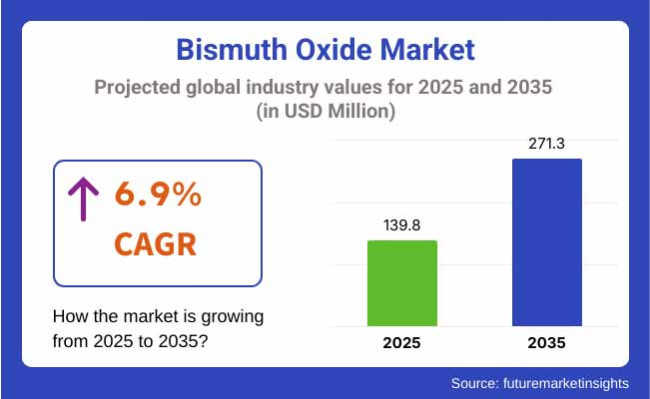

The bismuth oxide market is expected to grow steadily between 2025 and 2035, driven by increasing demand across electronics, pharmaceuticals, and ceramics applications. The market is projected to expand from USD 139.8 million in 2025 to USD 271.3 million by 2035, exhibiting a compound annual growth rate (CAGR) of 6.9% during the forecast period.

The non-toxic nature of bismuth oxide along with its excellent optical and electrical properties makes it a promising solution to replace the lead-based compounds. In electronics, it finds extensive applications in varistors, thermistors and capacitors.

Additionally, its utilization in the pharmaceutical industry as an ingredient in ulcer treatments and antibacterial formulations further propels the market growth. Bismuth oxide also has uses in the ceramics industry for the production of specialty glass and pigments.

Asia Pacific is the largest and fastest growing region due to the presence of several electronics manufacturing bases especially, in countries such as China, Japan, and South Korea. At the same time, North America and Europe remain locked in on bismuth oxide in environmentally friendly product lines, solidifying regulatory momentum towards sustainable materials.

Investments directed towards sustainable material science and replacing toxic substances are highly likely to provide bismuth oxide market long-term prospects in various high-performance industrial domains.

The bismuth oxide market is witnessing growth due to its application in electrical, optical materials, and pyrotechnics. With the increasing demand for lead-free and green alternatives and specialty ceramics and optical components, bismuth oxide has become an important material for diverse applications.

For those segments of applications, the effect is based on its extreme applicability and growing consumption, most often which will integrate new market essential trends,due to which powdered bismuth oxide and bismuth oxide for optical glasses are anticipated to become more popular.

Powdered Bismuth Oxide Dominates Due to Ease of Processing and Wide Industrial Usage

| Form | Market Share (2025) |

|---|---|

| Powdered Bismuth Oxide | 47.8% |

Powdered bismuth oxide is anticipated to represent 47.8% of the total market share by the year 2025, making it the dominating form in the global market. Its ultra-fineness, fine particulate morphology, can produce more versatility and uniform dispersion, which is especially important in ceramics, glass manufacturing and catalysts.

Moreover, the powdered form is more preferred in advanced ceramics and electronics due to precision applications for which end-users have shown strong preference. With its increasing application in the manufacture of superconductors and optical devices, bismuth oxide gains further importance in the industry.

Optical Glasses Segment Leads Application Category Due to Growth in High-Tech Optics and Photonics

| Application | Market Share (2025) |

|---|---|

| Bismuth Oxide for Optical Glasses | 42.6% |

The envisaged application segments for bismuth oxide used in optical glasses in 2025 will have the leading market share at 42.6%. Bismuth oxide is intermediate oxide for high end optical glasses / lenses, infrared optics, and laser systems for refractive index enhancement, infrared transmission, and dispersion properties.

Furthermore, demand for it is fuelled by its use as a non-toxic alternative to lead oxide in eco-friendly optical glass formulations. Advancements in photonics key technologies, AR products and telecommunication structures will potentially drive this segment for the long term.

Due to North America having the most advanced pharmaceutical, electronics and chemical manufacturing, it is set to retain its stronghold over the global bismuth oxide market. North America, with the United States leading the regional consumption, is expected to be the fastest-growing region due to the increasing appointment of bismuth oxide in medical diagnostics and catalysts and optical coatings.

Rising investment in environmentally friendly compounds and lead-free substitutes in industrial processes further creates demand. More recently, the region has oriented towards the use of bismuth-based materials in place of toxic constituents, due to the low toxicity and relatively high density of bismuth which has further increased its adoption in offering shielding (of radiation) for medical imaging alongside.

Furthermore, the dominant manufacturers and researchers add to the ongoing process of product innovation. The increasing utilization of bismuth oxide in solid oxide fuel cells (SOFCs), on the back of its ionic conductivity, is witnessing momentum in the renewable energy and power industries.

But volatile raw material prices and a lack of domestic bismuth mining could prove a barrier to scaling. However, the development of nanotechnology and growing need for high purity bismuth oxide in specialized applications will likely keep the North America market growing.

Another dominant market is Europe which targets sustainable technologies and clean energy solutions while high standards and regulations for materials are forced to favours low toxicity materials. Germany, the UK, France, and Italy are the top countries in the development and application of bismuth oxide in ceramics, automotive catalysts, pigments, and pharmaceuticals.

The EU REACH regulations support bismuth-based alternatives by European companies in the sectors of coatings, glazes and electronics as replacements for lead-based compounds.

The increasing focus on green energy has increased the demand for bismuth oxide in solid oxide fuel cells and piezoelectric components. Additionally, European R&D efforts have also been driven by exploring new photonic bismuth compounds and biomedical bismuth, making Europe the forefront of specialty material development.

On the other hand, reliance on imported bismuth ores and geopolitics-associated risks of supply chain disruption may protract the market. Though these factors may restrain the eco-friendly functional materials market during the forecast period, a positive policy environment (compared to traditional alternatives) and the increasing demand for eco-friendly functional materials are likely to further support growth in the eco-friendly functional materials market at the regional level.

Due to the availability of bismuth resources, the low manufacturing cost, and an increasingly growing industrial infrastructure in the Asia-Pacific region, it is a major contributor to global production and consumption of the product. The versatility of bismuth means China commands the bismuth and bismuth oxide market via its role as the world’s largest producer and exporter to the regional and global markets.

Strong market dynamics are supported by the extensive utilization of bismuth oxide in metallurgy, flame retardants, semiconductors, and pharmaceuticals.

Robust growth is propelled by a growing demand from the electronics industry, medical diagnostics and catalysts in automotive in India, Japan and South Korea. The drive towards renewable energy technologies (especially in China and Japan) has opened up new opportunities for bismuth oxide adoption in SOFCs and photovoltaic systems.

Moreover, rising government initiatives toward minimizing environmental pollution and lead-free technologies are also going hand-in-hand with the adoption of bismuth-based alternatives. Mining and refining environmental regulations and exporting strategies from major suppliers may affect the stability of global supply. In general, Asia-pacific holds largest market share and will continue to do so in the coming years due to their vast manufacturing base and technological enhancements.

Supply Chain Volatility and Cost Constraints

Supply chain uncertainties and pressure on costs drive challenges in the bismuth oxide market. This gives access to bismuth in the form of by-products of lead and tungsten mining, therefore the availability of bismuth depends on both those industries. Such dependency can lead to varying prices and a basic lack of supply, especially when geopolitical activity tense or mining activity drops.

Additionally, high costs of processing and purification of bismuth oxide is likely to restrict its use in cost-sensitive applications, such as pigments and low-temperature ceramics. And regulatory issues surrounding mining operations in certain areas have made raw material sourcing even more complicated.

Expanding Use in Electronics and Green Energy Application

Despite these barriers, the bismuth oxide market is expected to rise due to the increasing applications in advanced electronics, solid-state fuel cells (SOFCs), and radiation shielding. With the increased demand for lead-free alternatives stemming from environmental and health regulations targeting lead-based products, the low toxicity and superior dielectric properties of bismuth oxide position it to fill the void left in capacitors, varistors, and other electronic products.

Moreover, rising investments toward green energy technologies, particularly steam gas-powered fuel cells (SOFCs), are expected to increase demand for high-purity bismuth oxide formulations. Improved yield efficiency and supply chain sustainability resulting from technological innovations in material processing and recycling.

The bismuth oxide market grew steadily from 2020 to 2024, supported by demand in electronics, medical, and ceramic industries. Supply disruptions due to the pandemic underscored the vulnerabilities of these bismuth sources, while the need for accelerated supply diversification and enhanced recycling processes has become evident. The progress in lead-free materials and functional oxides driven by research created the conditions for the gradual migration toward niche applications.

An additional period of rapid innovation and expansion knows as the 2025 to 2035 market phase is predicted to commence. Bismuth oxide is expected to be pivotal in energy-efficient electronics and clean energy technologies. Regional processing hubs and the development of nanostructured bismuth oxides will provide opportunities for application-specific adaptation.

Simultaneously, strict regulations around the world regarding the use of toxic substances will further force manufacturers to replace conventional materials with bismuth-based substitutes.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Push for lead-free alternatives in select applications |

| Technological Advancements | Functional oxide research and ceramic usage |

| Industry Adoption | Use in pigments, medical imaging, and ceramics |

| Supply Chain and Sourcing | Dependence on by-product recovery from mining |

| Market Competition | Limited players with specialized processing capabilities |

| Market Growth Drivers | Medical and ceramic industry demand |

| Sustainability and Energy Efficiency | Low emphasis on energy-efficient processing |

| Consumer Preferences | Minimal direct influence |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Global mandates favouring non-toxic, sustainable raw materials |

| Technological Advancements | Advanced nanostructures and fuel cell compatibility |

| Industry Adoption | Integration into green electronics, SOFCs, and photonic devices |

| Supply Chain and Sourcing | Regional production centers and enhanced recycling infrastructure |

| Market Competition | Entry of green tech innovators and vertical integration by large players |

| Market Growth Drivers | Rise in green energy and lead-free electronics |

| Sustainability and Energy Efficiency | Emphasis on low-waste, circular production models |

| Consumer Preferences | Increasing preference for sustainable and non-toxic materials |

The United States is also a major growth area for the bismuth oxide market, thanks to its well-developed pharmaceuticals, electronics and ceramics industries. Bismuth oxide has low toxicity and high therapeutic properties, therefore, widely applied in medical formulations. In addition, the rapid adoption of advanced electronic applications, such as varistors, gas sensors, and optical coatings, is creating a tremendous boost for the market.

Government investment in medical research and renewable energy technologies further promote the uptake of bismuth compounds. Furthermore, one of the reasons USA-based refineries are profitable is the stability of USA imports of bismuth in refined form, while promoting long-term industrial demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.6% |

The bismuth oxide market in the UK is growing, as applications are becoming increasingly vital for sustainable electronics and green chemistry solutions. The country has taken effective measures toward green and sustainable industries, owing to which there is a growing demand for non-toxic materials, such as bismuth oxide, across verticals.

The compound’s growing use in dental materials, pigments and superconductors mirrors advances in the countries biomedical and electronics sectors. Moreover, UK research institutions are focusing on eco-safe replacements for lead-based compounds, bismuth oxide emerging as a better alternative, fuelling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.3% |

Well-established industrial base, along with stringent regulations and usage restrictions centers around dangerous substances such as lead, expedited the demand for bismuth oxide market in EU. The increasing investment of German, French, and Italian countries in green manufacturing and material safety is driving substantial growth geared toward ecological approaches, with bismuth oxide being utilized in ceramics, pharmaceuticals, and electronic components.

Innovation projects funded by the European Union (EU) are encouraging research on bismuth-based alternatives, especially for energy-efficient devices and medical imaging technologies. This move towards a circular economy is also driving the adoption of bismuth oxide in recycling and specialty material markets.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.5% |

Japan is emerging the market for bismuth oxide as it is the advanced electronics industry and also the increasing application in the solid oxide fuel cells and optical devices. The demand for materials such as bismuth oxide is growing as the country is continuously investing in clean energy technologies and electronics components in smaller sizes.

Additionally, as the third biggest pharmaceutical market globally, Japan makes extensive use of bismuth-containing compounds for their therapeutic effects in gastroenterology, dermatology and other indications. Market growth across the country is also diversified by the integration of bismuth oxide in niche applications such as thermoelectric and catalysts.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

On account of quick technological advancements in consumer electronics, semiconductors, and green energy systems, South Korea is projected as the high-potential market for bismuth oxide. Its applications in multilayer ceramic capacitors (MLCCs), gas sensors, and photonic devices fit well with the country’s dominance in technology-industry sectors.

Simultaneously, a growing adoption of bismuth oxide in pharmaceuticals and dental products is more likely as standards in healthcare improves. Projects involving the development of sustainable and non-toxic compounds further highlight the increasing strategic significance of bismuth oxide within the South Korean innovation ecosystem.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.7% |

The bismuth oxide market is undergoing significant growth as its application has expanded in pharmaceutical formulations, glass production, ceramics and electronics. Being a non-toxic substitute for lead-based compounds, bismuth oxide has received a strong demand across industries, which are pursuing for sustainability and environmental compliance.

Its unprecedented electrical and optical characteristics are beneficial for solid oxide fuel cells, varistor, and as catalyst in the chemical process. The global market penetration is being facilitated by rising R&D activities and regulatory endorsement for environmental-friendly materials.

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Hunan Province Guiyang Yinxing Nonferrous Smelting Co., Ltd. | 14-19% |

| Merck KGaA | 11-15% |

| The Shepherd Chemical Company | 9-13% |

| 5N Plus Inc. | 7-11% |

| Other Manufacturers | 42-51% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Hunan Province Guiyang Yinxing Nonferrous Smelting Co., Ltd. | Offered high-purity bismuth oxide for electronics and ceramics applications in 2024 . |

| Merck KGaA | Expanded bismuth-based reagents portfolio for pharmaceutical applications in 2025 . |

| The Shepherd Chemical Company | Released engineered bismuth oxide formulations for high-temperature catalysts in 2024 . |

| 5N Plus Inc. | Introduced refined bismuth oxide for advanced material synthesis in 2025 . |

Key Market Insights

Hunan Province Guiyang Yinxing Nonferrous Smelting Co., Ltd. (14-19%)

The company is one of the top suppliers of CT as well as high purity bismuth oxide and maintains a dominant position in Asia, in particular for cermets (ceramic-metal composites),special pigment production, and a wide range of superconductors.

Merck KGaA (11-15%)

Merck serves pharmaceutical and laboratory sectors with analytical-grade and functional-grade bismuth oxide, widely adopted in medications and X-ray shielding.

The Shepherd Chemical Company (9-13%)

Known for its specialized metal-based chemicals, Shepherd Chemical provides custom formulations of bismuth oxide for industrial catalysis and pigment use.

5N Plus Inc. (7-11%)

5N Plus is investing in refined and ultra-pure bismuth oxide materials for advanced electronics, optics, and green energy technologies, contributing significantly to the North American market.

Other Key Players (42-51% Combined)

Other important contributors include:

The overall market size was USD 139.8 million in 2025.

The market is expected to reach USD 271.3 million in 2035.

Growth is driven by rising demand in electronics for varistors and capacitors, expanding pharmaceutical applications, and increasing use in ceramics and optical glass manufacturing.

The top 5 countries driving the development of the market are China, the United States, Germany, Japan, and India.

Powdered form and optical glass application is expected to command a significant share over the assessment period.

Table 1: Global Bismuth Oxide Market Value (US$ Mn) Forecast by Region, 2017-2032

Table 2: Global Bismuth Oxide Market Volume (Tons) Forecast by Region, 2017-2032

Table 3: Global Bismuth Oxide Market Value (US$ Mn) Forecast by Source, 2017-2032

Table 4: Global Bismuth Oxide Market Volume (Tons) Forecast by Source, 2017-2032

Table 5: Global Bismuth Oxide Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 6: Global Bismuth Oxide Market Volume (Tons) Forecast by Application, 2017-2032

Table 7: Global Bismuth Oxide Market Value (US$ Mn) Forecast by Grade, 2017-2032

Table 8: Global Bismuth Oxide Market Volume (Tons) Forecast by Grade, 2017-2032

Table 9: North America Bismuth Oxide Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 10: North America Bismuth Oxide Market Volume (Tons) Forecast by Country, 2017-2032

Table 11: North America Bismuth Oxide Market Value (US$ Mn) Forecast by Source, 2017-2032

Table 12: North America Bismuth Oxide Market Volume (Tons) Forecast by Source, 2017-2032

Table 13: North America Bismuth Oxide Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 14: North America Bismuth Oxide Market Volume (Tons) Forecast by Application, 2017-2032

Table 15: North America Bismuth Oxide Market Value (US$ Mn) Forecast by Grade, 2017-2032

Table 16: North America Bismuth Oxide Market Volume (Tons) Forecast by Grade, 2017-2032

Table 17: Latin America Bismuth Oxide Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 18: Latin America Bismuth Oxide Market Volume (Tons) Forecast by Country, 2017-2032

Table 19: Latin America Bismuth Oxide Market Value (US$ Mn) Forecast by Source, 2017-2032

Table 20: Latin America Bismuth Oxide Market Volume (Tons) Forecast by Source, 2017-2032

Table 21: Latin America Bismuth Oxide Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 22: Latin America Bismuth Oxide Market Volume (Tons) Forecast by Application, 2017-2032

Table 23: Latin America Bismuth Oxide Market Value (US$ Mn) Forecast by Grade, 2017-2032

Table 24: Latin America Bismuth Oxide Market Volume (Tons) Forecast by Grade, 2017-2032

Table 25: Europe Bismuth Oxide Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 26: Europe Bismuth Oxide Market Volume (Tons) Forecast by Country, 2017-2032

Table 27: Europe Bismuth Oxide Market Value (US$ Mn) Forecast by Source, 2017-2032

Table 28: Europe Bismuth Oxide Market Volume (Tons) Forecast by Source, 2017-2032

Table 29: Europe Bismuth Oxide Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 30: Europe Bismuth Oxide Market Volume (Tons) Forecast by Application, 2017-2032

Table 31: Europe Bismuth Oxide Market Value (US$ Mn) Forecast by Grade, 2017-2032

Table 32: Europe Bismuth Oxide Market Volume (Tons) Forecast by Grade, 2017-2032

Table 33: East Asia Bismuth Oxide Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 34: East Asia Bismuth Oxide Market Volume (Tons) Forecast by Country, 2017-2032

Table 35: East Asia Bismuth Oxide Market Value (US$ Mn) Forecast by Source, 2017-2032

Table 36: East Asia Bismuth Oxide Market Volume (Tons) Forecast by Source, 2017-2032

Table 37: East Asia Bismuth Oxide Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 38: East Asia Bismuth Oxide Market Volume (Tons) Forecast by Application, 2017-2032

Table 39: East Asia Bismuth Oxide Market Value (US$ Mn) Forecast by Grade, 2017-2032

Table 40: East Asia Bismuth Oxide Market Volume (Tons) Forecast by Grade, 2017-2032

Table 41: South Asia & Pacific Bismuth Oxide Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 42: South Asia & Pacific Bismuth Oxide Market Volume (Tons) Forecast by Country, 2017-2032

Table 43: South Asia & Pacific Bismuth Oxide Market Value (US$ Mn) Forecast by Source, 2017-2032

Table 44: South Asia & Pacific Bismuth Oxide Market Volume (Tons) Forecast by Source, 2017-2032

Table 45: South Asia & Pacific Bismuth Oxide Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 46: South Asia & Pacific Bismuth Oxide Market Volume (Tons) Forecast by Application, 2017-2032

Table 47: South Asia & Pacific Bismuth Oxide Market Value (US$ Mn) Forecast by Grade, 2017-2032

Table 48: South Asia & Pacific Bismuth Oxide Market Volume (Tons) Forecast by Grade, 2017-2032

Table 49: MEA Bismuth Oxide Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 50: MEA Bismuth Oxide Market Volume (Tons) Forecast by Country, 2017-2032

Table 51: MEA Bismuth Oxide Market Value (US$ Mn) Forecast by Source, 2017-2032

Table 52: MEA Bismuth Oxide Market Volume (Tons) Forecast by Source, 2017-2032

Table 53: MEA Bismuth Oxide Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 54: MEA Bismuth Oxide Market Volume (Tons) Forecast by Application, 2017-2032

Table 55: MEA Bismuth Oxide Market Value (US$ Mn) Forecast by Grade, 2017-2032

Table 56: MEA Bismuth Oxide Market Volume (Tons) Forecast by Grade, 2017-2032

Figure 1: Global Bismuth Oxide Market Value (US$ Mn) by Source, 2022-2032

Figure 2: Global Bismuth Oxide Market Value (US$ Mn) by Application, 2022-2032

Figure 3: Global Bismuth Oxide Market Value (US$ Mn) by Grade, 2022-2032

Figure 4: Global Bismuth Oxide Market Value (US$ Mn) by Region, 2022-2032

Figure 5: Global Bismuth Oxide Market Value (US$ Mn) Analysis by Region, 2017-2032

Figure 6: Global Bismuth Oxide Market Volume (Tons) Analysis by Region, 2017-2032

Figure 7: Global Bismuth Oxide Market Value Share (%) and BPS Analysis by Region, 2022-2032

Figure 8: Global Bismuth Oxide Market Y-o-Y Growth (%) Projections by Region, 2022-2032

Figure 9: Global Bismuth Oxide Market Value (US$ Mn) Analysis by Source, 2017-2032

Figure 10: Global Bismuth Oxide Market Volume (Tons) Analysis by Source, 2017-2032

Figure 11: Global Bismuth Oxide Market Value Share (%) and BPS Analysis by Source, 2022-2032

Figure 12: Global Bismuth Oxide Market Y-o-Y Growth (%) Projections by Source, 2022-2032

Figure 13: Global Bismuth Oxide Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 14: Global Bismuth Oxide Market Volume (Tons) Analysis by Application, 2017-2032

Figure 15: Global Bismuth Oxide Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 16: Global Bismuth Oxide Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 17: Global Bismuth Oxide Market Value (US$ Mn) Analysis by Grade, 2017-2032

Figure 18: Global Bismuth Oxide Market Volume (Tons) Analysis by Grade, 2017-2032

Figure 19: Global Bismuth Oxide Market Value Share (%) and BPS Analysis by Grade, 2022-2032

Figure 20: Global Bismuth Oxide Market Y-o-Y Growth (%) Projections by Grade, 2022-2032

Figure 21: Global Bismuth Oxide Market Attractiveness by Source, 2022-2032

Figure 22: Global Bismuth Oxide Market Attractiveness by Application, 2022-2032

Figure 23: Global Bismuth Oxide Market Attractiveness by Grade, 2022-2032

Figure 24: Global Bismuth Oxide Market Attractiveness by Region, 2022-2032

Figure 25: North America Bismuth Oxide Market Value (US$ Mn) by Source, 2022-2032

Figure 26: North America Bismuth Oxide Market Value (US$ Mn) by Application, 2022-2032

Figure 27: North America Bismuth Oxide Market Value (US$ Mn) by Grade, 2022-2032

Figure 28: North America Bismuth Oxide Market Value (US$ Mn) by Country, 2022-2032

Figure 29: North America Bismuth Oxide Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 30: North America Bismuth Oxide Market Volume (Tons) Analysis by Country, 2017-2032

Figure 31: North America Bismuth Oxide Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 32: North America Bismuth Oxide Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 33: North America Bismuth Oxide Market Value (US$ Mn) Analysis by Source, 2017-2032

Figure 34: North America Bismuth Oxide Market Volume (Tons) Analysis by Source, 2017-2032

Figure 35: North America Bismuth Oxide Market Value Share (%) and BPS Analysis by Source, 2022-2032

Figure 36: North America Bismuth Oxide Market Y-o-Y Growth (%) Projections by Source, 2022-2032

Figure 37: North America Bismuth Oxide Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 38: North America Bismuth Oxide Market Volume (Tons) Analysis by Application, 2017-2032

Figure 39: North America Bismuth Oxide Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 40: North America Bismuth Oxide Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 41: North America Bismuth Oxide Market Value (US$ Mn) Analysis by Grade, 2017-2032

Figure 42: North America Bismuth Oxide Market Volume (Tons) Analysis by Grade, 2017-2032

Figure 43: North America Bismuth Oxide Market Value Share (%) and BPS Analysis by Grade, 2022-2032

Figure 44: North America Bismuth Oxide Market Y-o-Y Growth (%) Projections by Grade, 2022-2032

Figure 45: North America Bismuth Oxide Market Attractiveness by Source, 2022-2032

Figure 46: North America Bismuth Oxide Market Attractiveness by Application, 2022-2032

Figure 47: North America Bismuth Oxide Market Attractiveness by Grade, 2022-2032

Figure 48: North America Bismuth Oxide Market Attractiveness by Country, 2022-2032

Figure 49: Latin America Bismuth Oxide Market Value (US$ Mn) by Source, 2022-2032

Figure 50: Latin America Bismuth Oxide Market Value (US$ Mn) by Application, 2022-2032

Figure 51: Latin America Bismuth Oxide Market Value (US$ Mn) by Grade, 2022-2032

Figure 52: Latin America Bismuth Oxide Market Value (US$ Mn) by Country, 2022-2032

Figure 53: Latin America Bismuth Oxide Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 54: Latin America Bismuth Oxide Market Volume (Tons) Analysis by Country, 2017-2032

Figure 55: Latin America Bismuth Oxide Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 56: Latin America Bismuth Oxide Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 57: Latin America Bismuth Oxide Market Value (US$ Mn) Analysis by Source, 2017-2032

Figure 58: Latin America Bismuth Oxide Market Volume (Tons) Analysis by Source, 2017-2032

Figure 59: Latin America Bismuth Oxide Market Value Share (%) and BPS Analysis by Source, 2022-2032

Figure 60: Latin America Bismuth Oxide Market Y-o-Y Growth (%) Projections by Source, 2022-2032

Figure 61: Latin America Bismuth Oxide Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 62: Latin America Bismuth Oxide Market Volume (Tons) Analysis by Application, 2017-2032

Figure 63: Latin America Bismuth Oxide Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 64: Latin America Bismuth Oxide Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 65: Latin America Bismuth Oxide Market Value (US$ Mn) Analysis by Grade, 2017-2032

Figure 66: Latin America Bismuth Oxide Market Volume (Tons) Analysis by Grade, 2017-2032

Figure 67: Latin America Bismuth Oxide Market Value Share (%) and BPS Analysis by Grade, 2022-2032

Figure 68: Latin America Bismuth Oxide Market Y-o-Y Growth (%) Projections by Grade, 2022-2032

Figure 69: Latin America Bismuth Oxide Market Attractiveness by Source, 2022-2032

Figure 70: Latin America Bismuth Oxide Market Attractiveness by Application, 2022-2032

Figure 71: Latin America Bismuth Oxide Market Attractiveness by Grade, 2022-2032

Figure 72: Latin America Bismuth Oxide Market Attractiveness by Country, 2022-2032

Figure 73: Europe Bismuth Oxide Market Value (US$ Mn) by Source, 2022-2032

Figure 74: Europe Bismuth Oxide Market Value (US$ Mn) by Application, 2022-2032

Figure 75: Europe Bismuth Oxide Market Value (US$ Mn) by Grade, 2022-2032

Figure 76: Europe Bismuth Oxide Market Value (US$ Mn) by Country, 2022-2032

Figure 77: Europe Bismuth Oxide Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 78: Europe Bismuth Oxide Market Volume (Tons) Analysis by Country, 2017-2032

Figure 79: Europe Bismuth Oxide Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 80: Europe Bismuth Oxide Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 81: Europe Bismuth Oxide Market Value (US$ Mn) Analysis by Source, 2017-2032

Figure 82: Europe Bismuth Oxide Market Volume (Tons) Analysis by Source, 2017-2032

Figure 83: Europe Bismuth Oxide Market Value Share (%) and BPS Analysis by Source, 2022-2032

Figure 84: Europe Bismuth Oxide Market Y-o-Y Growth (%) Projections by Source, 2022-2032

Figure 85: Europe Bismuth Oxide Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 86: Europe Bismuth Oxide Market Volume (Tons) Analysis by Application, 2017-2032

Figure 87: Europe Bismuth Oxide Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 88: Europe Bismuth Oxide Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 89: Europe Bismuth Oxide Market Value (US$ Mn) Analysis by Grade, 2017-2032

Figure 90: Europe Bismuth Oxide Market Volume (Tons) Analysis by Grade, 2017-2032

Figure 91: Europe Bismuth Oxide Market Value Share (%) and BPS Analysis by Grade, 2022-2032

Figure 92: Europe Bismuth Oxide Market Y-o-Y Growth (%) Projections by Grade, 2022-2032

Figure 93: Europe Bismuth Oxide Market Attractiveness by Source, 2022-2032

Figure 94: Europe Bismuth Oxide Market Attractiveness by Application, 2022-2032

Figure 95: Europe Bismuth Oxide Market Attractiveness by Grade, 2022-2032

Figure 96: Europe Bismuth Oxide Market Attractiveness by Country, 2022-2032

Figure 97: East Asia Bismuth Oxide Market Value (US$ Mn) by Source, 2022-2032

Figure 98: East Asia Bismuth Oxide Market Value (US$ Mn) by Application, 2022-2032

Figure 99: East Asia Bismuth Oxide Market Value (US$ Mn) by Grade, 2022-2032

Figure 100: East Asia Bismuth Oxide Market Value (US$ Mn) by Country, 2022-2032

Figure 101: East Asia Bismuth Oxide Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 102: East Asia Bismuth Oxide Market Volume (Tons) Analysis by Country, 2017-2032

Figure 103: East Asia Bismuth Oxide Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 104: East Asia Bismuth Oxide Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 105: East Asia Bismuth Oxide Market Value (US$ Mn) Analysis by Source, 2017-2032

Figure 106: East Asia Bismuth Oxide Market Volume (Tons) Analysis by Source, 2017-2032

Figure 107: East Asia Bismuth Oxide Market Value Share (%) and BPS Analysis by Source, 2022-2032

Figure 108: East Asia Bismuth Oxide Market Y-o-Y Growth (%) Projections by Source, 2022-2032

Figure 109: East Asia Bismuth Oxide Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 110: East Asia Bismuth Oxide Market Volume (Tons) Analysis by Application, 2017-2032

Figure 111: East Asia Bismuth Oxide Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 112: East Asia Bismuth Oxide Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 113: East Asia Bismuth Oxide Market Value (US$ Mn) Analysis by Grade, 2017-2032

Figure 114: East Asia Bismuth Oxide Market Volume (Tons) Analysis by Grade, 2017-2032

Figure 115: East Asia Bismuth Oxide Market Value Share (%) and BPS Analysis by Grade, 2022-2032

Figure 116: East Asia Bismuth Oxide Market Y-o-Y Growth (%) Projections by Grade, 2022-2032

Figure 117: East Asia Bismuth Oxide Market Attractiveness by Source, 2022-2032

Figure 118: East Asia Bismuth Oxide Market Attractiveness by Application, 2022-2032

Figure 119: East Asia Bismuth Oxide Market Attractiveness by Grade, 2022-2032

Figure 120: East Asia Bismuth Oxide Market Attractiveness by Country, 2022-2032

Figure 121: South Asia & Pacific Bismuth Oxide Market Value (US$ Mn) by Source, 2022-2032

Figure 122: South Asia & Pacific Bismuth Oxide Market Value (US$ Mn) by Application, 2022-2032

Figure 123: South Asia & Pacific Bismuth Oxide Market Value (US$ Mn) by Grade, 2022-2032

Figure 124: South Asia & Pacific Bismuth Oxide Market Value (US$ Mn) by Country, 2022-2032

Figure 125: South Asia & Pacific Bismuth Oxide Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 126: South Asia & Pacific Bismuth Oxide Market Volume (Tons) Analysis by Country, 2017-2032

Figure 127: South Asia & Pacific Bismuth Oxide Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 128: South Asia & Pacific Bismuth Oxide Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 129: South Asia & Pacific Bismuth Oxide Market Value (US$ Mn) Analysis by Source, 2017-2032

Figure 130: South Asia & Pacific Bismuth Oxide Market Volume (Tons) Analysis by Source, 2017-2032

Figure 131: South Asia & Pacific Bismuth Oxide Market Value Share (%) and BPS Analysis by Source, 2022-2032

Figure 132: South Asia & Pacific Bismuth Oxide Market Y-o-Y Growth (%) Projections by Source, 2022-2032

Figure 133: South Asia & Pacific Bismuth Oxide Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 134: South Asia & Pacific Bismuth Oxide Market Volume (Tons) Analysis by Application, 2017-2032

Figure 135: South Asia & Pacific Bismuth Oxide Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 136: South Asia & Pacific Bismuth Oxide Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 137: South Asia & Pacific Bismuth Oxide Market Value (US$ Mn) Analysis by Grade, 2017-2032

Figure 138: South Asia & Pacific Bismuth Oxide Market Volume (Tons) Analysis by Grade, 2017-2032

Figure 139: South Asia & Pacific Bismuth Oxide Market Value Share (%) and BPS Analysis by Grade, 2022-2032

Figure 140: South Asia & Pacific Bismuth Oxide Market Y-o-Y Growth (%) Projections by Grade, 2022-2032

Figure 141: South Asia & Pacific Bismuth Oxide Market Attractiveness by Source, 2022-2032

Figure 142: South Asia & Pacific Bismuth Oxide Market Attractiveness by Application, 2022-2032

Figure 143: South Asia & Pacific Bismuth Oxide Market Attractiveness by Grade, 2022-2032

Figure 144: South Asia & Pacific Bismuth Oxide Market Attractiveness by Country, 2022-2032

Figure 145: MEA Bismuth Oxide Market Value (US$ Mn) by Source, 2022-2032

Figure 146: MEA Bismuth Oxide Market Value (US$ Mn) by Application, 2022-2032

Figure 147: MEA Bismuth Oxide Market Value (US$ Mn) by Grade, 2022-2032

Figure 148: MEA Bismuth Oxide Market Value (US$ Mn) by Country, 2022-2032

Figure 149: MEA Bismuth Oxide Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 150: MEA Bismuth Oxide Market Volume (Tons) Analysis by Country, 2017-2032

Figure 151: MEA Bismuth Oxide Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 152: MEA Bismuth Oxide Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 153: MEA Bismuth Oxide Market Value (US$ Mn) Analysis by Source, 2017-2032

Figure 154: MEA Bismuth Oxide Market Volume (Tons) Analysis by Source, 2017-2032

Figure 155: MEA Bismuth Oxide Market Value Share (%) and BPS Analysis by Source, 2022-2032

Figure 156: MEA Bismuth Oxide Market Y-o-Y Growth (%) Projections by Source, 2022-2032

Figure 157: MEA Bismuth Oxide Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 158: MEA Bismuth Oxide Market Volume (Tons) Analysis by Application, 2017-2032

Figure 159: MEA Bismuth Oxide Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 160: MEA Bismuth Oxide Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 161: MEA Bismuth Oxide Market Value (US$ Mn) Analysis by Grade, 2017-2032

Figure 162: MEA Bismuth Oxide Market Volume (Tons) Analysis by Grade, 2017-2032

Figure 163: MEA Bismuth Oxide Market Value Share (%) and BPS Analysis by Grade, 2022-2032

Figure 164: MEA Bismuth Oxide Market Y-o-Y Growth (%) Projections by Grade, 2022-2032

Figure 165: MEA Bismuth Oxide Market Attractiveness by Source, 2022-2032

Figure 166: MEA Bismuth Oxide Market Attractiveness by Application, 2022-2032

Figure 167: MEA Bismuth Oxide Market Attractiveness by Grade, 2022-2032

Figure 168: MEA Bismuth Oxide Market Attractiveness by Country, 2022-2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Copper Bismuth Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide Sunscreens Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide for Sunscreens Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Iron Oxide Market Report - Growth, Demand & Forecast 2025 to 2035

Zinc Oxide Market Analysis & Forecast 2024-2034

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Amine Oxide Market Size and Share Forecast Outlook 2025 to 2035

Solid Oxide Fuel Cell Market

Nitric Oxide Asthma Testing Market - Growth, Demand & Forecast 2025 to 2035

Cerium Oxide Nanoparticle Market Growth – Trends & Forecast 2024-2034

Calcium Oxide Market Growth - Trends & Forecast 2025 to 2035

Carbon Dioxide Lasers Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Dioxide Synthesis Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Enhanced Oil Recovery (CO2 EOR) Market Analysis by Application, Source and Region: Forecast from 2025 to 2035

Carbon Dioxide Incubators Market Insights - Growth & Trends 2024 to 2034

Aluminum Oxide Coated Films Market

Magnesium Oxide Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Oxides Market Size and Share Forecast Outlook 2025 to 2035

Nano Zinc Oxide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Monoxide Analyzers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA