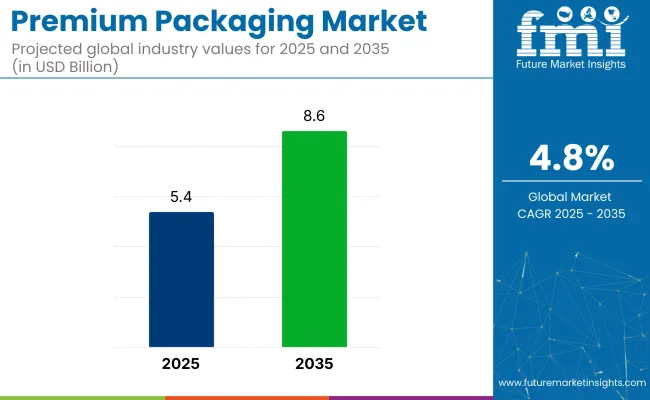

Premium packaging market is projected to grow from USD 5.4 billion in 2025 to USD 8.6 billion by 2035, expanding at a CAGR of 4.8%. Increased preference for distinctive, high-quality packaging that enhances product value is shaping demand across luxury goods, cosmetics, food, beverages, and pharmaceuticals.

| Attribute | Detail |

|---|---|

| Industry Size (2025) | USD 5.4 billion |

| Industry Size (2035) | USD 8.6 billion |

| CAGR (2025 to 2035) | 4.8% |

In upscale retail, packaging has become integral to brand identity, using embossed finishes, rigid boxes, and glass formats to create elevated experiences. Customization, including limited-edition designs and personalized wraps, is being prioritized to appeal to consumer individuality and gifting trends. Functional appeal, visual aesthetics, and perceived exclusivity are being used to strengthen brand recall and drive consumer engagement across premium categories.

The industry holds a notable share within these parent industries. Specifically, in the packaging market, the premium packaging segment is estimated to capture around 8-10% due to its focus on high-quality materials and unique designs. In the luxury goods market, premium packaging can represent up to 15-20% as packaging becomes a crucial part of the luxury consumer experience.

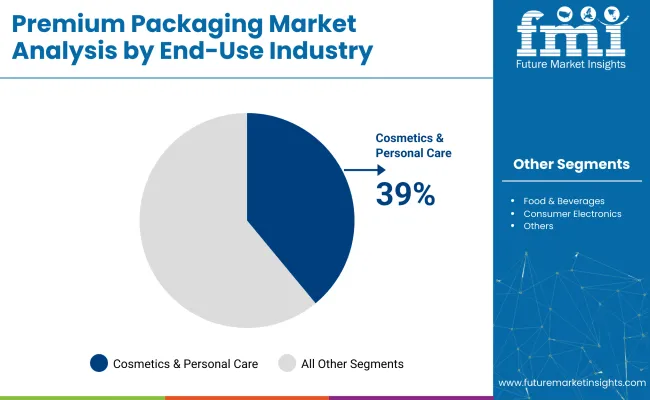

The cosmetics and personal care market contributes approximately 12-14% due to increasing demand for aesthetic packaging in skincare and fragrance products. Within the food and beverage market, premium packaging accounts for roughly 5-7%, driven by gourmet products. Lastly, the consumer electronics market sees around 6-8% share, with packaging playing a key role in high-end product presentation.

In a 2024 interview with Premium Beauty News, Claudia D’Arpizio, Senior Partner at Bain & Company and Global Head of the Fashion & Luxury Practice, stated, “Packaging is evolving from a static container into a dynamic brand touchpoint.

It’s no longer about choosing between beauty and responsibility. Today, you can and must deliver both.” This statement reflects how premium packaging is being repositioned as a strategic branding element that must meet both aesthetic and functional expectations.

With heightened demand across luxury sectors for design innovation, personalization, and environmental compliance, the premium packaging market is projected to expand steadily through 2035.

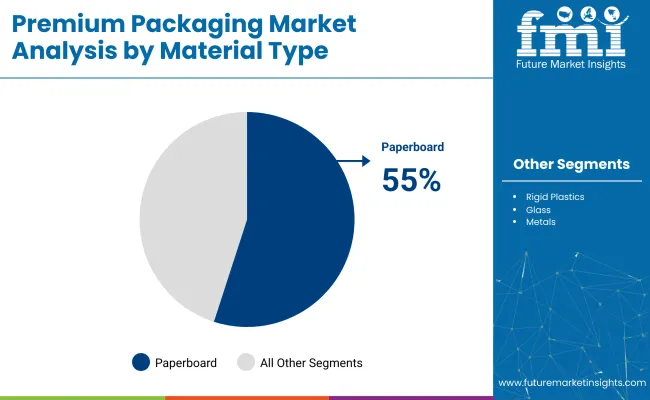

Paperboard is projected to dominate the premium packaging material segment, capturing 55% industry share in 2025 due to its strength, versatility, and eco-friendly properties. The cosmetics and personal care sector leads the end-use industry, holding 39%. Rigid boxes represent 30% of packaging demand, while luxury retail and e-commerce account for 60%.

Paperboard is expected to lead the material type segment of the premium packaging industry with a 55% industry share in 2025. This material is preferred for its strength, versatility, and renewability, making it an ideal choice for luxury packaging solutions.

The cosmetics and personal care sector is projected to capture 39% of the industry share in 2025. Premium packaging plays a crucial role in the beauty industry, as consumers increasingly value aesthetically pleasing, eco-conscious packaging solutions.

Rigid boxes are likely to hold 30% of the market share in the premium packaging industry, driving growth across various industries. These boxes offer superior durability and a premium unboxing experience, which is essential for high-end products.

Luxury retail stores and e-commerce platforms are expected to dominate the distribution channels of the premium packaging industry, with luxury retail accounting for 60% of the industry share.

The industry is expanding as consumers demand high-quality, visually appealing packaging. Innovations in material use, customization, and distribution channels are driving the shift towards more premium offerings in various industries.

Recent Market Trends and New Innovations by Key Players

Challenges Facing the Premium Packaging Market

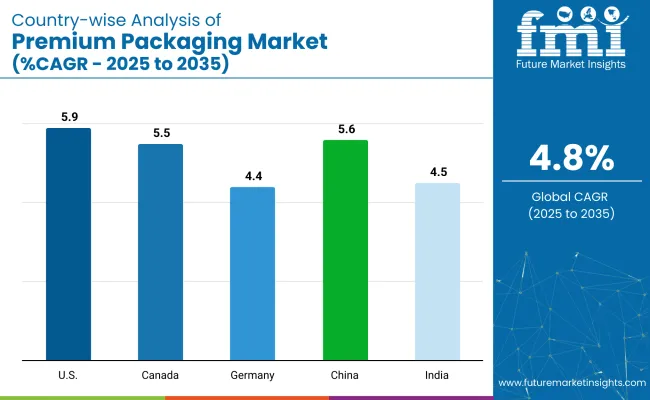

India’s momentum is driven by the expanding consumer goods sector, coupled with rising demand for premium packaging solutions in the food and beverage industry. China follows closely, with a projected 5.6% CAGR, supported by its growing retail industry and e-commerce expansion, increasing the demand for high-quality packaging. Also the developed economies such as Germany (4.4%), the United States (5.9%), and Canada (5.5%) are expanding at a steady pace.

The United States leads in premium packaging demand, driven by the increasing consumer preference for high-end, green packaging options. Canada also shows strong demand for premium packaging, particularly in the food and beverage sectors. The industry adds over USD 700 million by 2035, both high-growth regions like India and China, as well as stable demand from OECD countries, will significantly shape its trajectory.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

| Canada | 5.5% |

| Germany | 4.4% |

| China | 5.6% |

| India | 4.5% |

Premium packaging in the United States is forecasted to grow at 5.9% CAGR from 2025 to 2035. Federal and state-level policy shifts are reshaping packaging across luxury retail, DTC beauty, and gourmet food categories. EPR laws in multiple states are increasing compliance costs for multi-material formats, while new trade frameworks reduce input expenses. Brands are investing in structure simplification and premium coatings.

Canada’s segment is projected to grow at a 5.5% CAGR through 2035. Provincial enforcement of design-for-recovery rules has made paperboard-based formats dominant in premium applications. Folding cartons and luxury tubes are preferred by personal care and alcohol companies targeting duty-free and e-commerce channels. Plastic restrictions and packaging tax frameworks guide new investments in automated board converting units.

Germany is expected to grow at 4.4% CAGR, driven by strict compliance obligations under VerpackG and material-specific penalties. Luxury packagers are shifting from complex laminates to mono-material rigid boxes to meet mandatory recycling certifications. Automation grants for board-processing machinery have supported upgrades in Hamburg and Munich. Recyclability thresholds are now enforced on both primary and secondary packaging.

China’s industry is projected to grow at 5.6% CAGR, supported by increased domestic gifting and regulatory caps on excess packaging. GB 23350 restricts the ratio of pack weight to product weight, prompting reduced use of layered formats in tea and confectionery. MIIT mandates for smart packaging and RCEP-driven tariff cuts have driven lower-cost innovation for upscale brands targeting online channels.

India is expected to register a 4.5% CAGR through 2035. Compliance with updated PWM Rules has led to a shift toward paper-based premium formats. Import duties on luxury rigid boxes have encouraged local production, while PLI benefits support board conversion and embellishment upgrades. DTC beauty and jewellery brands are driving demand for magnetic and embossed packs.

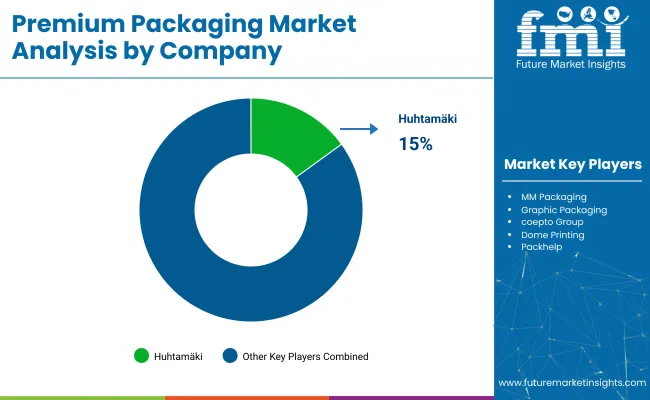

Leading Player - Huhtamäki: 15%

Premium packaging suppliers operate in a semi-consolidated landscape, where large firms such as Huhtamäki, MM Packaging, and Graphic Packaging dominate through integrated operations and region-specific production hubs. MM Packaging has scaled its footprint through targeted acquisitions in Central Europe, while Graphic Packaging advanced design capabilities using automation for luxury electronics and beverage segments. High upfront investment, proprietary design frameworks, and regulatory packaging norms serve as major deterrents for new entrants.

Premium packaging suppliers operate in a semi-consolidated landscape, where large firms such as Huhtamäki, MM Packaging, and Graphic Packaging dominate through integrated operations and region-specific production hubs. MM Packaging has scaled its footprint through targeted acquisitions in Central Europe, while Graphic Packaging advanced design capabilities using automation for luxury electronics and beverage segments. High upfront investment, proprietary design frameworks, and regulatory packaging norms serve as major deterrents for new entrants.

Newer entrants like Pack help and Hunter Luxury are gaining traction by offering flexible production runs and design tools tailored to online-first brands. Hunter Luxury expanded its UK R&D division to support structural box innovations for niche liquor firms. Premier Packaging introduced an artisan fragrance carton line, targeting short-lead launches for upscale grooming brands.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 5.4 billion |

| Projected Market Size (2035) | USD 8.6 billion |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Material Types Analyzed | Paperboard, Rigid Plastics, Glass, Metals, Wood, Textiles |

| Packaging Formats Analyzed | Rigid Boxes, Magnetic Closures, Custom Sleeves, Folding Cartons, Tubes |

| Applications Analyzed | Product Display, Branding, Gifting, Collector’s Edition |

| End-Use Industries Analyzed | Cosmetics & Personal Care (Skincare, Perfumes, Haircare, Makeup), Food & Beverages (Gourmet Products, Alcohol & Spirits, Chocolates, Teas), Consumer Electronics (Smartphones, Smartwatches, Accessories), Fashion & Apparel (Jewelry, Watches, Luxury Clothing), Corporate Gifting (Employee Kits, Premium Giveaways) |

| Distribution Channels Analyzed | Luxury Retail Stores, Brand Outlets, E-commerce |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, South Korea, India, Australia, UAE, South Africa |

| Key Players | Premier Packaging LLC, Keenpac, Hunter Luxury, Axilone, Huhtamäki, MM Packaging, Graphic Packaging, coepto Group, Dome Printing, Packhelp |

| Additional Attributes | Dollar sales growth by application (cosmetics, electronics), regional demand trends, competitive landscape, pricing strategies, distribution channel insights, material innovations, luxury packaging demand. |

The industry size is projected to be USD 5.4 billion in 2025 and USD 8.6 billion by 2035.

The expected CAGR is 4.8% from 2025 to 2035.

Paperboard is expected to dominate the material segment with a 55% market share.

Huhtamäki is the leading company in the market, holding a 15% industry share.

China is projected to grow at a CAGR of 5.6% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Premium Bottled Water Market Size and Share Forecast Outlook 2025 to 2035

Premium Outdoor Apparel Market Size and Share Forecast Outlook 2025 to 2035

Premium Electric Motorcycle Market Size and Share Forecast Outlook 2025 to 2035

Premium Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Premium Spirits Glass Bottle Market Size and Share Forecast Outlook 2025 to 2035

Premium Alcoholic Beverage Market - Size, Share, and Forecast 2025 to 2035

Premium Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Lager Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Cigarette Market Growth – Demand & Industry Outlook to 2035

Premium Wine Cooler Market Analysis - Growth & Forecast 2025 to 2035

Premium Bicycle Market Analysis by Type, Usage Type, End-user, and Region Forecast Through 2035

A2P & P2A Messaging – AI-Driven Communication & Security

Demand for Lactoferrin Premiumization in Immune SKUs in EU

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA