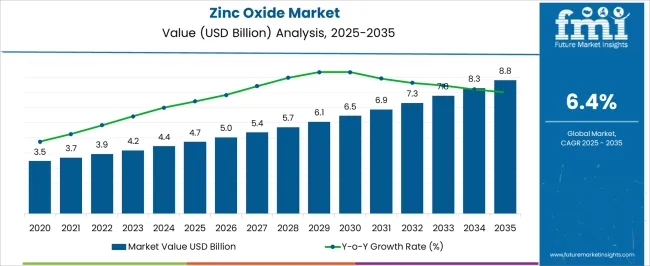

The Zinc Oxide Market is estimated to be valued at USD 4.7 billion in 2025 and is projected to reach USD 8.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

The zinc oxide market is exhibiting stable growth, driven by its diverse industrial applications and increasing demand across manufacturing, pharmaceutical, and chemical sectors. Industry communications and corporate disclosures have highlighted the critical role of zinc oxide in improving the durability, heat resistance, and elasticity of rubber-based products. Regulatory emphasis on environmental compliance in tire manufacturing has further promoted the use of high-purity zinc oxide grades.

Advancements in zinc processing techniques and raw material sourcing have enabled producers to optimize cost-efficiency while maintaining product quality across various end-use applications. Additionally, rising investments in infrastructure and automotive sectors in emerging economies have sustained demand for rubber, ceramics, paints, and coatings—key areas where zinc oxide is utilized.

Strategic collaborations between mining and chemical companies have improved supply chain integration, ensuring consistent feedstock availability. Looking forward, the market is expected to benefit from innovations in nanostructured zinc oxide and its expanding role in electronics, energy storage, and antimicrobial formulations, with dominant contributions coming from industrial-grade material, the indirect production route, and rubber applications.

| Metric | Value |

|---|---|

| Zinc Oxide Market Estimated Value in (2025 E) | USD 4.7 billion |

| Zinc Oxide Market Forecast Value in (2035 F) | USD 8.8 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

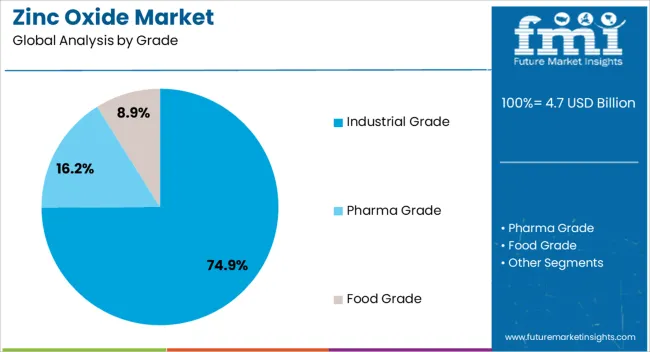

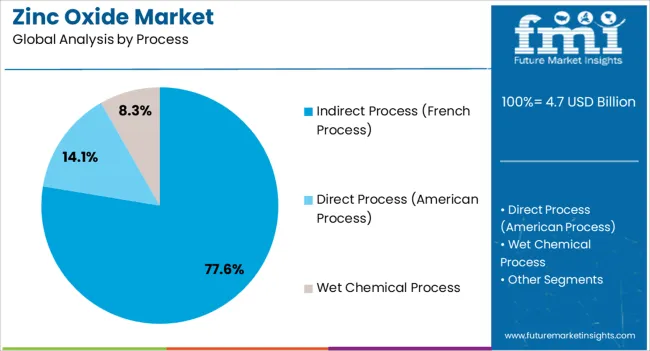

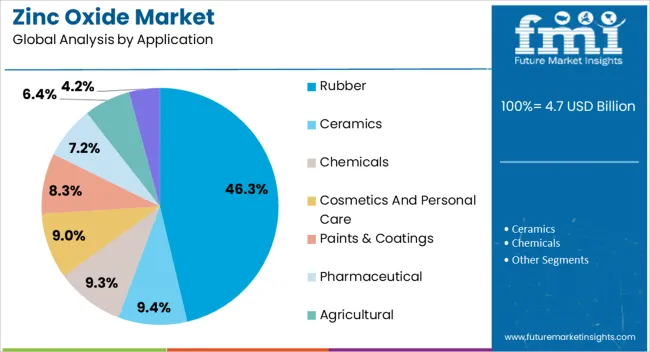

The market is segmented by Grade, Process, and Application and region. By Grade, the market is divided into Industrial Grade, Pharma Grade, and Food Grade. In terms of Process, the market is classified into Indirect Process (French Process), Direct Process (American Process), and Wet Chemical Process. Based on Application, the market is segmented into Rubber, Ceramics, Chemicals, Cosmetics And Personal Care, Paints & Coatings, Pharmaceutical, Agricultural, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Industrial Grade segment is projected to contribute 74.9% of the zinc oxide market revenue in 2025, retaining its position as the leading grade due to its widespread utility across high-volume manufacturing sectors. Demand for industrial grade zinc oxide has been consistently strong in rubber production, ceramics, paints, and chemical processing.

Manufacturers have favored this grade for its cost-effectiveness, moderate purity level, and ability to meet the performance specifications required in mass-market products. Industrial usage patterns in tire manufacturing, lubricants, glass, and surface treatments have created a stable consumption base for this grade.

Supply agreements between raw zinc providers and downstream processors have further secured its availability across global markets. As industrial growth continues in both developed and developing regions, the Industrial Grade segment is expected to remain central to the market’s volume-driven growth.

The Indirect Process (French Process) segment is forecasted to account for 77.6% of the zinc oxide market revenue in 2025, affirming its dominance among production methods. This process has been widely adopted due to its ability to produce high-purity, fine-particle zinc oxide with consistent morphology, which is essential for applications requiring superior dispersion and chemical reactivity.

Industries producing rubber compounds, ceramics, and cosmetics have preferred indirect process output for its higher whiteness and lower impurity content. Production facilities utilizing this method have reported operational efficiencies and product uniformity, supported by refined furnace technology and stable zinc metal feedstock supply.

The process’s adaptability for large-scale manufacturing and its alignment with quality control standards across industries have reinforced its continued market preference. As quality requirements become more stringent across downstream applications, the Indirect Process is expected to sustain its leading position.

The Rubber segment is projected to represent 46.3% of the zinc oxide market revenue in 2025, establishing it as the leading application category. Zinc oxide has been a critical activator in the vulcanization process, enhancing the mechanical strength, heat aging resistance, and flexibility of rubber products.

The segment’s growth has been driven by the global expansion of the automotive and transportation industries, where tire manufacturing accounts for significant zinc oxide consumption. Reports from tire producers and elastomer manufacturers have highlighted the consistent performance benefits provided by zinc oxide in rubber compounding.

Additionally, industrial rubber goods, hoses, belts, and footwear have contributed to sustained demand. Environmental and safety regulations in the tire sector have encouraged the use of high-purity zinc oxide to reduce sulfur-based emissions during processing. As vehicle production scales in emerging markets and demand for durable elastomer products rises, the Rubber segment is expected to remain the primary consumer of zinc oxide across the global market.

Need For the Ceramic Products to Lead the Way in Market Expansion

The upsurge in the usage of zinc oxide in ceramic products is presumed to lead to the demand for zinc oxide during the projected years. By providing greater control transparency or opacity to the glaze, zinc oxide has gained popularity among ceramic manufacturers over the years. Moreover, having the ability to the enhancement of whiteness and color consistency of ceramic surfaces, zinc oxide has emerged as the prominent ingredient in the ceramic industry nowadays.

Regulatory Standards are Setting up Industry Barriers

The increasing regulator standards for zinc oxide in feed applications in animals are expected to hinder the demand for zinc oxide in the coming years. Individuals are increasingly using zinc oxide in their animal diet to complete their zno needs but this excess of zno feeding in animals results in reduced feed intake and growth in animals. Therefore, several governments are actively implementing initiatives to reduce this excess use of zno in animal feed nowadays.

The properties such as excellent biocompatibility and others create substantial growth opportunities

Having excellent biocompatibility and low toxicity is anticipated to create lucrative opportunities for zinc oxide nanoparticles during the projected period. The Nanoparticles are expected to merge as an important element in anticancer and antibacterial applications.

The evaluation of the estimated sector, the zinc oxide side production in the multiple components bolsters the consumption at the CAGR 2.90% of 2020 to 2025. That is utilized in multiple end-use industries like rubber, paints and coating, personal care and cosmetics, textiles, and others. Zinc oxide is highly demanded in the personal care and cosmetic sectors for the formulation of numerous products due to the non-availability of appropriate knowledge and technologies for manufacturing techniques hampering the growth of revenues.

The continued research and development by the various academies is an upsurge in industry development. The manufacturers and the government are significantly investing in the research and innovation sector to develop economic growth and fulfill the consumer's needs.

Recently zinc oxide has gained popularity in the textile and pharmaceutical industries are estimated to expect a valuation of a CAGR of 6.4% through 2035 2035. The multipurpose use of zine-like in India is utilized for the construction sector also aided by the number of government flagships that promote the expansion of the market surge in the demand for zine oxide.

In the pharmaceutical industry, zinc oxide plays a vital role due to its biochemical properties and the advantageous characteristics of flourishing industry upswings. The rising focus on research and development are efforts to innovate product technologies that prioritize sustainability. This advancement offerings growth opportunities.

A deep analysis of segmentation is below. In terms of grade type, the industrial segment is estimated to account for a share of 74.9% by 2035. By application, the rubber sector is anticipated to dominate by holding a share of 46.3% in 2035.

| Segment | Industrial |

|---|---|

| Value Share (2035) | 74.9% |

The industrial grade is widely utilized due to its physical and chemical qualities, which make it suited for usage in a variety of end-use industries, including the rubber industry. Rubber is widely utilized in the automobile industry for the manufacture of tires and other vehicle components.

It is also utilized in a wide range of sectors, including building and construction, industrial machines, and others. The industrial grade of zinc oxide is less pure than the other two grades. Industrial-grade zinc oxide is widely used in the ceramics, chemical, paint and coatings, and rubber sectors.

| Segment | Rubber |

|---|---|

| Value Share (2035) | 46.3% |

The rubber subdivision accounted for the large revenue in the projected period. The rubber sector utilizes zinc oxide in large quantities as it’s the key significant application area. Rubber vulcanization has been used to formulate tires, hoses, sports equipment, shoe bottoms, and so on rubber goods. It is the procedure that turns natural rubber into a robust material.

In every component production, there are 50 % zine oxide has been used. The pigmentary abilities provided by zine oxide develop the capacity of the rubbers to protect the product from heat friction and improve performance. These are the foremost factors that influence the growth of this segment.

The zinc oxide industry builds greater dominance in the Asia Pacific and growth forefronts with India and China. Furthermore, the Germany and United Kingdom are the significant contributors in the market after India with a steady CAGR.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| United States | 3.6% |

| Germany | 3% |

| United Kingdom | 2.5% |

| China | 7.2% |

| India | 9.5% |

The zinc oxide market in the United States is projected to experience a moderate growth rate with a 3.6% CAGR over the forecast period.

The skincare products industry is ready to gain a prominent market share in the nation during the forecast period. The usage of zinc oxide has been increasingly seen in the production of sunscreens and other over-the-counter drugs (OTC) in the United States in recent years. For instance, the US Food and Drug Administration approved the inclusion of active ingredients in sunscreen in 2024. These ingredients include zinc oxide additives.

China’s zinc oxide market is expected to experience gradual growth in the years ahead, with a projected CAGR of 7.2% until 2035, signaling a promising outlook.

The enlarged rubber industry is accelerating the zinc oxide market growth in China in the current period. Zinc oxide is recognized as an important aspect of the vulcanization process in rubber manufacturing. As manufacturers are increasingly seeking out greater product output, as a result, producers are highly using zinc oxide in the rubber manufacturing process for the greater physical properties of these rubber products in China.

The India zinc oxide market is poised for steady success, with a projected compound annual growth rate (CAGR) of 9.5%, propelling it to new heights.

The rapid expansion of the pharmaceutical industry is leading the demand for zinc oxide in India's current period. As the rising concern about skin irritations like cuts, burns, and diaper rash, individuals are increasingly seen using zinc oxide-included products. Zinc oxide can control these types of issues and also healthcare professionals are prescribing these types of medicines in the country nowadays.

Manufacturers are constantly increasing their product capacities to meet the consumer's demand. Also, manufacturers are increasingly seen in investing research and development activities for the enhancement of production. Producers are highly introducing new machinery in their project sites to reduce production burdens from the laborers.

Moreover, the stakeholders are applying key strategies for brand promotions such as digital marketing and online advertisements. Also, manufacturers are targeting emerging economies where mega infrastructure projects are emerging. By diversifying the product offerings for industries such as rubber and ceramic industry, producers are ready to gain substantial market potential during the forecast period.

Acquisition, Partnerships, and Merger

In 2025, Nevada Zinc has recently formed a partnership with BelZinc, a renowned zinc oxide producer, to expand its production capabilities. This partnership will enable Nevada Zinc to leverage BelZinc's expertise and state-of-the-art facilities to produce high-quality zinc oxide and meet the growing demand for this essential ingredient in various industries. Together, they are committed to delivering innovative solutions and exceptional value to their customers.

In 2025, LBB Specialties has recently established a significant partnership with VIZOR, a well-known player in the industry. This strategic alliance will enable LBB Specialties to offer a wide range of innovative products and services to its clients, ensuring that they receive top-notch solutions for their respective needs. With VIZOR's expertise and LBB Specialties' strong market presence, this partnership is expected to bring about positive changes and contribute to the growth of the industry.

Depending on the grade type, the segment is divided into Industrial, Pharma, and Food

The process type is further separated into Wet Chemical, Indirect, and Direct

The usage of zinc oxide in applications such as Rubber, Ceramics, Chemicals, Cosmetics and personal care, Paints & Coatings, Pharmaceuticals, Agricultural

Regional analysis was conducted on the industry in North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa.

The global zinc oxide market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the zinc oxide market is projected to reach USD 8.8 billion by 2035.

The zinc oxide market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in zinc oxide market are industrial grade, pharma grade and food grade.

In terms of process, indirect process (french process) segment to command 77.6% share in the zinc oxide market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Zinc Oxide Block Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide Sunscreens Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide for Sunscreens Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nano Zinc Oxide Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Zinc-tin Alloy Sputtering Target Market Size and Share Forecast Outlook 2025 to 2035

Zinc Acetate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Dialkyldithiophosphates Additive Market Size and Share Forecast Outlook 2025 to 2035

Zinc Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chloride Market Analysis - Size, Share, and Forecast 2025 to 2035

Zinc Citrate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Zinc Sulphate Market Size, Growth, and Forecast 2025 to 2035

Zinc Methionine Chelates Market - Growth & Demand 2025 to 2035

Zinc-Air Batteries Market Growth – Trends & Forecast 2023-2033

Iron Oxide Market Report - Growth, Demand & Forecast 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Amine Oxide Market Size and Share Forecast Outlook 2025 to 2035

Solid Oxide Fuel Cell Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA