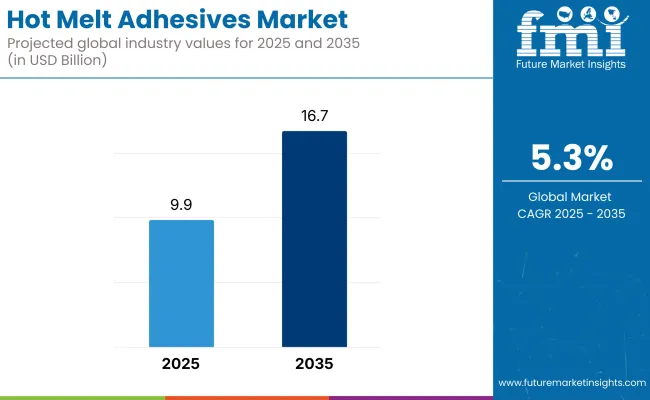

Global sales of hot melt adhesives is projected to reach USD 9.98 billion in 2025, rising from USD 7,833.5 million in 2020. Over the forecast period from 2025 to 2035, the market is expected to grow at a CAGR of 5.3%, culminating in a valuation of USD 16.7 billion by 2035, as reported in annual performance reviews of leading adhesive manufacturers.

Continued dominance in the packaging segment has been observed. In a 2025 press disclosure, Henkel AG noted that the TECHNOMELT product line experienced double-digit volume growth in the European market, fueled by automation in e-commerce fulfillment centers. The Henkel Corporate Sustainability Report 2025 stated, "Quick-setting, food-compliant adhesives are now integral to modern packaging lines. Market adaptation has accelerated due to evolving hygiene and energy efficiency norms."

In the hygiene sector, nonwoven product applications have driven substantial adhesive consumption. The 2025 Annual Report of H.B. Fuller confirmed a revenue surge in Asia-Pacific hygiene applications, with CFO John Corkrean stating during the Q1 2025 earnings call, “Demand in India and Southeast Asia continues to climb, particularly for hot melt adhesives formulated for baby diapers and feminine hygiene pads.” Their newly launched low-temperature spray adhesives have also passed dermatological compatibility tests aligned with ISO 10993 guidelines.

In the automotive sector, hot melt adhesives have been increasingly used for wire harnessing, interior paneling, and thermal insulation. A 2024 technical paper by Jowat SE highlighted the implementation of PUR-based hot melts in electric vehicle (EV) assembly lines across Germany. According to CEO Ralf Nitschke, “The adaptability of thermoplastic bonding in multi-substrate assemblies ensures structural integrity in next-gen lightweight EV models.”

The 2025 inauguration of a Bostik R&D center in Lyon, France, has marked a strategic push toward bio-based feedstocks. Their internal release emphasized, “Our decarbonization pathway is embedded in regional industrial policies and relies on plant-derived input materials for next-gen hot melts.” Compliance with EU REACH regulations and the European Green Deal has guided formulation shifts across the board.

Ongoing challenges include high-temperature resilience and incompatibility with select plastics and foams. These are currently being addressed through polymer engineering and substrate-specific R&D. Technical collaborations between applicator manufacturers and formulators have resulted in multi-zone precision heads, offering adaptive viscosity controls and automated quality assurance protocols.

As per a joint white paper published in early 2025 by the Adhesive and Sealant Council (ASC) and the Association for European Adhesive Manufacturers (FEICA), a 36% rise in global R&D investments toward low-emission, high-performance hot melts was recorded over the previous two years, reinforcing the industry's forward trajectory.

The table below presents the annual growth rates of the global hot melt adhesives market from 2025 to 2035. With a base year of 2024 extending to 2025, the report examines how the market’s growth trajectory progresses from the first half of the year (January to June, H1) to the second half (July to December, H2). This analysis provides stakeholders with an in-depth understanding of the industry’s performance, highlighting key developments and trends that could influence the market moving forward.

The market is projected to grow at a CAGR of 5.3% from 2025 to 2035. In H2, the growth rate is expected to rise slightly.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 5.0% (2024 to 2034) |

| H2 2024 | 5.2% (2024 to 2034) |

| H1 2025 | 5.3% (2025 to 2035) |

| H2 2025 | 5.5% (2025 to 2035) |

From H1 2025 to H2 2025, the CAGR is anticipated to see a modest increase, growing from 5.3% in the first half to 5.5% in the second half. This semi-annual shift reflects a 30 BPS increase in the first half, followed by an additional 30 BPS rise in H2. This report highlights the hot melt adhesives market’s growth potential, fueled by technological advancements and increasing demand for efficient, eco-friendly bonding solutions.

The market is segmented based on base polymers, end use industry, and region. By base polymers, the market is divided into ethylene vinyl acetate, polyolefins, polyamides, polyurethanes, styrene block copolymers, and others (polyesters, metallocene-based polymers, silicone-based polymers, and acrylics).

Based on end use industry, the market is categorized into packaging solutions, disposable hygiene products, furniture & woodwork, automotive & transportation, footwear, textile, polyamide bookbinding, and others (electronics, construction, medical devices, and DIY crafts). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

The polyolefins segment is projected to be the most lucrative in the hot melt adhesives market. It is poised to grow at a CAGR of 7.2% between 2025 and 2035. Polyolefin-based adhesives are preferred across packaging, hygiene, and electronics due to their clean melt behavior, thermal stability, and ability to bond to a wide range of substrates.

The evolution of metallocene technology has further enhanced performance, enabling reduced odor, lower application temperatures, and better sustainability profiles-critical in personal care and medical applications. These formulations are also compliant with food contact regulations, driving their use in flexible food packaging.

Ethylene vinyl acetate (EVA), despite its mature presence, remains widely used in carton sealing, bookbinding, and labeling due to cost-effectiveness and versatility. Polyamides are favored in automotive and textile applications for their high adhesion and thermal resistance, while polyurethanes offer superior flexibility and bonding to difficult substrates in footwear and furniture.

Styrene block copolymers dominate pressure-sensitive adhesive formulations, used in labels, tapes, and hygiene products. The “others” category-including polyesters, silicone-based polymers, acrylics, and metallocene polymers-caters to specialized needs in electronics, automotive interiors, and high-end packaging. While all segments show growth, polyolefins’ broad application versatility and alignment with regulatory trends ensure their dominant role over the forecast period.

| Base Polymer | CAGR (2025 to 2035) |

|---|---|

| Polyolefins | 7.2% |

The disposable hygiene products segment is projected to be the fastest-growing in the hot melt adhesives market, expected to grow at a CAGR of 7.6% from 2025 to 2035. Growth is supported by rising consumption of baby diapers, feminine hygiene items, and adult incontinence products, especially in Asia-Pacific, Latin America, and parts of Eastern Europe.

These applications require adhesives that offer strong tack, soft feel, and excellent bonding with nonwoven substrates while remaining skin-safe and free from harmful emissions. Polyolefin-based hot melts are rapidly replacing traditional adhesives due to better processability, thermal resistance, and lower odor.

Packaging solutions remain the largest segment by volume, driven by rising e-commerce and retail-ready packaging formats. Adhesives used here must provide fast setting, temperature stability, and compatibility with a wide range of substrates. Furniture and woodwork segments continue to adopt polyurethane and polyamide adhesives for strong bonding in challenging materials and moisture-prone environments.

Automotive and transportation applications utilize hot melts for bonding interior trims, wire harnesses, and acoustic panels, with an emphasis on lightweight, vibration-resistant materials. Footwear and textile industries benefit from rapid bonding and flexible adhesive films, while bookbinding and niche applications like polyamide-based adhesives support specialized use cases.

| End Use Industry | CAGR (2025 to 2035) |

|---|---|

| Disposable Hygiene Products | 7.6% |

Rising Demand for Efficient, Fast-Setting Hot Melt Adhesives Drives Expansion in Packaging Industry

Rapid expansion of the packaging industry is attributed to increased demand for efficient and fast-setting adhesives, especially in reference to the rise of e-commerce. There is a growing demand for hot melt adhesives; they provide fast bonding through a high-strength bond that is very necessary within high-speed production lines. With the advent of e-commerce, there now exists the absolute necessity for packaging solutions where the packaging is secure, reliable, and done speedily.

Due to their ability to bond diverse materials such as cardboard, plastics, etc., with little or no curing, hot melt adhesives are preferred in this regard for typical packaging systems that allow greater uptimes. In addition, being relatively eco-friendly because of their minimal use of solvents also mirrors the packing industry's growing emphasis on sustainability. All these jointly provide that great combination of speed, efficiency, and environmental benefit.

Rising Automotive Industry Growth Fuels Demand for Hot Melt Adhesives in Vehicle Assembly

The development of the automotive industry has considerably opened up the demand for hot melt adhesives. With a growing emphasis on less weight and optimum fuel efficiency from automobile vehicles, the demand for lightweight, durable bonding agents is on the rise. Hot melt adhesives are perfect for such automotive applications as strong bonding polymers that bond together very quickly and can strongly bind to a variety of materials such as metals, plastics, and composites.

These adhesives offer a consistent solution for bonding interior components, trim, and structural parts providing both steadfastness and flexibility. The automotive industry's emphasis on reducing production time while enhancing efficiency takes it right in line with the rapid cure and ease of application that hot melt adhesives present. There could be an additional spur in market growth due to the burgeoning automotive industry, especially since electric and hybrid vehicles-the fastest growing section-are gaining focus in the fast-paced world today.

Increased Use of Adhesives in Consumer Electronics Drives Demand for Efficient Bonding Solutions in Product Assembly

The growing demand for effective adhesives in the consumer electronics industry particularly for the assembly of products such as smartphones, laptops, and other products related to electronics, is rising. Manufactures condition adhesive's growing demand to provide strong bonding, durability, and flexibility without adding bulk and weight, hence meeting increasingly complex and compact electronic products. Several manufacturers in consumer electronics are now using hot melt adhesives in the light of their fast-setting property, which helps in enhancing production efficiency.

They demonstrate suitability when bonding a host of materials, such as plastics, glass, and metals, used in electronics, in addition to providing them with good cushioning qualities against shocks, thus prolonging their life. Other demand arising from manufacturers seeking to produce thinner, lighter, and greener leverages the hot melt adhesives to the sustainable fabric of bonding solutions. As the consumer electronics market continues to grow, the need for versatile, high-performance adhesives is expected to accelerate the growth in adhesive.

Tier-1 companies account for around 40% to 45% of the overall market with a product revenue from the hot melt adhesives market of more than USD 120 million. H.B. Fuller Company, Henkel, 3M, Arkema, and other players.

Tier-2 and other companies such as Beardow Adams, HEARTLAND ADHESIVES LLC, and other players are projected to account for 55% to 60% of the overall market with the estimated revenue under the range of USD 120 million through the sales of hot melt adhesives.

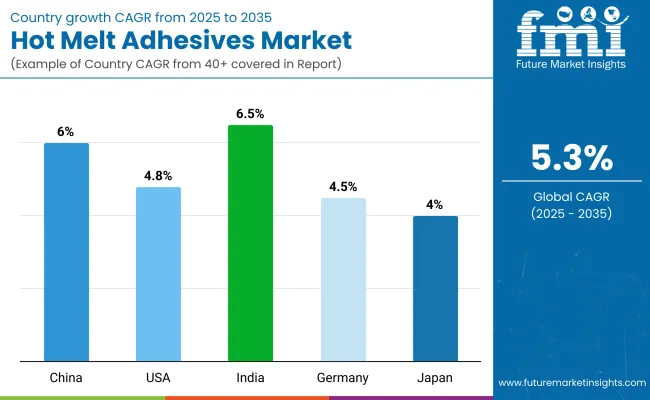

The section below covers the industry analysis for hot melt adhesives in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East and Africa is provided. This data helps investors to keenly observe and go through the recent trends and examine them in an ordered manner.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| China | 6.0% |

| The USA | 4.8% |

| India | 6.5% |

| Germany | 4.5% |

| Japan | 4.0% |

As online retail continuously grows at a fast pace, in China, it has become increasingly important to provide efficient and reliable packaging solutions. Given their fast-setting properties, hot melt adhesives are being adopted more and more frequently in high-speed automated packaging processes. Such adhesives give strong adhesion, ensuring that packages remain safe and secure during transit, thereby enhancing customer satisfaction and minimizing returns.

Also, the vast logistics network in China and the emphasis on enhancing efficiency in deliveries have elevated the demand for adhesives that support fast production cycles. With the expansion of the e-commerce sector driven by a mammoth consumer base and the development of technology in online retail, the demand for hot melt adhesives is expected to go up, stimulating growth in the market of the nation. The trend also corresponds to the increasing stress upon sustainable and eco-friendly packaging solutions.

The rapid growth of consumer electronics manufacturing is one of the key drivers of hot melt adhesive requirements for product assembly in USA. With smartphone, laptop, and wearable designs becoming increasingly compact and feature-rich, manufacturers are seeking further effective adhesion between different substrates, like metals, plastics, and glass. Hot melt adhesives are getting increasingly popular because they provide fast-setting adhesion, thus allowing for faster production cycles.

These adhesives have great adhesion, flexibility, and durability; thus, they make the precise assembly of complex parts very easy. Thus, as the consumer electronics market continues to expand, further demand for reliable, high-performing adhesives in product assembly is anticipated to drive demand for hot melt adhesives in the USA market.

The automotive industry in Germany is undergoing transformation with the shift toward electric vehicles (EVs) and the increasing demand for lightweight vehicle construction. This innovation has led to a rising need for advanced adhesives in vehicle assembly. These adhesives are particularly important for bonding the many different materials on EVs-while providing reliable adhesion the adhesive should not add to the vehicle's weight, an important factor in energy efficiency and performance in EVs.

Use of lightweight materials such as composites and aluminum, two attributes of modern vehicle design, requires adhesives with special bonding characteristics to properly bond these materials without compromising strength and durability. Hot melts form the ideal class of adhesives for these applications due to their advantages of fast setting and ability to endure severe conditions and are hence indispensable for producing quality, effective products.

Technological advancement in the hot melt adhesives market is propelling the improvements in precision, performance, and versatility. Developments in specialized formulations, including polyolefins and ethylene vinyl acetate beads, make it possible for adhesives to work better with an array of different materials, such as metals, plastics, and composites. The automotive and electronics industries use high-performance hot melt adhesives where strong reliable bonds are required.

Innovations such as PSAs and low-temperature curing systems increase the efficiency of product assembly while enhancing safety and durability. The ever-growing demand for green solutions reflects itself in the use of sustainable, eco-friendly materials in different formulations of adhesives.

Concurrently, technologies in automated application techniques are being developed to enhance manufacturing processes, reduce costs, and ensure consistency. Such technological developments are expanding the applicability and efficiency of hot melt adhesives across various industries.

Recent Industry Developments:

The base polymer is further categorized into ethylene vinyl acetate, polyolefins, polyamides, polyurethanes, styrene block copolymers and others.

The end use industry is classified into packaging solutions, disposable hygiene products, furniture & woodwork, automotive & transportation, footwear, textile, polyamide bookbinding and others.

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

The hot melt adhesives was valued at USD 9,486.1 million in 2024.

The demand for hot melt adhesives is set to reach USD 9,988.8 million in 2025.

The hot melt adhesives is driven by their fast-setting properties, strong bonding capabilities, energy efficiency, environmental sustainability, and versatility in packaging, automotive, consumer electronics, and construction applications.

The hot melt adhesives demand is projected to reach USD 16,741.7 million in 2035.

The ethylene vinyl acetate are expected to lead during the forecasted period due to its excellent bonding strength, flexibility, low-temperature performance, and ability to adhere to diverse materials efficiently.

Table 01: Global Market Volume (Kilo Tons) Forecast by Polymer Base, 2014 to 2032

Table 02: Global Market Value (US$ Million) & Volume (Kilo Tons) Forecast by End Use Industry, 2014 to 2032

Table 03: Global Market Value (US$ Million) & Volume (Kilo Tons) Forecast by Region, 2014 to 2032

Table 04: North America Market Size Volume (KiloTons) and Value (US$ Million) Forecast By Country, 2014 to 2032

Table 05: North America Market Size (US$ Million) and Volume (KiloTons) Forecast by Polymer Base, 2014 to 2032

Table 06: North America Market Size (US$ Million) and Volume (KiloTons) Forecast by Polymer Base, 2014 to 2032

Table 07: North America Market Size (US$ Million) and Volume (KiloTons) Forecast by End Use, 2014 to 2032

Table 08: North America Market Size (US$ Million) and Volume (KiloTons) Forecast by End Use, 2014 to 2032

Table 09: Latin America Market Size Volume (KiloTons) and Value (US$ Million) Forecast By Country, 2014 to 2032

Table 10: Latin America Market Size (US$ Million) and Volume (KiloTons) Forecast by Polymer Base, 2014 to 2032

Table 11: Latin America Market Size (US$ Million) and Volume (KiloTons) Forecast by Polymer Base, 2014 to 2032

Table 12: Latin America Market Size (US$ Million) and Volume (KiloTons) Forecast by End Use, 2014 to 2032

Table 13: Latin America Market Size (US$ Million) and Volume (KiloTons) Forecast by End Use, 2014 to 2032

Table 14: Europe Market Size Volume (KiloTons) and Value (US$ Million) Forecast By Country, 2014 to 2032

Table 15: Europe Market Size (US$ Million) and Volume (KiloTons) Forecast by Polymer Base, 2014 to 2032

Table 16: Europe Market Size (US$ Million) and Volume (KiloTons) Forecast by End Use, 2014 to 2032

Table 17: East Asia Market Size Volume (KiloTons) and Value (US$ Million) Forecast By Country, 2014 to 2032

Table 18: East Asia Market Size (US$ Million) and Volume (KiloTons) Forecast by Polymer Base, 2014 to 2032

Table 19: East Asia Market Size (US$ Million) and Volume (KiloTons) Forecast by End Use, 2014 to 2032

Table 20: South Asia & Pacific Market Size Volume (KiloTons) and Value (US$ Million) Forecast By Country, 2014 to 2032

Table 21: South Asia & Pacific Market Size (US$ Million) and Volume (KiloTons) Forecast by Polymer Base, 2014 to 2032

Table 22: South Asia & Pacific Market Size (US$ Million) and Volume (KiloTons) Forecast by End Use, 2014 to 2032

Table 23: MEA Market Size Volume (KiloTons) and Value (US$ Million) Forecast By Country, 2014 to 2032

Table 24: MEA Market Size (US$ Million) and Volume (KiloTons) Forecast by Polymer Base, 2014 to 2032

Table 25: MEA Market Size (US$ Million) and Volume (KiloTons) Forecast by End Use, 2014 to 2032

Figure 01: Global Market Historical, Current, and Forecast Volume (Tons), 2022 to 2032

Figure 02: Global Market Historical, Current, and Forecast Value (US$ Million), 2022 to 2032

Figure 03: Global Market Incremental $ Opportunity, 2022 to 2032

Figure 04: Global Market Share and BPS Analysis By Polymer Base, 2022 to 2032

Figure 05: Global Market Y-o-Y Growth Projections By Polymer Base, 2022 to 2032

Figure 06: Global Market Absolute $ Opportunity by Ethylene Vinyl Acetate (EVA) Segment, 2014 to 2032

Figure 07: Global Market Absolute $ Opportunity by Styrenic Block Copolymers (SBC) Segment, 2014 to 2032

Figure 8: Global Market Absolute $ Opportunity by Polyolefins Segment, 2014 to 2032

Figure 9: Global Market Absolute $ Opportunity by Polyamides Segment, 2014 to 2032

Figure 10: Global Market Absolute $ Opportunity by Polyurethane (PU) Segment, 2014 to 2032

Figure 11: Global Market Absolute $ Opportunity by Others Segment, 2014 to 2032

Figure 12: Global Market Attractiveness Analysis By Polymer Base, 2022 to 2032

Figure 13: Global Market Share and BPS Analysis By End Use Industry, 2022 to 2032

Figure 14: Global Market Y-o-Y Growth Projections By End Use Industry, 2022 to 2032

Figure 15: Global Market Absolute $ Opportunity by Packaging Solutions Segment, 2014 to 2032

Figure 16: Global Market Absolute $ Opportunity by Disposable Hygiene Products Segment, 2014 to 2032

Figure 17: Global Market Absolute $ Opportunity by Furniture & Woodwork Segment, 2014 to 2032

Figure 18: Global Market Absolute $ Opportunity by Automotive & Transportation Segment, 2014 to 2032

Figure 19: Global Market Absolute $ Opportunity by Footwear Segment, 2014 to 2032

Figure 20: Global Market Absolute $ Opportunity by Textile Segment, 2014 to 2032

Figure 21: Global Market Absolute $ Opportunity by Electronics Segment, 2014 to 2032

Figure 22: Global Market Absolute $ Opportunity by Bookbinding Segment, 2014 to 2032

Figure 23: Global Market Absolute $ Opportunity by Others Segment, 2014 to 2032

Figure 24: Global Market Attractiveness Analysis By End - Use, 2022 to 2032

Figure 25: Global Market Share and BPS Analysis By Region, 2022 to 2032

Figure 26: Global Market Y-o-Y Growth Projections By Region, 2022 to 2032

Figure 27: Global Market Absolute $ Opportunity by North America Region, 2014 to 2032

Figure 28: Global Market Absolute $ Opportunity by Latin America Region, 2014 to 2032

Figure 29: Global Market Absolute $ Opportunity by Europe Region, 2014 to 2032

Figure 30: Global Market Absolute $ Opportunity by East Asia Region, 2014 to 2032

Figure 31: Global Market Absolute $ Opportunity by South Asia & Pacific Region, 2014 to 2032

Figure 32: Global Market Absolute $ Opportunity by Middle East & Africa Region, 2014 to 2032

Figure 33: Global Market Attractiveness Analysis Projections By Region, 2022 to 2032

Figure 34: North America Market Share and BPS Analysis By Country 2022 to 2032

Figure 35: North America Market Y-o-Y Growth Projections By Country, 2022 to 2032

Figure 36: North America Market Attractiveness Projections By Country, 2022 to 2032

Figure 37: North America Market Share and BPS Analysis by Polymer Base 2022 to 2032

Figure 38: North America Market Y-o-Y Growth Projections by Polymer Base, 2022 to 2032

Figure 39: North America Market Attractiveness Analysis by Polymer Base, 2022 to 2032

Figure 40: North America Market Share and BPS Analysis by End Use 2022 to 2032

Figure 41: North America Market Y-o-Y Growth Projections by End Use, 2022 to 2032

Figure 42: North America Market Attractiveness Analysis by End Use, 2022 to 2032

Figure 43: Latin America Market Share and BPS Analysis By Country 2022 to 2032

Figure 44: Latin America Market Y-o-Y Growth Projections By Country, 2022 to 2032

Figure 45: Latin America Market Attractiveness Projections By Country, 2022 to 2032

Figure 46: Latin America Market Share and BPS Analysis by Polymer Base 2022 to 2032

Figure 47: Latin America Market Y-o-Y Growth Projections by Polymer Base, 2022 to 2032

Figure 48: Latin America Market Attractiveness Analysis by Polymer Base, 2022 to 2032

Figure 49: Latin America Market Share and BPS Analysis by End Use 2022 to 2032

Figure 50: Latin America Market Y-o-Y Growth Projections by End Use, 2022 to 2032

Figure 51: Latin America Market Attractiveness Analysis by End Use, 2022 to 2032

Figure 52: Europe Market Share and BPS Analysis By Country 2022 to 2032

Figure 53: Europe Market Y-o-Y Growth Projections By Country, 2022 to 2032

Figure 54: Europe Market Attractiveness Projections By Country, 2022 to 2032

Figure 56: Europe Market Share and BPS Analysis by Polymer Base 2022 to 2032

Figure 57: Europe Market Y-o-Y Growth Projections by Polymer Base, 2022 to 2032

Figure 58: Europe Market Attractiveness Analysis by Polymer Base, 2022 to 2032

Figure 59: Europe Market Share and BPS Analysis by End Use 2022 to 2032

Figure 60: Europe Market Y-o-Y Growth Projections by End Use, 2022 to 2032

Figure 61: Europe Market Attractiveness Analysis by End Use, 2022 to 2032

Figure 62: East Asia Market Share and BPS Analysis By Country 2022 to 2032

Figure 63: East Asia Market Y-o-Y Growth Projections By Country, 2022 to 2032

Figure 64: East Asia Market Attractiveness Projections By Country, 2022 to 2032

Figure 65: East Asia Market Share and BPS Analysis by Polymer Base 2022 to 2032

Figure 66: East Asia Market Y-o-Y Growth Projections by Polymer Base, 2022 to 2032

Figure 67: East Asia Market Attractiveness Analysis by Polymer Base, 2022 to 2032

Figure 68: East Asia Market Share and BPS Analysis by End Use 2022 to 2032

Figure 69: East Asia Market Y-o-Y Growth Projections by End Use, 2022 to 2032

Figure 70: East Asia Market Attractiveness Analysis by End Use, 2022 to 2032

Figure 71: South Asia & Pacific Market Share and BPS Analysis By Country 2022 to 2032

Figure 72: South Asia & Pacific Market Y-o-Y Growth Projections By Country, 2022 to 2032

Figure 73: South Asia & Pacific Market Attractiveness Projections By Country, 2022 to 2032

Figure 74: South Asia & Pacific Market Share and BPS Analysis by Polymer Base 2022 to 2032

Figure 75: South Asia & Pacific Market Y-o-Y Growth Projections by Polymer Base, 2022 to 2032

Figure 76: South Asia & Pacific Market Attractiveness Analysis by Polymer Base, 2022 to 2032

Figure 77: South Asia & Pacific Market Share and BPS Analysis by End Use 2022 to 2032

Figure 78: South Asia & Pacific Market Y-o-Y Growth Projections by End Use, 2022 to 2032

Figure 79: South Asia & Pacific Market Attractiveness Analysis by End Use, 2022 to 2032

Figure 80: MEA Market Share and BPS Analysis By Country 2022 to 2032

Figure 81: MEA Market Y-o-Y Growth Projections By Country, 2022 to 2032

Figure 82: MEA Market Attractiveness Projections By Country, 2022 to 2032

Figure 83: MEA Market Share and BPS Analysis by Polymer Base 2022 to 2032

Figure 84: MEA Market Y-o-Y Growth Projections by Polymer Base, 2022 to 2032

Figure 85: MEA Market Attractiveness Analysis by Polymer Base, 2022 to 2032

Figure 86: MEA Market Share and BPS Analysis by End Use 2022 to 2032

Figure 87: MEA Market Y-o-Y Growth Projections by End Use, 2022 to 2032

Figure 88: MEA Market Attractiveness Analysis by End Use, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyester Hot Melt Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Hot Fill Packaging Market Size and Share Forecast Outlook 2025 to 2035

Hot Stamping Foil Market Size and Share Forecast Outlook 2025 to 2035

Hot And Cold Therapy Packs Market Size and Share Forecast Outlook 2025 to 2035

Hotplate Stirrers Market Size and Share Forecast Outlook 2025 to 2035

Hot Runner Temperature Controller Market Size and Share Forecast Outlook 2025 to 2035

Hot Fill Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Hot Rolled Or Cold Finished Alloy Steel Bars Market Size and Share Forecast Outlook 2025 to 2035

Hot Sauce Market Size and Share Forecast Outlook 2025 to 2035

Hot Food Vending Machine Industry Analysis in USA & Canada - Size, Share, and Forecast 2025 to 2035

Hotel Central Reservation System Market Size and Share Forecast Outlook 2025 to 2035

Hot Sauce Powder Market Analysis by Sauces, Dips, Soups, Convenience Food Products and other Applications Through 2035

Hotel Ice Dispensers Market - Hospitality Trends & Industry Forecast 2025 to 2035

Hot Chamber Die Casting Machine Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Hot Fill Packaging Manufacturers

Hot and Cold Therapy Market Trends – Size, Share & Forecast 2025-2035

Hotel Channel Management Market Analysis – Growth & Forecast 2024-2034

Hot and Cold System Market Growth – Trends & Forecast 2024-2034

Hot Melt Intermediate Joint Market Size and Share Forecast Outlook 2025 to 2035

Hot Melt Adhesive Tapes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA