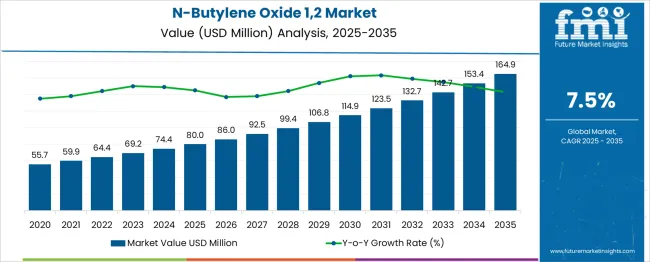

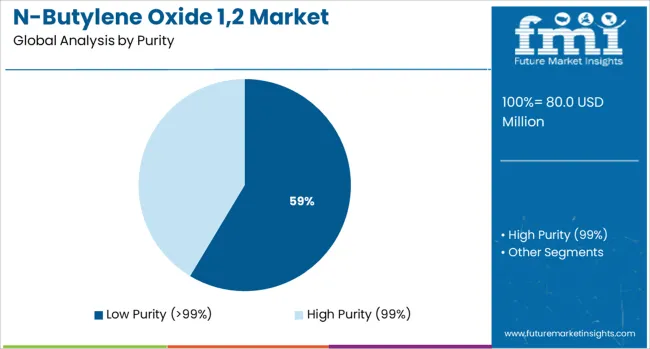

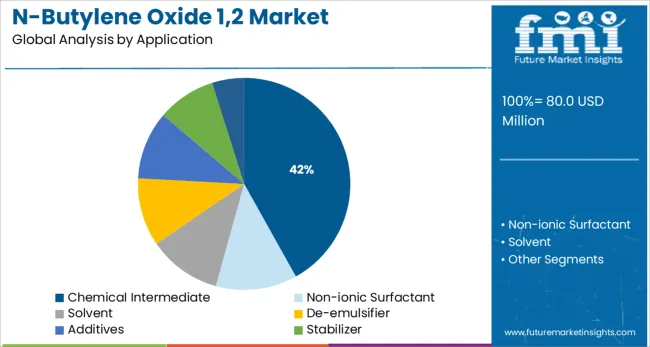

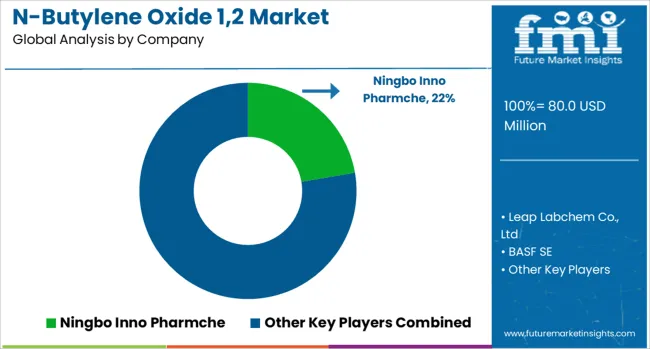

The global n‑butylene oxide 1,2 market is valued at USD 80.0 million in 2025 and is projected to reach USD 164.9 million by 2035, expanding at a compound annual growth rate (CAGR) of 7.5%. This growth is underpinned by intensified industrial activity across the oil & gas, textiles, and chemical manufacturing sectors, which drive demand for highly specialized chemical intermediates. The low‑purity (>99%) grade is the dominant product class thanks to its cost‑effectiveness and versatility in industrial applications, while usage as a chemical intermediate leads applications, reflecting its foundational role in manufacturing downstream surfactants, stabilizers, and de‑emulsifiers.

Expansion is fueled by rising global crude‑oil extraction and refining operations, where n‑butylene oxide 1,2 is used to aid demulsification and processing, as well as the expanding volume of textile production in Asia‑Pacific that leverages the compound in non‑ionic surfactant systems. Growth is further stimulated by the growing plastics and polymer sectors, which utilise n‑butylene oxide 1,2 as a fundamental building block. While emerging environmental regulations limiting VOCs (volatile organic compounds) and tightened emission standards pose headwinds, especially in developed markets, ongoing improvements in greener synthesis methods and manufacturing transparency help mitigate these impacts. Key regions such as Asia‑Pacific, North America, and Europe remain significant contributors to growth, driven by regional industrialisation, supportive manufacturing ecosystems, and expanding end‑user sectors.

| Metric | Value |

|---|---|

| N-Butylene Oxide 1,2 Market Estimated Value in (2025 E) | USD 80.0 million |

| N-Butylene Oxide 1,2 Market Forecast Value in (2035 F) | USD 164.9 million |

| Forecast CAGR (2025 to 2035) | 7.5% |

The low‑purity (>99%) grade segment is expected to maintain its lead in 2025, supported by its broad applicability across industrial formulations and cost‑competitive structure. Its dominance is driven by its use in large‑volume sectors, such as textiles, chemicals, and oil & gas, where ultra‑high purity is not essential. Manufacturers favor this grade due to its balanced performance‑to‑cost ratio, enabling widespread usage in surfactants, solvents, and de‑emulsifier systems. Additionally, the growth of textile manufacturing in Asia‑Pacific, the expansion of chemical production in Middle‑East & Africa, and cost‑sensitive demand in emerging economies reinforce the segment’s position as the preferred product class for industrial applications.

The chemical intermediate application segment is projected to lead usage patterns by 2025, given that n‑butylene oxide 1,2 serves as a key precursor in formulating surfactants, polymer additives, solvents, stabilizers, and defoamers. Its role as a building block in diverse industrial chains, from textiles to plastics to oil‑field chemicals, ensures sustained demand. The segment’s strength is underpinned by robust industrial investment in polymer manufacturing, petrochemical derivatisation, and growth in specialty additives. As manufacturers continue to seek versatile intermediates that enable downstream customization, n‑butylene oxide 1,2’s established role in these production lines secures its leadership among application categories.

Due to the rapid industrialization and growing usage of oil and gas derivatives such as diesel, gasoline, and liquefied petroleum gas (LPG) among others, there is a swift rise in the consumption of crude oil across the world. Hence, governments in several countries are emphasizing on increasing the production of crude oil to address the surging demand for fuel.

For instance, according to a study by the India Brand Equity Foundation, the Indian Government announced the allocation of around USD 80 billion for drilling over120 exploration wells to double the production of oil & gas in the country by 2025.

As N-butylene oxide 1,2 is extensively used as de-emulsifiers in oil & gas production and refineries facilities for better separation of oil, a multiplicity of such initiatives are expected to augment the demand in the global market.

With growing environmental concerns pertaining to the emission of volatile organic compounds (VOCs) and greenhouse gasses, government and various other regulatory organizations are implementing strict regulations for declining the use of VOCs such as N-butylene oxide 1,2. Imposition of such regulations across North America, Europe, and Asia Pacific in restraining the demand for N-butylene oxide 1,2 in the global market.

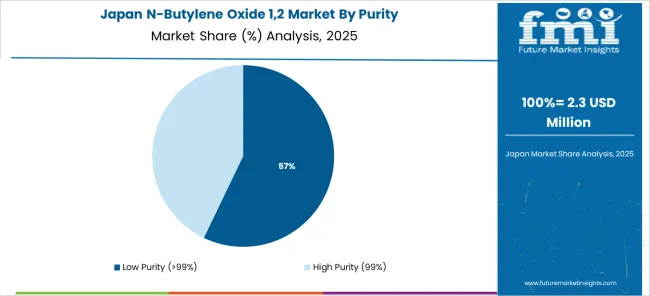

As per a study by FMI, Asia Pacific excluding Japan is projected to exhibit growth at a robust CAGR in the global market for N-butylene oxide 1,2 between 2025 and 2035.

Governments across Asia Pacific countries are focusing on launching various initiatives and favorable policies to assist textile manufacturers in increase their production for rising the overall textile exports. Hence, key industry players are emphasizing on investing for increasing their textile production capacity to get benefited from the favorable policies.

For instance, in 2020, Pallavaa Group, a leading textile manufacturer headquartered in India announced investing around USD 65 Mn for increasing the company’s textile production in Tamil Nadu, India. As N-butylene oxide 1,2 is finding a wide range of usage as a non-ionic surfactant in textiles manufacturing, such developments are estimated to drive the growth in the market.

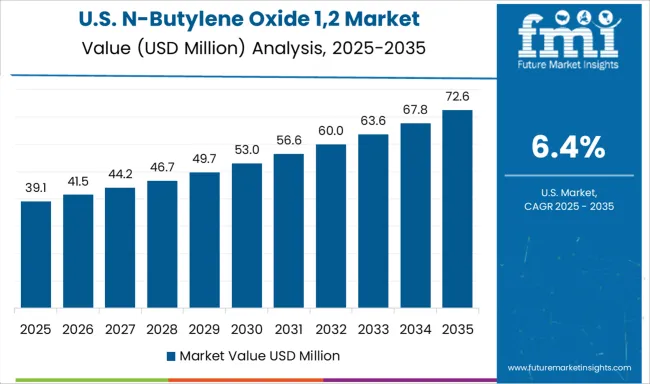

Future Market Insights reveals that North America is expected to emerge as a highly remunerative market for N-butylene oxide 1,2 during the forecast period 2025-2035.

The oil & gas industry is registering robust growth in North America, driven by the accelerating demand for petroleum derivatives due to the increasing vehicular fleet and growing industrialization. Hence, leading industry players are aiming at increasing their petroleum derivative production and refining capacity to meet the growing demand.

For instance, in 2020, Targa Resources Corporation, a USA-based oil & gas company announced developing a new petroleum refinery at Channelview, the USA which can refine nearly 35,000 barrels per day for expanding its refining capacity. A slew of such developments is anticipated to bolster the sales of N-butylene oxide 1,2 in the North America market.

Some of the leading players in the n-butylene oxide 1,2 market are Ningbo Inno Pharmche, Leap Labchem Co., Ltd, BASF SE, Tokyo Chemical Industry Co., Ltd., Santa Cruz BIoTechnology, Inc., Kinbester Co., Ltd., Hangzhou Dayangchem Co. Ltd., DowDupont Inc., Merck KGaA, Haihang Industry Co., Ltd., Chemos GmbH & Co. KG, Zehao Industry Co., Ltd., and others.

The market for is highly competitive, due to large number of participants and increasing adoption of strategies such as collaboration, agreement, and partnership to strengthen the market share.

| Report Attribute | Details |

|---|---|

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Purity, Application, End Use, Region |

| Countries Covered | North America, Latin America, Western Europe, Eastern Europe, APEJ, Japan, Middle East and Africa |

| Key Companies Profiled | Ningbo Inno Pharmche; Leap Labchem Co., Ltd; BASF SE; Tokyo Chemical Industry Co., Ltd.; Santa Cruz BIoTechnology, Inc.; Kinbester Co., Ltd.; Hangzhou Dayangchem Co. Ltd.; DowDupont Inc.; Merck KGaA; Haihang Industry Co., Ltd.; Chemos GmbH & Co. KG; Zehao Industry Co., Ltd.; Others |

| Customization | Available Upon Request |

The global n-butylene oxide 1,2 market is estimated to be valued at USD 80.0 million in 2025.

The market size for the n-butylene oxide 1,2 market is projected to reach USD 164.9 million by 2035.

The n-butylene oxide 1,2 market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in n-butylene oxide 1,2 market are low purity (>99%) and high purity (99%).

In terms of application, chemical intermediate segment to command 41.9% share in the n-butylene oxide 1,2 market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Zinc Oxide Block Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide Market Forecast and Outlook 2025 to 2035

Zinc Oxide Sunscreens Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide for Sunscreens Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Iron Oxide Market Report - Growth, Demand & Forecast 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Amine Oxide Market Size and Share Forecast Outlook 2025 to 2035

Solid Oxide Fuel Cell Market

Nitric Oxide Asthma Testing Market - Growth, Demand & Forecast 2025 to 2035

Cerium Oxide Nanoparticle Market Growth – Trends & Forecast 2024-2034

Bismuth Oxide Market Growth – Trends & Forecast 2025 to 2035

Calcium Oxide Market Growth - Trends & Forecast 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Lasers Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Dioxide Synthesis Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Enhanced Oil Recovery (CO2 EOR) Market Analysis by Application, Source and Region: Forecast from 2025 to 2035

Aluminum Oxide Coated Films Market

Magnesium Oxide Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Oxides Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA