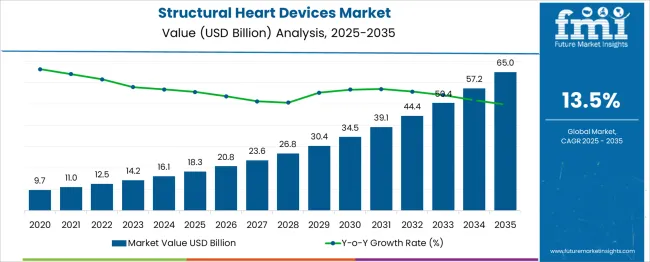

The global structural heart devices market is anticipated to grow from USD 18.3 billion in 2025 to approximately USD 65 billion by 2035, recording an absolute increase of USD 46.6 billion over the forecast period. This translates into a total growth of 254.6%, with the market forecast to expand at a compound annual growth rate (CAGR) of 13.5% between 2025 and 2035. The overall market size is expected to grow by nearly 3.5X during the same period, supported by increasing prevalence of cardiovascular diseases, rising geriatric population, and growing adoption of minimally invasive cardiac procedures.

Between 2025 and 2030, the structural heart devices market is projected to expand from USD 18.3 billion to USD 33.8 billion, resulting in a value increase of USD 15.5 billion, which represents 33.3% of the total forecast growth for the decade. This phase of growth will be shaped by technological advancements in transcatheter valve technologies, increasing procedural volumes in emerging markets, and growing physician expertise in minimally invasive cardiac interventions. Medical device manufacturers are expanding their product portfolios to address the growing demand for innovative structural heart solutions that offer improved patient outcomes and reduced procedural complications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 18.3 billion |

| Forecast Value in (2035F) | USD 65 billion |

| Forecast CAGR (2025 to 2035) | 13.5% |

From 2030 to 2035, the market is forecast to grow from USD 33.8 billion to USD 65 billion, adding another USD 31.1 billion, which constitutes 66.7% of the overall ten-year expansion. This period is expected to be characterized by expansion of transcatheter technologies to new valve positions, integration of artificial intelligence in procedural planning, and development of next-generation devices with improved durability and hemodynamic performance. The growing adoption of value-based healthcare models and focuses on cost-effective treatment solutions will drive demand for structural heart devices that demonstrate superior clinical outcomes and long-term patient benefits.

Between 2020 and 2025, the structural heart devices market experienced robust expansion, driven by increasing awareness of structural heart disease treatment options and growing accessibility of transcatheter procedures. The market developed as healthcare systems recognized the need for less invasive alternatives to traditional open-heart surgery, particularly for high-risk and elderly patients. Clinical evidence supporting the efficacy of transcatheter technologies began influencing treatment guidelines and expanding patient eligibility criteria for minimally invasive interventions.

Market expansion is being supported by the increasing prevalence of valvular heart diseases globally and the corresponding demand for effective treatment solutions. The aging population worldwide is driving higher incidence rates of structural heart conditions, particularly aortic stenosis and mitral regurgitation. Advanced transcatheter technologies are enabling treatment of patients who were previously considered inoperable or high-risk for traditional surgical approaches, significantly expanding the addressable patient population.

The growing focuses on minimally invasive procedures is driving demand for transcatheter devices that offer reduced hospital stays, faster recovery times, and improved quality of life for patients. Healthcare systems are increasingly recognizing the cost-effectiveness of transcatheter interventions when considering total healthcare resource utilization and long-term patient outcomes. The rising influence of clinical evidence demonstrating comparable or superior outcomes to surgical alternatives is contributing to increased adoption across different patient risk profiles and age groups.

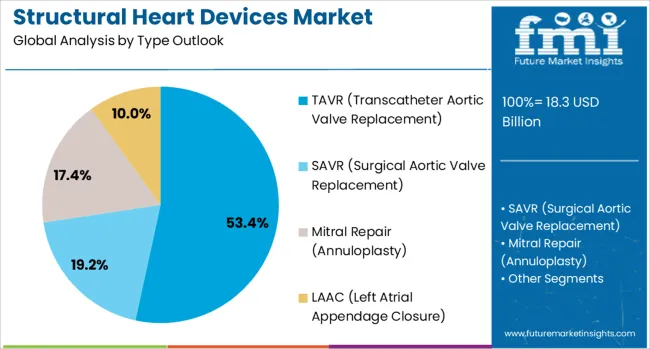

The market is segmented by type and region. By type, the market is divided into TAVR (Transcatheter Aortic Valve Replacement), SAVR (Surgical Aortic Valve Replacement), Mitral Repair (Annuloplasty), and LAAC (Left Atrial Appendage Closure).

The TAVR segment is projected to account for 53.4% of the structural heart devices market in 2025, reaffirming its position as the category's dominant technology. Healthcare providers increasingly recognize TAVR as the standard of care for patients with severe aortic stenosis across various risk profiles. The technology's proven clinical efficacy, demonstrated through extensive real-world evidence and randomized controlled trials, directly addresses the growing burden of aortic valve disease in aging populations worldwide.

This segment forms the foundation of structural heart programs globally, as it represents the most mature and widely adopted transcatheter valve technology. Regulatory approvals for expanded indications and ongoing clinical validation continue to strengthen confidence in TAVR procedures. With continuous technological improvements in valve design, delivery systems, and procedural techniques, TAVR maintains its position as the primary growth driver in the structural heart devices market. Its broad applicability across patient populations ensures dominance in transcatheter valve interventions.

The structural heart devices market is advancing rapidly due to increasing prevalence of cardiovascular diseases and growing adoption of minimally invasive treatment options. The market faces challenges including high procedural costs, reimbursement complexities, and the need for specialized training and infrastructure. Innovation in device design and expanding clinical evidence continue to influence treatment paradigms and market expansion patterns.

The growing body of clinical evidence is enabling expansion of transcatheter technologies beyond traditional high-risk patient populations to intermediate and low-risk groups. Regulatory approvals for expanded indications are broadening the addressable patient population for minimally invasive structural heart interventions. Clinical trials demonstrating long-term durability and favorable outcomes are driving adoption among younger patient cohorts who benefit from avoiding open-heart surgery.

Modern structural heart programs are incorporating advanced imaging modalities such as 3D echocardiography, cardiac CT, and fusion imaging to enhance procedural planning and execution. These technologies improve device sizing accuracy, reduce procedural complications, and optimize patient outcomes. Artificial intelligence and machine learning algorithms are being integrated to assist in patient selection, risk stratification, and procedural guidance, enhancing the precision of structural heart interventions.

| Country | CAGR (2025-2035) |

|---|---|

| China | 18.2% |

| India | 16.9% |

| Germany | 15.5% |

| France | 14.2% |

| UK | 12.8% |

| USA | 11.5% |

| Brazil | 10.1% |

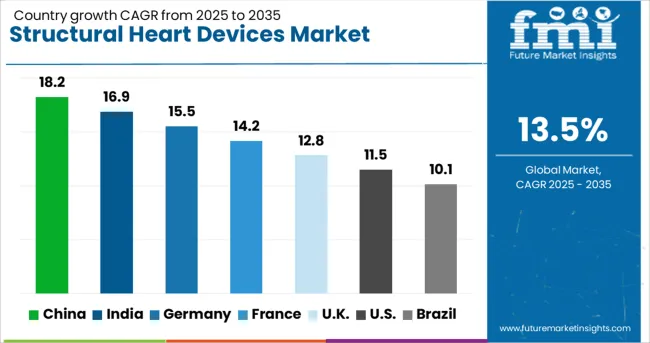

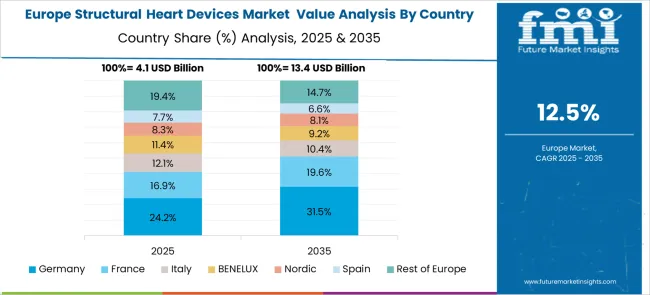

The structural heart devices market is experiencing robust growth globally, with China leading at an 18.2% CAGR through 2035, driven by rapidly expanding healthcare infrastructure, increasing cardiovascular disease burden, and growing adoption of advanced medical technologies. India follows at 16.9%, supported by rising healthcare awareness, expanding insurance coverage, and increasing availability of specialized cardiac care. Germany shows steady growth at 15.5%, emphasizing clinical excellence and innovative treatment approaches. France records 14.2%, focusing on comprehensive cardiac care and evidence-based medicine. The UK demonstrates 12.8% growth, prioritizing cost-effective healthcare solutions and patient outcomes. The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from structural heart devices in China is projected to exhibit strong growth with a CAGR of 18.2% through 2035, driven by rapid healthcare modernization and increasing government investment in cardiovascular care infrastructure. The country's aging population and rising prevalence of structural heart diseases are creating significant demand for advanced interventional solutions. Major international device manufacturers are establishing partnerships with local healthcare providers to expand access to transcatheter technologies across tier-1 and tier-2 cities.

Revenue from structural heart devices in India is expanding at a CAGR of 16.9%, supported by increasing healthcare expenditure, growing medical tourism, and rising awareness of minimally invasive treatment options. The country's large patient population with untreated structural heart disease represents significant market opportunity for device manufacturers. International collaborations and technology transfer initiatives are enhancing local capabilities for complex cardiac interventions.

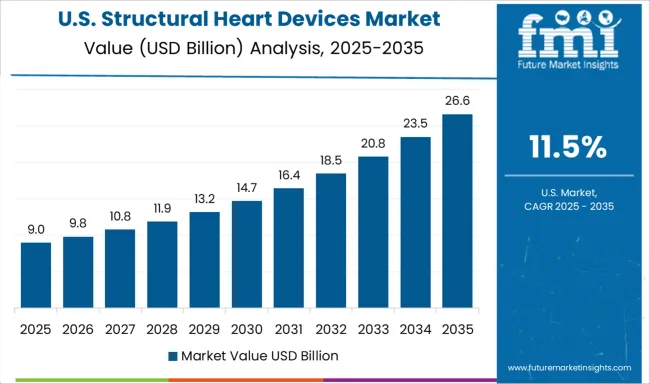

Demand for structural heart devices in the USA is projected to grow at a CAGR of 11.5%, supported by comprehensive clinical trial infrastructure and rapid adoption of innovative technologies. American healthcare providers are at the forefront of expanding indications for transcatheter interventions and developing novel treatment approaches. The market is characterized by strong focuses on clinical outcomes, quality metrics, and value-based healthcare delivery.

Revenue from structural heart devices in Germany is projected to grow at a CAGR of 15.5% through 2035, driven by the country's advanced healthcare system, high procedural volumes, and strong focuses on clinical research. German cardiac centers consistently demonstrate excellence in complex structural heart interventions and contribute significantly to global clinical evidence generation.

Revenue from structural heart devices in France is projected to grow at a CAGR of 14.2% through 2035, supported by the country's centralized healthcare system and focus on equitable access to advanced cardiac care. French medical centers are recognized for clinical expertise in structural heart interventions and active participation in international clinical trials.

Revenue from structural heart devices in the UK is projected to grow at a CAGR of 12.8% through 2035, supported by the National Health Service's focus on cost-effective healthcare delivery and improved patient outcomes. British cardiac centers are implementing innovative care pathways that optimize resource utilization while maintaining high quality standards.

Revenue from structural heart devices in Brazil is projected to grow at a CAGR of 10.1% through 2035, supported by increasing healthcare investment and growing availability of specialized cardiac services. Brazilian medical centers are expanding capabilities for transcatheter interventions to address the significant burden of structural heart disease in the population.

The structural heart devices market is characterized by competition among established medical device manufacturers, specialized cardiovascular companies, and emerging technology innovators. Companies are investing in advanced device design, clinical evidence generation, physician training programs, and global market expansion to deliver effective, safe, and accessible structural heart solutions. Product innovation, clinical validation, and procedural support are central to strengthening device portfolios and market presence.

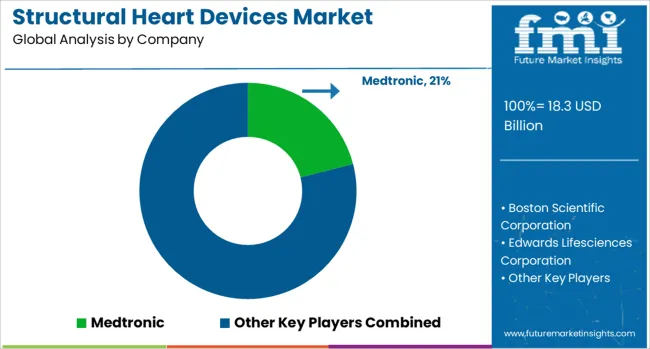

Medtronic, USA-based, leads the market with 21% global value share, offering comprehensive structural heart solutions including transcatheter aortic and mitral valve technologies with focus on clinical innovation and global accessibility. Boston Scientific Corporation, USA, provides advanced structural heart devices with focuses on differentiated technologies and procedural efficiency. Edwards Lifesciences Corporation, USA, delivers pioneering transcatheter heart valve solutions with strong clinical evidence and market leadership in TAVR technologies. Abbott Laboratories, USA, focuses on comprehensive structural heart portfolio including left atrial appendage closure and mitral repair devices.

ST. JUDE MEDICAL, now part of Abbott, contributed significant innovation in structural heart technologies and electrophysiology solutions. Biomerics provides specialized manufacturing and engineering services for structural heart device components. Comed BV offers innovative cardiac devices and accessories supporting structural heart procedures. LivaNova PLC delivers cardiac surgery and neuromodulation solutions with focus on improving patient outcomes. JenaValve Technology, Inc. specializes in transcatheter aortic valve replacement systems for treating aortic regurgitation. CardioKinetix develops innovative devices for treating heart failure and structural heart conditions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 18.3 billion |

| Type | TAVR (Transcatheter Aortic Valve Replacement), SAVR (Surgical Aortic Valve Replacement), Mitral Repair (Annuloplasty), LAAC (Left Atrial Appendage Closure) |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Medtronic, Boston Scientific Corporation, Edwards Lifesciences Corporation, Abbott Laboratories, ST. JUDE MEDICAL, Biomerics, Comed BV, LivaNova PLC, JenaValve Technology, Inc., and CardioKinetix |

| Additional Attributes | Dollar sales by device type and procedural volume, regional adoption trends, competitive landscape, hospital preferences for transcatheter versus surgical approaches, integration with hybrid operating rooms, innovations in valve design, delivery systems, and imaging guidance technologies |

The global structural heart devices market is estimated to be valued at USD 18.3 billion in 2025.

The market size for the structural heart devices market is projected to reach USD 65.0 billion by 2035.

The structural heart devices market is expected to grow at a 13.5% CAGR between 2025 and 2035.

The key product types in structural heart devices market are tavr (transcatheter aortic valve replacement), savr (surgical aortic valve replacement), mitral repair (annuloplasty) and laac (left atrial appendage closure).

In terms of , segment to command 0.0% share in the structural heart devices market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Structural Waterproofing Services Market Size and Share Forecast Outlook 2025 to 2035

Structural Health Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Structural Copper Wire Market Size and Share Forecast Outlook 2025 to 2035

Structural Wood Screws Market Size and Share Forecast Outlook 2025 to 2035

Structural Composites Market Size and Share Forecast Outlook 2025 to 2035

Structural Foam Market Size and Share Forecast Outlook 2025 to 2035

Structural Adhesive Market Outlook & Growth 2025 to 2035

Metal Structural Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Bridge Structural Health Monitoring (SHM) Solution Market Size and Share Forecast Outlook 2025 to 2035

Silicone Structural Glazing Market Size and Share Forecast Outlook 2025 to 2035

Offshore Structural Analysis Software Market Size and Share Forecast Outlook 2025 to 2035

Frameless Structural Glass Balustrade Market Size and Share Forecast Outlook 2025 to 2035

Automotive Structural Steel Market Growth - Trends & Forecast 2025 to 2035

Heart Pump Device Market Forecast and Outlook 2025 to 2035

Heart Beat Sensor Market Size and Share Forecast Outlook 2025 to 2035

APAC Heart Health Functional Food Market Size and Share Forecast Outlook 2025 to 2035

Heart Block Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Heart Beat Irregularity Detection Device Market Trends - Growth & Forecast 2025 to 2035

Heart Beat Monitor and Sensor Market

Heart Failure Testing Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA