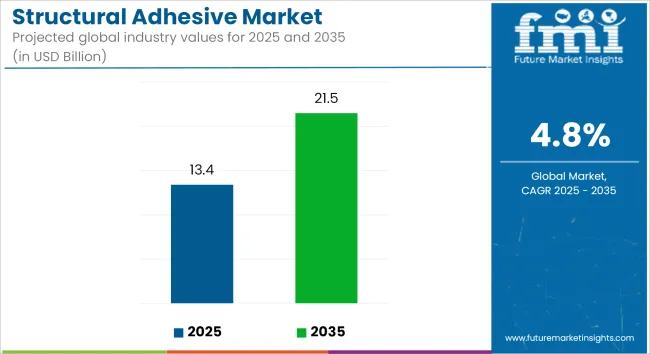

The global structural adhesive market is expected to increase from USD 13.4 billion in 2025 to USD 21.5 billion by 2035, reflecting a CAGR of 4.8% over the forecast period. Growth is being supported by the rising adoption of high-performance bonding technologies across automotive, aerospace, construction, and electronics industries.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 13.4 billion |

| Industry Value (2035F) | USD 21.5 billion |

| CAGR (2025 to 2035) | 4.8% |

Structural adhesives are being utilized to replace traditional mechanical fasteners and welding in multiple engineering applications. These materials are offering advantages such as uniform stress distribution, reduced assembly weight, and enhanced fatigue resistance. As industries continue to prioritize efficient load-bearing and material integrity, adhesives are being integrated into next-generation assembly lines and composite structures.

In automotive manufacturing, structural adhesives are being adopted to meet increasing requirements for lightweight assemblies and crash-resistant components. These adhesives are being used to bond dissimilar materials such as aluminum and fiber-reinforced plastics, contributing to fuel economy improvements and structural durability. Similarly, in the aerospace sector, the use of adhesives in fuselage, wing, and interior component assemblies is helping reduce vibration, noise, and corrosion risk.

Construction and infrastructure applications are also driving demand. Structural bonding solutions are being applied in curtain wall systems, modular panels, and seismic-resistant assemblies where mechanical fasteners are less feasible or more labor-intensive. In the electronics sector, adhesives are being used to provide shock absorption, thermal management, and insulation in compact device architectures.

Technological advancements in adhesive formulations are enabling stronger bonds, faster cure times, and compatibility with automated dispensing systems. Hybrid chemistries, such as epoxy-acrylate blends and polyurethane-based systems, are being introduced to offer enhanced performance under variable environmental conditions.

Regulatory expectations surrounding product safety and manufacturing efficiency are prompting the adoption of low-VOC and solvent-free formulations. These developments are being supported by investments in R&D focused on adhesion to lightweight composites, long-term reliability, and simplified application processes.

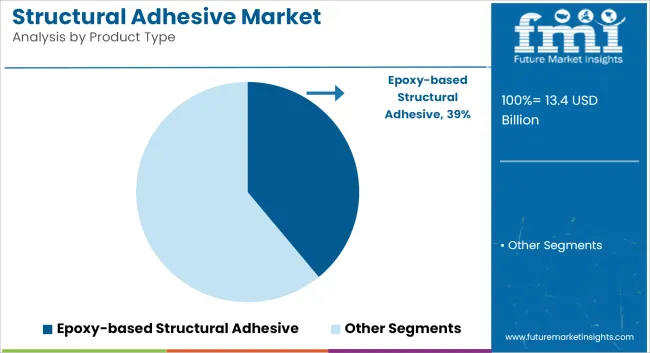

Epoxy-based adhesives are estimated to account for approximately 39% of the global structural adhesive market share in 2025 and are projected to grow at a CAGR of 4.9% through 2035. These adhesives are widely used in structural bonding applications that require high mechanical performance, including composite assemblies, metal joining, and high-load components.

The aerospace, automotive, and construction industries rely heavily on epoxy systems due to their excellent adhesion to dissimilar substrates, resistance to extreme temperatures, and long-term structural stability. Manufacturers are developing advanced epoxy formulations with faster cure times, enhanced peel strength, and low VOC emissions to meet sustainability and production efficiency requirements.

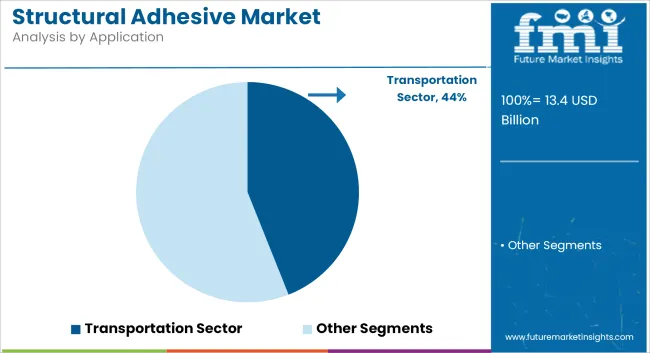

The transportation segment is projected to hold approximately 44% of the global structural adhesive market share in 2025 and is expected to grow at a CAGR of 5.0% through 2035. Structural adhesives are increasingly replacing mechanical fasteners and welds in vehicle body panels, chassis components, and battery enclosures, especially in electric vehicles and lightweight vehicle platforms.

Automotive OEMs are adopting high-strength bonding solutions to reduce vehicle weight, enhance crashworthiness, and improve NVH (noise, vibration, and harshness) characteristics. Rail, marine, and aerospace industries are also contributing to segment growth by integrating structural adhesives into composite structures and interior assembly systems. As global transportation manufacturers pursue performance, fuel efficiency, and modular design goals, the demand for advanced structural adhesives continues to rise steadily.

Volatile Raw Material Prices and Supply Chain Disruptions

Moreover, the fluctuations in petroleum gross materials which are a vital source of raw material for key raw material impurities such as epoxy resins, acrylics and polyurethanes are forming a mild challenge for the structural adhesive market in terms of its cost. Geopolitical instability, trade restrictions, and supply chain disruptions that prevent access to critical materials can all increase production costs.”

In addition, rending and aviation problems increase manufacturing pressure, and place constraints on pricing strategies and profit. To mitigate risks, companies have to look for alternative raw materials, bio-based adhesives, and localized supply chains. Maintaining compliance on environmental elements of EHS adds another degree of complexity in trade cost for the material, feedstock impact (sustainable and renewable feedstock’s), and environmental compliance.

Stringent Environmental Regulations and Compliance Issues

With exposure to hazardous chemicals in adhesives becoming a point of concern, the government regulations regarding VOC emissions are only tightening further due to an increasing focus on environmental impact and sustainability. Also, regulations like the EPA (USA), REACH (Europe) and China’s environmental standards are restricting conventional adhesive formulations, which result in manufacturers developing low-VOC and solvent-free alternatives.

These regulations often require significant R&D investments, reformulation of products, and lengthy certification processes, resulting in increased costs and longer time-to-market. Although eco-friendly adhesives offers a wider growth opportunity, transitioning to such sustainable production processes without compromising the performance and durability is a challenge ahead for market participants.

Rising Demand for Lightweight and High-Performance Adhesives

The increasing preference for lightweight material in automotive, aerospace, and industrial applications is creating demand for structural adhesives with high strength properties and low weight. Car makers are eager to replace mechanical fasteners and welding with higher-tech adhesives to achieve better fuel efficiency and vehicle performance. In aerospace, the move toward composite materials in aircraft manufacturing is an additional driver for adhesive use.

Moreover, industries like electronics and renewable energy also require long-lasting and reliable high-performance bonding solutions. This is a great opportunity for the adhesive manufacturers to introduce the next-generation adhesives formulations with better thermal resistance, flexibility, and load-bearing capacity.

Growth of Bio-Based and Eco-Friendly Adhesives

Bio-based and low-VOC structural adhesives are creating new opportunities with a push for sustainability and green manufacturing. Around the world, governments and regulatory bodies are implementing more stringent environmental policies, pushing industries to shift toward more sustainable alternatives. Novel biodegradable, water-based and solvent-free glues are starting to take hold, especially in the construction, packaging and automotive industries.

This growing market trend, through bio-based polymers and nanotechnology-enhanced adhesives, creates opportunities for companies to invest. Moreover, concerning the green and sustainable chemistry and manufacturing sourcing, end-users are becoming more aware of these factors and will drive the demand for non-toxic and recyclable bonding solutions in particular, making way for manufacturers to be placed strategically for long-term competitive edge within the target market.

The USA structural adhesive market is driven by innovation in aerospace, automotive light weighting, and infrastructure projects. Other key growth driver is the growing penetration of high-performance adhesives in the manufacturing processes of EVs as well as aerospace applications.

However, sustainability trends favour bio-based adhesives, and regulatory compliance with VOC emissions impacts market preference. Key manufacturers and the continuous research and development (R&D) in bonding technologies also contribute to the growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

This growth is also due to increasing applications in aerospace, renewable energy, and sustainable construction in the UK structural adhesive market. Strengthening environmental regulations along with the push for light weighting has been fostering demand in automotive manufacturing for lightweight materials.

So the development of environmentally friendly high strength adhesives is also a big highlight, such as wind energy industry. Domestic innovations gleaned from Brexit-related regulatory changes may change trading dynamics.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.5% |

Stringent policies in the European region support the low-VOC segment adhesive market, which is one of the top segments held in the market and is driving a surge in the EU market. The automotive and construction industries are significant consumers, and innovations that reduce environmental impact with bio-based adhesives are gaining traction.

Adhesives developments are influenced by the Green Deal policies and REACH regulations encouraging investment in environmentally friendly solutions. The use of sophisticated applications in aerospace and rail transport also drives demand in the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.6% |

Technological progresses in high-performance adhesives for electronic, automotive and robotics industries are driving Japan's market growth. Demand is being fueled by the country’s concentration on precision engineering and miniaturization, especially for use in semiconductors and EV batteries.

Moreover, sustainability initiatives are driving research and development (R&D) activities in biodegradable adhesives. The development of high-tech manufacturing technology is in line with the development of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

The growth of electronics, shipbuilding and automotive sectors is driving growth in South Korea's structural adhesive market. One major trend in the global smart adhesive market is the rising adoption of smart adhesives in semiconductor manufacturing and EV production.

Additionally, government initiatives and policies that encourage the use of hydrogen fuel cell vehicles as well as the development of renewable energy infrastructure are also driving demand. Market growth is shaped by strategic investments in high-performance bonding solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.7% |

The structural adhesives market is increasingly centered around the development of high-performance products capable of offering superior bonding strength, durability, and resistance to extreme conditions, including high temperatures and chemical exposure.

As industries push for more sustainable solutions, manufacturers are prioritizing eco-friendly formulations, such as low-VOC and bio-based adhesives, to meet tightening environmental regulations and consumer demand for greener alternatives. Technological innovation is driving the market forward, with a focus on creating lighter, stronger, and more flexible adhesives that cater to evolving industry needs.

In terms of Product Type, the industry is divided into Epoxy-based Structural Adhesive, Acrylic-based Structural Adhesive, Polyurethane-based Structural Adhesive, Cyanoacrylates, Others

In terms of Application, the industry is divided into Transportation Sector, Building & Construction Sector, Energy Sector, Others

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Structural Adhesive market is projected to reach USD 13.4 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 4.8% over the forecast period.

By 2035, the Structural Adhesive market is expected to reach USD 21.5 billion.

The Epoxy-based Structural Adhesive segment is expected to dominate the market, due to their superior bonding strength, durability, chemical resistance, and versatility across industries like automotive, aerospace, and construction, ensuring long-term structural integrity in demanding applications.

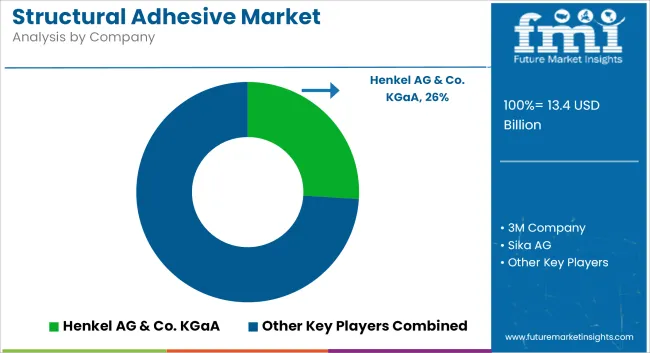

Key players in the Structural Adhesive market include Henkel AG & Co. KGaA, 3M Company, Sika AG, H.B. Fuller Company, Arkema S.A.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Structural Waterproofing Services Market Size and Share Forecast Outlook 2025 to 2035

Structural Health Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Adhesives for Electric Vehicle Power Batteries Market Forecast and Outlook 2025 to 2035

Adhesive Films Market Size and Share Forecast Outlook 2025 to 2035

Adhesive Tester Market Size and Share Forecast Outlook 2025 to 2035

Structural Copper Wire Market Size and Share Forecast Outlook 2025 to 2035

Structural Heart Devices Market Size and Share Forecast Outlook 2025 to 2035

Adhesives And Sealants Market Size and Share Forecast Outlook 2025 to 2035

Structural Wood Screws Market Size and Share Forecast Outlook 2025 to 2035

Structural Composites Market Size and Share Forecast Outlook 2025 to 2035

Structural Foam Market Size and Share Forecast Outlook 2025 to 2035

Adhesive Modifier Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Adhesive Transfer Tape Market Growth, Trends, Forecast 2025 to 2035

Assessing Adhesive Transfer Tape Market Share & Industry Insights

Market Share Breakdown of Adhesive films market Industry

Adhesive for Resilient Floor Market Growth – Trends & Forecast 2024-2034

Adhesive Bubble Wrap Market

Adhesive Removers Market

UV Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Bioadhesives for Packaging Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA