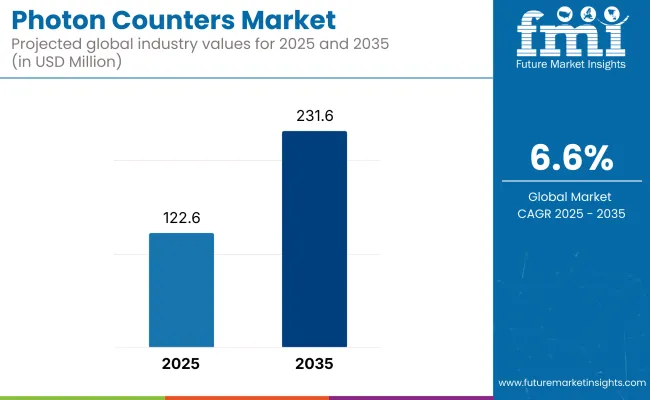

The global photon counters market is projected to grow from USD 122.6 million in 2025 to USD 231.6 million by 2035, expanding at a CAGR of 6.6%. This growth is primarily fueled by the convergence of quantum computing, AI-powered imaging, and high-speed optical communication systems.

China, the United States, and Germany are among the largest contributors, with India and South Korea emerging as fast-adoption markets due to domestic semiconductor and photonics initiatives. Key end-user industries include healthcare, aerospace, cybersecurity, and optical networking.

Photon counters are increasingly vital to advanced diagnostic systems like photon-counting computed tomography (PCCT), LIDAR systems in autonomous vehicles, and quantum key distribution in secure communications. The fusion of AI and photon detection is improving image quality, enhancing detection accuracy, and enabling low-noise environments for photon-sensitive operations. As such, applications in CT scans, fluorescence microscopy, and quantum research are accelerating adoption.

From 2025 onward, the market will evolve rapidly through miniaturization trends, silicon-gallium hybrid materials, and integration of AI-driven noise reduction. Regional demand will be shaped by regulatory environments-such as FDA and MDR certifications-and by strategic partnerships between manufacturers and research institutions.

Leading players are investing heavily in R&D, focusing on low-power, portable, and real-time photon counting technologies for both healthcare and defense sectors. Customized designs and flexible pricing models are expected to help navigate cost-sensitive emerging markets.

In addition, global efforts to standardize photon detection protocols across sectors are creating new momentum for commercialization. As photon counting technology expands from niche academic use to mainstream industrial and clinical applications, interoperability, data security, and certification will become critical success factors.

Stakeholders are increasingly prioritizing materials innovation-such as silicon photomultipliers and superconducting nanowires-for their high gain, low noise, and energy efficiency. Meanwhile, supply chain stability for high-purity semiconductors remains a challenge, prompting manufacturers to localize production and diversify sourcing.

Overall, the decade ahead is poised to witness a transition from experimental prototypes to scalable, application-specific photon counting solutions across medical diagnostics, secure networks, and space-based sensing.

Basic mounting will continue to dominate due to its affordability and wide applicability across research labs, telecommunications, and medical imaging facilities. These mounts are simple, cost-effective, and sufficient for general photon counting needs, particularly in diagnostics and fiber-optic testing.

However, background compensation mounting is expected to record the fastest growth, especially in fields like fluorescence microscopy and quantum optics, where eliminating background noise is crucial for measurement accuracy. This mounting type enhances signal fidelity in low-photon environments, making it ideal for molecular imaging, pharmaceutical R&D, and spectroscopic systems.

Radiation source compensation mounting will see stable adoption in nuclear medicine, astrophysics, and radiation therapy as precision and safety concerns drive its use.

| Mounting Type Segment | CAGR (2025 to 2035) |

|---|---|

| Background Compensation | 6.9% |

Medical imaging will continue to lead the photon counters market, driven by the adoption of PCCT (photon-counting computed tomography), PET scans, and AI-enhanced radiology. Photon counters enable superior image resolution at lower radiation doses, which is critical in cancer diagnostics, cardiovascular imaging, and neuroimaging.

The integration of AI for real-time reconstruction and automated diagnostics will further boost adoption in hospitals and diagnostic labs. LIDAR is projected to witness the fastest growth as photon counting is increasingly used in geospatial mapping, autonomous vehicles, and climate observation. Meanwhile, applications like fluorescence microscopy and quantum communications will also scale due to their role in genomics, cryptography, and secure networking.

| End-Use Segment | CAGR (2025 to 2035) |

|---|---|

| LIDAR & SLR Applications | 7.1% |

The photon counting industry is undergoing a revolutionary transformation, fostered by developments in quantum optics, biomedical imaging, and high-accuracy communication networks. With a core focus on ultra-sensitive detection and advanced signal processing, the counting technology is being extensively adopted by large businesses, making it a crucial component for next generation medical diagnostics, cybersecurity measures, and fiber-optic data transmission.

Furthermore, the growing convergence of quantum computing, machine learning, and AI is further accelerating adoption, bringing new opportunities for telecom businesses, research organizations, and healthcare innovators.

Advance Quantum and AI-Based Photon Detection

Businesses are required to invest progressively in quantum-backed photon counting and AI-driven signal processing to provide ultra-sensitive detection, low-noise imaging, and high-accuracy data transmission. Collaborations with renowned AI research institutions, quantum computing companies, and biomedical research firms will foster fast innovation, reshaping industry leadership in high-impact applications, including medical diagnostics, cryptography, and fibre-optic networks.

Align with High-Growth Applications and Evolving Regulatory Frameworks

With photon counting assuming center stage roles in quantum communications, precision medicine, and robust security measures, meeting future industry requirements and upholding stringent worldwide standards becomes imperative. Healthcare companies need to engage actively towards compliance in healthcare, cybersecurity regulations, and data integrity requirements to smooth the adoption and avoid potential regulatory chokepoints.

Develop Strategic Alliances and Focused M&A to Differentiate Competition

Market scaling demands for increased engagement across semiconductor, quantum optics, and AI imaging ecosystems. Forging high-value partnerships with premier photonics makers, AI imaging companies, and quantum security innovators, coupled with selective acquisitions, will build a competitive scenario through enlarged technological capability and go-to-market acceleration.

| Risk Factor | Probability & Impact |

|---|---|

| Component Shortages and Supply Chain Disruptions-Depending on custom semiconductors and quantum hardware can delay the production process and may cause price fluctuations. | High Probability, High Impact |

| Technological Limitations in the Integration of AI and Quantum-Challenges like noise elimination, scalability, and computational efficiency obstacles might slower the adoption rate. | High Probability, Medium Impact |

| Uncertainty in Regulatory Compliance-Stringent international norms on data security, medical imaging, and quantum encryption may limit or delay the approval processes. | Medium Probability, High Impact |

| Priority | Immediate Action |

|---|---|

| Fortify Semiconductor and Quantum Hardware Supply Chains | Implement a multi-level sourcing strategy by contracting with substitute suppliers in various locations. Create strategic inventory buffers for key components to mitigate potential shortages. |

| Advance AI-Driven Photon Detection Capabilities | Create a focused R&D program aimed at maximizing quantum noise reduction and computational performance Obtain funding for next-generation photon detection research to improve medical imaging, fiber-optic communications, and cybersecurity applications. |

| Preempt Regulatory Shifts in Quantum and Medical Imaging | Create an executive-guided regulatory task force to monitor developing compliance requirements in major segments. Collaborate with policymakers and industry associations to influence future quantum encryption, medical imaging standards, and data protection regulations. |

In order to maintain segment leadership, the firm should invest at once in building supply chain robustness, establishing multi-region semiconductor alliances and strategic stockpiles to anticipate disruptions. AI-powered photon detection technology should be accelerated through high-impact research and development and partnerships with quantum leaders, unlocking innovations in medical imaging, cybersecurity, and fiber-optic networks.

A decisive shift toward technological pre-eminence, regulatory vision, and strengthened infrastructure will secure the company's place at the vanguard of a rapidly changing, high-stakes industry.

The United States will continue to be a leader in photon counter adoption, spurred by quantum computing, artificial intelligence, and medical imaging technology advancements. Strong R&D infrastructure support from entities such as NASA, NIH, and DARPA are propelling photon-counting application innovations in defense, space exploration, and biomedical science. Increased interest in photon-counting computed tomography (PCCT) for early disease detection will also continue to fuel demand.

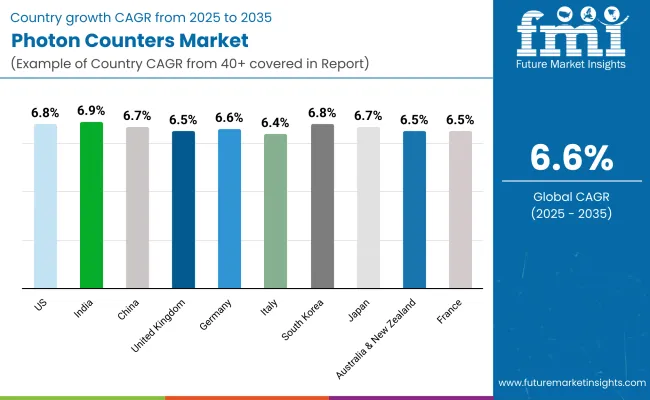

Furthermore, the growth of autonomous car technology and LIDAR technologies is driving adoption in automotive and geospatial use cases. The location of major tech companies and medical giants will keep the USA at the forefront of the industry. FMI opines that the USA industry is expected to expand at a 6.8% CAGR.

India's photon counter sector is poised for strong growth, driven by increased spending on healthcare diagnostics, space exploration, and fiber-optic communication. Make in India and Digital India initiatives of the government are promoting local semiconductor and photonics manufacturing, cutting dependence on imports. The nation's growing quantum research infrastructure is propelling quantum cryptography and quantum sensing innovations.

Additionally, the rising need for secure data communication networks is fueling investment in QKD technology. As telecom operators concentrate on fiber-optic growth, the demand for photon counters for high-speed data transmission is building. FMI opines that Indian industry is forecasted to expand at a 6.9% CAGR.

China's photon counter sector is seeing a massive growth phase, led by heavy government expenditure on quantum computing, semiconductor R&D, and aerospace technologies. The strategic drive of the nation to become independent in high-technology domains is creating large-scale R&D for photon-based computation, quantum cryptography, and state-of-the-art imaging solutions.

China's increasing leadership in autonomous cars and LIDAR-driven navigation is also driving sector adoption at a faster rate. The country's increasing semiconductor industry is also solidifying its position as a leading global supplier of photonics technology. FMI analysis found that China’s industry is projected to grow at a 6.7% CAGR from 2025 to 2035.

The United Kingdom is becoming a serious contender in photonics and quantum technologies, supported by government support and research partnerships with top universities. The National Quantum Technologies Programme is driving the application of counters in secure communication, defense systems, and future computing. The nation's growing healthcare industry is using photon-counting technology for high-resolution imaging in cancer diagnosis and neurology.

Private sector engagement, especially from photonics startups and research-oriented companies, is promoting innovation. FMI opines that the UK industry is expected to expand at a 6.5% CAGR, reflecting steady growth driven by technological advancements, strategic government initiatives, and increasing commercial applications of photon detection.

Germany's photon counter industry is gaining from its robust industrial ecosystem, optical engineering expertise, and dominance in semiconductor research. Germany's robust healthcare industry, which is renowned for its sophisticated diagnostic imaging and medical device technology, is incorporating photon-counting technology into next-generation radiology and molecular imaging solutions.

The aerospace industry in the country, assisted by European Space Agency partnerships, is also using photon counters in high-precision satellite and space observing equipment. With sustained investments in quantum research and semiconductor development, Germany is poised to continue its technological dominance. FMI opines that, the industry will expand at a 6.6% CAGR, aligning closely with the global growth trajectory.

South Korea is moving fast on photon-based technology, fueled by robust semiconductor manufacturing capacity and massive investments in AI-based medical imaging. The top tech companies of the country are leading R&D in photonics, quantum computing, and optical communication systems, fueling adoption in various industries.

South Korea's healthcare industry is also changing, with hospitals incorporating photon-counting X-ray and PET scan technology to enhance the detection of disease at an early stage. With sustained innovation and strong government backing, FMI analysis found that South Korea’s photon counter industry is expected to grow at a 6.8% CAGR, positioning the country as a regional leader in photonics-driven technologies.

Japan's photon counting industry is exceptionally advanced, backed by the solid contributions of its semiconductor, quantum computing, and medical imaging industries. The vast investments made in quantum communication and cryptography in Japan are reinforcing its position in safe data transfer and cybersecurity.

The country's automotive and robotics sectors are incorporating photon detection in future-generation autonomous vehicles, LIDAR mapping, and optical sensors in factory automation. With strong private sector involvement and robust research funding, FMI opines that Japan’s photon counter industry is set to grow at a 6.7% CAGR, ensuring sustained leadership in high-precision photonics applications.

France's industry for photon counters is growing owing to advances in defense technology, medical imaging applications, and studies in quantum optics. The defence industry in the country is also using photon counting detection systems in secure communication as well as for surveillance with overwhelming support from government security agencies. Photon counting also improves accuracy in nuclear medicine as well as in radiology with better patient results. France's active contribution to the European Quantum Flagship initiative is accelerating innovation in photonic computing and quantum cryptography.

FMI analysis found that France is expected to maintain steady growth at a 6.5% CAGR, driven by its commitment to technological innovation and sustainability-focused applications.

Italy's photon counter industry is witnessing consistent growth with increased biomedical research, advances in semiconductors, and space exploration efforts. Italy's flourishing pharma and biotech industry is adopting photon-counting fluorescence microscopy for drug discovery and molecular diagnostics. Italy's space industry is utilizing photon detection in space exploration and earth observation activities towards facilitating global scientific advancements.

The investments of the government in quantum cryptography and optical communication are also driving industry adoption. Further, Italy's cultural heritage project is using photon-based imaging to restore and study ancient artworks and historical relics. FMI opines that Italy’s photon counter industry is set to grow at a 6.4% CAGR, aligning with broader European industry trends.

Australia and New Zealand are becoming major players in photon counter technology applications, especially in astronomy, quantum sensing, and climate monitoring. The research institutes in both nations are developing photon-based remote sensing for environmental studies and geological exploration. The increasing emphasis in the region on space technology, underpinned by government and private investments, is opening up new applications in satellite imaging and deep-space observation.

In addition, the need for photon-counting medical imaging systems is increasing, enhancing diagnosis in rural healthcare facilities. FMI analysis found that with the increased funding in quantum optics and photonics innovation, the industry is set to expand at a 6.5% CAGR.

(Surveyed Q4 2024, n=500 stakeholder participants, including manufacturers, R&D institutions, healthcare providers, and industrial end-users across the US, Europe, China, Japan, and South Korea.)

Photon counter stakeholders prioritized high detection accuracy, increased sensitivity, and the measurement of photons in real-time as primary needs. 82% of the respondents worldwide indicated that they needed better quantum efficiency and reduction of noise in medical imaging, quantum computing, and fiber-optic communication. Reducing costs and having the ability to produce in large numbers were essential for 67% of the manufacturers looking to increase commercial feasibility.

Regional Variance

Photon counters are experiencing fast integration with AI, machine learning, and quantum photonics to enhance performance and accuracy. 59% of the stakeholders surveyed indicated the adoption of machine learning algorithms for real-time analysis of photons, while 49% intend to invest in AI-based noise reduction methods.

High Variance

73% of USA stakeholders concluded that photon-counting technology in CT imaging warrants high upfront investment, whereas just 35% of Japanese healthcare providers found it cost-effective.

Material Preferences

Photon counters need specially designed semiconductor materials like silicon, gallium arsenide, and superconducting nanowires. 65% of the global respondents preferred silicon photomultipliers for their low noise and high gain characteristics.

Regional Variance

Industry participants are extremely price-sensitive, with 88% of respondents mentioning increasing semiconductor and rare-earth material prices as a significant challenge.

Regional Differences

Manufacturers and users of counters identified supply chain disruption, regulatory hurdles, and a lack of standardization as major pain points. 68% of manufacturers indicated that complicated fabrication processes were the biggest barrier to scale.

Manufacturers

Distributors

End-Users

Photon counter stakeholders are making strategic investments in AI-enabled upgrades, multi-modal detection systems, and quantum-resistant cryptography implementations. 72% of international manufacturers intend to increase R&D for low-noise, high-speed photon counters.

Region-Specific Investment Areas

Adoption of these counters is highly dependent upon developing regulations, especially in healthcare, telecommunications, and defense. 71% of the respondents in the survey are of the opinion that regulatory clarity will drive commercial adoption.

AWS Consensus: Across global markets, cost pressures, miniaturization, and AI integration are top industry drivers.

The Key Variances

One-size-fits-all will not be a solution. Companies need to model these counters according to regional agendas-AI-driven imaging for the USA, quantum encryption for Europe, and affordable miniaturization for Asia.

| Country | Regulatory Impact & Certifications |

|---|---|

| United States | FDA 510(k) clearance needed for medical photon counters; NIST calibration standards; export restrictions on quantum photonics. |

| India | BIS compliance is obligatory; Make in India encourages domestic production, but high import tariffs affect costs. |

| China | CCC certification obligatory; tough cybersecurity regulations on photonic encryption; government funds R&D in quantum photonics. |

| United Kingdom | MHRA approval required for medical applications; tax credits for photonics R&D; post-Brexit import rules. |

| Germany | EU MDR compliance for medical devices; CE marking obligatory; government funds R&D in quantum photonics. |

| South Korea | KTR regulates certification; stricter data laws control photonic communication; focus on semiconductor-photonics integration. |

| Japan | PMDA certification necessary; steep entry barriers for foreign companies; government promotes quantum cryptography R&D. |

| France | ANSM controls medical devices; Green Industry Plan encourages environmentally friendly photonics manufacturing. |

| Italy | CE marking obligatory; biomedical photonics research grants. |

| Australia-NZ | TGA & Medsafe control healthcare use; stringent import regulation on high-tech components. |

The market for photon counters is fragmented, with many players involved in a diversified competitive environment.

Top players in the photon counting sector are emphasizing innovation, strategic alliances, and technology advancements in order to ensure competitiveness. Competitor strategies include competitive pricing, creating state-of-the-art technologies, entering collaborations with research centers, and diversifying product portfolios to address changing market requirements.

In November 2024, Canon Inc., its subsidiaries Canon Medical Systems Corporation and Canon Healthcare USA, Inc., launched a research partnership with Penn Medicine. The collaboration centers on the use of photon-counting computed tomography (CT) technology, after Canon installed its fourth photon-counting CT system at the Hospital of the University of Pennsylvania.

Basic, Background Compensation, Radiation Source Compensation

Medical Imaging, Fluorescence Microscopy, LIDAR / Satellite Laser Ranging (SLR), Others

North America, Latin America, Europe, Asia Pacific, MEA

Breakthroughs in AI-powered photon detection, applications of quantum computing, and improved medical imaging are propelling the industry forward.

Firms are competing by offering innovative products, forging strategic collaborations, and moving into new segments such as space exploration and structural health monitoring.

More stringent radiation safety requirements, quantum communication cybersecurity regulations, and changing medical imaging standards are defining product compliance.

The integration of AI is enhancing detection precision, refining imaging quality, and improving data processing speed in medical and research applications.

Healthcare, quantum computing, aerospace, and fiber-optic communications are seeing fast adoption with the advancement in performance and emergence of new applications.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Photonic Crystal Displays Market Size and Share Forecast Outlook 2025 to 2035

Photonic Integrated Circuit Market Size and Share Forecast Outlook 2025 to 2035

Photonics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Photonic Sensor Market - Trends & Forecast 2025 to 2035

Photonic Integrated Circuit & Quantum Computing Market - Trends & Forecast 2025 to 2035

Photonic Sensors & Detectors Market Insights - Growth & Forecast 2024 to 2034

Biophotonics Market Growth - Trends & Forecast 2025 to 2035

Multi-photon Microscopic System Market Size and Share Forecast Outlook 2025 to 2035

Single-Photon Emission Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Quantum Photonics Market Size and Share Forecast Outlook 2025 to 2035

Silicon Photonics – High-Speed Data & Optical Innovations

Geiger Counters Market Analysis by Application, Type, and Region: Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA