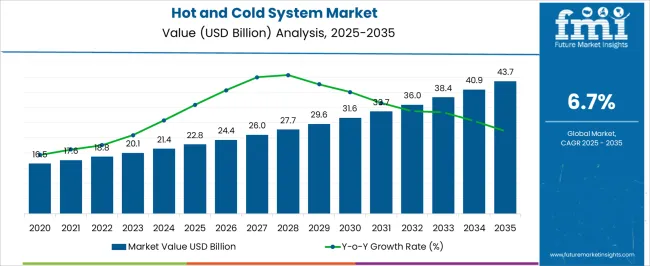

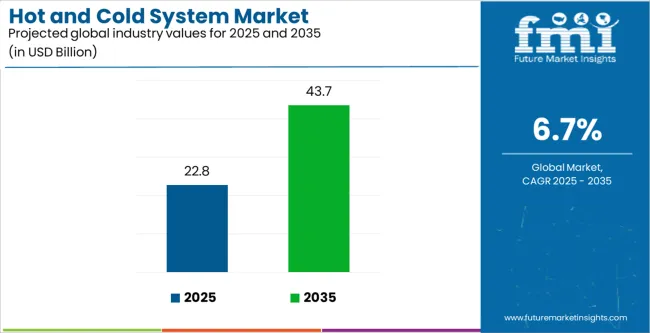

The Hot and Cold System Market is estimated to be valued at USD 22.8 billion in 2025 and is projected to reach USD 43.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

The hot and cold system market is experiencing steady growth driven by rapid urbanization, rising infrastructure development, and increasing investments in residential and commercial plumbing networks. Market expansion is being supported by ongoing modernization of water distribution systems and the replacement of outdated infrastructure with advanced materials offering durability, energy efficiency, and cost-effectiveness.

Demand is further influenced by regulatory initiatives promoting sustainable building solutions and water conservation. Manufacturers are focusing on improving thermal resistance, corrosion protection, and system longevity to meet diverse climatic and operational conditions.

The future outlook indicates continued adoption of integrated hot and cold water systems across developing economies, where construction activity and household modernization remain robust Growth rationale is underpinned by product innovation, improved installation techniques, and expanding demand for low-maintenance piping solutions that ensure consistent water delivery and temperature control, thereby positioning the market for sustained growth and technological advancement across all end-use sectors.

| Metric | Value |

|---|---|

| Hot and Cold System Market Estimated Value in (2025 E) | USD 22.8 billion |

| Hot and Cold System Market Forecast Value in (2035 F) | USD 43.7 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

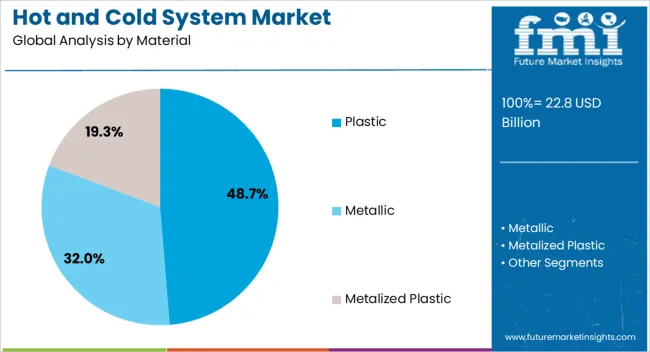

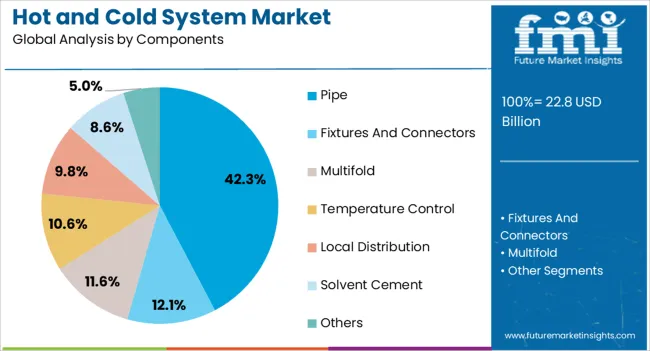

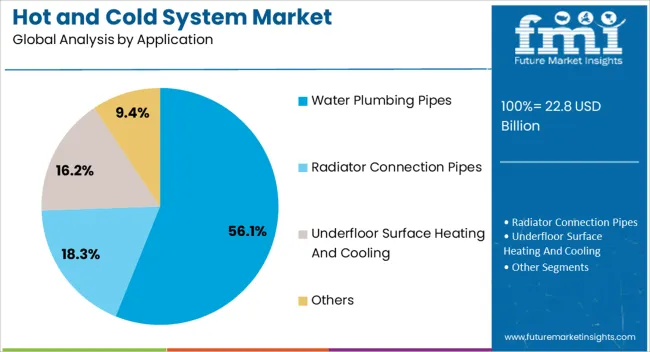

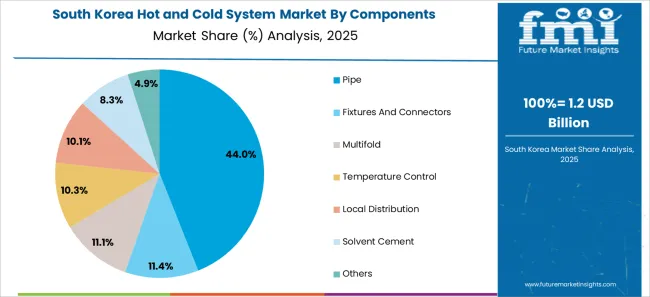

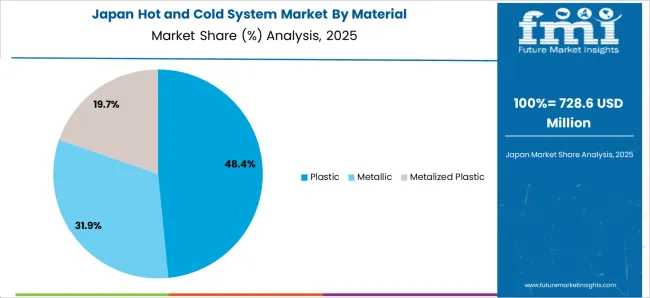

The market is segmented by Material, Components, Application, and End Users and region. By Material, the market is divided into Plastic, Metallic, and Metalized Plastic. In terms of Components, the market is classified into Pipe, Fixtures And Connectors, Multifold, Temperature Control, Local Distribution, Solvent Cement, and Others. Based on Application, the market is segmented into Water Plumbing Pipes, Radiator Connection Pipes, Underfloor Surface Heating And Cooling, and Others. By End Users, the market is divided into Residential, Commercial, and Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic segment, accounting for 48.70% of the material category, has maintained dominance due to its lightweight nature, resistance to corrosion, and ease of installation. Preference for plastic materials such as PVC, CPVC, and PEX has been reinforced by their superior thermal insulation and flexibility compared to traditional metal alternatives.

The segment’s leadership is further supported by cost advantages in both production and transportation, which have strengthened adoption in residential and commercial plumbing projects. Environmental sustainability and recyclability initiatives have promoted the use of advanced plastic composites that reduce leakage and extend operational lifespan.

As construction standards evolve toward higher efficiency and safety, plastic materials are expected to remain the preferred choice for hot and cold system applications, ensuring consistent market share and enhanced long-term performance.

The pipe segment, holding 42.30% of the components category, leads the market due to its essential function in ensuring reliable water flow and temperature regulation within system networks. Its share is being sustained by advancements in multilayer piping technologies that improve pressure handling and minimize heat loss.

Demand from residential and industrial plumbing applications continues to drive large-scale adoption, supported by infrastructure expansion and retrofitting activities. Manufacturers are emphasizing quality assurance and durability testing to meet compliance standards and ensure operational safety.

Ease of installation and compatibility with modern fittings have increased adoption rates among contractors and engineers Continuous development of pipe materials optimized for higher temperature tolerance and chemical resistance is expected to reinforce the segment’s leadership position throughout the forecast period.

The water plumbing pipes segment, representing 56.10% of the application category, dominates the market due to its widespread use in household and commercial water supply systems. Growth has been supported by the expansion of smart housing projects, improved sanitation standards, and rising consumer preference for efficient water delivery solutions.

Integration of energy-efficient piping systems that minimize thermal losses and optimize water flow has strengthened adoption. Government initiatives to modernize plumbing infrastructure and promote sustainable water management have further enhanced market penetration.

The segment’s performance is bolstered by innovations in design and material engineering that improve system durability, prevent leaks, and reduce maintenance costs With increasing focus on efficient and long-lasting water distribution systems, the water plumbing pipes segment is expected to maintain its leading position in the overall hot and cold system market.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 14.4 billion |

| Market Value for 2025 | USD 19.9 billion |

| Market CAGR from 2020 to 2025 | 8.4% |

The following part provides a fully segmented market analysis of hot and cold systems based on extensive research. Based on a significant body of research, the plastics sector is the front-runner in the material category.

Pipe is the most dominant sector in the component category, indicating a strong market presence. The present analysis highlights the crucial functions of plastic materials and pipe components in hot and cold systems, influencing market dynamics and trends.

| Attributes | Details |

|---|---|

| Top Material | Plastic |

| CAGR % 2020 to 2025 | 8.2% |

| CAGR % 2025 to End of Forecast (2035) | 6.5% |

| Attributes | Details |

|---|---|

| Top Component | Pipe |

| CAGR % 2020 to 2025 | 8.0% |

| CAGR % 2025 to End of Forecast (2035) | 6.3% |

The hot and cold system market can be observed in the subsequent tables, which focus on the leading economies in the United Kingdom, Japan, China, the United States, and South Korea. A comprehensive evaluation demonstrates that the United Kingdom has enormous opportunities.

| Country | South Korea |

|---|---|

| HCAGR (2020 to 2025) | 14.3% |

| CAGR (2025 to 2035) | 9.0% |

| Nation | Japan |

|---|---|

| HCAGR (2020 to 2025) | 11.9% |

| CAGR (2025 to 2035) | 8.1% |

| Nation | United Kingdom |

|---|---|

| HCAGR (2020 to 2025) | 11.6% |

| CAGR (2025 to 2035) | 8.0% |

| Nation | China |

|---|---|

| HCAGR (2020 to 2025) | 10.4% |

| CAGR (2025 to 2035) | 7.8% |

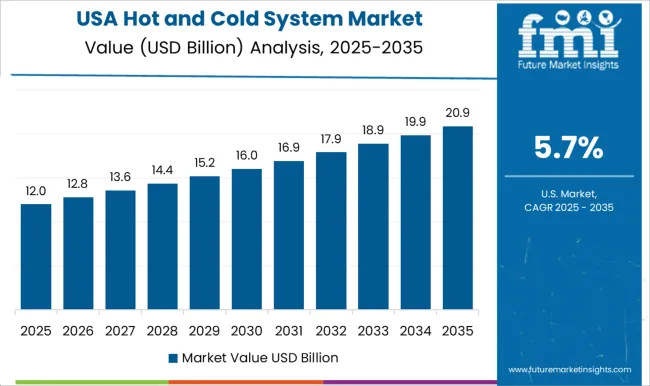

| Nation | United States |

|---|---|

| HCAGR (2020 to 2025) | 9.2% |

| CAGR (2025 to 2035) | 7.0% |

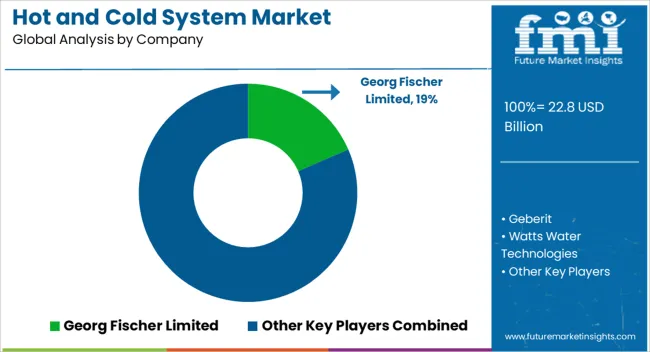

Prominent producers of hot and cold systems dominate the market, creating a competitive landscape. Notable hot and cold system vendors influencing the industry dynamics include Georg, Fischer Limited, Geberit, Watts Water Technologies, Chevron Phillips Chemical LLC, and Wienerberger. These hot and cold system manufacturers are essential to fostering innovation, guaranteeing the products' quality, and satisfying the wide range of consumer demands.

Georg, a trusted hot and cold system supplier recognized for its technological innovations, competes with Fischer Limited. Geberit is known for its creative ideas as part of the competitive mix, while Watts Water Technologies is distinguished by its dedication to environmentally friendly methods. Wienerberger and Chevron Phillips Chemical LLC contribute their knowledge, enhancing the ecology of competition even further.

These hot and cold system providers fight for market share in this competitive sector, going above and beyond to improve the sustainability and efficiency of hot and cold system solutions. Ongoing research and development initiatives, strategic alliances, and a commitment to satisfying changing client needs characterize the competitive landscape of the hot and cold system industry.

With innovation and dependability, the hot and cold system market continues to shift as these main providers take advantage of new opportunities and manage industry problems.

Notable Developments

| Company | Details |

|---|---|

| Zypho | In May 2025, Zypho, a Portuguese tech business pioneer in drain water heat recovery technologies, was bought by Aliaxis SA. Aliaxis's market position is strengthened, and its product line of energy-efficient goods is expanded through this strategic purchase. Innovative products have been produced due to Aliaxis and Zypho's collaboration. One such product is the horizontal heat recovery unit, sold in France, the United Kingdom, and Spain. |

| Toolstation | To provide clients with a selection of expertly designed water control valves, Toolstation teamed up with Reliance Worldwide Corporation (RWC) in March 2025. Reliance Valves is an expert in temperature, pressure, and combination valves that safeguard heating and hot and cold-water systems. Through this partnership, RWC hopes to supply effective water control valves for residential and light-duty businesses. |

| InukshukSynergie | The Canadian government announced in August 2024 that InukshukSynergie would receive a USD 165,000 award through the Department of Natural Resources Canada to help commercialize their biomass-based heating systems. |

| Japanese Government | In 2024, the Japanese government passed the Renewable Energy Act to encourage the development of renewable energy plants. During this period, the statute's most recent revisions were put into effect. |

The global hot and cold system market is estimated to be valued at USD 22.8 billion in 2025.

The market size for the hot and cold system market is projected to reach USD 43.7 billion by 2035.

The hot and cold system market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in hot and cold system market are plastic, metallic and metalized plastic.

In terms of components, pipe segment to command 42.3% share in the hot and cold system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hot And Cold Therapy Packs Market Size and Share Forecast Outlook 2025 to 2035

Hot and Cold Therapy Market Trends – Size, Share & Forecast 2025-2035

Hot Rolled Or Cold Finished Alloy Steel Bars Market Size and Share Forecast Outlook 2025 to 2035

Photovoltaic Mounting System Market Analysis - Size, Share, and Forecast 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Hotel Central Reservation System Market Size and Share Forecast Outlook 2025 to 2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

Multi-photon Microscopic System Market Size and Share Forecast Outlook 2025 to 2035

Europe Photovoltaic Mounting System Market – Trends & Forecast 2025 to 2035

MicroLED Photoluminescence Inspection System Market Size and Share Forecast Outlook 2025 to 2035

Semiconductors in Solar PV Power Systems Market Growth - Trends & Forecast 2025 to 2035

Hot Air Sterilization Dust Mite Controller Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Transport Insulated Truck Market Size and Share Forecast Outlook 2025 to 2035

Hot Melt Intermediate Joint Market Size and Share Forecast Outlook 2025 to 2035

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Hot Fill Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Hot Stamping Foil Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA