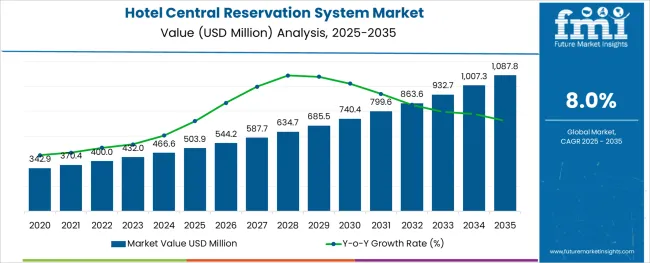

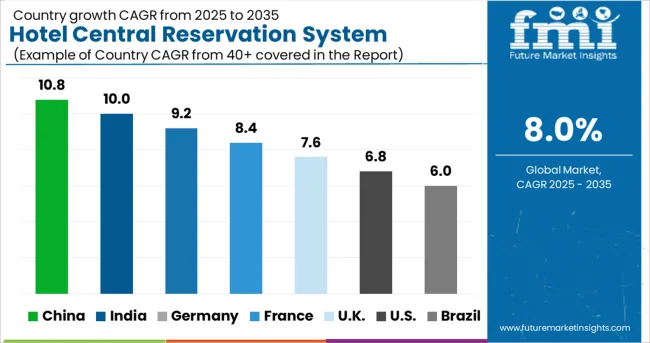

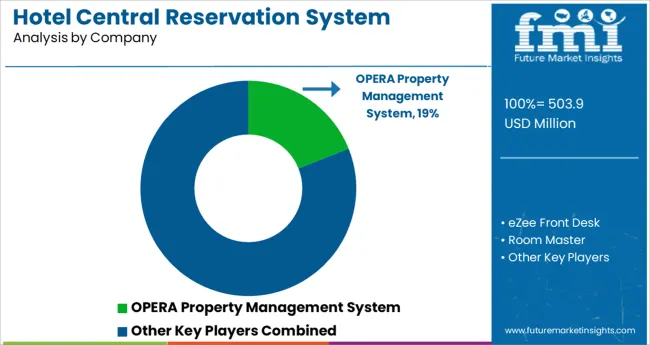

The Hotel Central Reservation System Market is estimated to be valued at USD 503.9 million in 2025 and is projected to reach USD 1087.8 million by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

The hotel central reservation system (CRS) market is experiencing accelerated growth due to rising digital transformation across the hospitality sector and the increased need for real-time inventory and pricing management. The integration of cloud infrastructure, AI-driven personalization, and omnichannel distribution is reshaping how hotels manage bookings, customer data, and rate parity across platforms.

Improved interoperability with property management systems (PMS) and customer relationship management (CRM) platforms is enabling hoteliers to streamline operations, reduce overbookings, and enhance guest experience. Industry adoption is being further influenced by the need for automation in handling reservations from multiple booking channels-particularly as online travel continues to dominate the hospitality booking landscape.

With growing competition among both independent hotels and global chains, CRS platforms are becoming essential for dynamic pricing, cross-selling, and maintaining competitive advantage. Future growth is expected to be sustained by investments in scalable, cloud-native solutions that offer API integration, mobile accessibility, and advanced reporting for real-time business insights.

The market is segmented by Operation Type, Booking Channel, Sales Type, and User Type and region. By Operation Type, the market is divided into Cloud-Based and Offline. In terms of Booking Channel, the market is classified into Online Booking, Phone Booking, and In Person Booking.

Based on Sales Type, the market is segmented into Direct Sales and Distribution Sales. By User Type, the market is divided into Big Enterprises, Small Enterprises, and Individuals. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

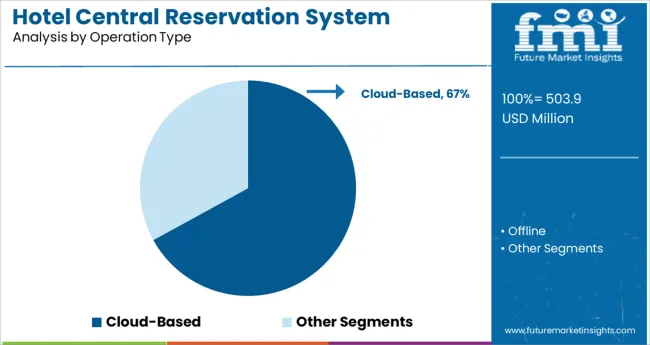

Cloud-based systems are expected to dominate the hotel CRS market with a 67.0% revenue share in 2025. This leadership is being driven by the operational flexibility, scalability, and cost-efficiency offered by cloud infrastructure compared to traditional on-premise systems. Adoption has been accelerated by the hospitality industry's demand for remote access, centralized control, and seamless system updates without physical IT intervention.

Cloud-based CRSs also support data redundancy and stronger cybersecurity protocols, addressing rising concerns around data breaches and compliance with global data protection regulations. The reduced need for hardware investments and lower total cost of ownership has made cloud solutions particularly attractive to small and mid-sized hotels.

Moreover, the ability to integrate with third-party applications and enable mobile-first operations has reinforced their relevance in a digitally evolving travel environment. As hotels continue to prioritize agility and business continuity, cloud-based operations are expected to remain the preferred choice..

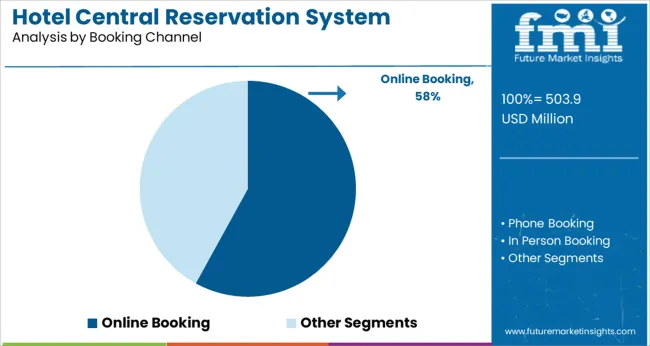

Online booking channels are projected to hold 58.0% of the hotel CRS market revenue in 2025, reflecting a clear shift in traveler behavior toward digital-first engagement. The dominance of online travel agencies (OTAs), meta-search engines, and direct brand websites has led to the widespread use of centralized reservation systems that can manage rates and inventory in real time.

The growing use of smartphones and mobile apps for travel planning and booking has made online platforms a critical revenue stream for hotels. CRS systems are being optimized for channel management, enabling hoteliers to push live availability and pricing across multiple online platforms simultaneously.

Additionally, data analytics derived from online booking behaviors are helping hotels enhance personalization, improve upselling, and increase repeat bookings. As digital bookings continue to outpace traditional methods, CRS platforms integrated with online channels are becoming indispensable to maximize occupancy and drive profitability.

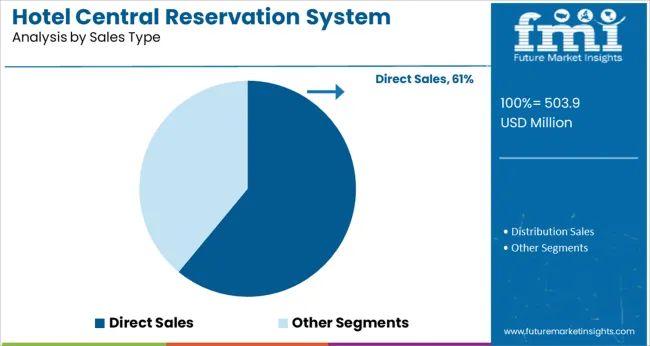

Direct sales are expected to account for 61.0% of total market revenue in 2025, reinforcing their importance in hotel CRS strategies. The growth of this segment is being fueled by hoteliers’ efforts to reduce dependency on OTAs and regain control over customer relationships and profit margins.

Central reservation systems now enable branded websites, call centers, and loyalty platforms to offer real-time availability, member-only pricing, and bundled packages-encouraging travelers to book directly. Enhanced integration with CRM tools has allowed personalized offers and retention strategies that strengthen guest loyalty and increase lifetime value.

Moreover, direct sales are contributing to cost savings by reducing third-party commission fees and enabling better data ownership for targeted marketing campaigns. As hotels seek to balance distribution mix and optimize revenue management, direct booking channels supported by advanced CRS capabilities are gaining strategic importance in both independent and chain hotel operations.

The Central Reservation System is software that is related to inventory management and hotel reservation. This software helps in managing reservations and related processes more efficiently. In this world full of competition, one has to maximize its functionality and exposure to customers.

Along with GDS, traveling agencies and tour agents, search engines, and OTAs, the use of CRS is on the rise as there is an increase in the use of the internet. There is a number of such CRS software, with different features for the different needs of hotel owners.

With the help of the internet and websites, people from all around the world are connected to each other. People around the have freedom for choosing on their own what to do with the help of these facilities. The positive factor of the internet for tourism is that people are searching for tours on their own.

Many tourists can plan their big tour at their homes. They even have a choice to talk with tour agents and agencies and book a trip with them or offered them. This freedom is giving tourists confidence and ultimately encourages them to travel more.

The CRS is one big help for this self-dependent movement of tourists. Using the CRS, multiple hotel and transportation-providing companies are open for tourists. Tourists can check the websites and choose between options, according to their needs.

Because of CRS, tourists are not depending upon anyone for their tickets and accommodation. Also, there are no last-minute problems at the front desk, as tourists have documents as proof, saving money and hassle for checking reservation books and records on the spot.

Tour operators, travel providers, and hotel owners are using CRS as it makes their work really easy. The CRS gathers all the required data of the guests, including their booking time and arrival time, what they have specified for accommodation, and the type of transportation they are preferring. As the endpoint services have all this information, they can plan everything up and ensure the tour goes smoothly. As there is data saved in the system, service providers can refer to earlier data and offer similar services to tourists.

The data saved on the system is in one place and always ready for utilization. There is accuracy in such systems, making minimum mistakes in bookings, giving tourists a seamless and hassle-free tour they can enjoy without worrying about tickets and accommodation.

Hotel and resort chains in India are using Central Reservation Systems to tackle booking problems.

Leigia solutions are providing a Central Reservation System to hotel owners in Goa. This system is helpful for managers to keep track of new reservations and bookings in resorts during rush hours. The hotel staff cannot handle the reservation data from OTA and third parties. This leads to problems and conflicts and issues regarding service. The use of a CRS system facilitates the immediate organization of guest reservations and bookings, enabling personnel to deliver essential services quickly and without interruption.

The Verda group of Hotels is one of many users of CRS by Leigia Solutions. There is a number of hotels and resorts under this name, located in Goa, Jharkhand, and Karnataka.

Controlling reservations at popular tourist destinations is made easier by reservation systems.

Many hotels from famous tourist countries are using CRS systems for simplifying the booking of hotel rooms and resort reservations. Some guests want modifications in their stays or have unique requirements than other customers. If there are reservations with requirements specified with them, hotel managers can issue orders to get requirements done before guests’ arrival.

Many popular hotels from tourist destinations like the Philippines, France, Sweden, Romania, and America are using these CRS systems. eZee Absolutes, Cendyn, and GuestCentric are some of the commonly used central reservation systems, that work along with OTA and third-party software for hotel bookings. These providers also help in marketing and management to customers around the globe.

Cloud-based reservations systems are connecting hotels and customers can book hotels without actually visiting Hotels.

The CRS software is provided in many forms. Some can be used on computers without internet connectivity and some require connectivity. Online and cloud-based CRS work along with OTA’s and third-party booking websites and applications, collecting information from them and updating the inventory in hotels. This online CRS helps access customers via multiple channels. They are also accurate and prevent mistakes like double bookings. As the cloud-based reservation is working in real-time, they keep track of guest reservations and last-minute cancellations, preventing further problems.

Big Enterprises with chains and franchises of hotels and resorts use CRS for maintaining reservations and Inventories.

The Hotel Reservation systems are paid services and software. These are provided to anyone who is working in the Hospitality sector. Mainly CRS is used by big enterprises, with multiple hotels in the same or different regions. These systems help in keeping the bookings under control and make handling multiple hotels at the same time possible. The owners can keep track of requirements and take necessary actions accordingly.

Hotel Central Reservation Systems are essential tools for getting attraction tourists traveling around the globe. The CRS help in getting bookings from websites, mobile applications, and OTAs.

Around the world, there are numerous service providers who offer a wide range of services and tailored reservation methods that cater to their client's requirements. Numerous companies create and offer CRS services with the understanding that every hotel has unique requirements, traits, and budgets.

For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value |

| Key Region Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania & MEA |

| Key Countries Covered | The united state, Canada, South Africa, Northern Africa, GCC Countries, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia & New Zealand, Brazil, Mexico, Germany, UK, France, Spain, Italy, and Russia. |

| Key Segments Covered | Tourism Type, Booking Channel, Tourist Type, Tour Type |

| Key Companies Profiled |

OPERA Property Management System; eZee Front desk; Room Master; Hotelogix PMS; MSI CloudPM; Rezlynx PMS; CenDyn; Vertical booking; Amadeus; eRevMax; SHR; GuestCentric; Others |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global hotel central reservation system market is estimated to be valued at USD 503.9 USD million in 2025.

It is projected to reach USD 1,087.8 USD million by 2035.

The market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types are cloud-based and offline.

online booking segment is expected to dominate with a 58.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hotel Ice Dispensers Market - Hospitality Trends & Industry Forecast 2025 to 2035

Hotel Channel Management Market Analysis – Growth & Forecast 2024-2034

Pet Hotel Market Forecast and Outlook 2025 to 2035

Micro Hotel Market Forecast and Outlook 2025 to 2035

Market Positioning & Share in the Beach Hotels Industry

Beach Hotels Market Trends - Growth & Forecast 2025 to 2035

Luxury Hotel Market Size and Share Forecast Outlook 2025 to 2035

Pop-up Hotels Market Size and Share Forecast Outlook 2025 to 2035

Casino Hotel Market Analysis - Growth & Forecast 2025 to 2035

Capsule Hotels Market Size and Share Forecast Outlook 2025 to 2035

Boutique Hotel Market Size and Share Forecast Outlook 2025 to 2035

Floating Hotel Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region – Forecast for 2025-2035

Market Share Distribution Among Floating Hotel Providers

Tech Savvy Hotel Chains Market Size and Share Forecast Outlook 2025 to 2035

Underwater Hotel Market Forecast and Outlook 2025 to 2035

USA Boutique Hotel Market Trends - Growth & Forecast 2025 to 2035

Extended Stay Hotels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Extended Stay Hotel Industry

UK Extended Stay Hotel Market Report – Trends, Demand & Forecast 2025-2035

USA Extended Stay Hotel Market Report – Size, Share & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA