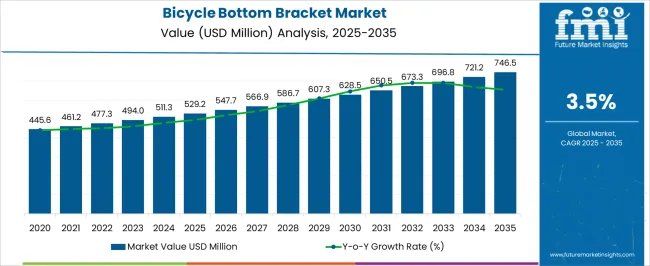

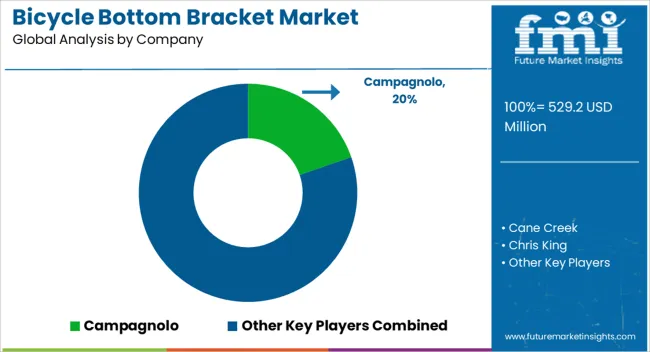

The bicycle bottom bracket market is projected to reach USD 746.5 million by 2035 from an estimated USD 529.2 million in 2025, growing at a CAGR of 3.5% during the forecast period. Early-stage growth is primarily driven by increasing demand for high-performance bicycles in recreational cycling, sports, and competitive racing, where lightweight, durable, and low-friction bottom bracket systems are essential for efficiency and rider performance.

Mid-stage expansion is anticipated through urban mobility and e-bike adoption, as electric bicycles require precision-engineered bottom brackets to handle higher torque, longer lifespans, and enhanced reliability under variable riding conditions. Manufacturers are focusing on innovations in material selection, such as titanium, stainless steel, and carbon-reinforced composites, to reduce weight while maintaining durability. Market growth is further supported by aftermarket upgrades, where cycling enthusiasts seek performance improvements for existing bicycles. Regional demand varies, with Europe and North America leading in premium and performance segments, while Asia-Pacific shows rapid adoption in urban commuting and e-bike markets.

Strategic collaborations with OEMs, specialized component suppliers, and cycling brands are being leveraged to expand distribution, enhance product visibility, and introduce technologically superior offerings. A combination of competitive sports, sustainable commuting trends, and material innovations in bottom bracket design drives incremental growth.

| Metric | Value |

|---|---|

| Bicycle Bottom Bracket Market Estimated Value in (2025 E) | USD 529.2 million |

| Bicycle Bottom Bracket Market Forecast Value in (2035 F) | USD 746.5 million |

| Forecast CAGR (2025 to 2035) | 3.5% |

The bicycle bottom bracket market is strongly influenced by five interconnected parent markets, each contributing differently to overall demand and growth. The recreational and sports cycling market holds the largest share at 35%, driven by performance bicycles, competitive racing, and high-end mountain and road bikes that require lightweight, durable, and low-friction bottom bracket systems for efficiency and rider performance.

The urban mobility and e-bike market contributes 25%, as electric bicycles and city commuters demand precision-engineered bottom brackets capable of handling higher torque, longer lifespans, and consistent reliability under frequent use. The aftermarket and replacement components market accounts for 20%, where cycling enthusiasts upgrade or replace bottom brackets to enhance bicycle performance, durability, and riding comfort. The OEM bicycle manufacturing market holds a 15% share, integrating advanced bottom bracket designs into new bicycles to differentiate offerings and meet regional performance expectations. The accessories and maintenance service market represents 5%, supporting repair, installation, and optimization services that ensure long-term operational efficiency.

Recreational cycling, urban mobility, and aftermarket upgrades account for 80% of overall demand, highlighting that high-performance riding, e-bike adoption, and component replacement remain the primary growth drivers, while OEM integration and service solutions provide additional opportunities for market expansion globally.

The bicycle bottom bracket market is experiencing steady expansion driven by the growing popularity of cycling as a sport, leisure activity, and sustainable mode of transportation. Rising consumer interest in high performance bicycles for competitive and recreational use has increased demand for durable and efficient bottom bracket systems.

Advancements in precision engineering, sealing technology, and material science have improved performance, reduced maintenance needs, and enhanced rider experience. Growing urban cycling infrastructure and government incentives promoting eco friendly mobility are also contributing to market growth.

The market outlook remains positive as manufacturers focus on lightweight, corrosion resistant, and high strength solutions that cater to both professional athletes and everyday riders, ensuring continued innovation and product adoption across diverse cycling segments.

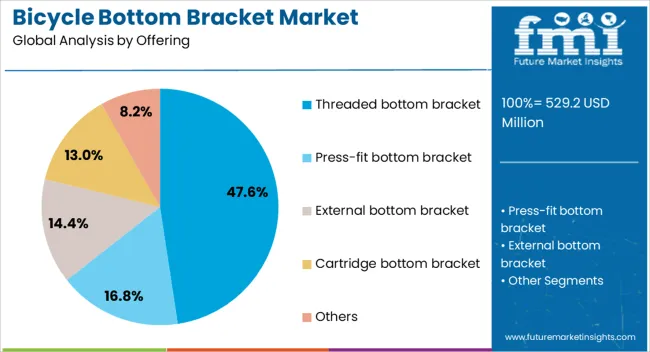

The bicycle bottom bracket market is segmented by offering, application, material, distribution channel, and geographic regions. By offering, bicycle bottom bracket market is divided into Threaded bottom bracket, Press-fit bottom bracket, External bottom bracket, Cartridge bottom bracket, and Others.

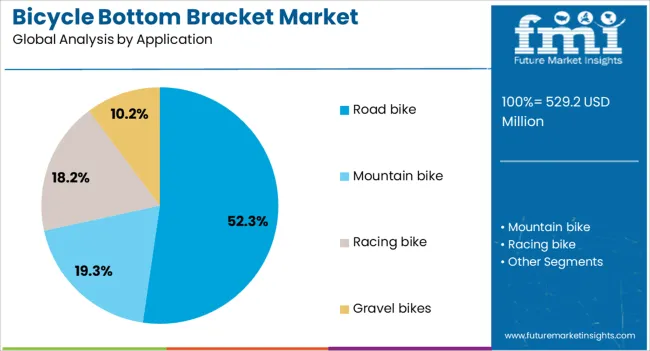

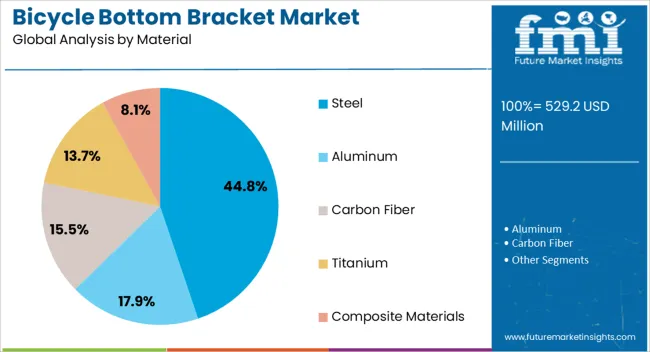

In terms of application, the bicycle bottom bracket market is classified into Road bikes, Mountain bikes, Racing bikes, and Gravel bikes. Based on material, bicycle bottom bracket market is segmented into Steel, Aluminum, Carbon Fiber, Titanium, and Composite Materials. By distribution channel, bicycle bottom bracket market is segmented into OEM and Aftermarket. Regionally, the bicycle bottom bracket industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The threaded bottom bracket segment is projected to hold 47.60% of total market revenue by 2025 within the offering category, making it the dominant type. Its widespread use is attributed to its proven reliability, ease of maintenance, and compatibility with a wide range of bicycle frames.

The secure threading mechanism reduces the risk of creaks and loosening, enhancing overall ride quality. Additionally, it is favored among both professional cyclists and hobbyists for its long service life and resistance to challenging riding conditions.

These attributes continue to reinforce its market leadership.

The road bike segment is expected to account for 52.30% of total market revenue by 2025 within the application category, positioning it as the leading use case. Growth in this segment is supported by increasing participation in competitive cycling events, rising demand for lightweight performance bicycles, and the popularity of road cycling as a fitness activity.

The precision and efficiency offered by advanced bottom bracket systems are particularly valued in road bikes, where speed and endurance are key performance factors.

This sustained demand solidifies its position as the dominant application.

The steel segment is projected to capture 44.80% of total market revenue by 2025 within the material category, making it the largest material choice. This preference is driven by steel’s durability, strength, and cost effectiveness.

Its resilience against wear and deformation under high stress conditions makes it suitable for both professional and recreational bicycles. Additionally, steel bottom brackets offer excellent load-bearing capacity, making them ideal for riders seeking long-term reliability.

These qualities have ensured steel’s continued prominence in the market.

The bicycle bottom bracket market is growing through demand from recreational cycling, e-bike adoption, aftermarket upgrades, and OEM integration. Performance, durability, and torque management define its key growth drivers.

The bicycle bottom bracket market is being fueled by the rising popularity of recreational cycling across road, gravel, and mountain biking segments. Riders seek durable, lightweight, and high-performance bottom brackets to improve pedaling efficiency and reduce energy loss. Growth in cycling tourism, fitness adoption, and competitive events creates strong replacement and upgrade demand. Manufacturers are focusing on ceramic bearings, press-fit designs, and precision engineering to meet the performance expectations of enthusiasts and professionals alike. This trend strengthens aftermarket sales as riders prioritize comfort and efficiency. With premium bicycles driving adoption, bottom bracket suppliers are innovating around load distribution, weight reduction, and wear resistance, ensuring continued expansion in performance-driven segments worldwide.

The surge in electric bicycle adoption has reshaped demand for bottom brackets, as e-bikes require systems capable of withstanding higher torque loads and extended riding cycles. The integration of motors and battery-powered drivetrains places greater mechanical stress on components, creating opportunities for heavy-duty and long-life bottom bracket designs. OEMs are increasingly sourcing reinforced models with stronger spindle interfaces and advanced sealing systems to ensure reliability. Commuters prefer low-maintenance solutions that balance strength with smooth pedaling efficiency. This shift also drives collaboration between e-bike manufacturers and component suppliers to tailor solutions to regional commuting needs. As electric mobility expands, bottom brackets designed for durability and torque resilience will play a central role in market expansion.

Aftermarket sales remain a crucial growth driver in the bicycle bottom bracket market, as cyclists frequently replace factory-installed units with higher-quality or specialized alternatives. Performance-focused riders upgrade to ceramic or hybrid models that offer smoother rotation and enhanced efficiency. Mountain bikers and gravel riders often switch to bottom brackets engineered for resistance against dirt, mud, and water ingress. The variety of frame standards, including press-fit, threaded, and proprietary designs, ensures ongoing demand for replacement parts. Retailers and e-commerce platforms have amplified accessibility, making it easier for riders to find specialized solutions. With consumer awareness growing, aftermarket demand is expected to expand steadily, reinforcing the bottom bracket’s role as a performance-enhancing upgrade.

OEM bicycle manufacturers are increasingly adopting advanced bottom bracket designs as a differentiating factor in competitive markets. High-end brands emphasize lightweight materials, tighter tolerances, and innovative sealing technologies to enhance product appeal. Partnerships between OEMs and component specialists drive co-development, ensuring compatibility and performance in new bike models. Mid-tier bicycles also benefit from upgraded designs, as affordability and reliability are prioritized to cater to mass-market demand. Global manufacturing hubs, particularly in Asia, are scaling production to serve both domestic and export markets. Supply chain optimization and material sourcing efficiency also shape OEM strategies. With consumer expectations evolving, OEM-driven integration of advanced bottom brackets reinforces long-term industry competitiveness.

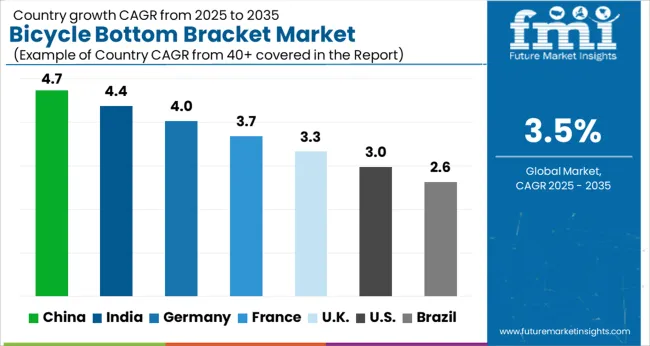

| Country | CAGR |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| France | 3.7% |

| UK | 3.3% |

| USA | 3.0% |

| Brazil | 2.6% |

The global bicycle bottom bracket market is projected to grow at a CAGR of 3.5% from 2025 to 2035. China leads expansion at 4.7%, followed by India (4.4%), Germany (4.0%), the UK (3.3%), and the USA (3.0%). Growth is supported by increasing cycling participation, fitness adoption, and demand for performance-driven bicycles across road, mountain, and electric bike categories. China and India dominate production and export activities, benefiting from large-scale manufacturing hubs and domestic cycling adoption. Germany, the UK, and the USA focus on premium performance components, aftermarket upgrades, and durability enhancements. Advancements in ceramic bearings, torque-resilient designs, and lightweight materials continue to influence global demand. The analysis spans over 40+ countries, with the leading markets shown below.

The bicycle bottom bracket market in China is projected to grow at a CAGR of 4.7% from 2025 to 2035, driven by rising participation in recreational cycling, expanding e-bike production, and the country’s dominant role in component manufacturing. Demand is concentrated in both OEM supply chains and aftermarket channels where cost-effective, torque-resilient, and low-maintenance systems are required. Domestic manufacturers are investing in precision machining and quality control to meet global standards for bearing tolerance, spindle strength, and sealing performance. E-bike drivetrain requirements are increasing adoption of reinforced bottom brackets capable of handling higher torque and continuous loads, while performance road and mountain segments sustain demand for lightweight, low-friction solutions.

The bicycle bottom bracket market in India is expected to expand at a CAGR of 4.4% from 2025 to 2035 as commuter and leisure cycling trends support unit sales and replacement cycles. Growth is supported by increased local assembly of e-bikes and mid-range performance bicycles where durable and serviceable bottom brackets are required. Manufacturers are focusing on supply chain localization, cost-competitive production, and variants that meet regional fitment standards including threaded, press-fit, and BB30 interfaces. Demand from repair shops and aftermarket retailers is rising as riders opt for upgrades such as ceramic bearings and reinforced spindles to improve efficiency and longevity. Component suppliers are establishing technical service centers to reduce downtime for fleet operators and rental services. Compatibility with motor-assisted drivetrains is being emphasized in product specifications to handle higher torque and torque spikes from mid-drive systems.

The bicycle bottom bracket market in Germany is projected to grow at a CAGR of 4.0% from 2025 to 2035, supported by a strong premium bicycle segment and rigorous performance expectations. Demand is concentrated in high-end road, gravel, and e-performance bikes where material selection, bearing precision, and fatigue life are critical purchasing criteria. Manufacturers and suppliers are being evaluated on measured friction losses, service intervals, and resistance to environmental ingress in independent test protocols. Collaboration between component specialists and OEMs is being used to co-develop proprietary standards that optimize drivetrain stiffness and rider power transfer. Aftermarket purchases are driven by competitive cyclists and enthusiasts seeking ceramic or hybrid bearing systems to reduce rotational losses. Reliability under variable load cycles and compatibility with integrated crankset systems are being emphasized in technical documentation.

The bicycle bottom bracket market in the UK is anticipated to grow at a CAGR of 3.3% from 2025 to 2035, with steady demand across commuter, leisure, and performance segments. Urban and rural riding communities are sustaining aftermarket activity where durability, weather resistance, and ease of service are prioritized. Product selection is being influenced by compatibility with common frame standards and the need for sealed units that provide long service life under wet riding conditions. Component distributors are leveraging online sales and community bike shops to expand reach and provide fitment support. E-bike adoption in delivery and rental fleets is generating requirement statements for reinforced bottom brackets capable of withstanding repeated torque cycles and prolonged duty. Warranty and field-repair metrics are being used by fleet buyers to select suppliers that minimize total cost of ownership.

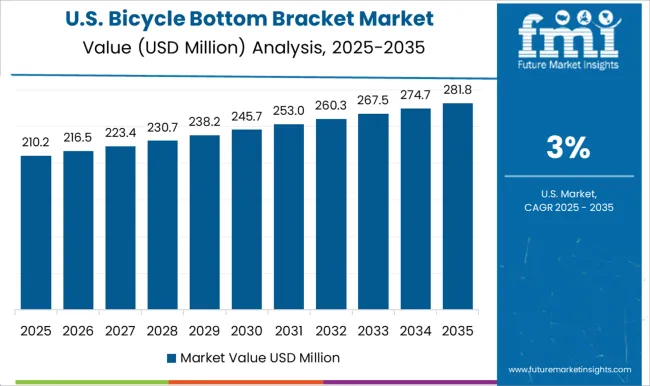

The bicycle bottom bracket market in the USA is projected to grow at a CAGR of 3.0% from 2025 to 2035, supported by stable demand in recreational riding, e-bike commuting, and the aftermarket upgrade channel. Preference is being shown for proven bearing technologies and service-friendly threaded systems in many consumer segments, while performance niches drive interest in press-fit and integrated crank solutions for weight and stiffness gains. Component lifecycles and replacement intervals are being scrutinized by service providers to optimize inventory and reduce turnaround times for repair shops. E-bike adoption by delivery services and commuter fleets is increasing orders for heavy-duty units with reinforced spindles and advanced sealing.

Competition in the bicycle bottom bracket market is shaped by product precision, material engineering, and compatibility with diverse drivetrain systems. Shimano and SRAM dominate through scale, technical expertise, and strong integration with complete groupsets, allowing them to control aftermarket and OEM channels. Campagnolo competes with premium positioning, leveraging its heritage and performance credibility within road cycling.

Chris King and Cane Creek target the high-end consumer base, emphasizing craftsmanship, serviceability, and long-lasting bearings that attract enthusiasts seeking reliability. Enduro Bearings focuses on specialized bearing technologies with ceramic and hybrid offerings, catering to both competitive riders and custom bike builders seeking performance upgrades. Full Speed Ahead (FSA) and Race Face are influential in the MTB and performance segments, offering a wide portfolio of bottom brackets engineered for both traditional and press-fit standards. Rotor Bike Components differentiates itself with modular crank systems and lightweight designs, gaining traction among cyclists demanding stiffness-to-weight optimization.

| Item | Value |

|---|---|

| Quantitative Units | USD 529.2 Million |

| Offering | Threaded bottom bracket, Press-fit bottom bracket, External bottom bracket, Cartridge bottom bracket, and Others |

| Application | Road bike, Mountain bike, Racing bike, and Gravel bikes |

| Material | Steel, Aluminum, Carbon Fiber, Titanium, and Composite Materials |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Campagnolo, Cane Creek, Chris King, Enduro Bearings, Full Speed Ahead, Race Face, Rotor Bike Components, Shimano, SRAM, and Token Products |

| Additional Attributes | Dollar sales, share, by type (threaded, press-fit), material (aluminum, steel, carbon, titanium), bearing type (ceramic, steel, hybrid), end-use segments (road, MTB, e-bike), regional demand patterns, aftermarket vs OEM trends, and adoption of high-performance components. |

The global bicycle bottom bracket market is estimated to be valued at USD 529.2 million in 2025.

The market size for the bicycle bottom bracket market is projected to reach USD 746.5 million by 2035.

The bicycle bottom bracket market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in bicycle bottom bracket market are threaded bottom bracket, press-fit bottom bracket, external bottom bracket, cartridge bottom bracket and others.

In terms of application, road bike segment to command 52.3% share in the bicycle bottom bracket market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bicycle Tire Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Components Aftermarket Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Crankset Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Drivetrain Cassette Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Frames Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bicycle Saddle Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Electronic Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Device Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Gear Shifter Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Brake Lever Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Front Hub Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Rim Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Disc Brake Rotor Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Trip Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Mechanical Disc Brake Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Light Market Growth - Trends & Forecast 2025 to 2035

Bicycle Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bicycle Bags and Backpacks Market - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA