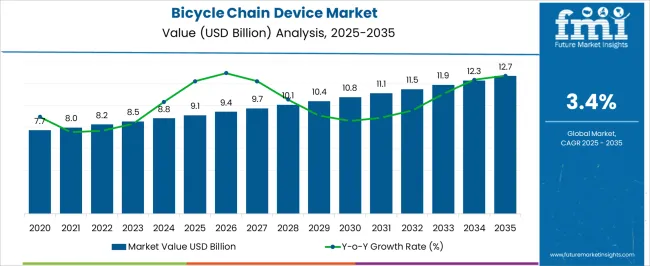

The bicycle chain device market is estimated to be valued at USD 9.1 billion in 2025 and is projected to reach USD 12.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period. The early phase of growth is characterized by steady but consistent demand driven by the continued popularity of bicycles for both recreational and commuting purposes. The market sees moderate increases in value as the adoption of high-quality and durable bicycle chain devices rises. Between 2026 and 2030, the market strengthens further from USD 9.1 billion to USD 10.8 billion, with values progressing through USD 9.4 billion, 9.7 billion, 10.1 billion, and 10.4 billion.

This phase reflects a more defined upward trajectory, fueled by innovations in bicycle technology, including advanced chain materials and better shifting mechanisms, making bicycle chain devices more efficient and long-lasting. The growth curve in this period follows a steady upward slope, driven by growing demand in the electric bicycle (e-bike) segment and the continuous rise in cycling as a mainstream mode of transportation globally.

| Metric | Value |

|---|---|

| Bicycle Chain Device Market Estimated Value in (2025 E) | USD 9.1 billion |

| Bicycle Chain Device Market Forecast Value in (2035 F) | USD 12.7 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The bicycle components market is the largest contributor, accounting for approximately 40-45%, as the chain device is a critical part of the bicycle’s drivetrain. The growing need for durable and high-performance bicycle parts, including chains, gears, and drivetrains, directly influences the demand for chain devices. The sports and recreation equipment market follows with about 20-25%, as cycling continues to be a popular sport and recreational activity.

Competitive cycling and recreational cycling, including mountain biking and road racing, contribute significantly to the demand for high-performance chain devices. The automotive and transportation market contributes approximately 10-12%, driven by the rising trend of using bicycles as an eco-friendly transportation option in urban areas. As more people choose bicycles for commuting, the need for efficient and reliable bicycle components, including chain devices, grows. The electric bicycle (e-bike) market accounts for around 15-18%, as the growth of e-bikes increases the demand for specialized chain devices designed to work with both pedal and motor power.

The bicycle chain device market is experiencing solid growth, supported by rising health awareness, growing environmental concerns, and increased adoption of bicycles for urban commuting and recreational purposes. Consumer demand is shifting towards efficient, lightweight, and durable drivetrain components, prompting manufacturers to focus on precision engineering and advanced materials.

Road and hybrid bikes, in particular, are driving consistent sales, while growing interest in cycling as a sport and sustainable mobility option continues to attract investments in infrastructure and product innovation. The future outlook remains favorable as OEMs ramp up production to meet global demand, and technological integration, such as anti-rust coatings and smoother shifting mechanisms, becomes more widespread.

As global cities implement cycling-friendly policies and consumers seek high-performance and low-maintenance components, the market is expected to sustain upward momentum.

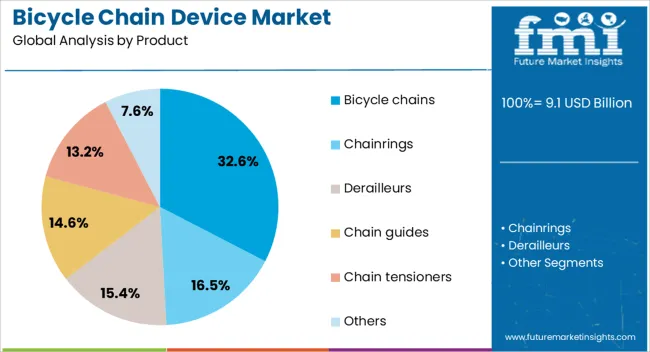

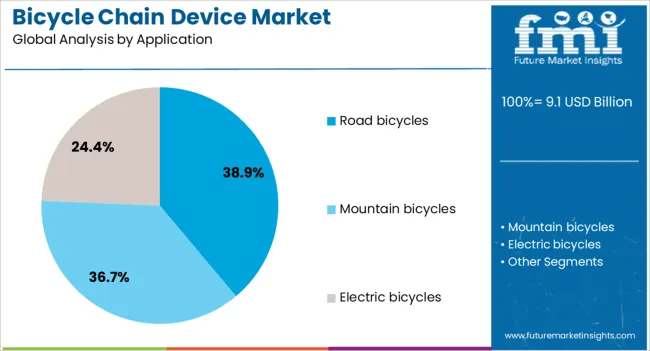

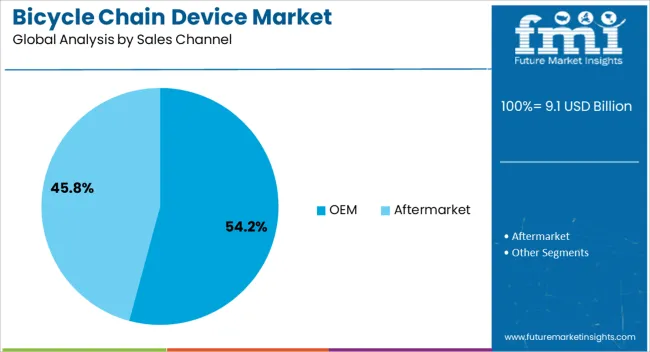

The bicycle chain device market is segmented by product, application, sales channel, and geographic regions. By product, bicycle chain device market is divided into Bicycle chains, Chainrings, Derailleurs, Chain guides, Chain tensioners, and Others. In terms of application, bicycle chain device market is classified into Road bicycles, Mountain bicycles, and Electric bicycles. Based on sales channel, bicycle chain device market is segmented into OEM and Aftermarket. Regionally, the bicycle chain device industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bicycle chains segment captured 32.6% of the product category share, reflecting its critical function in ensuring drivetrain efficiency and ride performance. As one of the most frequently replaced components, chains are in constant demand across all bicycle types.

Manufacturers are innovating with corrosion-resistant materials, optimized link designs, and reduced-friction coatings to enhance durability and performance, particularly for competitive and long-distance cyclists. Increasing penetration of multi-gear bicycles, including e-bikes, further supports the demand for specialized chain variants.

Additionally, the trend toward lightweight bikes has led to the development of compact yet robust chains that align with modern frame geometries. This segment’s growth is expected to continue steadily, fueled by technological advancements, rising customization needs, and a global increase in cycling frequency and distances

The road bicycles segment leads the application category with a 38.9% market share, indicating strong alignment between performance-focused cycling and demand for premium chain devices. Road cyclists prioritize precision, weight optimization, and drivetrain smoothness, driving the need for high-efficiency chain systems.

Urbanization trends and the increasing use of road bikes for fitness and commuting are accelerating product adoption. Growth in amateur racing events and cycling clubs has also intensified product replacement cycles and customization preferences.

Manufacturers are tailoring product lines to meet the aerodynamic and high-mileage requirements of this segment, while also introducing wear-resistant coatings to improve longevity. As more consumers invest in road biking as a lifestyle or competitive pursuit, the demand for specialized chain devices tailored for high-speed and endurance performance is projected to expand

The OEM sales channel dominates with a 54.2% market share, highlighting its strategic importance in driving volume sales and long-term partnerships for bicycle chain device manufacturers. OEM integration ensures consistent product compatibility and performance, aligning with brand-specific drivetrain standards and design preferences.

As global bicycle production scales to meet surging demand, especially from established manufacturers and startups alike, OEM supply agreements are increasingly critical. This segment benefits from bulk purchasing, streamlined logistics, and early adoption of innovative technologies developed in close collaboration with original bike manufacturers.

Additionally, OEM demand is being reinforced by rapid expansion in the electric bicycle segment, where drivetrain reliability is vital. The OEM segment is expected to retain its leadership position as manufacturers prioritize consistency, performance, and lifecycle value in their sourcing strategies.

Bicycle chain devices, including chains, cassettes, derailleurs, and other related components, are essential for ensuring smooth and efficient transmission of power from the pedals to the wheels. Rising demand for bicycles in urban environments, the growing interest in electric bicycles (e-bikes), and advancements in cycling technology are driving market expansion.

Challenges include the fluctuating prices of raw materials like steel and the need for manufacturers to offer high-quality, durable products that can withstand varying weather conditions. Opportunities exist in developing lightweight, corrosion-resistant materials and expanding the range of devices for different types of bicycles, such as mountain bikes, road bikes, and e-bikes.

The growing popularity of cycling, driven by a shift toward healthier lifestyles, environmental awareness, and urban mobility, is propelling demand for bicycle chain devices. The increasing adoption of e-bikes, which offer electric assistance for longer commutes or rougher terrains, is further fueling market growth. These bicycles require specialized chain devices that are designed to handle higher torque and power levels compared to traditional bicycles. As urban areas become more bicycle-friendly and cycling infrastructure improves, the need for reliable, high-performance chain devices continues to rise. Additionally, the increasing number of cycling enthusiasts and participation in competitive cycling events further supports the market’s growth, with consumers looking for high-quality components to enhance their cycling experience.

The bicycle chain device market faces constraints related to the rising cost of raw materials, such as steel, aluminum, and synthetic polymers, which are essential for the production of chain devices. Fluctuations in the prices of these materials can affect production costs and market prices. Furthermore, the global supply chain for these materials can be impacted by regional disruptions, leading to delays or price increases. Manufacturers must also comply with various industry standards and certifications to ensure the safety, durability, and performance of their products, which can add to production complexity. Technical challenges, such as designing components that withstand extreme conditions (e.g., mud, rain, or rough terrain) while maintaining lightweight and high-performance characteristics, remain a key focus for manufacturers. As demand for specialized bicycles increases, suppliers must offer advanced solutions to meet diverse customer needs.

Opportunities in the bicycle chain device market are strongest in the development of lightweight, corrosion-resistant materials that offer enhanced durability and performance. With a growing demand for high-performance bicycles, especially in the mountain bike and e-bike segments, manufacturers are focusing on materials that can handle the rigors of intense cycling conditions while reducing overall weight. Materials such as titanium, carbon fiber, and specialized alloys are gaining traction in the production of chains and related components. Additionally, the growing trend of urban cycling is driving the need for devices that require less maintenance and have longer lifespans. Suppliers who innovate with these materials and focus on developing durable, low-maintenance chain devices will be well-positioned to capture a significant market share, particularly among serious cyclists and urban commuters.

Many consumers are seeking products that cater to specific cycling needs, such as racing, touring, or off-road cycling, which is driving the demand for customizable chain devices. Furthermore, innovations in technology are enabling the development of smart components that can provide real-time data on chain wear, performance, and maintenance needs. As the cycling industry embraces more advanced technology, smart bicycle chain devices are becoming increasingly popular, particularly in the e-bike and performance cycling sectors. The trend toward personalized cycling experiences is expected to continue, with manufacturers developing products that offer greater precision, durability, and efficiency. Suppliers focusing on customization and integrating advanced technologies into their chain devices are well-positioned for future growth.

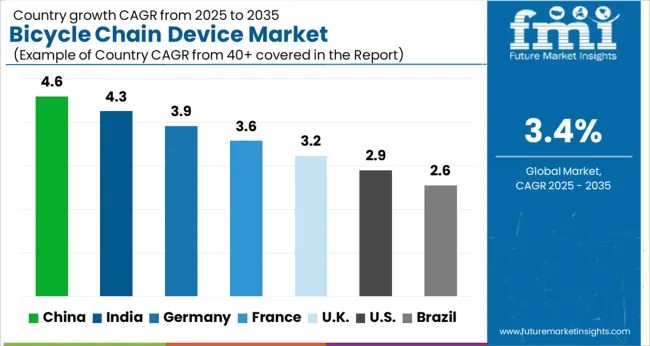

| Country | CAGR |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| France | 3.6% |

| UK | 3.2% |

| USA | 2.9% |

| Brazil | 2.6% |

The global bicycle chain device market is growing at a CAGR of 3.4% from 2025 to 2035. China leads the market with a growth rate of 4.6%, followed by India at 4.3% and Germany at 3.9%. The UK and USA show more moderate growth rates of 3.2% and 2.9%, respectively. The market is primarily driven by the increasing popularity of cycling, the rise in e-bike adoption, and the growing demand for high-performance, durable bicycle components. The ongoing government support for cycling infrastructure and green transportation solutions further strengthens the market dynamics. The analysis includes over 40+ countries, with the leading markets detailed below.

The bicycle chain device market in China is set to grow at a CAGR of 4.6% from 2025 to 2035. With a booming cycling culture, especially in urban areas, the demand for high-quality bicycle chain devices is on the rise. China has a rapidly expanding bicycle market, driven by factors such as government initiatives promoting cycling as an eco-friendly transportation mode and the increasing popularity of e-bikes. As the world’s largest producer and consumer of bicycles, as more consumers are opting for performance-oriented bicycles for recreational and competitive cycling, the demand for advanced chain devices with better durability, smooth operation, and low maintenance is increasing. The presence of major bicycle component manufacturers in China further supports the market growth. The increasing focus on fitness and outdoor activities also contributes to the rising demand for bicycles, indirectly boosting the market for bicycle chain devices.

The bicycle chain device market in India is expected to grow at a CAGR of 4.3% from 2025 to 2035. The rise in urbanization and the growing popularity of cycling as both a recreational activity and a mode of transport are contributing to the growth of the bicycle market. As more people turn to cycling for health and environmental reasons, the demand for better-performing bicycle components, such as chain devices, is increasing. India’s increasing middle class and the growing awareness about fitness are driving consumers to invest in better-quality bicycles with advanced features. The surge in the popularity of both traditional bicycles and electric bicycles (e-bikes) is also contributing to the demand for superior chain devices. Cycling infrastructure improvements in major cities are making cycling a more attractive commuting option, driving the need for efficient and durable chain devices. As e-bike sales rise in India, the demand for high-quality, long-lasting chain devices is also expected to grow.

The bicycle chain device market in Germany is expected to grow at a CAGR of 3.9% from 2025 to 2035. Germany is known for its strong cycling culture, with cycling being a popular mode of transport and leisure activity, particularly in urban and suburban areas. As the demand for bicycles rises, so does the need for high-quality chain devices. Germany’s commitment to promoting sustainable mobility options and green transport solutions is supporting this trend. The market is further bolstered by a growing preference for high-performance bicycles, including racing bikes, mountain bikes, and electric bikes, which require advanced chain systems for smooth operation and longevity. The rising adoption of electric bikes is also pushing the demand for innovative, high-performance chain devices to accommodate the specific needs of e-bikes.

The UK bicycle chain device market is projected to grow at a CAGR of 3.2% from 2025 to 2035. Cycling is increasingly seen as a sustainable and healthy alternative to traditional transport, which is driving the growth of the bicycle market in the UK As cycling infrastructure improves in urban areas and the government encourages the use of bicycles to reduce carbon emissions, the demand for better-quality bicycle components, such as chain devices, is rising. Additionally, the growing interest in cycling for fitness, leisure, and commuting is pushing the need for advanced and durable chain devices that ensure smooth and efficient operation. The increasing trend toward electric bicycles in the UK is also contributing to the demand for specialized chain devices suited to the performance requirements of e-bikes. With more people opting for high-end bicycles with enhanced functionality, the demand for high-quality chain devices is expected to rise.

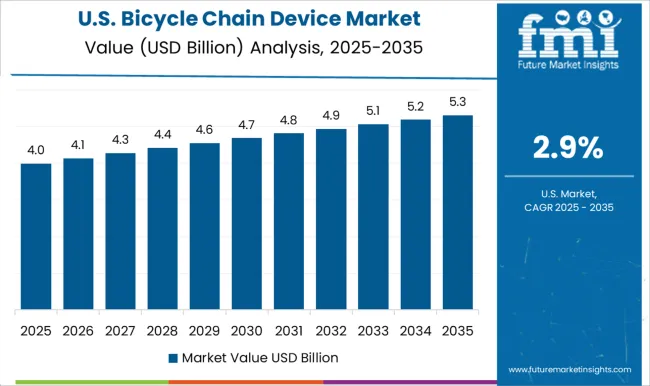

The USA bicycle chain device market is expected to grow at a CAGR of 2.9% from 2025 to 2035. The demand for bicycles is on the rise as cycling becomes an increasingly popular mode of transport and a recreational activity in many cities across the USA As more people embrace cycling as part of their active lifestyle, the need for better-performing and more durable bicycle chain devices is increasing. The growing trend of e-bikes is expected to contribute significantly to this market’s growth, as these bicycles require more advanced chain systems for smooth performance. The USA market is also driven by the rising popularity of outdoor activities, including cycling for leisure and fitness, and a growing interest in cycling races and competitions. With a broad range of bicycles, from traditional models to e-bikes, the demand for specialized and high-performance chain devices is expected to rise.

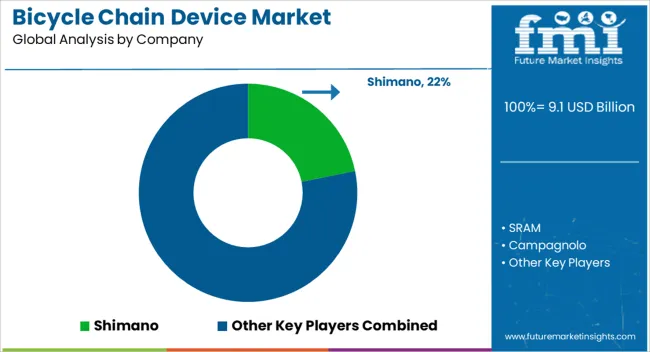

In the bicycle chain device market, competition is shaped by performance, durability, and technological innovation. Shimano, the market leader, offers a wide range of bicycle chains and drivetrain components, catering to both casual cyclists and competitive riders. Their products are known for high performance, precise shifting, and long-lasting durability, with a strong focus on electronic and mechanical drivetrains for road, mountain, and hybrid bikes. SRAM competes with its advanced chain devices, particularly targeting high-end and performance cycling markets. Known for its innovation, SRAM has popularized wireless shifting and wide-range cassettes, improving the overall cycling experience. Campagnolo follows with premium offerings that appeal to professional cyclists, providing chains known for smooth shifting, efficiency, and precision, particularly within the road cycling and racing segments. FSA, a key player in the market, combines competitive pricing with high-quality components, focusing on innovation in its drivetrain systems and chain devices. Hawley-Lambert provides a range of cycling products, including chains, catering to both the aftermarket and OEM markets. KMC Chains offers a variety of chains for all cycling types, with a strong emphasis on value, reliability, and extensive product options.

KMC has made significant strides in chain longevity and smooth performance, further establishing itself as a major competitor. Race Face stands out with its focus on mountain biking, offering robust chains designed to handle the demanding terrain and conditions that mountain bikers often encounter. Trek Bicycle and TRP Cycling focus on providing integrated drivetrain solutions, with Trek producing chains as part of its bicycle systems. TRP Cycling is known for offering high-quality braking systems, but they also compete in the chain device market, ensuring overall performance and synergy within their product line. Wippermann competes in the high-performance segment, known for its durability and precision, offering chains that are a popular choice among racing cyclists. Product brochures from these brands typically emphasize durability, smooth shifting, corrosion resistance, and compatibility with a variety of cycling disciplines.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.1 Billion |

| Product | Bicycle chains, Chainrings, Derailleurs, Chain guides, Chain tensioners, and Others |

| Application | Road bicycles, Mountain bicycles, and Electric bicycles |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Shimano, SRAM, Campagnolo, FSA, Hawley-Lambert, KMC Chains, Race Face, Trek Bicycle, TRP Cycling, and Wippermann |

| Additional Attributes | Dollar sales by product type (chains, chainrings, derailleurs, chain guides), application (road bikes, mountain bikes, e-bikes, hybrid bikes), and material type (steel, titanium, aluminum, composite). Demand dynamics are influenced by increasing cycling participation, advancements in chain technology, and the popularity of cycling as both a recreational and competitive sport. Regional trends show steady growth in North America, Europe, and Asia-Pacific, with rising interest in urban cycling, e-bikes, and recreational cycling activities. |

The global bicycle chain device market is estimated to be valued at USD 9.1 billion in 2025.

The market size for the bicycle chain device market is projected to reach USD 12.7 billion by 2035.

The bicycle chain device market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in bicycle chain device market are bicycle chains, chainrings, derailleurs, chain guides, chain tensioners and others.

In terms of application, road bicycles segment to command 38.9% share in the bicycle chain device market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA