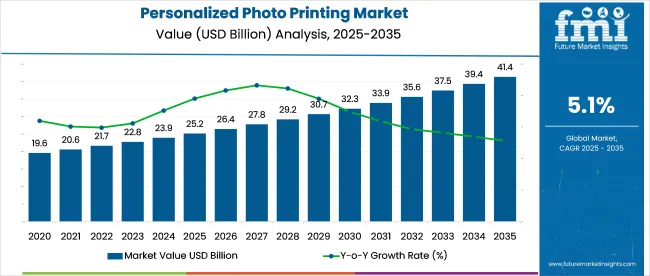

The Global photo printing and merchandise market is expected to grow from USD 25.16 billion in 2025 to USD 40.1 billion by 2035. A CAGR of 5.1% is forecasted during this period. Growth is being driven by rising demand for personalized photo products and expanding mobile photo editing capabilities.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 25.16 billion |

| Industry Value (2035F) | USD 40.1 billion |

| CAGR (2025 to 2035) | 5.1% |

The introduction of high-resolution smartphone cameras post-2023 has accelerated photo printing volumes. Shifts in consumer behavior toward memory-based gifting have expanded demand for photo calendars, books, and wall art. Regulatory focus on sustainable production, including the EU’s 2024 Green Printing Directive, has encouraged the use of recyclable substrates in merchandise.

Snapfish CEO Laura Thomas remarked in 2025, “Convenience, quality, and eco-focus are now inseparable in consumer expectations.” The merchandise segment, especially mugs, apparel, and wall décor, has seen rapid uptake due to social media-driven personalization trends and influencer-led campaigns.

Traceability features have been introduced across major platforms. In 2024, CEWE CEO Dr. Christian Friege announced QR-code-enabled tracking for personalized orders to ensure delivery transparency. Blockchain-based order verification is being piloted in logistics hubs. The 2024 Digital Imaging Sustainability Award was awarded to Printique for its zero-waste waterless ink technology.

The photo printing and merchandise market holds varying share percentages within its parent markets. In the personalized gifts industry, photo products like custom mugs, calendars, and apparel likely account for around 25%. In the consumer electronics industry, photo printing's share is minimal, at about 1%, as it’s more of a complementary sector driven by smartphone advancements.

In the e-commerce market, the photo printing and merchandise industry holds a more significant portion, estimated at 5%, due to the integration of personalized products into e-commerce platforms. The printing industry sees around 5% dedicated to photo-based printing, while in the home décor industry, photo merchandise like wall art and photo books likely captures around 8% of the market, as personalized home décor items continue to rise in popularity.

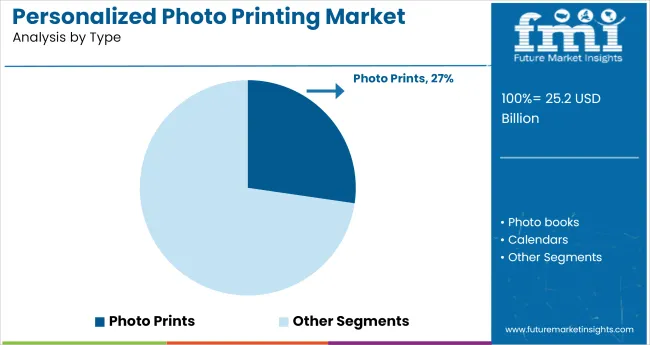

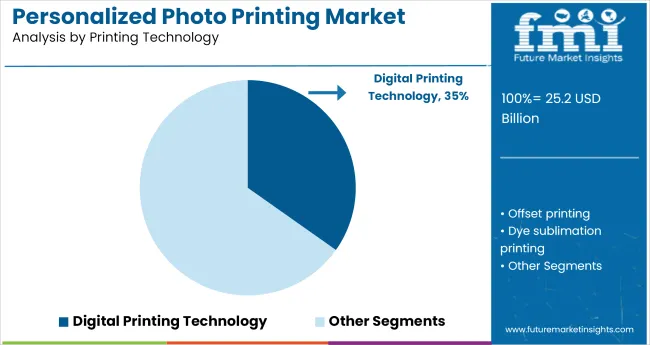

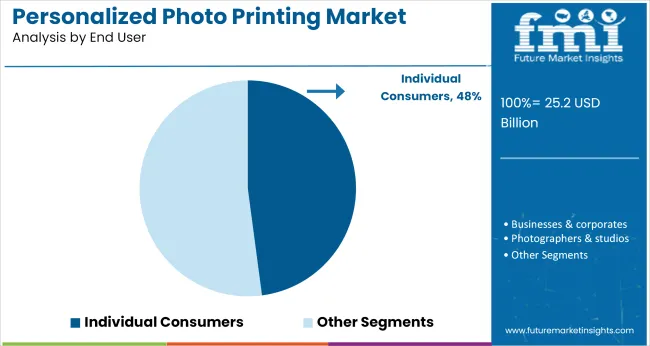

The market is segmented by product type, printing technology, end user, and region. Photo prints are expected to dominate the product type segment, holding a 27.3% share in 2025. Digital printing technology is anticipated to lead the printing technology segment, with a 34.8% share. Individual consumers are projected to drive the largest market share in the end-user segment, with 47.9% share.

The photo prints product segment is projected to capture 27.3% of the market in 2025. Photo prints remain a popular choice due to their wide range of customization options, from family portraits to event memories. Advances in digital printing technology and high-quality paper are enhancing the appeal of photo prints. Leading companies like Shutterfly, Snapfish, and Vistaprint dominate this segment, offering consumers quick turnaround times and various print formats, including framed prints, canvases, and calendars.

Digital printing technology is expected to hold 34.8% share in 2025. This technology offers fast production times and superior image quality compared to traditional printing methods, making it the preferred choice for personalized photo printing services. Digital printing is also cost-effective for short-run print jobs, catering to a wide range of consumer needs. Companies like Canon, HP, and Epson are key players in advancing digital photo printing technology, offering advanced printing solutions for both personal and business use.

Individual consumers are projected to capture 47.9% share in 2025. The demand for personalized photo prints is primarily driven by consumers seeking customized solutions for gifts, home decor, and special memories. Social media trends and a growing preference for online personalization services are fuelling this segment's growth. Companies like Snapfish and Shutterfly have capitalized on this trend by offering user-friendly online platforms for personalized printing services.

The market is experiencing steady growth, supported by rising consumer interest in personalized products and gift items. While digital platforms continue to dominate image storage and sharing, demand for tangible photo-based products remains strong across retail, event, and gifting channels. However, the industry faces headwinds from declining in-store photo printing demand and the need to adapt to shifting consumer expectations around delivery speed, customization, and mobile integration.

Personalization and Occasion-Based Demand Boost Growth

Rising demand for personalized gifting and keepsakes is fueling growth in photo printing services and merchandise. Consumers are increasingly turning to photo books, calendars, mugs, and apparel for birthdays, weddings, and holidays. In Asia and Latin America, demand is growing by over 7% annually, led by mobile-first platforms that simplify image uploads and design. Print-on-demand infrastructure is enabling faster fulfillment while reducing inventory risks for suppliers.

Shift Toward Digital Alternatives and Low Margins Pose Risks

The rise of cloud photo storage and social sharing platforms is reducing dependency on printed images, particularly among younger consumers. Photo merchandise margins are under pressure due to competition from low-cost online vendors and the need for constant innovation in formats and themes. Retail photo kiosks are experiencing lower foot traffic, prompting players to shift toward e-commerce fulfillment hubs.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4% |

| China | 6% |

| India | 8% |

| Germany | 4% |

| United Kingdom | 3.8% |

The global personalized photo printing market is set to grow at a 5.1% CAGR from 2025 to 2035. The United States and Germany, both OECD countries, are projected to grow slower than the global average at 4.0% and 4.0%, respectively. This slower growth can be attributed to market saturation and a shift towards digital and automated printing solutions.

In contrast, India, a BRICS nation, is forecasted to grow at 8.0%, surpassing the global rate by 2.9 percentage points. This surge is driven by increasing disposable incomes, a burgeoning e-commerce sector, and a growing trend of personalized gifting.

China, also part of the BRICS, is forecast to grow at 6.0%, driven by a young consumer base and rapid adoption of mobile-based photo printing services. The United Kingdom lags with the lowest projected CAGR at 3.8%, influenced by reduced consumer spending and a preference for digital alternatives.

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

Demand for personalized photo printing in the United States is set to grow at a CAGR of 4% from 2025 to 2035. Strong consumer demand for personalized gifts and home décor items is a key driver of growth. Digital printing technology and the expansion of online platforms have facilitated easy access to customized products.

Major players like Shutterfly and Vistaprint are extending their portfolios to include various photo-based products, including framed prints, calendars, and photo books. The growing trend of photo prints as gifts and home decor is expected to fuel demand, particularly during holidays and special events.

Sales for personalized photo printing in the United Kingdom are growing at a CAGR of 3.8% from 2025 to 2035. The market benefits from an established e-commerce infrastructure and strong consumer demand for personalized photo products, particularly photo cards, invitations, and gifts.

A growing trend of customized products for special occasions like weddings, birthdays, and Christmas is propelling growth. Online platforms such as Photobox and Snapfish continue to lead the market, offering consumers a wide range of customizable photo products. Additionally, DIY photo projects, scrapbooking, and personalized gifts are gaining popularity, further driving demand for photo printing services.

Demand for personalized photo printing in China is expanding at a 6% CAGR from 2025 to 2035, driven by a rapidly expanding middle class and higher disposable incomes. The trend of personalized gifting and home décor, especially during holidays like Chinese New Year, is propelling market demand.

E-commerce platforms such as Taobao and JD.com are increasingly promoting personalized photo products, making them more accessible to both urban and rural consumers. Additionally, the growing consumer preference for unique, custom-made items is expected to further boost the demand for personalized photo products across various sectors.

India is expected to lead the personalized photo printing market, with a high CAGR of 8% from 2025 to 2035. This growth is fueled by the rise of e-commerce, smartphone penetration, and a growing middle-class population. Online photo printing services are increasingly popular, with platforms like Printo and Zoomin offering customized photo products like calendars, photo books, and wall décor.

The strong demand for personalized gifting during festivals such as Diwali, weddings, and birthdays is expected to drive further growth. The penetration of internet services and the growing trend of online shopping will continue to contribute to market expansion.

Demand for personalized photo printing in Germany is forecast to grow at a 4% CAGR from 2025 to 2035. The demand for high-quality custom photo products, such as photo books, personalized calendars, and framed prints, continues to rise. Consumers are increasingly seeking personalized items as keepsakes, particularly around holidays like Christmas.

The strong growth of online photo printing platforms, including those offering premium-quality prints, is helping to cater to the demand. The market is also benefiting from the German preference for high-end, customized photo products, which are being sold via both domestic and international e-commerce platforms.

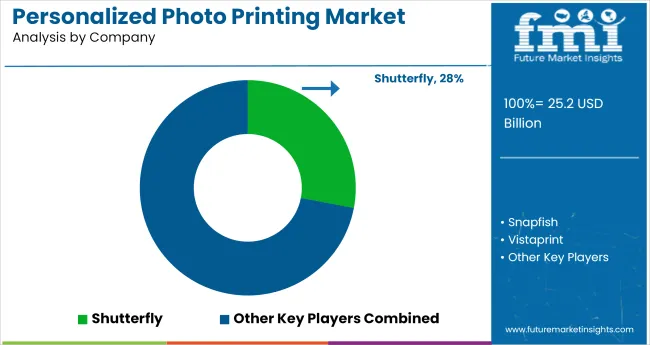

The market is driven by key players like Shutterfly, Snapfish, and Vistaprint, which dominate with extensive product portfolios, strong brand recognition, and customizable photo options. Shutterfly leads with its vast customization capabilities and high-quality offerings, while Snapfish and Vistaprint attract customers with affordable and diverse photo gifts and prints.

Mixbook has gained popularity in the premium photo book segment, offering high-quality personalized options. Mpix, Printique, and Blurb are targeting photography enthusiasts and professionals with specialized, high-end print services, known for their superior quality and customization. Zazzle and Redbubble have built success by offering photo printing on various merchandise beyond traditional items. Nations Photo Lab focuses on professional photo prints, appealing to photographers and studios.

With increasing competition, companies must improve e-commerce platforms, enhance customer experience, and expand product offerings to maintain their edge. Social media partnerships and digital solutions are key growth strategies.

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 25.16 billion |

| Projected Industry Size (2035) | USD 40.1 billion |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Types Analyzed (Segment 1) | Photo Prints, Photo Books, Calendars, Photo Cards & Invitations, Wall Décor, Mugs & Drinkware, T-shirts & Apparel, Others |

| Printing Technologies Analyzed (Segment 2) | Digital Printing, Offset Printing, Dye Sublimation Printing, Inkjet Printing, Thermal Printing, Silver Halide Printing |

| End Users Analyzed (Segment 3) | Individual Consumers, Businesses & Corporates, Photographers & Studios, Educational Institutions, Others |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, South Korea, Australia, South Africa, Saudi Arabia, UAE |

| Key Players | Shutterfly, Snapfish, Vistaprint, Mixbook, Mpix, Printique, Blurb, Zazzle, Redbubble, Nations Photo Lab |

| Additional Attributes | Dollar sales, share by product type, printing technology adoption trends, rise of custom merchandise, impact of e-commerce platforms in market growth, seasonal demand fluctuations= |

The industry is segmented into photo prints, photo books, calendars, photo cards & invitations, wall décor, mugs & drinkware, t-shirts & apparel, and others.

The industry is divided into digital printing, offset printing, dye sublimation printing, inkjet printing, thermal printing, and silver halide printing.

The industry is segmented into individual consumers, businesses & corporates, photographers & studios, educational institutions, and others.

The industry is categorized into North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East and Africa.

The industry is projected to reach USD 25.16 billion in 2025.

The industry is expected to grow at a CAGR of 5.1% from 2025 to 2035.

The photo prints segment is expected to capture 27.3% of the market in 2025.

The South Asia region, particularly India, is projected to register a CAGR of 8% from 2025 to 2035.

The industry is projected to reach USD 40.1 billion by 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Photo Printing and Merchandise Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Japan Photo Printing & Merchandise Market Analysis - Size, Share & Trends 2025 to 2035

Korea Photo Printing and Merchandise Market Analysis - Size, Share & Trends 2025 to 2035

Photoresist Chemical Market Forecast and Outlook 2025 to 2035

Photomask Inspection Market Forecast and Outlook 2025 to 2035

Photostability Chamber Market Size and Share Forecast Outlook 2025 to 2035

Photo-Label Verifiers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Photographic Paper Market Size and Share Forecast Outlook 2025 to 2035

Photosensitive Alignment Film Market Size and Share Forecast Outlook 2025 to 2035

Photomultiplier Tube Accessories Market Size and Share Forecast Outlook 2025 to 2035

Photovoltaic Grade High Purity Crystalline Silicon Market Size and Share Forecast Outlook 2025 to 2035

Photographic Film Processing Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Equipment Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Photoluminescent Paints Market Size and Share Forecast Outlook 2025 to 2035

Photovoltaic Mounting System Market Analysis - Size, Share, and Forecast 2025 to 2035

Photosensitive Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Photoacoustic Tomography Market Size and Share Forecast Outlook 2025 to 2035

Photonic Crystal Displays Market Size and Share Forecast Outlook 2025 to 2035

Photoresist Electronic Chemical Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA