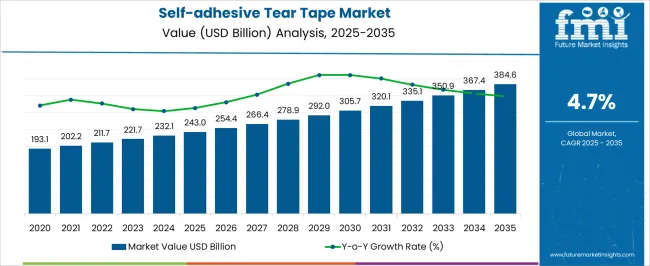

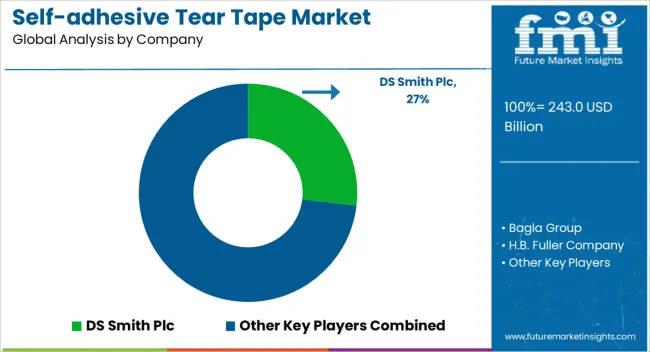

The Self-adhesive Tear Tape Market is estimated to be valued at USD 243.0 billion in 2025 and is projected to reach USD 384.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

| Metric | Value |

|---|---|

| Self-adhesive Tear Tape Market Estimated Value in (2025 E) | USD 243.0 billion |

| Self-adhesive Tear Tape Market Forecast Value in (2035 F) | USD 384.6 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The self adhesive tear tape market is expanding steadily as brand owners and manufacturers increasingly prioritize convenience, security, and sustainability in packaging solutions. Growing consumer demand for easy opening mechanisms in food, beverage, and tobacco packaging has significantly boosted adoption.

In addition, heightened awareness regarding anti counterfeiting measures has encouraged companies to integrate tear tapes with security features such as holograms and printed identifiers. Advances in material science, particularly in polypropylene substrates, have improved tape durability, flexibility, and compatibility with automated packaging lines.

Regulatory emphasis on eco friendly packaging and recyclability is further pushing innovations in bio based and recyclable tear tape formats. With increasing investments in packaging efficiency and consumer experience enhancement, the market outlook remains strong across both developed and emerging economies.

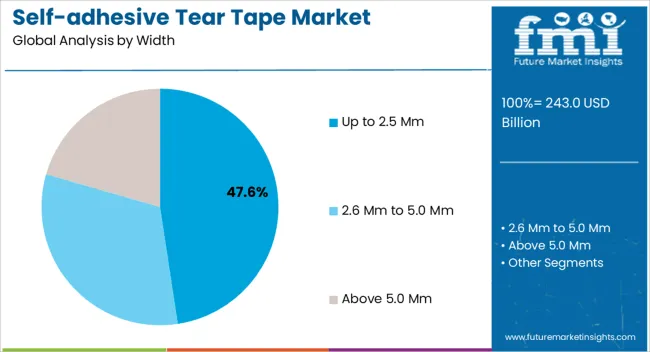

The up to 2.5 mm width segment is expected to account for 47.60% of the total revenue by 2025 within the width category, making it the dominant format. This preference is driven by its versatility, compatibility with high speed packaging machinery, and ability to deliver a clean tear line across multiple packaging substrates.

The narrow width enhances aesthetics while ensuring cost effectiveness for manufacturers.

Its use in lightweight flexible packaging has expanded significantly, further reinforcing its leadership in this segment.

The polypropylene material type segment is projected to represent 54.20% of the market revenue by 2025, positioning it as the leading material. Its dominance is attributed to properties such as high tensile strength, flexibility, and resistance to moisture, which are critical in food and consumer goods packaging.

Polypropylene also offers cost efficiency and compatibility with advanced printing technologies, enabling brand owners to incorporate promotional and security features.

The balance of performance, affordability, and recyclability has solidified its role as the preferred material type in tear tape production.

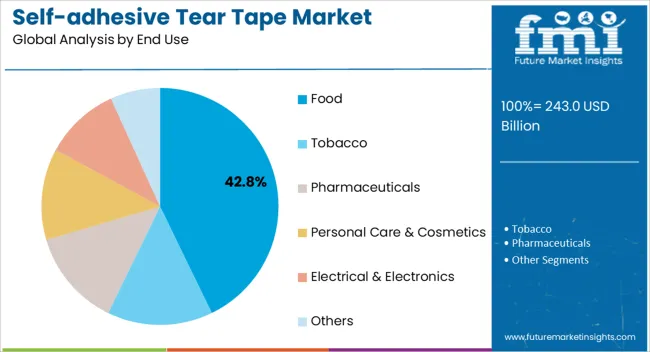

The food segment is expected to hold 42.80% of the total revenue by 2025 within the end use category, establishing it as the most significant contributor. This leadership is supported by rising consumer preference for convenient, tamper evident, and resealable food packaging formats.

Manufacturers are increasingly incorporating tear tapes into snack packs, confectionery, and frozen food packaging to enhance ease of access and product integrity.

With food safety regulations becoming more stringent and brand loyalty closely tied to packaging experience, the food segment continues to drive substantial demand for self adhesive tear tapes.

According to Future Market Insights, the global market was valued at USD 193.1 million in 2020 and is estimated to reach USD 384.6 million by 2035. The increasing demand for flexible, quick-opening packaging is increasing the adoption of self-adhesive tear tapes. The popularity of self-adhesive packaging tapes is growing due to their convenient and cost-effective solutions.

Several end-user industries, such as personal care, food & beverages, manufacturing, and healthcare, are advancing the global market. Countries in Asia are significantly growing due to the rising demand for suitable and easy packaging products in Japan, China, South Korea, and India.

Short-term (2025 to 2029): The increasing demand for convenient and safe packaging is driving the market growth. The significantly growing manufacturing and packaging industries are increasing the adoption of self-adhesive tear tapes during the forecast period.

Medium-term (2029 to 2035): Growing industries, innovations, launching unique products, and increasing demand for sustainability are fueling the market size. The notably growing e-commerce platform is another factor expanding the market size. Among regions, Asia Pacific is significantly growing the market size by rising demand for self-adhesive packaging tapes.

Long-term (2035 to 2035): Growing research and development activities, launching innovative products, and rising end-use industries are bolstering the market growth. The government takes initiatives to promote eco-friendly packaging, which drives the market size further.

Based on product type, the biaxially oriented polypropylene segment dominates the global market by securing a maximum share by 2035. The various end-use industries such as consumer goods, food & beverages, and pharmaceuticals are widely increasing the adoption of self-adhesive tear tapes. These end-users prefer biaxially oriented polypropylene due to its excellent properties, high resistance, high tensile strength, and printability.

The biaxially oriented polypropylene is moist-resistant, and chemical-free tapes, which drives market revenue. Consumers are increasing the demand for biaxially oriented polypropylene due to its visibility and clarity. They are widely used for gift wrapping, food packing, and labeling.

Based on end use, the packaging sector is dominating the global market by registering a significant share during the forecast period. The increasing demand for sustainable, easy-to-open, and flexible packing is expanding the packaging industry. Manufacturers are adopting sustainable packaging for various consumer products such as personal care, food, and beverages.

The manufacturers use different types of material for packaging, including plastic, adhesives, paper, and others. Packaging made using these kinds of materials is highly versatile and can adapt to any packaging product. Such packaging enhances the packaging style by printing brand names for promotion. Other end-use industries such as food, cosmetics, pharmaceuticals, and electricity & electronics are also vital to the global market.

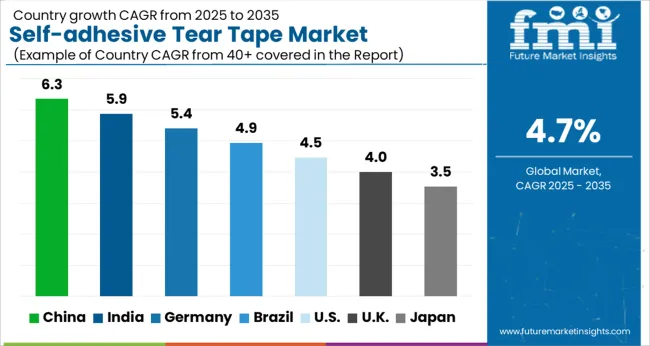

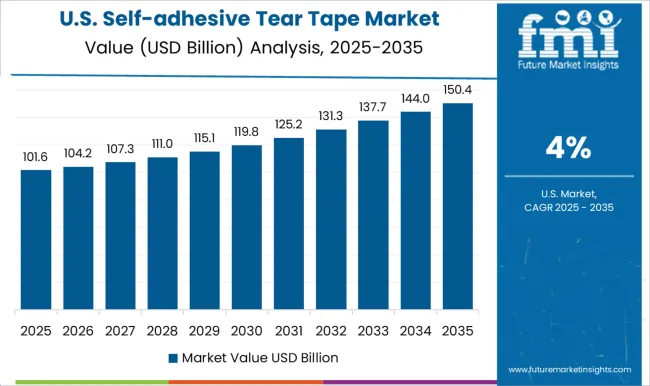

The United States is anticipated to dominate the global market by capturing a huge revenue during the forecast period. The rising demand for safe, convenient, and designer packaging among end-users is expanding the country’s market share. The popularity of pre-designed line packaging without any need for cutting is further driving market growth.

The increasing e-commerce and online shopping to buy large packaging materials drive the United States market. The key companies in the United States self-adhesive tear tapes market are Nitto Denko Corporation, 3M, and Tesa SE. The market is estimated to grow prominently by rising demand for safe and convenient packaging solutions in the coming years.

China is one of the key consumers and producers of self-adhesive tear tapes in the global market. China secures a huge share of the global market through several end-user industries. The demand for self-adhesive tear tapes is increasing among these end-use industries in China. These tapes are beneficial for sealing, fixing, and packaging industrial products in convenient ways.

The market is highly competitive in China by the number of competitors and essential players. The key companies in China include Tesa SE, 3M, and Nitto Denko Corporation. These essential companies are innovating sustainable and eco-friendly packaging to reduce environmental impact. Through their innovations, they are meeting consumers' expectations in the country.

India is another Asia Pacific nation estimated to contribute a significant share of the global market by 2035. The rising advanced technologies, e-commerce websites, and growing packaging and manufacturing industries fuel the Indian market. The growing demand for convenient and safe packaging is propelling the market growth in the country.

Industrial manufacturers use self-adhesive tear tapes to secure products during transportation. These tapes help to maintain the products while the loading and unloading processes. Due to growing hazardous pollution and chemicals, the government of India has taken initiatives to promote eco-friendly packaging. By developing high-quality packaging material, manufacturers can expand India self-adhesive tear tapes market.

The manufacturers are experimenting through their market research and making several strategies to innovate high-quality products to expand the business. A few of the strategies discussed here are as follows:

Developing Innovative Products: The manufacturers can innovate unique tear tapes that improve quality and strength and are easy to tear. The manufacturers can collaborate with key companies and research institutions to reach the relevant audience.

Expand Portfolio: Manufacturers can upsurge their product portfolio by providing a variety of self-adhesive tear tapes to several industries, including healthcare, food, cosmetics, and others.

Marketing: Manufacturers invest a few portions of capital in marketing to build their brand, reach relevant consumers and generate leads. They are investing in marketing through print media, social media, trade shows, and other online platforms to raise awareness of their products.

Competitive Pricing: Manufacturers attract consumers through their price strategy. They are offering products at a competitive price to expand the market growth.

The present prominent players in the global market highly fragment the market. These players are playing a vital role in uplifting the market by investing in research and development activities. These key players are adopting several marketing tactics, including collaborations, mergers, acquisitions, partnerships, and product launches.

Other Prominent Players Working in the Global Market are:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for Value |

| Key Countries Covered | The United States, The United Kingdom, Japan, India, China, Australia, Germany |

| Key Segments Covered | Product Type, Width, End Use, Region |

| Key Companies Profiled | DS Smith plc; Bagla Group; H.B. Fuller Company; 3M Company; Tesa SE; Wavelock Advanced Technology Co., Ltd.; Marotech Inc.; Tann Germany GmbH; Essentra Plc.; NADCO Tapes & Labels, Inc.; Uyumplast Ambalaj San.tic.ltd.Sti; AEC Group; Western Paper Industries (Pvt) Ltd.; NOWOFOL GmbH |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

Polypropylene

The global self-adhesive tear tape market is estimated to be valued at USD 243.0 billion in 2025.

The market size for the self-adhesive tear tape market is projected to reach USD 384.6 billion by 2035.

The self-adhesive tear tape market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in self-adhesive tear tape market are up to 2.5 mm, 2.6 mm to 5.0 mm and above 5.0 mm.

In terms of material type, polypropylene segment to command 54.2% share in the self-adhesive tear tape market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloth Self-adhesive Tapes Market

Tear-tab Lids Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Leading Tear-Tab Lids Manufacturers

Tear Tab Cap Market

Tear Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Tear Tape Providers

Market Share Insights of Tear Tape Dispenser Manufacturers

Stearic Acid Monoethanolamide (SMEA) Market Size and Share Forecast Outlook 2025 to 2035

Stearyl Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Stearic Acid Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Stearoyl Lactylates Market Analysis by Product Type, End Use, Sales Channel, and Region Through 2035

Stearyl Tartrate Market

Isotearic Acid Market Size and Share Forecast Outlook 2025 to 2035

Skin Tears Treatment Market Growth – Industry Outlook & Forecast 2024-2034

Lead Stearate Market

Butyl Stearate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactylate Market Growth - Functional Uses & Industry Expansion 2025 to 2035

Calcium stearoyl-2-lactylate Market

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA