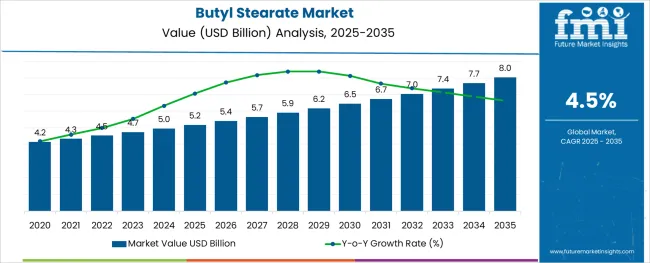

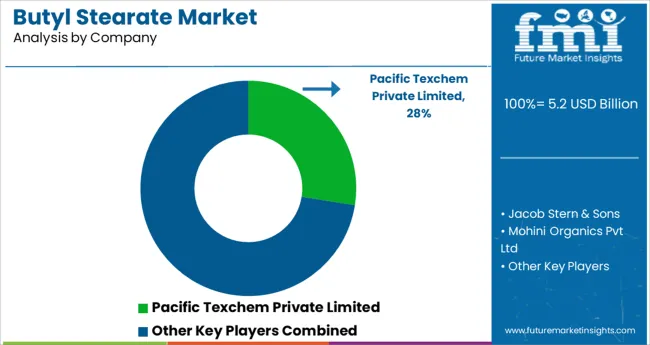

The Butyl Stearate Market is estimated to be valued at USD 5.2 billion in 2025 and is projected to reach USD 8.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The butyl stearate market is growing steadily, propelled by its increasing use in cosmetics and pharmaceutical products. Industry updates have highlighted the rising demand for high-purity compounds that serve as effective emollients and texture enhancers in skincare formulations. Consumers’ growing preference for smooth, moisturizing products has encouraged manufacturers to integrate butyl stearate into lotions, creams, and ointments.

Additionally, the rise in personal care awareness and pharmaceutical product innovation has expanded the application base. Advances in purification processes have improved the availability of cosmetic and pharmaceutical grade butyl stearate, meeting stringent quality standards.

Future market growth is expected to be driven by expanding product lines in emerging markets and increased formulation in both personal care and therapeutic products. Segmental growth is anticipated to be led by the oily liquid form, cosmetic/pharma grade with purity ≥99%, and emollient application due to their widespread acceptance and effectiveness.

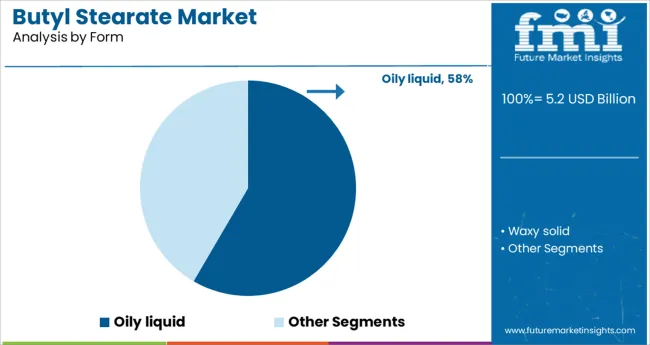

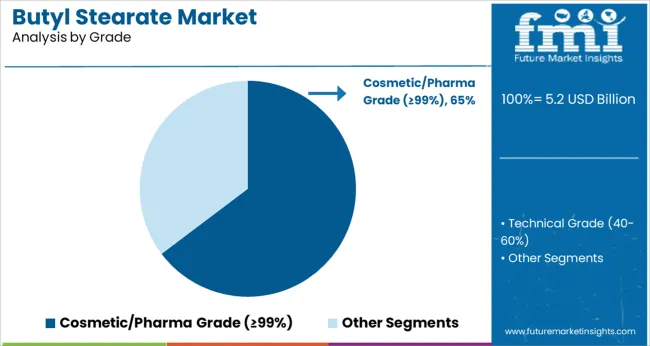

The market is segmented by Form, Grade, Application, and End Use and region. By Form, the market is divided into Oily liquid and Waxy solid. In terms of Grade, the market is classified into Cosmetic/Pharma Grade (≥99%) and Technical Grade (40-60%).

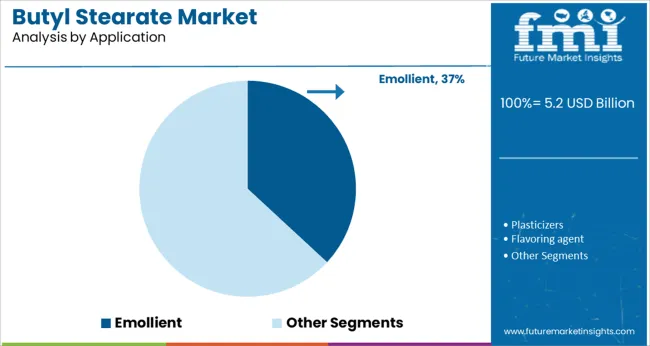

Based on Application, the market is segmented into Emollient, Plasticizers, Flavoring agent, Solvent, and Lubricant. By End Use, the market is divided into Cosmetics & Personal Care, Plastics & Polymers, Metalworking, Food & Beverages, and Textile. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The oily liquid form segment is projected to hold 58.4% of the butyl stearate market revenue in 2025, making it the leading form type. Its dominance is attributed to easy incorporation into various cosmetic and pharmaceutical formulations where smooth texture and moisturizing properties are required.

The fluid nature allows for better blending with other ingredients enhancing product stability and application. Producers prefer the oily liquid form for its versatility in multiple product categories including creams, lotions, and ointments.

Market adoption is further supported by formulation innovations that improve sensory attributes of final products. With growing demand for lightweight and non-greasy skincare solutions, the oily liquid form is expected to maintain strong market demand.

The cosmetic/pharma grade segment with purity equal or above 99% is expected to account for 64.7% of the butyl stearate market revenue in 2025, asserting its position as the leading quality grade. This segment benefits from stringent regulatory standards requiring high purity for topical and pharmaceutical applications to ensure safety and efficacy.

The purity level guarantees minimal impurities which is critical for sensitive skin formulations and pharmaceutical stability. Manufacturers prioritize high-grade butyl stearate to meet customer expectations and comply with quality certifications.

The segment growth is boosted by expanding cosmetic and pharmaceutical industries that demand consistent and reliable raw materials. As formulations become more sophisticated, the preference for high-purity butyl stearate is expected to rise.

The emollient application segment is projected to hold 36.9% of the butyl stearate market revenue in 2025, maintaining its leading role. Butyl stearate is valued for its ability to soften and soothe the skin, making it a preferred ingredient in moisturizers and skin protectants.

Its capacity to enhance spreadability and improve the feel of topical products has reinforced its demand among formulators. The segment benefits from growing consumer focus on skincare products that provide hydration and barrier repair.

Increased incidence of skin dryness and environmental skin stressors have further propelled the use of emollients like butyl stearate. As natural and effective skin conditioning agents remain central to personal care trends, the emollient application segment is expected to sustain its strong market position.

Over the years, rapid urbanization and increasing consumer spending have triggered the growth of the cosmetics & personal care industry. People across the world are spending large amounts on cosmetics and personal care products such as lipsticks, skin makeup, and numerous personal care products. According to the LOreal 2024 Annual Report, the global cosmetics market reached over 5 billion euros in 2024.

This is emerging as a major factor stimulating growth in the global butyl stearate market and the trend is likely to continue during the forecast period.

Butyl stearate has become an ideal green chemical alternative to several potentially hazardous ingredients used across industries like plastics, food & beverages, and cosmetics & personal care. It acts as a natural emollient and skin conditioning agent in personal care formulations. Rising spending on personal care products will therefore create lucrative opportunities for the butyl stearate manufacturers during the assessment period.

Similarly, the rapid expansion of the processed food industry worldwide due to changing lifestyles and rising disposable income is playing a key role in pushing the demand for butyl stearate. Food manufacturers are extensively using butyl stearate as an emulsifying and flavoring agent in foods and beverages.

The rising consumption of plastics & polymers and robust growth of the textile, metalworking, and printing ink industries will further expand the butyl stearate market size during the forthcoming years.

Although butyl stearate has numerous applications, there are certain factors negatively impacting the demand for butyl stearate. Some of these factors include the presence of alternative lubricants, flavoring agents, and several other additives, and shifting consumer preferences towards food & cosmetic products with natural ingredients.

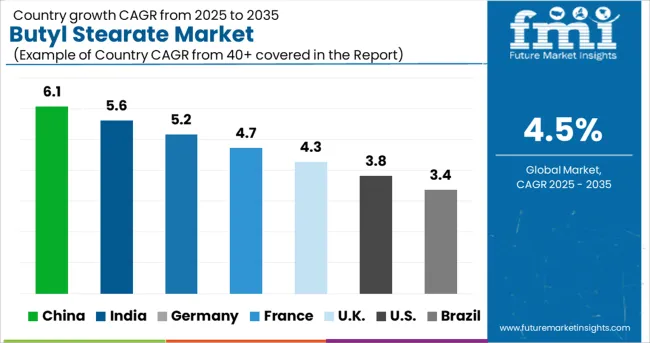

As per FMI, sales of butyl stearate in the Asia Pacific market are projected to grow at a steady pace during the forecast period, owing to the rapidly growing population, improved standard of living, increasing spending on food and beverages products, and rapid growth of personal care and cosmetics industry.

With changing lifestyles and growing awareness, there has been a sharp hike in the consumption of cosmetics and personal care products across emerging countries like China, South Korea, Japan, and India. For instance, according to the International Trade Administration (ITA), the total retail sales value of cosmetics in China rose to USD 5 billion in 2024.

Consumers are spending large amounts on products like makeup. lipsticks, lip guards, anti-aging lotions, etc. to improve their looks & style. As butyl stearate forms an integral part of these products, a rise in their sales will eventually spur the growth of the butyl stearate market in the region during the assessment period.

Similarly, increasing the adoption of butyl stearate plasticizers and lubricants will further expand the butyl stearate market size in the regions during the forthcoming years.

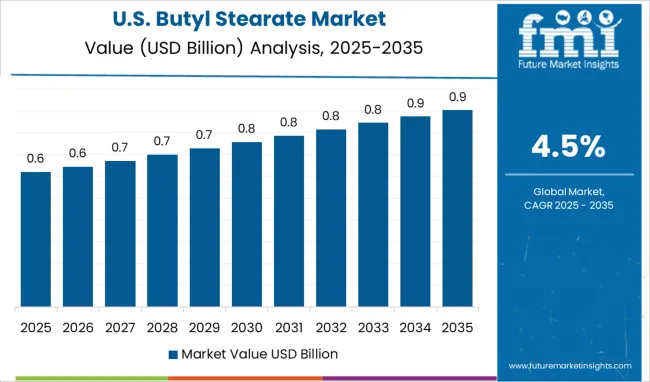

Over the years, North America has become a prominent market for butyl stearate and this trend is likely to continue during the forecast period between 2025 and 2035.

Growth in the North American butyl stearate market is driven by the flourishing cosmetics & personal care industry, high consumer spending, the strong presence of some of the world's leading cosmetic and personal care companies, and increasing usage of butyl stearate in metalworking, textile, and food & beverages industries.

Within North America, the USA remains the most dominant market for butyl stearate due to rising production and consumption of cosmetics and personal care products such as anti-aging creams, lipsticks, makeup, and men's care & grooming product. In fact, the USA has become the world’s largest beauty and personal care product market

Similarly, increasing spending on food products is creating space for butyl stearate market growth in the region, and the trend is expected to further escalate during the forecast period.

Rising disposable income and fast lifestyle have led to a surge in the consumption of processed products in the USA For instance, as per the USA Department of Agriculture (USDA), total food spending across the USA reached a massive valuation of USD 1.69 trillion in 2024.

Some of the key manufacturers of butyl stearate include Pacific Texchem Private Limited., Mohini Organics Pvt Ltd, Jacob Stern & Sons, Inc., Fine Organics, A&A Fratelli Parodi Spa, AcarKimya A.S., Allan Chemical Corporation, Nayakem Organics Pvt. Ltd., Green Biologics Ltd, and Penta Manufacturing Company among others.

These leading players are constantly indulging in strategies such as expanding production capacities, price reduction, the establishment of new manufacturing facilities, partnerships, acquisitions, and collaborations to expand their global footprint and gain an upper hand in the global butyl stearate market.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4% to 4.8% from 2025 to 2035 |

| Projected Market Valuation (2035) | USD 9.42 Billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered |

Form, Grade, Application, End Use, Region |

| Regions Covered |

North America; Latin America; Western Europe; Eastern Europe; Asia Pacific excluding Japan; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled |

Pacific Texchem Private Limited.; Mohini Organics Pvt Ltd; Jacob Stern & Sons, Inc.; Fine Organics; A&A Fratelli Parodi Spa; AcarKimya A.S.; Allan Chemical Corporation; Nayakem Organics Pvt. Ltd.; Green Biologics Ltd; Penta Manufacturing Company |

| Customization | Available Upon Request |

The global butyl stearate market is estimated to be valued at USD 5.2 billion in 2025.

It is projected to reach USD 8.0 billion by 2035.

The market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types are oily liquid and waxy solid.

cosmetic/pharma grade (≥99%) segment is expected to dominate with a 64.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Butyl Acrylate Market Size and Share Forecast Outlook 2025 to 2035

Butyl Hydroxytoluene Market Analysis Size Share and Forecast Outlook 2025 to 2035

Butyl Glycol Market Growth - Trends & Forecast 2025 to 2035

Butyl Elastomers Market-Trends & Forecast 2025 to 2035

Butylene-divinyl Fraction Market Growth – Trends & Forecast 2024-2034

N-Butylene Oxide 1,2 Market Size and Share Forecast Outlook 2025 to 2035

Dibutyl Ether Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of Tributyl Tin Fluoride Market Share

Isobutylene Market Growth – Trends & Forecast 2024-2034

1,3-Butylene Glycol Market Size and Share Forecast Outlook 2025 to 2035

Poly butylene Succinate Market Growth - Trends & Forecast 2025 to 2035

2-tert-Butylcyclohexanol Market Forecast and Outlook 2025 to 2035

4-tert-Butylcyclohexanone Market

Tertiary Butylhydroquinone Market

Acetyl Tributyl Citrate market Size and Share Forecast Outlook 2025 to 2035

Methyl Isobutyl Carbinol Market Size and Share Forecast Outlook 2025 to 2035

Ethyl Tertiary Butyl Ether Market Size and Share Forecast Outlook 2025 to 2035

Highly Reactive Polyisobutylene HR PIB Market Size and Share Forecast Outlook 2025 to 2035

Lead Stearate Market

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA