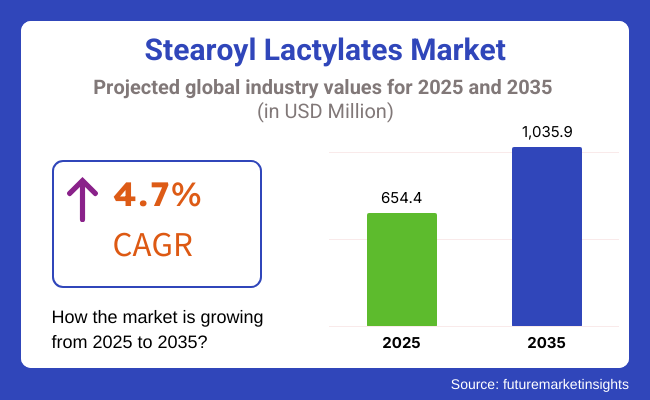

The global stearoyl lactylates market is projected to be valued at USD 654.4 million in 2025. It is anticipated to reach USD 1,035.9 million by 2035, expanding at a CAGR of 4.7% during the forecast period. There is a steady increase in sales owing to the rising demand from the food, pharmaceutical, and personal care sectors.

These lactylates include sodium stearoyl lactylate (SSL) and calcium stearoyl lactylate (CSL), which are the most commonly used compounds, such as emulsifiers and dough strengtheners as well as stabilizers in a diverse range of applications. Their action as multicomponent makes them irreplaceable in such products as snacks, dairy-free products, and such consistent foods as canned foods.

The bakery and confectionery industry is the main beneficiary of the companies that are using these types of glycolic acid along with SSL and CSL in their products. SSL and CSL are used as dough conditioners, which improve texture and are associated with shelf-life extension, thus making them the perfect choice for food suppliers. Besides, people tend to buy clean-label and plant-based food products with SSL and CSL as the most efficient emulsifiers in vegan and gluten-free formulations.

The pharmaceutical sector is one more area that is contributing to the growth of the industry, as these lactylates are used as excipients in medicine and are added to enhance solubility and stability. The personal care industry has also caught the trend, being exposed to companies interested in using lactylates in makeup and skincare products, as they are used as emulsifiers and conditioning agents in creams, lotions, and hair care products.

Technological changes in the processing and emulsification of food products, as well as the development of new formulations of these lactylates that are increasingly eco-compatible, are other drivers of innovation. The focus of producers will be on non-GMO and biodegradable sources to meet the customers' request for natural and environmentally friendly products. The proliferation of functional foods and health supplements is another factor giving rise to openings.

There are some challenges, including the instability in the prices of raw materials and the restrictions on food additives in some specific regions. Meeting international food safety regulations and the constantly changing consumer preferences for additive-free products will have an impact on the growth of some applications.

Irrespective of these challenges, the industry has potential for expansion. The increasing need for texture-enhancing components in plant-based and high-protein food items is anticipated to increase the utilization. The progress made in research on groundbreaking emulsification techniques and eco-sustainable ingredient sourcing will likely lead to the improvement of product innovation.

There was steady growth from 2020 to 2024, with rising demand from the food and beverage industry. Stearoyl lactylates, as emulsifiers and dough conditioners, gained prominence with rising interest among consumers for clean-label and natural foods. High demand for the baking sector, mostly in the developing world, fueled the demand to create baked foods of enhanced texture and shelf life.

Food manufacturers worked on promoting food product stability, reducing fat content, and responding to shifting consumer preferences for healthy products. Industry growth was enhanced by regulatory approval and stearoyl lactylates' Generally Recognized as Safe (GRAS) status.

Volatility in this period in the industry was produced, however, by issues such as volatile raw material costs, supply chain losses, and disparity in regional food safety legislation. In the coming 2025 to 2035 period, the industry is expected to undergo revolutionary changes. Food processing technology will provide cleaner and more effective processes of emulsification.

Expanding demand for gluten-free and plant foods will drive innovation in the development of lactylates to achieve these food opportunities. Greater attention to clean labels and organics will drive demand for manufacturers to find bio-based and non-GMO options as substitutes for these lactylates.

AI and machine learning will optimize manufacturing procedures to save on costs and product consistency. In addition, increased consumer awareness of food additives and their impact on health will lead to open labeling and increased product traceability. Green packaging and eco-friendly manufacturing processes will also be the drivers of competition.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased usage in the bakery industry. | Extension of plant-based and gluten-free stearoyl lactylate products. |

| Using lactylates for improved texture and extended shelf life. | Production of bio-based and non-GMO lactylates. |

| Regulatory approvals made growth easier. | Transparency labeling and traceability of products are becoming the focus. |

| Fluctuations in raw material prices and supply chain problems create issues. | Use of AI to automate manufacturing processes to improve cost-effectiveness. |

| Growing demand for natural and clean-label emulsifiers. | There is a growing focus on sustainable sourcing and green manufacturing. |

The industry is growing steadily due to its increasing application as an emulsifier and stabilizer in food, pharmaceutical, personal care, and animal nutrition applications. The products are in great demand due to their ability to enhance texture, increase shelf life, and enhance the dispersion of ingredients.

These lactylates are used mainly in the bakery, dairy, and processed food sectors in the food and beverage industry to reinforce dough, enhance moisture retention, and extend the freshness of products. The pharmaceutical industry employs these emulsifiers in drug preparations, particularly in oral and topical use, for improved stability and bioavailability.

Personal care industries utilize these lactylates in lotions, shampoos, and creams as they provide skin-conditioning and emulsification properties. They also provide nutrition and aid in the texture of animal foodstuffs. Business participants have turned away from making regular additives while following regulation concerns and increased pressures since they are also mandated to use non-GMO clean-label emulsifiers.

The industry is growing, particularly because of increasing needs in the food, cosmetics, and pharmaceutical industries. Yet, the strict food safety and regulatory standards create difficulties in compliance. Companies have to follow the dynamic changes in their policies, get the required certifications, and be open to the public.

The industry is affected by supply chain disruptions, which are caused by changes in the availability of raw materials, higher production costs, and logistical challenges. The industry, due to its reliance on palm oil and dairy-based materials, is susceptible to environmental regulations and supply limitations.

Businesses are advised to change their sourcing and purchasing methods to be more sustainable and to invest in alternative channels. The demand for organic and non-GMO emulsifiers is becoming more serious because of competition for plant-based alternatives.

Uncertainty in the economy, changes in trade laws, and changes in industry trends all impact growth. To provide a long future for themselves, companies need to simplify their supply chain and seek partnerships with food, personal care, and pharmaceutical firms to develop new lactylates for use across different industries.

Sodium Stearoyl Lactylates dominate with Strong Demand in the Food Industry

| Segment | Value Share (2025) |

|---|---|

| Sodium Stearoyl Lactylates (By Product Type) | 65.0% |

Sodium Stearoyl Lactylates (SSL) as a type of Stearoyl Lactylate hold the largest share that is estimated to be 65.0% of the total industry in 2025, followed by Calcium Stearoyl Lactylates (CSL) Sodium Stearoyl Lactylate (SSL) is used as a food additive in the bakery, dairy, and processed food industries because it serves as an excellent emulsion and stabilizes and strengthens the dough.

It enhances texture, shelf life, and volume in baked products like bread, rolls, and cakes. Prominent manufacturers, including Corbion, Kerry Group, and Palsgaard, produce SSL for industrial use. Furthermore, the cost-effectiveness and enhanced performance of SSL in food formulation have further helped the ingredient secure a larger share of the marketplace.

Calcium Stearoyl Lactylate (CSL) holds 35.0% of the share, which is mainly used in gluten-free & specialty baked products, provides dough-conditioning, and enhances crumb structure. It is also used in candy and instant noodle formulations, increasing the stability of the product. Riken Vitamin Co., Ltd., for example, and BASF SE, supply the CSL to the company for its application in clean-label and functional food products, among others.

With consumer demand for high-quality, shelf-stable, and clean-label food products increasing, SSL and CSL will both continue to be important in food processing, dairy, and bakery applications, providing texture, moisture retention, and overall product quality.

| Segment | Value Share (2025) |

|---|---|

| Bakery & Confectionery (By End Use) | 45.0% |

Based on end use, the Stearoyl Lactylates Market is segmented into Bakery & Confectionery, maintaining the lead with 45.0% of the total share in 2025, followed by the Food and Beverage Industry, accounting for 12.0% of the total market.

Stearoyl lactylates, for example, Sodium Stearoyl Lactylate (SSL) and Calcium Stearoyl Lactylate (CSL), are used to enhance dough strength, aeration, and texture in breads, cakes, pastries, and biscuits. Their emulsifying and moisture-retaining characteristics also contribute to shelf life and product freshness.

Corbion, Palsgaard, and Kerry Group are major companies supplying SSL and CSL to industrial bakers worldwide. Several areas, such as clean-label and gluten-free bakery products, are others that continue to drive demand by CSL adoption in the area of specialty formulations.

In the food & beverage sector, these lactylates function as stabilizers and emulsifiers in food such as dairy products, sauces, and instant foods. They're good at enhancing creaminess, solubility, and texture in products, including coffee creamers, ice creams, and processed cheeses.

Some companies, including Riken Vitamin Co., Ltd. and BASF SE, already manufacture food-grade SSL and CSL, driven by the growing demand for such functional ingredients used in processed foods. Because consumers prefer higher-quality and shelf-stable food products with clean labels, the demand will be high in bakery, confectionery, and general food applications.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

| UK | 4.3% |

| France | 4.0% |

| Germany | 4.2% |

| Italy | 4.1% |

| South Korea | 4.7% |

| Japan | 3.8% |

| China | 5.0% |

| Australia | 4.4% |

| New Zealand | 4.2% |

The USA industry CAGR will be 4.5% from 2025 to 2035. It is a leading country that produces these lactylates due to its well-developed food and beverage industry. Growing demand for clean-label foods is compelling consumers to choose food producers embracing emulsifiers in bakery foods, dairy foodstuffs, and meat substitutes.

Companies such as Archer Daniels Midland (ADM) and Cargill are putting a lot of money into research to enhance the functional attributes of emulsifiers, further expanding sales. The USA also has an established cosmetics and personal care industry, which is incorporating lactylates into skincare and haircare products.

Gaining consumer demand for natural and sustainable ingredients is driving the growth of products. Regulatory bodies like the FDA also provide high standards for products, which are attractive to global companies to manufacture and sell in the country.

The UK is projected to grow with a CAGR of 4.3% from 2025 to 2035. The strong demand in the UK for plant-based and organic products has given a lucrative platform to lactylates as a natural emulsifier. Confectionery products and bakeries like Premier Foods and Warburtons are making aggressive efforts to incorporate these emulsifiers in order to gain a better texture and shelf life.

The UK personal care and beauty industry is also a major growth driver. Major players like The Body Shop and Lush are turning their focus towards green formulations, which are increasing the use of plant-based emulsifiers. Expansion of e-commerce websites also supports growth by offering stearoyl lactylate-based skin care products worldwide.

The CAGR of France is anticipated to be 4.0% in 2025 to 2035. As a major dairy and bakery market, France has an increased demand to enhance food stability and texture. Companies such as Danone and Lactalis are expanding their product portfolio, incorporating these emulsifiers in dairy substitutes like vegan yogurts.

In addition, France's world-famous luxury cosmetics industry is a significant driver of market growth. Firms like L'Oréal and Clarins focus on employing high-quality emulsifiers to enhance the stability of their premium skincare and haircare products. The country's strict clean beauty legislation also fuels the demand for natural emulsifiers.

The CAGR for Germany is forecasted at 4.2% from 2025 to 2035. The emphasis on the country's food innovation and sustainability is fueling stearoyl lactylate demand in the food and beverage industry. Bakery firms in Germany, such as Dr. Oetker and Bahlsen, are deepening their use of clean-label emulsifiers to cater to consumers appetite for healthier food.

Moreover, Germany's well-established pharmaceutical and personal care markets contribute significantly to market development. Leading players like Beiersdorf (Nivea) and Henkel are employing lactylates to create moisturizing products. The country's emphasis on research and development ensures continual product development, which places Germany in a dominant position in the emulsifier market.

The CAGR for Italy is estimated to be 4.1% from 2025 to 2035. High per capita consumption of bakery products and dairy products, and Italy's rich food heritage, fuel the need for food-grade emulsifiers. Barilla and Ferrero incorporate lactylates in confectionery and baked goods for texture enhancement and shelf life extension.

The Italian cosmetics industry is also a major driver of growth. Luxury beauty brands such as Kiko Milano and Bottega Verde are formulating their products using high-grade emulsifiers to meet consumers' demands for smooth, stable, and sustainable cosmetics.

The South Korean CAGR is estimated to be 4.7% from 2025 to 2035. South Korea's rapidly expanding bakery industry, coupled with increasing demand for Western bread and pastries, is fueling the sales of emulsifiers like stearoyl lactylates. Large bakery chain companies like Paris Baguette have been aggressively embracing these emulsifiers to enhance product quality.

South Korea's dominance of the global beauty and skincare industry is another driving force. Brands like Amorepacific and Innisfree are at the forefront of using emulsifiers in light, long-lasting products. The Korean wave (Hallyu) has also driven worldwide popularity for K-beauty, expanding the industry for personal care emulsifiers.

Japan's CAGR is forecast to be 3.8% from 2025 to 2035. Japan's food industry has a high quality and consistent demand for products. Therefore, stearoyl lactylates are a must for bakery and dairy production. Yamazaki Baking and Meiji Holdings are two firms that use emulsifiers to maintain their product texture and stability.

The nation's sophisticated cosmetics business also plays a significant part in sales growth. Shiseido and Kosé create high-performance hair and skin care products utilizing premium emulsifiers. Japan's population of older consumers is driving demand, thus helping to sustain growth.

China's CAGR has been estimated at 5.0% from 2025 to 2035. As the world's largest food consumer, China witnesses rising demand for emulsifiers in processed foods, plant-based dairy alternatives, and baked foods. Domestic giants like Bright Dairy and Want Want Group invest in food innovation to keep up with evolving consumer needs for healthier food.

China's huge personal care industry, controlled by players such as Pechoin and Chando, is also fueling demand for emulsifiers. E-commerce growth and cross-border beauty commerce are similarly propelling the sector ahead, so China is an extremely appealing destination for stearoyl lactylates.

Australia's CAGR is projected to be 4.4% from 2025 to 2035. The country's strong organic and clean-label food movement has increased the demand for natural emulsifiers in dairy and baked foods. Goodman Fielder and Arnott are some of the brands that are adopting stearoyl lactylates to enhance the quality of their products.

Australia's booming skincare industry is also a significant driver for growth. Aesop and Jurlique are some of the brands that are using plant-based emulsifiers to attract consumers seeking sustainable beauty products. Growing demand for cruelty-free and vegan cosmetics is also driving the trend.

The CAGR for New Zealand is estimated at 4.2% from 2025 to 2035. The country's dairy-driven economy is one of the key drivers of emulsifier demand, with Fonterra and Tatua using stearoyl lactylates to improve the texture of their dairy products.

New Zealand's niche but high-end cosmetics industry is also a key driving force. Companies like Antipodes and Trilogy focus on applying natural ingredients, driving the use of clean emulsifiers in skin care. The export industry for organic foods and cosmetics in New Zealand ensures sustainable growth in the emulsifier industry.

The industry is undergoing constant growth and is influenced by the requirement of lactylates in bakery, dairy processing, food, and the pharmaceutical and cosmetic industries. They are important emulsifying agents for textural improvements, prolonged shelf-life, and enhanced stability of ingredients. Clean-label and plant-based emulsifiers and their associated trends are at the forefront of the very dynamic of changing trends.

Cargill, DuPont, Palsgaard, Corbion, and Kerry Group are said to imbibe a new age of product innovation, signaling sustainable purchasing of ingredients and incorporation of new emulsifying technologies to meet changing consumer demands. Complementary to all these activities is also governmental impetus concerning food safety and the formulation of functional ingredients.

Demand is increasing for natural emulsifiers as opposed to chemicals, mainly biobased, and companies are focusing on investments in R&D and forming partnerships with food manufacturers to boost their product performance. Growth remains especially prolific in the Asia-Pacific and Latin American regions that are experiencing an upsurge in the consumption of processed food.

Among several strategic fundamental factors influencing the dynamics of competing are cost-efficient production, optimized supply chain, and penetration into new markets. Companies, e-commerce, and direct-to-consumer are working on strengthening their presence in the industry and addressing the increasing quest for specialty food ingredients.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill | 18-22% |

| DuPont | 15-19% |

| Palsgaard | 12-16% |

| Corbion | 10-14% |

| Kerry Group | 8-12% |

| Other Players (Combined) | 25-30% |

| Company Name | Key Offerings & Focus |

|---|---|

| Cargill | Provides functional emulsifiers for the bakery and dairy industries, emphasizing sustainable production as well as clean-label trends. |

| DuPont | Specializes in high-performance emulsifiers, targeting texture improvement in food and beverage applications. |

| Palsgaard | Focuses on plant-based, sustainably sourced emulsifiers, catering to the rising demand for natural ingredients. |

| Corbion | Develops customized emulsifier solutions, emphasizing food safety, preservation, and performance. |

| Kerry Group | Expands its portfolio of emulsifiers and stabilizers, integrating them into functional food ingredient solutions. |

Key Company Insights

Cargill (18-22%)

Key leader with wide uses in food and beverages, focusing on sustainability and supply chain excellence.

DuPont (15-19%)

Develops advanced food emulsifiers, especially in bakery, dairy, and plant-based products.

Palsgaard (12-16%)

An expert in sustainable emulsifiers with a reputation for RSPO-certified and non-GMO products.

Corbion (10-14%)

It specializes in tailored, clean-label emulsifiers that combine food safety as well as functional benefits.

Kerry Group (8-12%)

Enhances its emulsifier solutions by including functional food ingredients for varied uses.

The industry is segmented into sodium and calcium stearoyl lactylates.

The industry is segmented into the food and beverage industry, bakery & confectionery, meat and poultry, dairy products, alcoholic beverages, convenience products, plastic industry, pet food, and cosmetic and personal care products.

The industry is segmented into direct sales/B2B, indirect sales/B2C, intermediate/bulk distributors, online retailers, and specialty stores.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

The global stearoyl lactylates market is expected to grow at a CAGR of 4.7% during the forecast period.

By 2035, the global stearoyl lactylates market is estimated to reach a valuation of USD 1,035.9 million.

Sodium stearoyl lactylates in the product type segment and bakery & confectionery in the end-use segment are expected to witness the highest growth rates.

The market is driven by increasing demand for emulsifiers in food processing, a shift towards clean-label ingredients, regulatory compliance, and rising applications in cosmetics and pharmaceuticals.

The major players in this market include Cargill, DuPont, Palsgaard, Corbion, Kerry Group, and DSM-Firmenich.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactylate Market Growth - Functional Uses & Industry Expansion 2025 to 2035

Calcium stearoyl-2-lactylate Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA