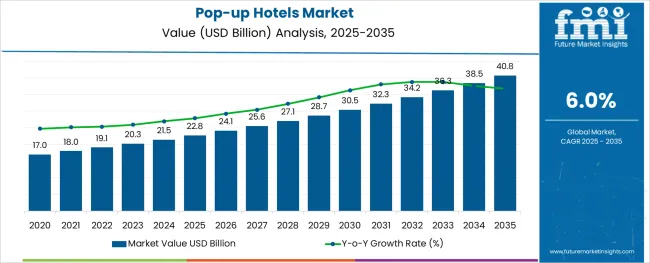

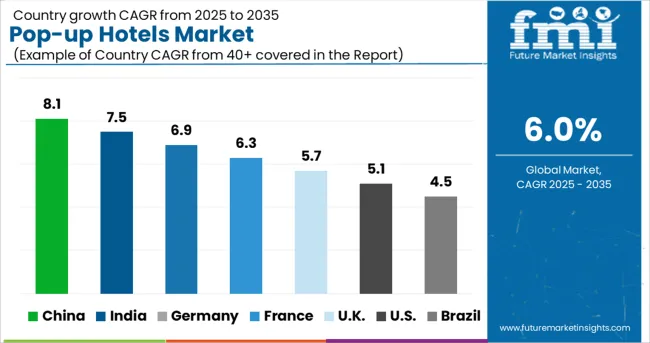

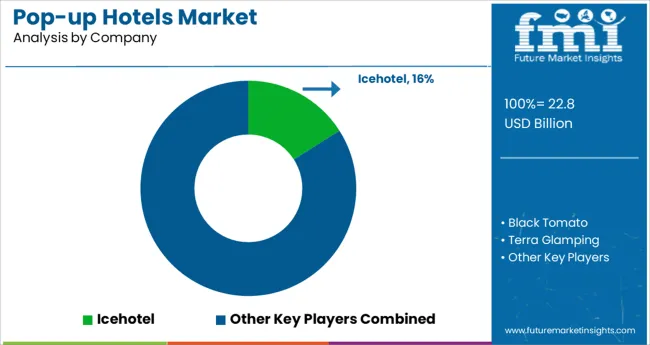

The Pop-up Hotels Market is estimated to be valued at USD 22.8 billion in 2025 and is projected to reach USD 40.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The pop-up hotels market is experiencing dynamic growth, influenced by evolving travel behaviors, short-term event demand, and a growing preference for low-impact, mobile accommodations. Increased interest in experiential and short-duration travel has prompted tourism operators and event planners to invest in flexible lodging models that require minimal infrastructure.

Supportive regulatory frameworks in eco-sensitive zones and public-private partnerships for tourism promotion have encouraged experimentation with pop-up formats across festivals, rural retreats, and seasonal hotspots. Advances in modular construction, improved on-site utility access, and rising consumer comfort with alternative accommodations have created a favorable environment for this market to scale.

Looking ahead, integration with digital booking platforms and demand for low-carbon, portable structures are expected to shape the next wave of innovation and deployment in the sector.

The market is segmented by Accommodation Type, Tourism Type, Event Type, Tourist Type, and Tour Type and region. By Accommodation Type, the market is divided into Tents, Yurts, Huts, Containers, and Others. In terms of Tourism Type, the market is classified into Eco/Sustainable Tourism, Cultural & Heritage Tourism, Adventure Tourism, Wellness Tourism, and Others.

Based on Event Type, the market is segmented into Festivals, Concerts, Business Events, and Others. By Tourist Type, the market is divided into Domestic and International. By Tour Type, the market is segmented into Independent Traveller, Package Traveller, and Tour Group. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

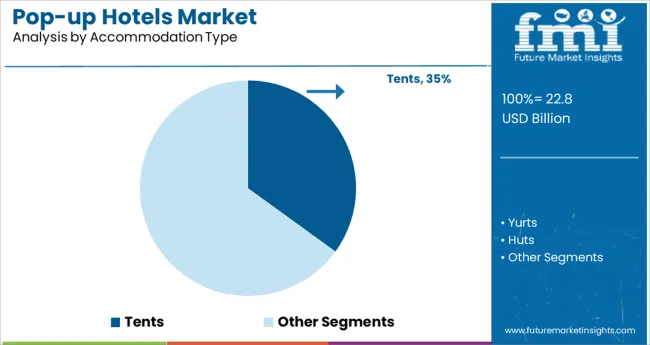

Tents are expected to contribute 35.0% of the total revenue in the pop-up hotels market by 2025, positioning them as the leading accommodation type. This segment’s growth is being supported by the cost-efficiency, transportability, and rapid deployment advantages tents offer across diverse terrains.

Increased interest in minimalistic and nature-integrated lodging has aligned with the flexible design possibilities of tents, making them popular for adventure travelers, eco-tourism destinations, and temporary hospitality solutions. Customization features such as insulation, modular flooring, and integrated lighting have improved user experience, making tents more viable even in extended-stay scenarios.

Their reduced environmental footprint and low setup requirements are encouraging widespread adoption for both commercial and community-driven initiatives.

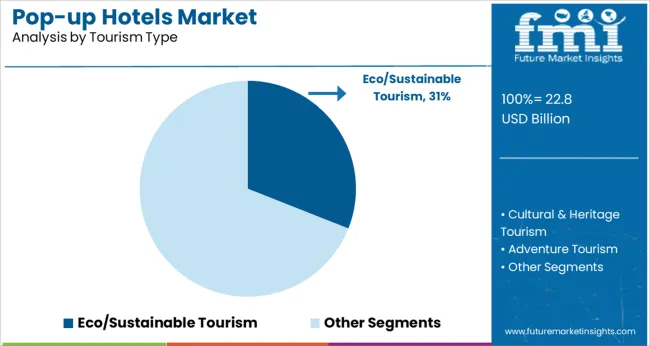

Eco/sustainable tourism is forecast to hold 31.0% of the overall market share in 2025, making it the leading tourism type for pop-up hotel demand. This dominance is being shaped by rising consumer awareness around environmental impact, waste minimization, and biodiversity conservation.

Travelers are actively seeking stays that minimize ecological disruption while supporting local communities. Pop-up hotels-especially those constructed from recyclable, renewable, or locally sourced materials-are increasingly seen as compatible with eco-tourism goals.

Operators focusing on low-impact mobility, carbon-neutral logistics, and off-grid solutions are gaining favor in protected and rural areas. As responsible travel continues to gain policy and public momentum, eco-sustainable tourism is anticipated to drive continued preference for transient, resource-conscious lodging models.

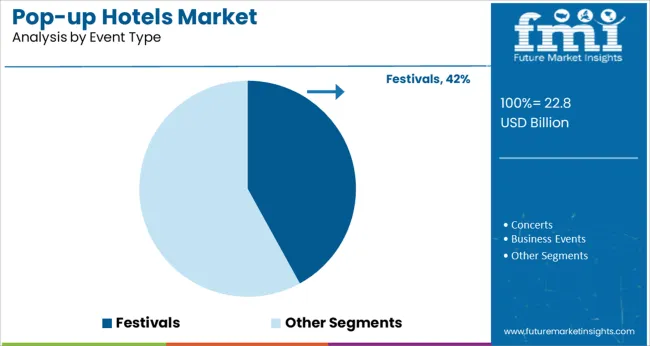

Festival-based deployment is projected to account for 42.0% of the pop-up hotels market share in 2025, establishing it as the leading event-driven segment. This leadership is attributed to the increasing frequency of large-scale music, cultural, and lifestyle festivals that require short-term but scalable accommodation solutions.

Pop-up hotels offer on-site lodging convenience, improving attendee experience and length of stay while reducing transportation strain on surrounding infrastructure. Partnerships between festival organizers and hospitality providers have further optimized the logistics and profitability of such models.

Moreover, the ability to brand and personalize accommodations has added marketing value for event sponsors. As festivals evolve into immersive, multi-day experiences, demand for secure, hygienic, and design-forward temporary lodging is expected to remain strong.

To experience such excitement, millennial travelers are now preferring camping and hikes. There are no accommodation services at such places, at this time tents and yurts are the only options for tourists.

Also, demand is currently shifting in the hospitality sector as a result of growing pressure from short-term rentals, changing consumer expectations, and a somewhat hazy economic picture. In particular, alternative lodgings are transforming the hospitality industry. The ten American cities with the highest market share for Airbnb experienced a decline in hotel bookings and revenue of ~ 1.5% and ~ 1.3%, respectively, in 2020.

One novel idea may offer an alternative that aids the hotel sector in maintaining strongholds inside key target areas as the fight for market share between conventional hotels and disruptors in the short-term rental business continues.

Pop-up hotels are becoming more popular as the most recent idea emerges from emerging consumer trends, and these adaptable accommodation options could revolutionize the hospitality industry.

The pop-up hotels are unique approaches to accommodation problems during a remote tour or where there is no alternative facility available. Pop-up hotels can be built and removed within a few minutes, and does not take much space, and can be moved from one place to other, without much trouble. These short-term modules of these types of hotels have high demand during seasonal events and remote adventure tours.

Living a minimal lifestyle is quite an experience, and customers are always ready to experience something new. The idea of living in a tent or yurt, with very limited supplies, is without a doubt a unique experience. Providing such facilities to tourists is becoming a market strategy and people do not want to miss such an opportunity. Such interaction is creating a ‘demand and supply kind’ of market.

The minimal lifestyle is living a life with fewer and essential resources, that may be related to accommodation or possessions. Such a lifestyle is considered a ‘trend’, and an ideal lifestyle for de-stressing and saving money. Such a lifestyle is attracting many people and is getting popular day by day, as it is effective.

The idea of minimal living also encouraged tourism with minimal resources. Such travellers are called ‘backpackers’, and they usually travel with limited resources, with or without planning the tour. For such travellers, pop-up hotels are ideal accommodation options.

Instead of booking a hotel room, they can get a tent and spend the night in an open space. This saves them money and also fulfils their ‘minimal lifestyle’. The pop-up hotel providers are also attracting tourists by promotion and teaming up with tour organisers.

The Summer Music Festivals are popular among local and international music lovers. These festivals are arranged between September and October months and include popular bands and artists performing. To experience the festival in person, music lovers and art enthusiast travel from all around the world. The music festivals are organized in open spaces or stadiums, and not everyone coming to these concerts and festivals can book a hotel for a night or two.

At such times pop-up hotels are the most popular accommodation option for travelers. There are many pop-up hotel service providers in the UK, partnering with organizers and providing tents, camps, and yurts for the night, taking lands on lease. There are also theme-based pop-up hotels, from camping-themed, under-the-sky tents to minimal and modern shipping container rooms for living.

Camping in woods and hills and spending a night in open, starry sky is another way of de-stressing and escaping the daily routine for relaxation. Numerous locations nearby New York, USA, are well-liked by both domestic and foreign tourists for camping.

Such camping gates ways are referred to as ‘Glamping’, a combination of ‘glamour’ and ‘camping’. Hither Hills State Park, Rip Van Winkle Campgrounds, Wildwood State Park, and Gunks Campground are popular campsites, with lots of natural attractions and adventure sports.

Organizations that cooperate with local government agencies offer lodging options such as tents, camps, RVs, suits, and cottages. These locations offer a unique experience for both tourists and locals who like the simplicity of life and outdoor camping.

Sweden is a big country, with a number of regions around to explore and experience in different seasons around the year. Tourists are welcome to visit and enjoy the mountains, beaches, forests, cities, farms, and snowy plains. All these attractions change their avatar as the seasons change making it an entirely new experience.

The Swedish Laplands are consisting forests and arctic plains, where tourists can experience the northern lights and arctic wilderness. There are special campsites around these locations, where the camps are carved out of snow and ice. Tourists can also choose between budget camps and tents to luxurious motor houses and suites for living. Anywhere in Sweden that you go, you can discover a top-notch camping area with the necessary amenities.

There are more than 300 campsites in Sweden that are members of the National Swedish Campsite Association. More than 75,000 camping spaces and 9,000 cottages and cabins are available at the campgrounds, which are located all around Sweden.

The majority of guests staying in pop-up hotels choose tents.

There are multiple accommodation types in Pop-up Hotels, including huts, yurts, Rooms made inside storage containers or boxes, igloos, etc.

The most popular and commonly used accommodation type is tents, as these are easy to carry, build and remove, are lightweight and flexible, and do not require much capital investment. Numerous tents with multiple-person capacities are available in various sizes. All these factors make tents the most common type of accommodation utilized by pop-up hotels.

Cultural/Heritage Tours are mostly associated with Pop-up Hotels for accommodation.

Cultural/Heritage tours and adventure tourism are the most common type of tourism including the use of pop-up hotels. Tourists visiting countries during festivals and cultural programs and going camping around prefer pop-up hotels for their stay, instead of booking a room and traveling to a hotel. Some tour agencies partner with local lodging providers or provide such tents and camps themselves.

Festivals and cultural events take place all over the world, and they are the main source of business for pop-up hotels.

Festivals and cultural programs are the most common type of events, where pop-up hotels and lodging providers are preferred over hotel rooms. These types of events usually are organized in wide, open spaces. There may be chances that these locations are remote and do not have any mode of transportation or accommodation. For the convenience of tourists and visitors, pop-up hotels are the best available option for on spot stays for a night.

Pop-up hotel is an emerging segment in the lodging and accommodation market. There are not many big players, but there are some well-established organizations planning and ready to set foot in this market. The pop-up hotels can be a budget stay as well as a luxury stay, depending upon the preferences of the customers.

The form of pop-up hotels changes as we move from urban areas to the outskirts, including mountains, hills, and woodlands. Depending upon the areas and services provided by the hotels, there are types varying from single-person tents to modernized shipping container rooms.

For Instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Billion for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania & MEA. |

| Key Countries Covered | United States of America, Canada, Brazil, Mexico, Germany, The UK, France, Spain, Italy, Russia, Benelux, South Africa, Northern Africa, GCC Countries, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia & New Zealand. |

| Key Segments Covered | Accommodation Type, Tourism Type, Event Type, Tourist Type, Tour Type, and Region |

| Key Companies Profiled | Black Tomato; Terra Glamping; Zand Hotel; The Pop-Up Hotel; Snooze Box; Sleeping Around; San Giorgio; Icehotel; The Kimpton Gray; Others |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global pop-up hotels market is estimated to be valued at USD 22.8 USD billion in 2025.

It is projected to reach USD 40.8 USD billion by 2035.

The market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types are tents, yurts, huts, containers and others.

eco/sustainable tourism segment is expected to dominate with a 31.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Positioning & Share in the Beach Hotels Industry

Beach Hotels Market Trends - Growth & Forecast 2025 to 2035

Capsule Hotels Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Floating Hotel Providers

Extended Stay Hotels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA