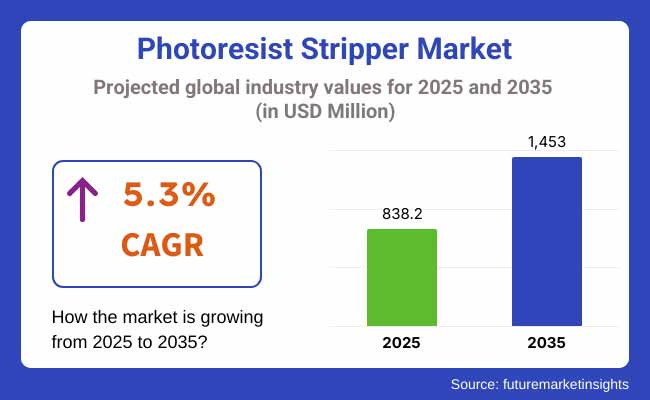

The photoresist stripper market is projected at USD 838.2 million in 2025. By 2035, the value is expected to reach USD 1,453 million. A CAGR of 5.3% will be recorded between 2025 and 2035. The USA will dominate as the most lucrative country throughout the period. Japan will exhibit the fastest growth across the same timeline.

Strong demand has been generated by rapid semiconductor innovation. Massive investments in wafer fabrication have supported growth. Demand has also been driven by printed circuit board (PCB) production. Increasing use in microelectronic devices has helped market expansion. Growth has been restrained by hazardous waste management concerns. Strict environmental policies have slowed deployment in several nations. Water-based and eco-friendly strippers have emerged as sustainable alternatives. Formulations with lower toxicity have gained attention.

Compact device manufacturing has driven finer geometries and precision cleaning. Operational costs have been managed through advanced formulations. Product portfolios have been diversified by industry players. Strategic expansions into Asia have been executed. New formulations have been introduced to meet regulatory standards.

Between 2025 and 2035, advanced strippers will be adopted across fabs. Compatibility with extreme ultraviolet (EUV) lithography is expected. More eco-compliant solutions will dominate development initiatives. Demand from chipmakers will surge with increasing chip design complexities. Packaging advancements will necessitate precision chemical stripping.

Research and development will be intensified for process-specific applications. Revenue gains will be realized through production scale-up and innovation. Industry value creation will be steered by material efficiency and reliability. Strategic partnerships are anticipated to support global scale and access. Regulatory alignment will remain central to long-term competitiveness.

The photoresist stripper market has been comprehensively segmented and analyzed across multiple categories to provide a complete investment outlook. Product type analysis covers aqueous and semi-aqueous strippers. By process, both positive and negative types are included. Application-wise, the study considers via etch, poly etch, and metal etch segments.

The end-use analysis spans memory, foundries, and integrated device manufacturers (IDM). Regional segmentation includes North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

Under product type, the aqueous segment is expected to exhibit the fastest growth at a CAGR of 6.1% between 2025 and 2035. This will be driven by increasing environmental regulations and growing preference for water-based, low-toxicity formulations. As fabs and semiconductor facilities adopt greener practices, aqueous strippers will benefit from compliance-friendly properties and cost-effective waste management.

The semi-aqueous segment, while established, is projected to witness more muted growth. Concerns around solvent residues, disposal complexities, and operational costs may limit its expansion. However, it will retain relevance in advanced packaging applications where deeper etching and higher material compatibility are required.

With sustainability moving from optional to strategic, aqueous products will remain top-of-mind for procurement heads in IDM and foundry environments. Innovation in surfactant blends and precision formulation will further propel adoption.

| Category | CAGR (2025 to 2035) |

|---|---|

| Aqueous | 6.1% |

In the photoresist stripper market, the positive process segment is anticipated to achieve the highest growth at 6.4% CAGR from 2025 to 2035. This can be attributed to its broad applicability in advanced lithography processes and superior resolution capabilities. Positive resists enable finer patterning, making them essential for next-generation semiconductor nodes. With the increasing shift toward EUV (Extreme Ultraviolet) lithography and shrinking chip geometries, demand for compatible stripping chemistries is expected to surge.

Conversely, the negative process segment is likely to experience relatively restrained growth. Although it holds importance in niche applications such as MEMS and certain analog ICs, it faces limitations in achieving ultra-fine resolutions and scalability. The segment's relevance will persist, but innovation and investment will skew toward positive process technologies.

Manufacturers are expected to prioritize positive resist-compatible formulations to align with future device roadmap needs, ensuring continued growth and strategic advantage.

| Category | CAGR (2025 to 2035) |

|---|---|

| Positive Process | 6.4% |

Among application segments, via etch is expected to register the fastest growth through 2035 at a CAGR of 6.6%. This growth will be supported by the semiconductor industry's transition to 3D integration and advanced packaging, where vertical interconnections- vias- are critical. As chip designs move toward higher density and lower power consumption, the complexity and volume of via etch applications will rise. This will, in turn, elevate demand for high-performance strippers capable of efficiently removing tough residues without damaging substrates.

Poly etch will remain a stable but moderate-growth segment, used widely in standard front-end-of-line (FEOL) processes. However, as device architectures evolve, their relative importance will plateau. Metal etch applications will continue to be used in niche processes but may be constrained by sensitivity to corrosion and the precision required for selective removal.

Players will need to align product development strategies with the via etch roadmap, focusing on process compatibility and material safety.

| Category | CAGR (2025 to 2035) |

|---|---|

| Via Etch | 6.6% |

In the photoresist stripper market, foundries are expected to be the fastest-growing end-use segment at 6.8% CAGR between 2025 and 2035. The surge in fabless semiconductor design activity and outsourced manufacturing is driving this shift. As global chip demand rises and node scaling accelerates, foundries are expanding aggressively to serve clients across AI, mobile, automotive, and high-performance computing. This leads to a significant uptick in lithography and etching steps, which directly fuels demand for advanced stripping solutions.

The memory segment will remain large but show slower growth. Saturation in traditional DRAM and NAND markets and cost pressures may limit capex in mature facilities. Meanwhile, IDMs (Integrated Device Manufacturers) will see steady but moderate growth. Their vertically integrated nature provides control but limits flexibility compared to pure-play foundries.

To stay competitive, stripper solutions tailored for high-volume foundry processes and compatibility with emerging nodes will be prioritized.

| Category | CAGR (2025 to 2035) |

|---|---|

| Foundries | 6.8% |

Challenge: Environmental and Safety Regulations

Conventional photoresist strippers consist of severe solvents such as NMP, DMSO, and TMAH (tetramethylammonium hydroxide), which are human health and environmental hazards. Exposure to the chemicals exposes them to respiratory hazards, skin disorders, and reproductive toxins.

Governments acting on the global market, like EPA, European Chemicals Agency (ECHA), and China Ministry of Ecology and Environment, are intervening to acquire greater control over the chemicals. Players in the industry will be forced to invest inconceivable amounts on R&D procedures and regulation and convert to low-toxicity and degradable products instead.

Opportunity: Green Chemistry Solution Expansion

Growth in sustainability awareness represents a huge opportunity for the photoresist stripper market. Bio based strip solutions and water are being used increasingly, with aggressive chemical photoresist stripping decreasing as efficiency improves. Enzyme cleaning technology, ozone removal systems, and dry stripping by plasma are sustainable-friendly investments by companies without sacrificing wafer yield and performance.

Besides that, the selective strip technology innovations are providing residue-free strip solutions of high performance, which is of extreme importance in the emerging semiconductor future. As chip structure propels 3D NAND and advanced packaging into the forefront, high-performance residue-free strip solutions will be in enormous demand.

American photoresist stripper market is increasing increasingly driven by the growth of semiconductor fabs along with rising investments in cutting-edge chip manufacturing. Rising use of green strippers, especially among top-of-the-line fabs like those run by Intel, TSMC Arizona, and Micron, due to the nation's emphasis on minimizing the consumption of harmful chemicals has fueled the industry's growth further.

In the near future, demand for EUV lithography-compatible strippers will grow as chip manufacturers transition to scale down nodes. Aside from this, pressure from the environment to make semiconductor manufacturing more sustainable is driving the adoption of water-compatible and low-toxicity strippers. The USA government's CHIPS Act is stimulating local manufacturing and will generate humongous demand for premium stripping products in litho processes.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.1% |

The UK photoresist stripper market is growing with significant investment in research-intensive semiconductor manufacturing and defence electronics. Government-sponsored R&D work is promoting the development of new environmentally friendly stripping chemistries.

The increasing demand for high-performance photonics and compound semiconductors, especially in fields such as optical communication and power electronics, is driving the market. Also, the shift toward dry stripping technologies in upcoming chips in AI and automotive industries is picking up pace.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.6% |

The European Union market for photoresist stripper is witnessing strong growth due to increasing demand from automotive, aerospace, and IoT industries. The focus on the principles of green chemistry and circular economy in the region is leading manufacturers to adopt sustainable, low-VOC formulations.

Germany and France, where critical automotive and semiconductor R&D facilities are located, are at the forefront of eco-friendly stripping solution adoption. As the EU concentrates on strategic semiconductor autonomy, an increasing number of fabs are being set up, enhancing the demand for sophisticated stripping solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.1% |

Japan's electronics and semiconductor production sector drive the photoresist stripper market within Japan. Tokyo Electron and JSR Corporation are among the leaders that are investing in next-generation stripping technology to maintain EUV and high-density packaging. Wafer-level packaging and flexible electronics technology is driving low-damage stripper consumption with faster speeds.

In addition, the Japanese regulatory environment encourages recyclable solvent systems and plasma dry stripping so that chemical waste is minimized.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

South Korea's increasing display panel and semiconductor industry makes it an important market for photoresist strippers. Samsung and SK Hynix's emphasis on 3D NAND and DRAM manufacturing is driving demand for highly selective strippers with high cleaning rates.

MicroLED and OLED display markets are also fueling demand for new stripping technologies that do not destroy sensitive substrates as much. The country's investment in hydrogen-based etching and dry stripping technologies will redefine the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

The photoresist stripper market is a competitive market, with top global manufacturers and regional leaders determined to promote semiconductor and electronics applications. Large firms dominate market share with high-performance, low-defect, and eco-friendly technologies.

The firms concentrate on process effectiveness, material quality, and compliance with stringent environmental regulations. The market has established chemical majors and new firms, both leading to technology innovation and market expansion.

Entegris, Inc. (12-17%)

Being a market leader in the photoresist stripper industry, Entegris, Inc. is dedicated to high-performance products that minimize defects and enhance semiconductor yield. With high penetration in advanced packaging applications, it concentrates on sustainability by developing environmentally friendly as well as low-toxicity stripping chemicals. Being a global player, Entegris keeps on evolving and enhancing to meet the needs of leading-edge semiconductor manufacturing.

DuPont de Nemours, Inc. (10-14%)

DuPont is an early leader in semiconductor chemical process business offering a family of photoresist strippers for ultra-precise cleaning and best-in-class compatibility with advanced photolithography techniques. DuPont spends on sustainable solutions, as per industry criteria and delivering outstanding performance in the IC manufacturing segment.

Mitsubishi Gas Chemical Company, Inc. (8-12%)

Mitsubishi Gas Chemical is a company that produces specialty chemicals applied in the fabrication of semiconductors, for example, strong photoresist strippers. The company focuses on defect-free processing and metal ion contamination-free products, and these are qualified for high-precision use. Its R&D strategy assists it in resolving the challenges of next-generation semiconductor devices.

TOKYO OHKA KOGYO CO., LTD. (5-9%)

TOKYO OHKA KOGYO CO., LTD. has a good reputation for high purity and stable removers for front-end and back-end semiconductor processes. It invests heavily in R&D for the development of stripping solutions in response to the trend towards the adoption of small nodes and highly complex device structures by the industry.

Versum Materials, Inc. (3-7%)

Versum Materials is a lead provider of wet chemical formulations at high purity in the semiconductor fabrication industry. Their photoresist strippers have optimized high performance while emphasizing regulation support and sustainability. Versum Materials has sustained partnership with the semiconductor fabs for providing optimized technology needs solutions.

Other Substantial Players (45-55% Combined)

Various other participants in addition to market leaders engage in market innovation, cost optimization, and sustainability. These include:

The industry is slated to reach USD 838.2 million in 2025.

The industry is predicted to reach a size of USD 1,453 million by 2035.

Key companies include DuPont, Entegris, Fujifilm, Tokyo Ohka Kogyo, and Technic Inc.

Japan, slated to grow at 5.8% CAGR during the forecast period, is poised for the fastest growth.

Aqueous solutions are widely used.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Photoresist Chemical Market Forecast and Outlook 2025 to 2035

Photoresist and Photoresist Ancillaries Market Size and Share Forecast Outlook 2025 to 2035

Photoresist Electronic Chemical Market Size and Share Forecast Outlook 2025 to 2035

Urea Strippers Market Size and Share Forecast Outlook 2025 to 2035

Pneumatic Strippers Market

Paper Waste Strippers Market Size and Share Forecast Outlook 2025 to 2035

Assessing Paper Waste Strippers Market Share & Industry Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA