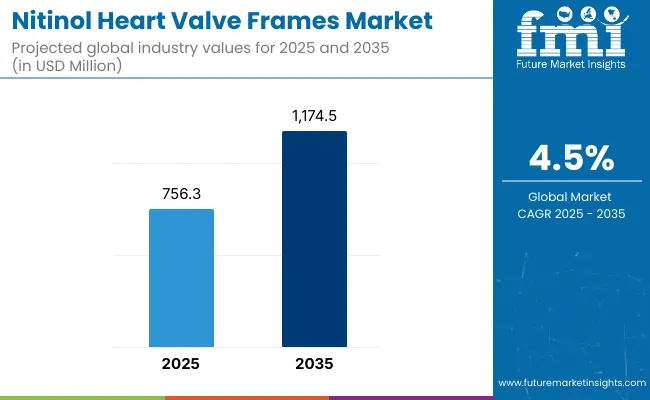

The nitinol heart valve frames market is expected to record a valuation of USD 756.3 million in 2025 and USD 1,174.5 million in 2035, with reflecting a growth of USD 418.2 million across the ten-year span. The overall expansion represents a CAGR of 4.5% and 1.77X increase in market size.

| Metric | Value |

|---|---|

| Nitinol Heart Valve Frames Market in (2025E) | USD 756.3 million |

| Nitinol Heart Valve Frames Market in (2035F) | USD 1,174.5 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

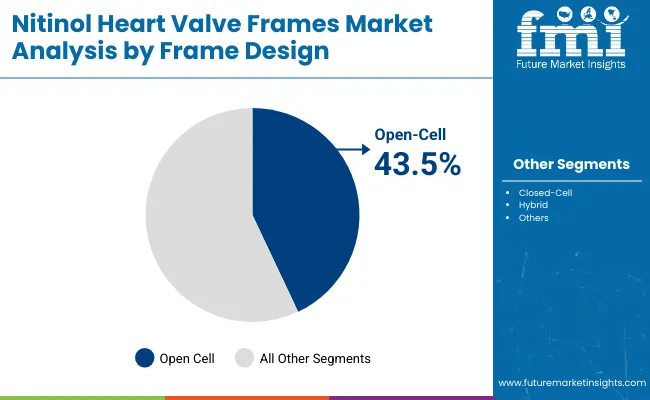

During the first five year period between 2025 to 2030, the nitinol heart valve frames market is projected to grow steadily form USD 756.3 million to USD 942.5 million, driven by rising transcatheter aortic valve replacement (TAVR) procedures and increasing adoption of minimally invasive valve technologies. The market is expected to register a compound annual growth rate (CAGR) of 4.5%, translating to an incremental revenue opportunity of USD 186.2 million over this periodwhich accounts for 44.5% of the total decade growth. The Open-Cell frame design will continue to dominate, accounting for approximately 43.5% of the total revenue share due to its superior radial force and conformability, which facilitate effective anchoring during deployment.

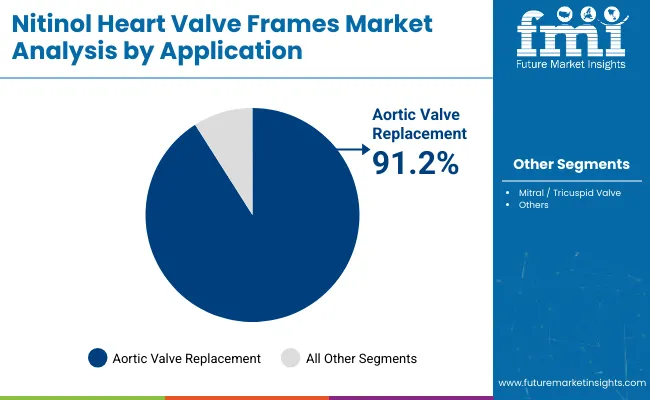

The second half from 2030 to 2035, the market is forecasted to gain further momentum, contributing an additional USD 232.0 million which accounts for 55.5% of the total decade growth, with a projected CAGR of 3.7%. As device engineering advances, Hybrid designs are anticipated to gain share due to their ability to combine flexibility and strength. However, Aortic Valve Replacement will remain the largest application, consistently accounting for more than 91.2% of overall market revenue due to high procedural volumes and aging patient demographics.

From 2020 to 2024, The Nitinol heart valve frames market grew from USD 618.4 Million in 2020 to USD 731.3 Million in 2024 with CAGR of 3.3%, driven by TAVR expansion into intermediate-risk cohorts and rising adoption of self-expanding frames for complex anatomies. The top three manufacturers held around 46.1% share in 2024, supported by proprietary laser-cut architectures, fatigue-resistant heat-setting, sealing skirts, and commissural alignment features. Strategies centered on delivery profile miniaturization, expanding valve-in-valve and bicuspid indications, enhancing durability, and localizing production. TMVR frames saw minimal uptake due to anchoring challenges and LVOT obstruction risk.

Demand for Nitinol heart valve frames is projected at USD 756.3 Million in 2025. Traditional surgical players risk share loss without transcatheter innovations; major incumbents will defend position through next-gen features and durability data, while new manufacturers from Europe and Asia pacific are targeting niche anatomies, aiming for 1-2 pp gains via cost-optimized, precision-engineered frames.

A key driver is the rising prevalence of aortic stenosis and degenerative valve diseases, particularly among the aging global population. As life expectancy increases, so does the pool of patients eligible for transcatheter valve replacement, especially those deemed high-risk for open-heart surgery. This has accelerated the shift toward minimally invasive interventions, where nitinol frames play a critical role due to their super elasticity, fatigue resistance, and shape memory properties, enabling precise deployment and durable anchoring in anatomically complex regions.

In parallel, advancements in valve frame design especially open-cell and hybrid configurations have improved conformability and radial strength, reducing complications such as paravalvular leak. Moreover, favorable reimbursement policies in the United States and Europe and regulatory fast-tracking of next-gen transcatheter devices have created a conducive market environment. Device manufacturers are also expanding access to emerging markets and investing in physician training programs, further broadening procedural adoption and fueling sustained growth in the nitinol frame segment.

The market is segmented by frame design, application, and end user. By frame design, the categories include open-cell, closed-cell, and hybrid configurations. Open-cell frames are the most widely adopted, offering superior flexibility and conformability to the dynamic anatomy of the aortic root, which enhances anchoring stability and reduces migration risk. Closed-cell designs provide higher radial strength, while hybrid frames combine the benefits of both geometries for specific procedural needs.

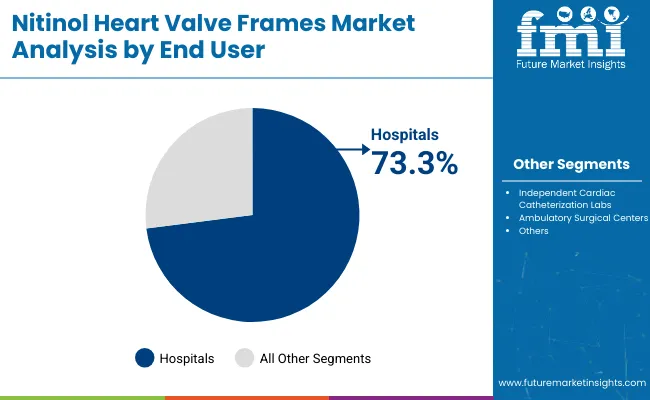

By application, Nitinol heart valve frames are primarily used in aortic valve replacement procedures, representing the bulk of global demand, with emerging use in mitral, pulmonary, and tricuspid interventions. By end user, hospitals dominate due to advanced infrastructure, hybrid operating rooms, and comprehensive reimbursement support. Independent cardiac catheterization labs are expanding their presence, particularly in urban, high-volume cardiovascular centers. Ambulatory surgical centers, while currently a smaller segment, are expected to record faster growth as transcatheter valve replacement becomes more viable in outpatient settings through streamlined protocols and lower-risk patient selection.

| By Frame Design | Market Value Share, 2025 |

|---|---|

| Open-Cell | 43.5% |

| Closed-Cell | 31.5% |

| Hybrid | 25.0% |

In 2025, Open-Cell frame designs lead the nitinol heart valve frames market in terms of market share it holds around 43.5%. Their dominance is attributed to their exceptional conformability, radial expansion capability, and deployment precision, making them ideal for navigating the complex anatomy of the aortic root. These structures allow better blood flow through the open struts and accommodate dynamic motion without compromising structural integrity.

The demand is particularly strong in aortic valve replacement procedures, where secure anchoring and adaptability are crucial to reduce complications like valve migration or paravalvular leak. Furthermore, top-tier manufacturers have heavily focused on advancing Open-Cell technologies in their TAVR systems, reinforcing physician familiarity and clinical trust. As transcatheter procedures expand into intermediate and low-risk populations, Open-Cell frames are expected to maintain their lead due to reproducible outcomes and favorable hemodynamics across varied patient profiles

| By Application | Market Value Share, 2025 |

|---|---|

| Aortic Valve Replacement | 91.2% |

| Mitral / Tricuspid Valve | 8.9% |

In 2025, Aortic Valve Replacement (AVR) is the dominant application segment driving demand for nitinol heart valve frames with market share of 91.2%. This leadership is rooted in the high global burden of aortic stenosis, particularly among aging populations. With the continued shift from surgical to transcatheter aortic valve replacement (TAVR) procedures, the demand for nitinol-based frames-valued for their super elasticity and reliable deployment-is rising sharply.

Clinical guidelines increasingly endorse TAVR for not only high-risk but also intermediate- and low-risk patients, expanding the addressable market. Additionally, the majority of regulatory approvals and commercialized TAVR systems are centered around aortic valve interventions, reinforcing AVR’s dominant position. As device iterations improve procedural outcomes and reduce recovery time, hospitals and cath labs are increasingly favoring AVR as a standard-of-care solution, sustaining its top-tier position in application-based segmentation.

| By End User | Market Value Share, 2025 |

|---|---|

| Hospitals | 73.3% |

| Independent Cardiac Catheterization Labs | 18.5% |

| Ambulatory Surgical Centers | 8.2% |

In 2025, Hospitals dominate the end-user landscape for nitinol heart valve frames with holding significant market share of 73.3%. Their leadership stems from their advanced infrastructure, access to hybrid operating rooms, and comprehensive cardiac care teams capable of handling complex transcatheter valve replacement procedures. Hospitals also benefit from established reimbursement frameworks and integrated care pathways, which support higher procedural volumes.

Furthermore, leading device manufacturers prioritize hospital partnerships for clinical trials, training, and early technology adoption, making hospitals the first point of access for new-generation frames. The growing number of TAVR-certified hospital centers globally, particularly in the United States, Europe, and Japan, amplifies this dominance. As procedural complexity rises especially in elderly or comorbid patient’s hospitals remain the preferred setting for managing intraoperative risks and post-operative care, ensuring their continued position as the primary demand driver.

Self-expanding, conformable frames have enabled treatment of anatomically challenging cases, boosting adoption globally. Growth is restrained by technical and anatomical complexities in non-aortic applications such as mitral, pulmonary, and tricuspid valves, where anchoring, sealing, and regulatory hurdles slow commercialization. A key trend is the development of next-generation self-expanding and hybrid frames with improved radial strength, sealing, fatigue resistance, and delivery systems, enhancing procedural precision, durability, and patient eligibility across diverse anatomical presentations.

Expanding Indications and Patient Eligibility for TAVR

A major growth driver for the Nitinol heart valve frames market is the rapid expansion of transcatheter aortic valve replacement (TAVR) indications into intermediate- and lower-risk patient populations, supported by strong clinical evidence from pivotal trials. Historically confined to inoperable and high-risk patients, TAVR is now being adopted for younger, more active patients due to demonstrated survival benefits, reduced procedural trauma, and faster recovery times.

Nitinol frames, particularly self-expanding and repositionable designs, have enabled this expansion by offering superior conformability in anatomically challenging cases, such as bicuspid valves and small annuli, which previously posed procedural limitations. This trend has increased procedure volumes in both mature and emerging markets, with hospitals investing in hybrid operating rooms and advanced imaging to handle higher throughput. Moreover, improved delivery systems with reduced sheath sizes have broadened access to patients with peripheral artery disease, directly contributing to market growth and reinforcing the dominance of Nitinol-based valve frames in TAVR procedures.

Technical and Anatomical Challenges in Non-Aortic Applications

While TAVR has driven strong adoption of Nitinol heart valve frames, their application in transcatheter mitral, pulmonary, and tricuspid valve replacement remains limited due to technical and anatomical challenges. In the mitral position, anchoring a frame securely without surgical suturing is complex, given the non-circular annulus, variable calcification, and risk of left ventricular outflow tract (LVOT) obstruction.

Pulmonary and tricuspid valve anatomies pose their own challenges, including low-pressure environments and larger, irregular annuli that complicate frame fixation. These anatomical barriers necessitate highly specialized frame geometries and anchoring mechanisms, increasing design complexity and development costs.

As a result, many emerging applications remain in early feasibility or limited commercial rollout phases, slowing overall market diversification. Regulatory pathways for these non-aortic applications are also less established, requiring extended clinical validation and long-term outcome data, which delays commercialization timelines. Until these engineering and procedural hurdles are addressed, growth in these segments will lag behind the aortic valve replacement market.

Shift Toward Next-Generation Self-Expanding and Hybrid Frame Designs

A defining trend in the Nitinol heart valve frames market is the shift toward next-generation self-expanding and hybrid frame designs that balance conformability with enhanced radial strength. Traditional open-cell frames dominate due to their flexibility, but newer designs are integrating hybrid geometries that maintain this adaptability while improving sealing and reducing paravalvular leak (PVL) rates.

Manufacturers are also optimizing frame fatigue resistance through advanced heat-setting processes, ensuring durability over billions of cardiac cycles-a critical factor as TAVR expands into younger populations with longer life expectancy. Furthermore, delivery system innovations, such as lower-profile sheaths and improved recapture mechanisms, are being paired with these advanced frames to facilitate precise positioning and enable coronary reaccess post-implantation.

These advancements not only improve procedural success rates but also expand patient eligibility to more complex anatomies, including bicuspid valves and heavily calcified annuli. This trend reflects a market-wide focus on engineering refinements that enhance both short-term outcomes and long-term valve durability.

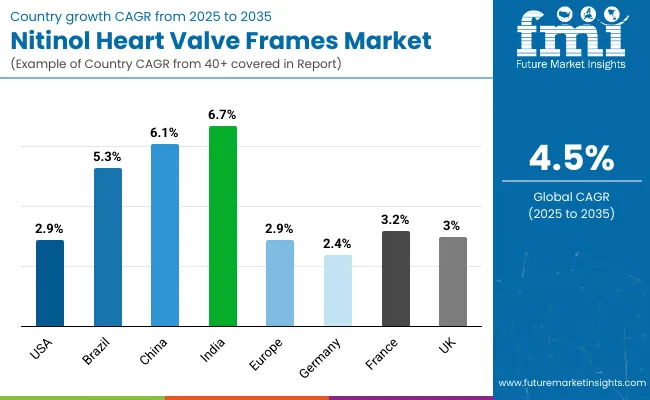

| Country | CAGR (%) |

|---|---|

| United States | 2.9% |

| Brazil | 5.3% |

| China | 6.1% |

| India | 6.7% |

| Europe | 2.9% |

| Germany | 2.4% |

| France | 3.2% |

| United Kingdom | 3.0% |

Asia-Pacific is emerging as the fastest-growing region in the Nitinol Heart Valve Frames Market, driven by robust healthcare infrastructure development, rising cardiovascular disease burden, and increasing access to advanced interventional cardiology. India (6.7% CAGR) and China (6.1% CAGR) are the two fastest-growing countries, supported by government-led public health programs, medical tourism growth, and the rapid expansion of TAVR-certified cardiac centers. Additionally, domestic device manufacturers are entering the space, improving price accessibility and local availability, which further accelerates adoption in previously underpenetrated markets.

Europe shows a moderate growth outlook (3.3% CAGR), with key countries like Germany (2.4%), France (3.2%), and the United Kingdom (3.0%) reflecting differentiated dynamics. France benefits from strong public insurance coverage for TAVR, while the United Kingdom is steadily expanding specialized cardiac centers under NHS modernization. Germany’s slower growth is due to high market saturation and conservative procedural guidelines. However, all three countries maintain stable demand due to aging populations and consistent clinical uptake in tertiary care hospitals.

North America remains a mature but strategically important market, with the United States growing at a 2.9% CAGR. Growth is driven by continuous expansion of low-risk TAVR indications, strong reimbursement frameworks (e.g., Medicare), and ongoing innovation by domestic manufacturers such as Medtronic and Edwards Lifesciences. United States hospitals also benefit from widespread adoption of hybrid ORs and structured training programs, making the country a leader in early adoption of next-gen frame designs. The focus on personalized cardiac care and value-based outcomes sustains long-term growth.

| Year | USA Nitinol Heart Valve Frames Market (USD Million) |

|---|---|

| 2025 | 756.3 |

| 2026 | 785.7 |

| 2027 | 820.5 |

| 2028 | 857.4 |

| 2029 | 896.1 |

| 2030 | 936.9 |

| 2031 | 979.3 |

| 2032 | 1024.2 |

| 2033 | 1072.4 |

| 2034 | 1123.6 |

| 2035 | 1174.59 |

The nitinol heart valve frames market in the United States is projected to grow at a CAGR of 2.9% from 2025 to 2035. Although the market is mature, it continues to expand steadily due to rising volumes of transcatheter aortic valve replacement (TAVR) procedures and favorable reimbursement through Medicare and private insurers. The growth is also supported by the aging population, increasing prevalence of aortic stenosis, and FDA approvals expanding TAVR indications to low-risk patient groups.

Hospitals remain the dominant end users, but Independent Cardiac Catheterization Labs are seeing rising adoption due to faster patient throughput and growing access to hybrid procedural suites in outpatient settings.

Germany’s Nitinol Heart Valve Frames Market is expected to grow at a CAGR of 2.4% between 2025 and 2035. Although growth is modest, Germany remains one of the largest markets in Europe due to its well-established cardiovascular treatment infrastructure, high procedural volume, and strong clinical adoption of TAVR. The market is largely driven by its aging population, universal insurance coverage, and continuous advancements in Open-Cell and Hybrid frame technologies. However, stringent clinical guidelines and slower reimbursement adjustments slightly temper the pace of growth.

Hospitals remain the primary end users, especially university-affiliated cardiac centers equipped with hybrid operating rooms. Outpatient catheterization centers are slowly gaining traction, particularly for low-risk cases.

The United Kingdom's nitinol heart valve frames market is projected to grow at a CAGR of 2.9% from 2025 to 2035. Growth is driven by the National Health Service (NHS) expansion of structural heart programs, increased referrals for TAVR in elderly patients, and wider adoption of minimally invasive procedures across regional cardiac centers. Government investments in modernizing cath labs and hybrid ORs are enhancing accessibility, especially in Tier-2 cities.

While hospitals remain the primary end users, Independent Cardiac Catheterization Labs are increasingly utilized for elective valve procedures due to shorter wait times and resource efficiency.

| Europe Countries Share | 2025 % Share |

|---|---|

| Germany | 27.9% |

| United Kingdom | 16.8% |

| France | 15.0% |

| Italy | 11.3% |

| Spain | 8.5% |

| BENELUX | 6.9% |

| Nordic Countries | 5.9% |

| Rest of Western Europe | 7.7% |

| Europe Countries Share | 2035 % Share |

|---|---|

| Germany | 27.3% |

| United Kingdom | 16.5% |

| France | 14.7% |

| Italy | 11.1% |

| Spain | 8.3% |

| BENELUX | 6.8% |

| Nordic Countries | 5.8% |

| Rest of Western Europe | 9.6% |

India’s Nitinol Heart Valve Frames Market is expected to grow at a CAGR of 6.7% between 2025 and 2035, making it one of the fastest-growing global markets. This growth is driven by an increasing burden of valvular heart disease, rising awareness of transcatheter therapies, and a growing number of TAVR-capable cardiac centers in metropolitan hospitals. Additionally, favorable regulatory pathways, government investments in cardiac care infrastructure, and the emergence of local valve manufacturers are improving cost accessibility.

Hospitals are the dominant end users due to their access to hybrid operating rooms and skilled interventional cardiologists. However, private multispecialty centers are seeing rising adoption, especially in Tier-1 cities, due to patient preference for premium, minimally invasive solutions.

China’s nitinol heart valve frames market is projected to grow at a CAGR of 6.1% from 2025 to 2035, driven by rapid expansion in cardiovascular care infrastructure and rising prevalence of aortic stenosis among the aging population. The Chinese government’s support for domestic innovation, through programs like “Made in China 2025,” has enabled local companies to develop cost-effective TAVR systems using nitinol frames, increasing accessibility beyond Tier-1 cities. The National Reimbursement Drug List (NRDL) and pilot insurance schemes in provinces are also improving procedural affordability.

Tertiary hospitals are the leading end users, but adoption is rapidly increasing in provincial cardiac centers due to government-backed training and equipment grants.

| Japan Nitinol Heart Valve Frames Market, By Frame Design, Market Share (%) Analysis, 2025 | 2025 Share (%) |

|---|---|

| Open-Cell | 44.4% |

| Closed-Cell | 32.2% |

| Hybrid | 23.4% |

Japan’s nitinol heart valve frames market is projected to grow at a CAGR of 3.5% from 2025 to 2035. The market is expanding steadily due to the country’s rapidly aging population, high prevalence of aortic stenosis, and widespread adoption of transcatheter aortic valve replacement (TAVR). Japan has a strong hospital-based healthcare system, and government-approved reimbursement for TAVR procedures under the National Health Insurance (NHI) significantly enhances affordability and access. Additionally, collaboration between domestic manufacturers and global firms is accelerating innovation and local clinical adoption.

University hospitals and large cardiovascular centers are the primary end users, but regional hospitals are seeing rising adoption due to government-led decentralization of structural heart programs.

| South Korea Nitinol Heart Valve Frames Market, By End User, Market Share (%) Analysis, 2025 | 2025 Share (%) |

|---|---|

| Hospitals | 74.0% |

| Specialty Clinics | 18.7% |

| Ambulatory Surgical Centers | 7.3% |

South Korea’s nitinol heart valve frames market is projected to grow at a CAGR of 5.9% from 2025 to 2035, positioning it among the fastest-growing Asian markets. Growth is fueled by a rapidly aging population, early government adoption of structural heart programs, and strong investments in public-private hospital collaborations. South Korea’s national health insurance covers TAVR procedures for high-risk patients, and newer-generation nitinol frames are increasingly being adopted in leading cardiovascular centers.

While tertiary hospitals continue to dominate usage, regional cardiac centers are seeing rising procedural volumes due to technology standardization and interventional cardiology training programs.

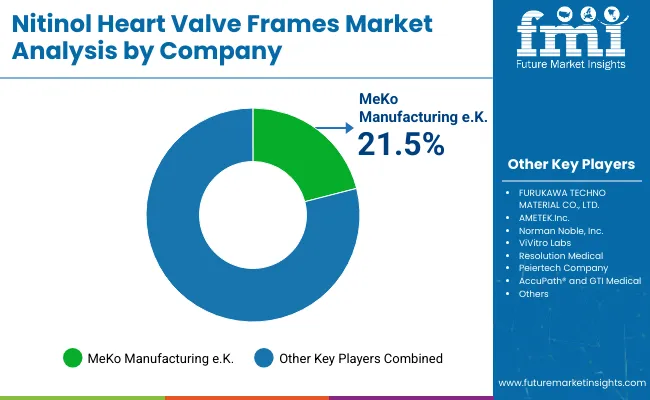

| Key Players | Global Value Share (%) 2025 |

|---|---|

| MeKo Manufacturing e.K. | 21.5% |

| Other Players | 78.5% |

The nitinol heart valve frames market is moderately consolidated, with a mix of global contract manufacturers, precision engineering firms, and niche suppliers supporting transcatheter valve system OEMs. MeKo Manufacturing e.K. holds the leading market share at 21.5%, driven by its specialization in laser-cutting and electro polishing of nitinol stents and valve frames, deep collaborations with Tier 1 device manufacturers, and superior quality validation protocols. The company’s competitive edge lies in its precision microfabrication technologies, vertical integration, and reputation for delivering high-reliability components for Class III cardiovascular implants.

Mid-sized players like FURUKAWA TECHNO MATERIAL CO., LTD., AMETEK Inc., and Norman Noble, Inc. are recognized for their innovation in high-nickel alloy processing, nitinol tubing, and multi-axis micromachining capabilities. These firms often serve as Tier 2/3 suppliers in co-development partnerships with global valve system leaders, offering flexibility in prototyping, scale-up, and multi-continent regulatory compliance.

Specialty providers including ViVitro Labs, Resolution Medical, Peiertech, and AccuPath® serve highly specific roles across R&D testing, preclinical validation, and custom-form nitinol device fabrication. These companies focus on agility, offering rapid design iterations, niche regulatory pathways (e.g., for mitral or tricuspid use cases), and regional contract manufacturing in support of early-stage and emerging valve system developers.

As the market evolves, competitive differentiation is shifting from standard fabrication toward IP-backed customization, integration with next-generation delivery systems, and support for bicuspid and redo-TAVR indications. Leaders are investing in closed-loop manufacturing analytics, materials traceability, and long-term fatigue data capture, essential for meeting the growing demand for lifetime durability in younger, low-risk patient populations.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1,174.5 million |

| Frame Design | Open-Cell, Closed-Cell and Hybrid |

| Application | Aortic Valve Replacement and Mitral / Tricuspid Valve |

| End User | Hospitals, Independent Cardiac Catheterization Labs and Ambulatory Surgical Centers |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Brazil, China, India, Germany, France, United Kingdom etc. |

| Key Companies Profiled | MeKo Manufacturing e.K., FURUKAWA TECHNO MATERIAL CO., LTD., AMETEK.Inc, Norman Noble, Inc., ViVitro Labs, Resolution Medical, Peiertech Company, AccuPath® and GTI Medical |

| Additional Attributes | Dollar sales by application and regions, a doption trends of frameless/self-expanding Nitinol valve technologies, Demand in bioprosthetic valve innovation and Growth across transcatheter aortic valve replacement (TAVR) and next-gen mitral/pulmonary valve devices |

The global nitinol heart valve frame is estimated to be valued at USD 756.3 million in 2025.

The market size for the nitinol heart valve frames market is projected to reach approximately USD 1,174.5 million by 2035.

The nitinol heart valve frames market is expected to grow at a CAGR of 4.5% between 2025 and 2035.

The key frame designs in the nitinol heart valve frames market include open-cell, closed cell and hybrid.

In terms of end user, the hospitals segment is projected to command the highest share at 73.3% in the Nitinol heart valve frames market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heart Pump Device Market Forecast and Outlook 2025 to 2035

Heart Beat Sensor Market Size and Share Forecast Outlook 2025 to 2035

APAC Heart Health Functional Food Market Size and Share Forecast Outlook 2025 to 2035

Heart Closure Devices Market Size and Share Forecast Outlook 2025 to 2035

Heart Block Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Heart Beat Irregularity Detection Device Market Trends - Growth & Forecast 2025 to 2035

Heart Beat Monitor and Sensor Market

Heart Failure Testing Market

Mobile Heart Monitoring Market

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Surgical Heart Valves Market Size and Share Forecast Outlook 2025 to 2035

Rheumatic-Heart Disease Management Market Analysis - Innovations & Outlook 2025 to 2035

Pulmonary Heart Valve Replacement Market Size and Share Forecast Outlook 2025 to 2035

Pediatric Heart Valve Repair and Replacement Analysis by Product, Induction, End Users and Region-2025 to 2035

Structural Heart Devices Market Size and Share Forecast Outlook 2025 to 2035

Prosthetic Heart Valve Market is segmented by product & end user from 2025 to 2035

Transcatheter Heart Valve Replacement Market Analysis - Trends & Forecast 2025 to 2035

Total Artificial Heart Market

Radiation-Free Fetal Heart Rate Monitor Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Frames Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA