles being sold on the market. This, in turn, has prompted various forms of innovations from companies, including the advancements in the smart biking technologies. Other compactness adding onto these fast-growing advancements in technology by key players well positioned in the market.

It accounts for a major part of the market's share, with Germany, UK, and France leading in terms of bicycle adoption, urban cycling policies, and sustainable transport initiatives. Rising emphasis on environmentally friendly mobility solutions, stringent environmental regulations compliance, and the growing adoption of e-bikes and performance bicycles are increasing market adoption.

Driven by stringent carbon emission reduction targets and growing investments in renewable powered infrastructure by the European Union, the market is expected to expand. This drives industry trends in long-distance touring, endurance sports, and urban commuting with high-quality bicycles.

In addition, this is accelerating adoption among arange of cycle enthusiasts with lightweight, high-performance bicycles embedded with integrated smart tracking and AI-assisted pedaling efficiencies. The growth in advanced frame materials and connectivity solutions is also driving the market growth.

The Asia Pacific is anticipated to record the most rapid growth in this market as a function of urbanization trends, increased disposable income levels, and rising fitness cultures in China, India, Japan, and South Korea. Demand for high-performance road bikes, electric bicycles, and adventure cycling gear keeps fuelling the market.

China still has the largest market, while huge investments in cycling infrastructure development, shared mobility services, and electric bike adoption also back it. On the other hand, India also sees an increasing demand for smart, lightweight bicycles as urbanization ramps up and interest in fitness cycling rises.

The region is turning itself into the world with the use of AI-based fitness tracking, electric possibilities features, and ultra-durable material in the industry itself. This is indeed supplemented with increased government initiatives aimed at promoting green transport, along with reinforced regulations governing the safety of cyclists, thus further pushing the market's growth.

Increased consumer interest for high-performance cycling; the continued development of urban bicycle infrastructure; and advancements in bicycle technologies that are lightweight and durable-all attribute to consistent growth in the USA. The USA Department of Transportation cites a gradual increase in urban commuting and recreational cycling, which calls for the development of a strong ecosystem for the maintenance, efficiency optimization, and product innovation.

Trekking, Specialized and Cannondale are companies embarking to a whole new line of service in diagnostics, modifications, and performance optimization for high-performance technology-driven bikes, which is growingly demanded during this time, and the demand for specialized servicing and maintenance is increasing.

Smart cycling solutions driven by AI acceptance are on the upswing with service providers linking their IoT-(Internet of Things) powered systems to improve ride efficiency and safety. This coupled with the growing influx of mobile and automated maintenance solutions is revolutionizing conventional bicycle servicing by giving cyclists access to real-time performance monitoring and adaptive cycling solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.0% |

There is also an increased demand for high-performance cycling gear in the UK, creating a potential influx of initiatives from the government towards eco-friendly transportation. The same can be said for the growing investments in urban bike infrastructure.

The growing transition to urban mobility in the UK embraces the recreational and commuting aspects of high-quality bicycles, including road racing and mountain biking. Manufacturers such as Brompton and Ribble are expanding as demand for effective maintenance, repair, and upgrade services improves.

The government is continuing to invest funds into improving cycling infrastructure, ensuring that high-quality bicycles will be supported with dedicated lanes and safety enhancements. Integration of AI-enabled monitoring applications for cycling is also factoring significantly in enhancing ride performance; therefore, reducing maintenance costs and improving user experience.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.6% |

The European Union is growing due to strong regulatory policies supporting sustainable mobility, increasing demand for high-end cycling solutions, and expanding urban cycling networks.

The EU’s Green Deal initiatives, with significant investments in smart and sustainable transportation, are boosting bicycle adoption across multiple countries. Germany, France, and Italy are leading the way in cycling technology, with brands like Canyon, Pinarello, and Bianchi developing cutting-edge solutions.

The integration of real-time performance tracking and AI-powered adaptive cycling is enhancing efficiency, reducing maintenance needs, and extending bike lifespans. Additionally, smart city cycling initiatives and predictive maintenance platforms are making high-performance bicycles more accessible for both commuters and enthusiasts.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.7% |

Japan is expanding due to increasing urban modernization, rising demand for high-end cycling products, and government initiatives promoting cycling-friendly infrastructure.

Japan boasts one of the most technologically advanced urban mobility sectors, driving innovation in cycling gear and performance optimization. The government has invested heavily in expanding smart transportation infrastructure, fostering the development and adoption of next-generation high-performance bicycles.

The adoption of AI-powered predictive maintenance tools in cycling networks is enhancing operational efficiency and rider experience. Additionally, the rise of real-time monitoring systems is streamlining bicycle maintenance operations, making cycling more cost-effective and sustainable.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

South Korea is growing rapidly due to increasing demand for advanced cycling solutions, government support for eco-friendly transport, and advancements in smart cycling technologies.

South Korea’s Ministry of Land, Infrastructure, and Transport has committed substantial funding to advancing premium bicycle technology, supporting research and development efforts aimed at increasing efficiency and durability.

The integration of 5G-enabled smart monitoring and IoT-powered adaptive cycling systems is enhancing ride performance, improving safety, and reducing maintenance needs. Additionally, South Korea’s focus on intelligent urban transport and sustainability is increasing the demand for high-performance premium bicycles across various segments.

The rise of automated and remote servicing solutions for high-end bicycles is further accelerating market growth, offering convenient maintenance and support solutions for professional riders and urban commuters.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The premium bicycle market is expanding due to increasing demand for high-performance, lightweight, and technologically advanced bicycles. Consumers are shifting towards premium bicycles for fitness, commuting, and recreational activities, driven by innovations in carbon fiber frames, electric-assist technology, and integrated smart features. The market consists of global leaders and specialized manufacturers, each contributing to advancements in bicycle engineering, sustainability, and connectivity.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Giant Manufacturing Co. Ltd. | 12-17% |

| Trek Bicycle Corporation | 10-14% |

| Specialized Bicycle Components, Inc. | 9-13% |

| Cannondale (Dorel Industries) | 7-11% |

| BMC Switzerland AG | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Giant Manufacturing Co. Ltd. | Provides high-performance road, mountain, and electric bicycles with cutting-edge frame technology. |

| Trek Bicycle Corporation | Expertise in high-performance road and mountain bikes, with light carbon frames and intelligent systems incorporated. |

| Specialized Bicycle Components, Inc. | Develops cutting-edge aerodynamic and electric bicycles featuring AI-driven performance analysis. |

| Cannondale (Dorel Industries) | Offers high-end bikes with revolutionary suspension technologies and light frames. |

| BMC Switzerland AG | Interested in competition-level racing and endurance bicycles with precision-crafted designs. |

Key Company Insights

Giant Manufacturing Co. Ltd. (12-17%)

Giant controls the market, offering a wide range of high-performance bikes with leading frame and component technology.

Trek Bicycle Corporation (10-14%)

Trek is expert in high-end bicycle innovation with emphasis on sustainability, light materials, and intelligent connectivity.

Specialized Bicycle Components, Inc. (9-13%)

Specialized is a key player in high-performance cycling, integrating aerodynamics, AI-powered tracking, and electric assist features.

Cannondale (Dorel Industries) (7-11%)

Cannondale offers technologically enhanced bicycles, giving importance to comfort, performance, and innovative suspension designs.

BMC Switzerland AG (5-9%)

BMC is a precision engineering company that manufactures racing and endurance bikes with cutting-edge frame technology and better ride dynamics.

Other Key Players (45-55% Combined)

A number of premium bicycle manufacturers provide next generation cycling innovations, sustainable materials, and high-performance riding solutions. These include:

With data handling capabilities improving by leaps and bounds, many cycling manufacturers have turned their attention toward aerodynamics and lightweight frame technology, as well as digital integration in order to meet the public demand for high-performance cycling solutions.

The market is segmented by type into electric and traditional.

Based on the usage type, the market is segmented into mountain, road, hybrid, and others.

Based on End-user, the market is segmented into men, women, and kids.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The overall market size for the market was USD 12,315.9 million in 2025.

The market is projected to reach USD 24,913.6 million by 2035, growing at a CAGR of 7.3% over the forecast period.

Demand will rise due to consumer preference for high-performance and luxury bicycles, increased health awareness, adoption of electric and carbon-fiber models, advancements in aerodynamic designs, and urban cycling infrastructure expansion.

The top five contributors-USA, Germany, Netherlands, China, and Japan-lead due to strong cycling cultures, higher incomes, and urban mobility investments.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Usage type, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Usage type, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by End-user, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Usage type, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Usage type, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by End-user, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 20: Latin America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Usage type, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Usage type, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by End-user, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 28: Western Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Usage type, 2019 to 2034

Table 30: Western Europe Market Volume (Units) Forecast by Usage type, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by End-user, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 36: Eastern Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Usage type, 2019 to 2034

Table 38: Eastern Europe Market Volume (Units) Forecast by Usage type, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 40: Eastern Europe Market Volume (Units) Forecast by End-user, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Type, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Usage type, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Usage type, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End-user, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 52: East Asia Market Volume (Units) Forecast by Type, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Usage type, 2019 to 2034

Table 54: East Asia Market Volume (Units) Forecast by Usage type, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 56: East Asia Market Volume (Units) Forecast by End-user, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Units) Forecast by Type, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Usage type, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Units) Forecast by Usage type, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Units) Forecast by End-user, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Usage type, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by End-user, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 10: Global Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Usage type, 2019 to 2034

Figure 14: Global Market Volume (Units) Analysis by Usage type, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Usage type, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Usage type, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 18: Global Market Volume (Units) Analysis by End-user, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 21: Global Market Attractiveness by Type, 2024 to 2034

Figure 22: Global Market Attractiveness by Usage type, 2024 to 2034

Figure 23: Global Market Attractiveness by End-user, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Usage type, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by End-user, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 34: North America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Usage type, 2019 to 2034

Figure 38: North America Market Volume (Units) Analysis by Usage type, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Usage type, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Usage type, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 42: North America Market Volume (Units) Analysis by End-user, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 45: North America Market Attractiveness by Type, 2024 to 2034

Figure 46: North America Market Attractiveness by Usage type, 2024 to 2034

Figure 47: North America Market Attractiveness by End-user, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Usage type, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by End-user, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Usage type, 2019 to 2034

Figure 62: Latin America Market Volume (Units) Analysis by Usage type, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Usage type, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Usage type, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 66: Latin America Market Volume (Units) Analysis by End-user, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Usage type, 2024 to 2034

Figure 71: Latin America Market Attractiveness by End-user, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Usage type, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by End-user, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 82: Western Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Usage type, 2019 to 2034

Figure 86: Western Europe Market Volume (Units) Analysis by Usage type, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Usage type, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Usage type, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 90: Western Europe Market Volume (Units) Analysis by End-user, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Usage type, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by End-user, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Usage type, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by End-user, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Usage type, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Units) Analysis by Usage type, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Usage type, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Usage type, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Units) Analysis by End-user, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Usage type, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by End-user, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Usage type, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by End-user, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Usage type, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Usage type, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Usage type, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Usage type, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End-user, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Usage type, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by End-user, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Usage type, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by End-user, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 154: East Asia Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Usage type, 2019 to 2034

Figure 158: East Asia Market Volume (Units) Analysis by Usage type, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Usage type, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Usage type, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 162: East Asia Market Volume (Units) Analysis by End-user, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Usage type, 2024 to 2034

Figure 167: East Asia Market Attractiveness by End-user, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Usage type, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by End-user, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Usage type, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Usage type, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Usage type, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Usage type, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End-user, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Usage type, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by End-user, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Premium Bottled Water Market Size and Share Forecast Outlook 2025 to 2035

Premium Outdoor Apparel Market Size and Share Forecast Outlook 2025 to 2035

Premium Electric Motorcycle Market Size and Share Forecast Outlook 2025 to 2035

Premium Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Premium Spirits Glass Bottle Market Size and Share Forecast Outlook 2025 to 2035

Premium Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Alcoholic Beverage Market - Size, Share, and Forecast 2025 to 2035

Premium Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Lager Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Cigarette Market Growth – Demand & Industry Outlook to 2035

Premium Wine Cooler Market Analysis - Growth & Forecast 2025 to 2035

A2P & P2A Messaging – AI-Driven Communication & Security

Demand for Lactoferrin Premiumization in Immune SKUs in EU

Bicycle Tire Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Components Aftermarket Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Crankset Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Drivetrain Cassette Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Frames Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA